Market

The Altcoin/BTC Spot Market Is Dying

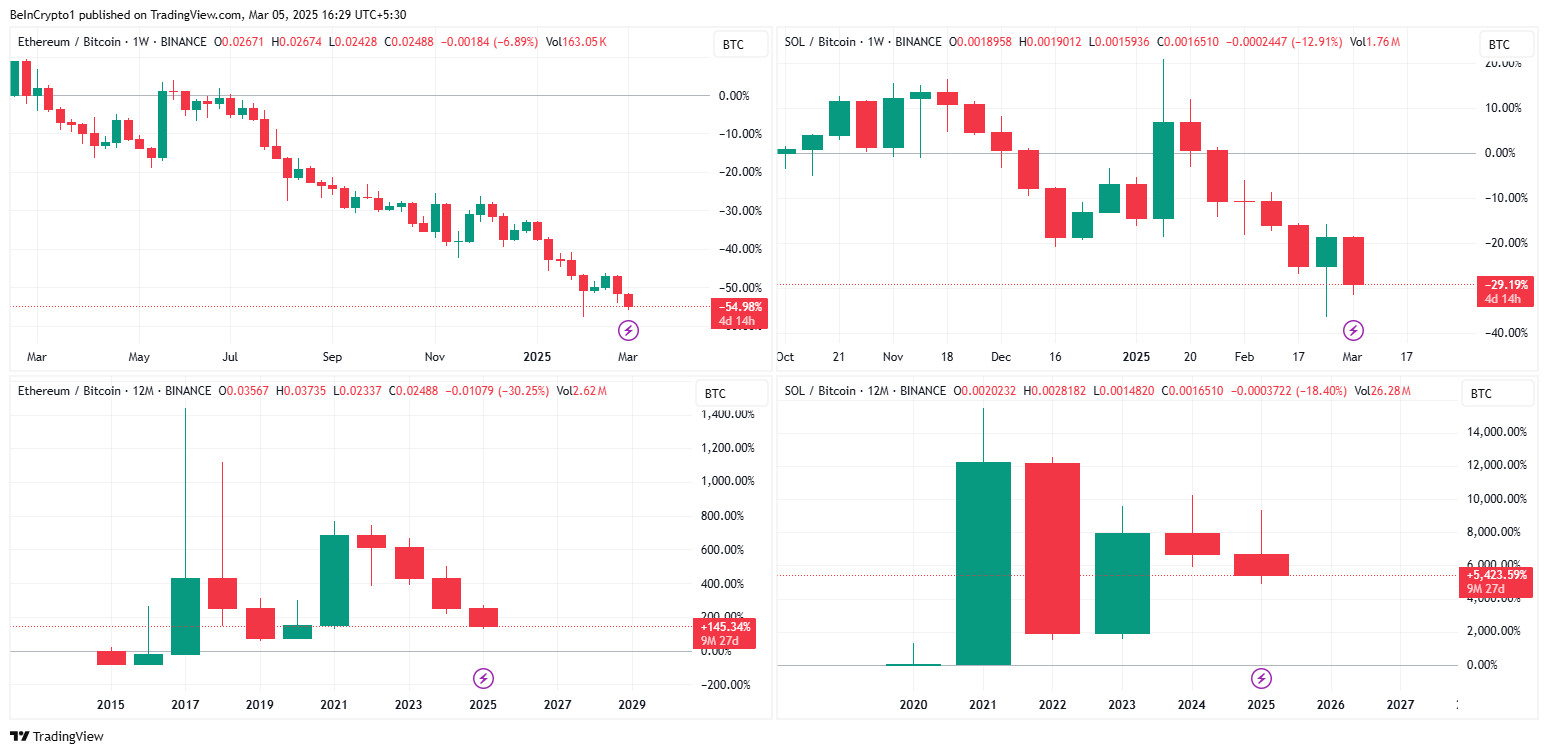

Altcoin/BTC spot trading pairs were once considered a key channel for investors to increase their Bitcoin holdings. However, this perception is fading. Data indicates a decline in interest, with many Altcoin/BTC pairs delisted in early 2025.

Meanwhile, Altcoin/USDT spot pairs remain the primary avenue for traders seeking profits.

Binance Delists Multiple Altcoin/BTC Spot Pairs

At the beginning of 2025, Binance removed several Altcoin/BTC spot pairs from its platform. Today, Binance announced the delisting of MDT/BTC, MLN/BTC, VIB/BTC, VIC/BTC, and XAI/BTC due to low liquidity and trading volume. This is not the first such announcement this year.

“To protect users and maintain a high-quality trading market, Binance conducts periodic reviews of all listed spot trading pairs and may delist selected spot trading pairs due to multiple factors, such as poor liquidity and trading volume,” Binance stated.

Since the start of the year, Binance has issued seven delisting announcements, affecting 34 spot trading pairs. Of these, 50% were Altcoin/BTC pairs, while the rest were Altcoin/ETH or Altcoin/BNB. Notably, the delisting of an Altcoin/BTC pair does not necessarily mean its corresponding Altcoin/USDT pair is removed (e.g., ENJ, C98, REZ).

This shift reflects traders’ preference for Altcoin/Stablecoin pairs, likely due to better liquidity and lower risk exposure.

Retail Investors Reduce Bitcoin Holdings While Institutions Accumulate

CryptoQuant data shows that retail investors have been reducing their BTC holdings since Q4 2024, while large investors continue to accumulate.

“Retail is panic-selling. Whales are accumulating,” Investor Mister Crypto commented.

Since the approval of Bitcoin ETFs and the start of Trump’s new term, Bitcoin has become a playground for institutional investors. Retail traders seem less interested, as BTC’s high price is out of reach for many. Instead, they hold fewer BTC and allocate more capital to altcoins, particularly meme coins.

Furthermore, trading Altcoin/BTC pairs exposes traders to two risks simultaneously—the volatility of both altcoins and Bitcoin. Even the most liquid pairs, such as ETH/BTC and SOL/BTC, have shown prolonged downtrends and high volatility, increasing the risk of losses.

Market analysts also tend to focus on Altcoin/USDT spot pairs, leaving Altcoin/BTC pairs with less attention.

According to CoinMarketCap data, USDT’s daily trading volume exceeds $115 billion, out of a total market trading volume of $147 billion. This confirms that USDT remains the primary channel for traders seeking opportunities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Gears Up—Can It Overcome Key Resistance Levels?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Uniswap’s Unichain L2 Raises Red Flags About Tokenholder Rights

Uniswap Labs’ decision to launch Unichain, its Layer-2 (L2) network, without extensive consultation with the Uniswap DAO has sparked significant controversy within the DeFi community.

Critics argue that this move raises serious concerns about transparency, centralization, and the broader impact on Uniswap’s ecosystem.

Uniswap Labs and Uniswap Foundation Under Fire

The launch of Unichain has highlighted governance concerns for the Uniswap ecosystem. Community members and delegates expressed frustration over the lack of input from UNI token holders.

Notably, DeFi analyst Ignas pointed out that Uniswap Foundation recently approved a $165.5 million funding proposal to support Unichain’s development and incentivize liquidity migration. However, many believe this funding benefits Uniswap Labs and the Uniswap Foundation at the expense of UNI holders, who currently receive no revenue from the platform.

Reportedly, Uniswap Labs has generated an estimated $171 million in front-end fees over the past two years. Unlike competitors such as Aave (AAVE), which shares protocol revenues with token holders through a fee switch mechanism, Uniswap has centralized all earnings, further fueling discontent among UNI investors.

“In a shifting era where Aave proposes buying back $1M of AAVE per week and Maker $30/month buy-backs, UNI holders are a milking cow with now value accrual to the token…Aave and Maker have a more aligned relationship with token holders, and I don’t see why front-end fees couldn’t be shared with UNI holders.,” Ignas expressed.

Duo Nine, a crypto analyst, criticized this strategy, suggesting that Uniswap should use its funds to buy back UNI tokens rather than investing heavily in Unichain.

“They are better off buying UNI with that cash. Their flywheel won’t work if they don’t reward token holders. Creating an L2 seems like an unnecessary cost now,” the analyst remarked.

In response to concerns about how the expansion would be funded, Ignas speculated that Uniswap would sell UNI tokens to cover the costs. However, such a move could lead to further dilution and dissatisfaction among holders.

Liquidity Fragmentation: A Major Concern

Another key issue surrounding Unichain’s launch is the risk of liquidity fragmentation. Uniswap DAO has allocated $21 million to attract Total Value Locked (TVL) to Unichain, aiming to grow it from $8.2 million to $750 million.

However, many worry that these incentives will primarily lure liquidity providers (LPs) away from Ethereum and other Layer-2 (L2) networks rather than attracting new capital.

Ignas warned that shifting liquidity to Unichain could weaken Uniswap’s market share on Ethereum, allowing competitors to gain ground.

“Incentivizing TVL on Unichain leads to LPs migrating from Ethereum and L2s, decreasing market share on ETH/L2s, and enabling competitors to emerge,” Ignas added.

This liquidity migration could lead to higher slippage and less favorable trading conditions across the broader DeFi ecosystem.

Despite concerns, the Uniswap Foundation remains committed to expanding Unichain’s adoption and incentivizing liquidity migration. BeInCrypto reported that the foundation intends to drive growth for Uniswap v4 and Unichain. However, skepticism remains over whether they will deliver long-term value to the protocol’s ecosystem.

However, since Unichain L2 launched on the mainnet on February 11, the Uniswap token price has been declining. As of this writing, UNI was trading for $7.52, up by a modest 2% since Thursday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Price Starts Fresh Increase—Can Bulls Sustain the Momentum?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Market23 hours ago

Market23 hours agoInsights from Outlier Ventures CEO

-

Altcoin23 hours ago

Altcoin23 hours agoLawyer Reveals If Ripple Vs SEC Resolution Possible In March

-

Altcoin22 hours ago

Altcoin22 hours agoBitcoin Tests $90K on Speculation of Trump’s Crypto Reserve Plan

-

Market17 hours ago

Market17 hours ago3 Key Things to Expect From the White House Crypto Summit

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Extends RedStone Backing; RED Price To Hit New ATH?

-

Altcoin17 hours ago

Altcoin17 hours agoWisdomTree Predicts XRP and Solana To Lead Altcoin Season

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum’s Price Next Move: ETH Eyes Bullish Breakout From Key Chart Pattern

-

Market22 hours ago

Market22 hours agoXCN Price in Freefall – Will It Recover?