Bitcoin

Bitcoin Dips After Trump’s Strategic Reserve Order: Why?

US President Donald Trump signed an executive order on March 7 establishing a Strategic Bitcoin Reserve (SBR) and a “Digital Asset Stockpile.” Both will initially be capitalized with cryptocurrency seized via government criminal and civil forfeiture proceedings, with future acquisitions possible under budget-neutral conditions.

Moments after the news went public, BTC’s price slipped from roughly $91,200 to about $84,667—a drop of more than 7%—in what many observers are calling a classic “sell the news” moment. Some market participants appear dissatisfied that the executive order is not immediately more aggressive in buying Bitcoin. Yet key industry voices maintain that the market may have misread the long-term implications.

Is The Strategic Bitcoin Reserve A Disappointment?

According to David Sacks, White House AI and crypto czar, who announced the development via X: “Just a few minutes ago, President Trump signed an Executive Order to establish a SBR. The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings. This means it will not cost taxpayers a dime.”

Sacks added that the US owns about 200,000 Bitcoin. However, he also clarified that “there has never been a complete audit” and that “the E.O. directs a full accounting of the federal government’s digital asset holdings.” Notably, the US President Trump commits to not selling “any Bitcoin deposited into the Reserve. It will be kept as a store of value. The Reserve is like a digital Fort Knox for the cryptocurrency often called ‘digital gold.’”

Additionally, the Secretary of Treasury and Commerce—led by well-known Bitcoin bull Howard Lutnick—is authorized to develop budget-neutral strategies for acquiring more Bitcoin. Although specific methods remain unclear, the move could lead to further US government BTC accumulation. “The Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring additional Bitcoin, provided that those strategies have no incremental costs on American taxpayers,” Sacks writes via X.

Separate from the SBR, the executive order establishes a US Digital Asset Stockpile, which will include seized digital assets other than BTC. According to Sacks, this stockpile will not be actively expanded beyond whatever coins the government gains via forfeiture. Its purpose, he explained, is to exercise “responsible stewardship of the government’s digital assets under the Treasury Department.”

In the midst of the price volatility, industry leaders struck an optimistic tone. David Bailey, CEO of BTC Inc, wrote on X: “The global response to tonight’s news will be immediate. This is the shot heard around the world. Could not be more proud of this moment or more excited for what comes next. See you on the moon.”

Nic Carter, general partner at Castle Island Ventures stated via X: “Announcement couldn’t have gone better: Campaign promise kept. Bitcoin Reserve clearly distinguished from altcoin Stockpile. Bitcoin gets official USG seal of approval, no other coin does. No taxpayer $ spent to acquire coins (so no backlash). Future acquisition of coins likely left to Congress, as it should be.”

Bitwise Chief Investment Officer (CIO) Matt Hougan listed four reasons why the executive order has major bullish impacts on Bitcoin:

1) Dramatically reduces the likelihood the US government will some day “ban” Bitcoin;

2) Dramatically increases the likelihood that other nations will establish strategic Bitcoin reserves;

3) Accelerates the speed at which other nations will consider establishing strategic Bitcoin reserves, because it creates a short-term window for nations to front-run potential additional buying by the US;

4) Makes it much harder for institutions — from national account advisor platforms to quasi-governmental agencies like the IMF — to position Bitcoin as somehow dangerous or inappropriate to hold.

Renowned crypto analyst MacroScope (@MacroScope17), commented: “The market has been unsure there would even be a strategic reserve. Now, not only will there be one, actually acquiring more BTC looks likely. The immediate sell-the-news reaction aside, over the longer term, this is hugely bullish compared to the market’s expectations up to this point.”

The analyst expects that this news will ignite a “nation-state arms race psychology”. Also, he expects to see more 13F filings by sovereign wealth funds who waited for this announcement. “Critical to watch this in coming weeks and months,” he concluded.

At press time, BTC traded at $88,104.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin: Analyzing Divergence In Investor Behavior – Who’s Buying And Selling BTC?

The Bitcoin price started the week on a strong footing, jumping back above $90,000 following the announcement of a strategic crypto reserve by US President Donald Trump. However, the flagship cryptocurrency barely sustained this momentum, dropping back beneath the $90,000 level before midweek.

The recent market uncertainty is mirrored in the Bitcoin action, as the price has moved mostly sideways (after the initial pump) within the $82,000 – $92,000 range. The question now is — who is behind the constant price retracement and consolidation?

Short-Term Sell-Offs Meet Long-Term Confidence: Analyst

In a Quicktake post on the CryptoQuant platform, an analyst with the pseudonym ShayanBTC discussed the divergence in investor behavior while using on-chain data to evaluate current market sentiment. The relevant on-chain indicator here is the Spent Output Age Bands (SOAB) metric, which sorts spent coins into categories depending on their age and as a proportion of total coins moved.

ShayanBTC specifically analyzed the bags of investors between the 1-week and 6-month cohorts (short-term holders) using the Spent Output Age Bands. Data from CryptoQuant shows that the selling activity of short-term investors drove the recent Bitcoin downturn.

These investors, known for their rapid reactions to market fluctuations, have been actively depositing BTC onto exchanges — which can be associated with selling pressure. Considering the sensitive nature of short-term holders to market sentiment and technical resistance levels, their selling behavior aligns with Bitcoin’s recent struggle to sustain any bullish momentum.

Source: CryptoQuant

On the other hand, long-term investors (those holding BTC for more than 6 months) have shown no signs of capitulation. While some level of profit-taking can be seen among this group of Bitcoin holders, it seems to be rather gradual and consistent with the behavior seen in healthy bull markets rather than mass liquidations.

The activity of long-term Bitcoin investors suggests that they anticipate future price appreciation before offloading larger portions of their holdings, thereby reducing the BTC supply in the open market. ShayanBTC added that “if sufficient demand enters the market, this supply shrinkage could fuel further price appreciation.”

Interestingly, the latest on-chain data shows that Bitcoin’s long-term investors are not the only market participants refraining from offloading their assets. Crypto pundit Ali Martinez revealed in a post on X that the BTC miners have recorded zero selling activity since February 28.

Bitcoin Price At A Glance

As of this writing, the premier cryptocurrency is valued at around $86,200, reflecting a mere 0.5% price decline in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

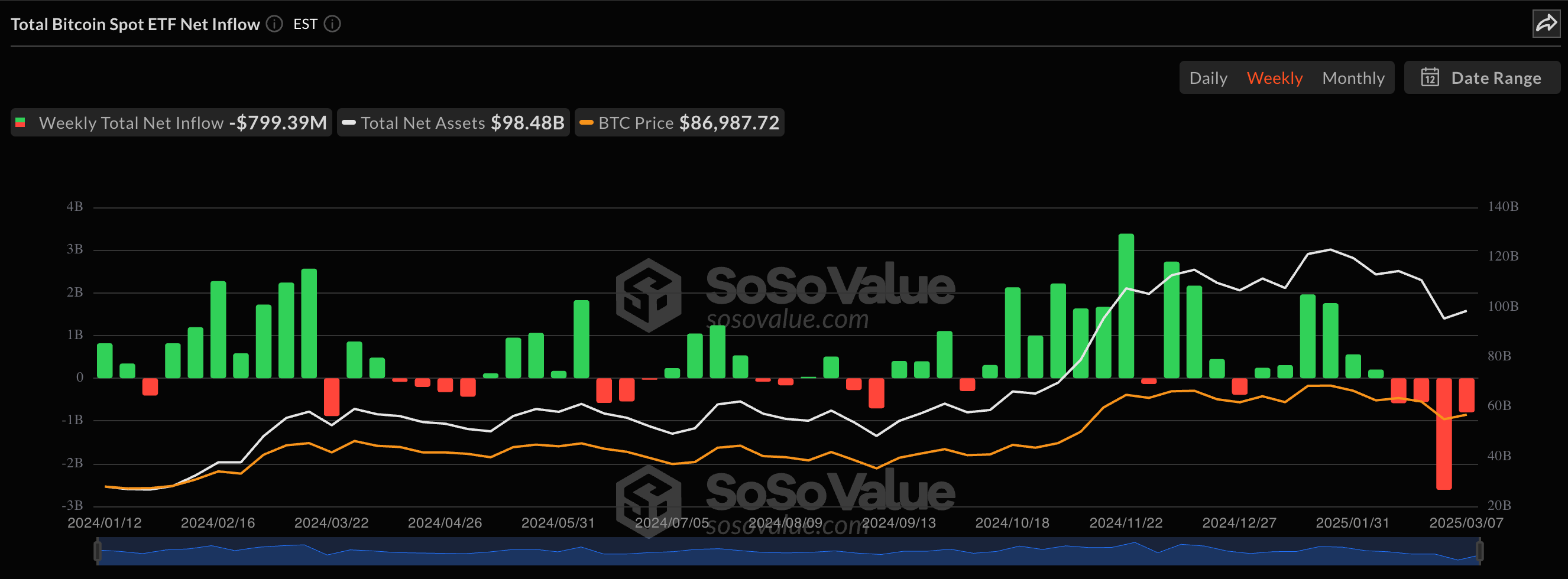

US Bitcoin ETFs Record $800 Million Net Outflow In Past Week — Details

The US-based Bitcoin ETFs (exchange-traded funds) have continued to struggle in terms of investor participation and interest over the last few weeks. In the last week of February, the crypto-based financial products witnessed a record-breaking $1.14 billion single-day withdrawal.

The story wasn’t any much different for the Bitcoin ETFs to start the month of March, registering a net outflow of nearly $800 million in the past week. This growing trend reflects the shift in the appetite and sentiment of institutional investors, especially in the United States.

Bitcoin ETFs Post $409 Million Daily Net Outflow

According to the latest market data, the United States Bitcoin ETF market posted a daily net outflow of roughly $409 million on Friday, March 7. This marked the fifth consecutive day of withdrawals for the Bitcoin exchange-traded funds.

Ark & 21 Shares Bitcoin ETF (with the ticker ARKB) saw the largest volume of withdrawals (over $160 million) on Friday. This was followed closely by Fidelity Wise Origin Bitcoin Fund (FBTC), which posted net outflows of approximately $155 million to close the week.

BlackRock’s Bitcoin Trust (IBIT), the largest Bitcoin exchange-traded fund by net assets, declined in net value by $39.85 million on Friday. Meanwhile, Grayscale’s Bitcoin Trust (GBTC) and Bitwise’s BTC fund (BITB) followed with total outflows of roughly $36.5 million and $18.6 million, respectively, on the day.

Source: SoSoValue

Interestingly, VanEck’s Bitcoin fund (with the ticker HODL) was the only one of the US-based Bitcoin ETFs that recorded a net inflow on Friday. The exchange-traded fund added about $617,500 in value to close the week.

As already mentioned, this single-day performance marked the fifth straight day of net outflows for the Bitcoin ETFs. The crypto-based products are yet to record an inflow day in March, as they last posted a net daily inflow on Friday, February 28.

This $409 million single-day withdrawal put the Bitcoin ETFs’ weekly performance at a net outflow of $799.9 million in the past week. Interestingly, this represents the fourth consecutive week (and the second-highest ever) of net outflows for the crypto exchange-traded funds.

Bitcoin Price At A Glance

The performance of the BTC exchange-traded funds in recent weeks somewhat mirrors the sluggish Bitcoin price action within this same period. The price of Bitcoin has been unable to sustain any positive momentum from the somewhat improving crypto climate in the United States.

As of this writing, the premier cryptocurrency is valued at around $86,100, reflecting an over 1% price decline in the past 24 hours. On the weekly timeframe, though, the Bitcoin price is up by more than 2%, according to data from CoinGecko.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

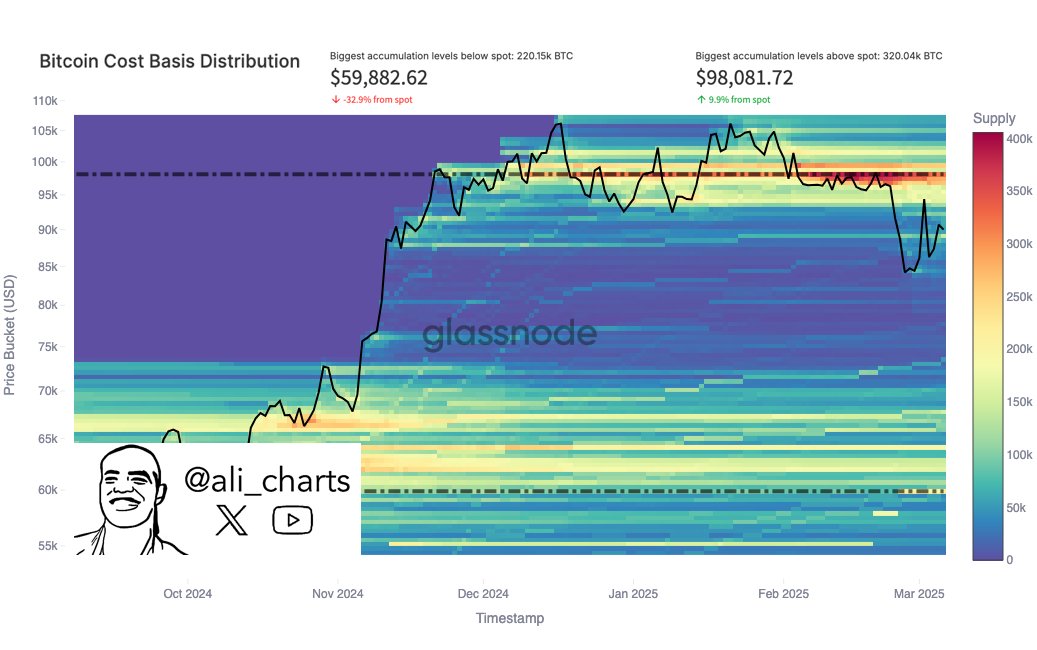

Bitcoin’s Path To $100,000 Faces Stiff Resistance At $98,000 — Analyst

The Bitcoin (BTC) market took a positive turn in the past week rising by 1.10% according to data from CoinMarketCap. While there are still expectations of a further price correction, the effects of macroeconomic developments as seen with recent statements from US President Donald Trump cast more uncertainty over the premier cryptocurrency’s future trajectory.

Bitcoin Bulls Face A Showdown At $98K Resistance – Can They Break Through?

Following an extended market correction, Bitcoin recorded spontaneous market gains in the last week reaching a local peak of round $95,000. Currently, the crypto asset trades around $86,000 with little indication of its future movement.

According to top market analyst Ali Martinez, Bitcoin’s price action is currently stuck between two key accumulation levels based on its cost basis distribution (CBD) — the allocation of Bitcoin holdings according to the price at which different investors acquired their BTC. The CBD helps to identify major support and resistance levels by showing where significant amounts of Bitcoin were bought or sold.

Based on the CBD data, Ali Martinez explains in making any further gains, Bitcoin will face a key resistance at $98,081. This prediction stems from investors previously acquiring 320,040 BTC at this price region and are likely to sell following a price rebound to exit the market with little or zero losses. However, if Bitcoin bulls can mount sufficient buying pressure to break past this resistance level, it paves the way for a return above $100,000 and perhaps a new all-time high.

On the other hand, should BTC resume its correction trend, Martinez highlights that the next significant support level based on accumulation data is at $59,882 at which 220,150 BTC have been previously accumulated.

If Bitcoin declines toward these support levels, it is likely to experience a strong bounce as long-term holders are likely to acquire more BTC to defend their positions. Interestingly, this analysis aligns with other market insights that suggest BTC is likely to undergo further correction. However, it’s worth noting that any decisive break below $59,882 would trigger a massive amount of panic selling.

BTC Price Outlook

At the time of writing, BTC trades at $85,995 following a minor 1.98% decline in the past day. Meanwhile, its daily trading volume is down by 6.38%, indicating a decrease in market interest. Amidst positive events like the establishment of a US Strategic Bitcoin Reserve, the BTC market remains in a rather volatile state as indicated by the larger market reaction to events of the past week.

Featured image from Morningstar, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market24 hours ago

Market24 hours agoPEPE Price Hits 6-Month Low; Recovery Delayed Further

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Eyes Key Support at $2,350 — Price Surge To Follow?

-

Altcoin24 hours ago

Altcoin24 hours agoCan XRP Become The Cornerstone OF US Global Financial Policy?

-

Altcoin21 hours ago

Altcoin21 hours agoWhat’s Next for Cardano Price as Bears Take Control Below Key Support?

-

Ethereum17 hours ago

Ethereum17 hours ago330,000 Ethereum Withdrawn From Exchanges In 72 Hours – Supply Squeeze Incoming?

-

Market17 hours ago

Market17 hours agoBitcoin Pepe maintains its shine as Bitcoin price bleeds further

-

Altcoin16 hours ago

Altcoin16 hours agoAndre Cronje Outlines Reasons For Ethereum’s Underperformance This Cycle

-

Regulation13 hours ago

Regulation13 hours agoGemini Cofounder Reveals How Much David Sacks Will Lose In Crypto Gains In Four Years