Altcoin

BTC & Altcoins Pump Hard Amid Trump’s Crypto Reserve Backing

The crypto market today (March 3) has reignited bullish sentiments among traders and investors globally. Bitcoin (BTC) price tapped a $95K high intraday, whereas Ethereum (ETH), Solana (SOL), & XRP prices gained 9%-25%. Notably, the broader bullish action comes amid U.S. President Donald Trump’s recent backing for a strategic crypto reserve that includes XRP, SOL, and ADA.

Crypto Market Today: BTC, ETH, XRP, & SOL Jump Amid Trump’s Crypto Reserve Saga

The global crypto market cap rose substantially by over 8% in the past 24 hours, regaining a break above $3 trillion. Further, the total market volume also skyshot 141% over the past day, reaching $185.95 billion.

Intriguingly, the broader market shows bullish actions primarily as the pro-crypto president is backing a crypto reserve in the U.S. As per a recent Forbes report, a crypto strategic reserve that includes XRP, SOL, and ADA is eagerly awaited nationwide, as indicated by Trump. Notably, this event emerged as potential buy-the-dip news for investors.

BTC Touches $95K High

As of press time, BTC price gained over 8% and exchanged hands at $92,759. The flagship coin hit a 24-hour low and high of $85,040.21 and $95,043.44 in the past 24 hours. Notably, BTC futures OI surged 7% to $54.74 billion today, signaling renewed market interest in the coin that triggered a bullish action. Nevertheless, Bitcoin’s dominance was down by 0.3% over the day, indicating altcoins gained harder.

ETH Price Jumps 10%

ETH price soared over 10% in the past 24 hours and closed in at $2,446. The coin hit a bottom and peak of $2,175.32 and $2,548.81 in the past 24 hours. Ethereum rises alongside a 6% surge in its futures OI to $21.17 billion, underscoring rising market interest. Nevertheless, Ethereum’s market dominance remained down to 9.6%.

XRP Price Shoots Up 24%

Ripple’s XRP led the broader market gains today, rallying 24% to $2.79. The coin’s intraday low and high were $2.23 and $2.97, respectively. XRP futures OI soared 38% over the day, reaching $4.33 billion. Overall, Ripple’s coin leverages renewed market interest amid Donald Trump’s crypto reserve backing.

SOL Price Rockets 18%

Simultaneously, SOL price witnessed an 18% uptick in the past 24 hours, closing in at $170 in sync with broader trends. The coin hit a bottom and a peak of $140.30 and $178.63 in the past 24 hours. Solana futures OI gained over 14% in a day, reaching $5.01 billion.

Meme Crypto Market Reflects Bullishness

Dogecoin (DOGE) price was up by 10% in the past 24 hours, trading at $0.2272. Also, Shiba Inu (SHIB) price followed, up nearly 6% to $0.00001451. Pepe Coin (PEPE) price sky shot nearly 10% to reach $0.000008508.

Top Crypto Market Gainers Today

Cardano (ADA)

Price: $1.05

24-Hour Gains: +59%

Onyxcoin (XCN)

Price: $0.01982

24-Hour Gains: +26%

Cronos (CRO)

Price: $0.09035

24-Hour Gains: +22%

Top Crypto Market Losers Today

Maker (MKR)

Price: $1,524

24-Hour Loss: -6%

Celestia (TIA)

Price: $3.97

24-Hour Loss: -5%

Berachain (BERA)

Price: $8.24

24-Hour Loss: -1%

In conclusion, the broader market mirrors a bullish action primarily as the pro-crypto U.S. President revealed plans for a strategic crypto reserve, including SOL, ADA, and XRP. Traders and investors continue to anticipate further gains, given the market sees such a feat moving ahead.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Why Bitcoin, Ethereum, Dogecoin, & XRP Price Are Dropping Today

Another crypto market crash has occurred, with Bitcoin, Ethereum, Dogecoin and the XRP price dropping significantly today. This development is due to several factors, including the CME gap which the flagship crypto needs to fill below $90,000.

Crypto Market Crash: Why BTC, ETH, DOGE & The XRP Price Are Down

CoinMarketCap data shows that another crypto market crash has occurred with Bitcoin, Ethereum, Dogecoin and the XRP price dropping significantly. Crypto analyst Hardy revealed that this price decline is happening due to the CME gaps.

The analyst stated that the Bitcoin price already filled one at today’s open between $93,500 and $92,700. He added that the flagship crypto needs to drop to $85,000 to fill another. Meanwhile, he noted that there is another CME gap at $77,900 that BTC hasn’t quite filled.

Hardy also remarked that the Bitcoin bears will fight to ensure that BTC fills all these CME gaps. As such, he stated that the quicker the flagship crypto fills them up, the quicker it can begin another upward trend.

Crypto analyst Titan of Crypto also highlighted the CME futures gap between $92,900 and $85,700. He noted that traditionally, BTC tends to fill these gaps. As such, the analyst had raised the possibility of a pullback before the next leg up, which is already happening.

Altcoins like Ethereum, Dogecoin and the XRP price are dropping because they share a strong positive correlation with the flagship crypto and experience significant drops whenever BTC declines.

Coinglass data shows that the latest crypto market crash has led to the liquidation of over $213 million in long positions in the last four hours. Meanwhile, short positions have taken a lesser hit, with just over $18 million in liquidations during this timeframe.

Mixed Sentiments Over The Strategic Reserve

US President Donald Trump announced yesterday that the crypto strategic reserve would include altcoins such as Solana, Cardano, and XRP. This has sparked mixed sentiments over this crypto reserve as market participants believed that the reserve would only include Bitcoin.

Although the crypto market rebounded following Trump’s announcement, the mixed sentiment in the crypto market at the moment also looks to be contributing to the crypto market crash as market participants question the seriousness of the strategic reserve if it would include altcoins.

Meanwhile, stakeholders such as BitMEX’s co-founder Arthur Hayes have downplayed Trump’s announcement. Hayes stated that there was nothing new in the announcement. He highlighted the role the US Congress has to play before the crypto reserve can become effective.

It is also worth mentioning that Trump contributed to this crypto market crash by announcing that the 25% tariffs on Mexico and Canada would begin tomorrow. The president also reiterated plans to double the tariffs on China from 10% to 20%.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

CryptoQuant CEO Explains How Trump Made Crypto a Weapon for US Dominance

CryptoQuant CEO Ki Young Ju has stated that the crypto market is increasingly being shaped into a tool for U.S. dominance under President Donald Trump. His remarks follow Trump’s recent announcement regarding the establishment of a U.S. crypto reserve, which triggered major market movements.

The initiative led to a $300 billion boost in total crypto market value, with Bitcoin rising by 8% and Ethereum gaining 11%.

CryptoQuant CEO Explains How Trump is Weaponizing Crypto

In a recent post, CryptoQuant CEO Ki Young Ju analyzed President Donald Trump’s approach to cryptocurrency. According to Ju, Trump’s decision to establish a U.S. crypto reserve marks a shift in the global crypto landscape. Ju noted that the announcement initially mentioned XRP, Solana, and Cardano, while Bitcoin and Ethereum were only included later.

Ju interpreted Trump’s actions as a move to assess the strategic value of different cryptocurrencies. He suggested that the initial exclusion of Bitcoin and Ethereum might indicate that Trump sees them as neutral assets rather than direct contributors to U.S. interests. Ju further stated that Trump’s strategy is positioning the U.S. to dominate the crypto market and absorb foreign capital.

Meanwhile, Binance founder reacted to BNB’s exclusion from the U.S. Crypto Strategic Reserve by urging holders to remain patient and not panic. CZ emphasized that BNB’s absence is likely due to the U.S. prioritizing domestically founded cryptocurrencies in the initial selection. He remains optimistic that BNB will be added in the future and pointed out that other nations may introduce their crypto strategic reserves.

Market Reaction to Crypto Reserve Announcement

Following Trump’s announcement, the crypto market experienced a rapid surge. The total market capitalization increased by $300 billion, driven by price jumps in multiple assets. Bitcoin saw an 8% increase, climbing past $93,000 before slightly dropping, while Ethereum rose by 11%.

Among the tokens first included in the U.S. crypto reserve, Cardano saw the highest surge, gaining up to 75%, while Solana and XRP also experienced double-digit growth. The sudden price movements reflected strong investor confidence in the crypto assets.

Following the CryptoQuant CEO insights, a recent report has highlighted other cryptos that could potentially be included in Trump’s Crypto Reserve. Dogecoin, SUI, and Chainlink have gained significant momentum, sparking speculation about their addition.

Concerns Over Bitcoin and Ethereum Position

While CryptoQuant CEO Ki Young Ju acknowledged the market benefits of Trump’s crypto policies, he also pointed out potential challenges for Bitcoin and Ethereum. He suggested that Trump’s focus on specific cryptocurrencies tied to U.S. interests could weaken the position of decentralized assets.

Ju emphasized that Bitcoin and Ethereum have historically been viewed as tools for decentralization rather than instruments of national influence. He noted that Trump’s statements positioned these two assets as neutral.

CryptoQuant CEO stated

“This trend is also unfavorable for #Bitcoin and #Ethereum, which strive for neutrality and aim to become global public goods. Judging by Trump’s recent posts, it seems that Bitcoin and Ethereum are now being signaled as “neither friend nor foe.”

The Shift in Crypto’s Perception Under New Administartion

According to CryptoQuant CEO Ki Young Ju, the perception of cryptocurrency has changed under Donald Trump’s administration. Ju noted that crypto, once regarded with skepticism, is now being embraced as a national asset.

