Market

5 Token Unlocks to Watch for the Second Week of March

Token unlocks are key events in the crypto market, releasing previously restricted tokens into circulation. These unlocks can impact liquidity, price action, and overall market sentiment.

Below are the top five token unlocks to watch this week.

1. Xai (XAI)

- Unlock Date: March 9

- Number of Tokens to be Unlocked: 35.89 million XAI (1.44% of Max Supply)

- Current Circulating Supply: 1.06 billion XAI

Xai is a Layer 3 gaming blockchain that leverages Ethereum’s security (Layer 1) and Arbitrum’s scalability (Layer 2). It allows gamers to seamlessly own, trade, and utilize in-game assets across multiple titles.

On March 9, the Xai network will unlock 35.89 million XAI tokens, valued at approximately $2.62 million. The network will allocate the largest portion of this unlock, around 17.33 million XAI tokens, to investors. Also, 11.9 million tokens will be for the team.

Meanwhile, the rest will be allocated to the Xai ecosystem and reserve.

With gaming-focused blockchains gaining momentum, this unlock could influence Xai’s liquidity and trading dynamics.

2. Moca Network (MOCA)

- Unlock Date: March 11

- Number of Tokens to be Unlocked: 178.51 million MOCA (2.01% of Max Supply)

- Current Circulating Supply: 1.91 billion MOCA

Moca Network is a digital identity infrastructure enabling seamless asset management across Web2 and Web3 ecosystems. It powers DeFi and consumer services, with MOCA as its utility token.

The upcoming unlock of 178.51 million MOCA tokens (valued at $17.36 million) represents 9.34% of its market cap. The largest distribution, around 93.32 million MOCA, will be allocated for network incentives.

Most importantly, the network will allocate 37.04 million tokens for liquidity and 33.33 million for the ecosystem. The network will reserve the rest for operational expenses.

With a significant portion going towards network incentives and liquidity, this unlock may impact MOCA’s supply dynamics.

3. Delysium (AGI)

- Unlock Date: March 11

- Number of Tokens to be Unlocked: 66.48 million AGI (2.22% of Max Supply)

- Current Circulating Supply: 1.53 billion AGI

Delysium is a blockchain-powered AI platform designed to create a virtual world where AI and humans coexist. Its native token, AGI, fuels ecosystem growth.

On March 11, the platform will unlock 66.48 million AGI tokens (valued at $3.78 million). Delysium will allocate 34.37 million AGI for the treasure, 24 million for the team, and the rest for strategic sales.

4. Cheelee (CHEEL)

- Unlock Date: March 10

- Number of Tokens to be Unlocked: 2.67 million CHEEL (0.27% of Max Supply)

- Current Circulating Supply: 56.8 million CHEEL

Cheelee is a blockchain-based short video platform that incorporates GameFi elements, rewarding users for engaging with content. The platform uses its native token, CHEEL, for governance, NFT upgrades, and in-app transactions.

The upcoming unlock consists of 2.67 million CHEEL tokens (valued at $20.62 million). The network will allocate the majority of these tokens (2.64 million) for liquidity, and only a small portion will be distributed as community airdrops.

As liquidity allocations tend to ease trading conditions, this unlock may provide additional market depth for CHEEL.

5. Xave (XAV)

- Unlock Date: March 11

- Number of Tokens to be Unlocked: 279.18 million XAV (2.79% of Max Supply)

- Current Circulating Supply: 201,950 XAV (self-reported)

Xave is a DeFi platform focused on decentralized foreign exchange (FX) markets. It enhances stablecoin liquidity through an automated market maker (AMM) model.

On March 11, the network will unlock 279.18 million XAV tokens. Xave will largely focus distribution to the team, investors, and treasury.

Also, the Xave protocol will add around 4.06 million tokens to DEX and CEX liquidity and another 6.19 million as rewards for liquidity providers.

With a large unlock relative to the reported circulating supply, XAV’s market performance may experience heightened volatility.

Overall, this week’s unlocks will introduce over $44 million worth of new tokens into the market. Monitoring these releases can help traders and investors assess potential price fluctuations and liquidity shifts.

The post 5 Token Unlocks to Watch for the Second Week of March appeared first on BeInCrypto.

