Market

Pi Network is more dangerous than meme coins

In a recent discussion, Bybit CEO Ben Zhou bluntly stated that Pi Network is “more dangerous than meme coins.”

Following Zhou’s remark, the Pi Network community reacted negatively, driving the rating of the Bybit app on the Google Play Store down to 2.7 stars.

Bybit CEO: Pi Network Is More Dangerous Than Meme Coins

Zhou explained his stance on Pi Network and pointed out that the project lacks a fully functional product. Pi Network’s PI coin has not been listed on major exchanges despite earlier listings on platforms like OKX and MEXC.

Moreover, Zhou emphasized that its value largely hinges on community expectations rather than fundamental factors. After years of development, Pi Network still lacks a fully operational blockchain. It cannot be traded publicly, which has raised many questions about the project’s transparency and true potential.

According to Zhou, relying on community trust and FOMO without a tangible product poses a real danger. It creates significant risks if the project fails to achieve key milestones like launching a mainnet or gaining widespread adoption. In the past, Pi Network has repeatedly delayed its mainnet launch and KYC processes. The project just recently announced an open network on February 20, 2025.

Most recently, the project extended its KYC deadline to March 14. However, many Pioneers reported unresolved technical issues. They are calling for more time to resolve them.

Given these issues, Zhou argued that the Pi Network is more dangerous than meme coins. Projects like Dogecoin (DOGE) and Shiba Inu (SHIB), while also community-driven, have established blockchain foundations and are listed on major exchanges. This gives them greater liquidity and clearer market value. Previously, Zhou has also commented that the Pi project was a scam.

Zhou’s remark about the Pi Network has shaken some Pioneers’ confidence in the project and triggered a strong backlash from the Pi Network community. Many argue that the assessment is unfair, as Pi Network is still in its development phase and, in their view, holds significant future potential.

“Bybit CEO Ben Zhou’s statements about Pi Network reveal a deep lack of understanding and a superficial assessment of the crypto ecosystem,” said X user s_nakotomo.

After this statement, the Pi Network community retaliated by downgrading the Bybit app’s rating on the Google Play Store to 2.7 stars. Zhou expressed hope that the Pi Network team would step forward publicly to clarify their project rather than resorting to personal attacks or targeting the exchange.

This isn’t the first time the Pi community has lashed out at exchanges over unfavorable remarks. Previously, they called for leaving 1-star rates for the Binance app after it proposed a vote on Pi but later declined to list it. Capitalizing on this enthusiasm, Binance introduced a feature allowing the community to vote on which tokens should be listed or delisted.

Meanwhile, Pi Network token struggles to hit $2 as bearish indicators dominate.

At press time, the PI coin was trading at $1.43, up less than 1% over the past 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Market Panic and What’s Next?

Bitcoin has dropped below $80,000, marking a 14% drop in a week. The leading cryptocurrency is currently trading at $77,800, while Ethereum has fallen to $1,860 – it’s lowest since November 2023.

This downturn comes amid rising market uncertainty, with sentiment hitting levels not seen since the 2022 bear market.

Extreme Fear is Driving Bitcoin Liquidations

Crypto market sentiment has plunged into extreme fear. The Crypto Fear & Greed Index, which soared to 92+ last year, now stands at just 17. This shift reflects a broad market correction fueled by significant capital outflows from digital assets.

In the past four hours, total liquidations have surpassed $195 million, with long positions accounting for $161 million.

The sell-off suggests traders were caught off guard, leading to forced liquidations and accelerating Bitcoin’s decline.

Institutional Investors Cut Exposure

Institutional investors have been offloading digital assets for four consecutive weeks. The week ending March 7 saw $876 million in outflows from digital asset investment products.

This brings the four-week total to $4.75 billion, slashing year-to-date inflows to just $2.6 billion. Bitcoin bore the brunt of these outflows, losing $756 million.

Total assets under management across digital funds have now dropped by $39 billion from their peak. It’s now sitting at $142 billion—the lowest since mid-November 2024.

US policy moves have intensified selling pressure. President Trump’s new tariffs on Canada, Mexico, China, and potentially the EU have driven institutional investors away from risk assets like crypto.

“The moves in crypto and stocks are becoming increasingly one-sided. Red days are DEEP red days and vice-versa, yet another sign of changing risk appetite. Sentiment is the ultimate driver of price,” wrote the Kobeissi Letter.

Additionally, Trump’s remarks at Friday’s White House Crypto Summit triggered further uncertainty.

He confirmed plans for a US Bitcoin Reserve, stating that the government will use seized BTC but will not make additional purchases. This dampened market confidence, leading to further sell-offs.

What’s Next for Bitcoin?

