Altcoin

SOL, XRP, ADA Surge As Donald Trump Announces Strategic Reserve

While conversations for a Bitcoin Strategic Reserve have been swirling in crypto circles, US President Donald Trump has confirmed his administration’s intention to proceed with the offering. Rather than put all its eggs in one basket, Trump is eyeing a Crypto Strategic Reserve including altcoins XRP, SOL, and ADA.

President Trump has announced plans to launch a US Crypto Reserve that will include BTC, XRP, SOL, and ADA. The President has since directed the Presidential Working Group on Digital Assets Market to proceed with the establishment of a Crypto Strategic Reserve.

“A US Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA,” said Trump on X.

This is a developing story.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

MicroStrategy Failed To Purchase Bitcoin Last Week, Still Holds 499,096 BTC

MicroStrategy, now known as Strategy, failed to make any Bitcoin purchases. The company didn’t also sell any shares, a move that usually precedes its BTC purchases. As a result, the software company still holds 499,096 BTC, with the 500k BTC milestone yet to be hit.

MicroStrategy Did Not Make Any Bitcoin Purchase Last Week

In an SEC filing, MicroStrategy revealed that it made no Bitcoin purchases between February 24 and March 2 last week. The company also revealed that it did not sell any shares of class A common stock under its at-the-market equity offering program.

It is worth mentioning that Strategy acquired 20,356 BTC for $1.99B at $97,514 per BTC two weeks ago. This came following a $2B zero-coupon convertible notes offering, in which it was able to raise the funds for this BTC purchase.

Meanwhile, following its failure to buy any Bitcoin last week, MicroStrategy still holds 499,096 BTC, which it acquired for $33.1 billion at an average price of $66,357 per BTC. Strategy remains the public company with the largest Bitcoin holdings, well ahead of MARA holdings, which is second on the list.

The company’s failure to buy any BTC last week is also notable considering that the Bitcoin price dropped below $80,000 last week following a major crypto crash. As such, the company didn’t take advantage of a major dip which could have lowered its average cost price.

MSTR Stock Recovers

MicroStrategy’s stock has crashed last week following the Bitcoin price decline, as both assets share a positive correlation. The MSTR stock price has now recovered following BTC’s rebound above $90,000 over the weekend.

Nasdaq data shows that the stock price is up over 14% in premarket, trading at around $292. MSTR closed last week at around $255 following the Bitcoin price crash. However, following last week’s crash, MSTR now boasts a year-to-date (YTD) loss of over 11%.

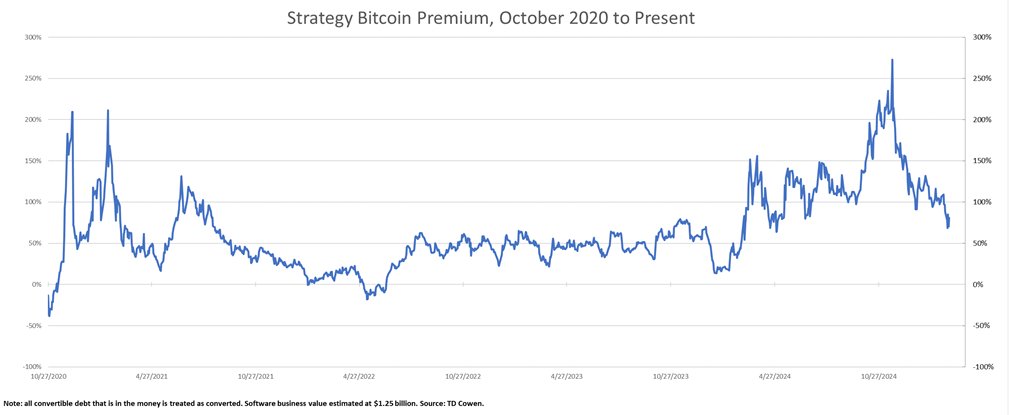

VanECK’s chief also revealed that MicroStrategy’s Bitcoin premium has dropped back to April 2024, which may be something for market participants to keep an eye on.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

XRP Defies Market Trend; Outpaces BTC & ETH Amid Crypto Blood Bath

As digital asset investment products saw a third consecutive week of outflows, Ripple’s XRP bucked the trend with substantial inflows. Major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) experienced significant outflows, leading the market’s negative sentiment.

Several events have likely contributed to these outflows, including the Bybit hack, the Federal Reserve’s hawkish stance, and the crypto market crash.

XRP Overpowers BTC & ETH in Weekly Inflows

CoinShares’ weekly report revealed a record-breaking outflow of $2.9 billion from digital asset investment products, marking the largest weekly withdrawal. This outflow extends a three-week streak, with total withdrawals reaching $3.8 billion over this period.

While major players like Bitcoin (BTC) and Ethereum (ETH) exhibited notable outflows, XRP defied the trend with a significant inflow of $5 million. Bitcoin was hit the hardest by the market’s bearish sentiment, experiencing a substantial outflow of $2.59 billion last week.

Following was Ethereum, with a negative flow of $300 million. Other assets like Solana and Ton also experienced outflows of $7.4 million and $22.6 million, respectively.

Are ETFs Driving the Positive Sentiment?

In stark contrast to the major crypto market trend, XRP gained $5 million in inflows over the past week. The positive trend was led by Sui, with a significant inflow of $15.5 million.

Meanwhile, the US was the country with the largest outflows, followed by Switzerland, Canada, and Sweden. The US saw a total outflow of $2,874 million, whereas Switzerland, Canada, and Sweden exhibited $73.1 million, $16.9 million, and $14.5 million outflows, respectively.

XRP’s notable performance has significantly gained attention. Possibly, the token’s positive sentiment is largely driven by the SEC’s optimistic approach to XRP ETFs. Over the past few weeks, the US SEC has acknowledged XRP ETF applications submitted by multiple asset managers. In the latest development, President Donald Trump announced his decision to include XRP in the national reserve.

However, top crypto assets like BTC and ETH were hit by the recent incidents like Bybit hack and the Fed’s hint at maintaining the current interest rates.

Donald Trump’s Crypto Reserve Sparks Bitcoin vs XRP Debate

Though Donald Trump is adopting BTC, XRP, SOL, and ADA to the national reserve, this has sparked a debate between Bitcoin enthusiasts and XRP Army. While Bitcoin aspirants celebrate the BTC reserve update, they question the addition of XRP. For instance, Bitwise CEO Hunter Horsely, stated, “Many crypto assets have merits, but what we’re talking about here isn’t a US investment portfolio — we’re talking about a reserve, and BTC is the undisputed store of value for the digital age.”

Meanwhile, Cardano Founder Charles Hoskinson backed XRP claiming that it is “great technology, global standard, survived for a decade through many harsh cycles, and has one of the strongest communities.”

Bearish Crypto Market Turns Green

Notably, the crypto market was experiencing severe downturns over the past week, with Bitcoin trading around a low of $85k. This bearish market sentiment has significantly contributed to the outflows exhibited last week.

However, the market has rebounded today, especially driven by Donald Trump’s crypto reserve strategy. While Bitcoin has surged to $93,366, ETH and XRP reached $2,383 and $2.68, respectively. The overall market cap has increased to $3.06 trillion, up by more than 8%.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Will Donald Trump Announcement Speed Up Ripple Vs SEC Resolution?

President Donald Trump’s move to add XRP to the US crypto reserve has fueled hopes for a swift resolution to the Ripple vs SEC case. However, legal expert Jeremy Hogan remains skeptical, believing the XRP lawsuit could still take until May to conclude.

Notably, Hogan has been vocal about the possible delays in XRP lawsuit, dismissing speculations of an imminent settlement. Let’s break down Jeremy Hogan’s recent statement and how Donald Trump’s decision could impact the Ripple vs SEC lawsuit.

How Will Donald Trump’s XRP Reserve Plan Influence the Lawsuit?

As Donald Trump has decided to include XRP to the US national reserve along with Bitcoin, Solana, and Cardano, the community is abuzz with enthusiasm. This has indeed fueled excitement over the imminent resolution of the long-anticipated XRP lawsuit. Despite growing optimism for an early dismissal, attorney Jeremy Hogan remains steadfast in his prediction that the Ripple vs SEC case will likely extend into May before reaching a conclusion.

Significantly, Jeremy Hogan shared his latest prediction via his X post. He stated that he expects the appeals to be dismissed by mid-April, with the entire case wrapping up by May. Meanwhile, an XRP community member asked the lawyer if XRP’s inclusion in the US crypto reserve could expedite the settlement. He responded skeptically, saying “I don’t think so…” However, he acknowledged the inherent uncertainty in estimating timelines, implying that his prediction is subject to change.

Is XRP Lawsuit Settlement Poised for Further Extension?

Hopes for a quick XRP lawsuit resolution continue to build. Nonetheless, experts like Jeremy Hogan and MetaLawMan have repeatedly cautioned that the case may face additional delays. Both of them pinpointed the complexities surrounding the Ripple lawsuit which could possibly lead to the case’s further extension.

According to Hogan’s recent comments, the delay is primarily linked to the injunction imposed by Judge Analisa Torres. This injunction restricts Ripple from selling securities to the public, effectively limiting its ability to pursue a future Initial Public Offering (IPO). Hogan says Ripple Labs is trying to get the injunction lifted, which is holding up the case’s resolution.

XRP Price Skyrockets Fueled by Trump’s Reserve Plans

In an interesting development, Donald Trump has revealed his plans to establish a crypto reserve in the country, including Bitcoin, XRP, Solana, and Cardano. Though the development reportedly has no significant impact on the XRP lawsuit, it has had a massive influence on the overall crypto market. The market exhibited a significant resurgence with the market cap surging to $3 trillion, up by more than 5%.

Aligning with the broader trend, XRP price saw a remarkable uptick of 14.12% over the last 24 hours. Currently trading at $2.57, XRP has surged by 4.37% over the last week despite a monthly decline of 14%. Investor sentiment has also risen following the Trump decision which is indicated by the staggering 514% hike in the 24-hour trading volume, currently at $20.44 billion.

Despite the token’s notable performance, the XRP lawsuit’s imminent dismissal hangs in balance. It needs to be seen if the case will end by May or even extend further.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market24 hours ago

Market24 hours agoPi Network Users Receive Legal Warning From Vietnam Police

-

Ethereum23 hours ago

Ethereum23 hours agoIf Ethereum Holds $2,200 Price Could Recover Fast – Analyst Sets Price Target

-

Market23 hours ago

Market23 hours agoTrump Announces US Crypto Reserve with XRP, SOL, and ADA

-

Market22 hours ago

Market22 hours agoXRP Skyrockets 30% After US Crypto Reserve Inclusion

-

Market21 hours ago

Market21 hours agoChina Exposes Major DeepSeek Crypto Scam

-

Altcoin20 hours ago

Altcoin20 hours agoRipple CEO Comments Following XRP’s Inclusion In Strategic Reserve

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Founder Reacts As Trump Fails To Name BNB In Strategic Reserve

-

Regulation16 hours ago

Regulation16 hours agoCardano Founder Breaks Silence On White House Crypto Role Speculations

✓ Share: