Market

Trump’s Summit, ENA Unlock, and More

This week in crypto, several major events are in the pipeline, with the potential to affect traders’ and investors’ portfolios. Among the top stories include the White House crypto summit, massive ecosystem-specific token unlocks, and Tron blockchain moving forward with its recent commitments.

With the following headlines primed to influence investor sentiment, traders should adjust their strategies to capitalize on the volatility.

White House Crypto Summit

Slated for Friday, March 7, US President Donald Trump’s crypto summit at the White House is the highlight of crypto news this week. The hype comes after the President’s executive order commissioning a crypto reserve featuring assets like Solana (SOL), Cardano (ADA), and Ripple’s XRP token.

The reserve also contains Bitcoin (BTC) and Ethereum (ETH), given their heft as the pioneer crypto and altcoin, respectively.

“…And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum,” read a post on Trump’s Truth Social.

Analysts at Greeks.live note the potential impact of the crypto summit on Bitcoin, given its growing reaction to macroeconomic data. Beyond this, they also cite the potential of Trump’s tariffs on Mexico and Canada, which are due for execution on Tuesday, March 4. Amidst the expected volatility, the analysts see opportunities for investors.

“The most notable event this week is the cryptocurrency summit coming up in the US on the 7th of March…Trump’s every move greatly affects the cryptocurrency market…With Trump’s tariff policy on Mexico and Canada coming into effect on Tuesday and important economic events on other days, events drive rare trading opportunities,” they wrote.

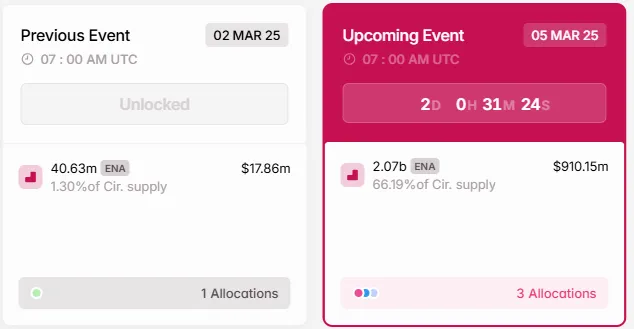

Ethena (ENA) Unlock

Also among the top crypto news items this week is the Ethena token unlock, due on March 5. On Wednesday, the Ethena network will unlock 2.07 billion ENA tokens, constituting 66.19% of its circulating supply and worth $910.15 million at current rates.

Given the typical market reaction of such events on asset prices, this event could inspire volatility for ENA. BeInCrypto recently reported that 90% of token unlocks drive prices down. Citing Keyrock Research, the report articulated how larger events cause sharper declines.

This means the Ethena token unlocks could see the ENA price drop significantly, especially if recipients quickly cash in for early gains. Other token unlocks to watch include Portal (PORTAL), AltLayer (ALT), and NFPrompt (NFP).

Pectra Upgrade Debut on Sepolia Testnet

Ethereum’s Pectra Upgrade will debut on the Sepolia Testnet on March 5. It features eight key enhancements, including wallet and staking improvements. The upgrade follows testing on the Holesky testnet on February 24.

These testnet deployments ensure stability before the mainnet implementation in April. Notably, the April launch marks a postponement after initial reports indicated a March launch. The delay comes amid a broader push for rigorous testing and coordination necessary for a smooth transition.

“EF Developer Operations Engineer Parithosh Jayanthi shared an update on the status of Pectra Devnet 6. He affirmed that the devnet is “doing well” and the validator participation rate is near perfect,” read a recent report, citing Parithosh Jayanthi, Ethereum Foundation’s Developer Operations Engineer.

Beyond the Pectra Upgrade, the Ethereum Foundation is also planning for Fusaka, which is expected to bring many enhancements to the Ethereum Virtual Machine (EVM) and increase block capacity.

