Market

Tether Appoints New CFO to Manage Transparency and Audits

Tether, the stablecoin giant, has announced the appointment of Simon McWilliams as its new Chief Financial Officer (CFO).

With Simon McWilliams’ expertise in financial auditing, it appears that Tether is hoping he can conduct a comprehensive financial audit. The company is aiming to become more transparent about its reserves as regulatory pressure mounts.

Simon McWilliams Becomes Tether’s New CFO

According to the latest announcement, Tether has appointed Simon McWilliams as its new Chief Financial Officer (CFO). With this appointment, Tether aims to strengthen the trust of users, regulators, and institutional partners while solidifying its dominant position in the $232 billion stablecoin market.

“Simon’s expertise in financial audits makes him the perfect CFO to lead Tether into this new era of transparency. With his leadership, we are moving decisively toward a full audit, reinforcing our role in supporting US financial strength and expanding institutional engagement,” wrote Paolo Ardoino, CEO of Tether.

Simon McWilliams brings over 20 years of experience in financial management. He has previously guided large investment firms through rigorous audits.

His appointment marks a significant step for Tether, especially given the ongoing skepticism regarding the legitimacy and transparency of its reserves.

Challenges Tether Faced Under CFO Giancarlo Devasini

Following McWilliams’ appointment, Tether’s former CFO, Giancarlo Devasini, will transition to the role of Chairman. In this new position, Devasini will now focus on macroeconomic strategy, steering Tether toward becoming part of the US financial system and promoting the global adoption of digital assets.

Under Devasini, Tether consistently faced criticism for lacking a comprehensive audit. From 2022 until now, the company relied solely on quarterly attestation reports from the accounting firm BDO.

These reports are considered to lack the detail that a comprehensive audit would require.

This lack of transparency has been creating many doubts, particularly after a 2021 settlement with the New York Attorney General (NYAG). The NYAG investigation revealed that Tether had misrepresented that USDT was backed 1:1 by the U.S. dollar.

Furthermore, Tether and Bitfinex, a closely affiliated company, denounced the amended price manipulation lawsuit.

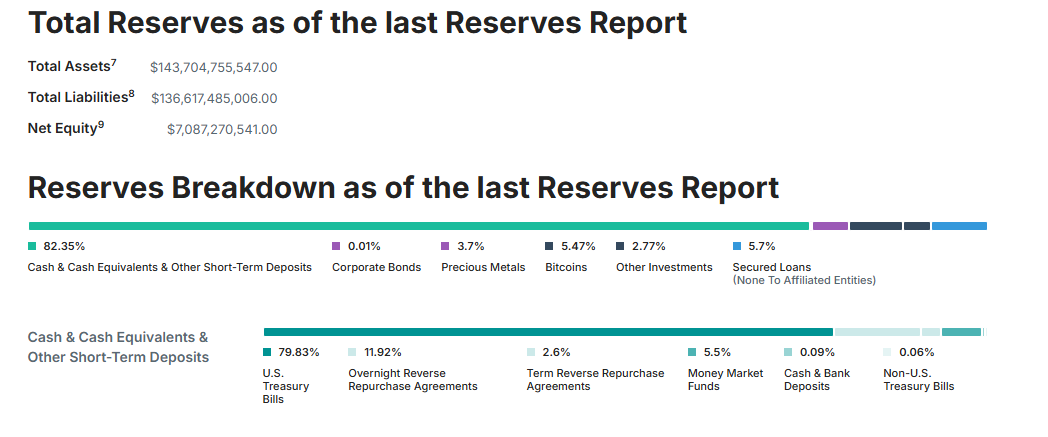

Although Tether has made efforts to disclose its reserves, 82.35% consist of Cash, Cash Equivalents, and Other Short-Term Deposits. Nearly 80% of them are in US Treasury Bills.

However, critics argue that only a full audit can fully dispel doubts about the company’s financial health.

Pushing for a comprehensive audit aligns with Tether’s broader strategic goals. The company recently relocated its headquarters to El Salvador, aiming to secure a Digital Asset Service Provider (DASP) license.

This move is seen as an effort to strengthen its operational foundation and signal intentions to expand within the institutional financial system.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Crashes to $2,000—Is More Downside Ahead?

