Altcoin

Farcaster Founder Predicts Role of XRP and ADA As Strategic Asset

US President Donald Trump’s decision to adopt Bitcoin, XRP, Solana (SOL), and Cardano (ADA) has sparked widespread optimism. However, the community remains ambiguous on the potential composition and management of the US crypto reserve. Farcaster co-founder Dan Romero’s recent predictions offer a glimpse into the utilization of crypto reserves and the potential roles of XRP and ADA.

US Crypto Reserve Management: Key Insights

Amid escalating ambiguity regarding the United States’ cryptocurrency reserve, Dan Romero, co-founder of Farcaster, has offered predictions regarding the government’s prospective plans.

In a recent X post, the Farcaster founder stated that Donald Trump’s government would retain seized assets rather than making new crypto purchases. This suggests that the administration is unlikely to invest in cryptocurrencies, despite its ambitious reserve plans.

Unveiling the Future of US Crypto Reserve: Roles of Bitcoin, XRP & ADA

According to the Farcaster founder’s predictions, Bitcoin will dominate the US crypto reserves. Possibly, Bitcoin will comprise about 80% of the government’s crypto holdings. This may be because of Bitcoin’s market dominance, widespread adoption, and global acceptance.

Notably, Trump’s crypto reserve announcement sparked widespread enthusiasm, particularly regarding Bitcoin’s potential role in the reserve. For instance, Gemini co-founder Cameron Winklevoss stated, “Bitcoin is the only asset that meets the bar for a store of value reserve asset.”

Meanwhile, the Farcaster founder highlighted the possibility of the Trump government including XRP and ADA in the crypto reserves through in-kind tax payments or quasi-donations. This implies Ripple and Cardano’s possible ways of collaborating with the government.

Inclusion of XRP & ADA Met with Skepticism

Despite the optimism surrounding the government’s Bitcoin reserve strategy, the inclusion of XRP and ADA has been met with skepticism. Gemini co-founder Taylor Winklevoss shared his disagreement with Trump’s choice of XRP, Solana, and Cardano. He stated,

I have nothing against XRP, SOL, or ADA but I do not think they are suitable for a Strategic Reserve. Only one digital asset in the world right now meets the bar and that digital asset is bitcoin.

Similarly, economist Peter Schiff questioned the government’s decision to include XRP, SOL, and ADA in the US crypto reserve. Though he initially seemed to endorse the Bitcoin reserve, later he retracted his support, accusing BTC proponents of disseminating misinformation.

XRP Proponents Celebrate Trump’s US Crypto Reserve Strategy

Though a portion of the community is against the XRP reserve, proponents celebrate the move. “XRP is great technology, a global standard, survived for a decade through many harsh cycles, and has one of the strongest communities. I think the president made the right decision,” stated Cardano founder Charles Hoskinson.

Ripple CEO Brad Garlinghouse hailed the development a major signal for the industry’s progress. In response to Trump’s announcement, Garlinghouse stated, “Happy to see that the President of the United States recognizes that we live in a multichain world.”

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Can Ethereum Price Sink To $1,000 After Drop Below $2000

Ethereum price briefly dipped under $2,000 for the first time in over a year as on-chain data points to a gloomy future. Pundits say Ethereum could be on a death march toward $1,000 in a steep decline that has left speculators scratching their heads.

Ethereum Price Could Be Headed To $1,000

Ethereum (ETH) woes appear to be worsening following a dip in prices below $2,000 since December 2023. Ethereum price touched $1,996 before staging a valiant climb back to $2,135, triggering concerns over its future direction.

On-chain data is grim for the largest altcoin with several indicators pointing toward a downward trend. Ethereum’s weekly RSI is at its lowest ebb for the first time since 2022 at 35.84. Similar RSI levels in 2022 saw the asset price fall even further by a staggering -60%.

Analysts say that the Ethereum price could fall to $1,000 given similar market conditions in 2022. The slip below $2000 follows an earlier dip below $2,200, leaving its parallel channel which experts say could induce correction to $1,600.

Ethereum’s triple-top pattern in its weekly chart is indicative of a 60% decline as bears have a field day. A 60% decline at current levels will see Ethereum price dip below the $1,000 mark.

Ethereum Is On Course To Record Its Worst Q1

The largest altcoin has endured a wave of negative sentiments since the start of 2025. Ethereum price has fallen by nearly 40% from its high of $3,300 at the start of the year.

A drop to $1,600 will see Ethereum record its worst Q1 performance, dwarfing the lows of the first quarter of 2024. US Ethereum ETFs recorded massive outflows while ETHA share price shed 38.59% since the start of the year.

While institutional interest around ETH sinks, the asset’s proposed inclusion into the US Crypto Strategic Reserve did little to stave off the massive decline. Despite the grim outlook, some pundits say the decline presents a buying opportunity for long-term investors.

“We are going into the undervaluation zone,” said the pseudonymous Venturefounder on X (formerly Twitter).

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Pi Coin Hits CoinMarketCap’s Top 11 Despite No Binance Listing

Pi Network’s PI Coin has made a notable entry into CoinMarketCap’s top ranks. This milestone highlights Pi’s increasing recognition in crypto, particularly as an altcoin made in the US.

Despite lacking a traditional exchange listing, the network continues to expand, demonstrating significant user adoption and circulation growth.

Analyzing Pi Coin’s Growth and Circulating Supply Increase

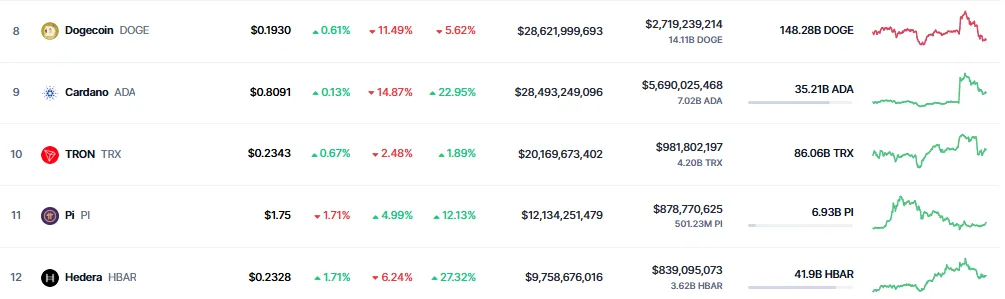

Data shows Pi Network’s PI token ranks 11th on CoinMarketCap, with a market capitalization exceeding $12 billion as of this writing. Nevertheless, it remains absent on CoinGecko as of this publication.

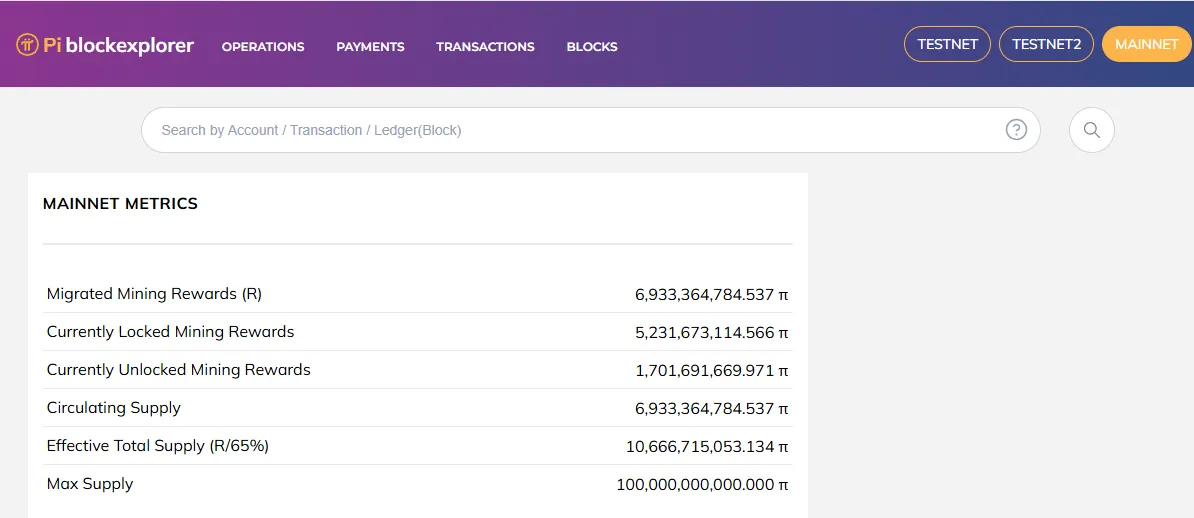

Further, data on Pi Network’s blockchain explorer shows the circulating supply of PI tokens has grown by 9.5% since its mainnet launch on February 20.

Initially, at 6.3 billion, the circulating supply now stands at 6.9 billion, reflecting increased activity within the ecosystem. This rise suggests greater engagement among Pi Network users as more coins enter circulation.

Further reinforcing its popularity, Pi Network has recorded over 113.2 million downloads on the Google Play Store alone. The rapid adoption reflects the project’s widespread interest, particularly among those drawn to its mobile-based crypto-mining model.

“Pi Network has been downloaded over 113.2 million times on Google Play Store alone,” the platforms update page on X highlighted.

The app’s ease of use and low barrier to entry are likely drivers of this exponential growth. Beyond that, another major selling point for Pi Network’s PI Coin is its growing adoption as a medium of exchange. BeInCrypto reported that several merchants and platforms have started accepting PI Coin for payments, a crucial step in driving real-world utility.

While mainstream adoption remains a work in progress, these developments indicate growing confidence in Pi’s transactional capabilities.

Despite its impressive market capitalization, PI Coin’s valuation remains a debate among analysts. BeInCrypto recently explained different hypotheses, including technology valuation and the Global Consensus Value (GCV) as possible value determinants.

While Pi Network continues to gain traction, it has also faced legal warnings in several jurisdictions. Regulatory bodies in countries like Vietnam and China have expressed concerns over the project’s structure, citing potential risks for investors.

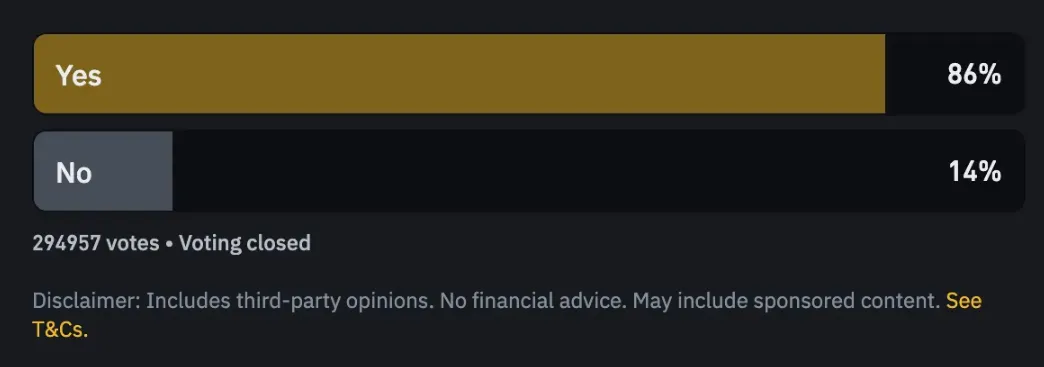

Another major factor weighing Pi Coin’s price is the delay in securing a Binance listing despite 86% voter support. The anticipation surrounding a potential Binance listing had fueled speculation and price surges. The delay has led to frustration among investors, contributing to a decline in price momentum.

However, the Binance exchange has not entirely ruled out a potential listing for Pi coin.

“The project’s launch is still undergoing evaluation, and the decision will be based on our official review processes and standards,” Binance stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Why Is The SHIB Team Silent on Big Announcements?

Shiba Inu News: SHIB marketing lead Lucie recently revealed why the crypto’s team is not making any major announcements amid the broader market crash. Notably, Lucie has reflected a gloomy outlook surrounding poor market conditions on X this Tuesday, deeming it to be the reason for no latest advancements. SHIB price also plummeted over 9% in tandem Lucie’s post, sparking investor discussions over future endeavours.

Shiba Inu News: Marketing Lead Deems Poor Market Condition As Reason For No Key Advancements

In an X post on March 4, Lucie stated, “The market crash isn’t the time to chase announcements, it’ll be dragged down by the bad market.” This statement aligns with why the SHIB community stood silent on any major developments amid the recent market turmoil.

Notably, the project’s lead developer, Shytoshi Kusama, also hasn’t made any key announcements on X amid the recent market crash since February. The last buzzworthy update revealed by the lead was in early February, the community’s partnership with the UAE Ministry of Energy and Infrastructure.

Lucie Says Build Connections Instead

Instead, the marketing lead believes that a market slump may be the best time to ‘focus on building connections.’ This statement in turn ignited speculations about whether the team is gearing up for another partnership, presenting as bullish Shiba Inu news.

Why Is The Crypto Market Crashing?

Meanwhile, the crypto market continues to face immense heat amid macroeconomic developments and liquidity setbacks. CoinGape reported that the crypto sector recorded over $1 billion in liquidations intraday amid Trump’s new tariffs saga.

Starting March 4, new U.S. import tariffs on Canada and Mexico have continued solidifying global trade war tensions. As a result, BTC & altcoins slump hard just after a prompt jump due to Trump’s previous crypto reserve announcement.

Shiba Inu Price Plunges 10%

SHIB price today crashed nearly 10% in sync with the broader market trend, reaching $0.00001281. The meme coin bottomed and peaked at $0.00001228 and $0.00001423 in the past 24 hours. Traders and investors remain apprehensive as they expect no major Shiba Inu news till the market recovers, as also hinted by Lucie.

Further, Coinglass data indicated a 22% decline in SHIB futures OI to $117.78 million. Also, the derivatives volume fell 6% to $156.66 million, underlining the waning market interest. In turn, crypto market watchers continue to monitor the token for further major price shifts.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market21 hours ago

Market21 hours agoPi Network Price Drops 43%

-

Regulation21 hours ago

Regulation21 hours agoPeter Schiff Calls For Congress To Investigate Trump’s Crypto Rug Pull

-

Market18 hours ago

Market18 hours agoXRP And Cardano Fall After Trump Reserve Backlash

-

Market17 hours ago

Market17 hours agoEthereum Price Crashes to $2,000—Is More Downside Ahead?

-

Market9 hours ago

Market9 hours ago10 Altcoins for Potential Delisting

-

Regulation22 hours ago

Regulation22 hours agoUS SEC Commissioner Hester Pierce Unveils Crypto Task Force Members

-

Market13 hours ago

Market13 hours agoXRP Rally Fades—Price Surrenders Recent Gains

-

Altcoin9 hours ago

Altcoin9 hours agoWhy Is The SHIB Team Silent on Big Announcements?

✓ Share: