Market

Crypto Liquidations Hit $1.5 Billion As Market Sentiment Slumps

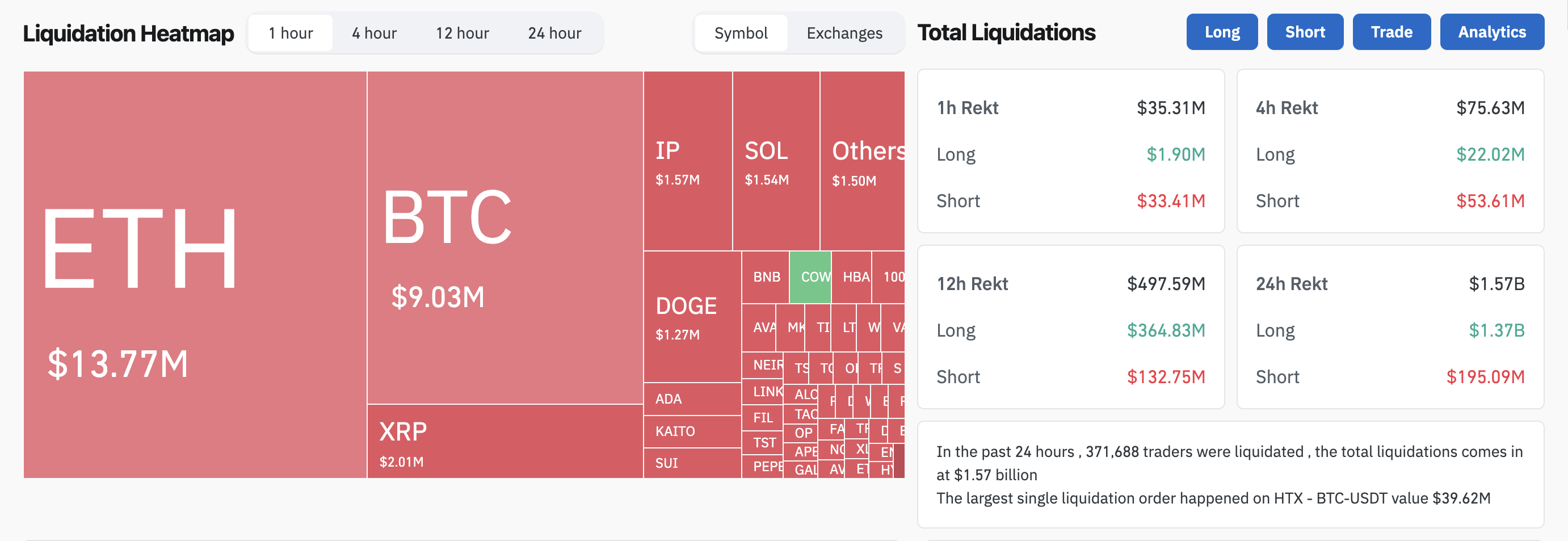

Crypto liquidations rise over $1.5 billion in 24 hours, pushing fears of a bear market. This is the third time in February that market liquidations have exceeded the billion mark in a 24-hour period.

However, even if the worst predictions come true, analysts think crypto is still well-positioned to consolidate and come back stronger by mid-2025.

Flash Crashes and Liquidations on the Rise

Rumors of a bear market are circulating throughout the crypto market. Bitcoin ETFs are seeing huge outflows with little sign of stopping, and this is having a negative effect on the asset’s price.

However, a broader look at the data shows heightened losses all across crypto, with over $1.5 billion in total liquidations in the last 24 hours:

Bitcoin is the biggest cryptoasset, and its declines are linked to a titanic ETF market, but it is not the biggest loser today. Ethereum was a standout for crypto liquidations, partially in the fallout from last week’s Bybit hack.

Bitcoin fell below $90,000 today, for the first time in over three months. The large amount of consecutive ETF outflows also reflects retreat from institutional investors.

Meanwhile, Ethereum saw the largest liquidations, as the fallout from last week’s Bybit hack is still visible to some extent. Most notably, today’s crash reflects a trend of frequent flash crashes in the market.

In 2025, the crypto market has witnessed four major crashes in a 24-hour window, driven by different macroeconomic factors.

Although the market has quickly recovered each time, the freuqency of these liquidations are concerning. However, it signals a clear trend that market sentiment is changing rapidly in the market, even more frequently than in previous cycles.

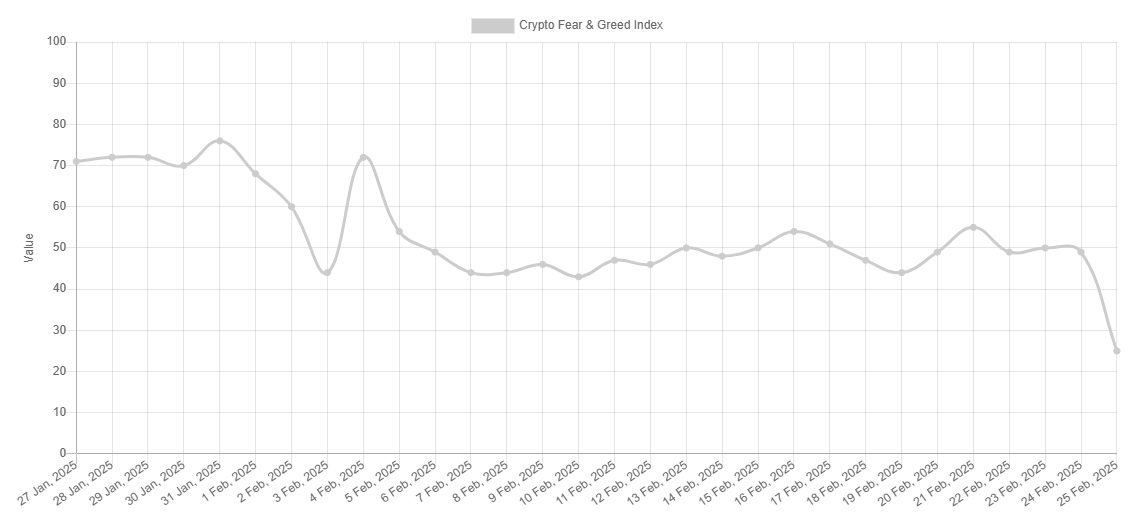

If we look at the fear and greed index from the past three months, this volatility in market sentiment is evident. Also, the market sentiment is currently at its lowest in 2025.

Despite these major crypto liquidations, not everybody in the industry is feeling bearish. Binance CEO Richard Teng claimed that these developments are a tactical retreat, not a reversal.

“Price movements often overshadow what’s happening beneath the surface, but the fundamental drivers of crypto growth remain firmly intact. Market corrections can feel unsettling, but they are also moments when experienced investors position themselves for the next bull trend. For those focused on the bigger picture, volatility presents an opportunity,” the Binance CEO claimed.

In other words, Teng encouraged pessimists to remember the cyclical nature of this industry. Massive crashes have happened before, and indeed, they will happen again.

All the leading crypto projects are facing liquidations; Solana’s price is at a four-month low and XRP is at its lowest point since December. Nonetheless, the industry has strong foundations.

The crypto industry’s political movement is still in its ascendancy, and institutional investors have a huge level of interest. Teng could only speak for his own firm, but Binance data shows a steady growth of new users.

Whenever the dust settles after these liquidations, the crypto community might find itself consolidated to pursue even larger gains.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Market Recovery: Analysts Weigh In

Bitcoin (BTC) is testing investor sentiment again as it hovers in a precarious position, teasing the possibility of a prolonged bear cycle.

Amid market uncertainty, analysts and traders are weighing in on the crypto market’s current state, debating whether the recent downturn is a signal of further losses or a setup for a major rebound.

Analysts Weigh Crypto Market Recovery

Julio Moreno, head of research at CryptoQuant, noted that on Wednesday, Bitcoin holders realized the largest single-day loss since August 2024, totaling a staggering $1.7 billion. This significant sell-off suggests widespread panic among traders, with many choosing to cut their losses as Bitcoin dipped below key support levels.

“Bitcoin holders realized today the largest loss since August 2024: $1.7 billion,” noted Moreno.

Meanwhile, market analyst Miles Deutscher highlighted that the Crypto Fear and Greed Index, a widely followed sentiment indicator, has plunged to its lowest since October 2024. In his opinion, however, extreme fear in the market could be a precursor to a price reversal, indicating that Bitcoin might be approaching a critical turning point.

“People are finally getting nervous again. Believe it or not, that’s exactly what we need to eventually form a bottom,” he explained.

In another observation, Deutscher pointed out that BTC exchange inflows hit their highest level of the year amid the recent market turmoil. This suggests that traders rushed to liquidate their holdings as Bitcoin dipped below the $90,000 mark.

However, he also speculated that such panic-driven selling could set the stage for an unexpected bounce, potentially catching those who sold off guard.

Mark Cullen, an analyst at AlphaBTC, weighed in on the situation, highlighting the role of market makers in stabilizing the price. According to Cullen, a Binance exchange market maker stepped in to prevent a deeper crash, recognizing that a further decline could trigger a widespread capitulation event.

“They know Bitcoin breaking any lower will cause a crypto market-wide crash and customers leaving with burnt fingers,” he stated.

Despite the intervention, Cullen remains cautious, suggesting that a temporary bounce may occur before the next leg down. While he does not expect an immediate crash, he did not rule out another drop to the $87,000 range to establish a higher low before a potential recovery.

M2 Money Supply Model Predicts Bitcoin Surge in March

Some analysts are eyeing March 2025 for a potential bullish turn. Colin Talks Crypto, a well-known crypto analyst, pointed to the strong correlation between Bitcoin’s price movements and the global M2 money supply.

His model suggests that Bitcoin’s price often reacts to changes in liquidity with a lag of approximately 46 days. According to the model, Bitcoin is expected to see a significant upward move around March 7, 2025, though this timeline could shift earlier based on recent trends.

The decreasing lag time between M2 movements and Bitcoin’s response suggests that increased global liquidity could soon boost BTC prices. While the correlation is imperfect, it has historically been a strong directional signal for Bitcoin’s price trends.

“It’s an uncanny correlation and it’s too close, in my opinion, to be coincidence,” the analyst quipped.

If the M2 Money Supply model holds, Bitcoin could be set for a recovery in early March. However, volatility remains the dominant theme in the short term, and traders should brace for potential bounces as macroeconomic factors influence institutional sentiment.

“… the price needs to recover above $96,000-$100,000, which will confirm the market’s readiness for new growth. If the pressure persists, the market may enter a phase of a deeper correction,” StealthEx CEO Maria Carola shared with BeInCrypto.

Adding to the bearish pressure, Bitcoin ETFs have recorded substantial net outflows. As BeInCrypto reported, Institutional investors, who played a major role in Bitcoin’s rally to new highs, appear to be pulling funds out of the market, raising concerns about further downside risk.

“This process [institutional redemptions] puts significant pressure on the BTC rate since issuers are forced to sell the asset to cover withdrawal requests,” MEXC COO Tracy Jin told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Investors Accumulate As Price Falls Below $2,500

Ethereum has recently struggled to maintain upward momentum after failing to break above the $2,800 resistance. The altcoin king’s price experienced a steep decline due to broader market bearish conditions, causing it to fall below $2,500.

Despite the downturn, Ethereum investors have remained confident, seizing the opportunity to accumulate at lower price levels.

Ethereum Investors See An Opportunity

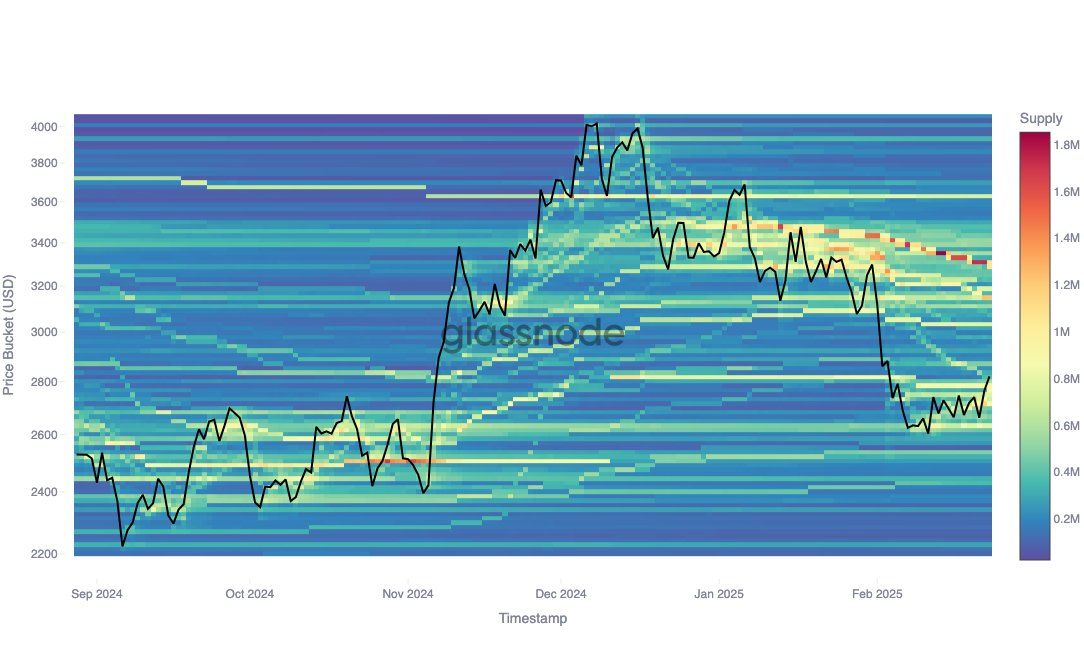

Ethereum’s market sentiment reveals investor conviction through the Cost Basis Distribution (CBD) data. According to Glassnode, the CBD shows that investors have consistently accumulated Ethereum even as the price dropped. Multiple cost bases are moving lower, indicating that market participants are taking advantage of the price dip.

The data reveals significant support at $2,632, with 786,660 ETH being acquired at this level, and resistance at $3,149, where 1.22 million ETH has been accumulated. This support and resistance range is crucial for Ethereum’s price stability, as it reflects where large groups of investors are buying or selling. As Ethereum’s price continues to trade within these zones, the market remains cautiously optimistic.

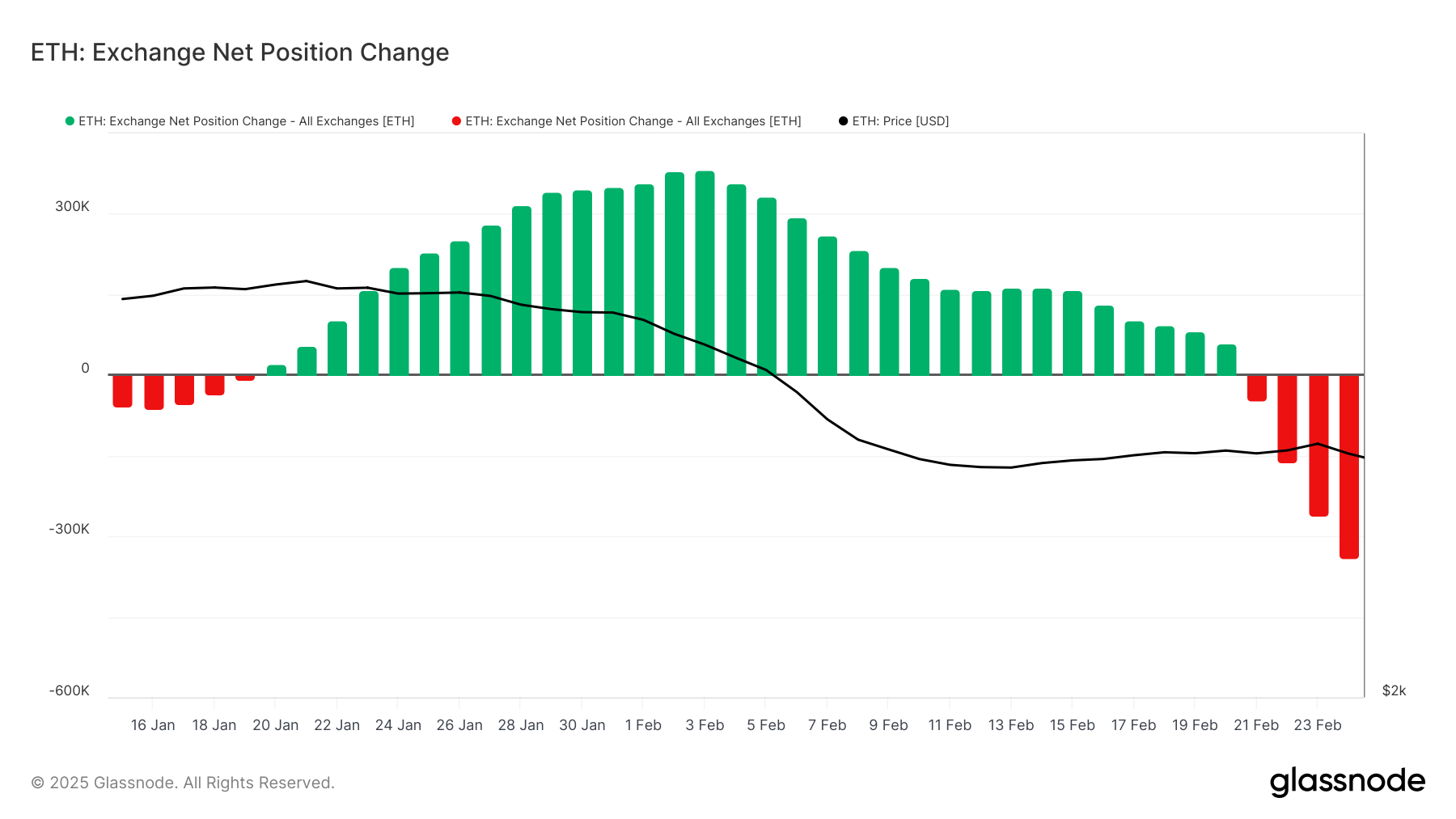

Ethereum’s macro momentum remains solid despite recent price declines. Ethereum’s exchange net position change shows a notable shift, with 178,500 ETH flowing out of exchanges over the last 48 hours.

This indicates that investors are moving their holdings off exchanges, possibly to hold long-term in anticipation of future gains. The outflows amount to roughly $444 million, signaling strong investor confidence in Ethereum’s recovery once the bearish trend subsides.

ETH Price Needs To Break This Pattern

Ethereum’s price currently sits at $2,486, marking an 11% drop over the past 48 hours. This decline follows a failed attempt to break above the $2,793 resistance, keeping Ethereum in a near 3-month-long downtrend. However, despite being below $2,500, Ethereum’s future price action shows potential for recovery.

The altcoin could see a rebound if it successfully flips the $2,654 level into support. If Ethereum manages to reclaim this level, it could potentially break above $2,793 again, aiming for the psychological $3,000 mark.

However, if Ethereum fails to reclaim $2,654 and struggles under the weight of continued market bearishness, the price could dip further to $2,344. Such a scenario would extend losses and possibly invalidate the current bullish outlook, leaving investors awaiting clearer signs of a price reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Takes a Hit—Is This Just the Beginning?

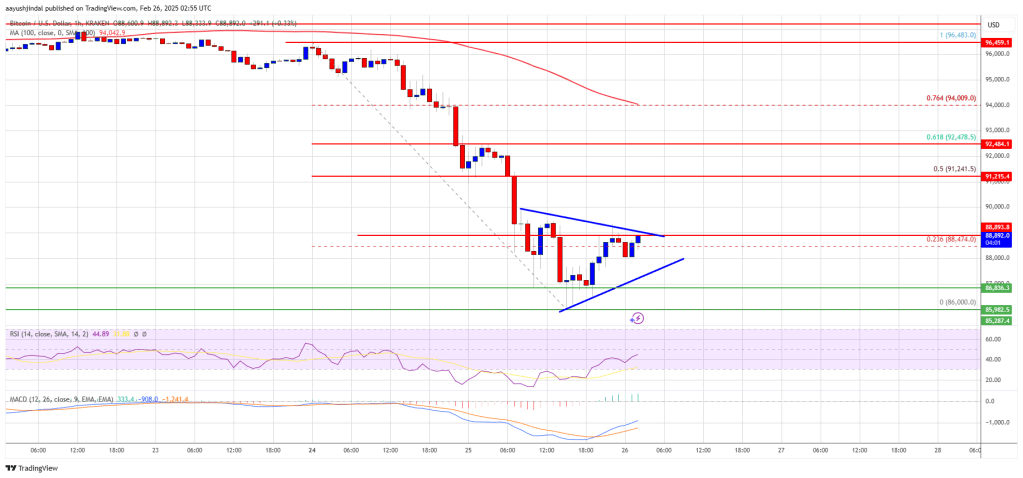

Bitcoin price started a fresh decline below the $90,000 support. BTC must stay above the $86,000 zone to avoid more losses in the near term.

- Bitcoin started a fresh decline from the $95,500 zone.

- The price is trading below $90,000 and the 100 hourly Simple moving average.

- There is a short-term triangle forming with resistance at $89,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another decline if it fails to stay above the $90,000 zone.

Bitcoin Price Dips Sharply

Bitcoin price failed to stay above the $95,500 level and started a fresh decline. BTC declined heavily below the $93,200 and $92,200 support levels.

The price even dived below the $90,000 level. It tested the $86,000 zone. A low was formed at $86,000 and the price is now consolidating losses. It is back above the $88,500 level and the 23.6% Fib retracement level of the downward move from the $96,482 swing high to the $86,000 low.

Bitcoin price is now trading below $91,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $89,000 level. There is also a short-term triangle forming with resistance at $89,000 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $90,000 level. The next key resistance could be $91,250 or the 50% Fib retracement level of the downward move from the $96,482 swing high to the $86,000 low.

A close above the $91,250 resistance might send the price further higher. In the stated case, the price could rise and test the $93,500 resistance level. Any more gains might send the price toward the $95,000 level or even $96,400.

Another Decline In BTC?

If Bitcoin fails to rise above the $90,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $88,000 level. The first major support is near the $87,250 level.

The next support is now near the $86,000 zone. Any more losses might send the price toward the $85,000 support in the near term. The main support sits at $83,200.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $88,000, followed by $86,000.

Major Resistance Levels – $90,000 and $91,250.

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin ร่วงหนัก! Saylor ยังซื้อเพิ่ม เชื่อมั่นระยะยาว

-

Market15 hours ago

Market15 hours agoLatest crypto crash leaves Bitcoin Pepe unscathed

-

Market24 hours ago

Market24 hours agoLINK Sudden Breakdown Sparks Fears Of Collapse To $12.5 Support Zone

-

Altcoin24 hours ago

Altcoin24 hours agoWill US SEC Approve Grayscale’s XRP ETF This Week?

-

Ethereum23 hours ago

Ethereum23 hours agoTime To Turn Bullish On Ethereum? CryptoQuant CEO Thinks So

-

Market23 hours ago

Market23 hours agoPi Coin Price Aims for New All-Time Highs Even as Bears Weigh In

-

Market16 hours ago

Market16 hours agoEthereum Whales Pause Buying, Price Could Drop Below $2,200

-

Ethereum15 hours ago

Ethereum15 hours agoExpert Analysis Highlights 4 Strong Bullish Indicators