Market

Bitwise Registers Aptos ETF in Delaware—What’s Next?

Bitwise Asset Management has taken the first step toward launching an Aptos (APT) exchange-traded fund (ETF), filing for a Delaware trust linked to the proposed product.

This move positions Bitwise as the first asset manager to pursue an ETF dedicated to Aptos.

Bitwise Lays the Groundwork for an Aptos ETF

The filing with Delaware’s Division of Corporations, dated February 25, is a preliminary step in registering the trust for the proposed Aptos ETF. This move does not guarantee immediate approval or the fund’s launch.

Next, Bitwise will need to submit a formal application to the US Securities and Exchange Commission (SEC). This will include a detailed prospectus outlining the ETF’s structure, investment strategy, and how it plans to track Aptos.

The SEC will then review the application, which could take several months. It can either approve, reject, or request modifications to the proposal.

If approved, the Aptos ETF would allow institutional and retail investors to gain exposure to APT tokens without purchasing or managing the cryptocurrency directly, potentially boosting liquidity and mainstream adoption.

It is worth noting that Bitwise’s registration of an Aptos ETF in Delaware follows the launch of several Aptos exchange-traded products (ETPs) in Europe, including the Bitwise Aptos Staking ETP and the 21Shares Aptos Staking ETP.

For context, Aptos is a Layer 1 blockchain designed for scalability, security, and reliability. It was developed by former Meta (Facebook) engineers who previously worked on the now-defunct Diem project. Aptos uses the Move programming language, originally created for Diem, to enhance security and efficiency in smart contracts.

The prospect of a US ETF tied to APT highlights a broader trend among asset managers to diversify beyond Bitcoin (BTC) and Ethereum (ETH) ETFs, which have dominated the space since their approvals last year.

Bitwise’s move follows its earlier registrations for ETFs linked to XRP (XRP), Solana (SOL), and Dogecoin (DOGE). This signals a strategic push to capitalize on the growing appetite for altcoin-based investment vehicles.

Meanwhile, the filing has sparked a double-digit surge in APT. The altcoin jumped 12.4% in the past 24 hours.

The cryptocurrency, currently ranked 36th by market capitalization, was trading at $6.31 at press time. Its trading volume also saw a significant boost, rising 14.15% to $336.42 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

$4 million Stolen, 6 Wallets Hit

According to Cyvers report, Mask Network founder Suji Yan’s account has been hacked. A suspicious address received nearly $4 million in digital assets before the funds were immediately swapped to ETH and distributed across six different addresses.

Mask Network’s native token, MASK, has been nearly 50% down in the past three months, and this incident could further impact its price.

Hackers Target Mask Network Founder

The breach involved a complex mix of tokens. The suspicious address collected 113 ETH, 923 WETH, 301 ezETH, 156 weETH, 90 pufET, 48,400 MASK, 50,000 USDT, and 15 swETH.

Reports from Web3 security firm Cyvers reflect that the hack unfolded rapidly. Following the initial acquisition of nearly $4 million worth of cryptocurrency, the hackers converted the stolen assets to ETH.

The ETH was then dispersed evenly to six separate addresses, a maneuver likely intended to obscure the money trail and complicate efforts to trace the funds.

“Our system has identified a suspicious $4 million transfer linked to an address associated with Suji Ya, founder of Mask Network. The stolen assets were swiftly converted to ETH and dispersed across multiple addresses, indicating a well-coordinated laundering attempt. This incident underscores the increasing sophistication of threat actors in the Web3 space and highlights the urgent need for real-time transaction monitoring, preemptive prevention, and rapid incident response,” Meir Dolev, Co-founder & CTO at Cyvers told BeInCrypto.

Mask Network, which bridges mainstream social media with blockchain technology, has yet to release an official statement confirming the hack.

However, the founder, Suji Yan, has confirmed the hack on his social media. According to him, the hack is likely to have occurred at his birthday party yesterday. Yan alluded to the idea of an offline attack, as he was away from his phone for a few moments during the party.

Overall, Yan confirmed that the funds were transferred manually from his wallet. More details are yet to be revealed.

“6 hours ago, I turned 29. About 3 hours ago, $4 million was stolen from one of my public wallets. All of the stolen transactions appear to have been manually transferred and lasted for more than 11 minutes. So, either my private keys were compromised on my birthday and the hacker manually moved the funds, or this could have been an offline attack. I was at a private party with a dozen friends and my phone was away from me for a few minutes, like when I went to the bathroom. I trusted my friends, but this situation is a nightmare for anyone,” Yan wrote on X (formerly Twitter).

Crypto hacks and scams have massively increased in the first two months of 2025. Last week, North Korea’s Lazarus Group carried out the biggest hack in crypto history, the Bybit attack.

At the same time, several high-profile social media accounts are almost regularly being hacked to promote fake meme coins. The latest incident is part of this growing trend that has been plaguing the industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bybit Nears Full UAE License After Overcoming $1.4 Billion Hack

Bybit has secured an in-principle approval (IPA) from the United Arab Emirates’ Securities & Commodities Authority (SCA) to establish itself as a Virtual Asset Platform Operator in the region.

The development marks a major step toward Bybit obtaining a full operational license.

Bybit to Establish Virtual Asset Platform in the UAE

This authorization moves Bybit closer to offering a broad range of digital asset services to retail and institutional clients in the UAE. It follows its existing regulatory approvals in the Middle East, further solidifying its commitment to compliance in key financial hubs.

Bybit’s co-founder and CEO, Ben Zhou, expressed optimism regarding the IPA and demonstrated optimism for full operational approval from the SCA in the statement.

“We are honored to have received the IPA from SCA. This approval marks a crucial step in our journey to providing secure and transparent crypto trading solutions,” Zhou shared in the announcement.

Meanwhile, this development reflects the UAE’s ongoing efforts to position itself as a crypto and blockchain innovation leader. Bybit’s regulatory progress aligns with the UAE’s forward-thinking stance on digital assets, ensuring a compliant and secure retail and institutional investors trading environment.

Bybit’s expansion in the UAE follows a similar development in India earlier this month. The exchange successfully registered with India’s Financial Intelligence Unit (FIU). This allowed it to resume full operations after a temporary suspension due to compliance issues.

“Big News! Bybit is officially registered with the FIU-IND and making strides in the Indian market! We’re thrilled to expand our presence in India, and this registration marks a huge milestone,” the announcement read.

Reportedly, Bybit Exchange paid a $1.06 million fine for previously operating without proper registration. It has since aligned with Indian regulatory standards.

Notably, the company confirmed that all services for existing users in India will be restored as of February 25. Further, the onboarding of new users will resume gradually.

Despite its regulatory progress in the UAE and India, Bybit faces scrutiny in Japan. In February, Japan’s Financial Services Agency (FSA) urged major app stores to delist Bybit and other unregistered crypto exchanges.

The FSA cited concerns over unlicensed operations and potential risks to investors, reinforcing Japan’s stringent approach to crypto regulation.

Beyond regulatory developments, Bybit remains in the headlines after a significant security breach. As beInCrypto reported, over $1.4 billion was withdrawn from its platform. Investigations suggest North Korea’s Lazarus Group was responsible for the attack, further intensifying concerns about security vulnerabilities in centralized exchanges (CEXs).

Despite the breach, Bybit reassured users that all funds remained secure and fully backed. The exchange launched a crisis management strategy, offering a $140 million bounty to track down exploiters and recover stolen assets. However, subsequent reports indicate that Safe Wallets’ system was the weak link, not Bybit’s internal system.

The incident highlights the importance of understanding the risks of crypto wallet security, especially for firms handling large amounts of customer funds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is a Major Price Rebound Coming for SOL?

Solana has seen a significant wave of profit-taking since reaching its all-time high of $295.83 on January 19. This has driven its price to multi-month lows, with the coin currently trading at levels last seen in October.

However, on-chain data and key technical indicators suggest a recovery could be on the way.

Solana Hits Capitulation Phase—What’s Next for SOL?

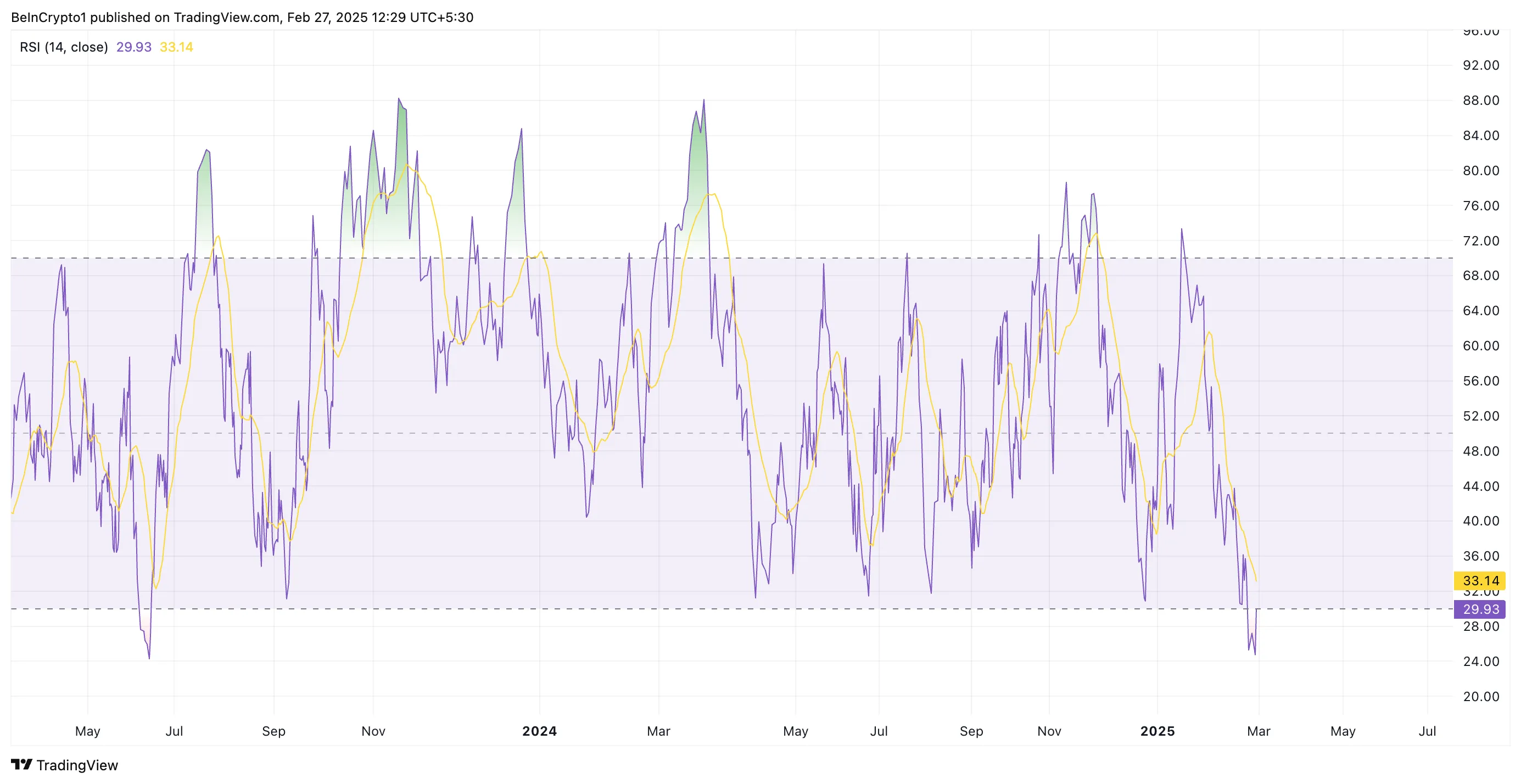

An assessment of the SOL/USD one-day chart shows that the coin’s Relative Strength Index (RSI) has dropped below the 30 level for the first time since June 2023. This means that SOL has become extremely oversold, indicating that selling pressure may be exhausted and a price correction could be underway.

When an asset’s RSI falls below 30, it is deemed oversold. This often signals a potential reversal or price rebound as traders seek buying opportunities at price lows. Historically, such oversold conditions have preceded sharp rebounds.

Hence, SOL might be primed for a rally if market participants interpret this as a buy signal and increase their coin accumulation.

Another indicator of a potential short-term rebound in SOL’s price is its poor market sentiment. In a post on X, popular crypto analyst Miles Deutscher states that the altcoin is experiencing extreme bearish sentiment, the worst it has been in over a year since it first regained the $100 price level.

According to Deutscher, “after being a top performer for so long,” SOL is “finally having its capitulation moment.” Capitulation refers to a phase where investors, exhausted by prolonged losses, begin to sell off their holdings in panic or frustration, often marking a market bottom.

This is because once the “paper hands” sell out, the selling pressure in the SOL market eases up, paving the way for a rebound if buyers interested in acquiring the coin at low prices step in.

SOL Hovers Near Key Support—Will Bulls Push It to $200?

SOL trades at $141.67 at press time, resting slightly above the support level of $136.62. If the altcoin witnesses a resurgence in buying pressure, this support level will strengthen, propelling SOL’s price toward $182.31, where a major resistance lies.

A successful breach of this level could send the coin’s price above $200 to exchange hands at $222.14.

On the other hand, if the downtrend continues, SOL’s price could fall to $120.72.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoIs a Rebound on the Horizon?

-

Market16 hours ago

Market16 hours agoHedera (HBAR) Slips Below $0.20 Amid Ongoing Downtrend

-

Market21 hours ago

Market21 hours agoThe Altcoins Trending Today—ONDO, TIA, and KAITO

-

Altcoin21 hours ago

Altcoin21 hours agoWhat’s Next for XRP Price as TD Sequential Flashes a Bearish Sell Signal?

-

Altcoin15 hours ago

Altcoin15 hours agoShiba Inu Price Eyes 450% As It Holds Above Critical Level

-

Market20 hours ago

Market20 hours ago3 Altcoins That Reached All-Time Highs Today — February 26

-

Market14 hours ago

Market14 hours agoTrump Announces EU Tariffs and Bitcoin Falls Below $85,000

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Blunder? Peter Schiff Blasts Strategy Inc. Over Stock Drop