Market experts have mixed opinions on Bitcoin’s next move. Former BitMEX CEO Arthur Hayes expects Bitcoin to drop to $70,000 before a renewed bullish cycle begins.

“An ugly start to the week. Looks like BTC will retest $78,000. If it fails, $75,000 is next in the crosshairs. There are a lot of options OI struck between $70,000 to $75,000. If we get into that range it will be violent,” wrote Arthur Hayes.

Meanwhile, MicroStrategy has announced plans to raise up to $21 billion through an 8.00% Series A Perpetual Preferred Stock issuance, potentially using the funds for further Bitcoin acquisitions.

Some analysts argue that Bitcoin’s price follows liquidity trends. M2 money supply has been recovering after bottoming out.

M2 money supply includes cash, checking deposits, and easily convertible near-money assets, reflecting overall liquidity in the economy.

“Some argue that liquidity—measured through M2 money supply—is the real driver of Bitcoin’s price. M2 money supply bottomed and has been recovering sharply. If this holds true, we should see Bitcoin start grinding higher in the coming weeks.” wrote analysts at Crypto Stream.

However, skeptics caution that not all M2 liquidity translates into crypto inflows.

For now, Bitcoin remains under pressure, and the coming weeks will determine whether this dip extends further or sets the stage for a fresh rally.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SuperRare (RARE) Surges 50% – Is a Correction Coming?

SuperRare (RARE) has surged roughly 50% in the last 24 hours, reaching its highest price levels in nearly two months. This sharp rally has pushed its Relative Strength Index (RSI) into overbought territory for the first time since November 2024, signaling extreme bullish momentum.

Additionally, RARE has broken above the Ichimoku Cloud, suggesting a potential shift in market sentiment. With no major catalysts behind the move, traders are closely watching key support levels in case a sharp correction follows.

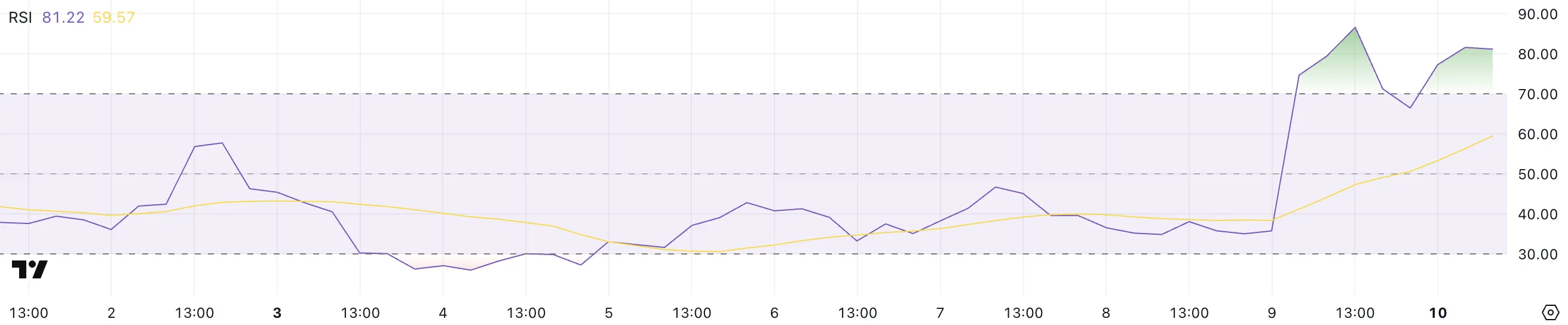

RARE RSI Reached Overbought Levels For The First Time In Months

SuperRare has seen a sharp spike in its Relative Strength Index (RSI), jumping from 35.8 yesterday to 81.2 today, alongside the strong price surge.

This rapid increase reflects intense buying pressure, pushing RARE from near-oversold levels into overbought territory.

Such a move signals heightened bullish momentum, but it also raises questions about whether the rally can be sustained or if a pullback is imminent.

RSI is a momentum indicator that measures the speed of price changes on a scale from 0 to 100. Readings below 30 indicate oversold conditions, while levels above 70 suggest an asset may be overbought.

With RARE’s RSI now at 81.2, it has reached overbought territory for the first time since November 2024, marking its highest level in seven months.

This could indicate exhaustion in buying pressure, increasing the likelihood of consolidation or a correction unless demand remains strong enough to sustain further gains.

SuperRare Ichimoku Cloud Shows Momentum Could Change Soon

SuperRare has made a strong breakout above the Ichimoku Cloud, signaling a shift in trend momentum.

After consolidating below the cloud for several days, the price surged, pushing well above the red resistance zone. The breakout was accompanied by strong bullish candles, confirming the strength of the move.

Additionally, the Tenkan-sen (red line) has turned upward, aligning with the bullish trend.

