Market

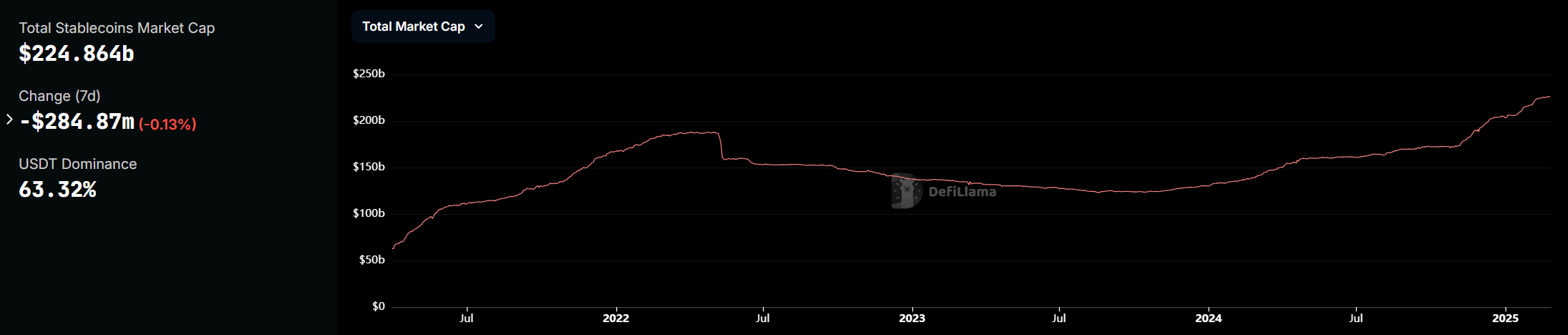

Bank of America May Launch Stablecoin, Claims CEO

Bank of America’s CEO Brian Moynihan says the company is considering launching its own stablecoin. The firm anticipates comprehensive new stablecoin regulation in the US, which would give it a great opportunity.

Moynihan noted that his firm was the first major US bank to launch its own mobile app alongside other technological innovations. Stablecoin adoption might have a similar transformative impact.

Bank of America’s Stablecoin Dreams

Stablecoin regulation is all the rage right now. The CFTC is trying to start a pilot program, and bipartisan congressional efforts are getting off the ground. Fed Chair Jerome Powell also considers a new framework a top priority.

Now that the writing is on the wall, Bank of America is also looking to launch its own stablecoin.

“It’s pretty clear there’s going to be a stablecoin. If they make that legal, we will go into that business. The question of what it’s useful for is going to be interesting,” said Brian Moynihan, Bank of America’s CEO.

Stablecoins are an integral part of the crypto industry. It’d make sense that Bank of America wishes to join the space. This market is quite competitive, but the firm has ample resources to make a powerful entry.

Also, Bank of America has maintained an interest in the space for several years. So, the institution would be primed to take advantage of regulatory changes.

Moynihan gave these comments at the Economic Club of Washington, D.C., and connected his position to a few milestones in the firm’s history.

If Bank of America was the first major bank to launch a mobile app, is it far-fetched to think it’d be the first to launch a stablecoin? He acknowledged that new technologies have a transformative impact on financial markets.

Tether’s USDT currently dominates the stablecoin market, but it may be in hot water over the proposed legislation. It has refused independent reserve audits, and other issuers are pushing for these requirements. Such changes would help these competitors build market share.

If crypto-native stablecoin issuers believe they can maintain a greater degree of compliance, then Bank of America would be practically guaranteed.

The firm’s predecessor was founded in 1904, and it boasts nearly $3 trillion in AUM. It’s a certifiable pillar of American TradFi, with a high level of institutional integration. In short, it could take the stablecoin market by storm.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

5 RWA Altcoins to Watch In March 2025

March 2025 could bring significant price movements among top Real-World Assets (RWA) altcoins. ONDO is attempting a recovery after a sharp decline, while TRADE struggles at its lowest levels since November 2023.

Meanwhile, OM is surging to new all-time highs, solidifying its position as a dominant force in the RWA ecosystem. XDC is showing signs of a rebound after trading below $0.1, and BKN is gaining momentum with a 20% increase, driven by its asset tokenization platform.

Ondo (ONDO)

ONDO has been down almost 20% in the last seven days, although it’s attempted a recovery in the last 24 hours. Its market cap now stands at $3 billion, a significant drop from the more than $5 billion it reached in the last days of January.

Even with this correction, ONDO remains one of the biggest RWA coins, although Mantra recently surpassed its market cap.

If ONDO can regain its momentum from previous months, it could test the resistance at $1.09. Breaking through this level could see it rising to $1.25 next, and if the uptrend gains enough strength, it might even reach $1.44.

This potential rally could be fueled by ONDO’s stronghold in tokenized credit markets, a dominance noted by Dave Rademacher, Co-Founder of OilXCoin, who emphasized ONDO’s strategic position.

“ONDO has carved out a dominant role in tokenized credit markets, securing backing from major players,” Rademacher told BeInCrypto.

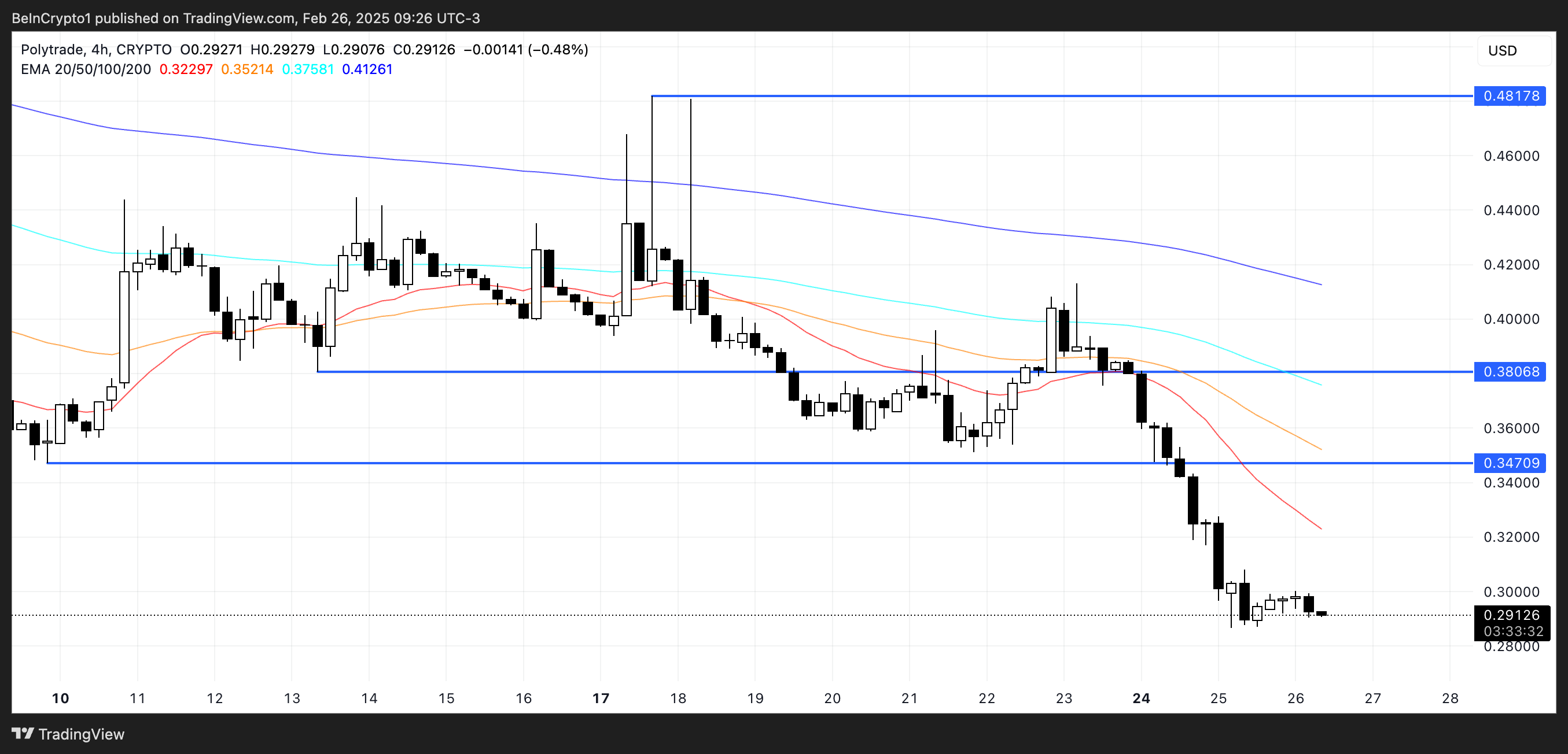

Polytrade (TRADE)

TRADE is down more than 43% in the last 30 days, with its market cap now standing at $12 million. It is currently trading at its lowest level since November 2023, reflecting a significant loss in momentum.

Polytrade offers a platform for users to find, buy, and trade RWA assets across more than 10 chains. According to their website, the marketplace hosts over 5,000 assets.

If TRADE can regain an uptrend, it could test resistances at $0.34 and $0.38. If the bullish momentum is strong enough, breaking through these levels could push TRADE to as high as $0.48.

Although Polytrade remains a small player and a few major players dominate the RWA ecosystem, there is considerable room for disruption coming from other players.

Pat Zhang, Head of WOO X Research, highlights this potential:

“Leading RWA projects will likely evolve into infrastructure, while innovation in RWAFi will drive new opportunities. The biggest players are positioned to maintain dominance, but challengers will continuously push for disruption. Whether market share remains concentrated or becomes more distributed will depend on the pace of innovation and overall RWA growth,” Zhang told BeInCrypto.

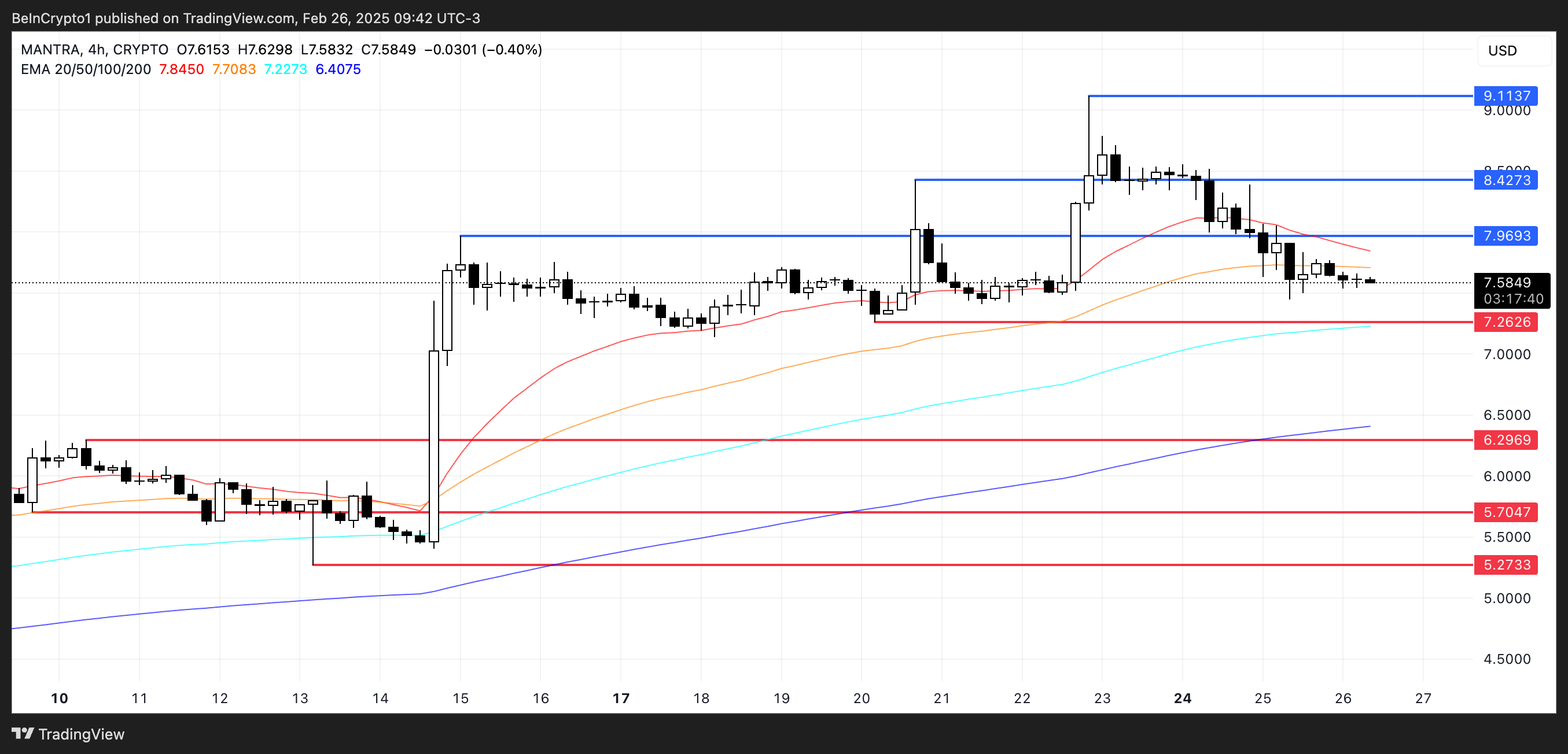

Mantra (OM)

OM is the clear winner in the RWA ecosystem over the last 30 days, with its price surging nearly 60% and its market cap reaching a new all-time high of $8.66 billion on February 22.

This impressive rally has positioned OM as a dominant force within the sector, attracting significant attention from investors. However, despite this momentum, questions remain about its sustainability.

If OM’s uptrend continues, it could test the resistances at $7.96 and $8.42. Breaking through these levels could push OM to new highs above $9 for the first time, solidifying its position as a leader in the RWA space.

However, if the momentum fades, OM could test the support at $7.26, and if that level is lost, it could decline further to $6.29. In the event of strong selling pressure, the price could drop as low as $5.70 or even $5.27.

“OM has strong momentum, but its sustainability is uncertain. Quantitative firms like Manifold Trading accumulated OM at lower prices, and if they take profits, the price could decline sharply. OM’s long-term growth depends on whether these early large-scale buyers hold or exit,” said Zhang.

XDC Network (XDC)

XDC is a mainnet that powers some of the most relevant RWA applications in the market. Despite trading below $0.1 for the last two weeks, it made a strong rebound attempt in the last 24 hours, showing signs of renewed momentum.

However, XDC price is still down roughly 14% over the last 30 days, reflecting the broader market’s volatility.

With this recent rebound, XDC’s market cap is back above $1.3 billion, signaling that investor interest remains strong.

If the uptrend continues, XDC could test the resistance at $0.098. Should this level be broken, XDC could push above $1 again, potentially sparking a more sustained rally.

However, if the previous downtrend resumes, XDC could test the first support at $0.072. If this support is lost, the price could decline further to $0.059.

Brickken (BKN)

Brickken is a platform for asset tokenization, with more than $250 million in Total Tokenized Value. It allows companies to tokenize franchises, real estate, venture capital, and more. As institutions increasingly enter the RWA ecosystem, regulation is expected to play a pivotal role in shaping its future.

“Regulatory uncertainty has been the biggest anchor holding back institutional adoption of RWAs in the US. But now, we’re seeing signs that the tide is shifting. Pair that with a new US administration that’s signaling a more pro-crypto stance, and we could be looking at a much-needed regulatory reset,” said Dave Rademacher, Co-Founder of OilXCoin.

Rademacher also pointed out the importance of regulation in addressing sector-specific challenges:

“If multiple jurisdictions create supportive frameworks for RWAs, the sector will diversify, with new entrants competing across different asset classes. In the end, RWAs are shaping up to be more like traditional finance – where a handful of major players lead, but there’s plenty of room for sector-specific challengers.”

BKN has been up more than 20% in the last 24 hours, reaching its highest levels since the beginning of February. If this bullish momentum continues, BKN could rise to test the next resistance at $0.33.

Breaking through this level could see it climb to $0.38 and potentially reach $0.43, which would push it above $0.4 for the first time since January 14.

However, if the positive momentum fades and a correction occurs, BKN could test the support at $0.24. If that support is breached, the price could drop to $0.21 or even as low as $0.18, marking its first dip below $0.20 since September 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Drops Gemini Probe, But Winklevoss Wants Penalties

The SEC dropped its long-running investigation into Gemini today, bringing no charges. This week alone, the Commission has dropped three other investigations and is also closing active lawsuits.

However, co-founder Cameron Winklevoss does not seem satisfied with this reconciliatory gesture. He suggested stiff penalties for the Commission to discourage another Gensler-style crypto crackdown in the future.

No Charges for Gemini

The SEC, one of the US largest financial regulators, has been on a spree recently. In the last week, it dropped investigations against Opensea, Robinhood, and Uniswap, but it isn’t done there.

Cameron Winklevoss, co-founder of Gemini, announced today that the SEC also shuttered an investigation against his firm.

“On Monday, the SEC informed our litigation counsel that it has closed its investigation into Gemini and will not be pursuing an enforcement action against us. While this marks another milestone to the end of the war on crypto… it does little to make up for the damage this agency has done to us, our industry, and America,” Winklevoss claimed via social media.

Winklevoss claimed that the SEC sent Gemini a Wells Notice under a year ago, but its investigation never involved formal charges.

Recently, the Commission has been dropping legal battles at a fast rate, settling with Coinbase and preparing an agreement with Tron in a civil fraud case. The SEC is also stalling its long-running suit against Ripple, but it’s technically active.

None of these reconciliatory measures seem to have moved Winklevoss much. Last month, Gemini had to pay a $5 million fine to the CFTC, and the SEC gave its business partner Genesis a $38 million fine.

Both firms were sued in 2023. In today’s statement, Winklevoss took an extremely hostile stance towards the regulators responsible:

“How many years of innovation were kicked down the road at the expense of Americans? We will never know. Unless there is a cost and price to be paid for this behavior, it will happen again. Everyone involved in these actions should be fired immediately and in a public way. Their names, roles, and the actions they participated in should be posted,” he said.

Some of his other suggestions include making the SEC pay Gemini 3x the cost of its legal bills, banning its employees from employment at federal agencies for life, and other “serious consequences for bad faith actors.”

For Winklevoss, the SEC’s investigation into Gemini is an outright policy failure that must be ferociously corrected.

This plays into a fundamental dilemma that the crypto industry is facing in light of its newfound political influence. The SEC was a powerful opponent under Gensler, but it’s on our side now.

Under new leadership, it has shown downright enthusiasm for making new regulations. In other words, it could be a powerful tool moving forward.

Therefore, the dilemma is this: should crypto try to use the Commission or destroy it? For Gemini and Coinbase, the SEC under Gensler engendered enough hostility that destruction seems preferable.

However, putting pro-industry Commissioners at its helm was a major accomplishment. It may be shortsighted to throw away years of work.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump Announces EU Tariffs and Bitcoin Falls Below $85,000

After consistent bearish signals, President Trump’s surprise announcement of EU tariffs has devastated Bitcoin and the broader crypto market. Crypto-related traditional stocks are feeling the heat as the contagion spreads.

Bitcoin ETF outflows are at a record high, the price of BTC is below $85,000, and liquidations are nearly at $745 million. We may be on the precipice of a bear market or genuine crypto crash, but the community must stay strong.

Did Tariffs Trigger a Bitcoin Crash?

Donald Trump’s proposed tariffs are looming over the markets today, and crypto is acting like the sky is falling. Although Bitcoin and other assets recovered after tariffs against Canada and Mexico were postponed, Trump recently confirmed that he plans to enact them, spiking the crypto market.

Today, he followed this by hinting at a new 25% tariff against the European Union.

“We have made a decision and we’ll be announcing it very soon. It’ll be 25 per cent generally speaking, and that will be on cars and all other things,” Trump said in his first Cabinet meeting.

With the price of Bitcoin already wobbling, new US tariffs are pushing the token towards the abyss. The asset began the week with losses, and $500 million in ETF outflows helped spur fears of an impending bear market.

Today, weekly BTC ETF outflows hit their all-time high, and Bitcoin’s price dipped below $85,000 for the first time since early November.

The Contagion Spread Across Crypto Stocks

So far, CoinGlass data shows total liquidations of just under $745 million. This is on top of the $1.5 billion liquidation seen yesterday. Crypto-related stocks are also taking a hard hit.

Strategy (formerly MicroStrategy) is closely entangled with the price of Bitcoin, thanks to its massive stockpiles. Recently, it bought nearly $2 billion in BTC, but its stock price lagged.

Today, its stock also plunged, fueling speculation it might have to liquidate its stockpile. The stock’s price has since recovered somewhat, but it looks very shaky.

Coinbase, too, saw temporary drops due to the tariffs’ impact on Bitcoin, but its revenue streams are quite diversified. Tesla, on the other hand, counts Bitcoin returns as a substantial portion of its revenue.

Between the steep drop in the crypto market and growing dissatisfaction from its traditional product buyers, the firm’s price is in trouble.

In short, Bitcoin and the rest of the crypto market fell hard, and Trump’s tariffs may or may not be the most direct trigger. Bearish indicators have been popping up for days, whereas Trump announced these EU tariffs with little fanfare.

After all, record-breaking hacks and shameless social media scams are only growing. Maybe it’s time for a correction.

Nonetheless, even if the crypto community’s worst fears do come true in the short term, that is no cause for despair. This industry is historically volatile, and it has always recovered from the largest crashes.

Whether these tariffs reduce Bitcoin to a fraction of its recent value or not, the community will remain resilient and innovative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market18 hours ago

Market18 hours agoBTC dips to $86k for the first since November amid market sell-off

-

Bitcoin17 hours ago

Bitcoin17 hours agoA Sign of Market Shifts?

-

Market17 hours ago

Market17 hours agoXRP Price Moves Higher—But Is This Just a Temporary Bounce?

-

Altcoin16 hours ago

Altcoin16 hours agoRipple Whales Dump 370M Coins; What’s Happening?

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum Tests “Make Or Break” Level, But Altseason Hopes Stay Alive – Details

-

Altcoin21 hours ago

Altcoin21 hours agoBTC Brushes $86K Low, Altcoins Jump

-

Market20 hours ago

Market20 hours agoSolana (SOL) Sees Red—What’s Next for the Price?

-

Bitcoin13 hours ago

Bitcoin13 hours agoCould Strategy (MSTR) Be Pressured to Sell $43 Billion in Bitcoin?