Market

XRP Price Moves Higher—But Is This Just a Temporary Bounce?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

3 Altcoins That Reached All-Time Highs Today — February 26

While the crypto market continues to recover from the weekend’s losses, some altcoins have already started to climb. Investor support and gradual recovery have helped these tokens avoid further declines and instead spark rallies.

BeInCrypto has analyzed three altcoins that reached new all-time highs today and explored what lies ahead for them.

Pi Network (PI)

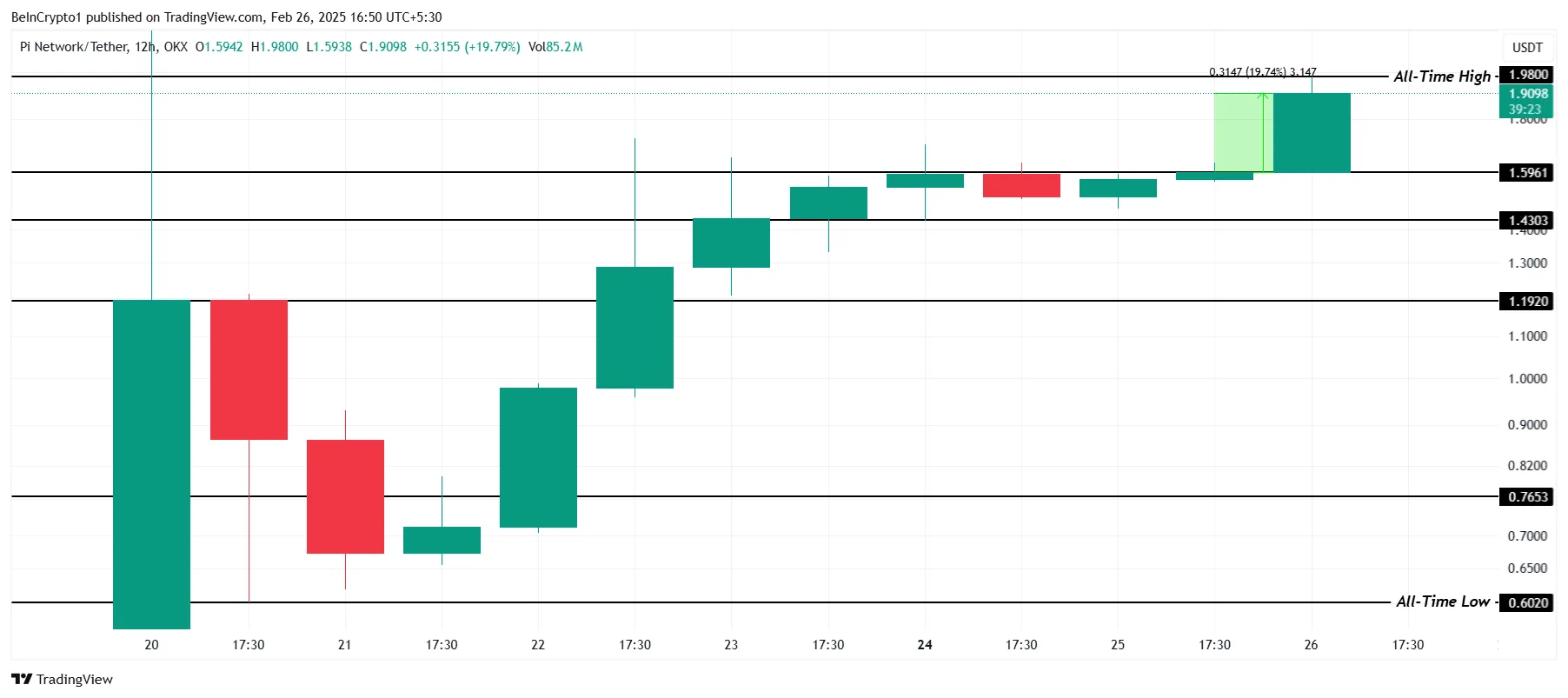

Pi Network’s price surged by 19% in the last 24 hours, reaching an all-time high of $1.98 during an intra-day rally. However, it has since fallen slightly, currently trading at $1.90. This price action highlights Pi’s volatility amid market fluctuations and investor interest.

Despite the recent dip, Pi Network has seen strong support from investors. The coin has garnered significant attention, especially due to its controversial mining methods. If this continued attention persists, Pi could see its price trend upward, potentially pushing above the $2.00 mark and forming a new all-time high.

