Market

XCN Price in Freefall – Will It Recover?

Onyxcoin has been on a persistent downtrend since reaching its all-time high of $0.049 on January 26. Trading at $0.015 at press time, the coin has since shed 57% of its value.

With mounting bearish pressure, the decline may not be over as market indicators signal further downside risks.

XCN Faces Heavy Sell Pressure

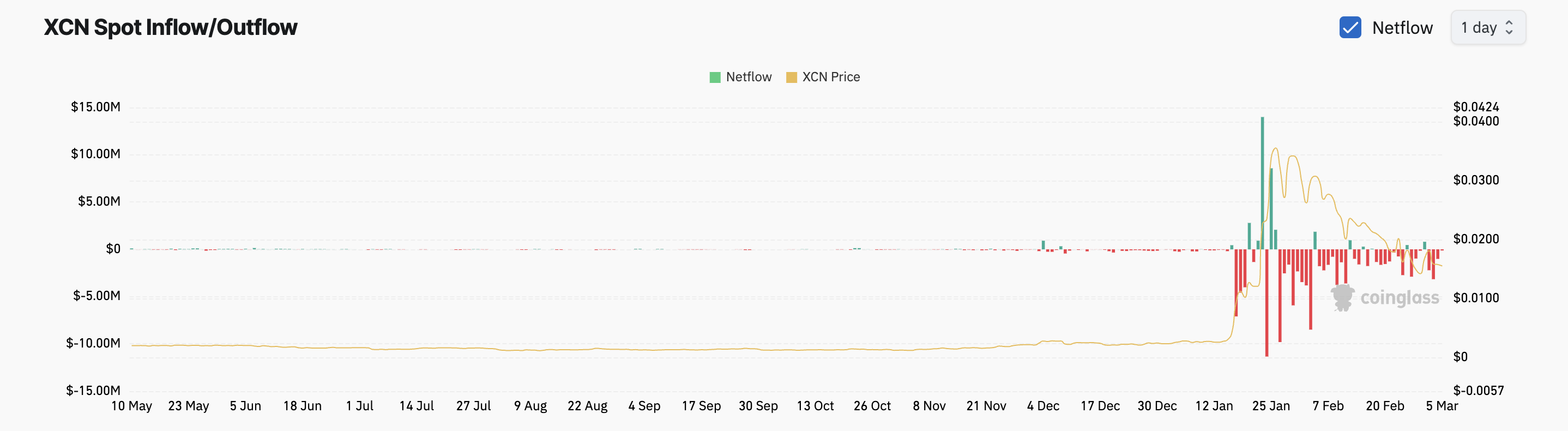

The steady outflows from XCN’s spot markets over the past month reflect the increased selling activity among its investors. Per Coinglass, in February, the altcoin only recorded four days of inflows, which totaled just $3.5 million. Conversely, XCN spot outflows exceeded $15 million during the same period.

Outflows from the XCN spot markets have reached $6.45 million so far this month. When an asset records significant spot outflows like this, its investors are selling their holdings.

This trend indicates that profit-taking is significant among XCN traders. It is a sign that there is no new demand for the altcoin, potentially lowering its prices in the short term.

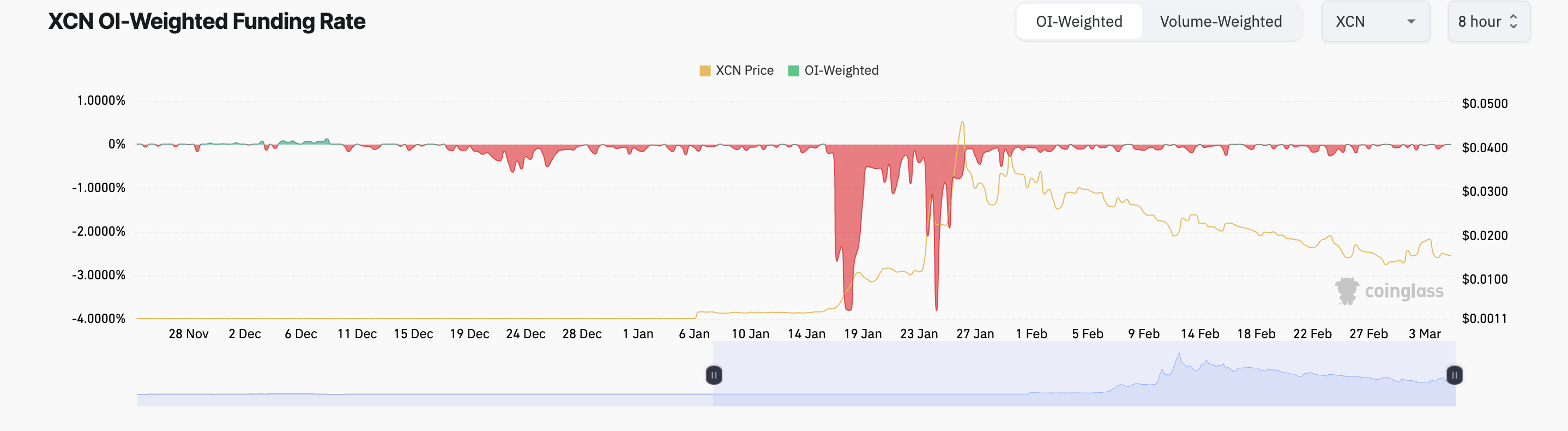

Moreover, its funding rate has been predominantly negative since the beginning of the year, highlighting the bearish bias toward XCN.

This periodic fee is exchanged between long and short traders in perpetual futures contracts. It is designed to keep contract prices aligned with the spot market. When persistently negative like this, it means short positions are dominant, indicating traders are betting on further price declines, which can further reinforce bearish sentiment.

XCN Stuck in Downtrend: Will It Break Free or Drop Further?

On the daily chart, XCN remains within the descending parallel channel it has traded within since January 26. This bearish pattern is formed when an asset’s price moves between two downward-sloping parallel trendlines, indicating a sustained downtrend.

The pattern suggests that XCN sellers are in control. A drop below the lower trend line, which forms support, hints at further downside. If this happens, XCN’s price could drop to $0.0075.

However, a bullish resurgence in the XCN market could prevent this. If new demand soars, the token’s value could climb to $0.022.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Pepe’s presale nears $4m as BTC’s price hits $92k

Key takeaways

- BTC is trading above $92k after adding 6% to its value in the last 24 hours.

- The Bitcoin Pepe presale is approaching $4 million as stage six nears completion.

Bitcoin surpasses $92k on tariff news

BTC, the number one cryptocurrency by market cap, was bullish on Wednesday, adding over 6% to its value and allowing it to cross the $92k level. At press time, the price of Bitcoin stands at $92,263 and could surge higher in the near term.

Bitcoin’s rally can be attributed to tariff news as President Trump delays tariffs on auto parts from Mexico and Canada. The news eased investor worries and could push Bitcoin’s price higher in the coming hours and days.

What is Bitcoin Pepe?

As Bitcoin’s price crosses the $90k level, altcoins are also performing excellently. New projects are not left out as investors continue to push funds into exciting projects in the crypto market.

Bitcoin Pepe is an exciting project that seeks to revolutionise the Bitcoin ecosystem. It is approaching a key level in its presale, with investors pushing millions of dollars into the project.

Bitcoin Pepe is seeking to leverage the liquidity and security of the Bitcoin blockchain. It will use Bitcoin’s position in the market to introduce memecoins to its ecosystem.

The team revealed in its whitepaper that they are building a layer-2 network on the Bitcoin blockchain. Bitcoin Pepe will be a meme-specialized layer-2 solution built on top of Bitcoin, bringing Solana-style scalability to the Bitcoin network.

As a L2 network, Bitcoin Pepe will build a home for memecoin activities within the Bitcoin ecosystem. This will help it unlock decentralized finance (DeFi) and meme trading on top of BTC.

