Market

Pi Network Price Drops 43%

Pi Network (PI) has seen a sharp decline of nearly 43% over the past four days after reaching levels close to $3. Despite the recent drop, technical indicators suggest that the downtrend may be losing momentum, with both the DMI and BBTrend showing signs of stabilization.

If bullish pressure returns, PI could attempt to break above key resistance levels, potentially setting the stage for a move toward $3. However, if selling pressure intensifies, PI could fall below $1.50 and test lower ranges.

Pi Network DMI Shows the Downtrend Is Losing Steam

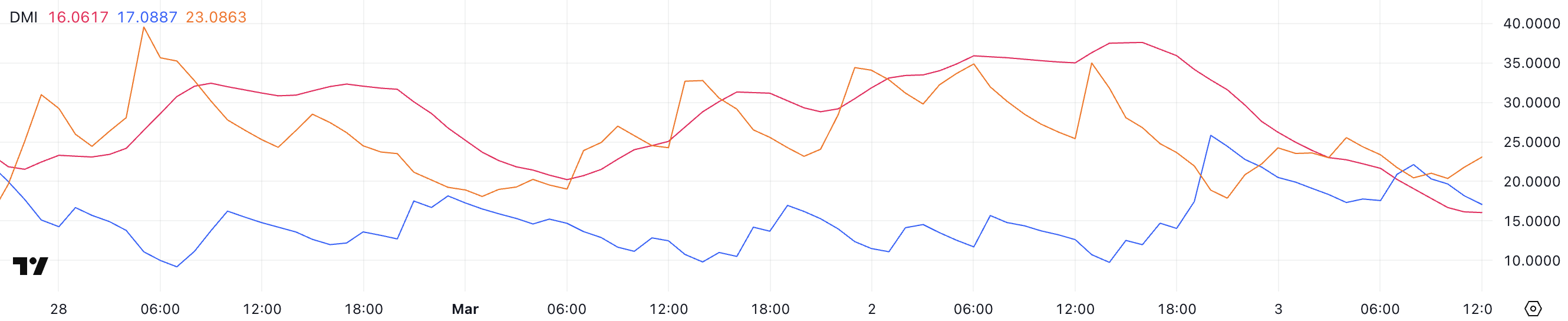

Pi Network’s trend strength has sharply declined, as reflected in its Directional Movement Index (DMI).

The Average Directional Index (ADX), which measures the strength of a trend, dropped from 37.5 yesterday to 16, indicating that the prior downtrend has significantly weakened.

The ADX does not indicate direction but rather the intensity of a trend, with values above 25 suggesting a strong trend and anything below 20 pointing to weak or indecisive price action. With the ADX at 16, PI is currently in a phase where momentum is fading, suggesting that neither buyers nor sellers have firm control.

Alongside this, PI’s +DI (positive directional index) has declined from 25.8 to 17, signaling a weakening bullish force. In contrast, the -DI (negative directional index) has risen from 17.8 to 23, reflecting an increase in selling pressure.

This shift indicates that PI is still in a downtrend, though not a particularly strong one, as the ADX suggests low trend strength overall. If -DI continues to rise while ADX stays below 20, PI could remain in a sluggish downtrend rather than a steep decline.

However, if ADX starts climbing again alongside the -DI, selling pressure could intensify, leading to a sharper drop. Conversely, if buyers step in and push +DI back above -DI, PI could stabilize and potentially enter a consolidation phase.

PI BBTrend Is Still Negative, But Recovering From Recent Lows

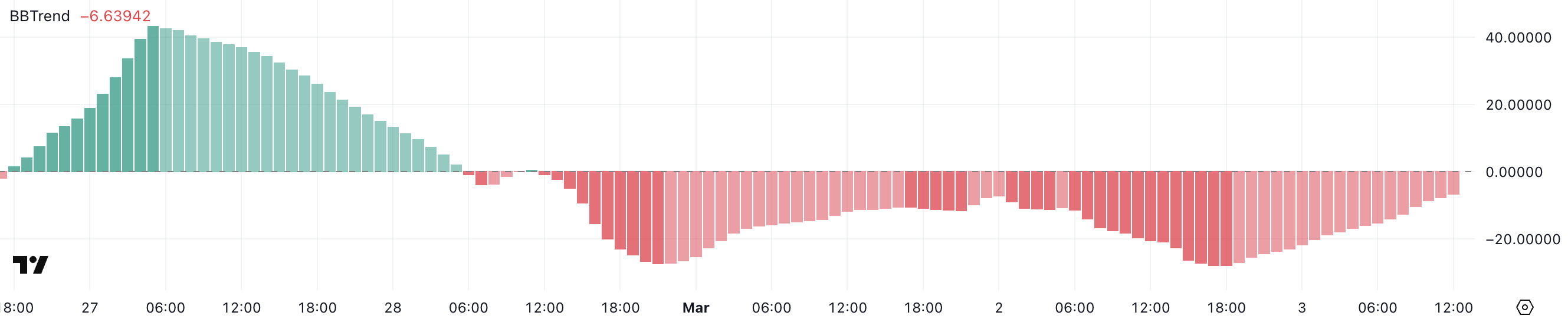

Pi Network has been in a prolonged downtrend, as indicated by its BBTrend indicator, which has remained negative since February 28.

Yesterday, PI’s BBTrend hit a negative peak of -27.9, signaling intense selling pressure before recovering to its current level of -6.6. The BBTrend, derived from Bollinger Bands, is a volatility-based indicator that helps measure the strength and direction of a trend.

Readings above zero suggest a bullish trend, while negative values indicate bearish momentum. When BBTrend falls below -10, it often signals a heavily oversold condition, while a rise back toward neutral territory suggests a potential slowdown in selling pressure.

Although PI’s BBTrend is still negative at -6.6, it has improved significantly from yesterday’s extreme low, indicating that selling pressure is easing.

This suggests that the market could be stabilizing, though PI is not yet in bullish territory. If BBTrend continues rising and moves closer to zero, it could indicate a potential trend reversal or at least a period of consolidation before the next move.

However, if BBTrend turns back down and fails to recover, PI could face renewed downside pressure, making it crucial to watch whether the recent improvement sustains or fades.

Pi Network Could Rise To Test $3 In March

Pi Network has dropped nearly 43% over the past four days after reaching levels close to $3, signaling a sharp reversal from its recent highs, with an 18% decline one day ago when Vietnam authorities issued legal warnings.

If the trend shifts back to the upside, the first key resistance to watch is at $1.80. A breakout above this level could indicate renewed buying interest, potentially driving PI toward $2.35.

If bullish momentum strengthens and mirrors the surge from a few days ago, PI could rally further to $2.97, with a chance of breaking above $3 for the first time.

However, this scenario depends on whether buyers step in to regain control and push the price above these resistance levels.

On the downside, if selling pressure intensifies and the downtrend resumes, PI could test the $1.50 support level.

A break below this zone would expose PI to further declines, with $0.80 emerging as the next major support. Such a move would indicate that bearish momentum remains strong, possibly leading to an extended period of downside movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What Traders Need to Know

Binance, the largest crypto exchange based on trading volume, announced plans to use GPS tokens, which powers GoPlus Security. This company provides open, permissionless, user-driven security services for the Web3 environment.

The exchange also adds GPS to HODLer airdrops, which rewards BNB holders with token airdrops based on historical snapshots of their BNB balances.

Binance New Listing: What Users Need To Know

GoPlus Security is a company that covers major blockchain networks with multidimensional risk detection. According to a recent Binance announcement, its token, GPS, will be available for trading on the exchange starting Tuesday, March 4, at 13:00 UTC, against select token pairs.

“Binance will then list GPS at 2025-03-04 13:00 (UTC) and open trading against USDT, USDC, BNB, FDUSD, and TRY pairs,” the announcement stated.

In the immediate aftermath of this Binance listing announcement, GPS soared by 16%,

Notably, users can start depositing GPS tokens at 10:20 UTC in preparation for trading. Cognizant of the token’s relative newness in the market, the Binance exchange articulated that it would attach a seed phrase. This special identifier is a precaution to distinguish GPS from any other token.

It is also worth noting that Binance will list GPS at zero listing fees, which means users can trade the GoPlus Security token without incurring any trading fees.

Beyond listing, the GPS token also joins the Binance Exchange HODLer airdrops program. These positions select BNB token holders to receive allocations. The initiative rewards users retroactively, offering a simple way to earn additional tokens.

“Binance is excited to announce the 11th project on the HODLer Airdrops page – GoPlus Security (GPS). Users who subscribed their BNB to Simple Earn (Flexible and/or Locked) and/or On-Chain Yields products from 2025-02-19 00:00 (UTC) to 2025-02-24 23:59 (UTC) will get the airdrop distribution,” the exchange added.

The listing and addition to the HODLer airdrops page is not Binance’s first interaction with GoPlus Security. In December 2022, YZi Labs (then Binance Labs) announced leading private round II funding for GoPlus Security.

The funding was intended to further develop GoPlus Security’s technology, create a security services marketplace, and attract top talent to help build a safer and more user-friendly Web3 ecosystem.

In April of the same year, GoPlus Security raised a multi-million dollar private funding round, but Binance did not participate.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Plunges 20%—Key Support Levels Now in Focus

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

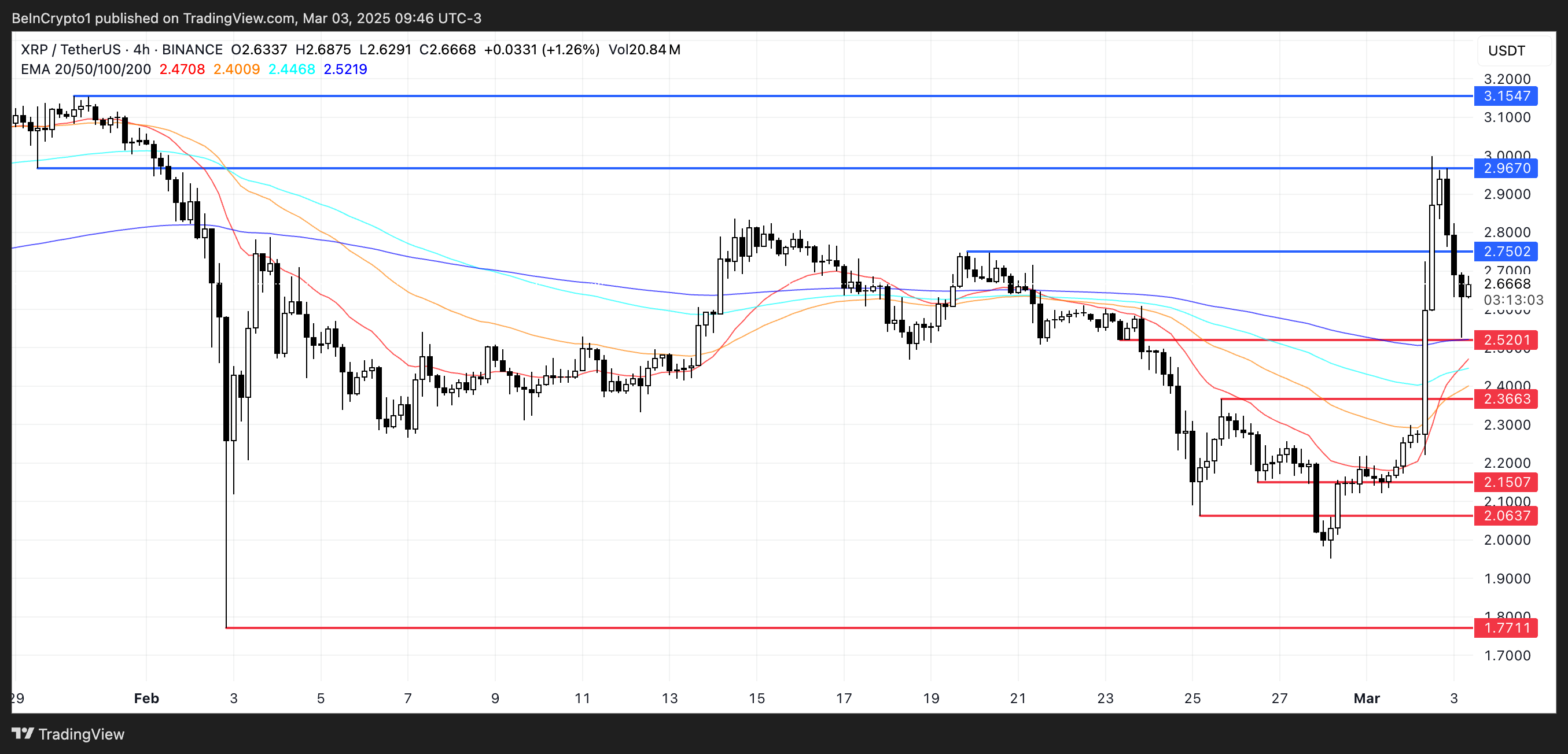

XRP Drops by 10% Again as the Altcoin Struggles to Hold Gains

XRP surged 30% yesterday after being included in the US crypto reserve. This pushed its price above $2.90 for the first time in a month. This massive rally ignited strong bullish momentum, but the altcoin slumped 10% a day later.

XRP is seeing notable correction today, suggesting that profit-taking is underway. Whether the price can regain bullish momentum or continue its retracement will depend on key resistance and support levels, with traders closely watching $2.75 on the upside and $2.52 on the downside.

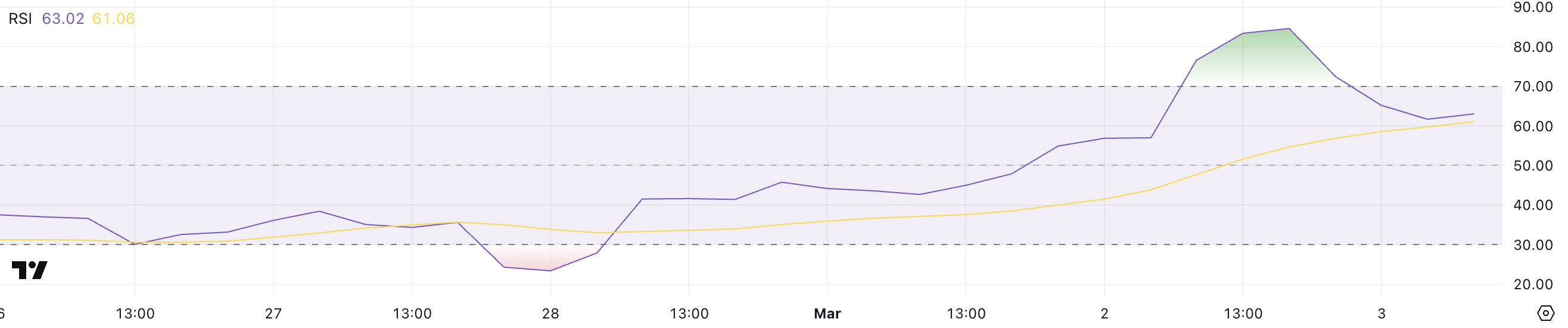

XRP RSI Is Neutral After Reaching Overbought Levels

XRP saw a significant surge in momentum after being included in the US crypto reserve. Its price rallied 30%, pushing its Relative Strength Index (RSI) to a peak of 84.5.

The RSI, a widely used momentum oscillator, measures the speed and change of price movements on a scale of 0 to 100. Readings above 70 indicate that an asset is overbought and could be due for a pullback. Readings below 30 suggest oversold conditions and a potential buying opportunity.

XRP’s RSI reached 84.5 – its highest level since December 2, 2024 – signaling extreme bullish sentiment, often preceding a short-term correction.

