Market

Pi Network Mainnet Woes: Pioneers Face Transfer Delays

Pi Network users, known as Pioneers, are expressing growing frustration over their inability to transfer their mined Pi Coins (PI) to the blockchain’s mainnet.

The concerns mount as the network’s Grace Period deadline approaches, leaving users with just four days to complete the necessary migration process.

Pi Network Sets March 14 Deadline for KYC and Mainnet Migration

The Pi Network has set a critical deadline for users to complete their Know Your Customer (KYC) verification and Mainnet migration. According to the announcement, Pioneers must finalize these processes by 8:00 AM UTC on March 14, 2025.

Failing to do so will result in the loss of most of their Pi holdings. However, coins mined within the past six months are exempt from this. The Grace Period, introduced to give users ample time to complete verification, has already been extended multiple times.

As per the Pi team, these extensions were designed to accommodate as many legitimate users as possible, ensuring their balances could be verified and migrated.

“The end of the Grace Period is inevitable to make sure the network can move on in its new phase without large sums of unverified and unclaimed mobile balances,” the blog read.

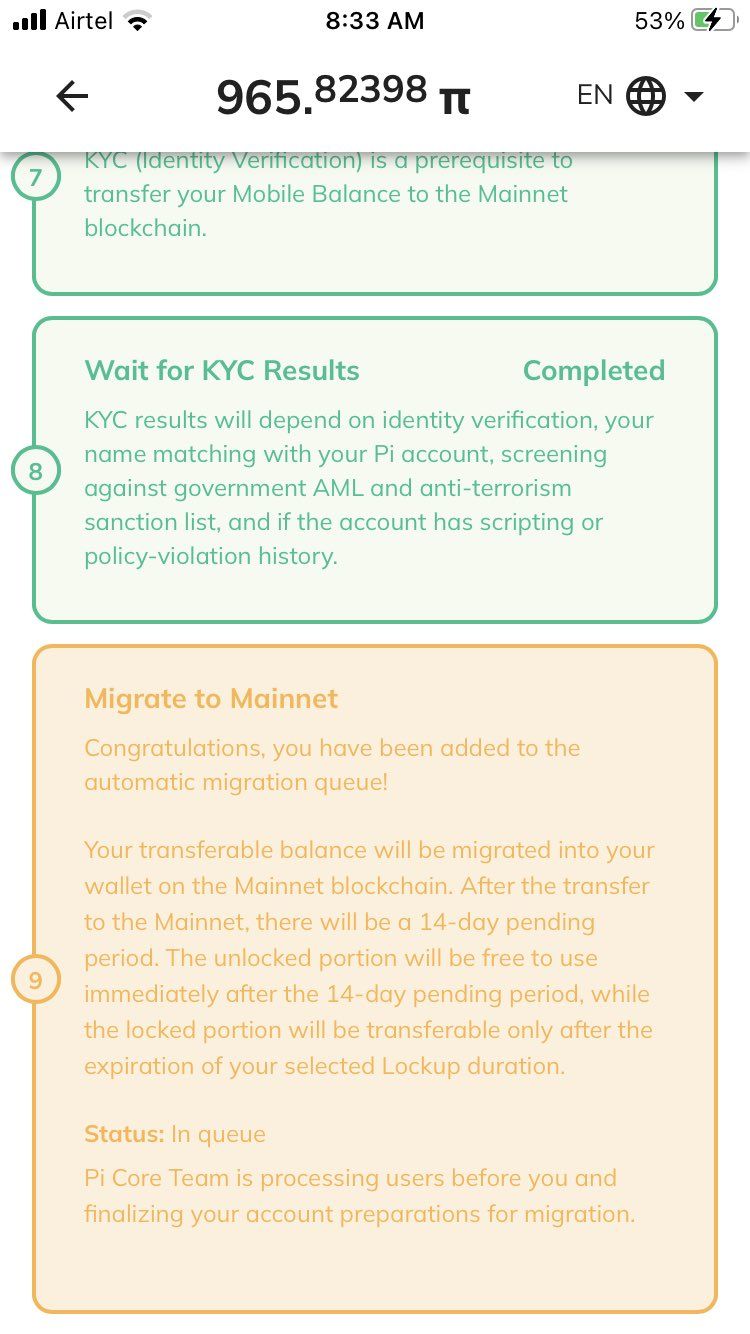

Despite this urgency, numerous Pioneers have reported issues preventing them from transferring their PI to the Mainnet. Among them is Jaro Giesbrecht. In a post on X (formerly Twitter), Giesbrecht claimed he had completed the Mainnet checklist but remained stalled.

“The Pi network has done nothing to help solve this problem. It is a very common problem. Pi has done nothing to help fix this and other problems,” he wrote.

Giesbrecht intensified his criticism, arguing that the deadline should be extended until all Pioneer issues are resolved. He suggested that failing to do so would render the entire process ineffective and raise concerns about the project’s legitimacy.

The issue appears widespread, with other Pioneers echoing similar complaints on X.

“The whole process is a joke. ~80% of my balance shows as unverified, although all of my security circle has completed KYC. No additional actions are listed to be taken in order to clear this up. Furthermore, nobody got back to me on a support ticket I opened weeks ago. What gives?” remarked a user.

Furthermore, users also noted that Step 9 on the Mainnet checklist—”Migrate to Mainnet”—remains unresolved, leaving their Pi balances in limbo.

“What’s the problem with the mainnet migration? Are we to forfeit our mined PI due to an error from your end?” a user posted.

Pi Coin Sees Double-Digit Losses Amid Binance Listing Uncertainty

While the looming deadline worries many, others eagerly await March 14, widely recognized as Pi Day. The occasion has sparked optimism for a potential price surge despite Pi Coin’s recent struggles in the market.

“As long as we don’t break $1.2 support, I’m bullish. PI day is approaching, and hopefully, we will see a pump,” an analyst wrote.

Over the past week, PI has lost 16.3% of its value. Moreover, in the last 24 hours, it suffered a double-digit drop, trading at $1.40 at press time. This represented a decline of 12.2% over the past day alone.

The Pi Network community’s concerns go beyond price movements, as many Pioneers continue to push for Binance to list Pi Coin.

While Binance has not officially announced anything regarding PI, it recently introduced “Vote to List” and “Vote to Delist” features. The system has fueled hopes that the move would make it easier for PI to get listed.

However, these tools do not grant users full authority, as Binance retains the final decision-making power. Therefore, the uncertainty surrounding the decision has led to frustration.

Notably, the community vote concluded on February 27 with an overwhelming 86% majority in favor of listing Pi Coin. Yet, with no official response from Binance, Pioneers have erupted in outrage.

In protest, they flooded the exchange with one-star reviews on Google Play Store. A similar decline in ratings was observed on Bybit. The exchange’s CEO had previously called Pi Network a scam.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

AI Agent Market Tanks 77%, But a Comeback May Be Near

The artificial intelligence (AI) agents crypto sector is facing continued losses, with its total market capitalization dipping below $5 billion amid a broader decline.

The ongoing slump has raised concerns about the sector’s stability, sparking debate regarding its long-term potential.

AI Agents Face Major Market Slump

This downturn follows a period of rapid growth. The majority of the top AI agent tokens saw substantial gains, peaking between December and January. Nonetheless, that momentum has now reversed.

The decline has affected nearly all AI tokens, with most following a similar trajectory in the crypto market.

“The sector has declined 77.5% from its peak,” Whale Insider posted on X.

According to the latest data, the sector suffered a 6.8% loss in the past 24 hours alone, bringing its total market capitalization down to $4.4 billion. Additionally, all of the top 10 AI tokens have recorded double-digit losses over the past week, signaling a widespread correction.

Further insights from Cookie Fun reveal that the downturn is spread across multiple blockchains. Solana’s (SOL) AI Agents sector has seen a 4.3% decline over the past day. Its market capitalization stood at $1.1 billion.

Similarly, Base’s AI sector has dropped to $736.6 million, marking a 5.8% loss over the same period.

Other blockchain networks hosting AI-related tokens have been hit even harder, with their collective market cap shrinking to $722.2 million, down a staggering 15.2% in the last 24 hours.

The Future of AI Agents: Still a Game-Changer?

While the sector’s sharp decline has raised concerns about its long-term viability, Guy Turner, founder of Coin Bureau, argues that it is still too early to dismiss the potential of AI Agents.

“With the right catalyst, not only could it recover, but it could even surge to new heights,” Turner said.

He believes AI Agents could see renewed interest as AI technology advances, drawing fresh adoption. Turner pointed to retail engagement, regulatory clarity, and institutional investment as key growth drivers.

According to him, support from governments, tech firms, and financial institutions could legitimize the sector, shifting it from speculation to a major market force.

That’s not all. Turner also acknowledged the possibility of a meme coin resurgence acting as a short-term catalyst. While AI Agent tokens are sometimes dismissed as “meme coins with a chatbot attached,” he believes this perception oversimplifies their true potential.

“AI agents are clearly a disruptive force, and we don’t yet know exactly how much value they can provide but you can bet your bottom dollar that tech companies everywhere are going to do whatever it takes to find out,” he added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HUD Explores Blockchain for Grants, Sparking Controversy

The US Department of Housing and Urban Development (HUD) manages billions of dollars in aid and insures over a trillion dollars in mortgages. Now, it is considering using blockchain to track grant recipients’ spending.

The agency may also explore stablecoins as a financial tool within its system. However, this proposal has sparked intense debate, especially as HUD faces challenges in financial management efficiency.

HUD’s Crypto Consideration Raises Concerns of a 2008-2009 Crisis Repeat

According to ProPublica, HUD is looking to leverage blockchain—the core technology behind cryptocurrencies—to improve oversight of grant funds.

A HUD official stated that the idea of using blockchain and stablecoins is being driven by Irving Dennis, the agency’s Deputy Chief Financial Officer. Dennis, who previously worked as a partner at the global consulting firm EY, believes the technology could enhance transparency and efficiency in grant monitoring. This area has historically been complex and prone to waste.

Additionally, ProPublica reported that HUD officials held at least two meetings last month to discuss the blockchain proposal. Staff from the Office of the Chief Financial Officer (CFO) and the Office of Community Planning and Development (CPD) attended these meetings.

During the discussions, CPD explored a “proof of concept” pilot project. In this project, blockchain would track funding for a CPD grant recipient.

“We might learn something from this, especially if the federal government is moving toward stablecoin adoption in the future,” one official who attended the meeting said.

However, ProPublica quoted a HUD employee expressing concerns: “People are trying to introduce another unregulated security into the housing market as if 2008 and 2009 never happened.” Another official compared cryptocurrency to “Monopoly money,” implying it could become worthless.

D.O.G.E. Highlights Internal Financial Issues at HUD

Recently, the Department of Government Efficiency (D.O.G.E.) shed light on internal financial problems at HUD, raising doubts about the agency’s ability to manage new technology. D.O.G.E. revealed that HUD had just completed a software license audit, uncovering severe waste.

“HUD completed the same audit. Initial findings on paid software licenses: 35,855 ServiceNow licenses across three products; only using 84. 11,020 Acrobat licenses with zero users. 1,776 Cognos licenses; only using 325. 800 WestLaw Classic licenses; only using 216. 10,000 Java licenses; only using 400. All are being fixed,” D.O.G.E. stated.

HUD’s official press account responded to D.O.G.E.’s findings, saying the agency is reviewing every dollar spent and working closely with D.O.G.E. to address taxpayer money waste.

As of this writing, HUD’s official X account has not made any announcements regarding blockchain trial discussions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Canada’s New PM Carney Is a Bitcoin Skeptic—What It Means

Mark Carney, the former governor of both the Bank of England and the Bank of Canada, is poised to become Canada’s next prime minister. However, he has long been skeptical and strongly critical of Bitcoin (BTC).

