Market

XRP Price Continuation After Crash Below $2.4? New Targets Emerge

XRP’s recent price movements have followed a pattern that crypto analyst Javon Marks believes signals the potential for a strong continuation rally. Sharing his analysis on the social media platform X, Marks pointed to a “hidden bullish divergence” on XRP’s daily candlestick chart. Despite the ongoing price crash, the presence of this bullish divergence opens up new bullish targets for the XRP price.

XRP’s Price Crash Worsens, But Hidden Bullish Divergence Suggests Next Move

XRP’s price action has faced consistent downward pressure over the past week, with the decline intensifying in the past 24 hours. At the time of writing, XRP has dropped by approximately 13% in the past 24 hours and is on the verge of retesting a crucial support level at $2.

Related Reading

However, an interesting analysis shows that this decline is part of a hidden bull divergence pattern, where both the price and the RSI indicators are creating a series of highs and lows on the 1-day candlestick timeframe. This interesting pattern is characterized by higher lows and higher highs on the XRP price chart, while there’s a series of lower lows and lower highs on the RSI indicator. This divergent formation between the cryptocurrency’s price and the RSI is known to be bullish. Particularly, it suggests the selling pressure shown by the RSI could be slowing down.

Javon Marks emphasized that XRP is preparing for a “massive continuation wave up” and that the necessary technical confirmations for such a move are already in place. This assertion builds upon his earlier February 18 analysis, where he described the hidden bullish divergence as forming in a “textbook fashion.

Crash To Reverse Soon? Price Targets To Watch

According to Javon Mark’s projection, an upside move would see the XRP price eventually creating a higher high, as expected from the bullish divergence pattern. In terms of a specific price target, Mark’s projection shows that the next peak could reach at least $3.80. If realized, this would push XRP beyond its current all-time high of $3.40.

Related Reading

However, this outlook hinges on the XRP price holding above the bullish divergence support at $2. Any sustained breakdown below this threshold could challenge the strength of the projected rally and alter the bullish outlook.

Adding to this perspective, Marks also noted the similarity between XRP’s consolidation in the past few weeks since it reached $3.36 and that of a consolidation after a strong rally in the first half of 2017 after a strong rally.

Although the current consolidation phase has lasted longer than the one observed back then, both formations share key structural similarities. The 2017 consolidation ultimately led to a continuation rally that pushed the XRP price to new highs. If history repeats itself, the present consolidation could also be a precursor to another significant leg up.

At the time of writing, XRP is trading at $2.15, down by 13.2% and 15.9% in the past 24 hours and seven days, respectively, and is now in danger of losing the $2.0 support soon.

Featured image from Adobe Stock, chart from Tradingview.com

Market

XRP Futures Traders Go Short as Price Drop Worsens

The broader market downturn since the beginning of February has affected XRP’s price. The fourth largest crypto by market capitalization has lost 10% of its value over the past week and now trades at $2.30.

This decline has intensified bearish sentiment, leading XRP futures traders to increase their short positions against any potential recovery.

XRP Faces Strong Selling Pressure as Bearish Sentiment Deepens

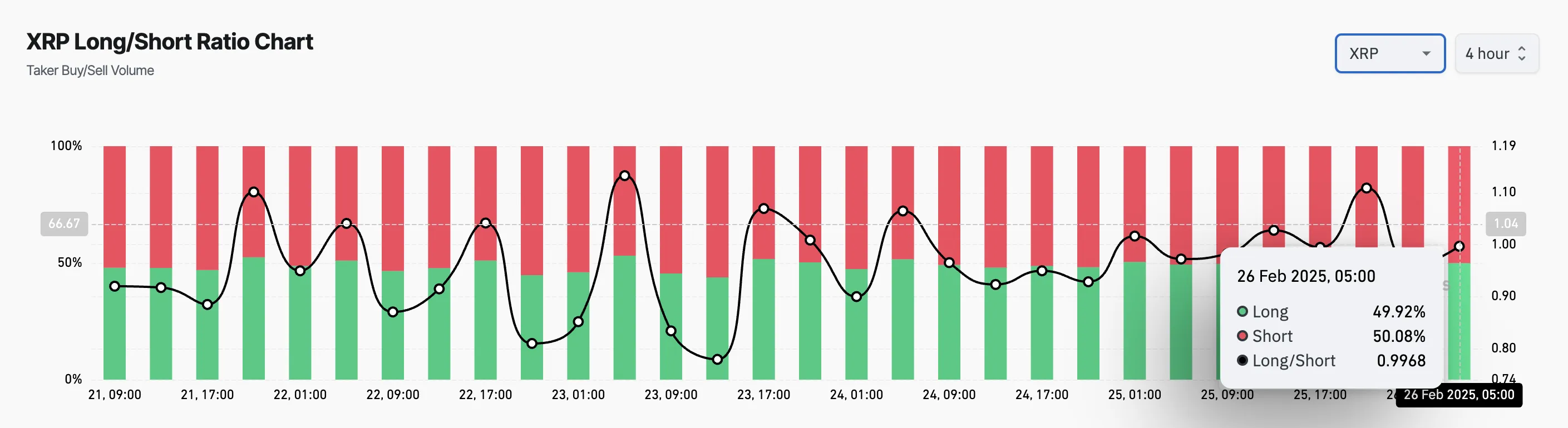

XRP’s persistent price dip has strengthened the bearish bias against it by its future traders. On-chain data reflects the pessimism as XRP’s long/short ratio indicates that more traders are betting on further downside rather than a rebound this week. As of this writing, this ratio stands at 0.99.

An asset’s long/short ratio compares the number of long positions (bets that the price will rise) to short positions (bets that the price will fall) in the market. When the ratio is above 1, there are more long than short positions, indicating that more traders are betting on a price increase.

Converesly, as in XRP’s case, a ratio below one suggests that traders are largely betting on a price decline. This signals a strong bearish sentiment in the market, reinforcing the likelihood of further downside.

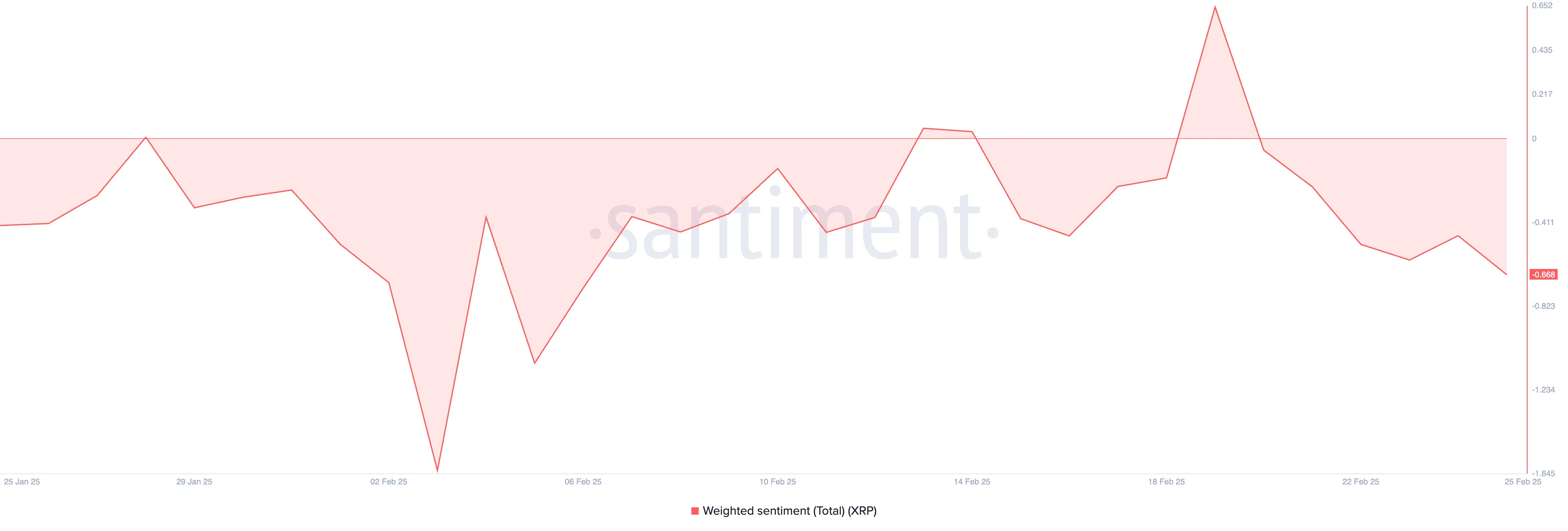

In addition, XRP’s negative weighted sentiment confirms this bearish bias. At press time, this metric is below zero at -0.66.

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the sentiment expressed in those mentions. When it is negative, as in the case of XRP, it is a bearish signal.

It suggests that XRP investors are increasingly skeptical about its near-term outlook, prompting them to trade less and worsening the price dip.

XRP Teeters on Key Support

Since reaching an all-time high of $3.40 on January 16, XRP has traded within a descending triangle. This bearish pattern is formed when an asset’s price creates lower highs while maintaining a strong support level, resulting in a downward-sloping trendline that converges with a horizontal base.

The pattern indicates that sellers are gaining control, and a breakdown below support could lead to further declines. At press time, XRP trades at $2.30, slightly above this support formed at $2.27.

If this line breaks, XRP’s price could drop to $2.13. If selling pressure gains momentum at this level, the token’s value could further dip toward $1.47.

On the flip side, if market sentiment becomes bullish, it would drive up XRP’s demand and could cause its price to break above the descending triangle to reach $2.81.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Moves Higher—But Is This Just a Temporary Bounce?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

BTC dips to $86k for the first since November amid market sell-off

Key takeaways

- BTC dipped to the $86k level for the first time since November 2024.

- The Bitcoin Pepe presale has surpassed $3.5m as investors eye stage six.

Bitcoin falls to a three-month low as total crypto market cap dips below $3T

The cryptocurrency market has been bearish since the start of the week. Bitcoin is down by nearly 4% in the last 24 hours and briefly touched the $86k level on Tuesday. The dip was BTC’s lowest level in three months as the broader crypto market experienced a massive sell-off.

At press time, the price of Bitcoin stands at $88,752 and could continue with its recovery if the bulls regain control. The total cryptocurrency market cap also dropped below $3 trillion as Ether and other altcoins underperformed.

What is Bitcoin Pepe?

Bitcoin and other major cryptocurrencies have been underperforming over the last few days. However, investors could consider the dip as an opportunity to purchase more tokens before a possible market recovery.

Investors also continue to push funds into new and exciting projects. Bitcoin Pepe is one of the projects gaining ground in its presale thanks to its unique value proposition to investors.

Bitcoin Pepe is a project seeking to leverage the liquidity and security of the Bitcoin blockchain. The project will use Bitcoin’s position in the market to introduce memecoins to its ecosystem.

According to the official website, Bitcoin Pepe is a layer-2 network building on the Bitcoin blockchain. This project is a meme-specialized layer-2 solution built on top of Bitcoin, bringing Solana-style scalability to the Bitcoin network.

The layer-2 network will enable Bitcoin Pepe to become home to all memecoin trading and move all this economic activity to the BTC ecosystem. It will unlock decentralized finance (DeFi) and meme trading on top of BTC.

Bitcoin Pepe is also the first-ever meme initial coin offering (ICO) on the Bitcoin blockchain, making it the perfect fusion between BTC’s security and the unstoppable force of memecoins.

The project will make it easy for BTC Maxis to trade memes. Combining high levels of trust (BTC) with high levels of performance (SOL) will lead to high levels of retail mass adoption.

Bitcoin Pepe presale to enter stage six, raises over $3.5m

The Bitcoin Pepe presale is two weeks old and has raised over $3.5 million so far. The presale will enter the sixth stage in the coming hours or days, with the $BPEP price set to slightly increase.

$BPEP, Bitcoin Pepe’s native token, can be purchased using various cryptocurrencies, including ETH, USDT, USDC, BNB, and SOL. In this fifth presale stage, $BPEP is going for $0.0255 and is set to increase to $0.0268 in the next stage. The Bitcoin Pepe presale could be an opportunity to purchase $BPEP at a discount.

Will Bitcoin Pepe improve the Bitcoin ecosystem?

Bitcoin Pepe will unveil products and services that would make memecoins available on the Bitcoin blockchain. While Bitcoin is the leading cryptocurrency in the world, its blockchain isn’t as versatile as Ethereum or Solana.

This project wants to change this narrative by introducing new utilities to the Bitcoin blockchain. With Bitcoin Pepe, memecoins can launch on the Bitcoin blockchain with ease. Introducing memecoins on the Bitcoin blockchain will enable it to become home to a crazy high-octane meme experience.

Bitcoin Pepe is set to unlock $2 trillion in dormant BTC capital and make it available for memecoin trading. This layer-2 network will provide the necessary infrastructure for all memes to migrate to BTC, ensuring security and liquidity for investors and users. Its native $BPEP token will power several activities within the Bitcoin Pepe L2 network.

Should you buy the $BPEP token ahead of the sixth presale stage?

The Bitcoin Pepe presale is heading into its sixth stage in the coming hours or days, with the token price set to increase slightly. This could be an excellent opportunity to get in on the project as presales allow investors to gain early exposure to projects.

Bitcoin Pepe is working hard to become the leading L2 network on the Bitcoin blockchain, offering users security and liquidity. By ushering in the era of memecoins, Bitcoin Pepe could become one of the most important projects within the Bitcoin ecosystem. The presale allows investors to purchase its native token at a discount before it goes live on trading platforms.

-

Market22 hours ago

Market22 hours agoGrayscale Pushes for Polkadot ETF as Nasdaq Submits SEC Filing

-

Altcoin22 hours ago

Altcoin22 hours agoThe Best Presale Coins and AI Projects Rise Amid Major Market Slump Caused by Bybit Hack

-

Market21 hours ago

Market21 hours agoLINK Sudden Breakdown Sparks Fears Of Collapse To $12.5 Support Zone

-

Altcoin21 hours ago

Altcoin21 hours agoWill US SEC Approve Grayscale’s XRP ETF This Week?

-

Market23 hours ago

Market23 hours agoWeekly Price Analysis: Prices Range on Uncertain Economic Outlook

-

Altcoin23 hours ago

Altcoin23 hours agoHere’s Why Crypto Market Faces $325 Bln Loss

-

Market17 hours ago

Market17 hours agoExperts Discuss How AI Agents Will Transform the Workplace

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Predicts XRP Price To Hit $77 Despite Market Correction