Bitcoin

Bitcoin Blunder? Peter Schiff Blasts Strategy Inc. Over Stock Drop

A known economist once again criticized the debt-fueled Bitcoin acquisition strategy of Michael Saylor’s Strategy Inc. despite the company’s decreasing share price.

Leading economist Peter Schiff argued that Strategy Inc.’s decision to go on a buying spree of the firstborn cryptocurrency has led to shareholder dilution, reducing the premium on the firm’s BTC holdings.

BTC Premium Down By 85%

In a recent X post, Schiff gave his take on the Saylor-led company’s Bitcoin investment strategy while the firm’s share price and Net Asset Value (NAV) premium decreased.

The prominent economist noted that Strategy Inc.’s stock has underperformed despite leveraging on Bitcoin buying.

“Today, Saylor bragged about his leveraged Bitcoin buys generating a BTC yield of 6.9% so far in 2025. However, the share price of $MSTR is down 6% in 2025,” Schiff said in a post.

The economist added that the massive dilution has diminished shareholder value, “causing the premium to its crypto holdings to collapse by 85%.”

Today, @saylor bragged about his leveraged Bitcoin buys generating a BTC yield of 6.9% so far in 2025. However, the share price of $MSTR is down 6% in 2025, while massive dilution has destroyed shareholder value, causing the premium to its Bitcoin holdings to collapse by 85%.

— Peter Schiff (@PeterSchiff) February 24, 2025

A Bitcoin hobbyist commented on Schiff’s post saying he agrees with the economist about not being sold with Strategy Inc. However, the crypto investor disputed the 85% premium collapse, saying the “claim seems off.”

“With 499,096 BTC at ~$97,514 each, that’s $48.7 billion. MSTR’s stock at, say, $297.50 today with ~290 million shares is a market cap of $86.3 billion—a 77% premium. Even at recent highs like 90%, an 85% drop would leave it near 13%, or $55 billion—way below current levels. The premium’s down, not demolished,” the Bitcoin hobbyist explained.

Skeptic On The Debt-Fueled Strategy

One of the reasons why Schiff did not buy into the Bitcoin acquisition of Strategy, Inc. is being funded by debt. The economist is at loggerhead with Saylor’s strategy of financing the BTC acquisitions through convertible debt.

“It looks like the new $MSTR convertible notes aren’t going over too well. Shares are down 4.5% today, even with Bitcoin up 2.5%,” Schiff said.

Schiff has been very critical of the debt-driven Bitcoin purchase, emphasizing that too much debt could be dangerous once the BTC price drops.

“When MSTR trades at a discount to its holdings, the game is over, as selling MSTR shares to buy crypto will produce a negative Bitcoin yield,” the economist explained.

Earlier, Schiff cited that the repayment of the firm’s debts might cause trouble to Strategy, Inc. when BTC price declines.

BTC Acquisition Strategy

Strategy Inc. has received heavy criticism for its BTC acquisition master plan. However, the firm does not mind its critics and continues to increase its digital currency holdings.

In a statement, Strategy Inc. said it recently bought 20,356 Bitcoins worth around $1.99 billion, increasing its BTC holdings to 478,740 coins with a total value of $44 billion.

Featured image from Pexels, chart from TradingView

Bitcoin

Are Bitcoin ETFs Responsible For The Crash? The Hidden Truth

In the past two days, the Bitcoin price has tumbled more than 10%, rattling a crypto market that had seen a sustained period of relative stability. The pullback has left investors questioning the role of US spot-based Bitcoin ETFs in the downturn, as data emerges revealing significant outflows from these products.

Vetle Lunde, Head of Research at K33 Research, highlighted on X that ETF outflows have reached notably high levels:“Yesterday’s net outflow of 14,579 BTC in BTC ETPs globally is the largest recorded net outflow since the launch of US spot ETFs. Outflows have dominated throughout February. 69% of all trading days have concluded with net outflows.”

Are Bitcoin ETFs To Blame?

These figures point to a steady drumbeat of selling pressure in the ETF market. The significance, according to Lunde, is not just the single-day spike in outflows but the persistent trend throughout the month of February.

However, not all market observers agree that the large outflows necessarily spell doom. Adam (@abetrade) from Trading Riot argues that dramatic ETF flows have historically preceded market corrections that eventually revert to mean behavior. He pointed out that, except for an exceptional inflow following Trump’s win on November 7th, such “big red numbers” typically trigger panic selling that sets the stage for a subsequent rebound.

Adam’s view is that the current situation might be an overreaction: once the initial wave of selling subsides, the market could stabilize or even see a relief rally. This perspective is built on historical precedents where similar episodes did not lead to sustained downturns, suggesting that the prevailing sentiment could eventually turn contrarian.

“Except for November 7th, when large inflows followed Trump’s win, every other occurrence of outsized inflows or outflows has been a mean-reverting signal. Generally, people see a big red number and start panic selling, or vice versa, which ends up sending the market in the opposite direction,” Adam stated.

Adding further complexity to the picture is the evolving dynamics in the futures markets. Zaheer Ebtikar, Chief Investment Officer and founder of Split Capital, connects the dots between ETF outflows and futures pricing. Until recently, CME Futures were trading at nearly double the premium of conventional cryptocurrency exchanges. However, a recent correction saw the futures premium dip below 5%—a level approaching the risk-free rate.

Ebtikar noted that this correction has been pivotal. As the futures premium normalized, market participants appeared to “throw in the towel” on Bitcoin ETFs, with CME Futures open interest falling to its lowest since the last election cycle. This decline in open interest, accompanied by near-record trading volumes on the CME, points to a shift in sentiment where investors are increasingly cautious about holding ETFs while still engaging in futures speculation.

The interplay between a shrinking futures premium and rising futures volume creates a paradox. “In a paradoxical way, futures premium down = futures start getting bid and ETFs start dumping. The final tell here was CME Futures volume in the past couple of days reaching near record highs since the election,” Ebtikar concluded.

Macro Headwinds

Macroeconomic unease is also dragging on crypto and traditional markets alike. Singapore-based QCP Capital describes the situation as a “global risk-off move” affecting equities, gold, and BTC, amid growing whispers of stagflation. Consumer sentiment has taken a hit, suggested by a weaker-than-expected Consumer Confidence Index of 98 (versus 103 expected), while the US administration’s newly confirmed 25% tariffs on Canadian and Mexican imports—effective March 3—have further dampened sentiment.

As QCP Capital sees it, investors are growing wary of potential trade escalations and elevated inflation, which together create an atmosphere of uncertainty. The once-crowded “Magnificent 7” equity trade is unraveling, and “long crypto” has also been identified as one of the most overextended positions. In choppy markets, crypto is often the first to be liquidated, reinforcing the negative price action.

Looking ahead, QCP Capital points to a pair of key events that could set the tone. The NVIDIA earnings and this week’s PCE print. Results from the chipmaker, which has ridden the wave of AI-driven demand, could trigger another leg down if guidance disappoints. The upcoming Personal Consumption Expenditures (PCE) data is forecast at 2.5% year-over-year, still above the Federal Reserve’s 2% target. Until inflation convincingly trends lower, the Fed is likely to keep rates steady. Markets currently price two rate cuts in 2025, the first in June or July.

QCP Capital warns that markets remain fragile, advising caution as consumer and retail sentiment surveys—often leading indicators—could provide early signals of a stagflationary trajectory.

At press time, BTC traded at $87,818.

Featured image created with DALL.E, chart from TradingView.com

Bitcoin

Could Strategy (MSTR) Be Pressured to Sell $43 Billion in Bitcoin?

Strategy’s (formerly MicroStrategy) stock (MSTR) has taken a significant hit. The stock fell by double digits following a sharp decline in Bitcoin’s (BTC) price.

As speculation swirls over whether the company could be forced to liquidate its Bitcoin holdings, The Kobeissi Letter weighed in, suggesting that while such a move remains highly unlikely, it’s not entirely off the table.

MSTR Dips Amid Bitcoin Downturn

Over the past 24 hours, Bitcoin’s price dropped more than 3%, triggering a ripple effect that sent MSTR down by 11%. According to Yahoo Finance, the stock closed at $250. This marked a 55% decline from its all-time high (ATH) in November 2024.

Amid this dip, The Kobeissi Letter delved into the prospects of a forced liquidation of the company’s Bitcoin holdings.

“Forced liquidation of MSTR is not necessarily impossible. But, it is highly unlikely. It would need a “mayday” situation to occur,” the post read.

The analysis elaborated that the company’s business model relies on raising capital, rather than selling Bitcoin, to fund its cryptocurrency purchases.

By issuing 0% convertible notes and selling new shares at a premium, Strategy has managed to finance its Bitcoin acquisitions without liquidating assets—even during market downturns.

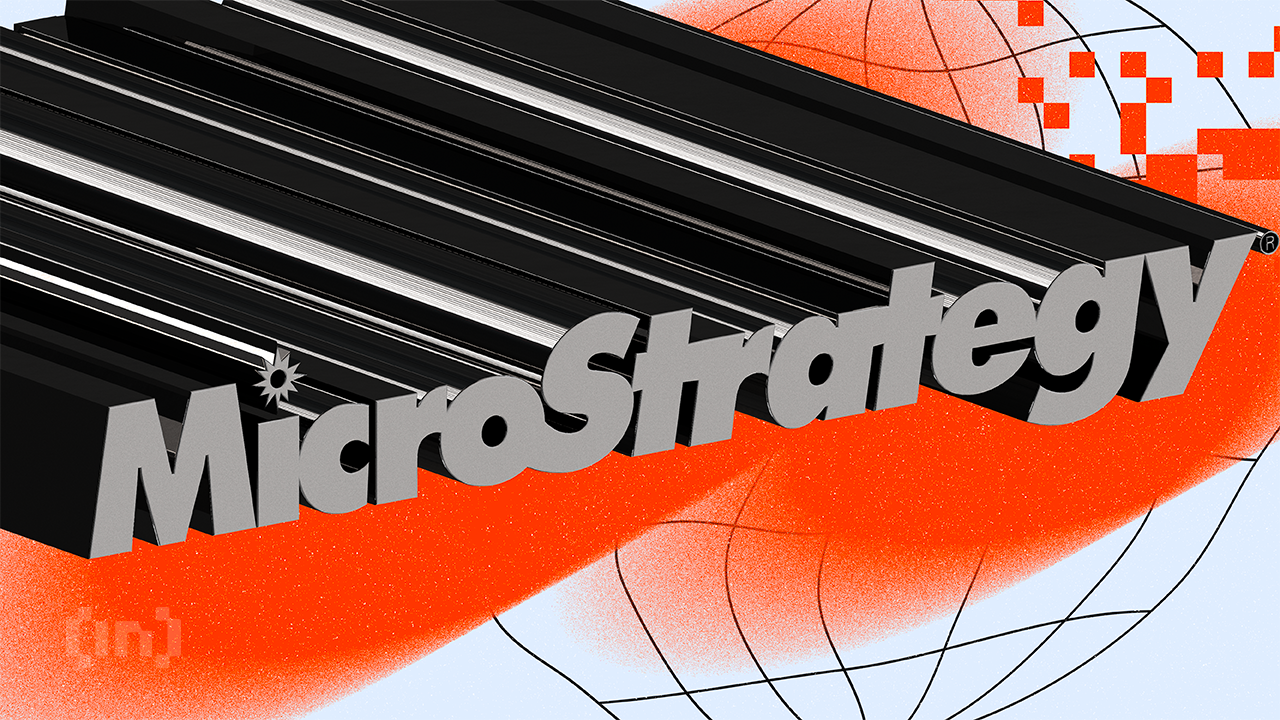

As of the latest data, Strategy holds approximately $43.4 billion in Bitcoin against $8.2 billion in debt. Thus, its leverage ratio is around 19%.

Notably, most of this debt consists of convertible notes. The conversion prices are below the current share price and maturities extending to 2028 and beyond. This structure provides significant breathing room for the company.

Despite this, the company’s ability to raise fresh capital is not entirely immune to challenges.

“In a situation where their liabilities rise significantly higher than their assets, this ability could deteriorate,” the analysis examined.

While this doesn’t automatically mean “forced liquidation,” it could strain the company’s financial flexibility. Yet, the analysis highlighted that liquidation still remains a possibility but only under a “fundamental change.”

“Effectively, for liquidation to occur, there would first need to be a stockholder vote or a corporate bankruptcy,” The Kobeissi Letter noted.

Nonetheless, the scenario was deemed unlikely given Michael Saylor’s 46.8% voting power. This effectively shields the company from such moves without his consent.

Saylor has been a vocal supporter of Bitcoin, emphasizing its long-term growth. In fact, last week, the firm increased its holdings with a 20,356 BTC addition.

However, The Kobeissi Letter stressed that the real concern for Strategy lies in the future, especially when the company’s convertible bonds mature after 2027.

If Bitcoin’s price falls more than 50% and stays low, Strategy might struggle to refinance or repay the debt in cash, potentially testing its reserves and investor confidence.

“Maintaining investor confidence will be crucial for MSTR in the wake of downswings,” the publication added.

Therefore, while liquidation remains unlikely in the short term, the long-term risks associated with Bitcoin’s volatility and the company’s debt obligations remain an area of concern.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

A Sign of Market Shifts?

Investment manager BlackRock has transferred 1,800 Bitcoin (BTC), valued at approximately $160 million, to Coinbase Prime.

The transaction has raised concerns about whether it signals a strategic shift, routine liquidity management, or potential selling pressure.

BlackRock’s Bitcoin Transfer Raises Questions

Arkham Intelligence, a blockchain analytics firm, first brought attention to the transfer in a post on X.

“BlackRock Selling BTC,” the post read.

The message quickly fueled discussions within the crypto community, with many interpreting the move as a potential signal of BlackRock offloading Bitcoin.

“People start regretting letting Blackrock control the market. Bitcoin lost its ethos,” a user wrote on X.

Yet, a closer look suggests a less dramatic explanation. The transfer is linked to BlackRock’s management of its iShares Bitcoin Trust (IBIT), a spot Bitcoin ETF custodied by Coinbase Prime. Thus, the movement of 1,800 BTC could probably reflect liquidity management, portfolio rebalancing, or efforts to facilitate investor redemptions rather than an outright sale.

Notably, the timing of this transfer coincides with significant outflows from the ETF. According to SoSoValue, on February 25, IBIT saw $164 million in net outflows. These investor withdrawals may explain the need for liquidity adjustments.

Meanwhile, the Bitcoin transfer isn’t the only activity from BlackRock that is catching attention. Data from Arkham Intelligence revealed that BlackRock’s iShares Ethereum Trust ETF (ETHA) also deposited 18,168 ETH, worth approximately $44 million, to Coinbase Prime amid comparable outflows from the ETF.

Bitcoin Dips Below $90,000 Amid Broader Sell-Off

The transfers coincide with a turbulent period for the cryptocurrency market. Bitcoin recently fell below $90,000 for the first time since November 2024, dragged down by a sell-off in US Bitcoin ETFs. These funds have recorded substantial outflows, ending the last two weeks in the red.

At press time, Bitcoin traded at $88,659, down 3.0% in the past 24 hours. The Fear and Greed Index stood at 21, indicating extreme fear in the market. This suggested that investors are highly cautious, potentially panicking and selling off their assets due to uncertainty or recent price declines.

The broader crypto market has also been under heavy pressure. According to CoinGlass, over $1 billion in leveraged positions were wiped out in the past day.

Of this total, a staggering $847 million came from liquidated long positions—traders betting on price increases. Meanwhile, only $191 million stemmed from short liquidations, where traders betting on price declines were forced out of their positions.

The scale of these liquidations is raising concerns that the market may be entering a bearish phase, with increased volatility and further downside risk for Bitcoin and other cryptocurrencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market17 hours ago

Market17 hours agoBTC dips to $86k for the first since November amid market sell-off

-

Altcoin16 hours ago

Altcoin16 hours agoRipple Whales Dump 370M Coins; What’s Happening?

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum Tests “Make Or Break” Level, But Altseason Hopes Stay Alive – Details

-

Altcoin20 hours ago

Altcoin20 hours agoBTC Brushes $86K Low, Altcoins Jump

-

Bitcoin17 hours ago

Bitcoin17 hours agoA Sign of Market Shifts?

-

Market16 hours ago

Market16 hours agoXRP Price Moves Higher—But Is This Just a Temporary Bounce?

-

Market15 hours ago

Market15 hours agoXRP Futures Traders Go Short as Price Drop Worsens

-

Market21 hours ago

Market21 hours agoEthereum Price Attempts Recovery—Can It Break $2,500?