Market

AGNT, Sedracoin, and Lens Protocol

The crypto market attempts a recovery, with Bitcoin (BTC) pushing to hold above the $90,000 psychological level. Amidst the broader market’s bump in optimism, investors are eyeing airdrops as a potentially lucrative avenue in March.

Airdrops aim to distribute free tokens while attracting new followers and expanding user bases. This week, there are three significant airdrops to watch.

AGNT Hub

AGNT Hub, a decentralized platform combining artificial intelligence and blockchain tech, is one of the confirmed airdrops this week. The project announced an airdrop of 30 million AGNT tokens, which will serve as a launchpad for AI-powered agents and enable them to operate in various environments.

“iAgent has reserved 30 million AGNT for its airdrop,” airdrops farmer Ben’s crypto shared on X.

This airdrop will reward early adopters and community members participating in the platform’s activities and accumulating experience points (XP). Specifically, the airdrop campaign’s points-based system allows participants to earn XP through various activities, including daily check-ins, social media engagement, NFT (non-fungible token) mints, and platform interactions.

“The more XP accumulated, the higher the potential airdrop allocation. Unique NFTs tied to your achievements may unlock additional benefits in future token distributions. Participation is free, requiring only a wallet connection and completion of designated tasks,” aidrops.io indicated, citing AGNT Hub.

Reportedly, AGNT Hub has also secured approximately $5.2 million in funding. Key backers include PGgroup and a team of experienced engineers with over 10 years of blockchain and AI expertise. Notably, the AGNT Hub crypto airdrop will coincide with AGNT Hub’s token generation event (TGE)

Sedracoin

Another crypto airdrop to watch this week is Sedracoin, which brings forth the Sedra ecosystem. The platform meets users where nature, spirituality, and technology intersect, delivering what is advertised as “a harmonious digital environment.”

Its powering token, SDR, is the ecosystem’s primary medium of exchange. It enables transactions, staking opportunities, and various reward mechanisms across the entire ecosystem.

The Sedracoin airdrop is also confirmed. It runs on Zealy to distribute SDR tokens to early community members and supporters.

It uses a task-based system requiring participants to complete various social activities to earn XP (experience points). Ultimately, these points will determine user eligibility and potential reward allocation for the airdrop.

“Join the Sedra Airdrop Event! Earn SDR tokens & exclusive CTAs by completing Zealy quests! The more XP you farm, the bigger your rewards,” Sedracoin articulated.

The campaign also prioritizes community engagement and awareness building, meaning participants must complete social media tasks across different platforms.

Lens Protocol

Also on the list is Lens Protocol, whose airdrop comes after raising $46 million and is backed by Balaji Srinivasan, former Coinbase exchange CTO. Other backers include Delphi Ventures and USD Coin (USDC) stablecoin issuer Circle.

While it is still in potential airdrop status, the project has a significant Social media following. Interest comes from ecosystem activity, funding rounds, and hints from the team.

“The Lens Protocol Testnet is now live, and you can officially mint your Reputation Score,” NFT builder Den Da shared in a post.

Recent developments suggest a points-based system or retroactive rewards for early users might trigger an airdrop. Eligibility is likely tied to owning a Lens Profile NFT and engaging with the ecosystem, including Lenster, Lenstube, and Hey. Recent testnet activity on Lens Chain (a zkSync-based Layer 2) may also factor in.

Further, according to speculative estimates on X, between $1,000 and over $10,000 in LENS tokens could be airdropped. Notably, these assumptions follow past airdrops like Aptos or Blur. However, this hinges on token launch and market conditions, as no official figures exist.

Meanwhile, participation is largely free beyond minimal gas fees. However, if not claimed earlier, acquiring a Lens Profile NFT costs around 0.1 ETH (approximately $250-$300) on the OpenSea marketplace.

For investors and crypto enthusiasts, these airdrops offer the chance to acquire new tokens and join the active crypto communities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Drops 43%

Pi Network (PI) has seen a sharp decline of nearly 43% over the past four days after reaching levels close to $3. Despite the recent drop, technical indicators suggest that the downtrend may be losing momentum, with both the DMI and BBTrend showing signs of stabilization.

If bullish pressure returns, PI could attempt to break above key resistance levels, potentially setting the stage for a move toward $3. However, if selling pressure intensifies, PI could fall below $1.50 and test lower ranges.

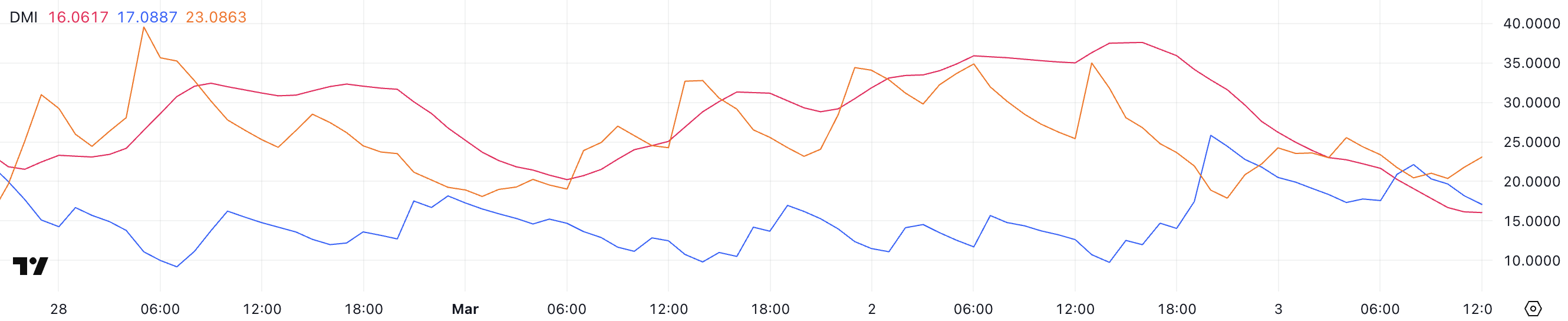

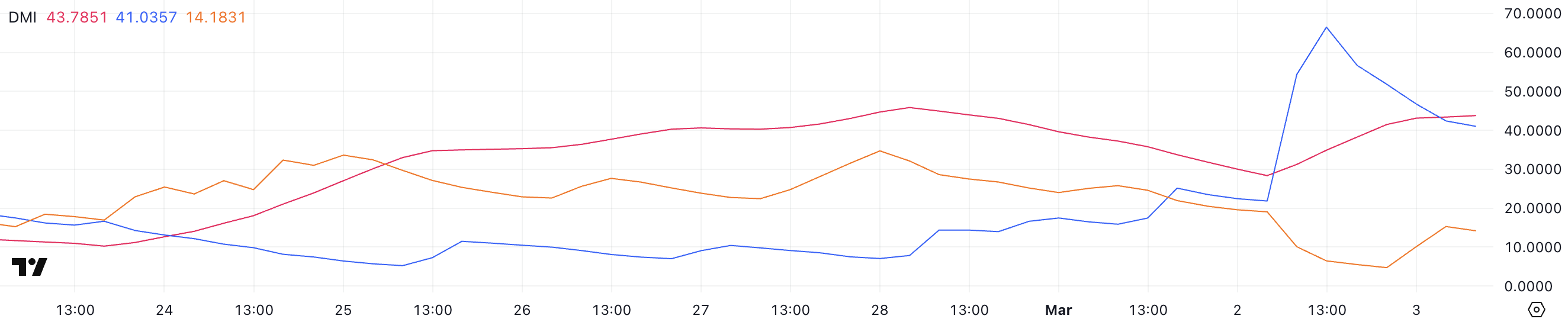

Pi Network DMI Shows the Downtrend Is Losing Steam

Pi Network’s trend strength has sharply declined, as reflected in its Directional Movement Index (DMI).

The Average Directional Index (ADX), which measures the strength of a trend, dropped from 37.5 yesterday to 16, indicating that the prior downtrend has significantly weakened.

The ADX does not indicate direction but rather the intensity of a trend, with values above 25 suggesting a strong trend and anything below 20 pointing to weak or indecisive price action. With the ADX at 16, PI is currently in a phase where momentum is fading, suggesting that neither buyers nor sellers have firm control.

Alongside this, PI’s +DI (positive directional index) has declined from 25.8 to 17, signaling a weakening bullish force. In contrast, the -DI (negative directional index) has risen from 17.8 to 23, reflecting an increase in selling pressure.

This shift indicates that PI is still in a downtrend, though not a particularly strong one, as the ADX suggests low trend strength overall. If -DI continues to rise while ADX stays below 20, PI could remain in a sluggish downtrend rather than a steep decline.

However, if ADX starts climbing again alongside the -DI, selling pressure could intensify, leading to a sharper drop. Conversely, if buyers step in and push +DI back above -DI, PI could stabilize and potentially enter a consolidation phase.

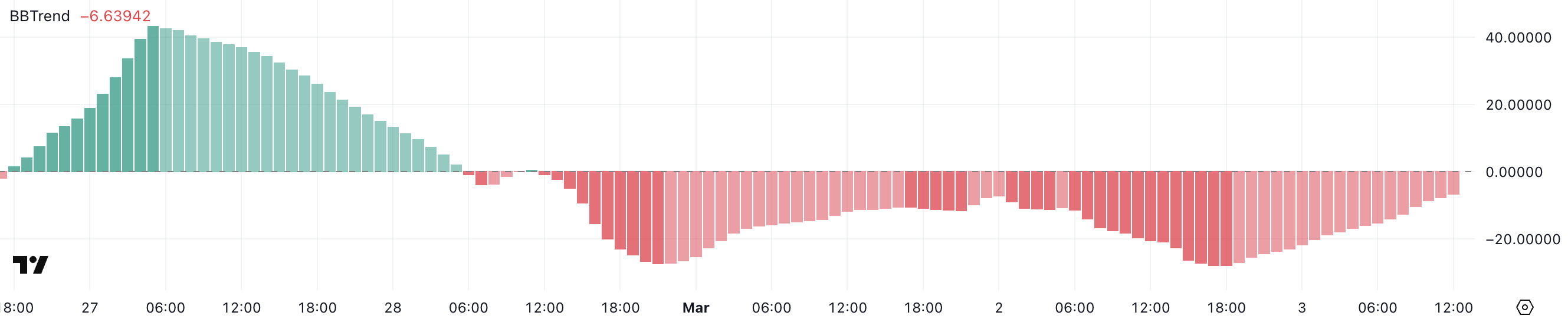

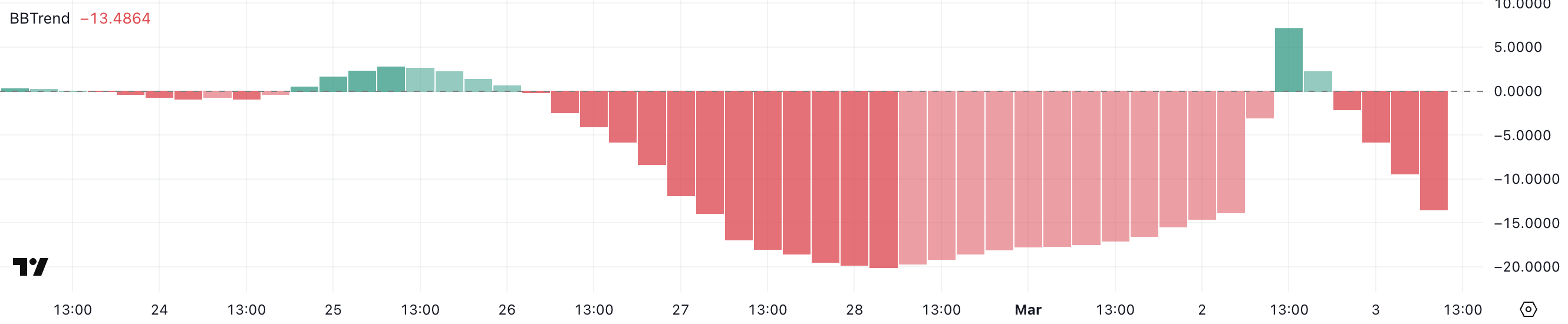

PI BBTrend Is Still Negative, But Recovering From Recent Lows

Pi Network has been in a prolonged downtrend, as indicated by its BBTrend indicator, which has remained negative since February 28.

Yesterday, PI’s BBTrend hit a negative peak of -27.9, signaling intense selling pressure before recovering to its current level of -6.6. The BBTrend, derived from Bollinger Bands, is a volatility-based indicator that helps measure the strength and direction of a trend.

Readings above zero suggest a bullish trend, while negative values indicate bearish momentum. When BBTrend falls below -10, it often signals a heavily oversold condition, while a rise back toward neutral territory suggests a potential slowdown in selling pressure.

Although PI’s BBTrend is still negative at -6.6, it has improved significantly from yesterday’s extreme low, indicating that selling pressure is easing.

This suggests that the market could be stabilizing, though PI is not yet in bullish territory. If BBTrend continues rising and moves closer to zero, it could indicate a potential trend reversal or at least a period of consolidation before the next move.

However, if BBTrend turns back down and fails to recover, PI could face renewed downside pressure, making it crucial to watch whether the recent improvement sustains or fades.

Pi Network Could Rise To Test $3 In March

Pi Network has dropped nearly 43% over the past four days after reaching levels close to $3, signaling a sharp reversal from its recent highs, with an 18% decline one day ago when Vietnam authorities issued legal warnings.

If the trend shifts back to the upside, the first key resistance to watch is at $1.80. A breakout above this level could indicate renewed buying interest, potentially driving PI toward $2.35.

If bullish momentum strengthens and mirrors the surge from a few days ago, PI could rally further to $2.97, with a chance of breaking above $3 for the first time.

However, this scenario depends on whether buyers step in to regain control and push the price above these resistance levels.

On the downside, if selling pressure intensifies and the downtrend resumes, PI could test the $1.50 support level.

A break below this zone would expose PI to further declines, with $0.80 emerging as the next major support. Such a move would indicate that bearish momentum remains strong, possibly leading to an extended period of downside movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance to Delist Tether’s USDT to Meet MiCA Compliance

Binance plans to delist Tether’s USDT to EU-based customers to comply with MiCA. European users will still be able to withdraw assets until midnight on March 31.

Most major exchanges delisted USDT as soon as MiCA went through, but sell-only transactions are still grandfathered in until the end of Q1 2025. Circle may have a chance to consolidate its EU market share even further.

Binance Delists Tether Due to MiCA

MiCA, the EU’s comprehensive new stablecoin legislation, is finally getting Coinbase to meet more of its requirements. Before the rollout, the exchange engaged in some proactive compliance, limiting unregulated stablecoins for EU users.

However, MiCA took effect in December, and Binance is only now agreeing to delist Tether’s USDT.

“We are making changes to the availability of non-MiCA compliant Stablecoins in the EEA to comply with regulatory requirements. Impacted assets are USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC and PAXG. Binance will restrict the availability of Spot trading pairs with non-MiCA Compliant Stablecoins for EEA users,” the firm’s statement claimed.

Tether’s USDT is the world’s largest stablecoin, but MiCA requirements have caused it a lot of hassle. Most exchanges delisted the asset in December, causing a $2 billion drop in USDT’s market cap.

Binance, however, bucked the trend by still Tether products in the EU. It still allows users to sell their tokens, but that functionality is about to go away.

The announcement cites an EU guidance statement published in January. However, most of the prior delistings took place before the deadline, which is March 31st. Binance is pushing the clock as long as possible, and it will delist Tether’s USDT one minute before midnight on that day.

Although Tether claims that MiCA didn’t have a large long-term impact, the firm had made active preparations several months beforehand. At the moment, it’s unclear how much more pain this Binance delisting will cause Tether. If nothing else, it’s not a bullish development.

Meanwhile, it’s clear that Tether’s biggest competitor is set to take advantage of the EU market. Last July, Circle already predicted that its own stablecoin could take some of Tether’s EU market share after MiCA.

In December, it also made overt preparations to seize this new territory and compete with smaller stablecoin issuers like Ripple.

Ultimately, Binance’s delisting choice is another piece of bad news for Tether, which might be in an uncomfortable moment. Already, Coinbase announced it would delist USDT if the US government implemented MiCA-style stablecoin regulations.

The firm has consistently rejected an independent audit of its reserves, which would be an integral part of future compliance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Dips 20% After Weekend Rally, Tests Key Support

Cardano (ADA) surged 60% yesterday after Donald Trump announced that ADA would be included in the US crypto reserve, pushing its price above $1.10. This massive rally fueled strong bullish momentum, with key indicators such as BBTrend and DMI confirming the strength of the uptrend.

However, the excitement appears to be fading, as ADA has since corrected below $1, with technical signals suggesting that selling pressure is increasing. As traders assess whether ADA can sustain its gains or enter a deeper retracement, key support and resistance levels will be crucial in determining the next move.

Cardano BBTrend Shows the Selling Pressure Is Getting Stronger

Cardano experienced a strong price surge after being officially included in the US crypto reserve. This sudden increase in demand pushed ADA’s BBTrend indicator from a deeply negative -14.5 to 7.1 within a few hours, signaling a shift in momentum.

The BBTrend, a volatility and trend-following indicator derived from Bollinger Bands, helps traders gauge the strength and direction of price movements.

When the BBTrend crosses above zero, it suggests a bullish trend, while a reading below zero indicates bearish momentum. Extreme values, such as below -10 or above 10, typically signal overextended moves that may soon correct.

Following its peak at 7.1, ADA’s BBTrend has since reversed, plunging back to -13.4, suggesting that the initial excitement surrounding its inclusion in the US crypto reserve has faded.

Such a rapid decline indicates that bullish momentum has weakened significantly, and ADA could now be facing a period of retracement or consolidation.

A BBTrend reading this low typically aligns with strong selling pressure, which could mean further downside unless fresh buying interest emerges. If ADA fails to hold key support levels, its price may continue to slide, though a reversal in BBTrend back toward neutral territory would indicate stabilization.

ADA DMI Shows That Buyers Are Still In Control

Cardano has seen a significant increase in trend strength, as reflected in its Directional Movement Index (DMI). The Average Directional Index (ADX), which measures the strength of a trend, has surged from 28.3 to 43.7 following the announcement of ADA’s inclusion in the US crypto reserve.

A rising ADX above 25 suggests that a trend is gaining strength, while values above 40 typically indicate a strong and sustained movement, whether bullish or bearish.

The ADX does not indicate trend direction but rather its intensity, making it a key metric for assessing whether a move has the potential to continue or weaken.

Alongside this, ADA’s +DI (positive directional index) has dropped from its high of 66.5 yesterday to 41, signaling that bullish momentum has cooled off. Meanwhile, the -DI (negative directional index) has climbed from 4.7 to 14.1, showing that sellers are starting to push back.

The combination of a high ADX with a falling +DI and rising -DI suggests that while the trend remains strong, bullish dominance is fading, and selling pressure is increasing. If this trend continues, ADA could face a deeper retracement or a shift toward consolidation unless buyers regain control.

Cardano Could Fall Below $0.80 Soon

Yesterday, Cardano’s price surged by a massive 60% following its inclusion in the US crypto reserve, propelling it above $1.10.

However, a correction has taken place in the last few hours, bringing ADA back to the $1 level as the initial buying frenzy fades.

The technical indicators DMI and BBTrend suggest that the uptrend may be losing momentum, raising the possibility of a deeper retracement. If ADA fails to maintain its current levels and selling pressure intensifies, it could test the $0.90 support level.

A breakdown below this could open the door for further declines to $0.81 and $0.65, with a strong downtrend potentially driving ADA as low as $0.50.

On the other hand, if bullish momentum reignites, Cardano price could make another push higher, testing the $1.16 resistance level.

A breakout above this zone would indicate renewed strength, potentially driving the price up to $1.32, which would mark its highest level since early December 2024.

Whether ADA sustains its upward trajectory or continues its pullback will depend on how traders react to the recent price surge and whether fresh buying interest can outweigh the emerging selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoEthereum Price Breaks Out—10% Surge Sparks Bullish Momentum

-

Altcoin19 hours ago

Altcoin19 hours agoBTC & Altcoins Pump Hard Amid Trump’s Crypto Reserve Backing

-

Market19 hours ago

Market19 hours agoXRP Price Explodes 30%—Can The Momentum Continue?

-

Bitcoin18 hours ago

Bitcoin18 hours agoTrump’s US Crypto Reserve: Why Experts Are Divided

-

Altcoin23 hours ago

Altcoin23 hours agoLawyer Reveals Likely Reason For Delay In Settling Ripple SEC Case

-

Market18 hours ago

Market18 hours agoCardano (ADA) Rockets Over 60%, Crushing Bears in a Stunning Rally!

-

Market17 hours ago

Market17 hours agoWhy Traders Might Get It Wrong

-

Altcoin16 hours ago

Altcoin16 hours agoPepe Coin Whale Shifts Focus To This Crypto; Sells 262B PEPE