However, if Pi fails to hold support at $1.59, it could face further declines. A drop below this support level might see the price slide to $1.43, with a critical support point at $1.19. Losing these levels would invalidate the bullish outlook and extend the downtrend.

Kaito (KAITO)

KAITO’s price surged by 28%, reaching $2.12, and briefly hit a new all-time high of $2.17 during the intra-day rise. This significant increase highlights strong investor interest and the potential for continued growth. The altcoin’s performance remains promising, suggesting an upward trajectory if bullish momentum continues.

Following last week’s launch, KAITO has captured investor attention, with a growing sense of optimism surrounding the token. If the current bullish sentiment continues, KAITO could climb toward $2.50 in the coming days, further reinforcing its position in the market.

However, if KAITO fails to break above $2.17, it could face a downturn. A failure to breach this resistance may lead the altcoin to fall back to $1.86 or even lower, to $1.71. Such a decline would invalidate the current bullish outlook and erase recent gains.

Staika (STIK)

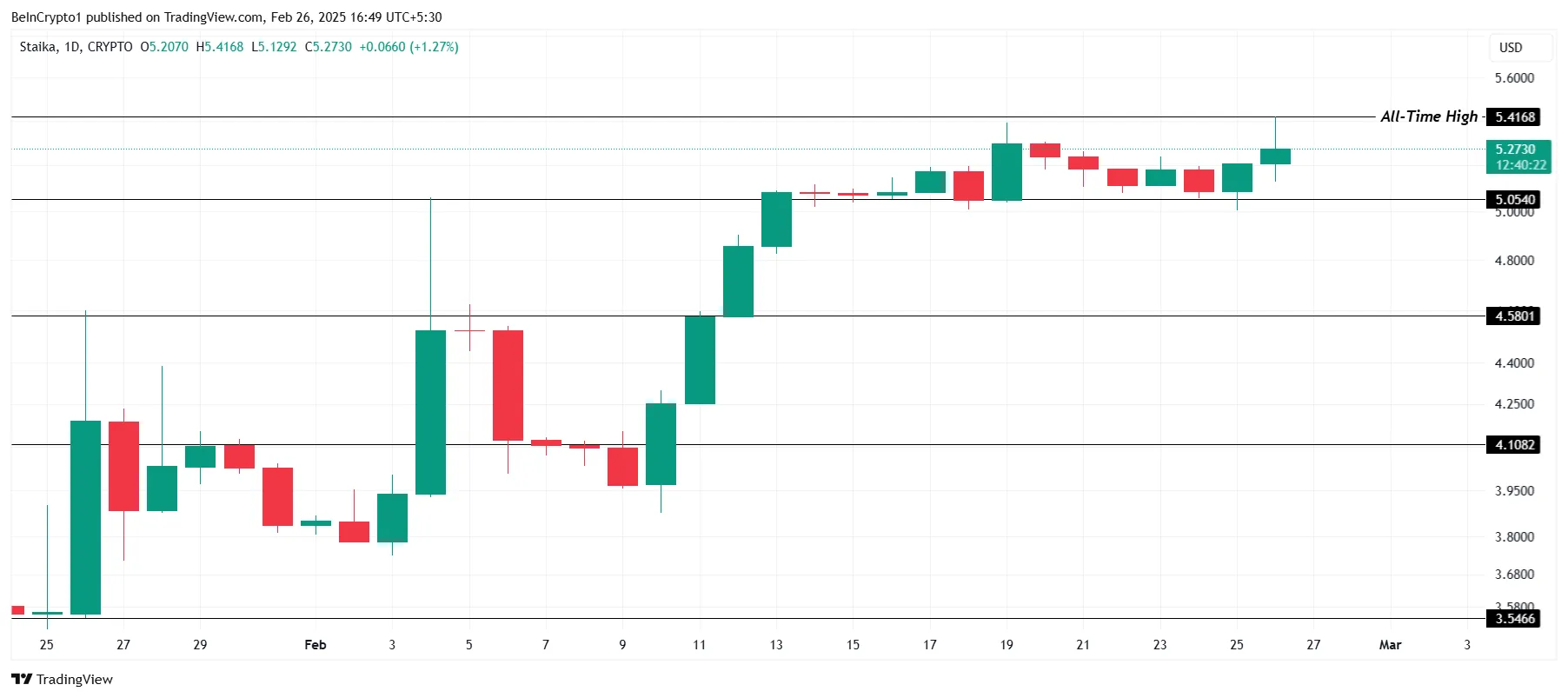

Another one of the altcoins, Staika (STIK), has made an impressive move, achieving a new all-time high (ATH) of $5.41. Despite broader bearish market conditions, the crypto token managed to hold steady above $5.05, preventing a further decline. This resilience shows strong investor confidence in its potential for further growth.

This marks the second ATH in just seven days for STIK, indicating a potential breakout. If the altcoin continues this upward momentum, it could soon surpass $5.60, establishing a new resistance level.

However, if STIK fails to breach the $5.41 resistance, it may face consolidation within the range of $5.41 to $5.05. A failure to hold the $5.05 support level would invalidate the bullish outlook, potentially pushing the price down to $4.58. Market sentiment will be crucial in determining the next move.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

The Altcoins Trending Today—ONDO, TIA, and KAITO

As the broader crypto market continues its decline today, some altcoins have stood out, gaining attraction from traders and investors alike.

Among today’s trending assets are Ondo (ONDO), Celestia (TIA), and KAITO (KAITO), each of which has defied the broader downturn with sizable gains.

Ondo (ONDO)

The Real-world asset (RWA) token ONDO is one of today’s most searched assets. It currently trades at $0.98, with a 2% price uptick in the past 24 hours.

Following an extended period of decline, readings from ONDO’s Relative Strength Index (RSI) suggest that the altcoin might be poised for a bullish rebound. At press time, this momentum indicator is in a downtrend at 31.70.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline.

On the other hand, values under 30 indicate that the asset is oversold and may witness a rebound. At 31.70, ONDO’s RSI signals that the token is nearly oversold and could experience a positive price correction if new demand enters the market.

ONDO’s price could climb above $1 to trade at $1.23 in this case.

However, ONDO’s price could fall to $0.87 if the decline continues.

Celestia (TIA)

TIA, the native coin of the modular blockchain network Celestia, is another altcoin trending today. It has also bucked the broader market downturn to record 21% gains over the past 24 hours.

Its positive Balance of Power (BoP) reflects the high demand for the altcoin among spot market participants. As of this writing, it is at 0.70.

An asset’s BoP compares the strength of its buyers and sellers by analyzing price movements within a given period. When its value is positive, it indicates that buyers are dominating the market, signaling strong bullish momentum and potential for further price gains.

If TIA maintains its rally, its price could reach $6.78.

On the flip side, a decline in demand could push TIA to its year-to-date low of $2.35.

KAITO (KAITO)

The newly launched AI token KAITO is a trending altcoin today. Despite the general market decline, its price has risen 7% in the past 24 hours.

Its Aroon Up Line, assessed on an hourly chart, confirms the strength of KAITO’s uptrend. As of this writing, it is at 100%.

The Aroon Indicator measures an asset’s trend strength and identifies potential reversal points. When the Aroon Up line is at 100%, it signals that the asset has recently hit a new high and suggests a strong uptrend with bullish momentum. If KAITO maintains its rally, it could revisit its all-time high of $2.10.

Conversely, a dip in buying pressure could cause its price to drop to $1.82.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is a Rebound on the Horizon?

After spending most of February trading within a range, Bitcoin (BTC) has broken below the consolidation zone, slipping under $90,000 for the first time since November. The leading coin now trades at $88,956.

This downturn signals growing bearish pressure, raising concerns that the decline could extend further into March.

Range-Bound or Breakout? Experts Weigh In

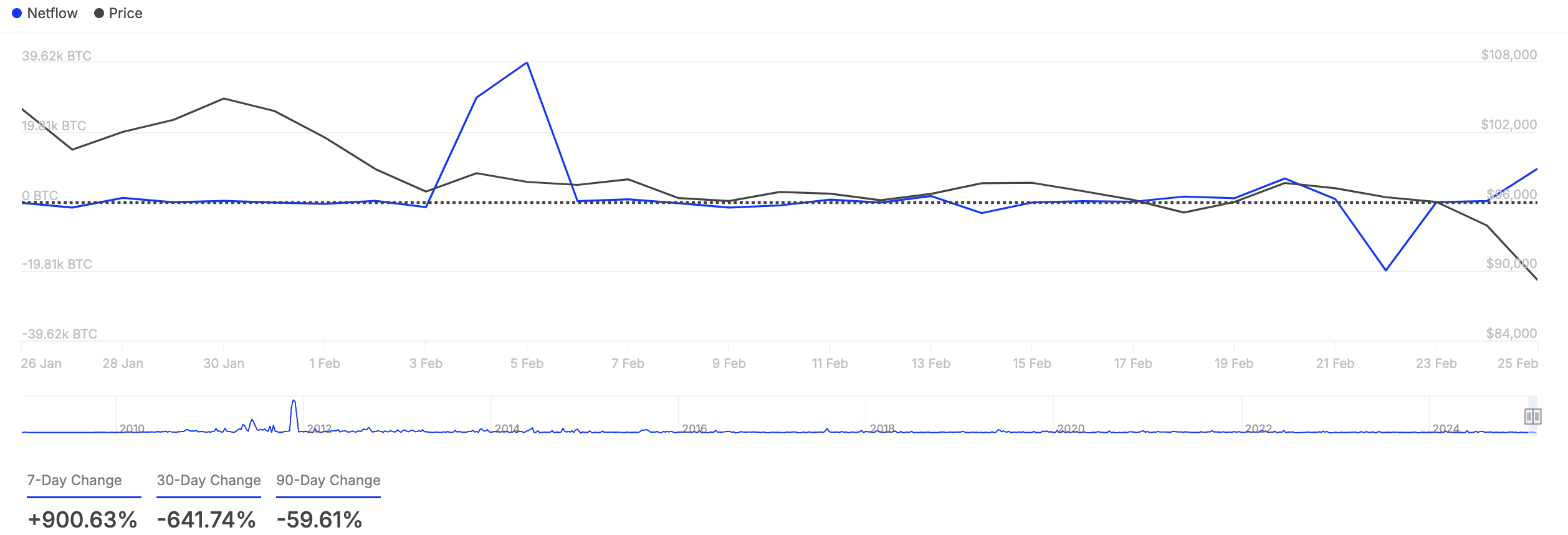

According to Brian, lead analyst at Santiment, Bitcoin whales continue to reduce their trading activity, increasing the likelihood of a further decline in the coin’s value.

“Bitcoin whales seem to have taken a bit of a breather and aren’t accumulating at the moment (mostly staying flat),” Brian told BeInCrypto.

The decline in Bitcoin’s large holders’ netflow corroborates Brian’s position. According to IntoTheBlock, the metric has plummeted by over 600% in the past 30 days.

Large holders refer to whale addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow tracks the amount of coins they buy and sell over a specific period.

When it falls, these key investors are reducing their token holdings, signaling increased selling activity. This may exacerbate the downward pressure on BTC’s price as supply increases in the market.

For John Glover, Ledn’s Chief Investment Officer (CIO), BTC will likely remain range-bound between $89,000 and $108,000 in March.

“From a technical perspective, BTC is following 1 of 2 paths. In the first place, there is a good potential for a dip to $89,000 or even $77,000 before the next rally. In the second, we have already seen the lows, and the next move will be higher, up to ~$130,000. It’s impossible to predict which path we’re on, and short-term predictions are meaningless when intraweek/intra-month moves are dictated by news and, recently, by the actions of big players like Strategy. My personal view is that we remain stuck in a range of $89,000 to 108,000 in March,” Glover said.

Further, given President Donald Trump’s pro-crypto stance, some investors wonder how his policies might impact Bitcoin’s price in March. However, Glover believes that most of the “Trump effect” has already played out.

“The majority of the “Trump effect” has already been felt. We know he is very supportive of digital assets and has set in motion his plans to streamline regulations associated with crypto. I don’t think he is a major factor in the short run,” Glover stated.

Bitcoin Nears Oversold Levels – Is a Rebound on the Horizon?

Bitcoin may be oversold and ready for a rebound, as reflected by its Relative Strength Index (RSI) readings. At press time, this momentum indicator is downward at 31.16.

The indicator measures an asset’s oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. On the other hand, values below 30 suggest that the asset is oversold and may witness a rebound.

BTC’s RSI reading suggests that it is nearing oversold territory. This hints at a possible rebound toward $92,325 if the selling pressure eases.

On the other hand, if this decline persists, the coin’s price could drop to $80,835.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market9 hours ago

Market9 hours agoBTC dips to $86k for the first since November amid market sell-off

-

Bitcoin9 hours ago

Bitcoin9 hours agoA Sign of Market Shifts?

-

Market24 hours ago

Market24 hours agoExperts Discuss How AI Agents Will Transform the Workplace

-

Market23 hours ago

Market23 hours agoThe Altcoins Trending Today – VANA, S, and TRUMP

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Predicts XRP Price To Hit $77 Despite Market Correction

-

Market22 hours ago

Market22 hours agoSEC Drops Uniswap Investigation After Coinbase and Robinhood

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Cost Basis Distribution Trends Downward – What Does This Mean For ETH?

-

Market21 hours ago

Market21 hours agoBlockchain Throughput is Overhyped, Claims Taraxa