Market

Michael Saylor Shares $81 Trillion Bitcoin Reserve Plan for Trump

Michael Saylor shared an ambitious proposal for the US government to accumulate a vast Bitcoin reserve that he claims could generate up to $81 trillion in wealth by 2045.

The outspoken Bitcoin (BTC) advocate and co-founder of Strategy (formerly MicroStrategy) shared the blueprint during the White House Crypto Summit.

Michael Saylor’s Bitcoin Accumulation Blueprint For Trump’s Government

Syalor’s plan, presented as a blueprint for economic dominance, calls for the nation to acquire between 5% and 25% of the Bitcoin network over the next decade through consistent, programmatic daily purchases.

“I shared this at the White House Digital Assets Summit,” Salor confirmed.

Saylor’s vision rests on the idea that Bitcoin will appreciate significantly over time due to its fixed supply and growing global adoption.

Under his plan, the US government would begin accumulating Bitcoin in 2025 and continue until 2035, by which point 99% of all Bitcoin will have been mined.

“Acquire 5-25% of the Bitcoin network in trust for the nation through consistent, programmatic daily purchases between 2025 and 2035, when 99% of all BTC will have been issued,” read an excerpt in the blueprint.

Following this strategy, the US could acquire up to a quarter (25%) of the total supply, locking in a dominant position in the global financial system. Saylor argued that such a move would have a transformative economic impact.

Saylor estimates that the Strategic Bitcoin Reserve could generate between $16 trillion and $81 trillion in value for the US Treasury by 2045. Notably, this prediction hinges on the scale of adoption and Bitcoin’s future price appreciation.

The reserve would act as a long-term store of value for the nation, offering an alternative to traditional monetary assets and providing a powerful hedge against inflation.

Also, Saylor said the strategy would secure America’s financial future, strengthen the dollar, reduce national debt, and cement the country’s status as a global economic leader.

Saylor Discourages US Government From Selling Bitcoin Holdings

One of the most striking aspects of Saylor’s proposal is his assertion that the US should never sell its Bitcoin holdings. Instead, he envisions the SBR generating at least $10 trillion annually by 2045 through appreciation and other financial mechanisms.

He claims this would create a self-sustaining economic engine capable of addressing national debt concerns. It would also position the US to fund technological advancements, critical infrastructure, and social programs without increasing taxes or borrowing excessively.

Beyond buying Bitcoin, Saylor’s broader digital asset framework includes sweeping regulatory changes designed to position the US as the epicenter of the digital currency wave.

He advocates for clear, supportive regulations that encourage innovation while ensuring market integrity.

“Hostile and unfair tax policies on crypto miners, holders, and exchanges hinder industry growth and should be eliminated, along with arbitrary, capricious, and discriminatory regulations,” Saylor added.

His plan divides digital assets into four categories—digital tokens, digital securities, digital currencies, and digital commodities. Each of these, he indicated, serves a specific function within the economy.

Notably, if the US government heeds Saylor’s 25% Bitcoin supply purchase, it would hold 5.25 million BTC. This would be more than the 1 million BTC (5% of the supply) Wyoming Senator Cynthia Lummis proposed in the Bitcoin Act introduced in August 2024.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

5 Token Unlocks to Watch for the Second Week of March

Token unlocks are key events in the crypto market, releasing previously restricted tokens into circulation. These unlocks can impact liquidity, price action, and overall market sentiment.

Below are the top five token unlocks to watch this week.

1. Xai (XAI)

- Unlock Date: March 9

- Number of Tokens to be Unlocked: 35.89 million XAI (1.44% of Max Supply)

- Current Circulating Supply: 1.06 billion XAI

Xai is a Layer 3 gaming blockchain that leverages Ethereum’s security (Layer 1) and Arbitrum’s scalability (Layer 2). It allows gamers to seamlessly own, trade, and utilize in-game assets across multiple titles.

On March 9, the Xai network will unlock 35.89 million XAI tokens, valued at approximately $2.62 million. The network will allocate the largest portion of this unlock, around 17.33 million XAI tokens, to investors. Also, 11.9 million tokens will be for the team.

Meanwhile, the rest will be allocated to the Xai ecosystem and reserve.

With gaming-focused blockchains gaining momentum, this unlock could influence Xai’s liquidity and trading dynamics.

2. Moca Network (MOCA)

- Unlock Date: March 11

- Number of Tokens to be Unlocked: 178.51 million MOCA (2.01% of Max Supply)

- Current Circulating Supply: 1.91 billion MOCA

Moca Network is a digital identity infrastructure enabling seamless asset management across Web2 and Web3 ecosystems. It powers DeFi and consumer services, with MOCA as its utility token.

The upcoming unlock of 178.51 million MOCA tokens (valued at $17.36 million) represents 9.34% of its market cap. The largest distribution, around 93.32 million MOCA, will be allocated for network incentives.

Most importantly, the network will allocate 37.04 million tokens for liquidity and 33.33 million for the ecosystem. The network will reserve the rest for operational expenses.

With a significant portion going towards network incentives and liquidity, this unlock may impact MOCA’s supply dynamics.

3. Delysium (AGI)

- Unlock Date: March 11

- Number of Tokens to be Unlocked: 66.48 million AGI (2.22% of Max Supply)

- Current Circulating Supply: 1.53 billion AGI

Delysium is a blockchain-powered AI platform designed to create a virtual world where AI and humans coexist. Its native token, AGI, fuels ecosystem growth.

On March 11, the platform will unlock 66.48 million AGI tokens (valued at $3.78 million). Delysium will allocate 34.37 million AGI for the treasure, 24 million for the team, and the rest for strategic sales.

4. Cheelee (CHEEL)

- Unlock Date: March 10

- Number of Tokens to be Unlocked: 2.67 million CHEEL (0.27% of Max Supply)

- Current Circulating Supply: 56.8 million CHEEL

Cheelee is a blockchain-based short video platform that incorporates GameFi elements, rewarding users for engaging with content. The platform uses its native token, CHEEL, for governance, NFT upgrades, and in-app transactions.

The upcoming unlock consists of 2.67 million CHEEL tokens (valued at $20.62 million). The network will allocate the majority of these tokens (2.64 million) for liquidity, and only a small portion will be distributed as community airdrops.

As liquidity allocations tend to ease trading conditions, this unlock may provide additional market depth for CHEEL.

5. Xave (XAV)

- Unlock Date: March 11

- Number of Tokens to be Unlocked: 279.18 million XAV (2.79% of Max Supply)

- Current Circulating Supply: 201,950 XAV (self-reported)

Xave is a DeFi platform focused on decentralized foreign exchange (FX) markets. It enhances stablecoin liquidity through an automated market maker (AMM) model.

On March 11, the network will unlock 279.18 million XAV tokens. Xave will largely focus distribution to the team, investors, and treasury.

Also, the Xave protocol will add around 4.06 million tokens to DEX and CEX liquidity and another 6.19 million as rewards for liquidity providers.

With a large unlock relative to the reported circulating supply, XAV’s market performance may experience heightened volatility.

Overall, this week’s unlocks will introduce over $44 million worth of new tokens into the market. Monitoring these releases can help traders and investors assess potential price fluctuations and liquidity shifts.

The post 5 Token Unlocks to Watch for the Second Week of March appeared first on BeInCrypto.

Market

Arkham Can Now Track Crypto Influencer Wallets

Arkham Intelligence has unveiled a new feature allowing users to track the wallets of Key Opinion Leaders (KOLs) on X (formerly Twitter).

This development comes amid a flurry of new meme coins, capitalizing on token launchpads for easy launches.

New Arkham Feature Lets Users Track Influencers’ Token Holdings

The update, announced in a recent post, introduces the “Key Opinion Leader (KOL) Label.” It tracks the wallets of influencers with over 100,000 followers on X.

“Influencers with more than 100K+ followers on Twitter/X are now tagged on Arkham with a new label: Key Opinion Leader,” read the announcement.

This means investors can monitor whether influencers genuinely back the tokens they promote or if their endorsements are merely paid advertising. The move has sparked widespread debate within the crypto community, particularly concerning its impact on influencer-endorsed meme coins.

“Biggest scammer on top! Now everyone can watch your wallets. But they should know y’all have multiple ones,” one user wrote.

