Bitcoin

Trump Signs Executive Order for US Bitcoin Reserve

Donald Trump has followed through on his promises and signed an executive order to establish a Strategic Bitcoin Reserve and a separate US Digital Asset Stockpile.

While some industry figures have lauded the order, others remain skeptical. They argue that the initiative is little more than a rebranding of existing government holdings with no substantive new strategy.

Donald Trump Signs Order for Strategic Bitcoin Reserve

The order directs the US Department of Treasury to initially fund the Strategic Bitcoin Reserve with BTC seized through criminal and civil asset forfeiture. The administration has vowed not to sell these assets.

“Bitcoin, the original cryptocurrency, is referred to as “digital gold” because of its scarcity and security, having never been hacked. With a fixed supply of 21 million coins, there is a strategic advantage to being among the first nations to create a Strategic Bitcoin Reserve,” the order read.

Arkham Intelligence data shows that the US government holds 198,109 BTC in its public wallets, valued at $17.5 billion at current market prices.

Despite this substantial holding, David Sacks, the White House’s AI and Crypto Czar, noted that a comprehensive audit of the government’s digital assets has never been conducted. The new executive order mandates this accounting.

“Premature sales of Bitcoin have already cost US taxpayers over $17 billion in lost value. Now the federal government will have a strategy to maximize the value of its holdings,” he wrote.

It also authorizes budget-neutral strategies for potentially acquiring more Bitcoin. Yet, critics argue that the reserve lacks substantive impact.

Industry Experts Divided on Strategic Bitcoin Reserve

Jacob King, founder of WhaleWire, dismissed the recent attention around the reserve.

“In reality, this has existed for over a decade—they’re just slapping a fancy title on it to appease Bitcoiners,” he remarked.

King also pointed out that the reserve would not involve any new Bitcoin purchases. Therefore, he believes, this makes the move largely insignificant in the grand scheme of the market.

Peter Schiff, an outspoken critic of Bitcoin, also weighed in on the order. According to Schiff, the move was made under pressure from donors and conflicted cabinet members.

He described the order as a “bogus” attempt to capitalize on the Bitcoin the government already holds.

“If they seize any more Bitcoin they can keep that too. But they can’t buy any more, as buying by definition requires a payment,” Schiff posted.

Despite the criticisms, some industry leaders see the order as a significant step toward legitimizing Bitcoin on the world stage.

“The end game was never the US government buys all of the world’s Bitcoin,” Ryan Rasmussen, Head of Research at Bitwise, said.

Rasmussen explained that the move will likely prompt other countries to buy Bitcoin. He also expects it to pressure wealth managers, financial institutions, pensions, and endowments to adopt the cryptocurrency.

The reserve, Rasmussen said, will alleviate concerns about the US selling its holdings and may pave the way for future acquisitions. He added that the move increases the likelihood of US states adopting Bitcoin.

Matt Hougan, CIO at Bitwise, also concurred. He pointed out that the order could significantly reduce the likelihood of future Bitcoin bans. Hougan added that the reserve,

“Accelerates the speed at which other nations will consider establishing strategic bitcoin reserves, because it creates a short-term window for nations to front-run potential additional buying by the US.”

Analyst Nic Carter also praised the decision, calling it a successful fulfillment of a key campaign promise. He highlighted that Bitcoin had received official US government approval, a distinction not granted to other cryptocurrencies. Carter emphasized that using no taxpayer funds helped shield the initiative from backlash.

“Announcement couldn’t have gone better,” he claimed.

The signing of the executive order took place just one day before the White House Crypto Summit. Initially, it was anticipated that Trump would sign the Bitcoin reserve order at the summit, which had driven Bitcoin prices up. Nonetheless, the actual signing led to a dip in the cryptocurrency’s value.

After briefly regaining that level on March 5, Bitcoin dropped below $90,000 again. At press time, Bitcoin was trading at $87,469, marking a 4.5% decrease over the past 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin: Analyzing Divergence In Investor Behavior – Who’s Buying And Selling BTC?

The Bitcoin price started the week on a strong footing, jumping back above $90,000 following the announcement of a strategic crypto reserve by US President Donald Trump. However, the flagship cryptocurrency barely sustained this momentum, dropping back beneath the $90,000 level before midweek.

The recent market uncertainty is mirrored in the Bitcoin action, as the price has moved mostly sideways (after the initial pump) within the $82,000 – $92,000 range. The question now is — who is behind the constant price retracement and consolidation?

Short-Term Sell-Offs Meet Long-Term Confidence: Analyst

In a Quicktake post on the CryptoQuant platform, an analyst with the pseudonym ShayanBTC discussed the divergence in investor behavior while using on-chain data to evaluate current market sentiment. The relevant on-chain indicator here is the Spent Output Age Bands (SOAB) metric, which sorts spent coins into categories depending on their age and as a proportion of total coins moved.

ShayanBTC specifically analyzed the bags of investors between the 1-week and 6-month cohorts (short-term holders) using the Spent Output Age Bands. Data from CryptoQuant shows that the selling activity of short-term investors drove the recent Bitcoin downturn.

These investors, known for their rapid reactions to market fluctuations, have been actively depositing BTC onto exchanges — which can be associated with selling pressure. Considering the sensitive nature of short-term holders to market sentiment and technical resistance levels, their selling behavior aligns with Bitcoin’s recent struggle to sustain any bullish momentum.

Source: CryptoQuant

On the other hand, long-term investors (those holding BTC for more than 6 months) have shown no signs of capitulation. While some level of profit-taking can be seen among this group of Bitcoin holders, it seems to be rather gradual and consistent with the behavior seen in healthy bull markets rather than mass liquidations.

The activity of long-term Bitcoin investors suggests that they anticipate future price appreciation before offloading larger portions of their holdings, thereby reducing the BTC supply in the open market. ShayanBTC added that “if sufficient demand enters the market, this supply shrinkage could fuel further price appreciation.”

Interestingly, the latest on-chain data shows that Bitcoin’s long-term investors are not the only market participants refraining from offloading their assets. Crypto pundit Ali Martinez revealed in a post on X that the BTC miners have recorded zero selling activity since February 28.

Bitcoin Price At A Glance

As of this writing, the premier cryptocurrency is valued at around $86,200, reflecting a mere 0.5% price decline in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

US Bitcoin ETFs Record $800 Million Net Outflow In Past Week — Details

The US-based Bitcoin ETFs (exchange-traded funds) have continued to struggle in terms of investor participation and interest over the last few weeks. In the last week of February, the crypto-based financial products witnessed a record-breaking $1.14 billion single-day withdrawal.

The story wasn’t any much different for the Bitcoin ETFs to start the month of March, registering a net outflow of nearly $800 million in the past week. This growing trend reflects the shift in the appetite and sentiment of institutional investors, especially in the United States.

Bitcoin ETFs Post $409 Million Daily Net Outflow

According to the latest market data, the United States Bitcoin ETF market posted a daily net outflow of roughly $409 million on Friday, March 7. This marked the fifth consecutive day of withdrawals for the Bitcoin exchange-traded funds.

Ark & 21 Shares Bitcoin ETF (with the ticker ARKB) saw the largest volume of withdrawals (over $160 million) on Friday. This was followed closely by Fidelity Wise Origin Bitcoin Fund (FBTC), which posted net outflows of approximately $155 million to close the week.

BlackRock’s Bitcoin Trust (IBIT), the largest Bitcoin exchange-traded fund by net assets, declined in net value by $39.85 million on Friday. Meanwhile, Grayscale’s Bitcoin Trust (GBTC) and Bitwise’s BTC fund (BITB) followed with total outflows of roughly $36.5 million and $18.6 million, respectively, on the day.

Source: SoSoValue

Interestingly, VanEck’s Bitcoin fund (with the ticker HODL) was the only one of the US-based Bitcoin ETFs that recorded a net inflow on Friday. The exchange-traded fund added about $617,500 in value to close the week.

As already mentioned, this single-day performance marked the fifth straight day of net outflows for the Bitcoin ETFs. The crypto-based products are yet to record an inflow day in March, as they last posted a net daily inflow on Friday, February 28.

This $409 million single-day withdrawal put the Bitcoin ETFs’ weekly performance at a net outflow of $799.9 million in the past week. Interestingly, this represents the fourth consecutive week (and the second-highest ever) of net outflows for the crypto exchange-traded funds.

Bitcoin Price At A Glance

The performance of the BTC exchange-traded funds in recent weeks somewhat mirrors the sluggish Bitcoin price action within this same period. The price of Bitcoin has been unable to sustain any positive momentum from the somewhat improving crypto climate in the United States.

As of this writing, the premier cryptocurrency is valued at around $86,100, reflecting an over 1% price decline in the past 24 hours. On the weekly timeframe, though, the Bitcoin price is up by more than 2%, according to data from CoinGecko.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin’s Path To $100,000 Faces Stiff Resistance At $98,000 — Analyst

The Bitcoin (BTC) market took a positive turn in the past week rising by 1.10% according to data from CoinMarketCap. While there are still expectations of a further price correction, the effects of macroeconomic developments as seen with recent statements from US President Donald Trump cast more uncertainty over the premier cryptocurrency’s future trajectory.

Bitcoin Bulls Face A Showdown At $98K Resistance – Can They Break Through?

Following an extended market correction, Bitcoin recorded spontaneous market gains in the last week reaching a local peak of round $95,000. Currently, the crypto asset trades around $86,000 with little indication of its future movement.

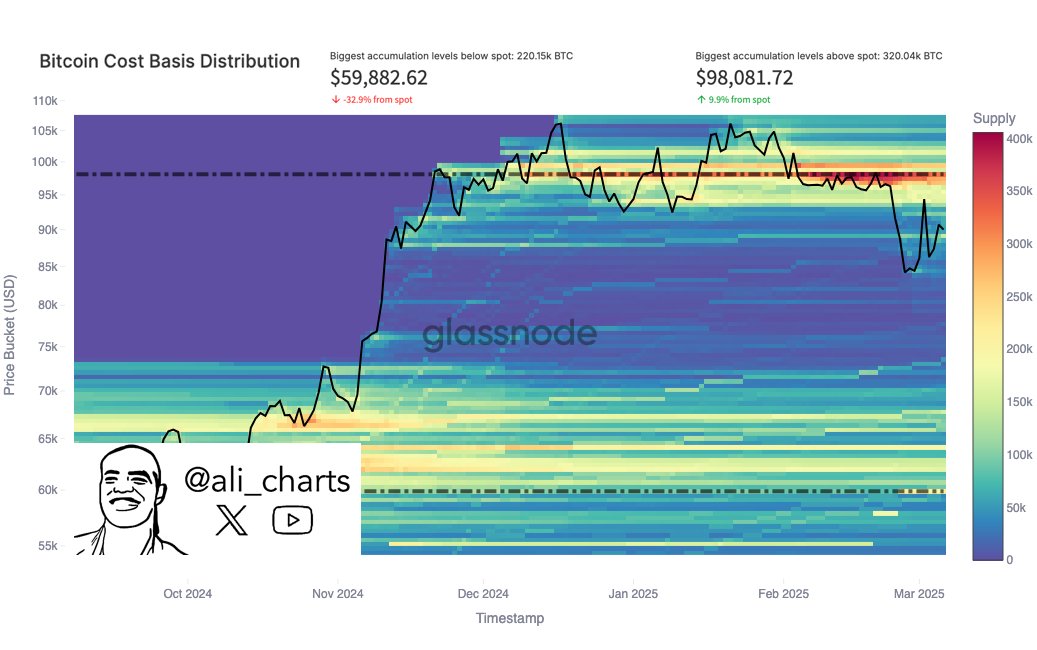

According to top market analyst Ali Martinez, Bitcoin’s price action is currently stuck between two key accumulation levels based on its cost basis distribution (CBD) — the allocation of Bitcoin holdings according to the price at which different investors acquired their BTC. The CBD helps to identify major support and resistance levels by showing where significant amounts of Bitcoin were bought or sold.

Based on the CBD data, Ali Martinez explains in making any further gains, Bitcoin will face a key resistance at $98,081. This prediction stems from investors previously acquiring 320,040 BTC at this price region and are likely to sell following a price rebound to exit the market with little or zero losses. However, if Bitcoin bulls can mount sufficient buying pressure to break past this resistance level, it paves the way for a return above $100,000 and perhaps a new all-time high.

On the other hand, should BTC resume its correction trend, Martinez highlights that the next significant support level based on accumulation data is at $59,882 at which 220,150 BTC have been previously accumulated.

If Bitcoin declines toward these support levels, it is likely to experience a strong bounce as long-term holders are likely to acquire more BTC to defend their positions. Interestingly, this analysis aligns with other market insights that suggest BTC is likely to undergo further correction. However, it’s worth noting that any decisive break below $59,882 would trigger a massive amount of panic selling.

BTC Price Outlook

At the time of writing, BTC trades at $85,995 following a minor 1.98% decline in the past day. Meanwhile, its daily trading volume is down by 6.38%, indicating a decrease in market interest. Amidst positive events like the establishment of a US Strategic Bitcoin Reserve, the BTC market remains in a rather volatile state as indicated by the larger market reaction to events of the past week.

Featured image from Morningstar, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Eyes Key Support at $2,350 — Price Surge To Follow?

-

Ethereum18 hours ago

Ethereum18 hours ago330,000 Ethereum Withdrawn From Exchanges In 72 Hours – Supply Squeeze Incoming?

-

Market17 hours ago

Market17 hours agoBitcoin Pepe maintains its shine as Bitcoin price bleeds further

-

Altcoin17 hours ago

Altcoin17 hours agoAndre Cronje Outlines Reasons For Ethereum’s Underperformance This Cycle

-

Regulation14 hours ago

Regulation14 hours agoGemini Cofounder Reveals How Much David Sacks Will Lose In Crypto Gains In Four Years

-

Altcoin24 hours ago

Altcoin24 hours agoCan XRP Become The Cornerstone OF US Global Financial Policy?

-

Altcoin21 hours ago

Altcoin21 hours agoWhat’s Next for Cardano Price as Bears Take Control Below Key Support?

-

Altcoin14 hours ago

Altcoin14 hours agoCardano Price Could Be On Its Way To $2 — Here’s How