Market

HEX Price Jumps 80% as Richard Heart Defeats SEC Lawsuit

A US federal court has dismissed the SEC’s lawsuit against Richard Heart, the founder of HEX, citing jurisdictional overreach.

Following the decision, tokens associated with Heart—HEX, PulseChain, and PulseX—have surged in value, with HEX leading the rally with a nearly 80% gain.

Judge Rules Against SEC in Richard Heart Case

On February 28, the US District Court for the Eastern District of New York ruled in favor of Richard Schueler, widely known as Richard Heart, dismissing the SEC’s lawsuit against him.

The agency had accused Heart of conducting an unregistered securities offering, alleging that he raised over $1 billion in cryptocurrency assets.

It also claimed that Heart and his blockchain project, PulseChain, misappropriated at least $12 million for luxury purchases, including high-end cars, watches, and a rare black diamond.

Heart resisted these claims, arguing that the SEC lacked jurisdiction over his activities. He maintained that the regulator failed to prove that his actions specifically targeted US investors or violated domestic securities laws.

US District Judge Carol Bagley Amon sided with Heart, stating that the SEC did not establish a sufficient legal basis for its case.

The judge also found that Heart’s marketing efforts were globally available and not specifically directed at US investors. The SEC had claimed Heart extensively promoted his projects through websites and social media.

However, the court determined that simply providing information online does not constitute sufficient grounds for jurisdiction.

“Heart did not directly message US-based investors or respond to questions through his websites. Rather, Heart disseminated ‘how to’ information, which alone is not sufficient. Accordingly, Heart’s website contacts simply provided globally available information and lack sufficient interactivity to constitute a significant contact,” Judge Amon wrote.

Additionally, the judge ruled that the SEC failed to demonstrate that Heart’s alleged misconduct, including misappropriation of funds and deceptive transactions, took place within the US.

“The alleged misappropriation occurred through digital wallets and crypto asset platforms, none of which were alleged to have any connection with the United States,” the Judge ruled.

Meanwhile, the ruling also determined that even if the SEC had proven jurisdiction, its complaint lacked substantial evidence of domestic securities law violations. As a result, the case was dismissed.

“Even if the SEC had established personal jurisdiction over Heart, the Complaint cannot stand because it fails to adequately plead that either the transactions or conduct at issue were domestic under the federal securities laws,” Judge Amon stated.

HEX and PulseChain Surge Following Legal Victory

Reacting to the court’s decision, Heart described the ruling as a rare victory for the cryptocurrency industry.

He emphasized that HEX, PulseChain, and PulseX should be allowed to operate freely, stating that HEX has functioned without issue for over five years.

“This type of victory over the SEC is quite rare. PulseChain, PulseX and HEX are not securities and should be allowed to flourish. HEX has operated flawlessly for over 5 years. Today’s decision in favor of a cryptocurrency founder and his projects over the SEC brings welcome relief and opportunity to all cryptocurrencies,” Heart stated.

Following the decision, the tokens linked to Heart experienced massive price gains.

According to CoinGecko data, HEX gained over 77% in the past 24 hours, trading at $0.003979. Meanwhile, PulseChain rose more than 65% to approximately $0.01575 at press time.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

KAITO Might Hit $3 If the Bitcoin Market Recovers

KAITO has recently experienced a slight drop from its all-time high (ATH) of $2.92, which it reached just two days ago. The altcoin is now attempting to reclaim that peak, but the broader market cues are exerting downward pressure.

KAITO’s recovery depends heavily on Bitcoin’s performance, with both coins showing an increasing correlation in price movements.

KAITO Needs Support

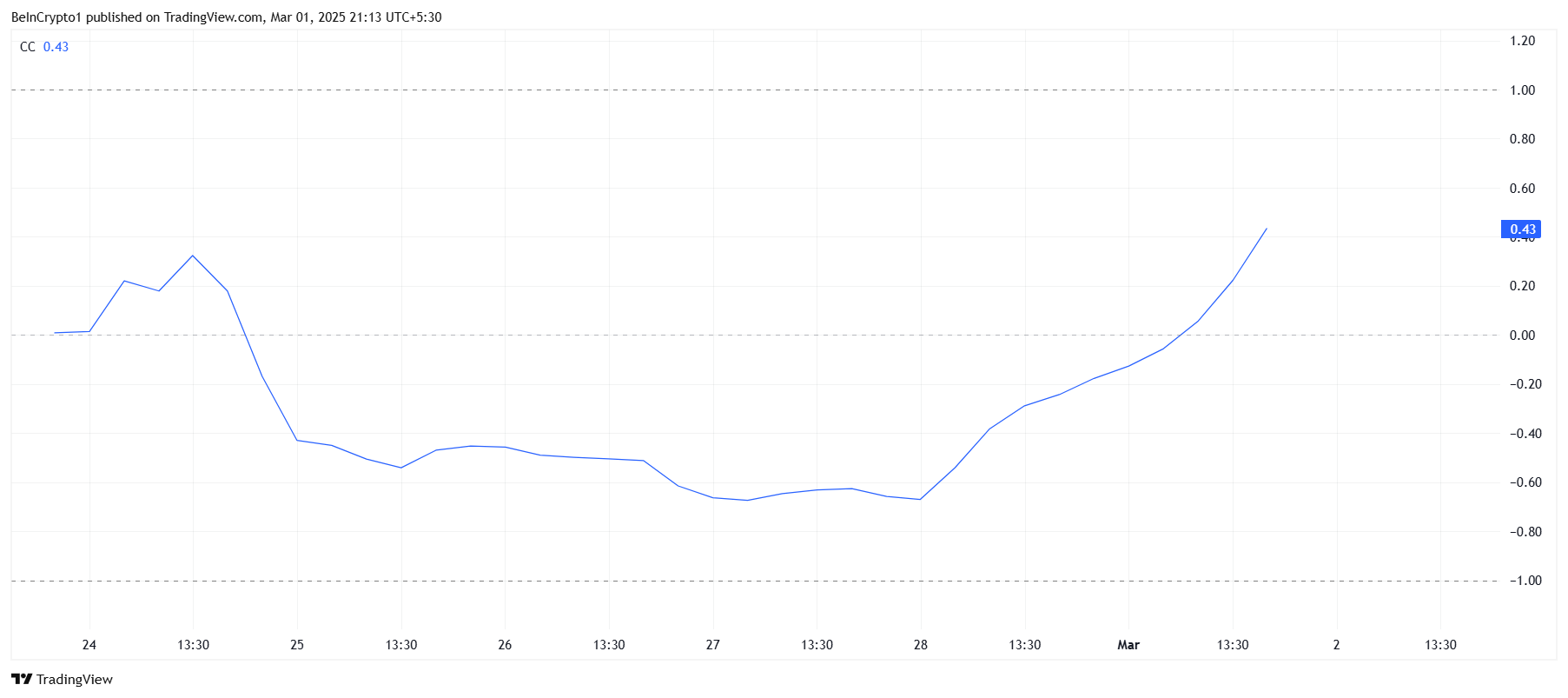

KAITO’s correlation with Bitcoin has been rising, suggesting that it closely follows Bitcoin’s market trends. This uptick in correlation indicates that KAITO’s price movement is becoming more aligned with BTC’s actions.

As Bitcoin recovers from its intra-day low of $78,250, reaching a trading price of $84,719, the broader market sentiment could shift. If Bitcoin continues its upward trajectory, KAITO’s price could follow suit, assuming the correlation strengthens further.

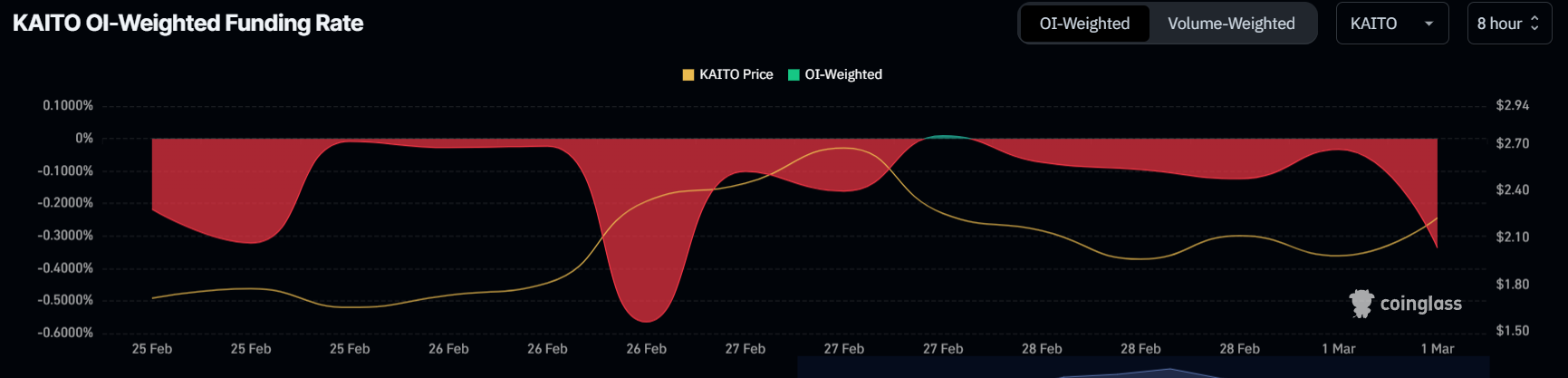

However, despite this potential for upward momentum, traders are still skeptical. The negative funding rate of KAITO, which has increased over the past 24 hours, reveals that many are betting against the altcoin.

Short contracts have dominated over long contracts, showing the traders’ reluctance to fully back KAITO’s recovery at this moment. The mixed signals from market sentiment point to a level of uncertainty that could stall KAITO’s price movement in the short term.

KAITO Price Attempts Recovery

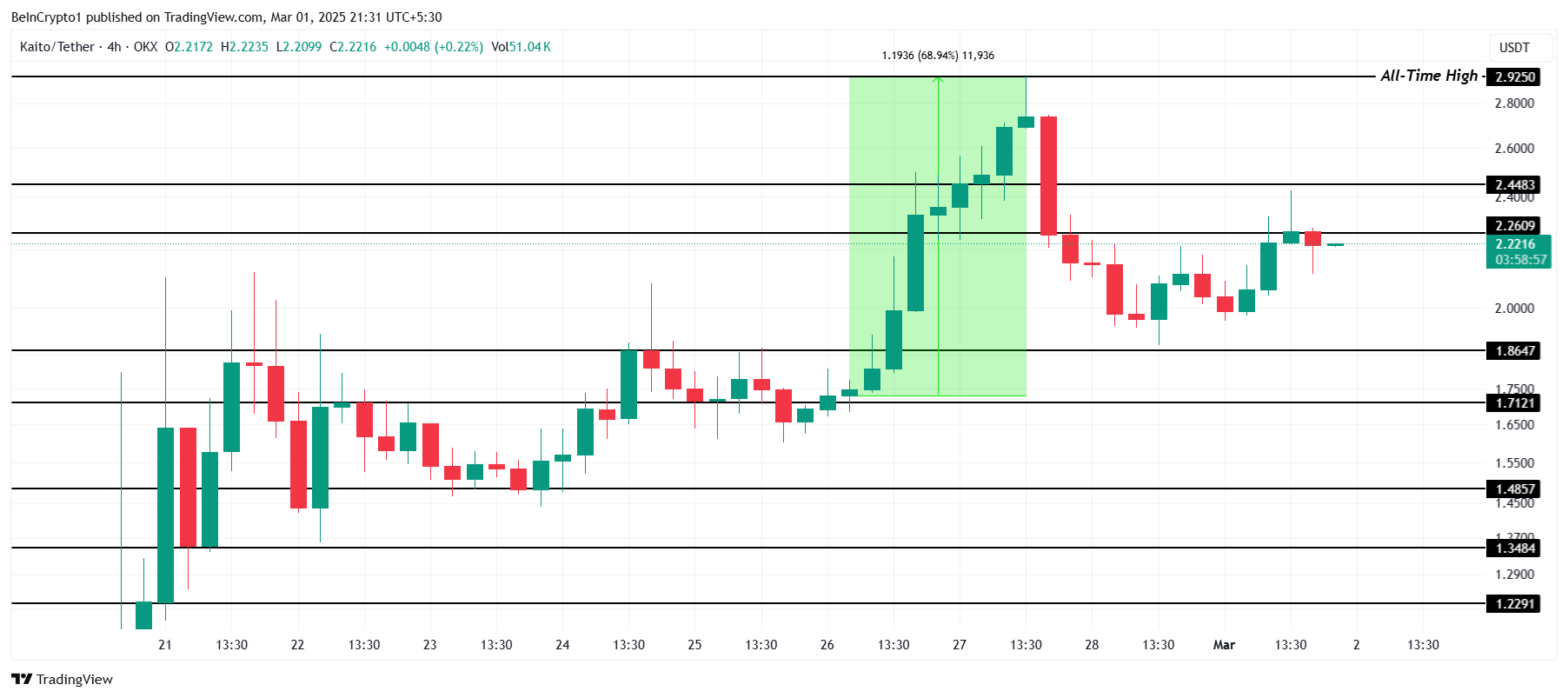

KAITO’s price is currently sitting at $2.22, just below the resistance level of $2.26. While the broader market conditions seem favorable for a potential recovery, traders’ sentiment remains cautious.

KAITO is attempting to breach this resistance, but if the negative funding rate continues, it may struggle to secure further gains.

Given the mixed signals, KAITO may continue to trade within a range between $1.86 and $2.44 in the near term. This consolidation suggests that the altcoin could remain trapped under $2.44, a critical resistance level.

A successful breach of $2.44 would indicate the possibility of a rally, with the potential for KAITO to break its ATH of $2.92 and reach above $3.00.

A failure to break the $2.44 resistance level could result in KAITO consolidating under this price point, with the altcoin remaining stuck within the same range. A breach of $1.86 would further invalidate the bullish outlook, signaling a possible continuation of the downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Vitalik Buterin Urges for ‘Bitcoin Jesus’ Roger Ver’s Pardon

Key figures in the crypto space, including Ethereum co-founder Vitalik Buterin, are advocating for former Bitcoin evangelist Roger Ver to receive a presidential pardon from Donald Trump.

Ver, often called “Bitcoin Jesus,” was arrested in February 2024 while attending a crypto conference in Barcelona, Spain. He faces charges in the US for allegedly evading over $48 million in taxes and filing a false tax return.

Industry Figures Question Legal Motives Behind Roger Ver’s Prosecution

Over the past months, Vitalik Buterin and other industry players have raised concerns about the severity of Ver’s prosecution.

Today, Buterin suggested that authorities may be targeting Ver because of his outspoken views on personal freedoms. He argued that the government should focus on recovering unpaid taxes rather than pursuing harsh legal action.

“The case against Roger seems very politically motivated; like with Ross Ulbricht, there have been plenty of people and corporations who have been accused of far worse and yet faced sentences far milder than what Roger is facing,” Buterin argued.

Considering this, the Ethereum co-founder proposed that the authorities should allow Ver to settle any outstanding taxes instead of imprisonment.

“Genuine good faith mistakes should be treated by giving the actor the opportunity to pay back taxes if needed with interest and penalties, not with prosecution,” Buterin concluded.

Similarly, Ross Ulbricht, the former Silk Road operator who recently secured clemency, has also backed Ver’s case.

“No one should spend the rest of their life in prison over taxes. Let him pay the tax (if any) and be done with it,” Ulbricht stated.

Ulbricht’s supporters had long argued that his own sentencing was excessively harsh, and now, many in the crypto space see parallels in Ver’s legal battle.

Jesse Powell, co-founder of Kraken, has questioned the credibility of the charges, suggesting that authorities are deliberately making Ver’s life difficult.

“The reality is, they just don’t like him and they want to get him, and they will use any excuse they can to get him or make his life hell for as long as they can,” Powell said.

Meanwhile, Ver himself has taken to social media, appealing directly to President Donald Trump. In January, he wrote that he needed the President’s help to deliver justice. He also shared a video describing himself as a victim of political persecution.

More recently, he suggested that his case was politically motivated, saying:

“I have always tried to pay what the law requires. This isn’t about taxes.”

Despite these efforts, predictions market odds on Polymarket show only a 7% chance that Trump will pardon Ver within his first 100 days in office.

This low probability may be partly due to Elon Musk’s stance on the matter. Now leading the Trump administration’s Department of Government Efficiency (DOGE), Musk has dismissed the possibility of a pardon.

The Tesla CEO argued that Ver forfeited his right to clemency by giving up his US citizenship.

“Roger Ver gave up his US citizenship. No pardon for Ver. Membership has its privileges,” Musk said.

Overall, most of the crypto community thinks Ver’s prosecution is extremely disproportionate to the alleged charges. Yet, Ver’s current residency in Spain might impact his plea to the US President.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

TRUMP Still Remains Bearish As US-Ukraine Tensions Rise

The TRUMP meme coin has been in a continuous downtrend for the past month, failing to break above the $21.45 barrier. The token fell below $12 earlier in the week but recovered after the political clash between US President Donald Trump and Ukrainian President Zelensky.

Despite being up by 8% today, technical indicators show persistent bearish pressure as the meme coin struggles to find a support level.

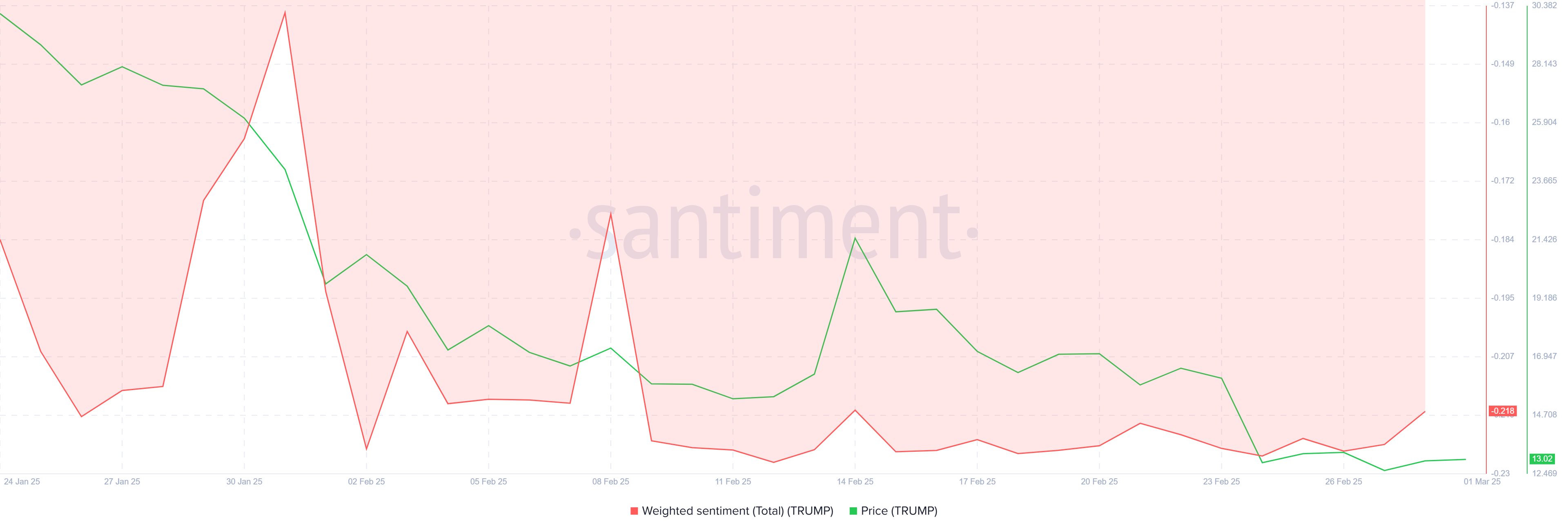

TRUMP Is Facing Bearish Pressure

The investor sentiment surrounding TRUMP has been largely negative in recent days. As the political showdown between Trump and Zelensky created significant buzz on social media, the meme coin saw some buying actions today, but the overall momentum remains notably low.

This reflects a lack of confidence in any immediate price recovery.

Negative sentiment surrounding political conditions is likely to discourage new investments, which will only deepen TRUMP’s ongoing price drawdown. This overall atmosphere suggests that further declines are possible unless significant changes occur.

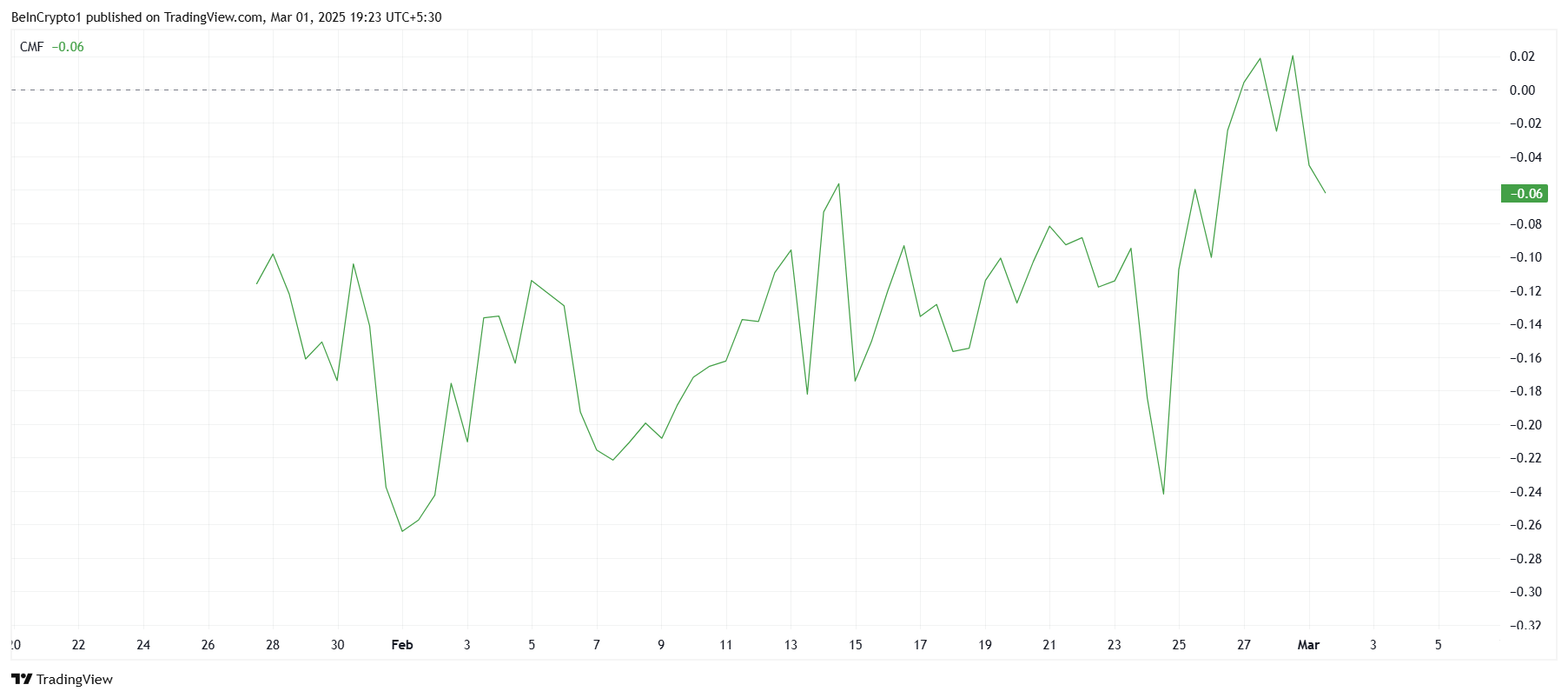

The technical indicators for TRUMP reflect the overall negative market sentiment. The Chaikin Money Flow (CMF) indicator, which tracks the accumulation and distribution of an asset, shows a clear downward trend.

The CMF has failed to secure the zero line as support, indicating that the inflows that once kept the altcoin afloat have turned into outflows.

This reflects weakening investor confidence, exacerbated by the ongoing political tension and the lack of bullish triggers for the asset. Without a shift in the broader market or sentiment, the downward pressure on TRUMP’s price is expected to continue.

TRUMP Price May Fall Further

TRUMP’s price has recently hit a new low of $11.07, marking a significant drop from its previous levels. At the time of writing, the altcoin has managed to recover slightly to $13.12, but it remains stuck below the critical resistance of $14.48.

This barrier has proven difficult to overcome, indicating that the altcoin could continue its struggle in the short term.

If the bearish momentum persists due to political factors like Trump’s tariff policies, TRUMP could slide even further. The next potential support level lies at $11.07, and if this fails, the altcoin could fall below $10.00, deepening losses for investors.

Given the current conditions, the price may continue its downtrend unless broader market cues shift.

Although the likelihood of breaking through the $14.48 resistance seems low, positive developments in the broader market could bring some relief. If this happens, TRUMP could attempt to flip the $16.00 level into support, but it would likely face consolidation below the key $21.45 barrier.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Hester Peirce Breaks Silence On Coinbase Lawsuit Dismissal

-

Market22 hours ago

Market22 hours agoWhales’ $600 Million XRP Accumulation To Drive Price Reversal

-

Market21 hours ago

Market21 hours agoPI Coin Rebound Possible After Drop – Could Recovery Be Near?

-

Market20 hours ago

Market20 hours agoBitcoin ETFs See a Record $2.7 Billion Weekly Net Outflow

-

Market24 hours ago

Market24 hours agoEthereum Foundation Launches Silviculture Society

-

Market16 hours ago

Market16 hours agoTop 3 Hidden Altcoin Gems For March

-

Market23 hours ago

Market23 hours agoCommissioner Crenshaw Publicly Attacks SEC Over Coinbase Suit

-

Altcoin23 hours ago

Altcoin23 hours agoHere’s Why Dogecoin Price Could Hit $10 This Cycle