Market

XRP’s Supply in Profit Shrinks as Bearish Sentiment Rises

XRP has maintained a downtrend since reaching an all-time high of $3.40 on January 16. It currently trades at $2.18, noting a 35% price drop over the past two months.

The double-digit dip has led to a decrease in the amount of XRP tokens held in profit. On-chain data shows that the bearish sentiment against the altcoin is climbing, hinting at an extended decline.

XRP Sees Drop in New Demand, Signaling Market Interest Slowdown

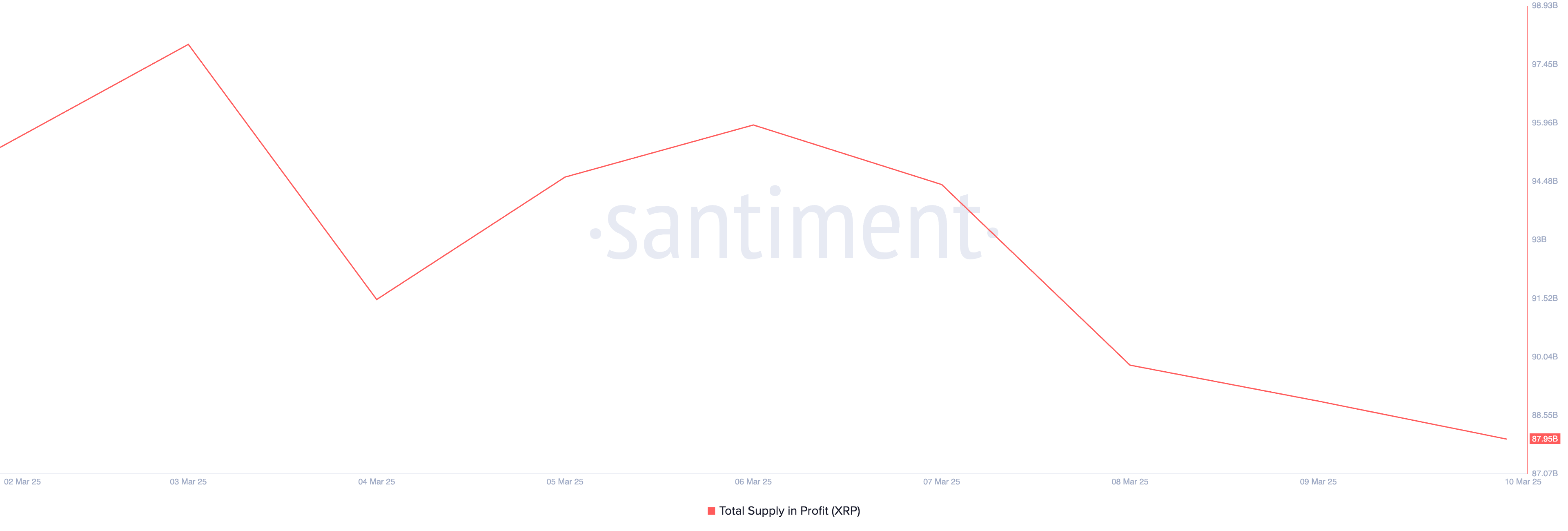

As XRP’s price falls, its total supply in profit has also reduced. According to Santiment, this has shrunk by 6.39 billion over the past week to fall to its year-to-date low.

As of this writing, 87.95 billion tokens out of a total supply of 99.98 billion are held at a profit. This signals that some investors are now holding XRP at a loss, reflecting increased selling pressure and weakening market sentiment.

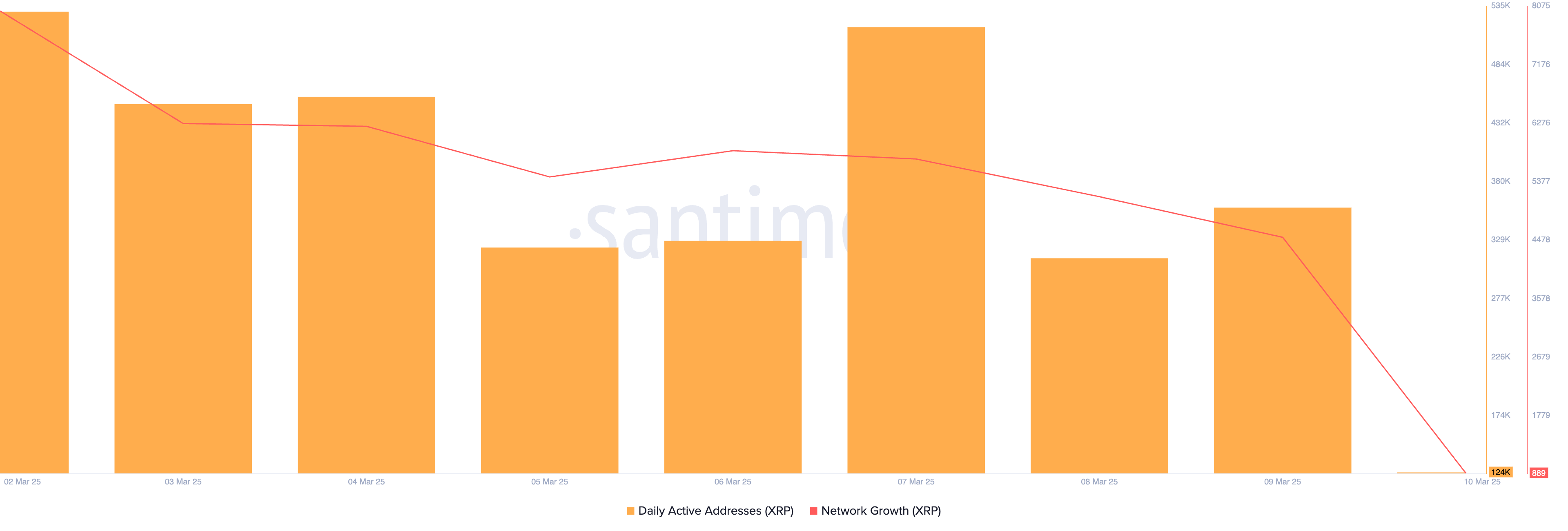

Moreover, on-chain data also shows a slump in new demand, with daily fresh purchases of XRP seeing a notable drop this month. Per Santiment, only 4,516 new wallet addresses were created on Sunday to trade XRP.

This represented the lowest daily count of new XRP demand since the beginning of the year.

When an asset sees a drop in new demand, it means fewer investors are buying it. As observed with XRP, this has reduced trading activity and weakened price support in its spot market. It signals waning market interest in the altcoin and can contribute to further price declines if selling pressure remains high.

XRP Faces Selling Pressure: Will Bulls Break the Downtrend?

On the daily chart, XRP has traded below a descending trend line since reaching its all-time high, reflecting the downward trend.

This bearish pattern is formed when an asset’s price consistently creates lower highs over time. It suggests that sellers are in control, and unless the price breaks above the trend line, further declines are likely.

XRP trades at $2.17 at press time, significantly below this descending trendline. With a growing bearish bias, the token’s price might fall further from this trendline. In that scenario, XRP’s value could drop below $2 to $1.47.

However, if buying pressure gains momentum, XRP could break above its descending trendline and climb to $2.93.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Open Interest Sinks—Signs of Further Decline?

Hedera’s HBAR has witnessed a sharp decline in price over the past week. Exchanging hands at $0.21 at press time, the token’s value has plummeted by 17% during that period.

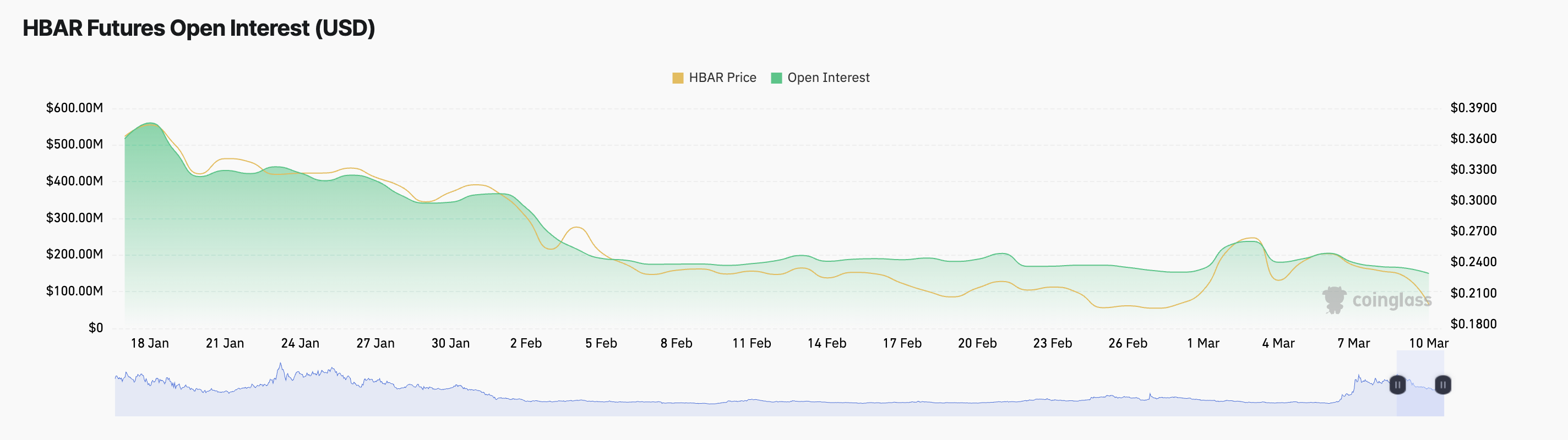

The token’s low demand is reflected in its open interest, which has fallen to its lowest level of the year. This signals a reduction in leveraged positions and could drive further price dips.

HBAR’s Open Interest Hits Yearly Low—Is More Downside Ahead?

HBAR’s open interest, which measures its total number of outstanding derivative contracts, such as futures or options, that have not been settled, has steadily declined since January 9. This month alone, it has plunged by 8% and is currently at $149 million, its lowest level since the year began.

When an asset’s price and open interest decline, it signals waning market participation and weakening trader confidence. This trend suggests that existing HBAR positions are being closed without new ones being opened. It presents a bearish outlook for the altcoin in the near term as its price may continue to decline unless new buying pressure re-emerges.

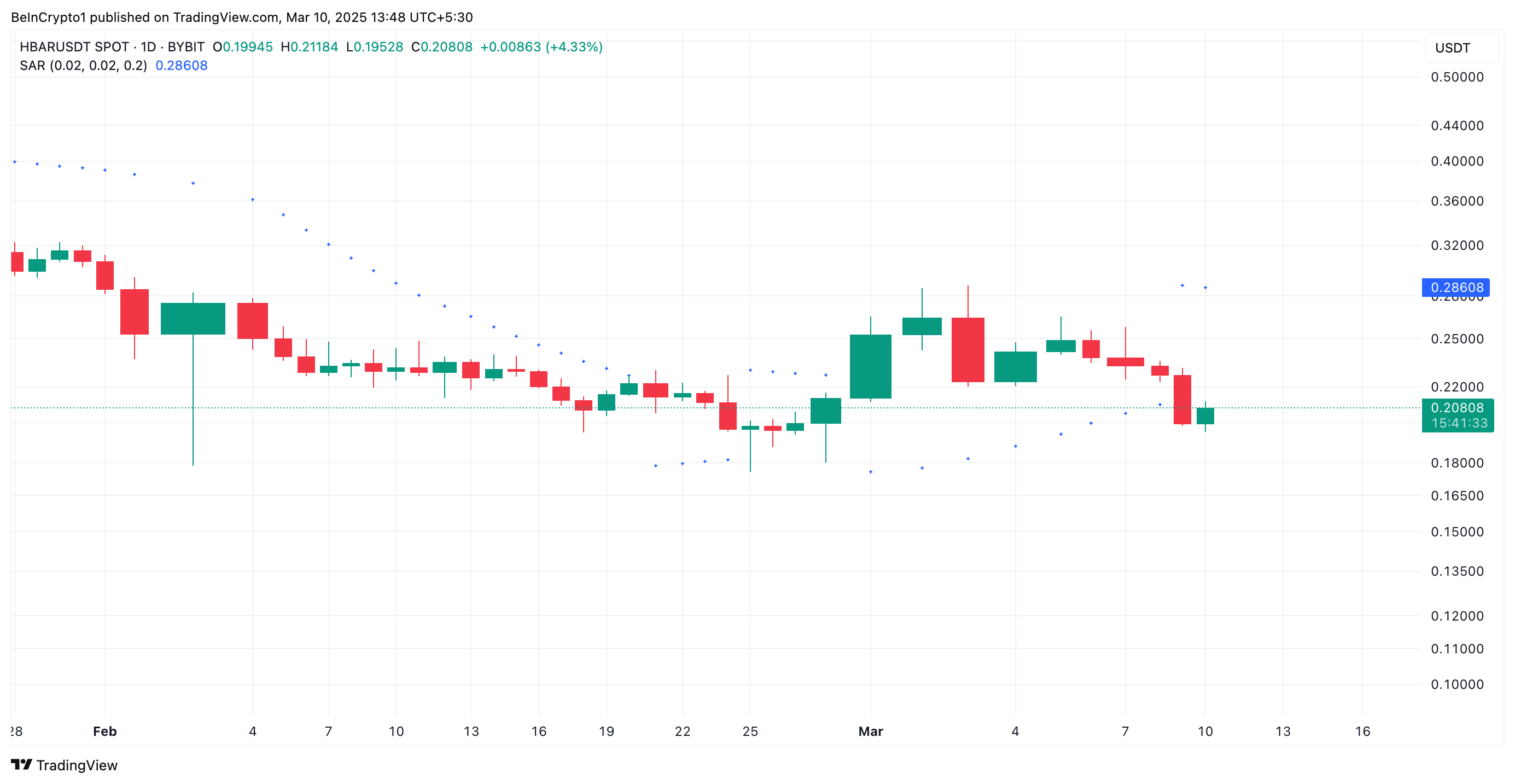

Furthermore, on the HBAR/USD one-day chart, the token trades below the dots of its Parabolic Stop and Reverse (SAR) indicator.

The Parabolic SAR indicator identifies an asset’s potential trend direction and reversals. When its dots are placed below an asset’s price, the market is in a downtrend. It confirms that HBAR’s price is declining, and the trend could continue if buying activity remains low.

HBAR Slips Back Into Bearish Channel

On the daily chart, HBAR has fallen back within the descending parallel channel, which kept its price in a downtrend between January 16 and March 1.

Last week, a surge in market volatility briefly pushed the token above this range, hinting at a potential breakout. However, waning demand has led HBAR to slip back into the bearish channel, signaling renewed downside pressure.

If this continues, HBAR’s price could fall to $0.16.

On the other hand, a resurgence in HBAR demand could drive its price to $0.24.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network is more dangerous than meme coins

In a recent discussion, Bybit CEO Ben Zhou bluntly stated that Pi Network is “more dangerous than meme coins.”

Following Zhou’s remark, the Pi Network community reacted negatively, driving the rating of the Bybit app on the Google Play Store down to 2.7 stars.

Bybit CEO: Pi Network Is More Dangerous Than Meme Coins

Zhou explained his stance on Pi Network and pointed out that the project lacks a fully functional product. Pi Network’s PI coin has not been listed on major exchanges despite earlier listings on platforms like OKX and MEXC.

Moreover, Zhou emphasized that its value largely hinges on community expectations rather than fundamental factors. After years of development, Pi Network still lacks a fully operational blockchain. It cannot be traded publicly, which has raised many questions about the project’s transparency and true potential.

According to Zhou, relying on community trust and FOMO without a tangible product poses a real danger. It creates significant risks if the project fails to achieve key milestones like launching a mainnet or gaining widespread adoption. In the past, Pi Network has repeatedly delayed its mainnet launch and KYC processes. The project just recently announced an open network on February 20, 2025.

Most recently, the project extended its KYC deadline to March 14. However, many Pioneers reported unresolved technical issues. They are calling for more time to resolve them.

Given these issues, Zhou argued that the Pi Network is more dangerous than meme coins. Projects like Dogecoin (DOGE) and Shiba Inu (SHIB), while also community-driven, have established blockchain foundations and are listed on major exchanges. This gives them greater liquidity and clearer market value. Previously, Zhou has also commented that the Pi project was a scam.

Zhou’s remark about the Pi Network has shaken some Pioneers’ confidence in the project and triggered a strong backlash from the Pi Network community. Many argue that the assessment is unfair, as Pi Network is still in its development phase and, in their view, holds significant future potential.

“Bybit CEO Ben Zhou’s statements about Pi Network reveal a deep lack of understanding and a superficial assessment of the crypto ecosystem,” said X user s_nakotomo.

After this statement, the Pi Network community retaliated by downgrading the Bybit app’s rating on the Google Play Store to 2.7 stars. Zhou expressed hope that the Pi Network team would step forward publicly to clarify their project rather than resorting to personal attacks or targeting the exchange.

This isn’t the first time the Pi community has lashed out at exchanges over unfavorable remarks. Previously, they called for leaving 1-star rates for the Binance app after it proposed a vote on Pi but later declined to list it. Capitalizing on this enthusiasm, Binance introduced a feature allowing the community to vote on which tokens should be listed or delisted.

Meanwhile, Pi Network token struggles to hit $2 as bearish indicators dominate.

At press time, the PI coin was trading at $1.43, up less than 1% over the past 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

AI Agent Market Tanks 77%, But a Comeback May Be Near

The artificial intelligence (AI) agents crypto sector is facing continued losses, with its total market capitalization dipping below $5 billion amid a broader decline.

The ongoing slump has raised concerns about the sector’s stability, sparking debate regarding its long-term potential.

AI Agents Face Major Market Slump

This downturn follows a period of rapid growth. The majority of the top AI agent tokens saw substantial gains, peaking between December and January. Nonetheless, that momentum has now reversed.

The decline has affected nearly all AI tokens, with most following a similar trajectory in the crypto market.

“The sector has declined 77.5% from its peak,” Whale Insider posted on X.

According to the latest data, the sector suffered a 6.8% loss in the past 24 hours alone, bringing its total market capitalization down to $4.4 billion. Additionally, all of the top 10 AI tokens have recorded double-digit losses over the past week, signaling a widespread correction.

Further insights from Cookie Fun reveal that the downturn is spread across multiple blockchains. Solana’s (SOL) AI Agents sector has seen a 4.3% decline over the past day. Its market capitalization stood at $1.1 billion.

Similarly, Base’s AI sector has dropped to $736.6 million, marking a 5.8% loss over the same period.

Other blockchain networks hosting AI-related tokens have been hit even harder, with their collective market cap shrinking to $722.2 million, down a staggering 15.2% in the last 24 hours.

The Future of AI Agents: Still a Game-Changer?

While the sector’s sharp decline has raised concerns about its long-term viability, Guy Turner, founder of Coin Bureau, argues that it is still too early to dismiss the potential of AI Agents.

“With the right catalyst, not only could it recover, but it could even surge to new heights,” Turner said.

He believes AI Agents could see renewed interest as AI technology advances, drawing fresh adoption. Turner pointed to retail engagement, regulatory clarity, and institutional investment as key growth drivers.

According to him, support from governments, tech firms, and financial institutions could legitimize the sector, shifting it from speculation to a major market force.

That’s not all. Turner also acknowledged the possibility of a meme coin resurgence acting as a short-term catalyst. While AI Agent tokens are sometimes dismissed as “meme coins with a chatbot attached,” he believes this perception oversimplifies their true potential.

“AI agents are clearly a disruptive force, and we don’t yet know exactly how much value they can provide but you can bet your bottom dollar that tech companies everywhere are going to do whatever it takes to find out,” he added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoShiba Inu Whales Cut Holdings—Is a Bigger Price Drop Ahead?

-

Altcoin19 hours ago

Altcoin19 hours agoPro XRP Lawyer Outlines Reasons To Accumulate Despite Crypto Market Crash

-

Market18 hours ago

Market18 hours ago5 Token Unlocks to Watch for the Second Week of March

-

Altcoin17 hours ago

Altcoin17 hours agoDogecoin Price Eyes Explosive Rally To $2.74 If Support Holds At $0.17

-

Altcoin16 hours ago

Altcoin16 hours agoBinance Founder Criticizes ‘Degens’, Advocates Support For Credible Projects

-

Market24 hours ago

Market24 hours agoFintech Leaders Push for US Federal Regulatory Sandbox

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Liquidation Heatmap Signals Potential Bitcoin Price Swings – What’s Next

-

Market21 hours ago

Market21 hours agoSafeMoon (SFM) Selling Pressure Threatens Previous Gains