Now sitting at 63, XRP’s RSI has cooled off from its overbought zone, reflecting the recent retracement in price. While a reading above 60 still suggests bullish momentum, the decline from extreme levels could indicate that buying pressure is waning.

If RSI continues to decline toward the neutral 50 zone, XRP could see further consolidation or even a deeper pullback.

However, if buyers step in again and push RSI back above 70, it could signal renewed strength and another potential attempt at higher price levels.

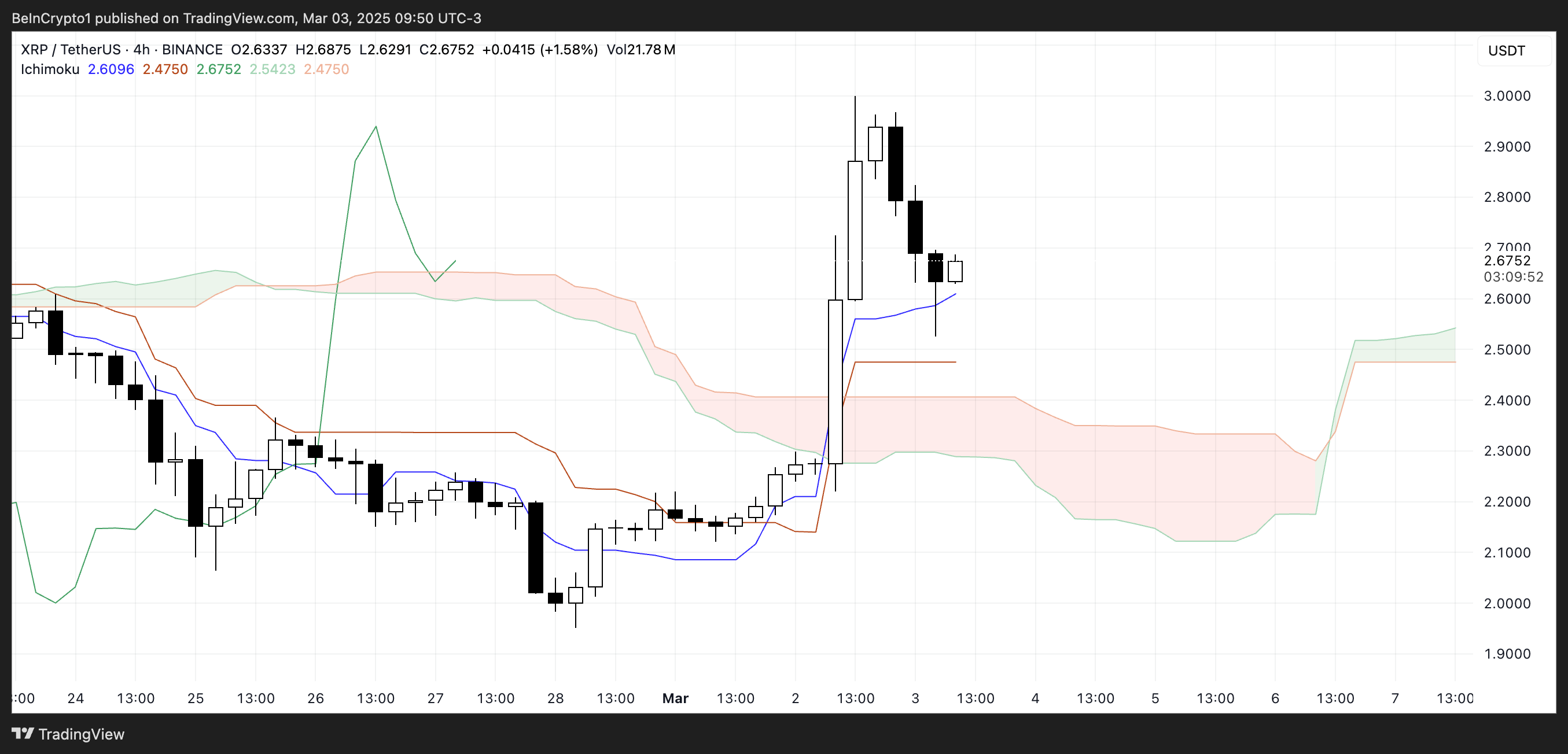

Ichimoku Cloud Shows the Bullish Setup Is Still Here, But This Could Change

XRP Ichimoku Cloud chart analysis shows that the price saw a sharp breakout above the cloud (Kumo) following its 30% surge after being included in the US crypto reserve.

This breakout confirmed a strong bullish move, with XRP moving well above both the Tenkan-sen (blue line) and Kijun-sen (red line), signaling short-term and medium-term trend strength.

The sharp spike pushed XRP into overextended territory. However, as seen in the last few candles, a pullback has started, bringing the price closer to the Kijun-sen.

This suggests that while the uptrend remains intact, the market is reassessing its recent gains, and XRP is testing key short-term support.

If the price holds above the Kijun-sen, XRP price could consolidate before making another attempt at higher resistance levels.

However, if the correction deepens and XRP falls back toward the cloud, it could indicate a loss of momentum. The future cloud (Senkou Span A and B) remains bullish but with some flattening. That indicates that the market is at a pivotal point.

XRP Price Can Have a Hard Time to Reach $3

XRP surged to nearly $2.95 following its inclusion in the US crypto reserve, marking a sharp bullish move.

However, after this rapid climb, the price has started to correct in the last few hours, suggesting that some traders are taking profits.

The technical outlook now depends on whether the uptrend can regain strength. If buying pressure returns, XRP could test the $2.75 resistance again. A breakout above this level could see it retesting $2.96, which acted as a barrier during yesterday’s rally.

A successful move past this resistance would open the door to a push toward $3.15, marking the first time XRP has traded above $3 since February 1. The SEC dropping the case against XRP could be a potential drive for that.

On the downside, if the correction continues and selling pressure increases, XRP price could find support at $2.52. A breakdown below this level would put the next key support at $2.36 in focus. Further declines could potentially drive the price toward $2.15 and $2.06.

This could be driven if more questions about the asset being included in the US crypto reserve start to emerge. Harrison Seletsky, director of business development at digital identity platform SPACE ID, told BeInCrypto that these assets are odd choices to the reserve:

“I’m certainly surprised that US President Donald Trump has chosen to announce a full-blown crypto strategic reserve, rather than just a Bitcoin strategic reserve, as everyone had been expecting. Beyond that, the choice of assets is also unusual. ETH and SOL make sense, given their strong and growing developer activity. But it’s not clear to me why XRP and ADA were included at all, considering they are virtually ghost chains compared to Ethereum and Solana. Indeed, the total value locked (TVL) and stablecoin capabilities on XRPL and Cardano are tiny compared to other ecosystem players – $80 million and $460 million, respectively. In my eyes, it somewhat delegitimizes the whole idea of crypto reserve assets like industry mainstays Bitcoin, Ether and Solana,” Harrison Seletsky told BeInCrypto.

If bearish momentum strengthens significantly, XRP could fall below the psychological $2 mark, with $1.77 emerging as the next major support level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Surges with Positive Bias Toward Key Levels

-

Bitcoin23 hours ago

Bitcoin23 hours ago5 US Economy Data Points That Could Move BTC Price This Week

-

Market22 hours ago

Market22 hours agoTrump’s Summit, ENA Unlock, and More

-

Market21 hours ago

Market21 hours agoExperts shift to Bitcoin Pepe as Trump’s crypto reserve hype fades

-

Altcoin21 hours ago

Altcoin21 hours agoUS Crypto Reserve to Add More Altcoins? Experts Weigh In

-

Regulation16 hours ago

Regulation16 hours agoUS SEC Agrees To Drop Kraken Lawsuit

-

Regulation14 hours ago

Regulation14 hours agoCoinbase Files FOIA To Reveal Cost Of SEC’s Crypto Lawsuits

-

Market20 hours ago

Market20 hours agoCelebrity Meme Coins: Hype or Long-Term Opportunity?