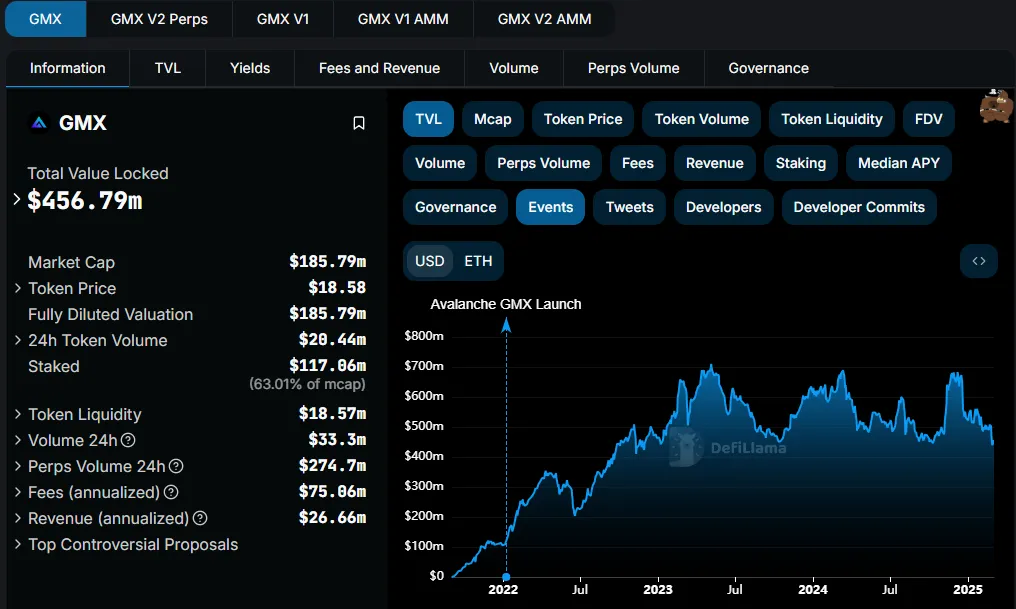

GMX Perpetual DEX Debut on Sonic

Further, crypto markets anticipate the launch of the GMX perpetual DEX (decentralized exchange) on Sonic. GMX, which boasts over $243 billion in historical volume, could launch a new Layer-1 (L1) blockchain from Fantom’s lineage, boasting 10,000 TPS on Sonic.

Currently on Arbitrum (ARB) and Avalanche (AVAX), GMX could leverage Sonic’s speed for faster, cheaper trades, tapping into a fresh ecosystem after its $1 million Hackathon. This could potentially boost GMX’s $456 million TVL (total value locked) towards rivaling peers like Hyperliquid at $642 million.

The GMX token, trading for $18.03 as of this writing, and Sonic’s S token could see speculative gains. Notably, however, the rumor remains unconfirmed.

MegaETH Testnet Launch

Additionally, MegaETH, an Ethereum Layer-2 network, aims to redefine blockchain performance with 100,000 TPS and sub-10ms block times. It targets real-time use cases like blockchain gaming and high-frequency trading.

Backed by $30 million from Vitalik Buterin, Dragonfly Capital, and others, MegaETH’s EVM-compatible platform promises seamless app integration. The testnet, kicking off in two days, will not be incentivized per X posts, but it is a chance to preview its tech—think Netflix-like speed on-chain.

“MegaETH has made know that their testnet would not be Incentivized,” a user on X indicated.

The mainnet is slated for late 2025, and no confirmed token launch has yet been announced, though speculation swirls about crypto airdrops. MegaETH could juice Ethereum’s ecosystem for markets, boosting ETH if adoption spikes, but its centralized sequencer raises decentralization concerns.

Tron Gas-Free Transactions for USDT

Another highlight this week is Tron blockchain’s planned gas-free transactions for USDT stablecoin. Once praised for cheap USDT transfers, Tron has seen fees soar to $3.20-$6.50 per TRC-20 USDT transaction, outpacing Ethereum’s $0.40 ERC-20 fees.

This shift eroded its cost edge, prompting founder Justin Sun to announce a “Gas Free” feature that would roll out within a week of February 25.

“Tron’s Gas Free feature supporting USDT gas payments without the need for TRX will launch within the next week,” Sun shared on X.

This means users can send USDT without needing TRX for fees, simplifying the process. Tron handles over $60 billion in USDT—51% of its supply—making this significant. It aims to reclaim affordability, boost adoption, and ease stablecoin use for big firms. Fees spiked to $9 in late 2024, so this could revive Tron’s appeal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Dips 20% After Weekend Rally, Tests Key Support

Cardano (ADA) surged 60% yesterday after Donald Trump announced that ADA would be included in the US crypto reserve, pushing its price above $1.10. This massive rally fueled strong bullish momentum, with key indicators such as BBTrend and DMI confirming the strength of the uptrend.

However, the excitement appears to be fading, as ADA has since corrected below $1, with technical signals suggesting that selling pressure is increasing. As traders assess whether ADA can sustain its gains or enter a deeper retracement, key support and resistance levels will be crucial in determining the next move.

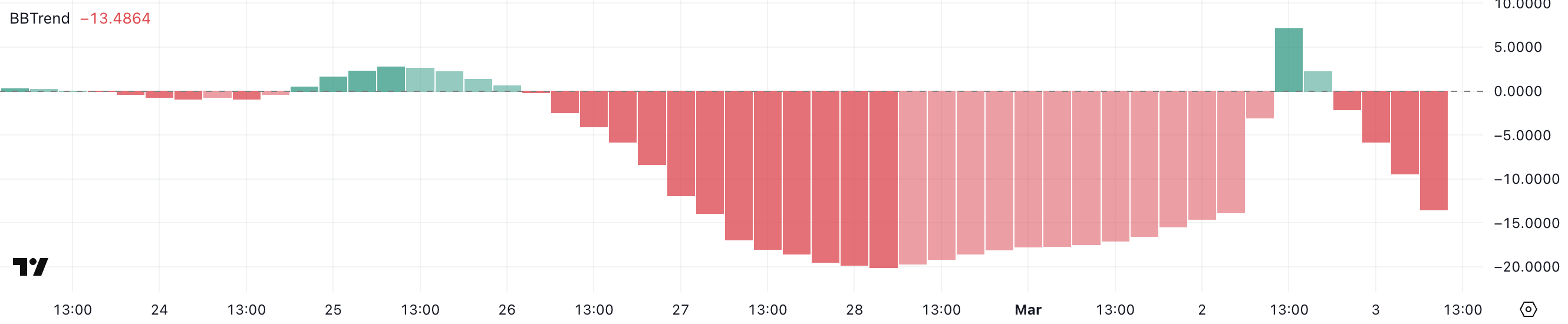

Cardano BBTrend Shows the Selling Pressure Is Getting Stronger

Cardano experienced a strong price surge after being officially included in the US crypto reserve. This sudden increase in demand pushed ADA’s BBTrend indicator from a deeply negative -14.5 to 7.1 within a few hours, signaling a shift in momentum.

The BBTrend, a volatility and trend-following indicator derived from Bollinger Bands, helps traders gauge the strength and direction of price movements.

When the BBTrend crosses above zero, it suggests a bullish trend, while a reading below zero indicates bearish momentum. Extreme values, such as below -10 or above 10, typically signal overextended moves that may soon correct.

Following its peak at 7.1, ADA’s BBTrend has since reversed, plunging back to -13.4, suggesting that the initial excitement surrounding its inclusion in the US crypto reserve has faded.

Such a rapid decline indicates that bullish momentum has weakened significantly, and ADA could now be facing a period of retracement or consolidation.

A BBTrend reading this low typically aligns with strong selling pressure, which could mean further downside unless fresh buying interest emerges. If ADA fails to hold key support levels, its price may continue to slide, though a reversal in BBTrend back toward neutral territory would indicate stabilization.

ADA DMI Shows That Buyers Are Still In Control

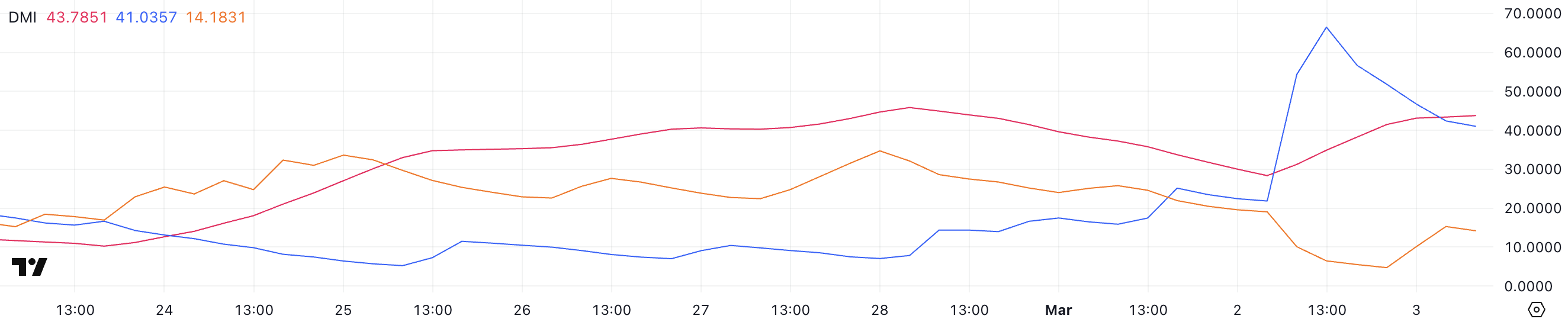

Cardano has seen a significant increase in trend strength, as reflected in its Directional Movement Index (DMI). The Average Directional Index (ADX), which measures the strength of a trend, has surged from 28.3 to 43.7 following the announcement of ADA’s inclusion in the US crypto reserve.

A rising ADX above 25 suggests that a trend is gaining strength, while values above 40 typically indicate a strong and sustained movement, whether bullish or bearish.

The ADX does not indicate trend direction but rather its intensity, making it a key metric for assessing whether a move has the potential to continue or weaken.

Alongside this, ADA’s +DI (positive directional index) has dropped from its high of 66.5 yesterday to 41, signaling that bullish momentum has cooled off. Meanwhile, the -DI (negative directional index) has climbed from 4.7 to 14.1, showing that sellers are starting to push back.

The combination of a high ADX with a falling +DI and rising -DI suggests that while the trend remains strong, bullish dominance is fading, and selling pressure is increasing. If this trend continues, ADA could face a deeper retracement or a shift toward consolidation unless buyers regain control.

Cardano Could Fall Below $0.80 Soon

Yesterday, Cardano’s price surged by a massive 60% following its inclusion in the US crypto reserve, propelling it above $1.10.

However, a correction has taken place in the last few hours, bringing ADA back to the $1 level as the initial buying frenzy fades.

The technical indicators DMI and BBTrend suggest that the uptrend may be losing momentum, raising the possibility of a deeper retracement. If ADA fails to maintain its current levels and selling pressure intensifies, it could test the $0.90 support level.

A breakdown below this could open the door for further declines to $0.81 and $0.65, with a strong downtrend potentially driving ADA as low as $0.50.

On the other hand, if bullish momentum reignites, Cardano price could make another push higher, testing the $1.16 resistance level.

A breakout above this zone would indicate renewed strength, potentially driving the price up to $1.32, which would mark its highest level since early December 2024.

Whether ADA sustains its upward trajectory or continues its pullback will depend on how traders react to the recent price surge and whether fresh buying interest can outweigh the emerging selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 5 USA Made Tokens to Watch Before Trump’s Crypto Summit

The upcoming White House Crypto Summit on March 7 could have a major impact on the market, with discussions set to focus on regulation and innovation. Five key assets – Hedera (HBAR), Chainlink (LINK), TRUMP, MELANIA, and Uniswap (UNI) – are currently in the spotlight, with speculation rising about their potential inclusion in the US crypto reserve.

While HBAR and LINK have strong positions in their respective sectors, TRUMP and MELANIA could see increased attention due to their ties to the summit. Meanwhile, UNI’s regulatory win against the SEC has fueled discussions about its long-term role in the DeFi ecosystem.

Hedera (HBAR)

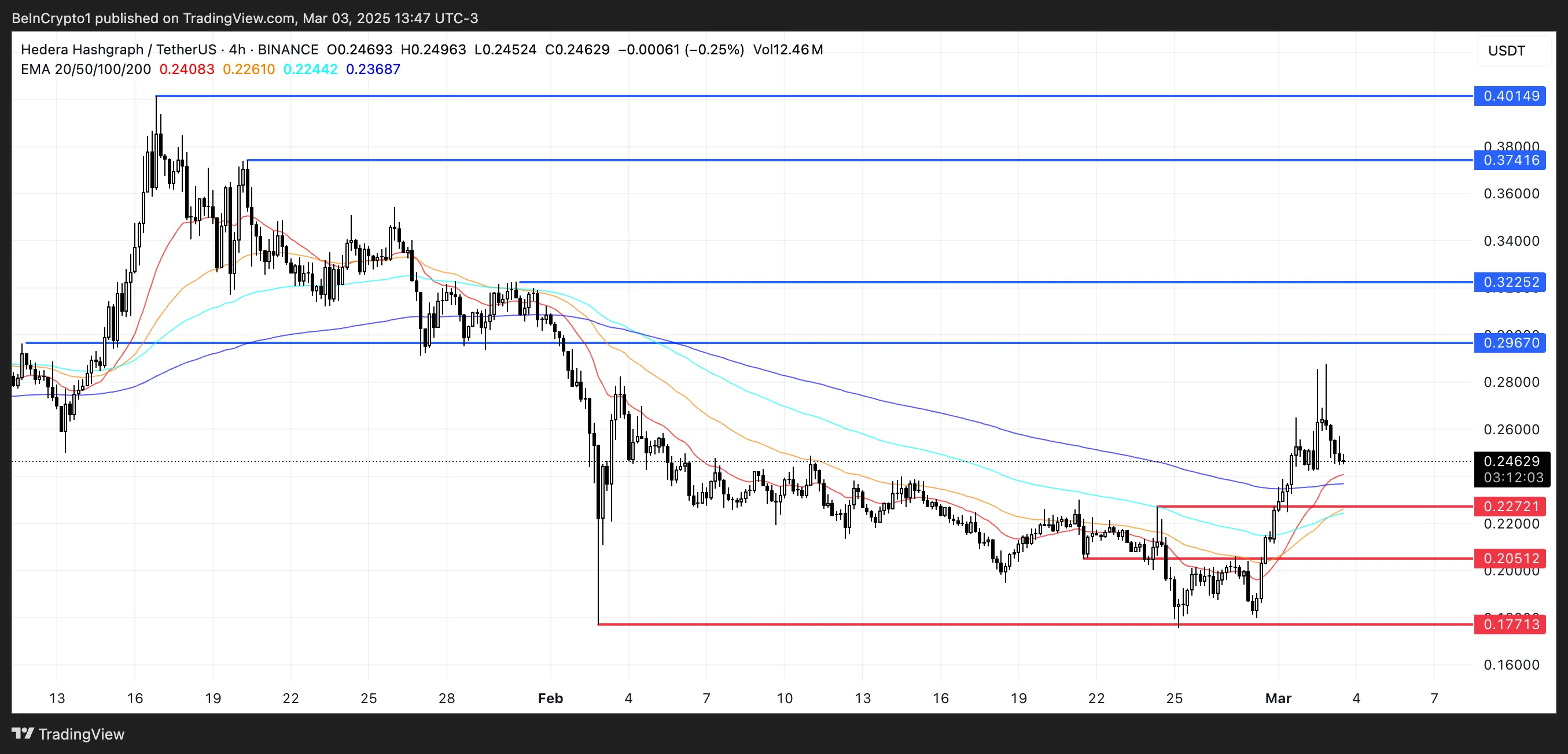

Hedera is among the top 5 biggest Made in USA cryptos by market cap, trailing only XRP, Solana, and USDC, and very close to Chainlink. With XRP and Solana already included in the US crypto reserve and USDC being a stablecoin, speculation is growing that HBAR could be next in line for inclusion.

Such a move would likely drive significant bullish momentum as investors anticipate increased institutional adoption and government recognition.

Despite a 7% decline in the last 24 hours, HBAR has been up over 13% in the past week. Its market cap hovers around $10.3 billion, reflecting sustained interest in the asset.

If HBAR is added to the US crypto reserve, its price could surge, potentially testing key resistance levels at $0.29 and $0.32.

A stronger rally could push it further toward $0.37, and if bullish momentum continues, HBAR could climb to $0.40, a level it hasn’t reached since November 2021.

However, if the recent price retracement deepens and HBAR loses support at $0.22, it could face further downside, with $0.20 and $0.17 emerging as the next critical support levels.

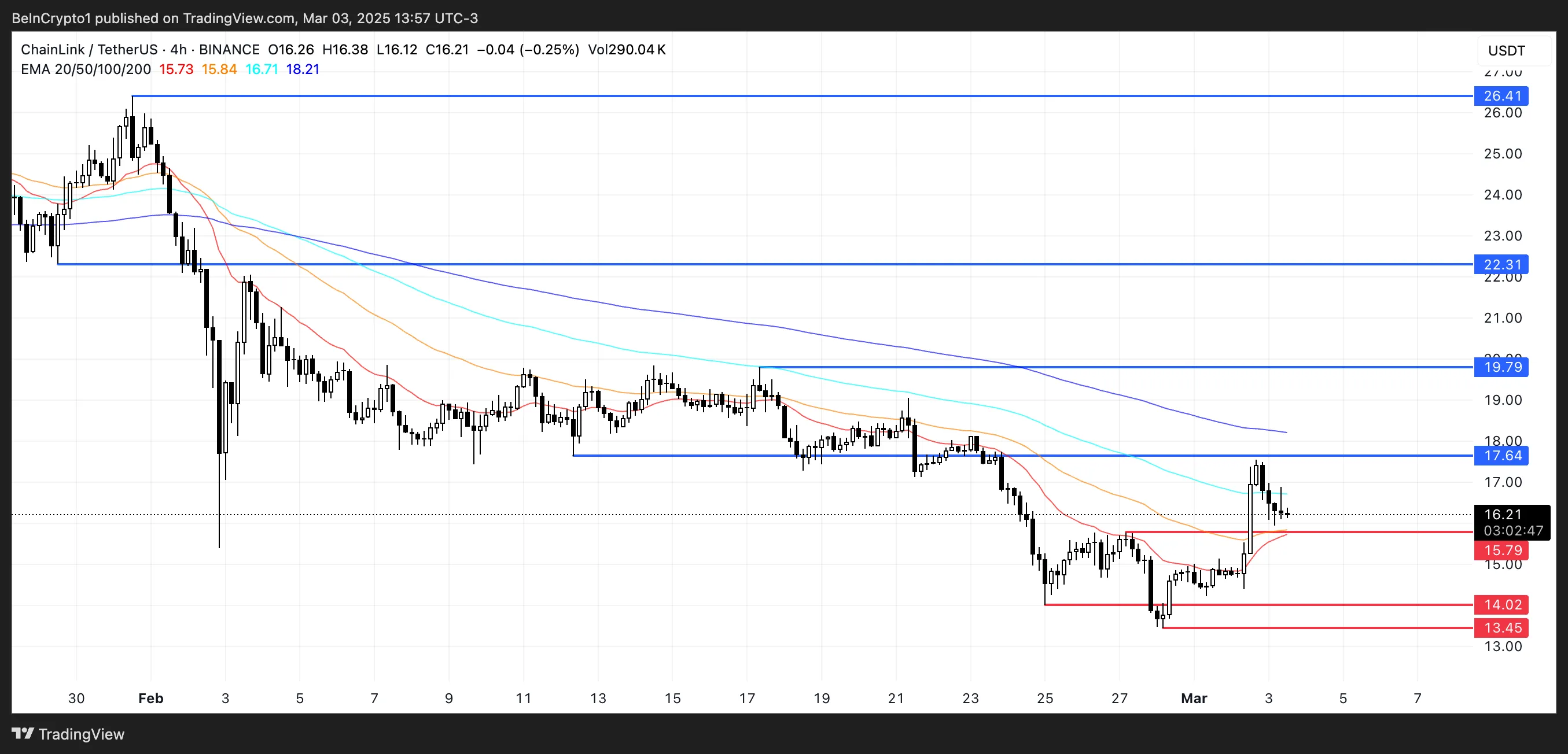

Chainlink (LINK)

Chainlink is a major player in the oracle sector and has been expanding its influence in real-world assets (RWA). Its role in both industries strengthens its case for inclusion in the US crypto strategic reserve, alongside XRP and Solana.

With a market cap close to Hedera’s, LINK remains one of the most relevant Made in USA cryptos since its launch in 2018. If it is added to the strategic reserve, demand could rise, driving its price higher.

A potential inclusion could push LINK to test $17.6, with further breakouts leading to $19.7 and $22.3. If momentum stays strong, it could climb to $26.4, surpassing $26 for the first time since mid-December 2024.

However, a market downturn could see LINK testing support at $15.7, with further declines toward $14 or even $13.45.

OFFICIAL TRUMP (TRUMP)

Trump’s Crypto Summit could have a major impact on his meme coin, Official Trump (TRUMP), which has been struggling below $20 for over two weeks. The event could reignite interest in the coin, potentially reversing its recent downtrend.

TRUMP was one of the most hyped meme coins ever, briefly reaching a $15 billion market cap on its first day and becoming the third-largest meme coin. However, it has since lost 80% of its value, with its market cap now around $2.9 billion.

If momentum picks up, TRUMP could test resistance at $17, $20, and $24.5, with a strong rally potentially pushing it toward $30 for the first time since January.

However, if the correction continues, TRUMP could test support at $12.1 or $11, with a break below $11 marking its lowest price since launch.

Melania Meme (MELANIA)

Just like TRUMP, MELANIA could also see a boost from Trump’s Crypto Summit. Launched on January 19, MELANIA quickly surged, reaching a $2 billion market cap within hours. However, it has been in a steep decline since then, dropping $50 in the last 30 days and struggling to find support.

MELANIA has been trading below $1 for nearly a week and is currently near its all-time lows. A strong rebound could push it back to $1.29 and $1.39, with a potential surge taking it to $1.61 for the first time since February 6.

If momentum fails to pick up, however, MELANIA could continue sliding below $0.80 and $0.70, setting new record lows.

The summit’s outcome will likely play a key role in MELANIA’s price action. If hype returns, it could regain lost ground, but if sentiment remains weak, further downside could be ahead.

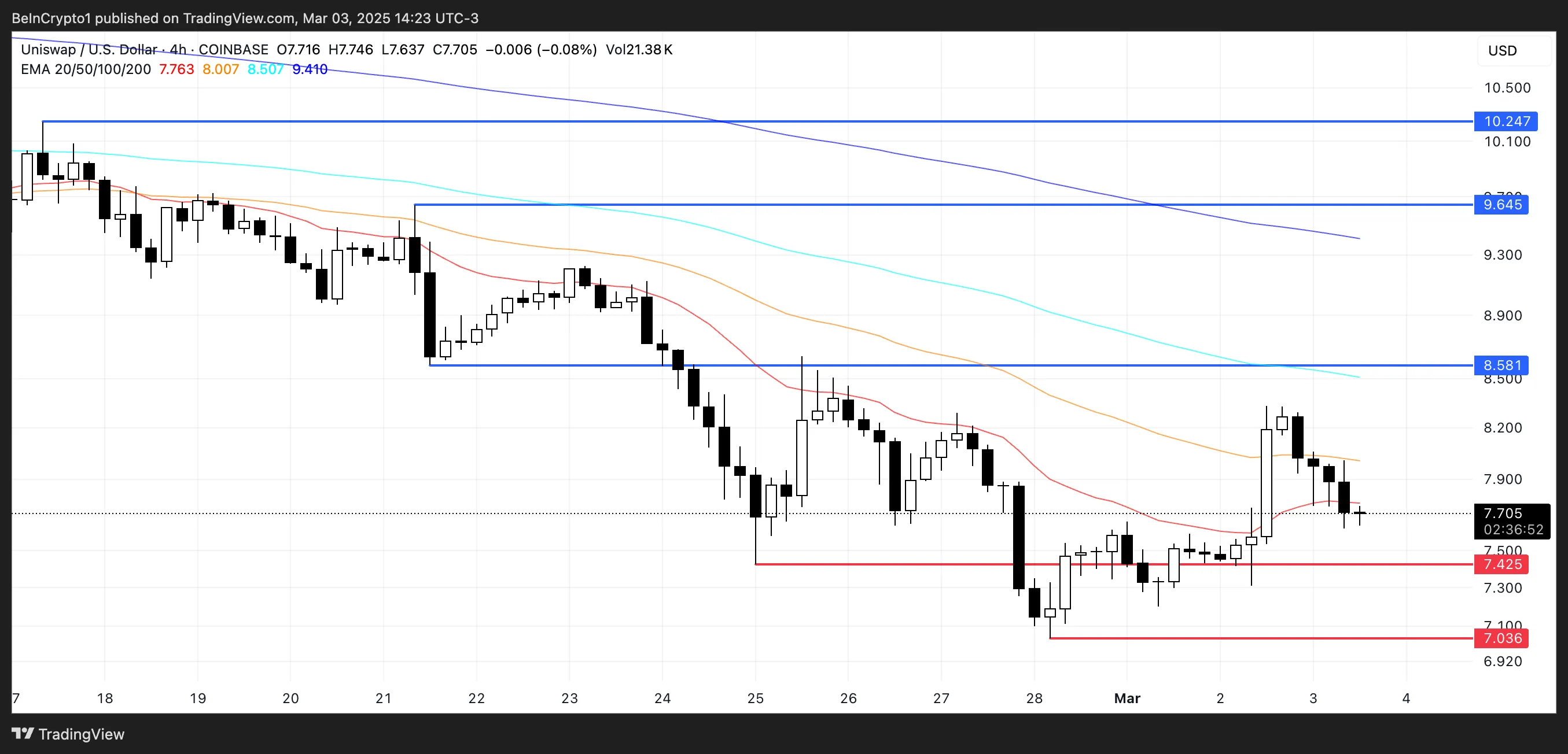

Uniswap (UNI)

Uniswap remains one of the most significant DeFi applications, even as it occasionally loses its lead to competitors like Raydium, Hyperliquid, and Pumpfun.

With the SEC dropping its case against Uniswap, speculation is growing that UNI could be one of the Made in USA cryptos included in the US strategic crypto reserve. If that happens, UNI could rally to test resistance at $8.5, with further upside toward $9.64 and even above $10 for the first time since mid-February.

However, UNI has dropped 33% in the last 30 days, and its correction could continue if buyers remain hesitant.

A further decline could see UNI price testing support at $7.42. If that level is lost, it may fall to $7 or even below for the first time since January 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tether Appoints New CFO to Manage Transparency and Audits

Tether, the stablecoin giant, has announced the appointment of Simon McWilliams as its new Chief Financial Officer (CFO).

With Simon McWilliams’ expertise in financial auditing, it appears that Tether is hoping he can conduct a comprehensive financial audit. The company is aiming to become more transparent about its reserves as regulatory pressure mounts.

Simon McWilliams Becomes Tether’s New CFO

According to the latest announcement, Tether has appointed Simon McWilliams as its new Chief Financial Officer (CFO). With this appointment, Tether aims to strengthen the trust of users, regulators, and institutional partners while solidifying its dominant position in the $232 billion stablecoin market.

“Simon’s expertise in financial audits makes him the perfect CFO to lead Tether into this new era of transparency. With his leadership, we are moving decisively toward a full audit, reinforcing our role in supporting US financial strength and expanding institutional engagement,” wrote Paolo Ardoino, CEO of Tether.

Simon McWilliams brings over 20 years of experience in financial management. He has previously guided large investment firms through rigorous audits.

His appointment marks a significant step for Tether, especially given the ongoing skepticism regarding the legitimacy and transparency of its reserves.

Challenges Tether Faced Under CFO Giancarlo Devasini

Following McWilliams’ appointment, Tether’s former CFO, Giancarlo Devasini, will transition to the role of Chairman. In this new position, Devasini will now focus on macroeconomic strategy, steering Tether toward becoming part of the US financial system and promoting the global adoption of digital assets.

Under Devasini, Tether consistently faced criticism for lacking a comprehensive audit. From 2022 until now, the company relied solely on quarterly attestation reports from the accounting firm BDO.

These reports are considered to lack the detail that a comprehensive audit would require.

This lack of transparency has been creating many doubts, particularly after a 2021 settlement with the New York Attorney General (NYAG). The NYAG investigation revealed that Tether had misrepresented that USDT was backed 1:1 by the U.S. dollar.

Furthermore, Tether and Bitfinex, a closely affiliated company, denounced the amended price manipulation lawsuit.

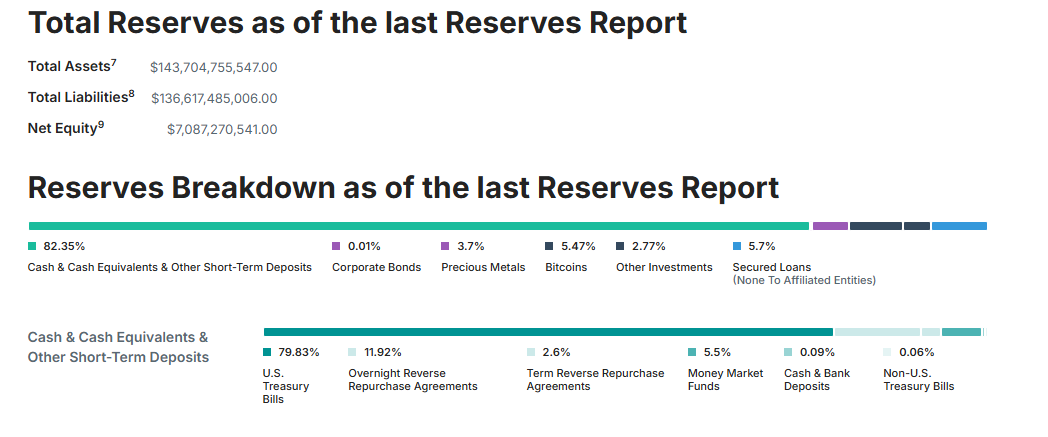

Although Tether has made efforts to disclose its reserves, 82.35% consist of Cash, Cash Equivalents, and Other Short-Term Deposits. Nearly 80% of them are in US Treasury Bills.

However, critics argue that only a full audit can fully dispel doubts about the company’s financial health.

Pushing for a comprehensive audit aligns with Tether’s broader strategic goals. The company recently relocated its headquarters to El Salvador, aiming to secure a Digital Asset Service Provider (DASP) license.

This move is seen as an effort to strengthen its operational foundation and signal intentions to expand within the institutional financial system.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoCardano Founder Breaks Silence On White House Crypto Role Speculations

-

Altcoin21 hours ago

Altcoin21 hours agoLawyer Reveals Likely Reason For Delay In Settling Ripple SEC Case

-

Market13 hours ago

Market13 hours agoBitcoin Surges with Positive Bias Toward Key Levels

-

Bitcoin13 hours ago

Bitcoin13 hours ago5 US Economy Data Points That Could Move BTC Price This Week

-

Market18 hours ago

Market18 hours agoEthereum Price Breaks Out—10% Surge Sparks Bullish Momentum

-

Market17 hours ago

Market17 hours agoXRP Price Explodes 30%—Can The Momentum Continue?

-

Altcoin16 hours ago

Altcoin16 hours agoBTC & Altcoins Pump Hard Amid Trump’s Crypto Reserve Backing

-

Bitcoin16 hours ago

Bitcoin16 hours agoTrump’s US Crypto Reserve: Why Experts Are Divided