Market

US Economic Data Looms, Bitcoin Braces for Volatility

Crypto markets brace for volatile days ahead, with key US economic data due for release this week, starting Tuesday. These macroeconomic events could affect the portfolios of Bitcoin (BTC) holders, making it imperative for investors to adjust their trading strategies.

Economic developments are progressively influencing Bitcoin market sentiment, increasing the likelihood of volatility this week.

US Economic Data With Crypto Implications This Week

The following macroeconomic data points could influence Bitcoin sentiment this week.

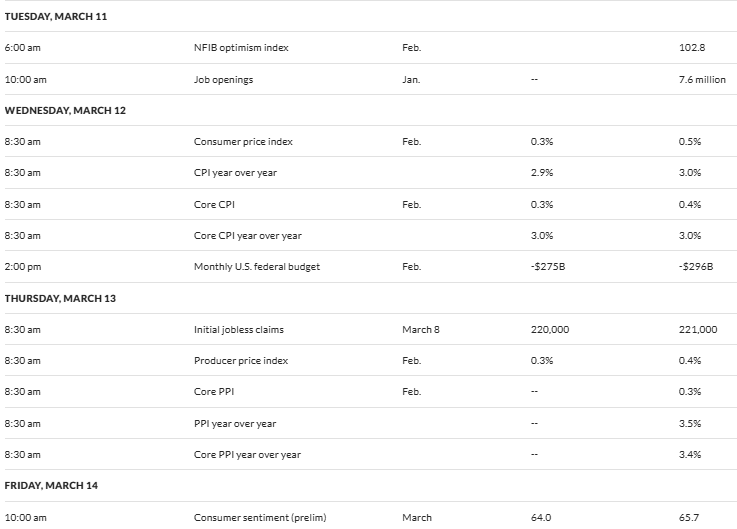

JOLTS

Starting the list of US economic data with crypto implications this week is the release of US job openings data on Tuesday, March 11. Commonly referred to as the Job Openings and Labor Turnover Survey (JOLTS), this data point could significantly sway Bitcoin sentiment by providing insights into the health of the labor market and broader economy.

If the data indicates a strong labor market with high job openings—say, exceeding the previous 7.6 million mark—it might signal persistent economic strength. This could reduce expectations for imminent Federal Reserve (Fed) rate cuts.

Historically, a strong labor market can bolster the US dollar and traditional assets like stocks, drawing investors away from riskier assets like Bitcoin. This could dampen Bitcoin sentiment, as investors might perceive less need for a decentralized hedge against monetary easing.

Conversely, if job openings come in lower than anticipated, it could heighten recession fears or signal a cooling economy. Such an outcome would prompt speculation of Fed intervention through rate cuts. This scenario often boosts Bitcoin’s appeal as a “digital gold” or haven, potentially driving positive sentiment and price momentum among crypto enthusiasts.

CPI

The US CPI (Consumer Price Index) data, set for release on Wednesday, March 12, could also sway Bitcoin sentiment. This data will signal inflation trends that influence Fed policy.

A higher-than-expected CPI forecasted at 2.9% compared to the previous 3.0% might suggest persistent inflation. This would reduce hopes for rate cuts and strengthen the dollar, dampening Bitcoin’s appeal as a hedge. Such an outcome could lower sentiment and prices as investors favor traditional assets.

On the other hand, a softer CPI could fuel expectations of looser monetary policy, weakening the dollar and boosting Bitcoin as a risk asset. This would lift sentiment among crypto traders.

“CPI report on Wednesday – Core Inflation number going to come in cool – potentially lower than most expect. BTC will pump,” one user on X stated.

Initial Jobless Claims

The US Initial Jobless Claims data, due Thursday, March 13, could also sway Bitcoin sentiment by reflecting labor market strength or weakness.

If claims drop below the expected 220,000 (following last week’s 221,000), it might signal a strong economy. This could strengthen the dollar and shift investors’ focus to traditional assets like stocks. Such an outcome would dampen Bitcoin’s appeal as a risk asset, lowering sentiment.

Meanwhile, higher-than-expected claims might indicate economic softening, raising hopes for Fed rate cuts. This often boosts Bitcoin as a hedge against fiat weakness, lifting sentiment and prices.

PPI

The US PPI (Producer Price Index) data, scheduled for release on Thursday, March 13, could impact Bitcoin sentiment by revealing wholesale inflation trends.

A higher-than-expected PPI, forecasted at 0.3% month-over-month, might indicate rising producer costs, potentially signaling persistent inflation. This could reduce expectations for Fed rate cuts, strengthening the dollar and pressuring Bitcoin as a risk asset, thus dampening sentiment.

However, a lower PPI could ease inflation fears, boost rate-cut hopes, and enhance Bitcoin’s appeal as an inflation hedge, lifting sentiment.

“A huge week for economic data, with JOLTS, CPI & PPI. We could either see some strength and markets claw back some of the losses of the last couple of weeks, or confirmation there are underlying issues and markets continue to sell off,” market analyst Mark Cullen indicated.

Consumer Sentiment

The US Consumer Sentiment Index, due for release on Friday from the University of Michigan, could significantly influence Bitcoin sentiment by reflecting public confidence in the economy.

A strong reading, potentially above the anticipated 64.0 (based on recent trends), might suggest optimism about economic stability, bolstering traditional markets and the dollar. This could dampen Bitcoin’s allure as a hedge against uncertainty, leading to bearish sentiment among crypto investors, as funds might flow toward equities.

Conversely, a weaker-than-expected figure could signal economic unease, enhancing Bitcoin’s appeal as a decentralized asset amid fears of inflation or recession. This would boost bullish sentiment and potentially its price. Given Bitcoin’s sensitivity to macroeconomic cues, this data could sway trader perceptions sharply.

“The University of Michigan’s consumer sentiment survey can tell us how optimistic people feel about the economy. This can impact consumer spending, which is a major driver of economic growth,” Pennybois Trades Alert highlighted in a post.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Mainnet Woes: Pioneers Face Transfer Delays

Pi Network users, known as Pioneers, are expressing growing frustration over their inability to transfer their mined Pi Coins (PI) to the blockchain’s mainnet.

The concerns mount as the network’s Grace Period deadline approaches, leaving users with just four days to complete the necessary migration process.

Pi Network Sets March 14 Deadline for KYC and Mainnet Migration

The Pi Network has set a critical deadline for users to complete their Know Your Customer (KYC) verification and Mainnet migration. According to the announcement, Pioneers must finalize these processes by 8:00 AM UTC on March 14, 2025.

Failing to do so will result in the loss of most of their Pi holdings. However, coins mined within the past six months are exempt from this. The Grace Period, introduced to give users ample time to complete verification, has already been extended multiple times.

As per the Pi team, these extensions were designed to accommodate as many legitimate users as possible, ensuring their balances could be verified and migrated.

“The end of the Grace Period is inevitable to make sure the network can move on in its new phase without large sums of unverified and unclaimed mobile balances,” the blog read.

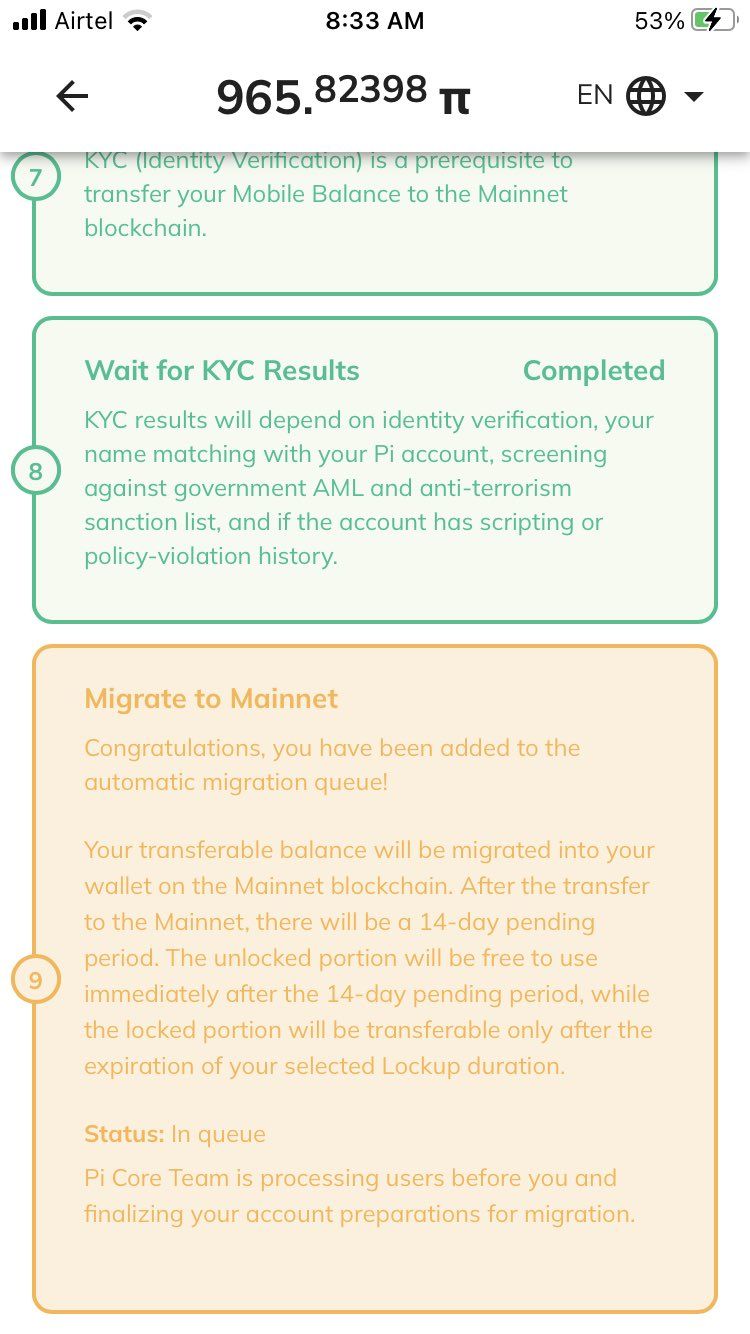

Despite this urgency, numerous Pioneers have reported issues preventing them from transferring their PI to the Mainnet. Among them is Jaro Giesbrecht. In a post on X (formerly Twitter), Giesbrecht claimed he had completed the Mainnet checklist but remained stalled.

“The Pi network has done nothing to help solve this problem. It is a very common problem. Pi has done nothing to help fix this and other problems,” he wrote.

Giesbrecht intensified his criticism, arguing that the deadline should be extended until all Pioneer issues are resolved. He suggested that failing to do so would render the entire process ineffective and raise concerns about the project’s legitimacy.

The issue appears widespread, with other Pioneers echoing similar complaints on X.

“The whole process is a joke. ~80% of my balance shows as unverified, although all of my security circle has completed KYC. No additional actions are listed to be taken in order to clear this up. Furthermore, nobody got back to me on a support ticket I opened weeks ago. What gives?” remarked a user.

Furthermore, users also noted that Step 9 on the Mainnet checklist—”Migrate to Mainnet”—remains unresolved, leaving their Pi balances in limbo.

“What’s the problem with the mainnet migration? Are we to forfeit our mined PI due to an error from your end?” a user posted.

Pi Coin Sees Double-Digit Losses Amid Binance Listing Uncertainty

While the looming deadline worries many, others eagerly await March 14, widely recognized as Pi Day. The occasion has sparked optimism for a potential price surge despite Pi Coin’s recent struggles in the market.

“As long as we don’t break $1.2 support, I’m bullish. PI day is approaching, and hopefully, we will see a pump,” an analyst wrote.

Over the past week, PI has lost 16.3% of its value. Moreover, in the last 24 hours, it suffered a double-digit drop, trading at $1.40 at press time. This represented a decline of 12.2% over the past day alone.

The Pi Network community’s concerns go beyond price movements, as many Pioneers continue to push for Binance to list Pi Coin.

While Binance has not officially announced anything regarding PI, it recently introduced “Vote to List” and “Vote to Delist” features. The system has fueled hopes that the move would make it easier for PI to get listed.

However, these tools do not grant users full authority, as Binance retains the final decision-making power. Therefore, the uncertainty surrounding the decision has led to frustration.

Notably, the community vote concluded on February 27 with an overwhelming 86% majority in favor of listing Pi Coin. Yet, with no official response from Binance, Pioneers have erupted in outrage.

In protest, they flooded the exchange with one-star reviews on Google Play Store. A similar decline in ratings was observed on Bybit. The exchange’s CEO had previously called Pi Network a scam.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Dives Once More—Is a Deeper Correction Underway?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

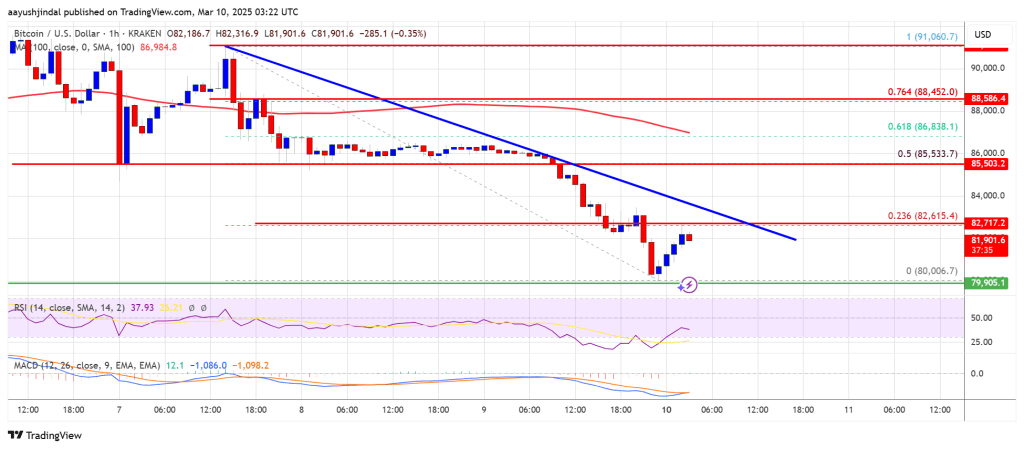

Bitcoin price started a fresh decline from the $92,000 zone. BTC is back below $85,500 and might continue to move down below $80,000.

- Bitcoin started a fresh decline below the $85,000 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There is a short-term bearish trend line forming with resistance at $83,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another decline if it fails to clear the $80,000 resistance zone.

Bitcoin Price Faces Resistance

Bitcoin price started a fresh decline below the $88,000 level. BTC traded below the $86,000 and $85,000 support levels. Finally, the price tested the $80,000 support zone.

A low was formed at $80,006 and the price recently started a recovery wave. There was a move above the $80,500 and $81,200 resistance levels. The bulls pushed the price toward the 23.6% Fib retracement level of the downward move from the $91,060 swing high to the $80,006 low.

Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $82,700 level. The first key resistance is near the $83,000 level.

There is also a short-term bearish trend line forming with resistance at $83,200 on the hourly chart of the BTC/USD pair. The next key resistance could be $85,000. It is near the 50% Fib retracement level of the downward move from the $91,060 swing high to the $80,006 low.

A close above the $85,000 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $90,000 level or even $96,200.

Another Decline In BTC?

If Bitcoin fails to rise above the $83,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $81,000 level. The first major support is near the $80,200 level.

The next support is now near the $80,000 zone. Any more losses might send the price toward the $78,000 support in the near term. The main support sits at $75,000.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $80,000, followed by $78,000.

Major Resistance Levels – $83,000 and $85,000.

-

Altcoin24 hours ago

Altcoin24 hours agoStablecoins Could Be Key To US Dollar Supremacy—Treasury Secretary

-

Market21 hours ago

Market21 hours ago1inch Hacker Returns $5 Million Stolen Funds After Bug Bounty

-

Market13 hours ago

Market13 hours agoShiba Inu Whales Cut Holdings—Is a Bigger Price Drop Ahead?

-

Altcoin21 hours ago

Altcoin21 hours agoExpert Predicts XRP Price Can Reach $280, Here’s When

-

Bitcoin20 hours ago

Bitcoin20 hours agoUS Bitcoin ETFs Record $800 Million Net Outflow In Past Week — Details

-

Bitcoin18 hours ago

Bitcoin18 hours agoBitcoin: Analyzing Divergence In Investor Behavior – Who’s Buying And Selling BTC?

-

Market17 hours ago

Market17 hours agoFintech Leaders Push for US Federal Regulatory Sandbox

-

Bitcoin14 hours ago

Bitcoin14 hours agoBitcoin Liquidation Heatmap Signals Potential Bitcoin Price Swings – What’s Next