Market

SEC Drops Uniswap Investigation After Coinbase and Robinhood

The SEC dropped its investigation into Uniswap Labs, causing the UNI token to briefly jump while bearish conditions still dominate the market. Despite the volatility, it has been a positive month for the decentralized exchange, as it launched the v4 upgrade and Unichain mainnet this month.

Uniswap’s CEO Hayden Adams claimed that TradFi regulations are not applicable to the crypto space and that new ones are required. Now that another enforcement case has been dropped, pressure is building to create these friendlier regulations.

SEC Vs Uniswap Ends Without Any Enforcement

When the SEC sent a Wells Notice to Uniswap last year, it kicked off a year-long investigation. The Commission claimed it was an operated unregistered broker, exchange, and clearing agency and issued an unregistered security.

In response, the industry rallied behind it. This probe, which was considered integral to the future of DeFi, has now been dropped by the SEC.

“This is a huge win, not just for Uniswap Labs but for DeFi as a whole. I’m grateful that the new SEC leadership is taking a more constructive approach, and I look forward to working with Congress and regulators to help create rules that actually make sense for DeFi. The best days for DeFi are ahead,” claimed Uniswap CEO Hayden Adams.

The quiet end to the Uniswap case is part of a new trend at the SEC. Since President Trump’s term began last month, the Commission has been dropping crypto enforcement suits left and right. In the last few days, it dropped a major suit against Coinbase, while ending investigations into Opensea and Robinhood.

Now that the SEC has dropped its case, Uniswap’s UNI token can breathe a little easier. Over the past month, its price has suffered a 30% drop. Even the long-awaited v4 update and the Unichain launch did not have any notable impact.

Despite the stale price movements, UNI jumped briefly after the SEC’s announcement, indicating some positive outlook. Also, the token’s daily trading volume surged over 140% today, according to CoinMarketCap data.

A New Future for Crypto Enforcement

It will be interesting to see how this development fits into a broader mosaic of federal crypto policy.

In his statement, Adams claimed that “decentralized technology and self-custody are inherently different” from TradFi and that they should be held to different regulations. This is a common refrain, and the SEC is working to receive constructive industry feedback.

To sum it up, The SEC is dropping a lot of enforcement cases made under Gary Gensler’s interpretation of the law, and Uniswap is part of that trend.

However, as the Commission changes its focus, it also puts pressure on developing this constructive new regulatory environment. Crypto has a real chance to chart its own future, but it must comply with the new rules it helps create.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Aya Miyaguchi Leads Ethereum Foundation as President

The Ethereum Foundation has undergone a major leadership transition. Aya Miyaguchi, who served as Executive Director for seven years, has stepped into the role of President.

On February 25, Miyaguchi announced her move, marking a significant shift in the foundation’s leadership structure.

Aya Miyaguchi Becomes Ethereum Foundation’s President

In the latest blog, Miyaguchi explained that the shift would allow her to focus more on institutional relationships and expanding Ethereum’s cultural and philosophical influence.

“It’s been amazing to witness this growth of the ecosystem. Seven years ago, when I joined EF, Ethereum had fewer voices. Participation—both in building and securing the network—was concentrated in fewer hands and regions,” the blog post read.

Nonetheless, Miyaguchi emphasized that the network has evolved significantly, transforming into a decentralized and diverse ecosystem. She highlighted that a wide array of contributors—including developers, Layer 2 teams, application builders, and local communities—actively shape its future.

She added that this expansion has bolstered Ethereum’s resilience and reinforced its commitment to decentralized, community-driven growth.

“This richness—where technical and social innovation intertwine and influence each other—isn’t just a feature of Ethereum; it’s the reason it endures,” Miyaguchi stated.

Ethereum co-founder Vitalik Buterin also praised Miyaguchi’s leadership, crediting her for Ethereum’s cultural and organizational stability.

“Every success of the EF – the steady execution of Ethereum hard forks, client interop workshops, Devcon, Ethereum’s culture and steadfast commitment to its mission and values, and more – is in part a result of Aya’s stewardship,” Buterin wrote.

Notably, discussions about Miyaguchi’s transition began a year ago. Just last month, Buterin confirmed that major leadership restructuring was underway.

However, Miyaguchi faced criticism from segments of the Ethereum community regarding the Ethereum Foundation’s leadership direction. Some community members, including a core developer, Eric Conner, pushed for Danny Ryan to be appointed the Executive Director.

The situation escalated when certain users resorted to harassment against Miyaguchi, demanding her resignation. Amid this turmoil, Conner even left the Ethereum Foundation.

Ethereum Pectra Upgrade Fails on Testnet

Meanwhile, the leadership shift coincides with technical challenges facing Ethereum’s development pipeline. Holesky, an Ethereum testnet, faced a major issue during the Pectra upgrade.

According to the report by Ether World, the issue stemmed from a misconfiguration in deposit contract tracking among Execution Layer (EL) clients.

This prevented most clients from correctly tracking validator deposits, disrupting network consensus. Minority clients continued producing valid blocks, highlighting inconsistencies in client implementations.

The issue was specific to Holesky, with the mainnet and other test environments unaffected. Despite the disruption, the incident provided valuable insights into Ethereum’s resilience and upgrade process.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Attempts Recovery—Can It Break $2,500?

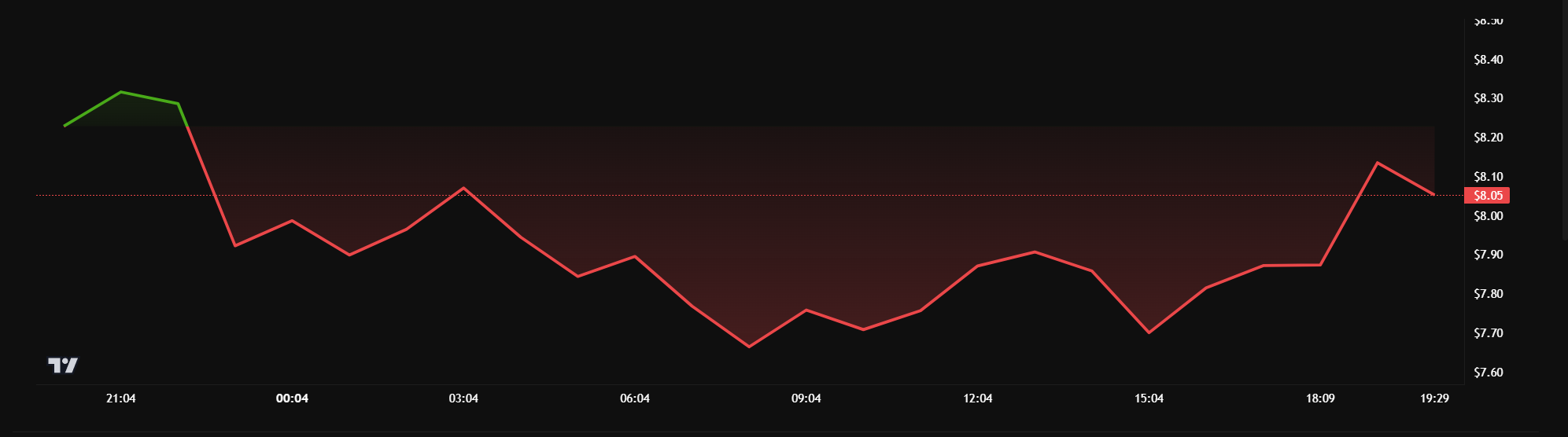

Ethereum price started a fresh decline from the $2,550 resistance zone. ETH is down over 10% and now attempts a recovery wave from the $2,300 zone.

- Ethereum is facing an increase in selling below the $2,550 zone.

- The price is trading below $2,550 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $2,500 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a decent upward move if it settles above $2,500 and $2,550.

Ethereum Price Dives Over 10%

Ethereum price failed to clear the $2,650 resistance zone and started a fresh decline, like Bitcoin. ETH gained pace below the $2,620 and $2,550 support levels to enter a bearish zone.

The price declined over 10% and even declined below the $2,500 support zone. A low was formed at $2,309 and the price is now consolidating losses. There was a minor recovery wave above the 23.6% Fib retracement level of the downward move from the $2,855 swing high to the $2,309 low.

Ethereum price is now trading below $2,550 and the 100-hourly Simple Moving Average. There is also a short-term bearish trend line forming with resistance at $2,500 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $2,500 level. The first major resistance is near the $2,580 level or the 50% Fib retracement level of the downward move from the $2,855 swing high to the $2,309 low.

The main resistance is now forming near $2,650. A clear move above the $2,650 resistance might send the price toward the $2,720 resistance. An upside break above the $2,720 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,850 resistance zone or even $2,920 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $2,580 resistance, it could start another decline. Initial support on the downside is near the $2,420 level. The first major support sits near the $2,350 zone.

A clear move below the $2,350 support might push the price toward the $2,300 support. Any more losses might send the price toward the $2,200 support level in the near term. The next key support sits at $2,120.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $2,420

Major Resistance Level – $2,580

Market

Pi Network Stabilizes, But Unverified Market Cap Fuels Concerns

Pi Network’s token price finally stabilized after a market correction, staying steady despite broader volatility. The token’s daily trading volume also reached $500 million.

PI is also experiencing high inflation, and its market cap claims remain unverified.

Pi Network Shows Stability

Pi Network, a blockchain project that’s taken the crypto space by storm, is having an eventful few days. Binance updated the results of its recent community vote to list the token, confirming that the proposal had 86% support. However, its listing decision is still pending.

Despite broader concerns about a possible bear market, the altcoin is stabilizing after a brief market correction.

As March 14 (Pi Day) approaches, some fans are anticipating a major announcement from developers. The project’s official X account surpassed Ethereum’s follower total and is currently the fourth-most-followed crypto account on the website.

Of course, the recent Pi airdrop was the most valuable airdrop in history at $12.6 billion, so making an even bigger announcement would be difficult.

Over the last five days, 200 million Pi tokens have been put into circulation. This translates to an inflation rate of 0.634% per day and 231.41% per year, which are extremely high.

Also, CoinMarketCap data shows that PI’s market cap has exceeded $10 billion, which places it among the top 15 cryptocurrencies in the market. Yet, the platform has not updated its ranking, potentially because the market cap is self-reported and not independently verified.

“Pi Network is currently ranked at 3157 on CoinMarketCap due to its unverified market cap and circulating supply. But if the self-reported supply is accurate, Pi would have over a $10 billion market cap, placing it at 11-12,” wrote poular influencer Zoe.

Nonetheless, these claimed numbers are still unverified, and Pi Network has some harsh critics. Ben Zhou, CEO of Bybit, loudly called the project a scam, reminding his followers that the Chinese government regards the project as an outright pyramid scheme.

CoinMarketCap is apparently reluctant to list the token as a top contender at this early stage. Other major data tracking platforms like CoinGecko omitted the token’s market cap.

In short, the recent news cycle about the Pi Network has been very chaotic. Its supporters continue to build up the project’s international notoriety, but critics wonder if the whole enterprise is a bubble.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours ago칸예 밈코인, 러그풀 우려 제기…모금액 400만 달러 임박한 밈인덱스가 제안하는 안전 밈코인 투자 솔루션

-

Market24 hours ago

Market24 hours agoEthereum Price Sinks 10% – Is This a Buying Opportunity?

-

Market17 hours ago

Market17 hours agoGrayscale Pushes for Polkadot ETF as Nasdaq Submits SEC Filing

-

Altcoin17 hours ago

Altcoin17 hours agoThe Best Presale Coins and AI Projects Rise Amid Major Market Slump Caused by Bybit Hack

-

Market16 hours ago

Market16 hours agoLINK Sudden Breakdown Sparks Fears Of Collapse To $12.5 Support Zone

-

Altcoin21 hours ago

Altcoin21 hours agoTRUMP & MELANIA Whale Dumps Rise Amid Market Crash, Is PolitiFi Frenzy Over?

-

Market20 hours ago

Market20 hours agoXRP Price Settles Lower—Will Sellers Push It Further Down?

-

Market23 hours ago

Market23 hours agoMoca Network on Fixing Fragmented Digital Identity in Web3