While he did not pass judgment on this approach, he observed that the U.S. is using cryptocurrency as a tool to expand its global financial influence.

Moreover, Ki Young Ju expressed worries that this shift in regulatory standards could lead to market manipulation. He emphasized that the lack of oversight might encourage fraudulent activities like rug pulls, harming retail investors.

The CEO added,

“Since Trump’s election, universal moral standards have declined.”

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

MicroStrategy Failed To Purchase Bitcoin Last Week, Still Holds 499,096 BTC

MicroStrategy, now known as Strategy, failed to make any Bitcoin purchases. The company didn’t also sell any shares, a move that usually precedes its BTC purchases. As a result, the software company still holds 499,096 BTC, with the 500k BTC milestone yet to be hit.

MicroStrategy Did Not Make Any Bitcoin Purchase Last Week

In an SEC filing, MicroStrategy revealed that it made no Bitcoin purchases between February 24 and March 2 last week. The company also revealed that it did not sell any shares of class A common stock under its at-the-market equity offering program.

It is worth mentioning that Strategy acquired 20,356 BTC for $1.99B at $97,514 per BTC two weeks ago. This came following a $2B zero-coupon convertible notes offering, in which it was able to raise the funds for this BTC purchase.

Meanwhile, following its failure to buy any Bitcoin last week, MicroStrategy still holds 499,096 BTC, which it acquired for $33.1 billion at an average price of $66,357 per BTC. Strategy remains the public company with the largest Bitcoin holdings, well ahead of MARA holdings, which is second on the list.

The company’s failure to buy any BTC last week is also notable considering that the Bitcoin price dropped below $80,000 last week following a major crypto crash. As such, the company didn’t take advantage of a major dip which could have lowered its average cost price.

MSTR Stock Recovers

MicroStrategy’s stock has crashed last week following the Bitcoin price decline, as both assets share a positive correlation. The MSTR stock price has now recovered following BTC’s rebound above $90,000 over the weekend.

Nasdaq data shows that the stock price is up over 14% in premarket, trading at around $292. MSTR closed last week at around $255 following the Bitcoin price crash. However, following last week’s crash, MSTR now boasts a year-to-date (YTD) loss of over 11%.

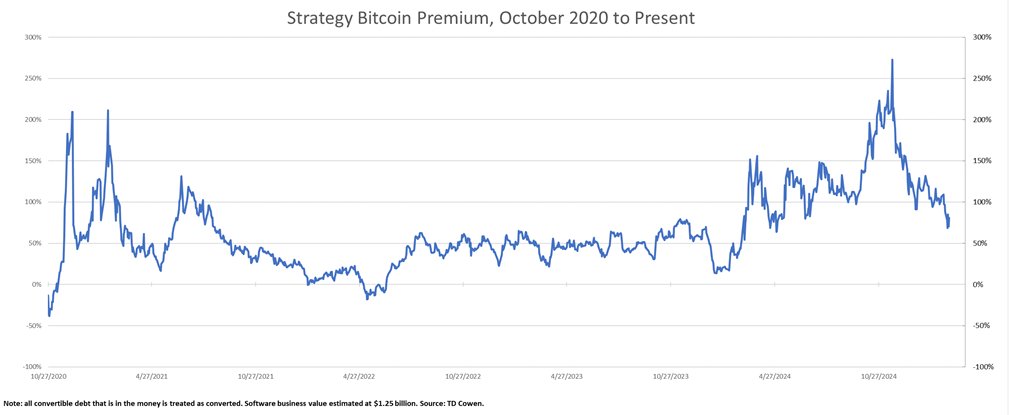

VanECK’s chief also revealed that MicroStrategy’s Bitcoin premium has dropped back to April 2024, which may be something for market participants to keep an eye on.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Regulation22 hours ago

Regulation22 hours agoCardano Founder Breaks Silence On White House Crypto Role Speculations

-

Altcoin19 hours ago

Altcoin19 hours agoLawyer Reveals Likely Reason For Delay In Settling Ripple SEC Case

-

Market16 hours ago

Market16 hours agoEthereum Price Breaks Out—10% Surge Sparks Bullish Momentum

-

Market15 hours ago

Market15 hours agoXRP Price Explodes 30%—Can The Momentum Continue?

-

Bitcoin14 hours ago

Bitcoin14 hours agoTrump’s US Crypto Reserve: Why Experts Are Divided

-

Market14 hours ago

Market14 hours agoCardano (ADA) Rockets Over 60%, Crushing Bears in a Stunning Rally!

-

Market12 hours ago

Market12 hours agoBitcoin Surges with Positive Bias Toward Key Levels

-

Bitcoin11 hours ago

Bitcoin11 hours ago5 US Economy Data Points That Could Move BTC Price This Week

✓ Share: