Market

Onyxcoin Price Stalls Despite Whales Buying 368 Million XCN

Onyxcoin (XCN) has been struggling to break its downtrend for over a month despite a notable surge in whale activity.

While whales have been accumulating XCN in large quantities, the lack of broader bullish market cues has prevented a significant price reversal. The altcoin continues to face downward pressure.

Onyxcoin Whales Take Charge

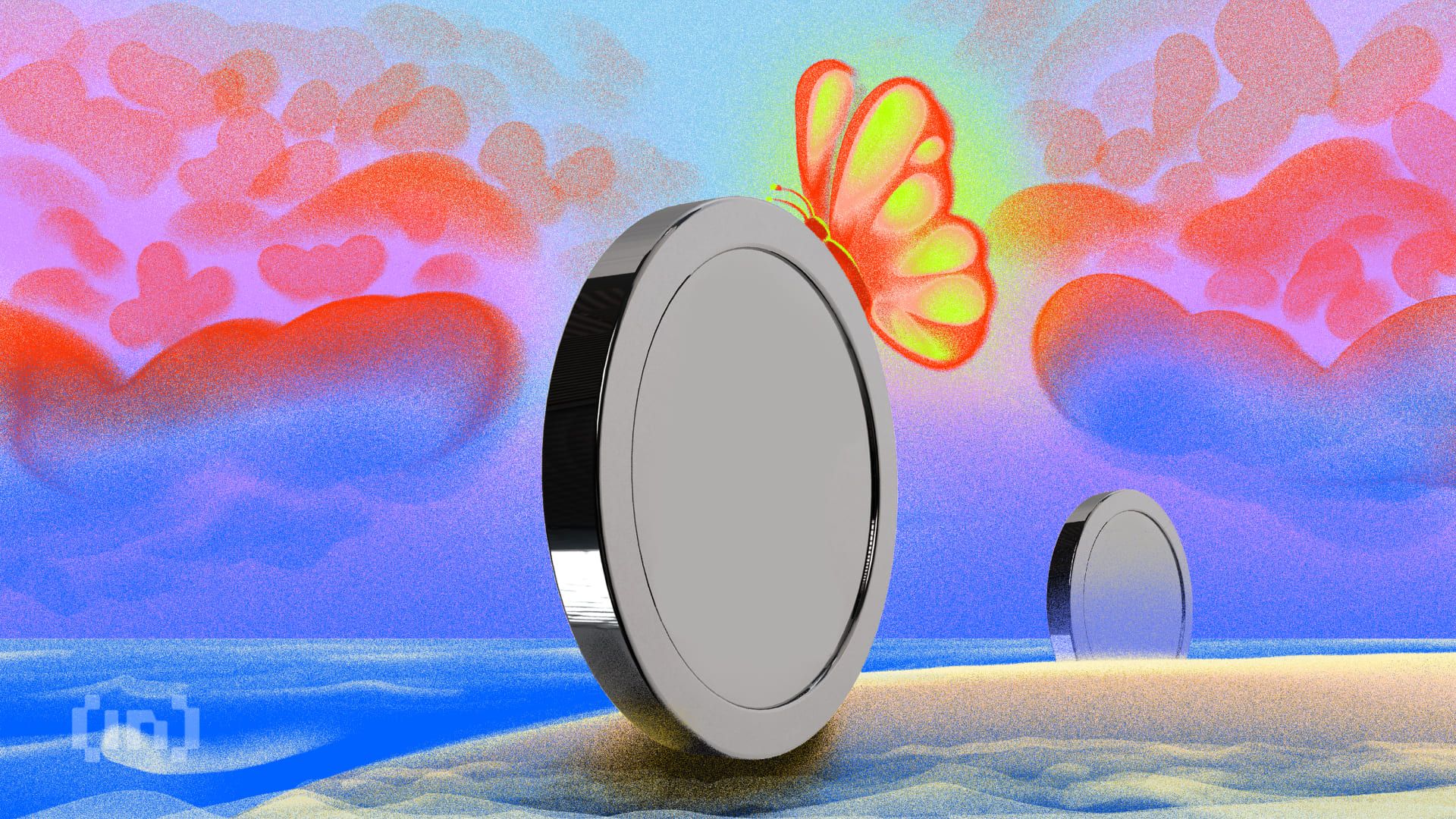

Whale investors holding between 10 million and 100 million XCN have been actively accumulating the token. Over the past three days, these investors have purchased over 368 million XCN, valued at $5.6 million. This shows that whale investors are confident in Onyxcoin’s eventual price recovery, accumulating at lower prices to capitalize on future gains.

The large-scale purchases demonstrate investor optimism, even as the broader market remains relatively bearish. The whales’ actions suggest that they believe the altcoin’s price will rise once the market sentiment shifts, but for now, the general investor sentiment appears mixed.

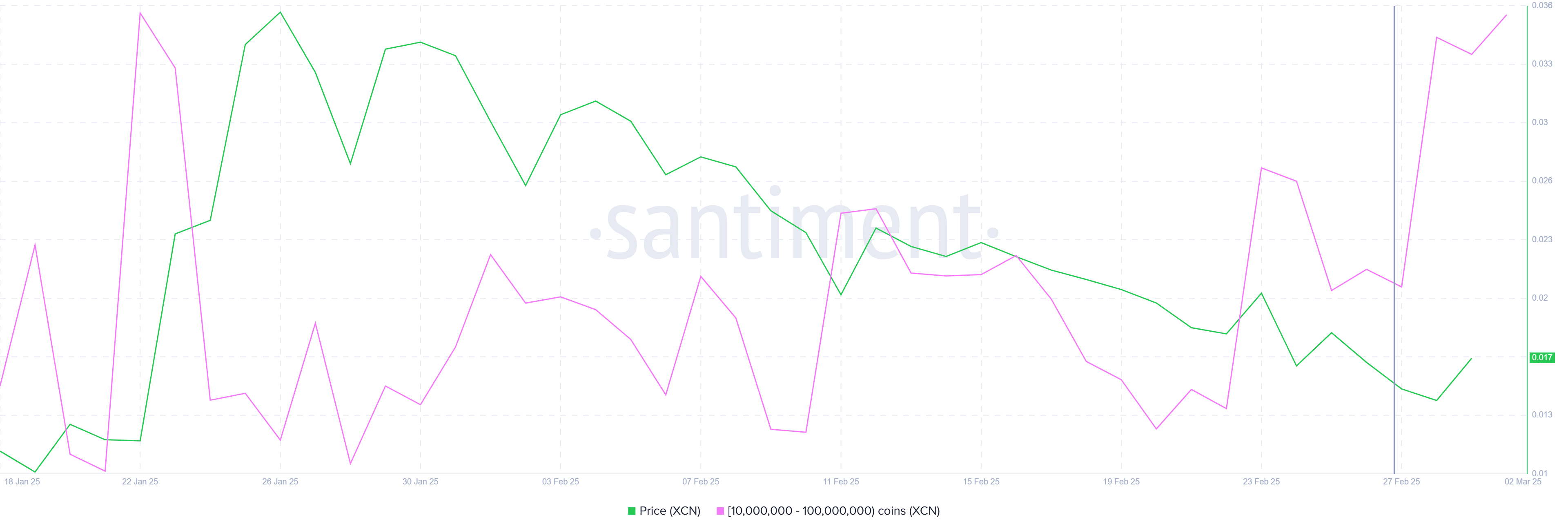

Onyxcoin’s network growth, an indicator of new addresses and transactions, is currently at a six-week low. This suggests a decline in new users and investors, pointing to Onyxcoin losing traction in the broader crypto market.

The current lack of network activity is a concern, as it signals that new entrants are not interested in purchasing or using the token at present.

The stagnation in network growth implies that while whales remain confident in XCN’s future, the altcoin is struggling to attract fresh retail investors. Without an influx of new investors, Onyxcoin faces challenges in sustaining momentum and reversing the downtrend.

XCN Price Needs A Push

At the time of writing, Onyxcoin’s price stands at $0.0152, with the altcoin stuck below its trend line for the past month. Despite multiple attempts to break out of this downtrend, XCN has yet to succeed. The resistance at $0.0150 continues to hold firm, creating a barrier to any significant price gains.

The recent whale activity could be a key factor in determining whether Onyxcoin can reverse its current trend. A successful breach of the trend line, particularly if $0.0182 is flipped into support, could push the altcoin towards $0.0237. If investor confidence strengthened, this would mark a strong recovery.

However, if new investor sentiment remains weak and retail interest continues to decline, the altcoin could fall through the support of $0.0150. This would push XCN towards $0.0127, invalidating the bullish outlook.

The future of Onyxcoin depends heavily on whether it can attract broader market support and capital.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cronos Eyes 70 Billion CRO Token Burn Reversal

Cronos, the EVM-compatible blockchain developed by Crypto.com, has proposed reissuing 70 billion previously burned CRO tokens.

Announced on March 3, 2025, the initiative seeks to restore the total supply of CRO to its original 100 billion. This would effectively reverse a significant token burn conducted in February 2021.

Cronos Calls for Token Burn Reversal

The reissued tokens will be allocated to a Cronos Strategic Reserve escrow wallet. The move is designed to support Cronos’ and Crypto.com’s long-term roadmap.

“Making America the World Capital of Crypto will ensure the successful execution of the Cronos roadmap, hence we are proposing that the community vote on the creation of a Cronos Strategic reverse, a reversal of the February 2021 token burn, to support this ambition,” the blog read.

Cronos’ leadership frames this as a pivotal step toward a “new golden age” for the blockchain. The restored token supply is intended to bolster liquidity and provide a financial buffer for ecosystem growth.

A core focus of this strategy is institutional adoption. The roadmap aims to position CRO among the top 10 blockchain protocols, with plans to develop a CRO exchange-traded fund (ETF) to offer regulated exposure to institutional investors. Additionally, the project is working toward US regulatory approval to integrate the ETF into institutional liquidity pools.

Beyond the ETF, the Cronos Strategic Reserve will support broader initiatives. These include traditional finance (TradFi) crossover projects, primarily by seeding the CRO ETF. It will also fund artificial intelligence (AI)-related initiatives, such as grants, developer tools, and funding for decentralized applications (dApps).

The reserve will operate under strict controls. Tokens will vest linearly over 10 years, approximately every 30.4 days, through the Cosmos SDK vesting account on the Cronos POS chain. This ensures a gradual release that aims to balance supply dynamics while funding strategic initiatives.

However, the move has raised eyebrows among the community.

“Did Cronos just become the Federal Reserve? Printing CRO out of thin air? A burn is a burn. Burnt tokens shouldn’t be brought back to life,” said one user on X.

Some investors worry that this might put downward pressure on CRO’s price.

“How in the world would this be healthy for CRO price action?” wrote another user.

Despite the concerns about potential dilution, CRO has shown strong price performance, rallying by double digits.

At press time, CRO was trading at $0.09. This marked a 15.5% increase over the past day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

AGNT, Sedracoin, and Lens Protocol

The crypto market attempts a recovery, with Bitcoin (BTC) pushing to hold above the $90,000 psychological level. Amidst the broader market’s bump in optimism, investors are eyeing airdrops as a potentially lucrative avenue in March.

Airdrops aim to distribute free tokens while attracting new followers and expanding user bases. This week, there are three significant airdrops to watch.

AGNT Hub

AGNT Hub, a decentralized platform combining artificial intelligence and blockchain tech, is one of the confirmed airdrops this week. The project announced an airdrop of 30 million AGNT tokens, which will serve as a launchpad for AI-powered agents and enable them to operate in various environments.

“iAgent has reserved 30 million AGNT for its airdrop,” airdrops farmer Ben’s crypto shared on X.

This airdrop will reward early adopters and community members participating in the platform’s activities and accumulating experience points (XP). Specifically, the airdrop campaign’s points-based system allows participants to earn XP through various activities, including daily check-ins, social media engagement, NFT (non-fungible token) mints, and platform interactions.

“The more XP accumulated, the higher the potential airdrop allocation. Unique NFTs tied to your achievements may unlock additional benefits in future token distributions. Participation is free, requiring only a wallet connection and completion of designated tasks,” aidrops.io indicated, citing AGNT Hub.

Reportedly, AGNT Hub has also secured approximately $5.2 million in funding. Key backers include PGgroup and a team of experienced engineers with over 10 years of blockchain and AI expertise. Notably, the AGNT Hub crypto airdrop will coincide with AGNT Hub’s token generation event (TGE)

Sedracoin

Another crypto airdrop to watch this week is Sedracoin, which brings forth the Sedra ecosystem. The platform meets users where nature, spirituality, and technology intersect, delivering what is advertised as “a harmonious digital environment.”

Its powering token, SDR, is the ecosystem’s primary medium of exchange. It enables transactions, staking opportunities, and various reward mechanisms across the entire ecosystem.

The Sedracoin airdrop is also confirmed. It runs on Zealy to distribute SDR tokens to early community members and supporters.

It uses a task-based system requiring participants to complete various social activities to earn XP (experience points). Ultimately, these points will determine user eligibility and potential reward allocation for the airdrop.

“Join the Sedra Airdrop Event! Earn SDR tokens & exclusive CTAs by completing Zealy quests! The more XP you farm, the bigger your rewards,” Sedracoin articulated.

The campaign also prioritizes community engagement and awareness building, meaning participants must complete social media tasks across different platforms.

Lens Protocol

Also on the list is Lens Protocol, whose airdrop comes after raising $46 million and is backed by Balaji Srinivasan, former Coinbase exchange CTO. Other backers include Delphi Ventures and USD Coin (USDC) stablecoin issuer Circle.

While it is still in potential airdrop status, the project has a significant Social media following. Interest comes from ecosystem activity, funding rounds, and hints from the team.

“The Lens Protocol Testnet is now live, and you can officially mint your Reputation Score,” NFT builder Den Da shared in a post.

Recent developments suggest a points-based system or retroactive rewards for early users might trigger an airdrop. Eligibility is likely tied to owning a Lens Profile NFT and engaging with the ecosystem, including Lenster, Lenstube, and Hey. Recent testnet activity on Lens Chain (a zkSync-based Layer 2) may also factor in.

Further, according to speculative estimates on X, between $1,000 and over $10,000 in LENS tokens could be airdropped. Notably, these assumptions follow past airdrops like Aptos or Blur. However, this hinges on token launch and market conditions, as no official figures exist.

Meanwhile, participation is largely free beyond minimal gas fees. However, if not claimed earlier, acquiring a Lens Profile NFT costs around 0.1 ETH (approximately $250-$300) on the OpenSea marketplace.

For investors and crypto enthusiasts, these airdrops offer the chance to acquire new tokens and join the active crypto communities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why David Sacks Sold His Crypto Holdings Before Taking on the “Crypto Czar” Role

David Sacks, appointed by President Donald Trump as the “Crypto Czar” in late 2024, recently announced that he has sold his entire cryptocurrency portfolio.

Here’s how experts and the crypto community are reacting to this unexpected move.

3 Reasons Why David Sacks Sold His Entire Crypto Portfolio

In a recent tweet on X (formerly Twitter), the Trump administration’s “Crypto Czar” confirmed that he sold all of his personal crypto assets ahead of the administration’s official start in January 2025. Specifically, David Sacks’ cryptocurrency portfolio included Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

David Sacks’ decision to withdraw from the market is seen as a personal choice. The community had given significant attention to his appointment, expecting him to promote crypto-friendly policies, facilitate the establishment of a national Bitcoin reserve for the US government, and balance investor protection with industry growth.

However, his decision to sell all crypto holdings can be understood through the following three reasons.

The first reason could be avoiding conflicts of interest. By not owning any cryptocurrencies, Sacks ensures there are no conflicts between his personal interests and those of the US government.

Secondly, the move signals neutrality. As the leader of US cryptocurrency-related policies, David Sacks needs to maintain transparency and objectivity. Owning any crypto could raise suspicions of bias whenever he makes decisions impacting the market.

The third reason could be compliance with ethics regulations. Senior US government officials are often required to disclose their assets. In some cases, officials need to divest from sectors directly related to their duties. For Sacks, relinquishing his crypto holdings is a logical step to meet federal ethics standards.

Some X users also suggested that David Sacks still holds a large amount of crypto indirectly through his status as an investor in Bitwise Asset Management.

However, Sacks has responded to this issue, claiming that it is not true.

“This community note is a lie. I had a $74k position in the Bitwise ETF which I sold on January 22. I do not have “large indirect holdings.” I’ll provide an update at the end of the ethics process,” Sacks posted on X.

In summary, David Sacks’ sale of his entire crypto portfolio does not definitively signal a rejection of the industry. It could just be “normal administrative procedure” and does not reflect his negative views on Crypto.

Nevertheless, due to investors’ sensitive psychology, Bitcoin and some altcoin prices have shown noticeable volatility.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoPi Network Users Receive Legal Warning From Vietnam Police

-

Ethereum23 hours ago

Ethereum23 hours agoIf Ethereum Holds $2,200 Price Could Recover Fast – Analyst Sets Price Target

-

Market23 hours ago

Market23 hours agoTrump Announces US Crypto Reserve with XRP, SOL, and ADA

-

Altcoin23 hours ago

Altcoin23 hours agoSOL, XRP, ADA Surge As Donald Trump Announces Strategic Reserve

-

Altcoin20 hours ago

Altcoin20 hours agoRipple CEO Comments Following XRP’s Inclusion In Strategic Reserve

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Founder Reacts As Trump Fails To Name BNB In Strategic Reserve

-

Regulation16 hours ago

Regulation16 hours agoCardano Founder Breaks Silence On White House Crypto Role Speculations

-

Altcoin13 hours ago

Altcoin13 hours agoLawyer Reveals Likely Reason For Delay In Settling Ripple SEC Case