Altcoin

CoinMarketCap’s Altcoin Season Index Hits Record Low

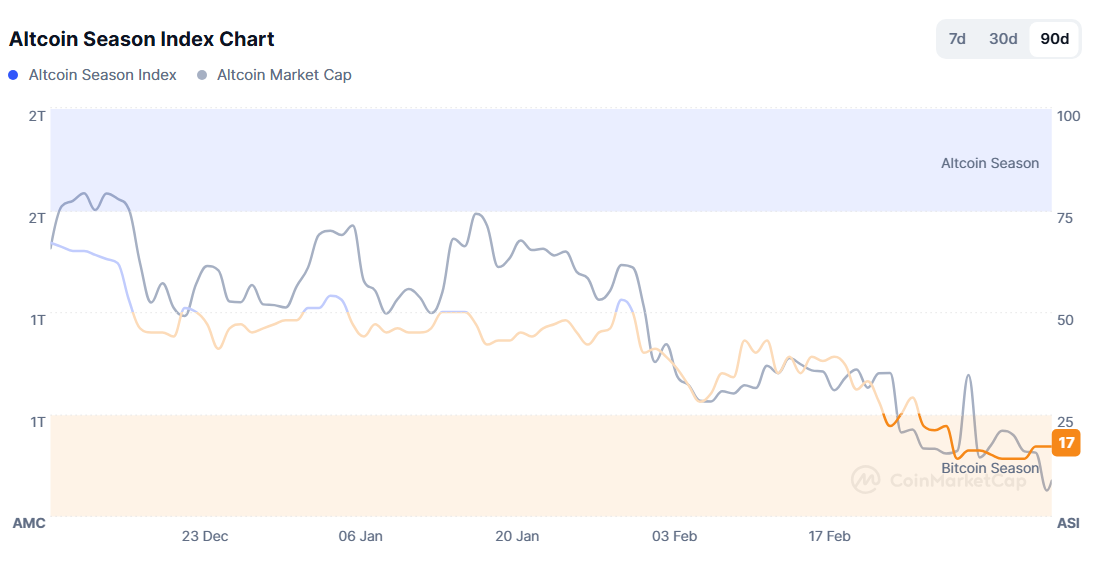

The Altcoin Season Index by CoinMarketCap (CMC) has fallen to its lowest level since its inception. The number of altcoins delivering better performance than Bitcoin has significantly declined.

Altcoin market capitalization (TOTAL2) has plummeted by 38% from its all-time high (ATH), with $600 billion exiting the market. Despite this, many analysts remain optimistic.

Only 17 Altcoins Outperformed BTC in the Last 90 Days

CMC’s Altcoin Season Index provides real-time insights into whether the crypto market is currently in an Altcoin Season. The index is based on the performance of the top 100 altcoins relative to Bitcoin over the past 90 days.

The index stands at 17 at the time of writing. This means that only 17 altcoins have outperformed Bitcoin in the last three months.

Meanwhile, CZ—the former CEO of Binance, the exchange that owns CMC—has suggested that an index level of 50 or higher is a positive sign.

“I think this is a tough ranking system. 50 is probably a really good score,” CZ commented.

Therefore, a level of 17 is alarming. It is also the lowest point since the index was introduced.

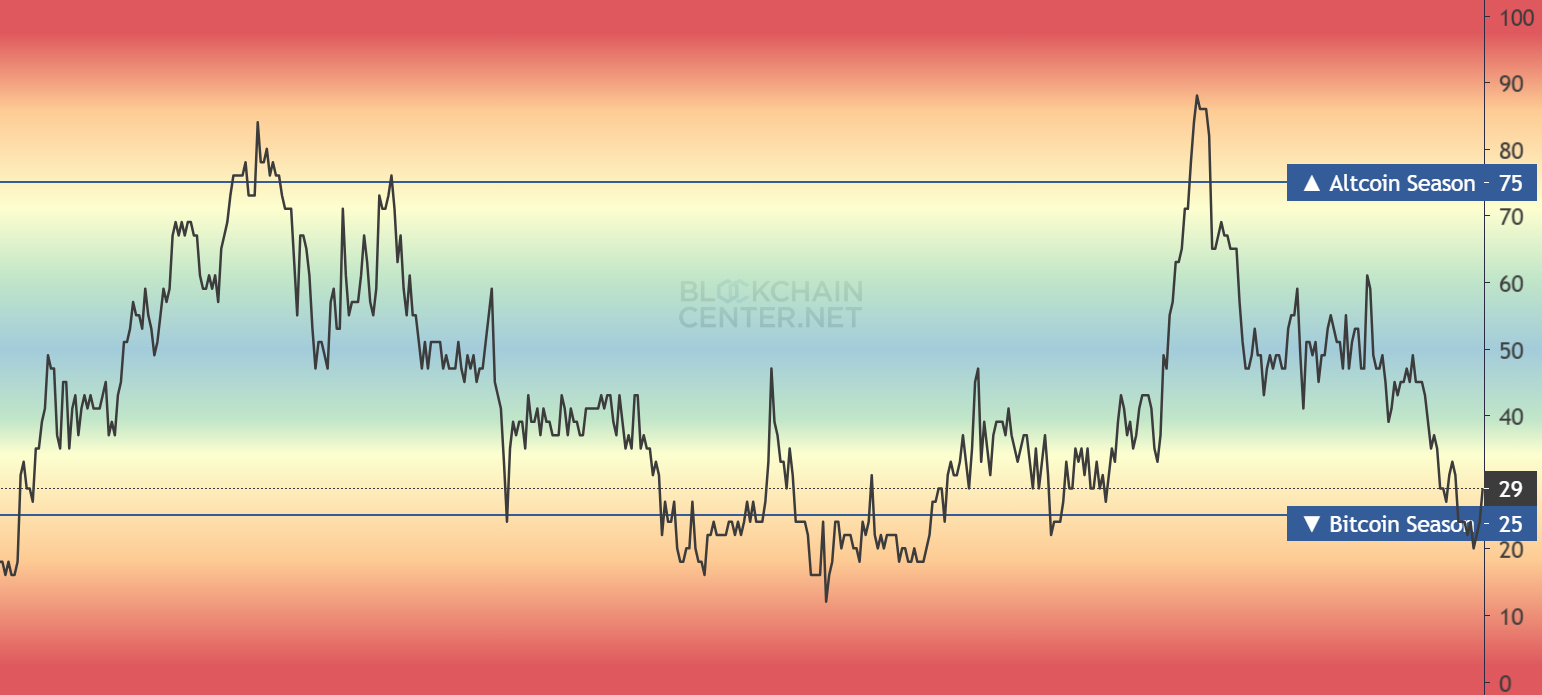

A separate Altcoin Season Index by Blockchain Center currently stands at 29. This index assumes that if 75% of the top 50 coins outperform Bitcoin in the last 90 days, it is considered an Altcoin Season. On March 7, the index even dropped to 10—the lowest level since October 2024.

These declining indices align with a significant drop in altcoin market capitalization. The total altcoin market cap has fallen by 38%, from its ATH of $1.64 trillion to around $1 trillion.

Analysts Remain Optimistic Despite the Sharp Decline

However, market analyst Master of Crypto, who has been active since 2016, believes that this downturn signals a promising future.

“The Altcoin Season Index has fallen to its lowest since October 2024. Interestingly, the last time the index was this low, altcoins staged an impressive rally. While each dip may worry new investors, those who hold on usually see significant returns,” Master of Crypto predicted.

Bitcoin investor Coinvo, active since 2017, also believes that current market volatility is not concerning but rather a repetition of previous cycles.

Coinvo observes that altcoin market capitalization expansions in 2017 and 2021 could repeat in 2025. According to Coinvo’s chart, the altcoin market cap could surge to $5 trillion in 2025—more than triple its current level.

Additionally, Ki Young Ju, CEO of CryptoQuant, offers a redefined perspective on Altcoin Season. He argues that the old Altcoin Season theory no longer applies. Instead, the new Altcoin Season will primarily direct capital into stablecoins or widely accepted altcoins rather than smaller, speculative tokens.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Ethereum Price Eye Bullish Breakout as This Pattern Develops

Ethereum price seems to be in good standing as technical indicators suggest an upward move is possible. The top altcoin is currently confined within an ascending triangle pattern, which might mean a surge is forthcoming. Analysts have identified a diamond pattern forming on the chart, a reversal structure signaling upward movement ahead.

Ethereum Price Bullish Diamond Pattern Signals Breakout

A recent analysis from Mikybull Crypto highlights the formation of a bullish diamond pattern on Ethereum’s chart. This technical setup suggests that the asset is nearing a turning point, where a breakout could trigger upward momentum.

Ethereum price has been trading within a narrowing range, creating conditions that often lead to a breakout. If buyers push the price above key resistance levels, the asset may see an accelerated move higher.

Meanwhile, an earlier analysis highlighted that the altcoin price breaking below key support levels could accelerate its decline toward $1,250. The surge in Ethereum ETF outflows and heavy liquidations in the derivatives market further reinforce the bearish outlook. However, large Ethereum whales have accumulated 330,000 ETH, hinting at potential future recovery.

Resistance Levels That Could Confirm a Breakout

Moreover, Ethereum price is facing key resistance around the $3,800 level, a crucial zone that has capped price advances in recent sessions. A decisive breakout above this point could confirm the bullish diamond pattern and open the door for further gains.

The next major resistance is at $4,150, a level that aligns with historical price action. A move past this threshold would reinforce buying interest and set Ethereum on a path toward its all-time high. On the downside, failure to break above resistance could invalidate the bullish setup, leading to possible retracement toward $3,500.

More so, analyst Ali Martinez highlights that Ethereum is currently consolidating within a descending triangle, a pattern often associated with bearish continuation. If the top altcoin breaks below the lower support, a sharp decline could follow, while an upward breakout may trigger an 18% rally.

At the time of writing, Ethereum price is $2,013.62, which is 3% down in the last 24 hours. However, the altcoin trading volume increased by 162%, reaching $28,94 billion, signaling that users’ interest is still high.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ripple Whale Moves $367M Amid Market Crash, What Next?

A Ripple whale has moved a sizable amount of XRP between addresses, triggering speculation over the asset’s price action. The unknown whale transferred over 167 million XRP in the middle of a massive price correction but experts say a reversal is on the horizon.

Ripple Whales Are Jostling For Position Amid Market Crash

According to an X post by Whale Alert, a Ripple whale is stirring up dormant XRP tokens in the middle of a price correction. The Ripple whale has transferred over 167 million XRP worth $367 million to an unknown address in a single transaction.

The move has caught the eye of market participants as they try to rationalize the transfers. Optimists are tagging the transfer as a mere consolidation of funds in anticipation of even larger whale acquisitions. On the other hand, pessimists say the movement could signal an over-the-counter trade given the sheer volume of the transfer.

XRP price is facing significant selling pressure, losing nearly 5% over 24 hours. The asset has lost a staggering 20% in the last 7 days but daily trading volumes are up by 68.37.

Barely three days ago, whales moved 150 XRP as prices began their steep descent in anticipation of a potential correction.

Experts See Better Days Ahead For XRP Price

Despite the grim market sentiments for XRP, experts say the asset is ripe for a big rally. Crypto analyst Dark Defender disclosed that XRP can reach $333 in a repeat of its 2017 bull run.

In upbeat XRP news, weekly inflows are outpacing Bitcoin and Ethereum for the fourth straight week straight. Institutional interest in XRP is buoyed by several factors including the Crypto Strategic Reserve announcement and the SEC’s acknowledgment of ETF filings.

While prices continue to wallow under selling pressure, XRP weekly active addresses have reached a new all-time high of 1.15 million. In the short term, XRP has its sights on the $3 price point but will have to surpass resistance at the $2.70 mark.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

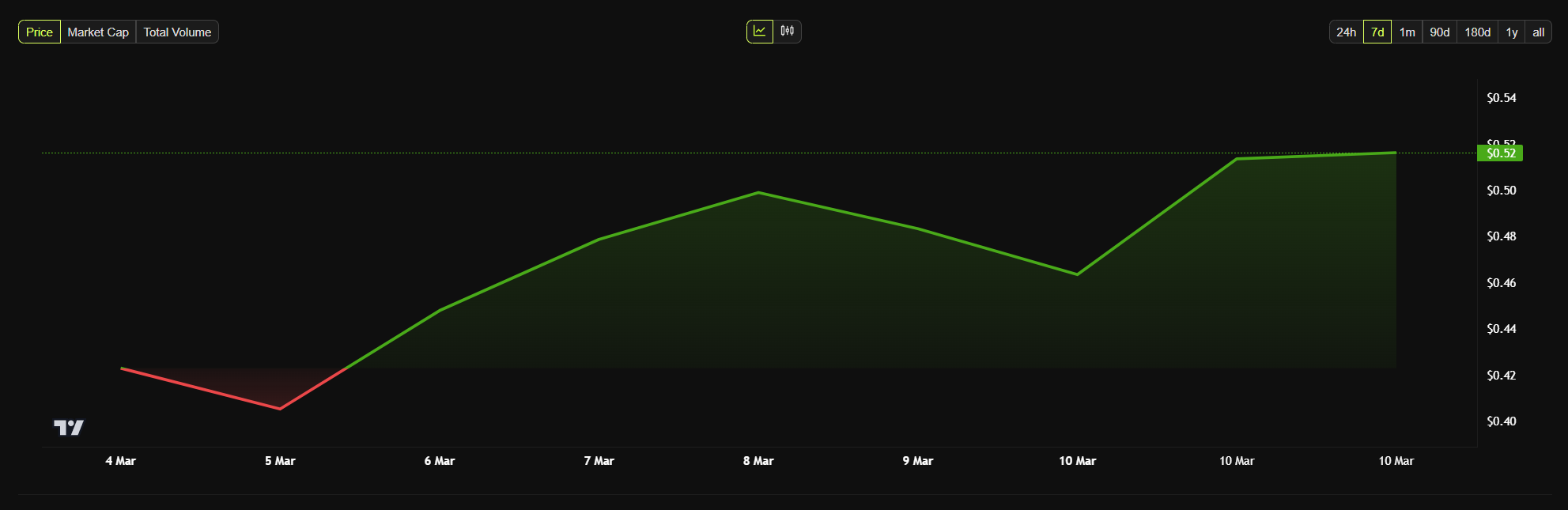

MOVE Surges 6% Amid Movement Mainnet and Rex ETF Filing

Despite the wider crypto market decline, Movement Network’s MOVE has surged over 6% today and 14% in a week.

The bullish momentum follows the launch of Movement’s mainnet beta and fresh ETF filings from Rex Shares and Osprey Funds.

Movement Network’s Mainnet Beta Goes Live

The mainnet became operational on March 10 at 15:00 UTC, offering a key bridging mechanism powered by LayerZero. Users can now move assets like MOVE, USDT, USDC, wBTC, and wETH onto the Movement blockchain.

The launch brings over $233 million in liquidity to the network, including BTC, ETH, and MOVE, sourced through the Movement Cornucopia program. With this rollout, developers and users can interact with the network freely for the first time.

MOVE was originally developed as part of Facebook’s digital currency initiative, which was abandoned in 2022.

Since then, the programming language has been used for layer-1 projects like Sui and Aptos, while Movement Labs has extended it to create an Ethereum-based layer 2.

Rex Shares File for a MOVE ETF With SEC

On the same day as the mainnet launch, investment firms Rex Shares and Osprey Funds have filed to introduce an ETF tracking the price of MOVE.

Previously, Rex Shares has sought ETF approvals for various crypto assets, including meme tokens like TRUMP, BONK, and DOGE.

The filings come as the SEC is seemingly turning more pro-crypto and dropping securities status for many assets. Earlier, the Commission announced that it does not consider meme coins as securities.

Also, Under the new leadership, the regulator has dismissed several lawsuits and investigations involving firms like Coinbase, Kraken, Robinhood, and more. These positive developments are influencing more altcoin ETF applications.

With these positive developments, MOVE has now crossed $1.2 billion in market cap. The altcoin’s trading volume has also surged by over 40% today.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Price Eyes Explosive Rally To $2.74 If Support Holds At $0.17

-

Altcoin21 hours ago

Altcoin21 hours agoBinance Founder Criticizes ‘Degens’, Advocates Support For Credible Projects

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Reveals Why Bitcoin And Solana Have An Edge Over Ethereum

-

Market23 hours ago

Market23 hours ago5 Token Unlocks to Watch for the Second Week of March

-

Market16 hours ago

Market16 hours agoBitcoin Price Dives Once More—Is a Deeper Correction Underway?

-

Altcoin15 hours ago

Altcoin15 hours agoBTC & Ether Prices Sink, Here’s Why

-

Market14 hours ago

Market14 hours agoPi Network Mainnet Woes: Pioneers Face Transfer Delays

-

Market13 hours ago

Market13 hours agoUS Economic Data Looms, Bitcoin Braces for Volatility

✓ Share: