Market

Aptos Price Set for Breakout as Bitwise Registers for APT ETF

Aptos (APT) has spent the past month consolidating within a tight range, with its price bouncing between $5.63 and $6.53. This stagnation has been primarily driven by broader market volatility, leaving traders uncertain about the token’s direction.

However, recent developments, such as Bitwise’s filing for an APT ETF, could provide the spark necessary for a breakout, potentially sending Aptos’ price to new highs.

Aptos Could Find Institutional Interest

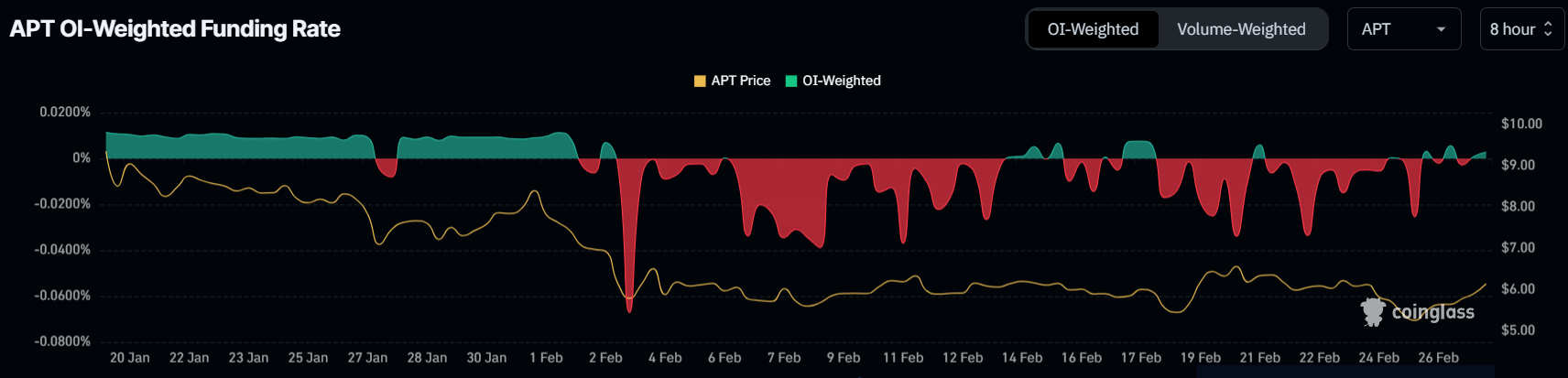

For most of the month, traders have expressed skepticism about Aptos’s price action. The prevailing sentiment has led to a dominance of short contracts over long ones, as evident in the funding rate, which reflects the overall bearish sentiment. As traders continued to place shorts, the pressure on APT to break free from its consolidation mounted. However, the recent filing for an APT ETF by Bitwise has shifted the market sentiment slightly, bringing new optimism and hinting at the potential for a price rise.

The shift in sentiment could help fuel a more bullish outlook for APT. With the ETF filing increasing institutional interest in the token, investors may start seeing more value in long positions, especially if Aptos can break free from its months-long consolidation pattern. This development could lead to increased confidence, further fueling buying activity and driving the price upwards.

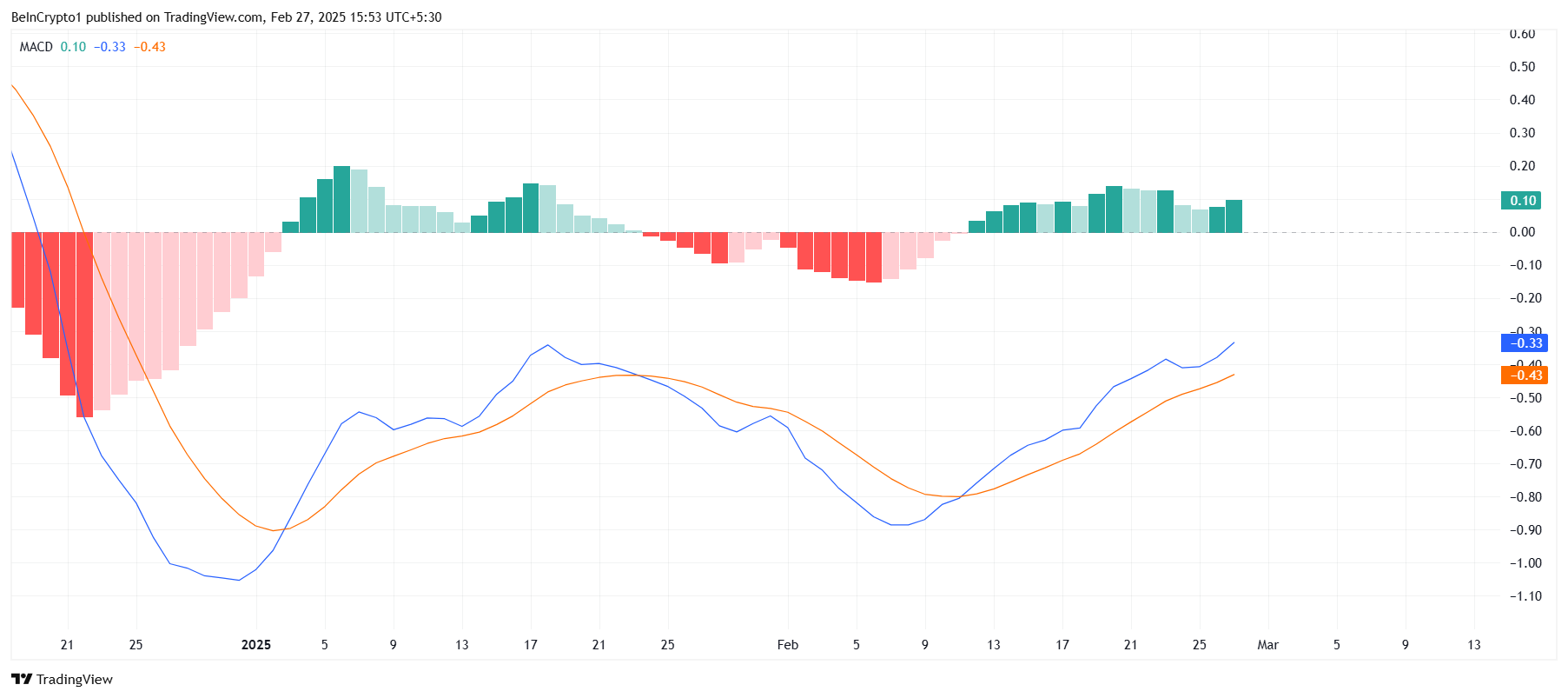

Aptos’ macro momentum is beginning to show signs of improvement, driven in part by the rising bullish momentum observed in the MACD indicator. After experiencing a slight dip last week, the MACD is now showing a resurgence in upward momentum, which could provide the catalyst needed for a breakout. If the MACD continues to trend higher, it will likely support the potential for Aptos to break through resistance levels and push toward a rally.

Technical indicators suggest that the shift in sentiment and momentum could set the stage for a significant price movement. The combination of improved market sentiment and growing investor interest, alongside a positive MACD trend, provides the conditions for a potential price surge. Aptos may be poised to make its move if this momentum continues.

APT Price Primed For Breakout

Aptos has already experienced a 9% rise over the past day, signaling that a rally could be underway. The altcoin has been stuck in consolidation for over a month, with prices bouncing between $5.63 and $6.53. However, the new developments in the market could be what pushes APT beyond its previous limits.

The positive factors at play suggest that Aptos could break the $6.53 barrier, signaling the end of its consolidation phase. This would likely pave the way for a rise toward $7.20, bringing a fresh wave of optimism and trading volume. If APT manages to breach this level, it could spark a full-scale rally.

If the breakout fails to materialize, however, Aptos might remain trapped within its consolidation range. A drop below the $5.63 support could indicate further weakness, with a potential decline toward $4.96. Such a scenario would invalidate the bullish outlook, stalling any potential rally for the altcoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

iDEGEN hits public shelves with momentum as crypto prices crash

AI meme crypto market has grown to a market cap of $2.4 billion, and iDEGEN is set to take its rightful position on the table. After three months in the presale stage, it has hit the public shelves with the same viral momentum.

Its early adopters are set to continue reaping big from the project as the uncensored AI agent revolutionizes the crypto space. In addition to the 300,000% gains already locked in, its value may surge by at least 10X in coming months. This is despite the selling pressure current felt across the crypto majors.

Ripple price chart pattern hints at further selling pressure in the short term

After trading steadily above the support zone of $2.5000 in the past one week, Ripple price has plunged by about 16% since Monday. Similar to other crypto majors, the altcoin is under pressure as extreme fear grips the broader market.

A look at its daily chart points to the formation of a bearish death cross pattern as the short-term 25-day EMA crosses the 50-day EMA to the downside. In the near term, the range between $2.0000 and $2.3357 is worth watching. For a firm trend reversal, the bulls will need to gather enough momentum to rebreak the resistance at $2.5500.

iDEGEN debuts on Raydium with the same viral momentum

iDEGEN has hit the public shelves as promised; ending the three-month-long presale. It has debuted on Raydium, a Solana-based DEX and is set to also list on BitMart on 4th March.

What started on a blank slate ready to learn from the crypto degens on X has grown into an ultra-popular AI crypto with the potential to compete with other AI meme coins like AI16Z, Hamster Kombat, and Fartcoin.

In three months, it has managed to raise $25 million. This has been made possible by its aggressive community, apt timing, and booming AI crypto market. If the presale is anything to go by, its viral momentum is set to yield growth of atleast 10X in the coming months. At its last stage price of $0.038, its early adopters are already enjoying returns of upto 300,000%.

Bitcoin spot ETF records streak of outflows as tariff jitters persist

Concerns over the impact that Trump’s trade policies will have on the US economy have triggered a shift in the market sentiment. Compared to last week’s neutral level of 49, the crypto fear & greed index is now at an extreme fear level of 10.

With the resultant plunge in Bitcoin price, Bitcoin spot ETFs have seen persistent outflows as its institutional demand falls. According to SoSoValue, Bitcoin spot ETFs recorded daily total outflows of $754.53 million on Wednesday. Notably, the trend has been on for 7 sessions in a row.

On its daily chart, the bearish death cross pattern points to continued selling pressure in the short term. At its current level, the bulls will be keen on defending the support at $81,600. A subsequent correction may have it rebound past $85,000 to find resistance at $90,000.

Market

Will XRP Crash Below $2 in March? Latest Insights

XRP is correcting by almost 30% in the last 30 days, with its price trading below $3 for nearly a month. The Directional Movement Index (DMI) shows a strong downtrend, with the Average Directional Index (ADX) surging above 35, indicating increased bearish momentum.

However, a potential reversal could occur if the SEC drops its lawsuit against XRP, possibly triggering a rally toward key resistance levels.

XRP DMI Shows the Lack of a Clear Direction

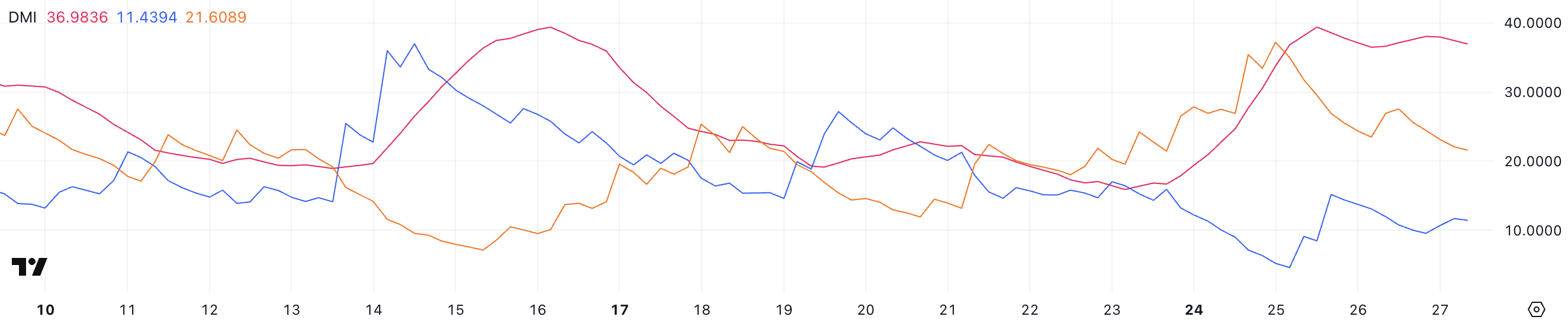

XRP’s Directional Movement Index (DMI) reveals that its Average Directional Index (ADX) is currently at 36.98, a significant increase from 15.89 just four days ago.

The ADX is a trend strength indicator that does not indicate the direction of the trend but measures its intensity. Typically, an ADX value above 25 signals a strong trend, while a value below 20 suggests a weak or non-trending market.

With XRP’s ADX rising sharply above 35, it indicates that the current downtrend is gaining momentum.

This surge in ADX suggests that market participants are showing stronger conviction, making the existing trend more likely to continue.

Meanwhile, XRP’s +DI (Positive Directional Indicator) is at 11.4, down from a high of 15.1 two days ago, indicating weakening bullish pressure. In contrast, the -DI (Negative Directional Indicator) has declined to 21.6 from 37.2 on February 2, showing a decrease in bearish momentum.

Despite the reduction in bearish pressure, the -DI remains above the +DI, confirming that the downtrend is still intact. The widening gap between the ADX and the directional indicators suggests that the downward trend is strong and persistent.

Until the +DI crosses above the -DI, signaling a potential trend reversal, XRP is likely to remain in a bearish phase.

XRP Active Addresses Are Recovering After Reaching Its Lowest Level In 3 Months

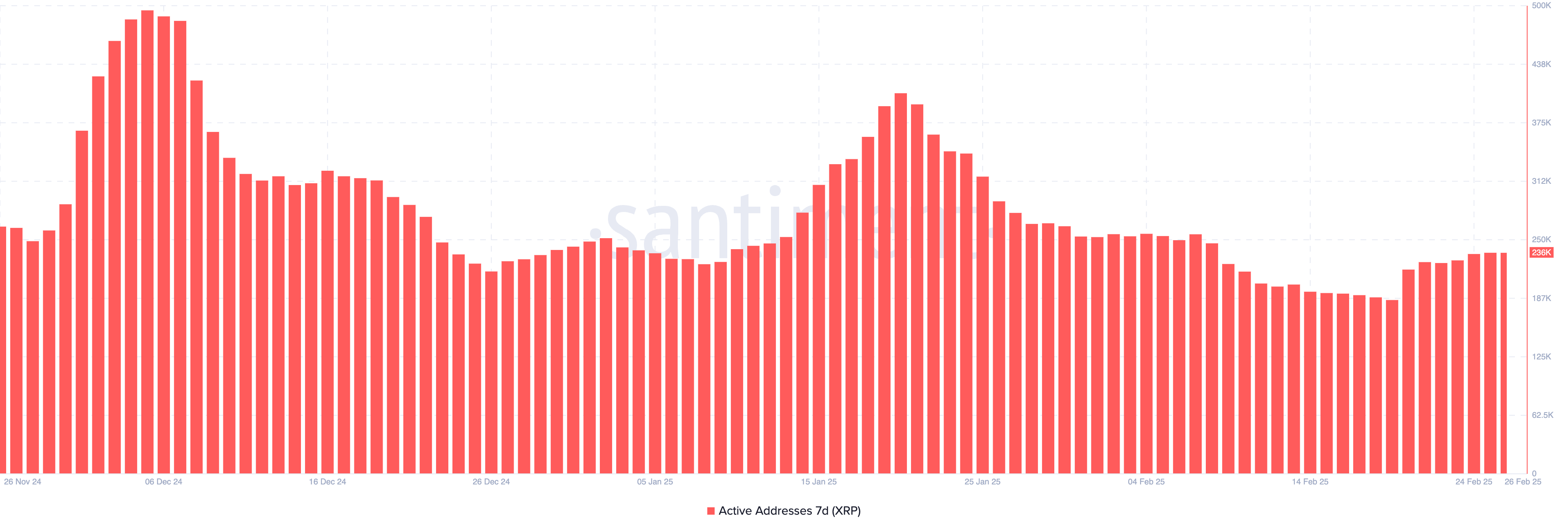

The number of 7-day XRP Active Addresses dropped from 407,000 on January 20 to about 186,000 on February 19, the lowest level since November 2024.

This metric is important because it measures user engagement and network activity, reflecting demand for XRP. A decline suggests reduced interest and bearish sentiment, while an increase indicates growing participation and potential buying pressure. The sharp drop signaled waning investor interest, contributing to XRP’s bearish outlook.

Recently, XRP Active Addresses started to recover, reaching 236,000 – up 26.8% in the last week. This increase suggests growing user activity and renewed interest in the network.

Historically, rising active addresses can precede price recoveries as participation leads to higher demand. If this trend continues, it could support a potential price rebound, but sustained growth is needed to confirm a bullish shift.

XRP’s Uptrend Largely Depends on the SEC and Ripple Lawsuit

XRP’s EMA lines currently show a bearish setup, with short-term lines below long-term ones. The price has been trading below $3 since February 1.

This alignment suggests continued downward momentum, as shorter EMAs reflect recent bearish sentiment. If the downtrend persists, XRP could test two strong support levels at $2.15 and $2.06.

If these are lost, XRP price could fall to $1.77, dropping below $2 for the first time since November 2024.

However, a trend reversal is possible, especially if the SEC drops its lawsuit against XRP in March. Recently, the SEC dropped cases against Gemini, Uniswap, Robinhood, and Coinbase, signaling a shift in regulatory pressure.

If the lawsuit is dropped, it could trigger an uptrend, with XRP testing resistances at $2.36 and $2.52. If these levels are broken, XRP could continue rising towards $2.71, potentially reversing the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Texas Bitcoin Reserve Bill Passes Committee 9-0

Texas’ Bitcoin Reserve proposal was unanimously passed by the Business and Commerce Committee and will proceed to a Senate vote.

However, several similar bills were handily defeated in other Republican-controlled states. Even Texas’ GOP is not unified behind the effort, and it might not succeed in the Senate.

Can Texas Pass a Bitcoin Reserve?

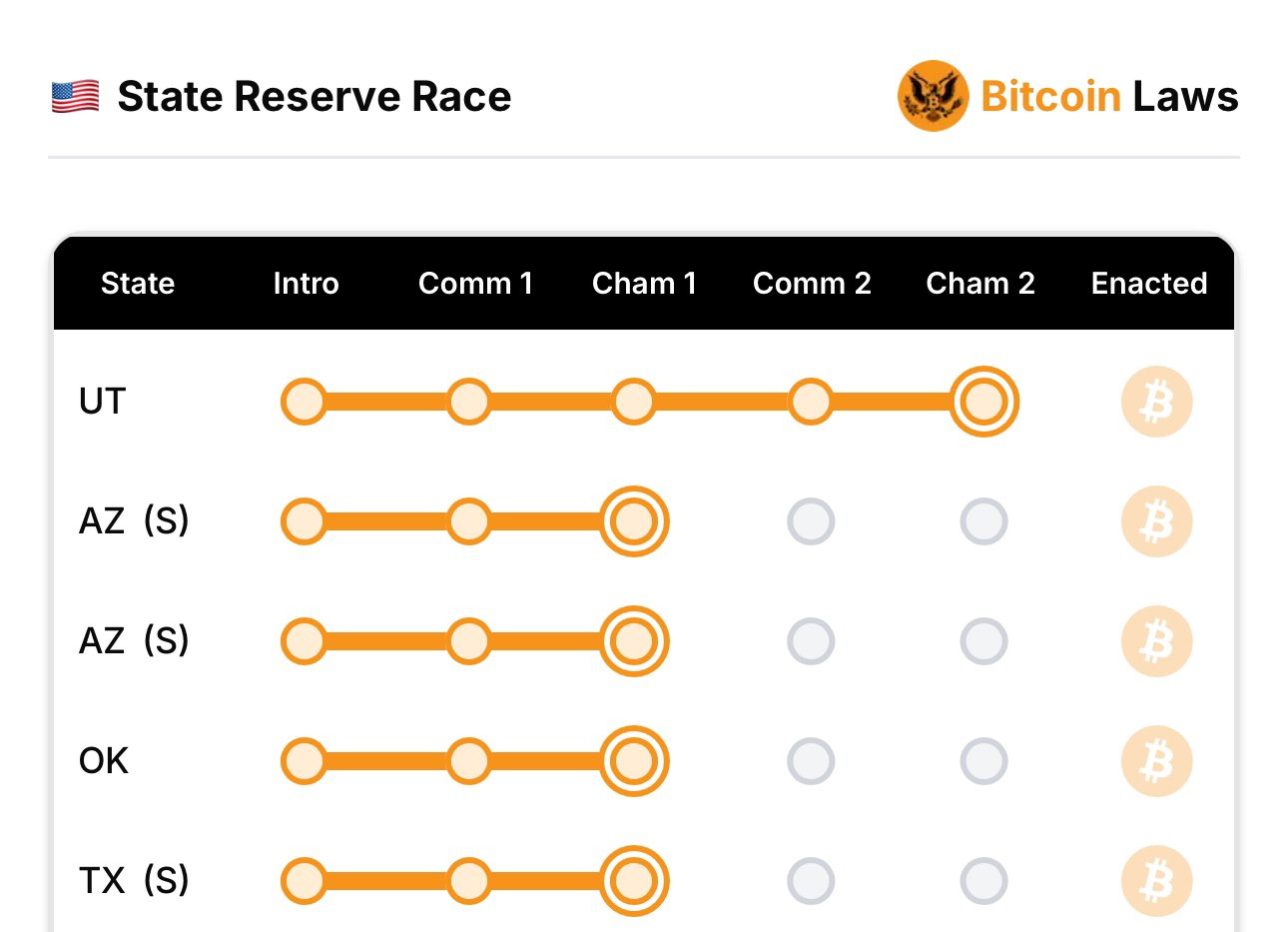

Several US states are trying to pass their own Bitcoin Reserves, which would make them major BTC holders. When these bills first started being introduced, the crypto community was ecstatic because they would guarantee up to $23 billion in new acquisitions.

Today, one more Bitcoin Reserve effort moved forward, thanks to a Committee in Texas:

“The committee sub for SB 21 [the Bitcoin Reserve bill] just passed the Business and Commerce Committee by a 9-0 vote. Strategic Bitcoin Reserve heading to the Senate floor,” claimed Brad Johnson, a local reporter.

When a proposal passes a committee vote, it means that a small group of legislators specializing in the subject matter—here, the Business and Commerce Committee—has reviewed it and agreed that it merits further consideration.

Once the proposal passes the committee stage, it moves to the full Senate. This is when all senators debate and vote on it. If a majority of senators support the proposal, it can proceed toward becoming law.

This news from Texas is a particular relief because it’s a fresh win for all Bitcoin Reserve legislation efforts. At the beginning of the month, they had strong momentum, with Utah making major progress.

However, Montana rejected its own Reserve bill, and this was followed by several other red states. In other words, it’s the first major crack in crypto’s new political coalition.

Texas’ new Lieutenant Governor strongly supports the Bitcoin Reserve bill, which has surely helped its chances. Wyoming’s legislative effort didn’t make it through the Committee despite one of the state’s Senators heavily supporting it.

One key factor that may help this legislation is that Texas is one of the US’ largest Bitcoin mining hubs. Currently, the bill does not explicitly mandate that Texas buy these assets from local businesses, but it easily could.

Presently, though, the recent proposal defeats in various red states are stinging. It’s still very unclear what the bill’s chances are.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoTrump Announces EU Tariffs and Bitcoin Falls Below $85,000

-

Altcoin23 hours ago

Altcoin23 hours agoThis Indicator Proves Chainlink (LINK) Price Has Bottomed Out

-

Bitcoin23 hours ago

Bitcoin23 hours agoAre Bitcoin ETFs Responsible For The Crash? The Hidden Truth

-

Market22 hours ago

Market22 hours agoSEC Drops Gemini Probe, But Winklevoss Wants Penalties

-

Market21 hours ago

Market21 hours ago5 RWA Altcoins to Watch In March 2025

-

Market20 hours ago

Market20 hours agoPi Network Hits All-Time High as Trading Volume Surges

-

Market18 hours ago

Market18 hours agoPump.fun Social Media Hacked to Promote Fake PUMP Token

-

Market19 hours ago

Market19 hours agoBitcoin Price Drops Again—Is $80K the Last Defense for Bulls?