This project is also the first-ever meme initial coin offering (ICO) on the Bitcoin blockchain, making it the perfect fusion between BTC’s security and the unstoppable force of memecoins.

The utility will enable Bitcoin Pepe to combine high levels of trust (BTC) with high levels of performance (SOL) to capture high levels of retail mass adoption.

Bitcoin Pepe presale nears $4m

The Bitcoin Pepe presale has been running for three weeks and has raised $3.9 million. It is approaching the $4 million mark and will soon enter its seventh stage, with 23 more stages to go.

The native token, $BPEP, is available to investors via the Bitcoin Pepe website. The token can be purchased using various cryptocurrencies, including ETH, USDT, USDC, BNB, and SOL. In this sixth presale stage, $BPEP is going for $0.0268 and is set to increase to $0.0281 in the next stage.

Bitcoin Pepe’s utility makes this presale an excellent opportunity for investors as it could enable them to get in early on an exciting project.

Will Bitcoin Pepe boost the Bitcoin ecosystem?

The Bitcoin Pepe project will unveil products and services that could improve the Bitcoin ecosystem. Introducing DeFi and memecoin trading on Bitcoin could enhance the network’s utility, enabling it to compete with smart contract blockchains like Ethereum and Solana in terms of utility.

Bitcoin Pepe will enable developers to launch memecoins on the Bitcoin blockchain with ease. Memecoins will empower the Bitcoin blockchain to become home to a crazy high-octane meme experience.

The Bitcoin Pepe project intends to unlock Bitcoin’s $2 trillion dormant market cap, making it available for memecoin trading. The layer-2 network will provide the necessary infrastructure for all memes to migrate to BTC, ensuring security and liquidity for investors and users. Bitcoin Pepe’s native $BPEP token will power several activities within the ecosystem.

Should you buy the $BPEP token in its presale stage?

The Bitcoin Pepe presale is in its sixth stage, with the $BPEP token going for $0.0268 and increasing in the next stage. As the team develops its L2 network and other products, the presale could be an excellent opportunity to get in on the project, allowing investors to gain early exposure to the project.

Bitcoin Pepe will roll out memecoin trading to the Bitcoin ecosystem. This could increase the utility of the $BPEP token and could make it a top performer in the broader crypto market. The presale allows investors to purchase Bitcoin Pepe’s native token at a discount before it launches on centralised and decentralised exchanges.

Market

AXL Jumps 14% as Canary Capital Files for Axelar ETF

Asset Manager Canary Capital has filed an S-1 registration statement with the US Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) tied to Axelar (AXL).

This marks the first-ever filing for AXL, the native cryptocurrency that powers the Axelar Network, setting the stage for the token’s institutional adoption.

Canary Capital Files for AXL ETF

The filing, which was submitted on March 5, outlines that the fund’s net asset value (NAV) will be calculated based on the price of AXL. However, specifics regarding the exchange where the ETF will be listed, its ticker symbol, and the custodian remain unspecified.

The proposed ETF builds on Canary Capital’s earlier efforts to bring Axelar to institutional investors. On February 19, the firm launched the Canary AXL Trust. The trust was Canary Capital’s first step into structured AXL offerings, and the ETF filing represents an extension of this effort.

“With Axelar driving some of the most advanced interoperability solutions in Web3, we see in AXL a significant opportunity for institutional investors to gain exposure to the technology underpinning next-generation blockchain connectivity,” Canary Capital’s CEO Steven McClurg said.

The news of the filing had an immediate impact on the market. AXL’s price jumped 14.3%, reaching $0.44.

Trading volume also spiked to $35.7 million. This marked a 131.8% increase from the previous day. With a market capitalization of $405.5 million, Axelar currently ranks 174 on CoinGecko.

Crypto ETFs Under Donald Trump: Opportunity or Bubble?

Canary Capital’s filing comes amid a broader surge in cryptocurrency ETF applications in the US, a trend that has accelerated since Donald Trump took office. According to Kaiko Research, more than 45 crypto ETF filings are currently pending SEC approval.

While Bitcoin (BTC) and Ethereum (ETH) ETFs have dominated the space, the scope has expanded to include unconventional assets like meme coins. Bitwise and Grayscale have filed for a Dogecoin (DOGE) ETF.

Moreover, the ETF filings from Rex Shares and Tuttle Capital feature newly launched meme coins like Official Trump (TRUMP) and Melania Meme (MELANIA).

Nonetheless, according to Kaiko Research, market depth, concentration, and trading structure present significant obstacles for non-BTC/ETH ETFs. Many altcoins associated with ETF applications suffer from shallow liquidity, making them more susceptible to price manipulation and volatility.

Additionally, most trading activity for these assets occurs on offshore platforms, creating transparency and regulatory oversight issues. The lack of sufficient USD trading pairs for certain assets further complicates their inclusion in ETFs, as these pairs are essential for accurate ETF valuations. Furthermore, the absence of regulated futures markets for many cryptocurrencies limits available trading strategies.

“All of these factors could limit the demand for more crypto-related ETFs going forward. While approval processes might change, market dynamics still have to catch up,” Kaiko noted.

For now, AXL has been added to a growing list of crypto ETF filings. However, its success—and that of similar ETFs—remains to be seen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Aims Higher—Can Bulls Push Past Key Resistance?

Ethereum price started a recovery wave from the $2,000 support zone. ETH is now rising and might aim for a move above the $2,350 resistance zone.

- Ethereum started a fresh upward move above the $2,220 support zone.

- The price is trading above $2,220 and the 100-hourly Simple Moving Average.

- There is a key rising channel forming with support at $2,200 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $2,275 and $2,350 resistance levels to start a decent increase.

Ethereum Price Eyes A Comeback

Ethereum price started a fresh decline below the $2,350 zone, like Bitcoin. ETH gained bearish momentum below the $2,220 and $2,250 support levels.

A low was formed at $2,003 and the price is now attempting a recovery wave. There was a move above the $2,150 and $2,200 resistance levels. It even tested the 50% Fib retracement level of the downward move from the $2,550 swing high to the $2,003 low.

Ethereum price is now trading above $2,200 and the 100-hourly Simple Moving Average. There is also a key rising channel forming with support at $2,200 on the hourly chart of ETH/USD. On the upside, the price seems to be facing hurdles near the $2,275 level.

The first major resistance is near the $2,340 level and the 61.8% Fib retracement level of the downward move from the $2,550 swing high to the $2,003 low. A clear move above the $2,340 resistance might send the price toward the $2,420 resistance.

An upside break above the $2,420 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,500 resistance zone or even $2,550 in the near term.

Another Drop In ETH?

If Ethereum fails to clear the $2,275 resistance, it could start another decline. Initial support on the downside is near the $2,240 level. The first major support sits near the $2,220 zone.

A clear move below the $2,130 support might push the price toward the $2,080 support. Any more losses might send the price toward the $2,050 support level in the near term. The next key support sits at $2,000.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $2,220

Major Resistance Level – $2,275

-

Altcoin19 hours ago

Altcoin19 hours agoBitcoin Tests $90K on Speculation of Trump’s Crypto Reserve Plan

-

Regulation22 hours ago

Regulation22 hours agoMatrixport subsidiary Fly Wing receives Major Payment Institution License from MAS in Singapore

-

Altcoin21 hours ago

Altcoin21 hours agoBinance Extends RedStone Backing; RED Price To Hit New ATH?

-

Market20 hours ago

Market20 hours agoInsights from Outlier Ventures CEO

-

Altcoin20 hours ago

Altcoin20 hours agoLawyer Reveals If Ripple Vs SEC Resolution Possible In March

-

Market11 hours ago

Market11 hours agoBitwise Files for Aptos ETF, Sparking a 18% Rally for APT

-

Market18 hours ago

Market18 hours agoThe Altcoin/BTC Spot Market Is Dying

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Predicts XRP Price To Hit $222 If History Repeats