Altcoin

Binance Founder Reacts As Trump Fails To Name BNB In Strategic Reserve

As the markets break into a frenzy following President Trump’s executive order for a Crypto Strategic Reserve, BNB is noticeably absent from the announcement. Binance founder Changpeng Zhao (CZ) is eyeing the addition of BNB to the Strategic Reserve at a later date while urging community member to remain chill.

BNB Fails To Make The Cut For Strategic Reserve

US President Donald Trump has issued an executive order for the establishment of a Crypto Strategic Reserve after weeks of speculation. The announcement extends the composition of the reserve beyond Bitcoin (BTC) to include a raft of altcoins including XRP, SOL, and ADA.

While the altcoins are part of the top 10 cryptocurrencies by market capitalization, the absence of BNB has raised eyebrows in certain quarters. BNB, with its $86 billion, market capitalization did not make the cut for the US Crypto Strategic Reserve, sparking theories for the exclusion.

Amid the altcoin rally, BNB has recorded only a modest bump in prices, rising by 3.3%. XRP, SOL, and ADA are basking in double-digit gains while BTC price has surged past the $90K mark following Trump’s announcement.

Binance Founder Urges BNB Holders To Chill, Eyes Future Inclusion

CZ, in a post on X, theorizes that the initial cryptocurrencies selected by Trump to join the Crypto Strategic Reserve are “clearly US coins.” The Binance founder argues that the US will want to test the waters with coins launched by US founders like Ripple CEO Brad Garlinghouse before expanding to other cryptocurrencies like BNB.

“This round is clearly US coins,” said CZ. “Kudos to them for moving things forward.”

He urged community members to remain “chill” and not overanalyze the decision to exclude BNB from the Crypto Strategic Reserve. CZ says Trump’s announcement that “other valuable cryptocurrencies” will be hints at future inclusion but the statement only namechecks BTC and ETH.

The Binance founder adds that other countries will roll out their Crypto Strategic Reserves in the coming months, hinting that their establishment will include BNB.

“More valuable crypto are likely to be added over time,” said CZ, citing Trump’s statement. “More countries will follow.”

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

CryptoQuant CEO Explains How Trump Made Crypto a Weapon for US Dominance

CryptoQuant CEO Ki Young Ju has stated that the crypto market is increasingly being shaped into a tool for U.S. dominance under President Donald Trump. His remarks follow Trump’s recent announcement regarding the establishment of a U.S. crypto reserve, which triggered major market movements.

The initiative led to a $300 billion boost in total crypto market value, with Bitcoin rising by 8% and Ethereum gaining 11%.

CryptoQuant CEO Explains How Trump is Weaponizing Crypto

In a recent post, CryptoQuant CEO Ki Young Ju analyzed President Donald Trump’s approach to cryptocurrency. According to Ju, Trump’s decision to establish a U.S. crypto reserve marks a shift in the global crypto landscape. Ju noted that the announcement initially mentioned XRP, Solana, and Cardano, while Bitcoin and Ethereum were only included later.

Ju interpreted Trump’s actions as a move to assess the strategic value of different cryptocurrencies. He suggested that the initial exclusion of Bitcoin and Ethereum might indicate that Trump sees them as neutral assets rather than direct contributors to U.S. interests. Ju further stated that Trump’s strategy is positioning the U.S. to dominate the crypto market and absorb foreign capital.

Meanwhile, Binance founder reacted to BNB’s exclusion from the U.S. Crypto Strategic Reserve by urging holders to remain patient and not panic. CZ emphasized that BNB’s absence is likely due to the U.S. prioritizing domestically founded cryptocurrencies in the initial selection. He remains optimistic that BNB will be added in the future and pointed out that other nations may introduce their crypto strategic reserves.

Market Reaction to Crypto Reserve Announcement

Following Trump’s announcement, the crypto market experienced a rapid surge. The total market capitalization increased by $300 billion, driven by price jumps in multiple assets. Bitcoin saw an 8% increase, climbing past $93,000 before slightly dropping, while Ethereum rose by 11%.

Among the tokens first included in the U.S. crypto reserve, Cardano saw the highest surge, gaining up to 75%, while Solana and XRP also experienced double-digit growth. The sudden price movements reflected strong investor confidence in the crypto assets.

Following the CryptoQuant CEO insights, a recent report has highlighted other cryptos that could potentially be included in Trump’s Crypto Reserve. Dogecoin, SUI, and Chainlink have gained significant momentum, sparking speculation about their addition.

Concerns Over Bitcoin and Ethereum Position

While CryptoQuant CEO Ki Young Ju acknowledged the market benefits of Trump’s crypto policies, he also pointed out potential challenges for Bitcoin and Ethereum. He suggested that Trump’s focus on specific cryptocurrencies tied to U.S. interests could weaken the position of decentralized assets.

Ju emphasized that Bitcoin and Ethereum have historically been viewed as tools for decentralization rather than instruments of national influence. He noted that Trump’s statements positioned these two assets as neutral.

CryptoQuant CEO stated

“This trend is also unfavorable for #Bitcoin and #Ethereum, which strive for neutrality and aim to become global public goods. Judging by Trump’s recent posts, it seems that Bitcoin and Ethereum are now being signaled as “neither friend nor foe.”

The Shift in Crypto’s Perception Under New Administartion

According to CryptoQuant CEO Ki Young Ju, the perception of cryptocurrency has changed under Donald Trump’s administration. Ju noted that crypto, once regarded with skepticism, is now being embraced as a national asset.

While he did not pass judgment on this approach, he observed that the U.S. is using cryptocurrency as a tool to expand its global financial influence.

Moreover, Ki Young Ju expressed worries that this shift in regulatory standards could lead to market manipulation. He emphasized that the lack of oversight might encourage fraudulent activities like rug pulls, harming retail investors.

The CEO added,

“Since Trump’s election, universal moral standards have declined.”

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

MicroStrategy Failed To Purchase Bitcoin Last Week, Still Holds 499,096 BTC

MicroStrategy, now known as Strategy, failed to make any Bitcoin purchases. The company didn’t also sell any shares, a move that usually precedes its BTC purchases. As a result, the software company still holds 499,096 BTC, with the 500k BTC milestone yet to be hit.

MicroStrategy Did Not Make Any Bitcoin Purchase Last Week

In an SEC filing, MicroStrategy revealed that it made no Bitcoin purchases between February 24 and March 2 last week. The company also revealed that it did not sell any shares of class A common stock under its at-the-market equity offering program.

It is worth mentioning that Strategy acquired 20,356 BTC for $1.99B at $97,514 per BTC two weeks ago. This came following a $2B zero-coupon convertible notes offering, in which it was able to raise the funds for this BTC purchase.

Meanwhile, following its failure to buy any Bitcoin last week, MicroStrategy still holds 499,096 BTC, which it acquired for $33.1 billion at an average price of $66,357 per BTC. Strategy remains the public company with the largest Bitcoin holdings, well ahead of MARA holdings, which is second on the list.

The company’s failure to buy any BTC last week is also notable considering that the Bitcoin price dropped below $80,000 last week following a major crypto crash. As such, the company didn’t take advantage of a major dip which could have lowered its average cost price.

MSTR Stock Recovers

MicroStrategy’s stock has crashed last week following the Bitcoin price decline, as both assets share a positive correlation. The MSTR stock price has now recovered following BTC’s rebound above $90,000 over the weekend.

Nasdaq data shows that the stock price is up over 14% in premarket, trading at around $292. MSTR closed last week at around $255 following the Bitcoin price crash. However, following last week’s crash, MSTR now boasts a year-to-date (YTD) loss of over 11%.

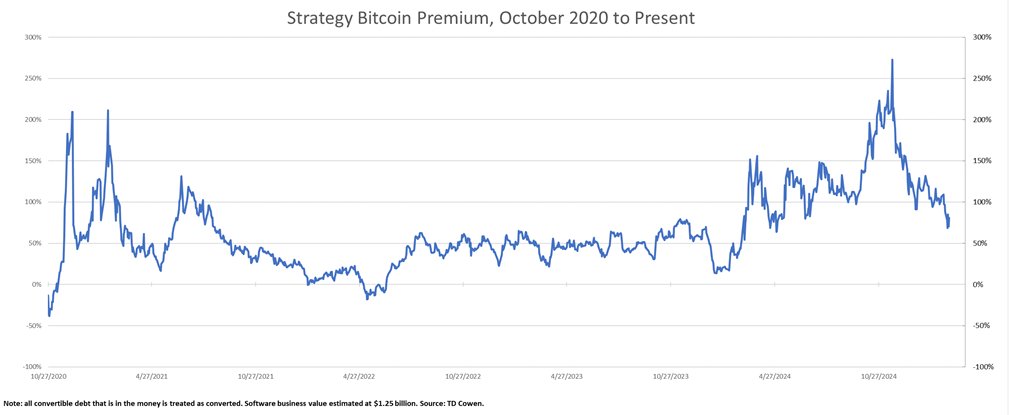

VanECK’s chief also revealed that MicroStrategy’s Bitcoin premium has dropped back to April 2024, which may be something for market participants to keep an eye on.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

XRP Defies Market Trend; Outpaces BTC & ETH Amid Crypto Blood Bath

As digital asset investment products saw a third consecutive week of outflows, Ripple’s XRP bucked the trend with substantial inflows. Major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) experienced significant outflows, leading the market’s negative sentiment.

Several events have likely contributed to these outflows, including the Bybit hack, the Federal Reserve’s hawkish stance, and the crypto market crash.

XRP Overpowers BTC & ETH in Weekly Inflows

CoinShares’ weekly report revealed a record-breaking outflow of $2.9 billion from digital asset investment products, marking the largest weekly withdrawal. This outflow extends a three-week streak, with total withdrawals reaching $3.8 billion over this period.

While major players like Bitcoin (BTC) and Ethereum (ETH) exhibited notable outflows, XRP defied the trend with a significant inflow of $5 million. Bitcoin was hit the hardest by the market’s bearish sentiment, experiencing a substantial outflow of $2.59 billion last week.

Following was Ethereum, with a negative flow of $300 million. Other assets like Solana and Ton also experienced outflows of $7.4 million and $22.6 million, respectively.

Are ETFs Driving the Positive Sentiment?

In stark contrast to the major crypto market trend, XRP gained $5 million in inflows over the past week. The positive trend was led by Sui, with a significant inflow of $15.5 million.

Meanwhile, the US was the country with the largest outflows, followed by Switzerland, Canada, and Sweden. The US saw a total outflow of $2,874 million, whereas Switzerland, Canada, and Sweden exhibited $73.1 million, $16.9 million, and $14.5 million outflows, respectively.

XRP’s notable performance has significantly gained attention. Possibly, the token’s positive sentiment is largely driven by the SEC’s optimistic approach to XRP ETFs. Over the past few weeks, the US SEC has acknowledged XRP ETF applications submitted by multiple asset managers. In the latest development, President Donald Trump announced his decision to include XRP in the national reserve.

However, top crypto assets like BTC and ETH were hit by the recent incidents like Bybit hack and the Fed’s hint at maintaining the current interest rates.

Donald Trump’s Crypto Reserve Sparks Bitcoin vs XRP Debate

Though Donald Trump is adopting BTC, XRP, SOL, and ADA to the national reserve, this has sparked a debate between Bitcoin enthusiasts and XRP Army. While Bitcoin aspirants celebrate the BTC reserve update, they question the addition of XRP. For instance, Bitwise CEO Hunter Horsely, stated, “Many crypto assets have merits, but what we’re talking about here isn’t a US investment portfolio — we’re talking about a reserve, and BTC is the undisputed store of value for the digital age.”

Meanwhile, Cardano Founder Charles Hoskinson backed XRP claiming that it is “great technology, global standard, survived for a decade through many harsh cycles, and has one of the strongest communities.”

Bearish Crypto Market Turns Green

Notably, the crypto market was experiencing severe downturns over the past week, with Bitcoin trading around a low of $85k. This bearish market sentiment has significantly contributed to the outflows exhibited last week.

However, the market has rebounded today, especially driven by Donald Trump’s crypto reserve strategy. While Bitcoin has surged to $93,366, ETH and XRP reached $2,383 and $2.68, respectively. The overall market cap has increased to $3.06 trillion, up by more than 8%.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market23 hours ago

Market23 hours agoChina Exposes Major DeepSeek Crypto Scam

-

Altcoin22 hours ago

Altcoin22 hours agoRipple CEO Comments Following XRP’s Inclusion In Strategic Reserve

-

Market24 hours ago

Market24 hours agoXRP Skyrockets 30% After US Crypto Reserve Inclusion

-

Market22 hours ago

Market22 hours agoCardano (ADA) Rallies by 60% Following Crypto Reserve Inclusion

-

Regulation18 hours ago

Regulation18 hours agoCardano Founder Breaks Silence On White House Crypto Role Speculations

-

Market10 hours ago

Market10 hours agoWhy Traders Might Get It Wrong

-

Altcoin10 hours ago

Altcoin10 hours agoPepe Coin Whale Shifts Focus To This Crypto; Sells 262B PEPE

-

Altcoin16 hours ago

Altcoin16 hours agoLawyer Reveals Likely Reason For Delay In Settling Ripple SEC Case

✓ Share: