Market

Bitcoin Price Dives Once More—Is a Deeper Correction Underway?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

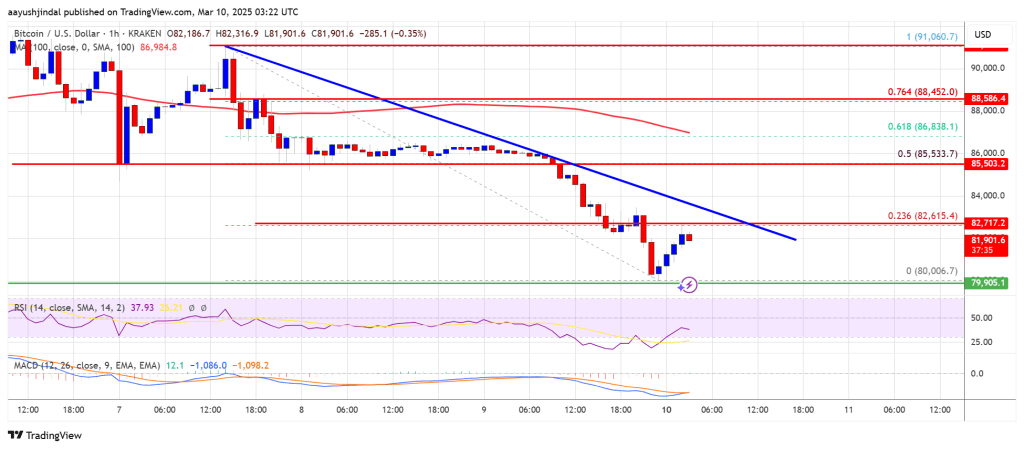

Bitcoin price started a fresh decline from the $92,000 zone. BTC is back below $85,500 and might continue to move down below $80,000.

- Bitcoin started a fresh decline below the $85,000 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There is a short-term bearish trend line forming with resistance at $83,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another decline if it fails to clear the $80,000 resistance zone.

Bitcoin Price Faces Resistance

Bitcoin price started a fresh decline below the $88,000 level. BTC traded below the $86,000 and $85,000 support levels. Finally, the price tested the $80,000 support zone.

A low was formed at $80,006 and the price recently started a recovery wave. There was a move above the $80,500 and $81,200 resistance levels. The bulls pushed the price toward the 23.6% Fib retracement level of the downward move from the $91,060 swing high to the $80,006 low.

Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $82,700 level. The first key resistance is near the $83,000 level.

There is also a short-term bearish trend line forming with resistance at $83,200 on the hourly chart of the BTC/USD pair. The next key resistance could be $85,000. It is near the 50% Fib retracement level of the downward move from the $91,060 swing high to the $80,006 low.

A close above the $85,000 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $90,000 level or even $96,200.

Another Decline In BTC?

If Bitcoin fails to rise above the $83,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $81,000 level. The first major support is near the $80,200 level.

The next support is now near the $80,000 zone. Any more losses might send the price toward the $78,000 support in the near term. The main support sits at $75,000.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $80,000, followed by $78,000.

Major Resistance Levels – $83,000 and $85,000.

Market

HUD Explores Blockchain for Grants, Sparking Controversy

The US Department of Housing and Urban Development (HUD) manages billions of dollars in aid and insures over a trillion dollars in mortgages. Now, it is considering using blockchain to track grant recipients’ spending.

The agency may also explore stablecoins as a financial tool within its system. However, this proposal has sparked intense debate, especially as HUD faces challenges in financial management efficiency.

HUD’s Crypto Consideration Raises Concerns of a 2008-2009 Crisis Repeat

According to ProPublica, HUD is looking to leverage blockchain—the core technology behind cryptocurrencies—to improve oversight of grant funds.

A HUD official stated that the idea of using blockchain and stablecoins is being driven by Irving Dennis, the agency’s Deputy Chief Financial Officer. Dennis, who previously worked as a partner at the global consulting firm EY, believes the technology could enhance transparency and efficiency in grant monitoring. This area has historically been complex and prone to waste.

Additionally, ProPublica reported that HUD officials held at least two meetings last month to discuss the blockchain proposal. Staff from the Office of the Chief Financial Officer (CFO) and the Office of Community Planning and Development (CPD) attended these meetings.

During the discussions, CPD explored a “proof of concept” pilot project. In this project, blockchain would track funding for a CPD grant recipient.

“We might learn something from this, especially if the federal government is moving toward stablecoin adoption in the future,” one official who attended the meeting said.

However, ProPublica quoted a HUD employee expressing concerns: “People are trying to introduce another unregulated security into the housing market as if 2008 and 2009 never happened.” Another official compared cryptocurrency to “Monopoly money,” implying it could become worthless.

D.O.G.E. Highlights Internal Financial Issues at HUD

Recently, the Department of Government Efficiency (D.O.G.E.) shed light on internal financial problems at HUD, raising doubts about the agency’s ability to manage new technology. D.O.G.E. revealed that HUD had just completed a software license audit, uncovering severe waste.

“HUD completed the same audit. Initial findings on paid software licenses: 35,855 ServiceNow licenses across three products; only using 84. 11,020 Acrobat licenses with zero users. 1,776 Cognos licenses; only using 325. 800 WestLaw Classic licenses; only using 216. 10,000 Java licenses; only using 400. All are being fixed,” D.O.G.E. stated.

HUD’s official press account responded to D.O.G.E.’s findings, saying the agency is reviewing every dollar spent and working closely with D.O.G.E. to address taxpayer money waste.

As of this writing, HUD’s official X account has not made any announcements regarding blockchain trial discussions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Canada’s New PM Carney Is a Bitcoin Skeptic—What It Means

Mark Carney, the former governor of both the Bank of England and the Bank of Canada, is poised to become Canada’s next prime minister. However, he has long been skeptical and strongly critical of Bitcoin (BTC).

On March 9, Carney secured an overwhelming victory with 85.9% of the vote. He is expected to assume office in the coming days.

Mark Carney’s Views on Bitcoin

Carney will become Canada’s next Prime Minister, replacing Justin Trudeau, who resigned in January 2025 after nearly a decade in power.

Although Carney has never held a seat in Parliament, his experience managing economic crises and international reputation have garnered significant support within the Liberal Party.

However, Carney’s rise to Canada’s new Prime Minister position does not appear to be a positive signal for the crypto market. For years, he has expressed deep skepticism and sharp criticism of Bitcoin (BTC) and other decentralized cryptocurrencies. He formed his stance during his tenure as Governor of the Bank of England and has reiterated it in the years since.

“Canada’s new Prime Minister Mark Carney, a known critic of Bitcoin, previously labeled it [BTC] as having serious deficiencies,” said X user EdGeraldX.

Specifically, in a 2018 speech on the Future of Money, Carney assessed that Bitcoin has “serious deficiencies” due to its fixed supply cap, which leads to price instability.

“The fixed supply of Bitcoin has sparked a global speculative frenzy, encouraging the proliferation of new cryptocurrencies,” he stated.

He likened Bitcoin to a “criminal act of monetary amnesia,” arguing that recreating a digital gold standard was a historical mistake. Carney believes Bitcoin and other cryptocurrencies are “poor short-term stores of value,” failing to meet the basic criteria of money, such as stability and usability in transactions.

In 2018, he warned that Bitcoin threatened financial stability if left unregulated, calling for strict oversight to curb illegal activities like money laundering and terrorism financing.

Carney Prefers CBDCs Instead

In contrast, Carney enthusiastically advocates for Central Bank Digital Currencies (CBDCs) while opposing Bitcoin. This view is somewhat similar to that of Indian regulators. He argues that CBDCs could expand banking access for individuals and businesses while enabling central banks to combat terrorism and economic crime.

“Carney calls Bitcoin’s fixed supply a crime, supports CBDCs, and now controls policy for a $1.9 trillion economy,” shared an X user.

Carney’s views on Bitcoin and cryptocurrencies align with and are arguably more rigid than those of his predecessor. In September 2022, Trudeau hit out at Pierre Poilievre, a pro-crypto politician chosen to lead Canada’s Conservative Party.

Carney assumes office as Canada faces a trade war sparked by US President Donald Trump’s tariff policies. The US has officially imposed a 25% tariff on Canada after suspending it in early February.

Carney’s anti-Bitcoin stance may lead to stricter regulations to control cryptocurrencies. He might focus on anti-money laundering measures and investor protection, similar to the approach he advocated at the Bank of England. This could affect the ETFs operating in Canada like the BlackRock’s Bitcoin ETF or 3iQ’s Solana ETF.

Additionally, Canada may soon develop a digital Canadian dollar, potentially diminishing the role of Bitcoin and altcoins in the economy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP’s Supply in Profit Shrinks as Bearish Sentiment Rises

XRP has maintained a downtrend since reaching an all-time high of $3.40 on January 16. It currently trades at $2.18, noting a 35% price drop over the past two months.

The double-digit dip has led to a decrease in the amount of XRP tokens held in profit. On-chain data shows that the bearish sentiment against the altcoin is climbing, hinting at an extended decline.

XRP Sees Drop in New Demand, Signaling Market Interest Slowdown

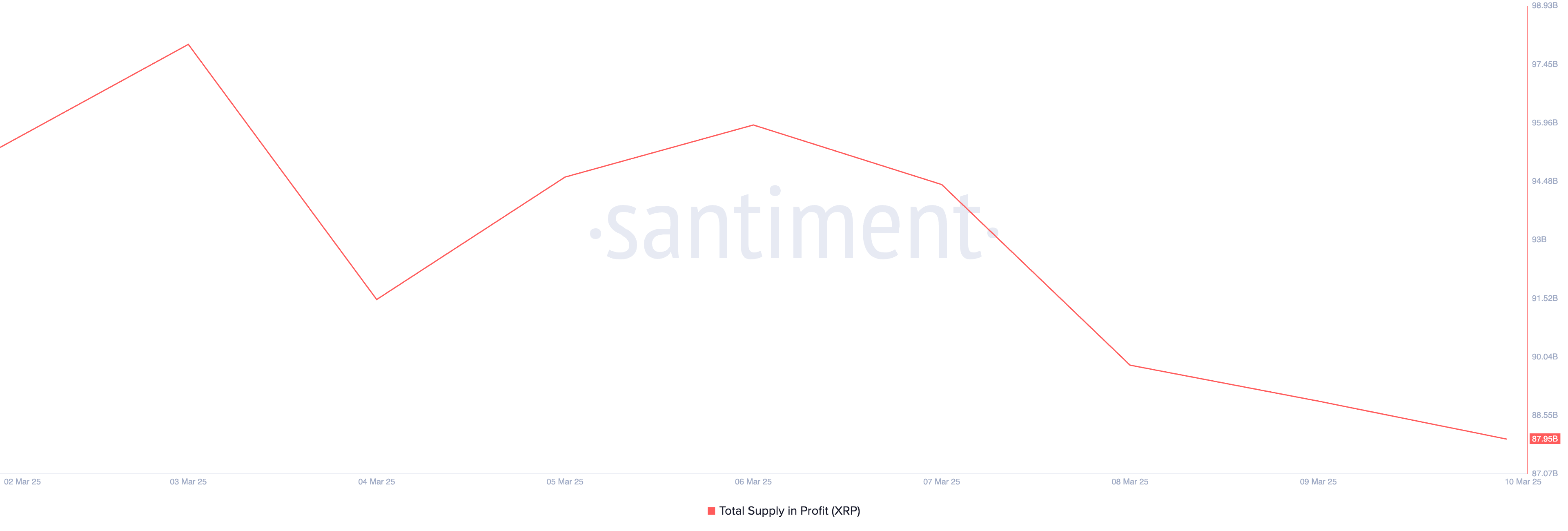

As XRP’s price falls, its total supply in profit has also reduced. According to Santiment, this has shrunk by 6.39 billion over the past week to fall to its year-to-date low.

As of this writing, 87.95 billion tokens out of a total supply of 99.98 billion are held at a profit. This signals that some investors are now holding XRP at a loss, reflecting increased selling pressure and weakening market sentiment.

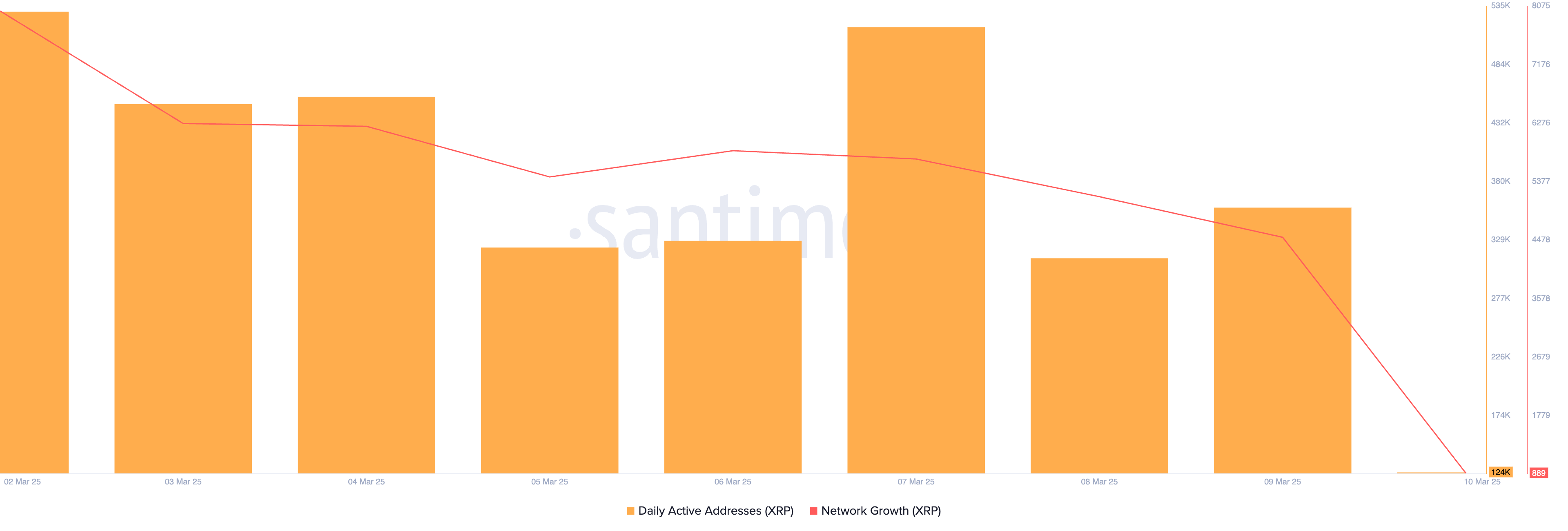

Moreover, on-chain data also shows a slump in new demand, with daily fresh purchases of XRP seeing a notable drop this month. Per Santiment, only 4,516 new wallet addresses were created on Sunday to trade XRP.

This represented the lowest daily count of new XRP demand since the beginning of the year.

When an asset sees a drop in new demand, it means fewer investors are buying it. As observed with XRP, this has reduced trading activity and weakened price support in its spot market. It signals waning market interest in the altcoin and can contribute to further price declines if selling pressure remains high.

XRP Faces Selling Pressure: Will Bulls Break the Downtrend?

On the daily chart, XRP has traded below a descending trend line since reaching its all-time high, reflecting the downward trend.

This bearish pattern is formed when an asset’s price consistently creates lower highs over time. It suggests that sellers are in control, and unless the price breaks above the trend line, further declines are likely.

XRP trades at $2.17 at press time, significantly below this descending trendline. With a growing bearish bias, the token’s price might fall further from this trendline. In that scenario, XRP’s value could drop below $2 to $1.47.

However, if buying pressure gains momentum, XRP could break above its descending trendline and climb to $2.93.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market17 hours ago

Market17 hours agoShiba Inu Whales Cut Holdings—Is a Bigger Price Drop Ahead?

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin: Analyzing Divergence In Investor Behavior – Who’s Buying And Selling BTC?

-

Market21 hours ago

Market21 hours agoFintech Leaders Push for US Federal Regulatory Sandbox

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Liquidation Heatmap Signals Potential Bitcoin Price Swings – What’s Next

-

Market18 hours ago

Market18 hours agoSafeMoon (SFM) Selling Pressure Threatens Previous Gains

-

Altcoin16 hours ago

Altcoin16 hours agoPro XRP Lawyer Outlines Reasons To Accumulate Despite Crypto Market Crash

-

Market15 hours ago

Market15 hours ago5 Token Unlocks to Watch for the Second Week of March

-

Market23 hours ago

Market23 hours agoMichael Saylor Shares $81 Trillion Bitcoin Reserve Plan for Trump