Market

Solana’s Death Cross Triggers 28% Crash; Recovery Is Difficult

Solana has faced a sharp decline, plunging to a multi-month low amid broader market weakness. The altcoin’s ongoing downtrend, exacerbated by recent technical indicators, has made a recovery uncertain.

Solana’s future price action largely depends on Bitcoin’s performance, as a potential BTC rebound could support SOL’s turnaround.

Solana Investors Need A Nudge

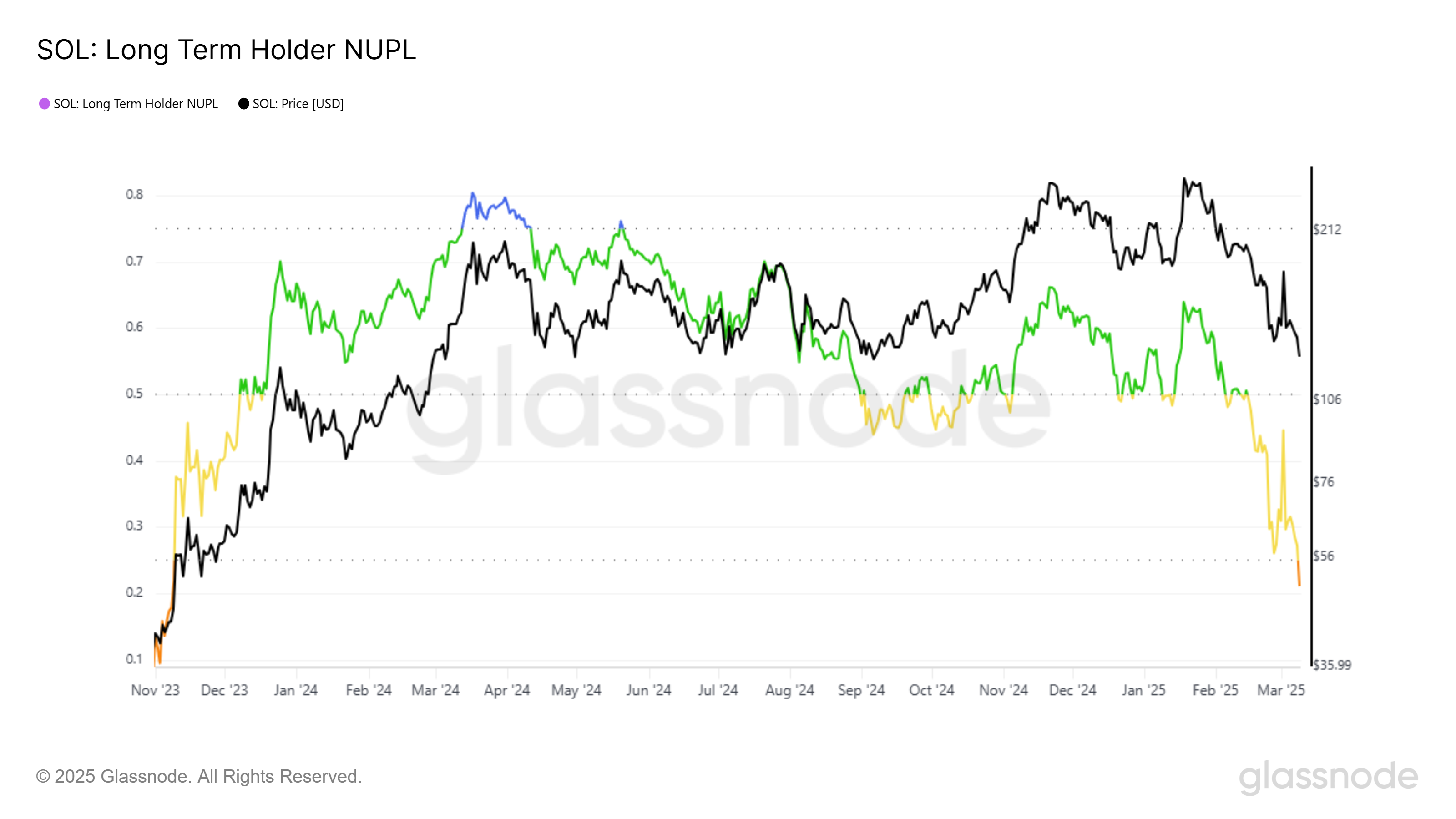

Solana’s Long-Term Holder Net Unrealized Profit/Loss (LTH NUPL) has entered the Fear zone, signaling increased market distress. Currently sitting at a 16-month low, this indicator reflects the broader market downturn’s impact on SOL investors. As long-term holders experience rising losses, the potential for significant selling pressure increases, posing a risk of further declines.

The sentiment among these investors could extend to retail traders if fear escalates. A mass sell-off could amplify bearish pressure, making it harder for SOL to recover. Unless Bitcoin stabilizes and market conditions improve, investor confidence in Solana is likely to remain weak in the near term.

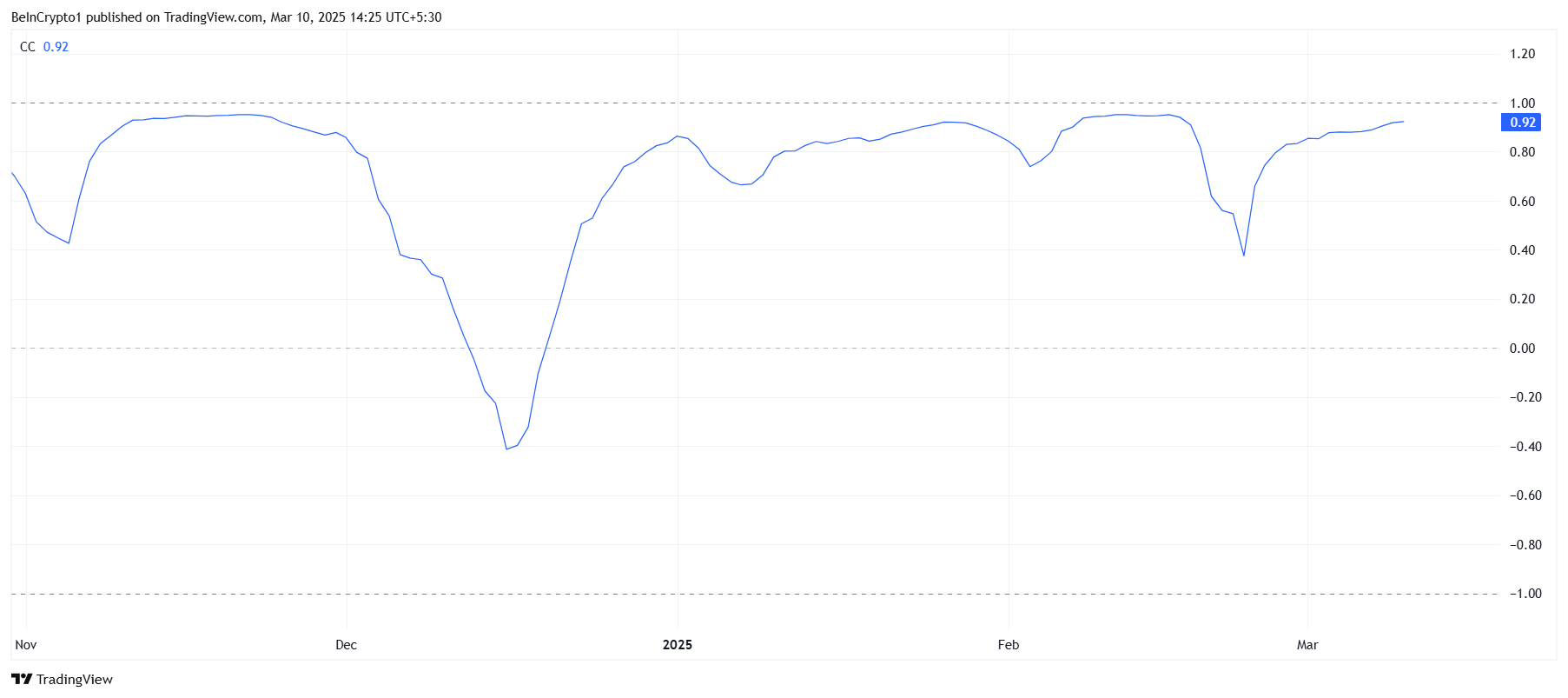

Solana maintains a strong correlation with Bitcoin, currently at 0.92. While high correlation typically signals bullish alignment, in SOL’s case, it is a bearish indicator. Bitcoin is struggling to hold above $80,000, meaning any further BTC weakness could pull Solana down alongside it.

If Bitcoin fails to regain momentum, Solana’s price could face additional losses. The altcoin’s reliance on BTC’s stability adds to its vulnerability. Until Bitcoin reclaims key support levels, SOL’s macro momentum will likely remain bearish, prolonging its downtrend.

SOL Price Takes A Hit

Solana’s price has dropped 28% in the past 24 hours, trading at $128. The decline stems from overall market bearishness and the Death Cross formation on SOL’s chart last week. This technical pattern suggests continued downside unless strong buying pressure emerges.

Currently, SOL is holding above $120, attempting to stabilize. However, if broader market conditions do not improve, the altcoin risks breaking below its key support at $128. A failure to hold this level could accelerate losses, leading to deeper corrections.

On the other hand, if investors take advantage of the lower price and accumulate, SOL could reclaim $137 as support. A successful breakout beyond this level would open the door for a potential rally toward $155, effectively invalidating the bearish outlook. Market sentiment and Bitcoin’s trajectory remain critical to Solana’s recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Cryptos Smart Money Wallets Are Buying After the Crash

Smart Money Wallets have been accumulating JoeToken (JOE), AI Rig Complex (ARC), and Mochi (MOCHI) despite the recent market crash. JOE saw nearly $44,000 in buys over the past week, while ARC attracted more than $32,000, even as its price dropped over 67%.

Meanwhile, MOCHI has faced a sharp 45% correction in the last seven days, but Smart Money still purchased $9,000 worth in the last 24 hours. Whether these tokens can recover or continue to decline will depend on key support and resistance levels in the coming days.

JoeToken (JOE)

JoeToken (JOE) is the native utility and governance token of the Trader Joe ecosystem, the leading decentralized exchange (DEX) on the Avalanche network.

Despite recent market fluctuations, Smart Money wallets have shown interest, purchasing nearly $44,000 worth of JOE in the last seven days. This accumulation suggests that some investors see potential in the token, even as its market cap hovers around $70 million.

If an uptrend develops, JOE could rise toward the $0.189 resistance level, with further breakouts potentially pushing it to $0.215 and even $0.243.

However, if the current downtrend continues, JOE may test support at $0.169, and a breakdown below that level could send it below $0.16.

AI Rig Complex (ARC)

ARC is developing the Rig framework, an open-source tool built in Rust that enables developers to create portable, modular, and lightweight AI agents.

Despite a sharp decline of over 67% in the past seven days and an additional 12% drop in the last 24 hours, Smart Money wallets have accumulated more than $32,000 worth of ARC. This suggests that some investors see the potential for a rebound despite the recent heavy correction.

If the downtrend continues, ARC could test the support at $0.072, which would be a crucial level to hold. However, if the trend reverses – as Smart Money activity hints – ARC could climb toward the $0.0956 resistance level.

A breakout above that could open the door for further gains to $0.13 and even $0.167, representing a potential 110% upside.

Mochi (MOCHI)

Mochi, a meme coin on the Base chain, has seen increased interest from Smart Money wallets, which bought nearly $9,000 worth in the past 24 hours.

Despite this, its price is facing a sharp correction, down 16% in the last day and nearly 45% over the past week. With its market cap now at $10.75 million, traders are watching whether MOCHI can regain momentum or continue its decline.

If MOCHI manages to recover and meme coins make a rebound, it could test resistance at $0.0000159, with further breakouts potentially pushing it toward $0.0000195 and $0.0000247.

However, the $0.000011 support level is crucial – if it is tested and lost, MOCHI could drop below $0.000010 for the first time since mid-January.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Drops Rule Targeting Crypto Exchanges, Shifts Approach

The SEC is stepping back from a proposal that could have expanded its control over crypto exchange platforms.

Acting Chair Mark Uyeda is pushing to withdraw the rule, which was introduced under former Chair Gary Gensler. The rule would require more trading venues, including those dealing with digital assets, to register with the agency.

SEC Will Not Regulate Crypto Exchanges

The proposal sought to redefine what qualifies as an exchange by including certain “communications protocols.” This broad approach would have affected multiple digital asset businesses.

Uyeda argues that the definition was unclear and risked regulating protocols that were never intended to fall under the SEC’s oversight.

The rule has been under consideration for years, and Gary Gensler was potentially in favor of implementing it.

Needless to say, had it been implemented, it would’ve been significantly damaging for major exchanges. However, Uyeda has now instructed the agency’s staff to stop pursuing it.

This reversal reflects a broader shift in the SEC’s stance on crypto under the new leadership appointed by President Donald Trump. Several regulatory actions taken during Gensler’s tenure are now being revisited or rolled back.

At the same time, the SEC has dropped multiple enforcement cases against crypto firms. Over the past week, at least six cases have been dismissed, including actions against Kraken, Coinbase, Robinhood, and MetaMask.

This marks a significant change in the SEC’s approach to crypto regulation.

Meanwhile, the agency’s Crypto Task Force, led by Commissioner Hester Peirce, is focusing on industry engagement. The task force includes experts like Richard Gabbert, Michael Selig, Taylor Asher, and Sumeera Younis.

They will host “Spring Sprint Toward Crypto Clarity” roundtables, starting on March 21, to discuss compliance challenges and digital asset policies.

With the SEC shifting its regulatory focus, the crypto industry is watching closely to see how these changes will impact businesses operating in the space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Market Panic and What’s Next?

Bitcoin has dropped below $80,000, marking a 14% drop in a week. The leading cryptocurrency is currently trading at $77,800, while Ethereum has fallen to $1,860 – it’s lowest since November 2023.

This downturn comes amid rising market uncertainty, with sentiment hitting levels not seen since the 2022 bear market.

Extreme Fear is Driving Bitcoin Liquidations

Crypto market sentiment has plunged into extreme fear. The Crypto Fear & Greed Index, which soared to 92+ last year, now stands at just 17. This shift reflects a broad market correction fueled by significant capital outflows from digital assets.

In the past four hours, total liquidations have surpassed $195 million, with long positions accounting for $161 million.

The sell-off suggests traders were caught off guard, leading to forced liquidations and accelerating Bitcoin’s decline.

Institutional Investors Cut Exposure

Institutional investors have been offloading digital assets for four consecutive weeks. The week ending March 7 saw $876 million in outflows from digital asset investment products.

This brings the four-week total to $4.75 billion, slashing year-to-date inflows to just $2.6 billion. Bitcoin bore the brunt of these outflows, losing $756 million.

Total assets under management across digital funds have now dropped by $39 billion from their peak. It’s now sitting at $142 billion—the lowest since mid-November 2024.

US policy moves have intensified selling pressure. President Trump’s new tariffs on Canada, Mexico, China, and potentially the EU have driven institutional investors away from risk assets like crypto.

“The moves in crypto and stocks are becoming increasingly one-sided. Red days are DEEP red days and vice-versa, yet another sign of changing risk appetite. Sentiment is the ultimate driver of price,” wrote the Kobeissi Letter.

Additionally, Trump’s remarks at Friday’s White House Crypto Summit triggered further uncertainty.

He confirmed plans for a US Bitcoin Reserve, stating that the government will use seized BTC but will not make additional purchases. This dampened market confidence, leading to further sell-offs.

What’s Next for Bitcoin?

Market experts have mixed opinions on Bitcoin’s next move. Former BitMEX CEO Arthur Hayes expects Bitcoin to drop to $70,000 before a renewed bullish cycle begins.

“An ugly start to the week. Looks like BTC will retest $78,000. If it fails, $75,000 is next in the crosshairs. There are a lot of options OI struck between $70,000 to $75,000. If we get into that range it will be violent,” wrote Arthur Hayes.

Meanwhile, MicroStrategy has announced plans to raise up to $21 billion through an 8.00% Series A Perpetual Preferred Stock issuance, potentially using the funds for further Bitcoin acquisitions.

Some analysts argue that Bitcoin’s price follows liquidity trends. M2 money supply has been recovering after bottoming out.

M2 money supply includes cash, checking deposits, and easily convertible near-money assets, reflecting overall liquidity in the economy.

“Some argue that liquidity—measured through M2 money supply—is the real driver of Bitcoin’s price. M2 money supply bottomed and has been recovering sharply. If this holds true, we should see Bitcoin start grinding higher in the coming weeks.” wrote analysts at Crypto Stream.

However, skeptics caution that not all M2 liquidity translates into crypto inflows.

For now, Bitcoin remains under pressure, and the coming weeks will determine whether this dip extends further or sets the stage for a fresh rally.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoDogecoin Price Eyes Explosive Rally To $2.74 If Support Holds At $0.17

-

Altcoin23 hours ago

Altcoin23 hours agoBinance Founder Criticizes ‘Degens’, Advocates Support For Credible Projects

-

Altcoin17 hours ago

Altcoin17 hours agoBTC & Ether Prices Sink, Here’s Why

-

Market16 hours ago

Market16 hours agoPi Network Mainnet Woes: Pioneers Face Transfer Delays

-

Market15 hours ago

Market15 hours agoUS Economic Data Looms, Bitcoin Braces for Volatility

-

Bitcoin14 hours ago

Bitcoin14 hours agoTrump Won’t Buy Bitcoin Until It Hits $60,000: Bitwise Exec

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Reveals Why Bitcoin And Solana Have An Edge Over Ethereum

-

Market18 hours ago

Market18 hours agoBitcoin Price Dives Once More—Is a Deeper Correction Underway?