Market

3 Altcoins to Watch in the Second Week of March 2025

The crypto market faced a challenging week, but the new week brings hope for recovery. Whether this rebound stems from broader market trends or individual network developments remains uncertain.

BeInCrypto has identified three altcoins for investors to watch closely as we enter the second week of March.

Movement (MOVE)

MOVE price hit a new all-time low of $0.370 as investors pulled back ahead of the anticipated mainnet launch scheduled for this week. This event could mark a turning point for the altcoin, influencing investor sentiment and potential market movements in the coming days.

Currently, MOVE is trading at $0.464, consolidating below the $0.527 resistance while holding above the $0.420 support. If bullish momentum builds, the altcoin could push toward $0.617. A successful breach of this level would confirm recovery and attract renewed investor confidence.

However, if MOVE remains heavily influenced by broader market trends, a breakdown below $0.420 could trigger further losses. This scenario might lead to the altcoin slipping past its all-time low of $0.370, potentially forming a new bottom and extending its bearish trajectory.

Immutable (IMX)

IMX has been trading within a descending wedge for the past two months, currently priced at $0.539. The altcoin has declined by 22% over the last two weeks, reflecting sustained bearish pressure. However, the technical pattern suggests the potential for a breakout, offering a chance for a trend reversal.

IMX is holding above its key support level at $0.508, reinforcing the possibility of an upward move. Supporting this is the upcoming launch of RavenQuest, a Sandbox MMORPG set for release on March 14. This event could attract fresh investment, drive renewed interest, and improve market sentiment around IMX.

If investor enthusiasm supports IMX, the altcoin could break through the $0.684 resistance and aim for $0.810. However, failure to breach this level would invalidate the bullish outlook. In a bearish scenario, IMX could lose support at $0.508, leading to a potential decline toward $0.400.

Tron (TRX)

Tron’s price, at $0.234, has demonstrated resilience, maintaining stability despite broader market fluctuations. Over the past three months, the altcoin has remained within a tight range, showing limited volatility. Unlike other cryptocurrencies that have faced sharp crashes, TRX has managed to hold its ground, avoiding significant downside moves during market uncertainty.

Currently, Tron is consolidating between $0.262 and $0.216, effectively preventing major losses. The altcoin appears poised to secure its 50-day Exponential Moving Average (EMA) as support. If successful, this could serve as a foundation for a breakout, allowing TRX to move beyond its established range and enter a bullish phase.

However, if the breakout attempt fails, consolidation may persist. A shift in market sentiment or intensifying bearish conditions could push TRX below its $0.216 support. A further decline could send the altcoin toward $0.194, invalidating the bullish-neutral outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Drops 39% After US Crypto Reserve Listing

Cardano (ADA) is facing intense selling pressure, dropping nearly 10% in the last 24 hours and almost 29% over the past week. Since its inclusion in the U.S. strategic crypto reserve, ADA has fallen 39%, struggling to regain bullish momentum.

Indicators like BBTrend and DMI show that bearish sentiment remains strong, with sellers still in control. If the current downtrend continues, ADA could test key support levels, but a reversal could push it back toward major resistance zones.

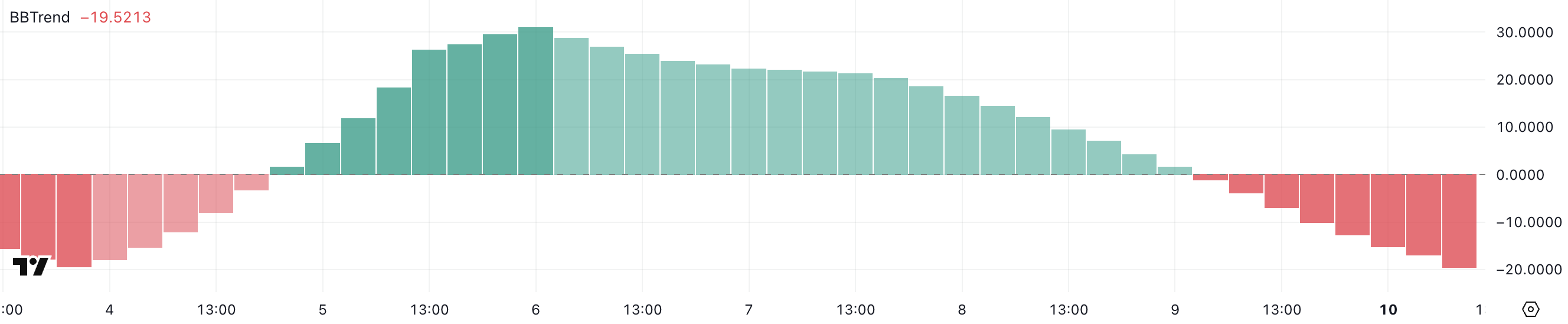

ADA BBTrend Shows the Selling Pressure Is Getting Stronger

Cardano BBTrend indicator is currently at -19.52, continuing its decline since yesterday. Earlier this month, from March 5 to March 8, BBTrend remained positive, reaching a peak of 31 on March 6.

This shift from positive to negative territory suggests a weakening bullish trend, with increasing downside pressure on ADA price. Traders are now watching whether this decline continues or if ADA can regain momentum.

BBTrend, or Bollinger Band Trend, is an indicator that measures price trends based on Bollinger Bands. It shows whether an asset is in a strong, bullish, or bearish phase. When BBTrend is positive, it suggests strong upward momentum, while negative values indicate growing selling pressure.

With ADA’s BBTrend now at -19.52, it signals increasing bearish sentiment, suggesting the price could continue declining unless buyers step in. If the downtrend persists, ADA may test key support levels in the coming days.

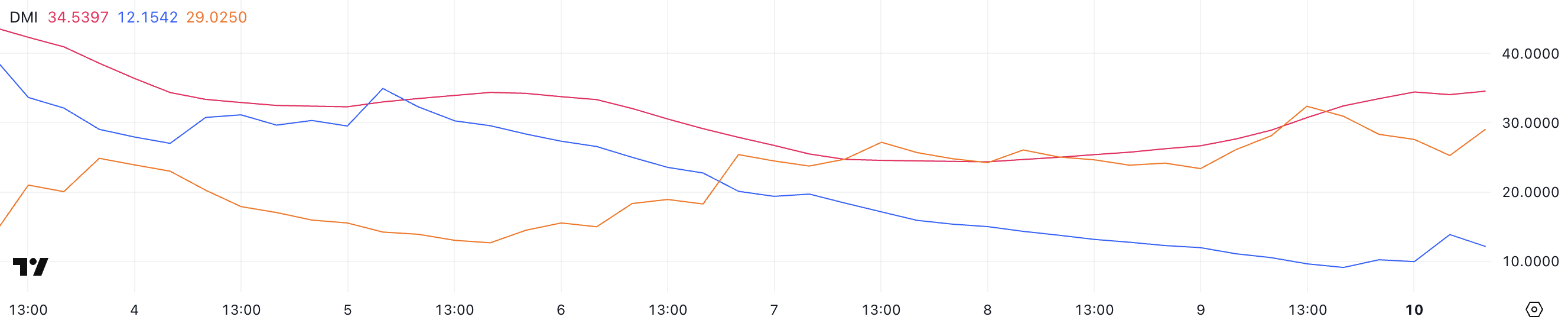

Cardano DMI Shows Sellers Are Still In Control

Cardano Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) has risen to 34.5, up from 26.6 yesterday. This increase suggests that ADA’s current trend – whether bullish or bearish – is gaining strength.

Given that ADA is in a downtrend, the rising ADX indicates that selling pressure is intensifying, making it more difficult for the price to reverse in the short term.

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 indicating a strong trend and above 50 suggesting an extremely strong trend.

Meanwhile, ADA’s +DI (positive directional index) has climbed to 12 from 9.6 yesterday but is slightly down from 13.8 a few hours ago, indicating weak bullish attempts.

At the same time, -DI (negative directional index) is at 29, lower than yesterday’s 32.3 but rising from 25.2 a few hours ago.

This suggests that while sellers still control the trend, some short-term pullbacks are occurring. If -DI remains dominant and ADX continues rising, ADA’s downtrend could extend further.

Will Cardano Fall Below $0.60?

Cardano EMA lines indicate that a potential death cross could form soon, signaling a bearish momentum.

A death cross occurs when a short-term EMA crosses below a longer-term EMA, often leading to increased selling pressure.

If this bearish crossover happens, ADA price could decline further, with the $0.58 support level becoming a key area to watch. A breakdown below this level could trigger even deeper losses.

However, if buyers regain control and ADA can reverse its trend, the price may rise toward the $0.818 resistance level. A breakout above that could open the door for further gains toward $1.02 and even $1.17 if momentum strengthens.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 5 Made in USA Cryptos to Watch This Week

Hedera (HBAR), Chainlink (LINK), Aptos (APT), Ondo Finance (ONDO), and Story (IP) are five of the most important Made in USA cryptos to watch this week. While IP has been the best-performing of the group in the last month, it is now undergoing a sharp correction, similar to ONDO, which has dropped over 22% in the past seven days.

Meanwhile, speculation is growing that HBAR and LINK could potentially be included in the U.S. strategic crypto reserve, which could impact their prices. With key support and resistance levels approaching, the coming days will determine whether these coins can regain bullish momentum or face further downside.

Hedera (HBAR)

Hedera is currently among the top 10 largest Made in USA cryptos by market cap, and there is growing speculation that it could be considered for inclusion in the U.S. strategic crypto reserve.

Despite this, HBAR has struggled in the past week, dropping 16.7% as its market cap hovers around $8.8 billion. The recent downturn has raised concerns about whether it can regain bullish momentum or continue facing selling pressure.

If HBAR can establish an uptrend, it could look to test key resistance levels at $0.219 and $0.258, with a stronger rally potentially pushing it toward $0.287. However, if the current price retracement deepens, it may face additional downside risk.

The $0.179 level stands out as a critical support area, where a breakdown could signal further losses. Whether HBAR can recover or extend its decline will depend on its ability to attract renewed buying interest.

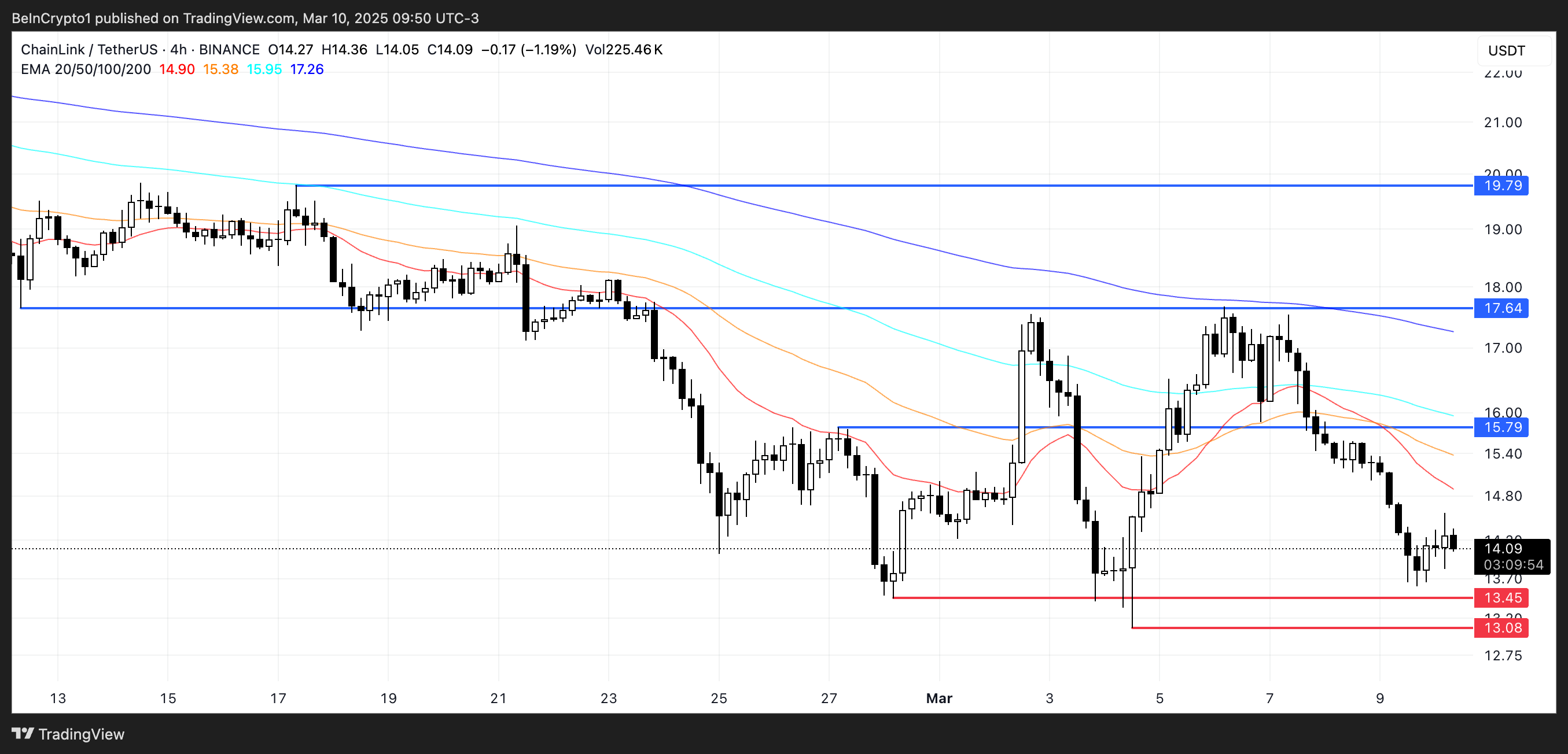

Chainlink (LINK)

Chainlink is a dominant force in the oracle sector and has been expanding its presence in real-world assets (RWA), solidifying its importance in blockchain infrastructure.

Its key role in these industries strengthens the case for its potential inclusion in the U.S. strategic crypto reserve, alongside XRP and Solana.

A potential inclusion could push LINK toward key resistance at $15.79, with further upside targeting $17.64 and $19.79 if momentum continues.

However, if market conditions turn bearish, LINK may retest support at $13.45, with the risk of further declines toward $13 or lower.

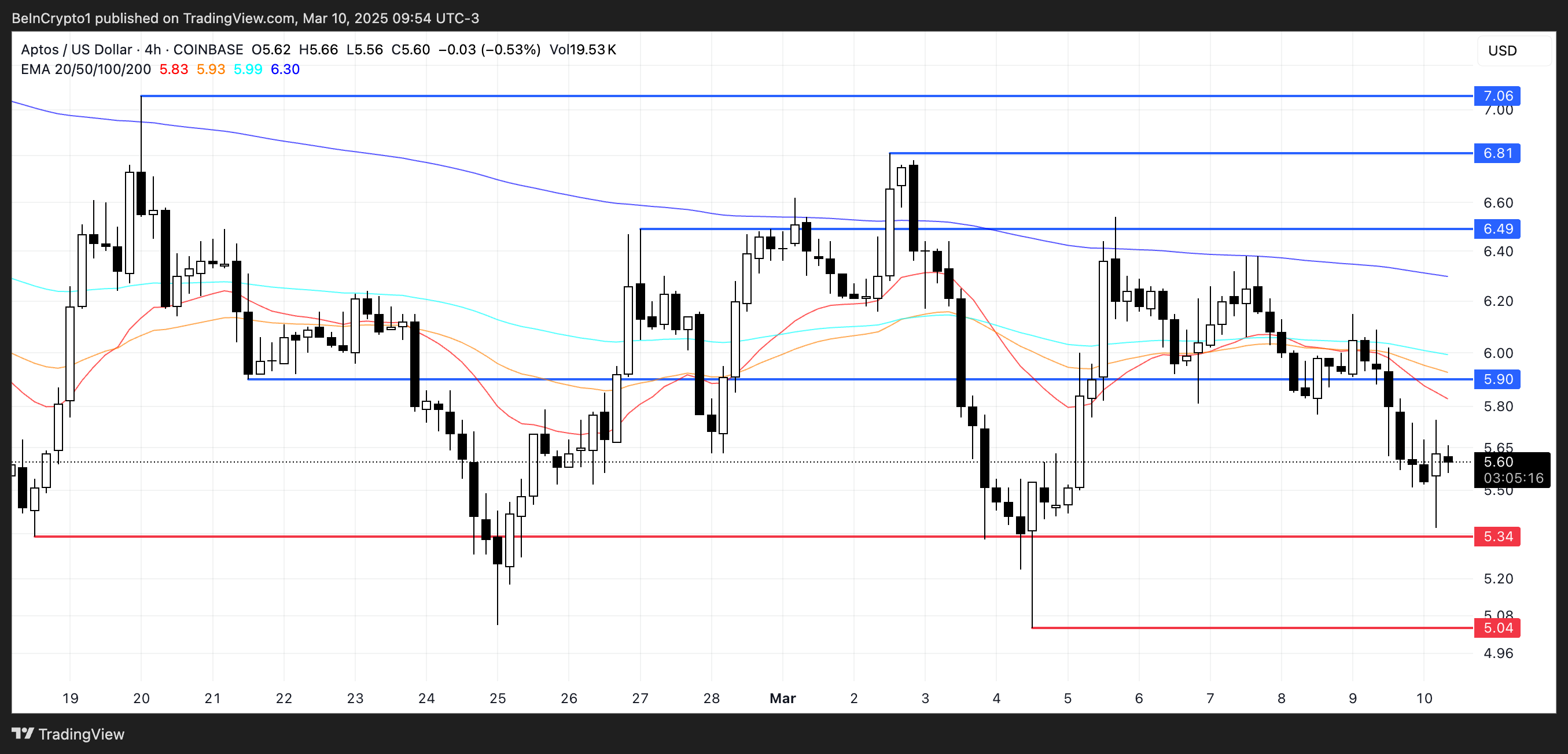

Aptos (APT)

Aptos has been one of the most hyped new layer-1 blockchains in recent years, and speculation about a potential ETF has fuelled discussions over the past week.

Despite this, APT has struggled, dropping nearly 12% in the last seven days. The recent downturn raises questions about whether it can regain bullish momentum or if further downside is ahead.

If the correction continues, APT could test support at $5.34, with a breakdown potentially sending it as low as $5.04. On the other hand, a reversal could see APT rising toward $5.90, with further resistance at $6.49.

If bullish momentum from previous months returns, APT could extend gains toward $6.81 or even $7.06. Whether it can turn the tide will depend on renewed buying interest and broader market conditions.

Ondo Finance (ONDO)

ONDO has dropped 22% in the last seven days, but it remains one of the most relevant real-world asset (RWA) tokens in the market. Despite the correction, its market cap still hovers around $2.8 billion, reflecting its strong position in the sector.

The recent pullback has put pressure on ONDO, raising questions about whether it can regain momentum or if further downside is ahead.

If the decline continues, ONDO could test support at $0.866, with a breakdown potentially sending it as low as $0.82.

On the upside, a recovery in momentum and renewed interest in RWA coins could push ONDO toward the $1.09 resistance level. If bullish momentum strengthens further, it could climb to $1.23

Story (IP)

IP has been one of the best-performing Made in USA cryptos, surging 77% in the last 30 days and standing out among top altcoins.

Despite its strong overall performance, IP has experienced a 19% correction over the past week, bringing its market cap to $1.27 billion.

If IP can recover its strength from last month, it could rise toward $6.96 and potentially test $7.95, with the possibility of breaking above $8 for the first time, making it one of the most important Made in USA cryptos.

However, if the current downtrend intensifies, the price may test support at $4.49, and a further breakdown could push it as low as $3.65.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Cryptos Smart Money Wallets Are Buying After the Crash

Smart Money Wallets have been accumulating JoeToken (JOE), AI Rig Complex (ARC), and Mochi (MOCHI) despite the recent market crash. JOE saw nearly $44,000 in buys over the past week, while ARC attracted more than $32,000, even as its price dropped over 67%.

Meanwhile, MOCHI has faced a sharp 45% correction in the last seven days, but Smart Money still purchased $9,000 worth in the last 24 hours. Whether these tokens can recover or continue to decline will depend on key support and resistance levels in the coming days.

JoeToken (JOE)

JoeToken (JOE) is the native utility and governance token of the Trader Joe ecosystem, the leading decentralized exchange (DEX) on the Avalanche network.

Despite recent market fluctuations, Smart Money wallets have shown interest, purchasing nearly $44,000 worth of JOE in the last seven days. This accumulation suggests that some investors see potential in the token, even as its market cap hovers around $70 million.

If an uptrend develops, JOE could rise toward the $0.189 resistance level, with further breakouts potentially pushing it to $0.215 and even $0.243.

However, if the current downtrend continues, JOE may test support at $0.169, and a breakdown below that level could send it below $0.16.

AI Rig Complex (ARC)

ARC is developing the Rig framework, an open-source tool built in Rust that enables developers to create portable, modular, and lightweight AI agents.

Despite a sharp decline of over 67% in the past seven days and an additional 12% drop in the last 24 hours, Smart Money wallets have accumulated more than $32,000 worth of ARC. This suggests that some investors see the potential for a rebound despite the recent heavy correction.

If the downtrend continues, ARC could test the support at $0.072, which would be a crucial level to hold. However, if the trend reverses – as Smart Money activity hints – ARC could climb toward the $0.0956 resistance level.

A breakout above that could open the door for further gains to $0.13 and even $0.167, representing a potential 110% upside.

Mochi (MOCHI)

Mochi, a meme coin on the Base chain, has seen increased interest from Smart Money wallets, which bought nearly $9,000 worth in the past 24 hours.

Despite this, its price is facing a sharp correction, down 16% in the last day and nearly 45% over the past week. With its market cap now at $10.75 million, traders are watching whether MOCHI can regain momentum or continue its decline.

If MOCHI manages to recover and meme coins make a rebound, it could test resistance at $0.0000159, with further breakouts potentially pushing it toward $0.0000195 and $0.0000247.

However, the $0.000011 support level is crucial – if it is tested and lost, MOCHI could drop below $0.000010 for the first time since mid-January.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Reveals Why Bitcoin And Solana Have An Edge Over Ethereum

-

Market20 hours ago

Market20 hours agoBitcoin Price Dives Once More—Is a Deeper Correction Underway?

-

Altcoin19 hours ago

Altcoin19 hours agoBTC & Ether Prices Sink, Here’s Why

-

Market18 hours ago

Market18 hours agoPi Network Mainnet Woes: Pioneers Face Transfer Delays

-

Market17 hours ago

Market17 hours agoUS Economic Data Looms, Bitcoin Braces for Volatility

-

Bitcoin16 hours ago

Bitcoin16 hours agoTrump Won’t Buy Bitcoin Until It Hits $60,000: Bitwise Exec

-

Market16 hours ago

Market16 hours ago$620 Million Liquidations Shake the Market

-

Altcoin15 hours ago

Altcoin15 hours agoBinance Issues Key Update On These 6 Crypto, What’s Happening?