Market

UNI Price Recovery Gains Traction – Will It Smash Through Resistance?

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

Market

FTX Would Still Have $93 Billion

Sam Bankman-Fried interviewed Tucker Carlson from prison. The former FTX CEO still thinks declaring bankruptcy was a bad decision, and the exchange would have $93 billion in assets from his investments.

Bankman-Fried’s answers showed that many of his beliefs have remained the same since 2022, but it’s important to remember his biases.

Sam Bankman-Fried’s First Video Interview From Prison

Sam Bankman-Fried, the infamous FTX co-founder, is reappearing in the media despite his 25-year incarceration. Last month, he conducted his first interview from prison, angling for a pardon from President Trump.

Today, Bankman-Fried sat down with Tucker Carlson for a new video interview covering a wide range of topics.

This time, however, he didn’t mention the pardon. When Carlson asked Bankman-Fried why his extensive political contributions didn’t help him avoid prison in 2022, he responded by talking about his disillusionment with the Democratic Party.

This aligns with statements made in his previous interview.

“One factor that might be relevant is, in 2020, I was center-left, and I gave a lot to Biden’s campaign. I was optimistic. By 2022, I was giving to Republicans, privately, as much as Democrats. That started becoming known right around FTX’s collapse. That probably played a role,” he claimed.

Other than that change, however, many of his crypto-related beliefs appear unchanged since the FTX collapse in 2022. For example, Carlson asked Bankman-Fried whether crypto crimes were bigger 10 years ago, and he replied that they were smaller, citing the Silk Road.

When asked if he had any liquid assets, Bankman-Fried talked about roads not taken.

“The company I used to own, had nothing intervened, today would have about $15 billion of liabilities and about $93 billion of assets. There was enough money to pay everyone back in kind at the time. Plenty of interest left over, and tens of billions left for investors. But that’s not how it worked out. It’s been a colossal disaster,” Bankman-Fried stated.

In other words, he doesn’t seem to think that his actions at FTX were wrong or fraudulent. Similarly, the Silk Road achieved widespread notoriety, but its transactions amounted to less than $200 million.

Meanwhile, crypto scams in 2025 can steal that much in one day. In other words, it’s important to remember his biases, especially since he is removed from the scene.

Carlson grilled Bankman-Fried on a few other topics, like whether crypto scams were tarnishing the industry’s reputation. For the most part, they talked about other topics, such as celebrities incarcerated with him, using muffins as “prison money,” Bankman-Fried’s upcoming birthday, etc.

The FTX founder is still trying to appeal his conviction but acknowledged that it’s a long shot.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Altcoin Season Remains Elusive as Market Struggles Amid Trump’s Trade Wars

At the start of 2025, several altcoins surged to new all-time highs. Others climbed to multi-month peaks, riding the wave of the Donald Trump-fueled rally that swept through the crypto market.

However, Trump’s escalating trade wars and broader macroeconomic unrest have led to a significant downturn in many altcoins, raising questions about the timing of the next altcoin season.

Altcoin Season Slips Further Away

Altcoin season refers to a market cycle in which crypto assets other than Bitcoin significantly outperform BTC in terms of price gains. Many altcoins witness significant price surges during this period, often due to increased investor speculation, capital rotation from BTC into other crypto assets, and bullish sentiment in the market.

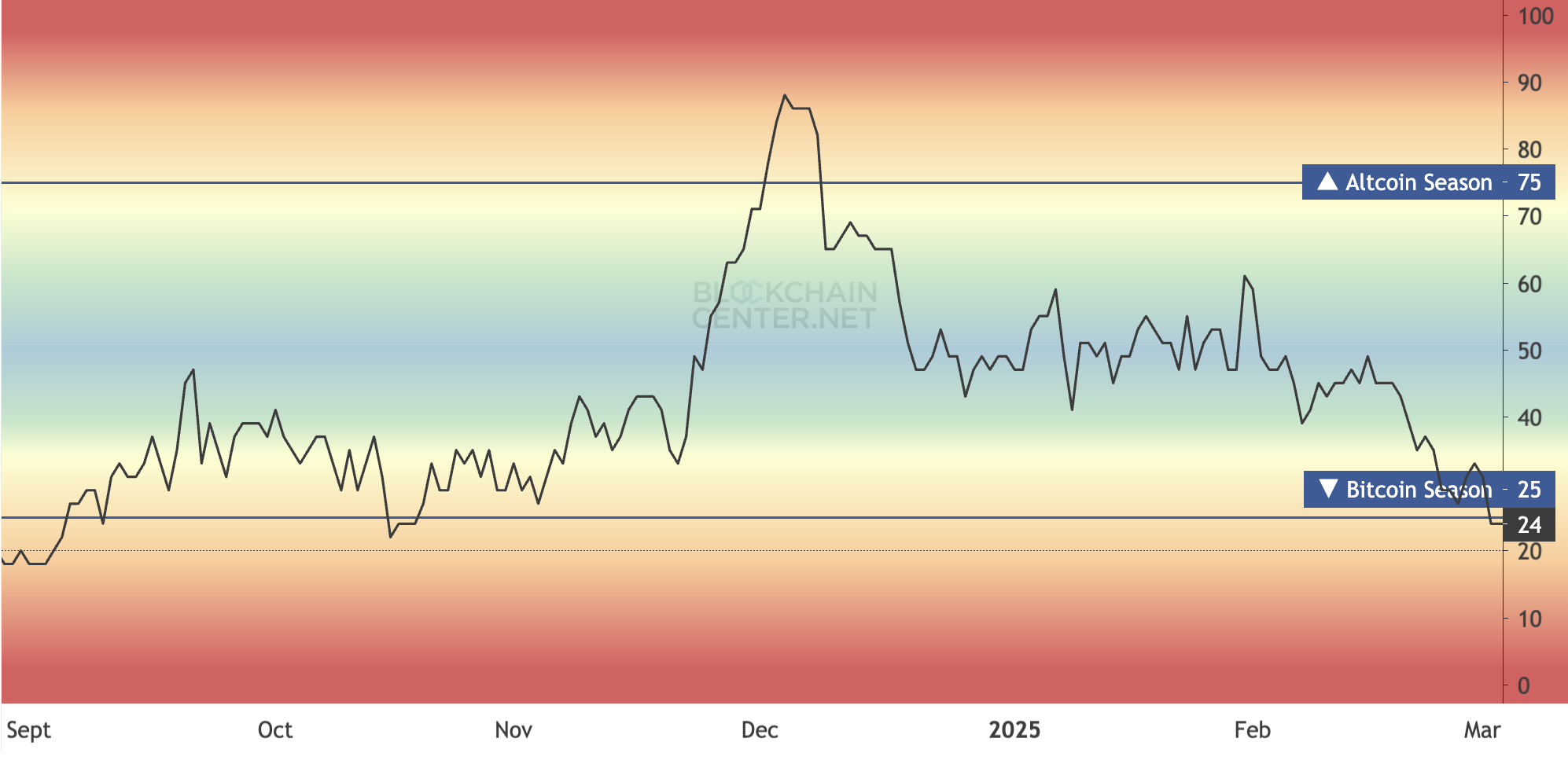

This cycle commences when at least 75% of the top 50 altcoins outperform BTC over a three-month period. However, this is far from the reality. The Altcoin Index, which tracks this trend, has plunged to its lowest level since October 2024, signaling continued weakness in the sector.

As of this writing, only 24% of top altcoins have outperformed leading crypto Bitcoin over the past 90 days, highlighting its dominance in the current market cycle. This persistent underperformance suggests that an altcoin season may still be far off.

Further reinforcing this bearish outlook, TOTAL2, the metric tracking the total market capitalization of all cryptocurrencies excluding BTC, has remained in a descending parallel channel since the beginning of the year.

This pattern signals a sustained downtrend. It is formed when an asset’s price moves between two downward-sloping parallel trendlines, with lower highs and lower lows over time. As of this writing, TOTAL2 is at $1.14 trillion, plummeting by 17% since January 1.

This decline confirms the lack of strong bullish momentum across the altcoin market, hinting at zero likelihood of an altcoin season kicking off anytime soon.

Bitcoin Dominance Climbs as Market Pullback Deepens

While the market has witnessed a significant pullback recently amid Trump’s trade wars, Bitcoin dominance has continued to increase. An assessment of Bitcoin’s dominance (BTC.D) on a daily chart confirms the same.

This metric, which measures the percentage of the total cryptocurrency market capitalization that Bitcoin holds, has remained above an ascending trend line since last December. As of this writing, it sits at 61.29%.

If BTC’s dominance remains elevated, it could further delay the prospects of an altcoin season.

The post Altcoin Season Remains Elusive as Market Struggles Amid Trump’s Trade Wars appeared first on BeInCrypto.

Market

Onyxcoin (XCN) Eyes Rebound After 50% Drop

Onyxcoin (XCN) lost over 50% in February after a massive rally of nearly 2,000% between January 13 and January 26. Despite the ongoing decline, its recent indicators show mixed signals. RSI has stayed neutral for the past nine days, and ADX is pointing to a weakening downtrend.

XCN is currently trading between resistance at $0.017 and support at $0.0143, with EMA lines still reflecting a bearish trend. Whether the price moves higher or lower will depend on whether momentum returns or if selling pressure continues to push XCN toward lower support levels.

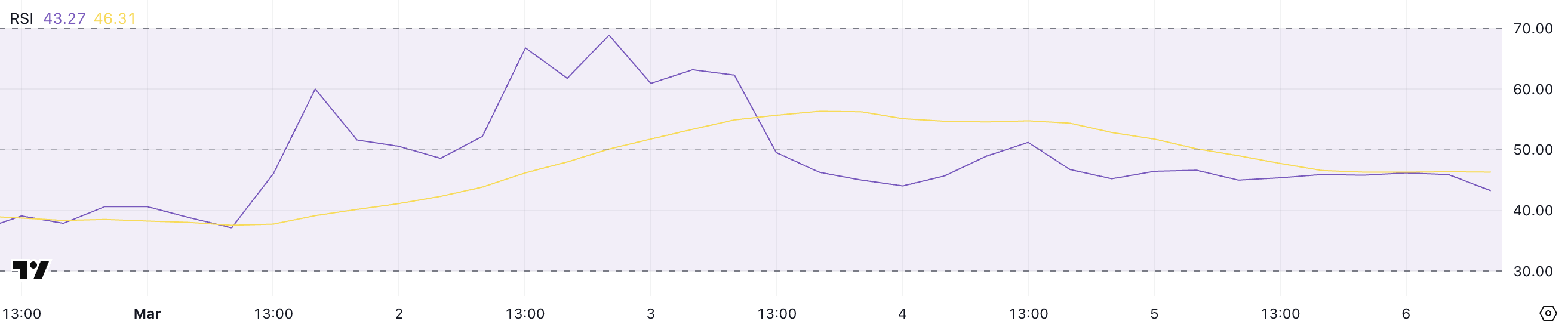

XCN RSI Has Been Neutral For 9 Days

Onyxcoin has an RSI of 43.2, down from its recent high of 68.9 on March 2.

Since yesterday, it has been fluctuating between 45 and 46, maintaining a neutral position without clear upward or downward momentum.

RSI, or the Relative Strength Index, is a momentum indicator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Readings above 70 indicate overbought conditions, suggesting a potential pullback, while readings below 30 signal oversold conditions, which could precede a rebound.

With XCN’s RSI at 43.2, the asset remains in neutral territory, where it has been since February 25.

A move above 50 could indicate growing bullish momentum, while a drop toward 30 may signal increasing selling pressure.

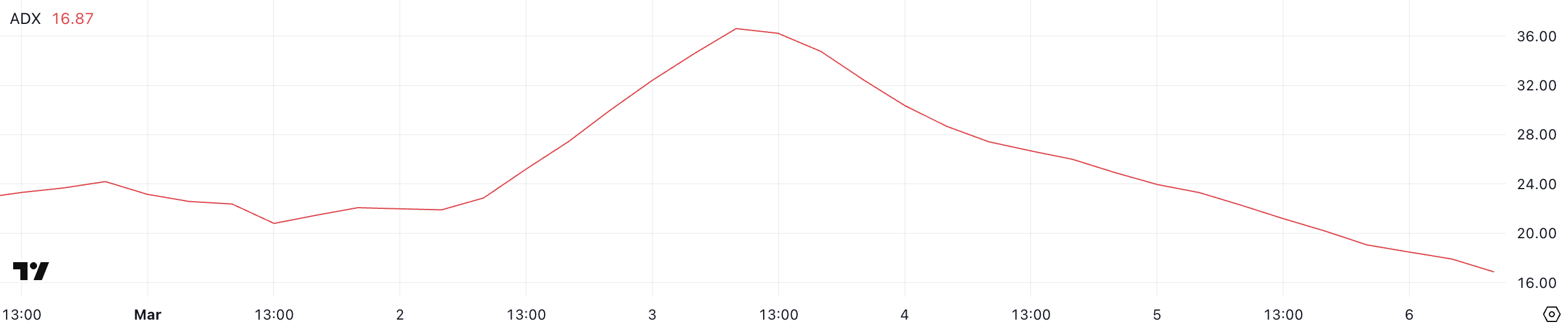

Onyxcoin ADX Shows the Downtrend Is Losing Steam

XCN’s ADX is 16.8, down from 36.6 three days ago, indicating a steady decline in trend strength. This drop suggests weakening momentum, aligning with XCN’s recent downtrend over the past few days.

The Average Directional Index (ADX) measures the strength of a trend on a scale from 0 to 100.

Readings above 25 typically indicate a strong trend, while values below 20 suggest weak or nonexistent trend momentum. With XCN’s ADX at 16.8, the current downtrend lacks strong conviction, meaning further downside may be limited unless momentum picks up again.

If ADX continues to decline, XCN could move into a consolidation phase rather than a sustained downward move.

Onyxcoin Could Fall Below $0.014 Soon

After a historical surge in January, when XCN was one of the best-performing altcoins in the market, Onyxcoin’s price is now trading between resistance at $0.017 and support at $0.0143. Its EMA lines show a bearish trend as short-term EMAs remain below long-term ones.

If the ongoing downtrend continues, XCN could test the $0.0143 support level, and a break below that could push the price further down to $0.0134.

However, ADX indicates that the downtrend is weakening, which could open the door for a reversal.

If buying momentum returns, Onyxcoin could test resistance at $0.017, and a breakout above that level could send the price toward $0.022. A stronger recovery, similar to its momentum in January, could push XCN as high as $0.0264.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Predicts Dogecoin Price Rally To $6.24 on This Condition

-

Market21 hours ago

Market21 hours agoBitcoin Regains $90,000 Ahead of Key White House Crypto Summit

-

Market24 hours ago

Market24 hours agoBitcoin Pepe readies for a crypto revolution amidst a risk-off mood

-

Market23 hours ago

Market23 hours agoCrypto AI Agents Face Bear Market, But DeFAI Brings Hope

-

Bitcoin15 hours ago

Bitcoin15 hours agoBitcoin Price Could Soar as Global M2 Money Supply Expands

-

Altcoin21 hours ago

Altcoin21 hours agoAnalysts Predict Solana Price Next Big Move As Key Support Holds

-

Market15 hours ago

Market15 hours agoBNB Price Starts Fresh Increase—Can Bulls Sustain the Momentum?

-

Altcoin19 hours ago

Altcoin19 hours agoBTC Nears $92K, Major Altcoins Gain