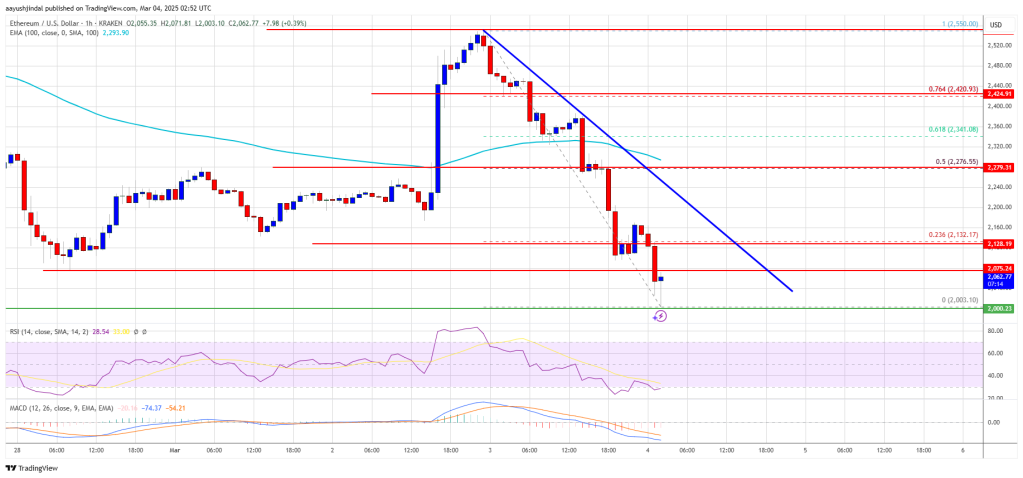

Ethereum price started a fresh decline from the $2,550 zone. ETH is now back below $2,200 and might decline further in the near term.

- Ethereum started a fresh decline below the $2,350 support zone.

- The price is trading below $2,250 and the 100-hourly Simple Moving Average.

- There is a new bearish trend line forming with resistance at $2,160 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $2,160 and $2,250 resistance levels to start a recovery wave.

Ethereum Price Dives 15%

Ethereum price failed to clear the $2,550 resistance zone and started a fresh decline, like Bitcoin. ETH gained bearish momentum below the $2,400 and $2,350 support levels.

There was a clear move below the $2,250 support zone and the 100-hourly Simple Moving Average. The price even dived below the last low and tested the $2,000 zone. A low was formed at $2,003 and the price is now consolidating losses below the 23.6% Fib retracement level of the recent decline from the $2,550 swing high to the $2,003 low.

Ethereum price is now trading below $2,250 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $2,080 level. The first major resistance is near the $2,150 level.

There is also a new bearish trend line forming with resistance at $2,160 on the hourly chart of ETH/USD. The main resistance is now forming near $2,275 and the 50% Fib retracement level of the recent decline from the $2,550 swing high to the $2,003 low.

A clear move above the $2,275 resistance might send the price toward the $2,350 resistance. An upside break above the $2,350 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,450 resistance zone or even $2,500 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $2,160 resistance, it could start another decline. Initial support on the downside is near the $2,020 level. The first major support sits near the $2,000 zone.

A clear move below the $2,000 support might push the price toward the $1,880 support. Any more losses might send the price toward the $1,750 support level in the near term. The next key support sits at $1,640.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $2,000

Major Resistance Level – $2,160

Market

XRP And Cardano Fall After Trump Reserve Backlash

Donald Trump’s Crypto Reserve has received considerable skepticism from the crypto community. Rather than a stand-alone Bitcoin Reserve, he is proposing to fill a national reserve with XRP, Cardano, and other US-based tokens.

Already, these assets’ weekend gains have evaporated. As Congress seems very unlikely to pass the Reserve bill into law, this plan may have little long-term impact on the market.

XRP and ADA Drop More Than 20%

Since Donald Trump announced a US Crypto Reserve with XRP, Cardano, and Solana, the markets have been conflicted. During his 2024 election campaign, Trump ran on establishing a Bitcoin Reserve, but his recent executive order included a focus on other US-based cryptoassets.

Already, the crypto community has harshly criticized the decision, and it’s only intensifying:

“I’ve been thinking about the US Strategic Bitcoin/Crypto Reserve and there are two possible outcomes: The reserve is BTC and none of the mentioned altcoins actually make it in, or we’re going to accelerate into degeneracy unlike anything seen before,” said Samson Mow, a renowned opinion leader in the space.

Essentially, President Trump cannot simply purchase the requisite amounts of altcoins. The Bitcoin Reserve was premised on the notion that the federal government already controls the relevant assets due to seizures.

However, Congress will need to approve new purchases, and even some Republican party members might be hesitant to do so.

“Nothing new here. Just words. Let me know when they get congressional approval to borrow money and or revalue the gold price higher. Without that, they have no money to buy Bitcoin and shitcoins,” wrote former BitMEX CEO Arthur Hayes.

Several community members have speculated that Trump named these assets to fend off increasingly dire warnings of a bear market.

Although he did cause a pump over the weekend, it completely evaporated by Monday, and the community is not happy. XRP fell by 18%, Cardano dropped by 23%, and the entire crypto market is looking quite bearish.

“XRP basically flat over the last 10 days despite the literal President of the United States posting its ticker and saying it should be part of a US strategic crypto reserve,” said Bloomberg analyst Joe Weisenthal.

A Political Handout?

There are also potential hypotheses that President Trump’s choice to include XRP and ADA was largely because of the company’s political donations to his administration. Solana, too, stood to benefit greatly from Trump’s administration, and TRUMP meme coin was launched on the network.

In other words, it’s incomplete to suggest that these assets are in Trump’s expanded Reserve plan because they’re US-based companies. Each firm’s leadership is also materially entangled with him.

XRP, Cardano, and Solana would all get a direct boost from major federal acquisitions, and the companies’ closeness to the President may influence matters here.

“ETH and SOL make sense, given their strong and growing developer activity. But it’s not clear to me why XRP and ADA were included at all, considering they are virtually ghost chains compared to Ethereum and Solana. Indeed, the total value locked (TVL) and stablecoin capabilities on XRPL and Cardano are tiny compared to other ecosystem players. In my eyes, it somewhat delegitimizes the whole idea of crypto reserve assets like industry mainstays Bitcoin, Ether and Solana,” director of business development at SPACE ID Harrison Seletsky told BeInCrypto.

All that is to say, a lot is standing in the way of Trump’s proposal. The Republicans control Congress, but only by a slight margin. Some Democrats may oppose using taxpayer funds for crypto purchases, while Republican fiscal conservatives may question the impact on federal spending.

Overall, there’s a long way for the US president’s proposed crypto reserve to become a reality.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

A Layer-1 Blockchain for Finance

Onyx has introduced Goliath, a Layer-1 blockchain designed for financial institutions. The project aims to provide a scalable and secure infrastructure for banks and financial service providers.

Onyx says Goliath will offer transaction speeds comparable to networks like Visa, which processes 24,000 transactions per second. It’s a bold claim, and the mainnet launch will reflect how true this might be.

Onyx Goliath Will Provide High-Speed Transactions with Proof-of-Stake

Goliath will use a Proof-of-Stake (PoS) consensus mechanism to support high-speed transactions. PoS reduces energy consumption by selecting validators based on the number of tokens staked.

According to the announcement, the project builds on XCN Ledger. Onyxcoin already uses it as a Layer-3 roll-up solution within the Onyx ecosystem.

Goliath will operate independently as a Layer-1 blockchain but will remain interoperable with existing financial networks.

Also, Onyx has outlined key milestones for the project. The testnet will be deployed in Q3 2025, while the mainnet launch will take place in early 2026.

Meanwhile, Onyx is also launching a Points Program for its Layer-3 XCN Ledger. Participants who bridge assets like WETH, USDT, CBTC, and USDC from the Base blockchain to Onyx will receive incentives.

“Onyx Goliath is a revolutionary Layer 1 blockchain aimed at reshaping global finance. Designed for banks and financial institutions, it promises unmatched scalability, security, and speed,” Onyx team wrote on X (formerly Twitter).

While Goliath will introduce a new blockchain layer, XCN will remain on Ethereum. The token will be bridged to the new network, maintaining compatibility with DeFi platforms.

XCN fell over 11% today, but a major drop took place hours before the Goliath announcement. The crypto market has taken a serious beating today, as bearish news from the Federal Reserve has combined with other economic woes to crater the big pump from this weekend.

Indeed, shortly after Onyxcoin jumped up this month, there was a mass exodus of old investors. The team made a valiant effort to regain this sliding momentum, but it slid 50% in February. Earlier today, a whale-led breakout attempt failed, and it doesn’t look like Goliath will do much to halt XCN’s slide either.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoEthereum Price Breaks Out—10% Surge Sparks Bullish Momentum

-

Market23 hours ago

Market23 hours agoXRP Price Explodes 30%—Can The Momentum Continue?

-

Altcoin23 hours ago

Altcoin23 hours agoBTC & Altcoins Pump Hard Amid Trump’s Crypto Reserve Backing

-

Bitcoin22 hours ago

Bitcoin22 hours agoTrump’s US Crypto Reserve: Why Experts Are Divided

-

Market22 hours ago

Market22 hours agoCardano (ADA) Rockets Over 60%, Crushing Bears in a Stunning Rally!

-

Market21 hours ago

Market21 hours agoWhy Traders Might Get It Wrong

-

Altcoin21 hours ago

Altcoin21 hours agoPepe Coin Whale Shifts Focus To This Crypto; Sells 262B PEPE

-

Market20 hours ago

Market20 hours agoBitcoin Surges with Positive Bias Toward Key Levels