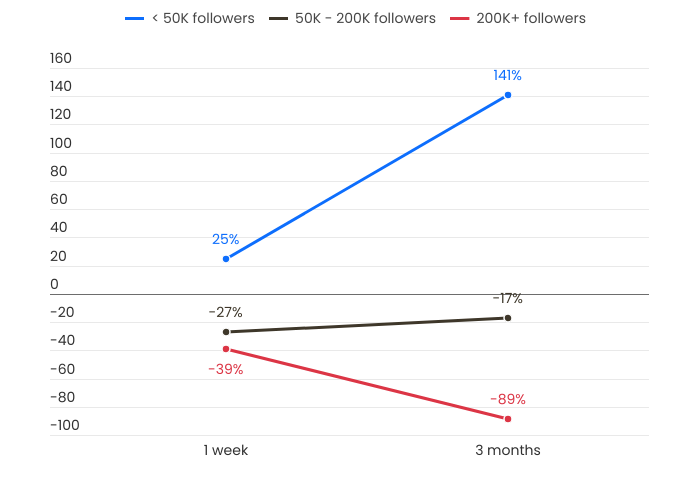

The introduction of Arkham’s KOL Label comes amid increasing concerns over the reliability of influencer-backed tokens. A recent report revealed that 76% of influencer-endorsed tokens fail to deliver.

Specifically, their value plummeted by more than 90% within just three months.

As BeInCrypto reported, the research suggested earning up to $399 per promotional tweet, incentivizing certain influencers to prioritize financial gain over credibility.

It also showed that many promoted tokens lack fundamental utility and community engagement, leading to inevitable crashes.

“Influencers with over 200,000 followers tend to have the worst performance. The larger the influencer’s following, the lower the performance of the meme coins they promote,” the report claims.

Similarly, blockchain investigator ZachXBT recently exposed 16 influencer accounts on X that coordinated pump-and-dump schemes, leaving their followers to absorb the losses. This fueled debates about the ethical responsibilities of influencers in crypto markets.

With Arkham’s new tracking feature, investors can now scrutinize whether influencers hold the tokens they endorse. This could provide greater transparency in an industry plagued by misinformation and deceptive marketing tactics.

“Interesting move—transparency meets influence,” a user on X remarked.

The pattern mirrors previous crypto fads, where early investors profit while latecomers bear the brunt of financial losses. Arkham’s new tool could expose questionable practices, distinguishing genuine endorsements from misleading promotions.

By tracking influencers’ wallet activities, users can identify whether influencers hold the tokens they promote, indicating a true conviction. They could also spot red flags, such as influencers dumping tokens shortly after promoting them.

Experts, including Tron founder Justin Sun, emphasize the importance of fundamentals, tokenomics, and risk management for investors within the volatile meme coin market.

“I will check on the real social engagement. Are those likes real, or it’s just general bullshit? Do they have lots of influence, and the people really believe them? Also, I will see the founders, see their material, and see the memes they made and the videos they made. I will see if this is the right video and the right social engagement,” Sun elaborated.

These approaches reflect the importance of caution and due diligence instead of relying solely on influencer endorsement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Shiba Inu Whales Cut Holdings—Is a Bigger Price Drop Ahead?

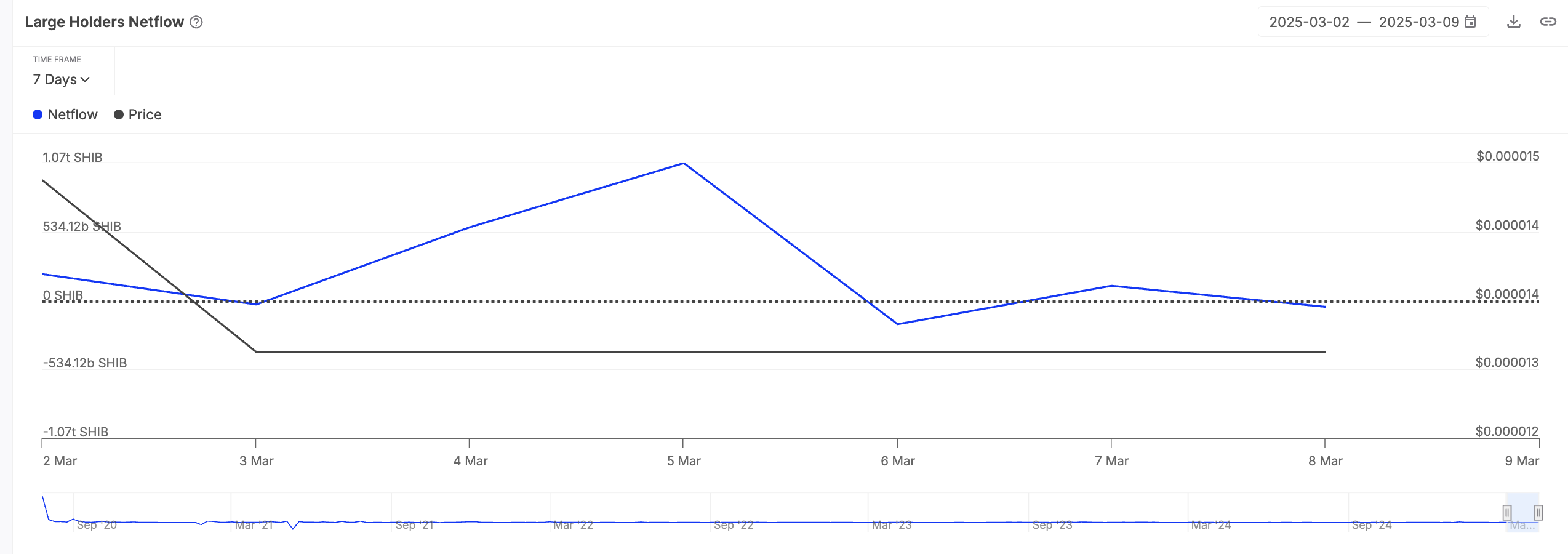

Leading meme coin Shiba Inu has shed almost 10% of its value over the past week. As of this writing, SHIB trades at $0.0000125.

This price decline coincides with a significant drop in whale holdings during the same period. This signals waning confidence among large investors amid broader market weakness.

SHIB’s Market Confidence Wanes as Whale Sell-Off Accelerates

According to IntoTheBlock, SHIB’s large holders ’netflow has fallen 123% in the past week. This comes amid the meme coin’s 8% price dip.

Large holders refer to whale addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow measures the inflow and outflow of tokens in their wallets to track whether they are accumulating (positive netflow) or offloading (negative netflow) their holdings.

When this metric falls, it indicates that whales are selling large portions of their assets, leading to increased supply and putting more downward pressure on price.

Moreover, this decline in SHIB whale netflow could worsen the weakening confidence among SHIB retail traders, prompting them to sell their coins in anticipation of further losses. This can accelerate SHIB’s price dip in the short term.

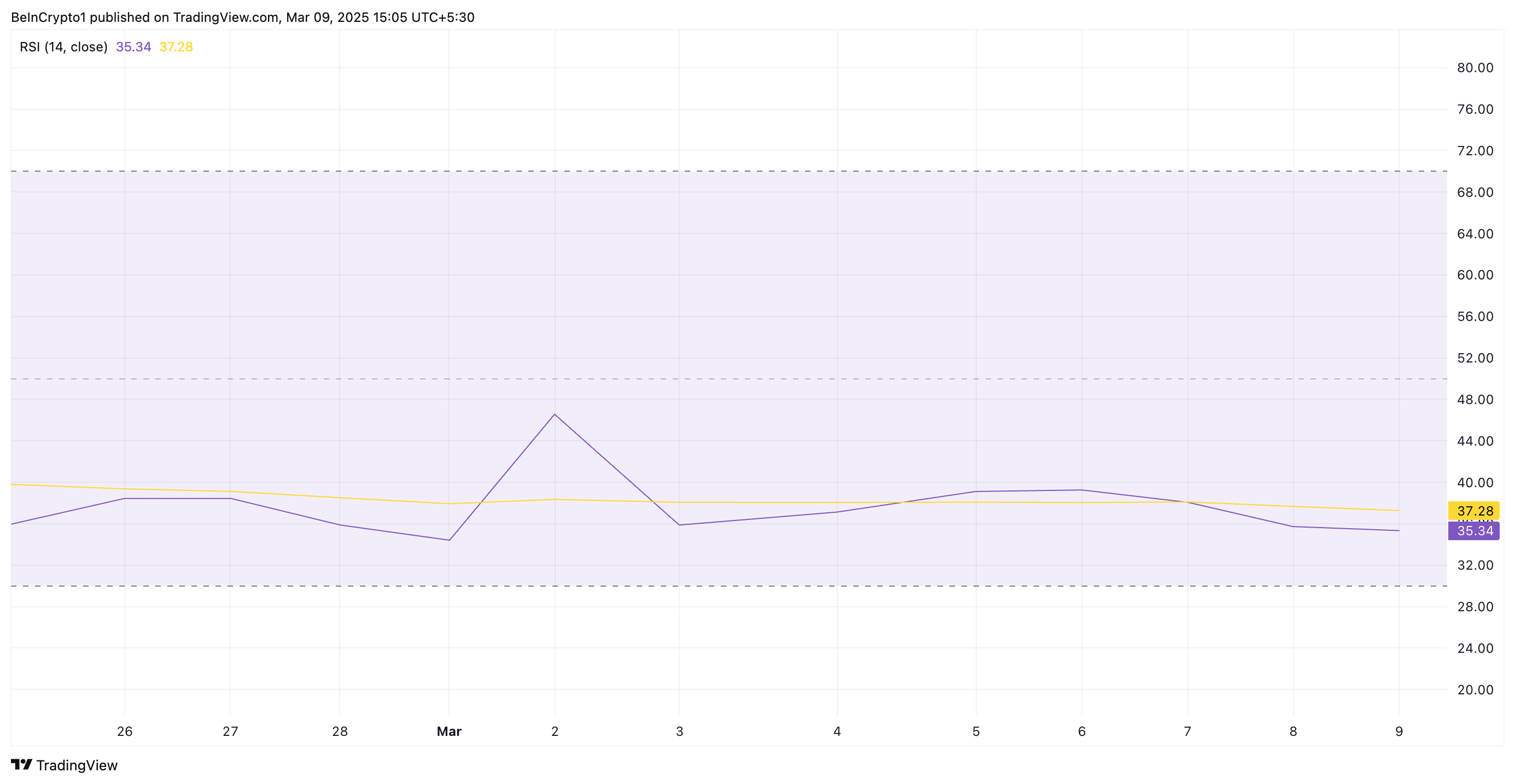

On the daily chart, SHIB’s falling Relative Strength Index supports this bearish outlook. At press time, this momentum indicator is a downward trend at 35.34.

An asset’s RSI measures an asset’s oversold and overbought conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. Conversely, values under 30 suggest that the asset is oversold and could witness a rebound.

At 35.05, SHIB’s RSI indicates that the asset is approaching oversold territory but has not fully entered it yet. This suggests weakening buying pressure and hints at the potential for further downside unless the meme coin demand picks up.

SHIB Holds Below Descending Trend Line

SHIB has remained below a descending trend line since December 8, keeping its price in decline. This pattern is formed when an asset’s price consistently makes lower highs over a period, connecting these peaks with a downward-sloping line. It is a bearish trend, indicating sustained selling pressure among SHIB market participants.

If this decline continues, SHIB risks falling to a seven-month low of $0.0000107.

However, if buying pressure regains momentum, it could drive SHIB’s value to $0.0000166.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoCardano Price Could Be On Its Way To $2 — Here’s How

-

Regulation24 hours ago

Regulation24 hours agoGemini Cofounder Reveals How Much David Sacks Will Lose In Crypto Gains In Four Years

-

Altcoin23 hours ago

Altcoin23 hours agoHere’s Why The Dogecoin And Shiba Inu Prices Have Been On A Recovery Trend

-

Altcoin21 hours ago

Altcoin21 hours agoUS Forges Ahead With Pro-Crypto Movers, Major Coins Still Volatile

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Breaks Out Of Descending Triangle Pattern – Fakeout Or Recovery Rally?

-

Altcoin19 hours ago

Altcoin19 hours agoStablecoins Could Be Key To US Dollar Supremacy—Treasury Secretary

-

Market20 hours ago

Market20 hours agoBitcoin Bear Market Ahead? Analyst Warns of 33% Price Drop

-

Altcoin20 hours ago

Altcoin20 hours agoPi Network Accelerates Rapidly To Catch Up With Dogecoin In Important Metric