On March 9, Carney secured an overwhelming victory with 85.9% of the vote. He is expected to assume office in the coming days.

Mark Carney’s Views on Bitcoin

Carney will become Canada’s next Prime Minister, replacing Justin Trudeau, who resigned in January 2025 after nearly a decade in power.

Although Carney has never held a seat in Parliament, his experience managing economic crises and international reputation have garnered significant support within the Liberal Party.

However, Carney’s rise to Canada’s new Prime Minister position does not appear to be a positive signal for the crypto market. For years, he has expressed deep skepticism and sharp criticism of Bitcoin (BTC) and other decentralized cryptocurrencies. He formed his stance during his tenure as Governor of the Bank of England and has reiterated it in the years since.

“Canada’s new Prime Minister Mark Carney, a known critic of Bitcoin, previously labeled it [BTC] as having serious deficiencies,” said X user EdGeraldX.

Specifically, in a 2018 speech on the Future of Money, Carney assessed that Bitcoin has “serious deficiencies” due to its fixed supply cap, which leads to price instability.

“The fixed supply of Bitcoin has sparked a global speculative frenzy, encouraging the proliferation of new cryptocurrencies,” he stated.

He likened Bitcoin to a “criminal act of monetary amnesia,” arguing that recreating a digital gold standard was a historical mistake. Carney believes Bitcoin and other cryptocurrencies are “poor short-term stores of value,” failing to meet the basic criteria of money, such as stability and usability in transactions.

In 2018, he warned that Bitcoin threatened financial stability if left unregulated, calling for strict oversight to curb illegal activities like money laundering and terrorism financing.

Carney Prefers CBDCs Instead

In contrast, Carney enthusiastically advocates for Central Bank Digital Currencies (CBDCs) while opposing Bitcoin. This view is somewhat similar to that of Indian regulators. He argues that CBDCs could expand banking access for individuals and businesses while enabling central banks to combat terrorism and economic crime.

“Carney calls Bitcoin’s fixed supply a crime, supports CBDCs, and now controls policy for a $1.9 trillion economy,” shared an X user.

Carney’s views on Bitcoin and cryptocurrencies align with and are arguably more rigid than those of his predecessor. In September 2022, Trudeau hit out at Pierre Poilievre, a pro-crypto politician chosen to lead Canada’s Conservative Party.

Carney assumes office as Canada faces a trade war sparked by US President Donald Trump’s tariff policies. The US has officially imposed a 25% tariff on Canada after suspending it in early February.

Carney’s anti-Bitcoin stance may lead to stricter regulations to control cryptocurrencies. He might focus on anti-money laundering measures and investor protection, similar to the approach he advocated at the Bank of England. This could affect the ETFs operating in Canada like the BlackRock’s Bitcoin ETF or 3iQ’s Solana ETF.

Additionally, Canada may soon develop a digital Canadian dollar, potentially diminishing the role of Bitcoin and altcoins in the economy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin: Analyzing Divergence In Investor Behavior – Who’s Buying And Selling BTC?

-

Market18 hours ago

Market18 hours agoShiba Inu Whales Cut Holdings—Is a Bigger Price Drop Ahead?

-

Market23 hours ago

Market23 hours agoXRP Price Chart Signals Trouble – Is A Drop To $1.20 Possible?

-

Market22 hours ago

Market22 hours agoFintech Leaders Push for US Federal Regulatory Sandbox

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Liquidation Heatmap Signals Potential Bitcoin Price Swings – What’s Next

-

Market19 hours ago

Market19 hours agoSafeMoon (SFM) Selling Pressure Threatens Previous Gains

-

Altcoin17 hours ago

Altcoin17 hours agoPro XRP Lawyer Outlines Reasons To Accumulate Despite Crypto Market Crash

-

Market16 hours ago

Market16 hours ago5 Token Unlocks to Watch for the Second Week of March