In Ichimoku analysis, the cloud (Kumo) acts as a support or resistance zone, with a breakout above it suggesting a potential trend reversal to the upside.

The fact that RARE has now cleared the cloud with strong momentum indicates buyers are in control. This is the first time in several months that RARE has established itself decisively above the cloud, suggesting a shift in market sentiment.

However, with the cloud still flat ahead, traders will watch whether the price can sustain above it or if a retest of the breakout level occurs.

RARE Could Strongly Correct Soon

SuperRare price is approaching a potential golden cross formation, where the shorter-term EMA could cross above the longer-term EMA, signaling a bullish trend shift.

If this crossover occurs, it could trigger further upward momentum, potentially pushing RARE toward the $0.10 level for the first time since mid-January.

The EMAs are gradually aligning for this setup, and if buying pressure remains strong, RARE could extend its rally as traders react to the bullish signal.

However, no fundamental catalysts or major developments appear to have contributed to this recent surge, raising concerns about its sustainability.

If momentum fades and a correction begins, RARE could first test support at $0.062.

A breakdown below that level would open the door for a deeper decline toward $0.052 or even $0.046, representing a potential correction of over 50% from its recent highs.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Altcoins to Watch in the Second Week of March 2025

The crypto market faced a challenging week, but the new week brings hope for recovery. Whether this rebound stems from broader market trends or individual network developments remains uncertain.

BeInCrypto has identified three altcoins for investors to watch closely as we enter the second week of March.

Movement (MOVE)

MOVE price hit a new all-time low of $0.370 as investors pulled back ahead of the anticipated mainnet launch scheduled for this week. This event could mark a turning point for the altcoin, influencing investor sentiment and potential market movements in the coming days.

Currently, MOVE is trading at $0.464, consolidating below the $0.527 resistance while holding above the $0.420 support. If bullish momentum builds, the altcoin could push toward $0.617. A successful breach of this level would confirm recovery and attract renewed investor confidence.

However, if MOVE remains heavily influenced by broader market trends, a breakdown below $0.420 could trigger further losses. This scenario might lead to the altcoin slipping past its all-time low of $0.370, potentially forming a new bottom and extending its bearish trajectory.

Immutable (IMX)

IMX has been trading within a descending wedge for the past two months, currently priced at $0.539. The altcoin has declined by 22% over the last two weeks, reflecting sustained bearish pressure. However, the technical pattern suggests the potential for a breakout, offering a chance for a trend reversal.

IMX is holding above its key support level at $0.508, reinforcing the possibility of an upward move. Supporting this is the upcoming launch of RavenQuest, a Sandbox MMORPG set for release on March 14. This event could attract fresh investment, drive renewed interest, and improve market sentiment around IMX.

If investor enthusiasm supports IMX, the altcoin could break through the $0.684 resistance and aim for $0.810. However, failure to breach this level would invalidate the bullish outlook. In a bearish scenario, IMX could lose support at $0.508, leading to a potential decline toward $0.400.

Tron (TRX)

Tron’s price, at $0.234, has demonstrated resilience, maintaining stability despite broader market fluctuations. Over the past three months, the altcoin has remained within a tight range, showing limited volatility. Unlike other cryptocurrencies that have faced sharp crashes, TRX has managed to hold its ground, avoiding significant downside moves during market uncertainty.

Currently, Tron is consolidating between $0.262 and $0.216, effectively preventing major losses. The altcoin appears poised to secure its 50-day Exponential Moving Average (EMA) as support. If successful, this could serve as a foundation for a breakout, allowing TRX to move beyond its established range and enter a bullish phase.

However, if the breakout attempt fails, consolidation may persist. A shift in market sentiment or intensifying bearish conditions could push TRX below its $0.216 support. A further decline could send the altcoin toward $0.194, invalidating the bullish-neutral outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Price Eyes Explosive Rally To $2.74 If Support Holds At $0.17

-

Altcoin21 hours ago

Altcoin21 hours agoBinance Founder Criticizes ‘Degens’, Advocates Support For Credible Projects

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Reveals Why Bitcoin And Solana Have An Edge Over Ethereum

-

Altcoin24 hours ago

Altcoin24 hours agoPro XRP Lawyer Outlines Reasons To Accumulate Despite Crypto Market Crash

-

Market23 hours ago

Market23 hours ago5 Token Unlocks to Watch for the Second Week of March

-

Market16 hours ago

Market16 hours agoBitcoin Price Dives Once More—Is a Deeper Correction Underway?

-

Altcoin15 hours ago

Altcoin15 hours agoBTC & Ether Prices Sink, Here’s Why

-

Market14 hours ago

Market14 hours agoPi Network Mainnet Woes: Pioneers Face Transfer Delays