Altcoin

Will History Repeat for Crypto Markets?

Crypto and financial markets are experiencing a sense of déjà vu as analysts compare the current macroeconomic outlook to past cycles, particularly the previous Trump-era trade wars.

As traders and investors wait with bated breath for a crypto market recovery, all eyes remain pegged to the US dollar index (DXY) and the M2 Money Supply for possible hints.

Bitcoin, Altcoins & Tariffs: Is a 2017-Style Rally Ahead?

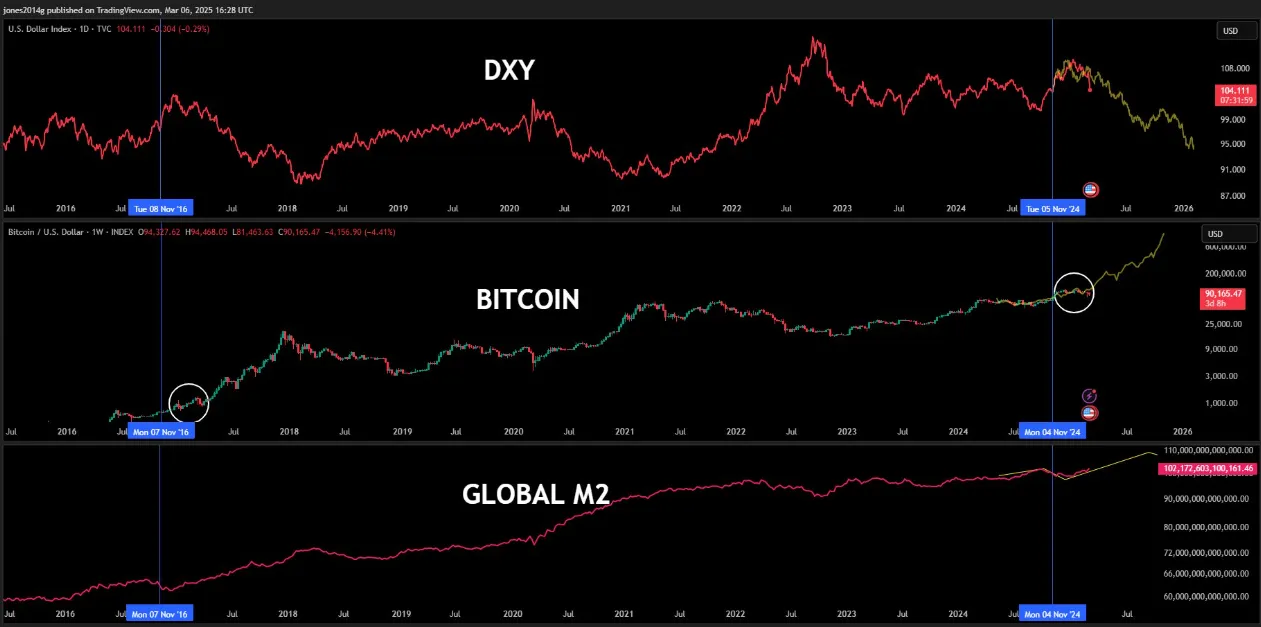

A recent chart from ZeroHedge highlights how the US Dollar Index (DXY) in 2025 closely mirrors its 2016 movements. This adds credence to the idea that market trends echo past patterns.

This parallel has drawn significant attention from investors, particularly in the crypto sector. Analysts assess whether Bitcoin (BTC) and altcoins will follow a similar trajectory to their 2017 bull cycle.

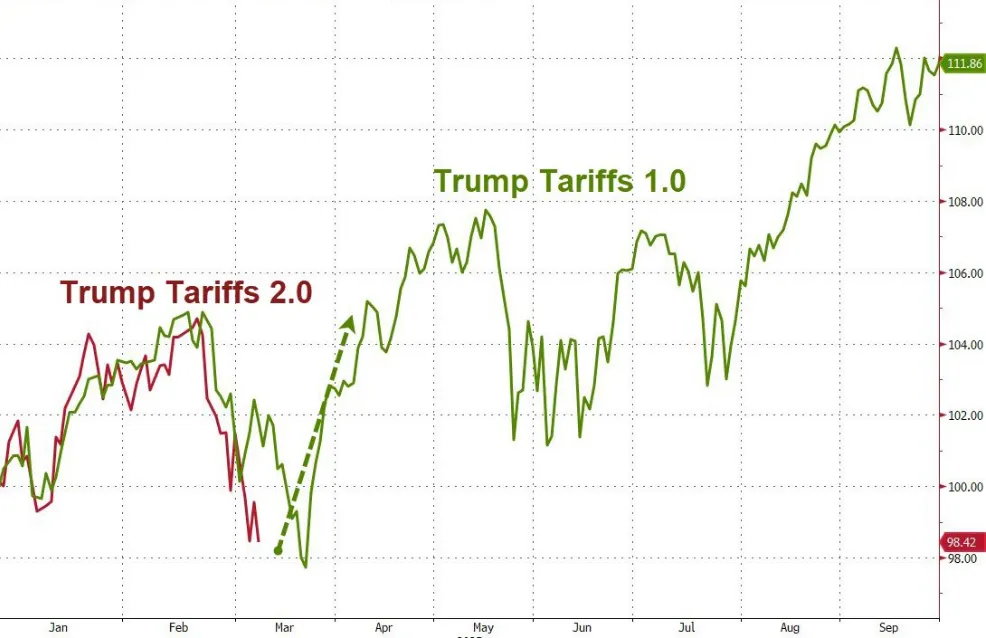

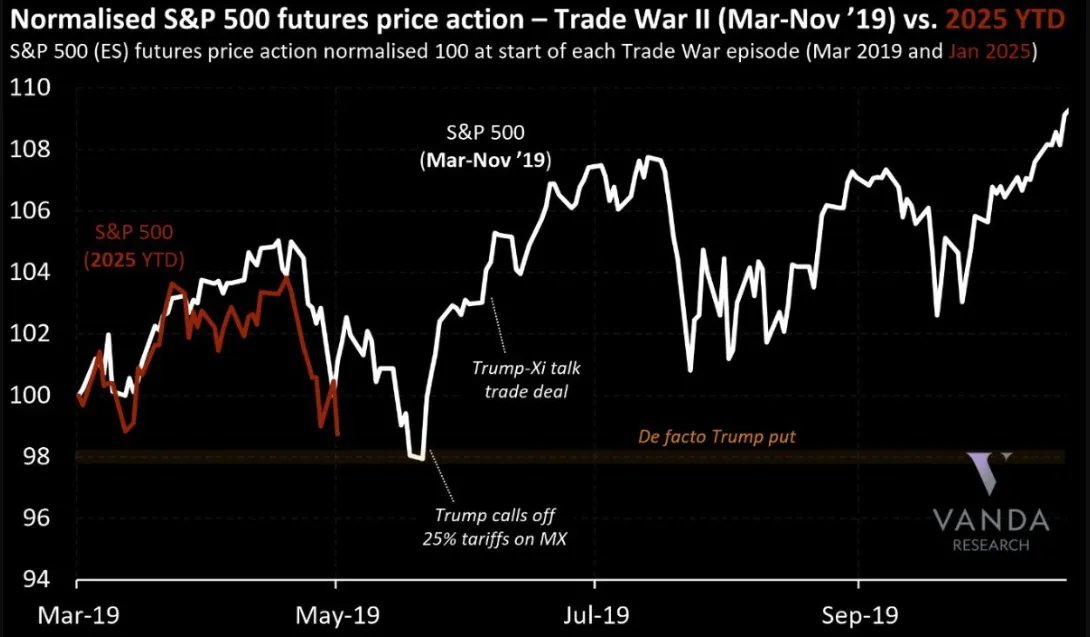

Financial market commentary, The Kobeissi Letter, weighed in on this discussion, emphasizing the similarities between Trump Tariff War 1.0 and 2.0.

The commentary acknowledges that today’s macroeconomic conditions differ from those of the previous Trump administration. However, it also notes that several technical movements across asset classes, including stocks, gold, oil, and Bitcoin, have been strikingly similar.

So far this year, gold prices have surged over 10%, reflecting a shift toward safer assets. Meanwhile, Bitcoin has declined nearly 10%. This divergence highlights the importance of risk appetite in shaping market sentiment.

Bitcoin’s recent price action further validates these observations. On March 4, Bitcoin experienced an abrupt $2,000 drop in just 25 minutes, approaching the resistance level at $90,000. Market participants have noted that cryptocurrency valuations frequently shift by over $100 billion, even without material news.

This suggests that liquidity-driven movements and technical resistance levels play a dominant role in price fluctuations. In this regard, The Kobeissi Letter noted that long-term investors who took advantage of volatility during Trump Trade War 1.0 found excellent bargain opportunities. This suggests that similar conditions could arise again.

Altcoin Season To Align with Trump Season

Meanwhile, a growing narrative within the crypto space is that “Altcoin Season” could align with “Trump Season.” Crypto investor and analyst bitcoindata21 highlighted how Bitcoin’s price action in 2025 resembles the 2017 cycle. This observation reinforces the belief that a major altcoin rally could be on the horizon.

Historical trends suggest that a strengthening Bitcoin market often precedes explosive growth in altcoins as capital rotates. This raises the possibility that an upcoming bullish cycle could mirror the altcoin boom seen during Trump’s first term.

Elsewhere, broader economic trends also point to potential upside for Bitcoin. As BeInCrypto reported, the DXY recently fell below a key support level, which has historically been a bullish signal for Bitcoin. A weakening dollar tends to push investors toward alternative assets such as cryptocurrencies and gold.

Additionally, analysts have highlighted the expanding M2 money supply as another factor that could fuel a Bitcoin rally. Historically, expansions in M2 have coincided with major Bitcoin bull runs, with experts predicting a surge in late March as liquidity conditions improve.

For now, uncertainty remains high due to macroeconomic factors and policy shifts. However, history suggests that investors strategically position themselves during volatile periods and often reap significant rewards.

If the pattern from 2017-2020 repeats, Bitcoin and altcoins could enter a renewed bull cycle in the coming months. Nevertheless, traders should remain vigilant, as short-term volatility remains a key characteristic of the current market environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Expert Predicts XRP Price Can Reach $280, Here’s When

Crypto expert Dark Defender predicted that the XRP price could rally to $280, providing a bullish outlook for the crypto. The expert alluded to XRP’s historical performance as to why the coin could reach such an ambitious price target.

Crypto Expert Predicts XRP Price Rally To $280

In an X post, Dark Defender predicted an XRP price rally to $280 as he raised the possibility of the crypto replicating its 2017 bull run performance. In 2017, XRP witnessed a price rally of over 60,000% on its way to its current all-time high (ATH) at around $3.3.

The expert’s accompanying chart showed that XRP could reach this $280 target between 2026 and 2027, although the parabolic rally could begin this year as the crypto looks to replicate its 2017 performance.

Interestingly, crypto analyst Egrag Crypto had also made a similar prediction to Dark Defender. The analyst predicted that XRP could rally to $222 if history repeats itself, alluding to the 2017 bull run.

Coffee-Cup Pattern Shows Rally To $44 Is Possible

In an earlier post, Dark Defender made a more conservative prediction of an XRP price rally to $44 based on a ‘Coffee Cup’ pattern. He explained that this market pattern is a U-shaped formation on a price chart, indicating a potential bullish trend reversal after a downtrend. This pattern typically takes weeks to months to develop fully.

The expert stated that he has paired this pattern with the Elliot Waves, which has given a better picture of XRP’s future trajectory. He remarked that wave 3 is charging toward $5.85 and $18.22. Wave 5 is eyeing $36, while the cup’s depth plus Coffee level is brewing up for a rally to as high as $44.22.

XRP Is Testing Critical Resistance

In an X post, crypto analyst CasiTrades stated that the XRP price is testing critical resistance at around $2.54 and is currently sitting just below the trendline of a consolidation pattern. She further remarked that if the crypto breaks and holds above this $2.54 price level, the next targets are still $2.70 and $3.05.

The analyst had previously highlighted those price levels as the upside targets when she warned that XRP could drop to as low as $1.5 if it fails to hold above $2.42. Meanwhile, in her recent analysis, CasiTrades remarked that she is still leaning towards the idea that the crypto is still in the early stages of Wave 3.

The analyst added that it is just not obvious yet, but once XRP breaks previous highs, the crypto could rally to $9.50 for the official Wave 3 extension. She noted that this aligns with the macro $8 to $13 price target.

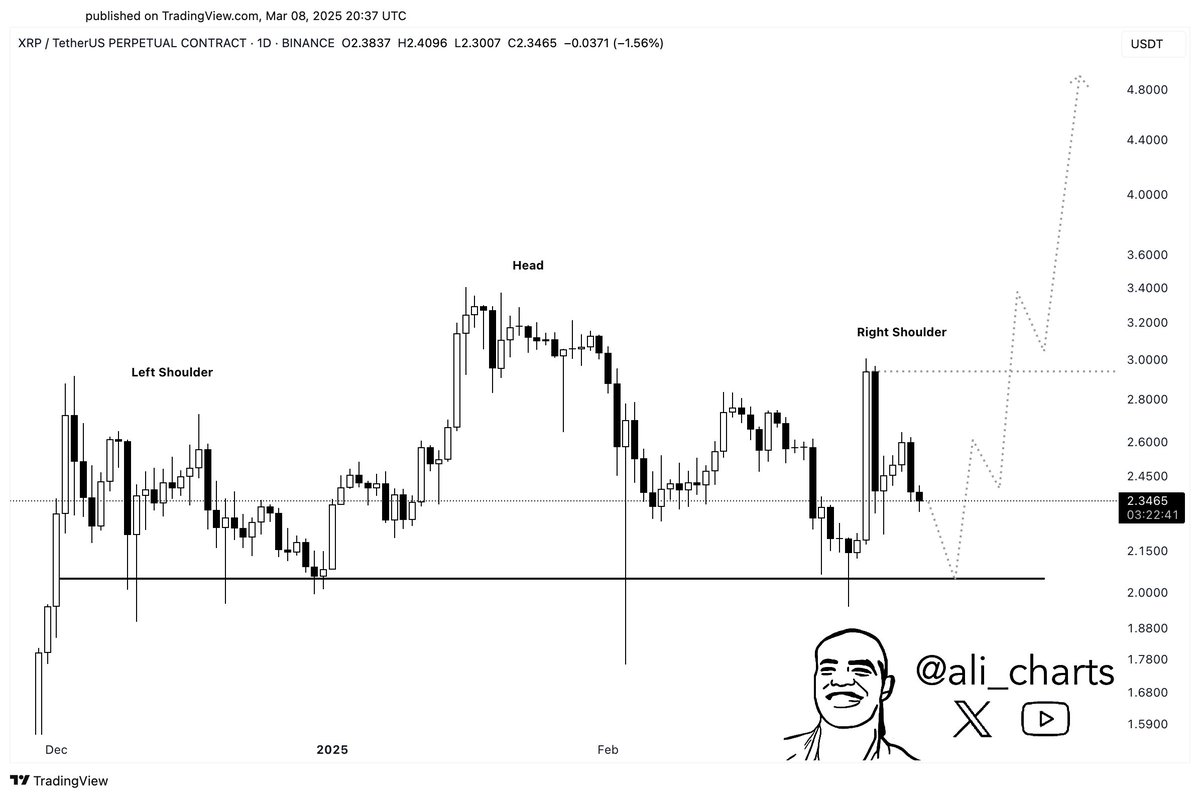

Crypto analyst Ali Martinez predicted that the XRP price could soon rally to $5. He stated that if XRP avoids closing below the head-and-shoulders neckline and breaks above the right shoulder instead, it could invalidate the bearish pattern. He added that this move might trigger a bullish breakout toward $5.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Stablecoins Could Be Key To US Dollar Supremacy—Treasury Secretary

United States President Donald Trump’s much-talked-about crypto summit produced plenty of soundbites and policy plans that will satisfy investors, analysts, and casual observers. One of the most intriguing policy statements came from the US Treasury Secretary Scott Bessent, who called for comprehensive and transparent regulations on stablecoins.

Secretary Bessent further stated that the US government plans to use stablecoins to back up the US dollar and retain its status as the primary global currency reserve.

The White House Crypto Summit on March 7th was the biggest gathering and attracted many crypto personalities. In addition to Trump and Bessent, the White House summit hosted Zach Witkoff of World Liberty Financial, Strategy CEO Michael Saylor, Coinbase co-founder and CEO Brian Armstrong, entrepreneur David Bailey, and investors Cameron and Tyler Winklevoss.

A Gathering For The Planned Crypto Reserve

Friday’s White House gathering focused on conversations on a strategic reserve for Bitcoin and crypto. Trump has already issued an executive order to create a stockpile for other crypto assets. This executive order authorizes the secretaries of Commerce and Treasury to propose “budget-neutral strategies” that can finance the acquisition of additional Bitcoins without passing the burden to taxpayers.

Image: StormGain

Trump reiterated that the planned reserve must not burden US taxpayers. According to crypto czar David Sacks, the reserve shall be built on Bitcoins currently controlled by the US government that were forfeited as part of civil asset and criminal forfeiture proceedings.

Stablecoins To Help Protect US Dollar

Another key theme during the summit was the growing importance of stablecoins, particularly in propping up the US dollar. Trump and Bessent issued statements supporting stablecoins. In his speech, Bessent echoed the president’s plan to end the war on cryptocurrencies. He then turned and talked about stablecoins, and shared that these tokens are part of the financial planning.

In his speech, Bessent admitted that they’re looking at stablecoins and that, upon Trump’s instructions, they will work to keep the USD as the dominant world currency.

Fed Governor Waller Pitches For Stablecoins

Federal Reserve Governor Christopher Waller also supported stablecoins in February 2024. He explained that increasing demand for stablecoins can address or mitigate crypto’s impact on the dollar’s market share.

For Waller, the US can rely on stablecoins by addressing capital controls in other countries and boosting payment rails. Responding to these suggestions, US representatives Bryan Steil and French Hill have already forwarded a stablecoin bill, the Stable Act of 2025, to draft transparent regulations for these tokens.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

Pi Network Accelerates Rapidly To Catch Up With Dogecoin In Important Metric

Pi Network (PI) is making waves in the crypto community with its explosive growth and increasing adoption. The popular cryptocurrency, which has been a hot topic due to its unique mining model and closed mainnet, is now gaining an unprecedented following on the X social media platform. The cryptocurrency is also rivaling top meme coins like Dogecoin (DOGE), quickly approaching the size of the meme coin’s loyal fanbase.

PI Network Closes In On Dogecoin With 4 Million Followers On X

Pi Network has achieved an incredible milestone by reaching 4 million followers on X, signaling a significant step forward in its rapid rise within the crypto market. This rapid growth and adoption positions the cryptocurrency on the verge of matching or even surpassing the social media presence of Dogecoin which has 4.3 million followers on X.

Since its inception in 2019, Pi Network has captured the attention of crypto enthusiasts, offering user-friendly and mobile-based mining services. This mining activity clearly contrasts with traditional cryptocurrencies like Bitcoin, which require high-powered hardware for mining.

To commemorate its massive growth, the team behind Pi Network took to X on March 5 to announce its milestone of reaching 4 million followers on X. They congratulated community members and PI enthusiasts who helped support the cryptocurrency in hitting this goal.

In addition to its growing adoption on X, Pi Network has become one of the trendiest cryptocurrencies in the market. While other top digital assets struggle with the broader market volatility and experience price declines, the value of PI is surging at an unexpected rate. CoinGecko has ranked PI Network as the number one trendy cryptocurrency in its top 20 list. The popular cryptocurrency has surpassed top dogs like Dogecoin, Ethereum, Cardano, Solana, XRP, Bitcoin, and other major digital currencies.

CoinMarketCap also ranks Pi Network as the 11th largest cryptocurrency by market capitalization, just two positions from Dogecoin’s 9th. This rapid growth to the 11th position underscores PI’s impressive growth in just a few weeks.

Community Advocates For Binance Listing For PI

Rumors of a potential PI Network listing on Binance, the largest crypto exchange, have been spreading across the crypto market. This speculation grows as the crypto community pushes for this integration on Binance.

The PI blockchain on X made a bold request on February 5, demanding Binance to officially list the Pi Network and make it available for trade on its exchange. Calling on all PI supporters and community members, the PI blockchain urged investors and holders to continually advocate for the listing and ensure their voices are heard.

Interestingly, an X user named ‘Satoshi Nakamoto’ reported that 86% of Binance community members had voted in favor of listing the Pi Network. Despite these results and the ongoing pressure from the PI community, Binance has yet to make an official statement.

Featured image from Live Science, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market24 hours ago

Market24 hours agoPEPE Price Hits 6-Month Low; Recovery Delayed Further

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Eyes Key Support at $2,350 — Price Surge To Follow?

-

Ethereum17 hours ago

Ethereum17 hours ago330,000 Ethereum Withdrawn From Exchanges In 72 Hours – Supply Squeeze Incoming?

-

Market17 hours ago

Market17 hours agoBitcoin Pepe maintains its shine as Bitcoin price bleeds further

-

Altcoin17 hours ago

Altcoin17 hours agoAndre Cronje Outlines Reasons For Ethereum’s Underperformance This Cycle

-

Regulation13 hours ago

Regulation13 hours agoGemini Cofounder Reveals How Much David Sacks Will Lose In Crypto Gains In Four Years

-

Altcoin24 hours ago

Altcoin24 hours agoCan XRP Become The Cornerstone OF US Global Financial Policy?

-

Altcoin21 hours ago

Altcoin21 hours agoWhat’s Next for Cardano Price as Bears Take Control Below Key Support?

✓ Share: