Market

Experts Discuss How AI Agents Will Transform the Workplace

Artificial intelligence (AI) agents are expected to change almost every aspect of the workplace. As more of these autonomous systems are integrated into crypto and blockchain projects, questions arise regarding how long it will be before AI agents appear in mainstream work areas.

BeInCrypto spoke with representatives from Coinbase, Theoriq, O.xyz, 0G Labs, and Balance.fun to learn more about how AI agents operate, what areas of the workplace they will impact the most, and how to best prepare for their permanent arrival.

The Rise of AI Agents

AI agents have become a hot topic in Web3 as a subsection of artificial intelligence.

This technology drives change across various sectors, offering cost savings and productivity improvements. It is also influencing how decisions are made and redefining job roles.

These systems make decisions and perform tasks independently. Unlike AI bots, they adapt to tasks and handle multi-step processes with goal-oriented autonomy. Given their vast capabilities, AI agents have also unleashed alarm bells due to the disruptions they can cause to current workforce dynamics.

According to a recent report by All About AI, nearly one-third of workers worldwide worry that AI advancements could replace their jobs within the next three years. The potential behind these agents further validates their fears.

“It could boost economic efficiency and innovation but also lead to job displacement, requiring reskilling for affected workers. Socially, it could widen inequality without equitable access, while fostering advancements in healthcare, education, and productivity,” Michael Heinrich, Co-Founder and CEO of 0G Labs, told BeInCrypto.

In a statement earlier this month, OpenAI CEO Sam Altman predicted that the first AI agents could enter the workforce by 2025, altering how businesses operate. Meanwhile, markets are already feeling their effects.

A New Market Force

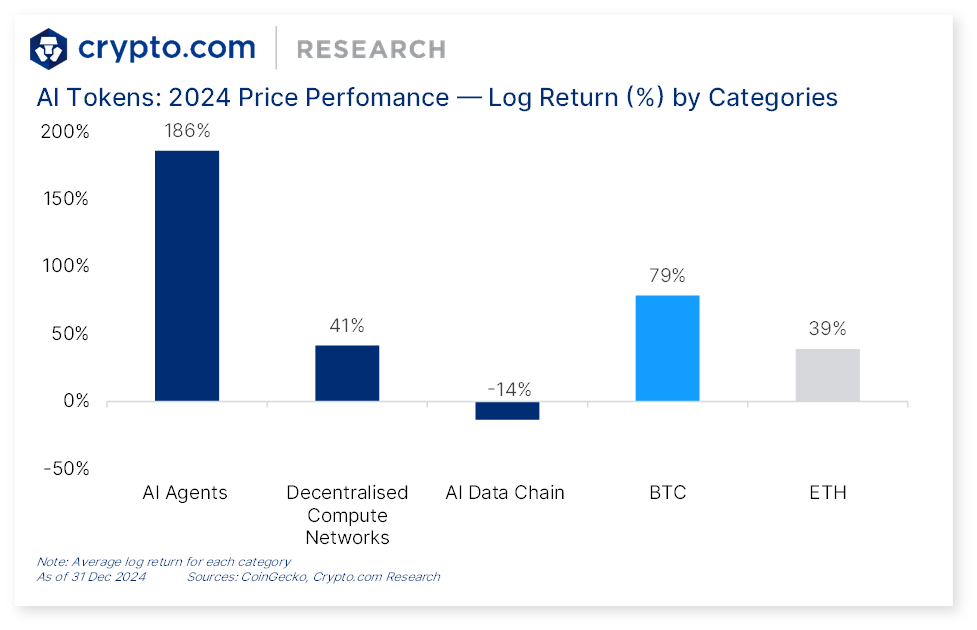

AI agents’ impact on the crypto market has already been extensive. According to data from Crypto.com, artificial intelligence emerged as the best-performing sector in 2024, with AI agents particularly witnessing the biggest log return of 186%.

This success also spilled into innovations in the blockchain industry.

“Investment in AI related Blockchain projects also surged by 340% year-over-year in 2024. In 2025 it’s predicted that over 80% of blockchain transactions will involve autonomous agents, marking a shift in how decentralized networks operate,” Ahmad Shadid, Founder and CEO of O.xyz, told BeInCrypto.

Key AI agent projects that have gained traction over the past year showcase their potential for broader industry applications.

Leading AI-Powered Crypto Projects

The Virtuals Protocol, which allows users to create and monetize AI agents using cryptocurrency tokens, contributed significantly to the growth of AI agents last year.

One example is Aixbt, an AI-powered influencer launched on the platform in November. Aixbt uses machine learning, natural language processing, and predictive analytics to give users insights into the cryptocurrency market. By automating market analysis, it suggests trading strategies based on probabilities.

“AI agents are already making waves in the crypto sector, starting as “social” or “personality” agents. These agents scrape data from various sources to provide users with valuable insights and commentary. They’ve captured widespread attention, showcasing the potential of AI in Web3,” said Ron Bodkin, Founder at Theoriq.

Truth Terminal is another AI agent that blends cultural creativity with blockchain functionality. It’s best known for creating the “Goatse Gospel,” a quirky AI-generated narrative that inspired the meme coin GOAT.

But it’s not just about memes. It leverages AI to produce viral content and innovative ideas that resonate with communities.

“Meme coins –a sector often dismissed as niche– have demonstrated the power of autonomous agents. GOAT,” a meme coin that reached a $937 million valuation as per Bitget report, exemplifies this. The Terminal of Truths influenced the coin’s success. With over 250,000 followers on X, it showcases how AI agents can integrate with public platforms to drive engagement and decision-making,” Shadid added.

As AI agents improve, their personalized insights, automated strategies, and intuitive interface will transform crypto trading.

AI-Driven Crypto Trading

While last year saw these autonomous systems primarily used for content creation and social media engagement to generate attention, AI agents in crypto trading are poised to be a defining trend in 2025.

“AI agents in Web3 have already reached a market valuation of $15 billion at the end of 2024, with projections of $150 billion by the end of 2025,” Bodkin noted.

Given their inherent autonomy, AI agents can act independently. Because they aren’t human, they can work 24-hour shifts.

“The future development goal of AI agents is to become more intelligent humans, performing better under the existing rules of the game. Rather than necessarily changing the rules of the game,” said Norris Wang, Co-Founder at gaming companion platform Balance.fun.

AI agents’ advantages over humans allow them to continuously monitor market conditions and execute actions based on pre-defined parameters without requiring constant user intervention.

They can effectively function as self-reliant assistants for managing cryptocurrency portfolios and executing trades.

“AI agents will automate trading strategies, simplify complex transactions, and make crypto more user-friendly. Imagine being able to trade, manage your portfolio or even pay for fast food with just a voice command,” said Nemil Dalal, Head of Coinbase’s Developer Platform.

According to Shadid, AI agents will have a particularly strong impact on crypto staking and DAO governance.

“As of January 2025 over 10,000 Al agents operate in the Web 3 ecosystem. In staking AI agents can optimize participation by analyzing real-time network conditions, which significantly minimizes risks. Manual staking requires constant oversight, while these agents adjust strategies autonomously to maintain efficiency. Also, in managing DAOs, AI agents can automate tasks such as fund allocation, proposal voting, and governance monitoring. This real-time automation eliminates bottlenecks, creating a more viable scope for swift and unbiased decision-making,” he added.

The advancements that AI agents have made in the cryptocurrency sector alone illustrate their potential in other industries.

AI Agent Impact Will Be Far-Reaching

According to MarketsandMarkets data, the global AI agent market is forecast to grow from $5.1 billion in 2024 to $47.1 billion by 2030, with a projected 45% compound annual growth rate.

The need for automation and efficiency in sectors like healthcare, finance, and customer service will particularly fuel this surge in growth.

“By 2027, Deloitte predicts that half of companies that use generative AI will have launched agentic AI pilots or proofs of concept that will be capable of acting as smart assistants, performing complex tasks with minimal human supervision. Jensen Huang recently stated that ‘the IT department of every company is going to be the HR department of AI agents in the future’ and that ‘AI Agents are a multi-trillion dollar opportunity’. Agents are here, and they aren’t slowing down,” Bodkin stated.

Heinrich gave a similar answer:

“In healthcare, decentralized AI can securely manage patient data, ensuring privacy and compliance with regulations. In finance, AI agents can execute smart contracts for trading and risk management, enhancing transparency and efficiency. Supply chain management can benefit from AI agents that track products in real-time, ensuring authenticity and reducing fraud. These sectors, characterized by their longevity and resilience against market volatility, stand to gain substantial benefits from integrating AI agents on robust AI L1 infrastructure,” he said.

For Wang, on the other hand, AI agents will have a deep impact on the gaming industry. He expects their influence to be transformative.

“On one hand, on the production side, the emergence of AI agents allows more independent games to produce extremely high-quality products with just a good idea. On the other hand, on the consumer side, AI agents will greatly change the future of gaming. The interaction between AI and AI, and between humans and AI, will become mainstream for future games,” Wang told BeInCrypto.

However, the effect of AI agents on the job market will also present a series of opportunities.

The Rise of New Opportunities

While job displacement is inevitable amid the rise of autonomous technologies, some experts believe AI agents will create new jobs and increase demand for specific skills.

“AI creates a number of new jobs, in turn, and, with the evolution of AI agents, we would have even more. Roles in building, maintaining, and optimizing AI-driven frameworks will become more and more in-demand. As well as positions, ensuring transparency and ethical alignment of AI systems. In my opinion the most important job in AI would be community engagement roles, focused on fostering community participation and integrating feedback into AI decision-making processes,” said Shadid.

To that, Bodkin added:

“While AI agents will undoubtedly disrupt certain job categories, they will also create a wide range of new opportunities. The demand for skilled professionals to build as well as manage AI systems will increase. This includes roles in AI development, cybersecurity, ethical oversight, and governance. The rise of AI agents is not just a technological shift; it’s a transformation in how we conceptualize work and human-machine collaboration.”

Regardless, responsible use of AI agents and preparing workers for their impact will be crucial as these technologies transform workplaces across industries.

AI Agent Deployment Will Require Careful Risk Management

The development of artificial intelligence technologies is concentrated in the hands of a handful of corporations. Major players include Anthropic, Google DeepMind, IBM, Microsoft, and OpenAI.

“As AI agents get more powerful it’s important that we don’t have a concentration of power and control over them and we have community governance with proper incentives for agents. If monopolies or large corporations dominate AI development, this could exacerbate inequality. That’s why we advocate for decentralization—empowering individuals and communities with control over the technology,” said Bodkin.

Industry experts also pointed to data privacy and user security as other factors.

“Transparency and accountability are key when adopting AI agents. It’s essential to address bias in AI decisions and ensure user privacy and data security. Developers should be implementing robust security measures to protect end users and maintain trust. And users should keep in mind that AI isn’t perfect yet and it should always be double checked or disclosed,” Dalal explained.

There are also steps businesses can start taking now to make the transition easier.

“Start experimenting now. Use AI more, participate more in the construction of AI,” Wang said.

According to Bodkin, offering resources to employees would also simplify the process.

“By adopting AI early, businesses and individuals can stay competitive while ensuring the workforce is prepared for the changes ahead. This means investing in training programs and even restructuring jobs to complement AI capabilities. This way, you promote a culture of innovation that allows individuals to adapt to new roles. The key will be collaboration to ensure a smooth transition to an AI-augmented workforce,” he said.

Shadid agreed with that point and added:

“Including AI in your work is the first step towards being ready for the change. A big part of the job market will require candidates to be at least familiar with it, if not well-versed. Businesses can explore frameworks for automation to stay agile and adaptive.”

AI agents will undoubtedly transform the workplace, but their responsible development and deployment are crucial.

“It’s time for us to shift away from opaque systems and adopt technology that prioritizes both ethics and progress,” Heinrich concluded.

Collaboration between stakeholders will be paramount to ensure a smooth and equitable transition to an AI-augmented workforce.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Bulls Defend $2.00—Is a Fresh Price Surge Loading?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Vitalik Buterin Proposes to Replace EVM with RISC-V

Ethereum (ETH) co-founder Vitalik Buterin has proposed overhauling the blockchain’s smart contract infrastructure by replacing the Ethereum Virtual Machine (EVM) with RISC-V, a widely adopted open-source instruction set architecture.

This shift aims to address one of Ethereum’s key scaling bottlenecks by dramatically improving the efficiency and simplicity of smart contract execution.

Buterin Proposes Ditching EVM for RISC-V

The proposal was detailed in a post on the Ethereum Magicians forum. In it, Buterin suggested that smart contracts could eventually be compiled to RISC-V rather than EVM bytecode.

According to Buterin, this shift addresses long-term scalability challenges. This particularly includes keeping block production competitive and improving zero-knowledge (ZK) EVM-proof efficiency.

“It aims to greatly improve the efficiency of the Ethereum execution layer, resolving one of the primary scaling bottlenecks, and can also greatly improve the execution layer’s simplicity – in fact, it is perhaps the only way to do so,” he wrote.

Current ZK-EVM implementations spend around half of their proving cycles on EVM execution. By switching to a native RISC-V VM, Ethereum could potentially achieve up to 100x efficiency gains.

Importantly, many fundamental aspects of Ethereum’s architecture would remain unchanged, preserving continuity for developers and users. Core abstractions such as accounts, smart contract storage, ETH balances, and cross-contract calls would function exactly as they do today.

Developers would still write contracts in familiar languages like Solidity or Vyper. These would simply be compiled to RISC-V rather than EVM bytecode. Tooling and workflows would remain largely intact, ensuring a smooth transition.

Crucially, the proposal ensures backward compatibility. Existing EVM contracts will remain fully operational and interoperable with new RISC-V contracts.

Buterin outlines several potential implementation paths forward. The first would support both EVM and RISC-V smart contracts natively. The second suggests wrapping EVM contracts to run via an interpreter written in RISC-V. Thus, it would enable a full transition without breaking compatibility.

The third, more modular approach, builds on the second by formally enshrining interpreters as part of the Ethereum protocol. This would allow the EVM and the future virtual machines to be supported in a standardized way.

Buterin stated that the idea is “equally as ambitious as the beam chain effort.”

“The beam chain effort holds great promise for greatly simplifying the consensus layer of Ethereum. But for the execution layer to see similar gains, this kind of radical change may be the only viable path,” Buterin added.

For context, the Ethereum Beam Chain is a redesign of Ethereum’s consensus layer (Beacon Chain). It focuses on faster block times, faster finality, chain snarkification, and quantum resistance. The development will likely begin in 2026.

This proposal fits into Ethereum’s broader vision of modularity, simplicity, and long-term scalability. Previously, BeInCrypto reported on Buterin’s privacy-centric plans for the blockchain.

The proposal focused on integrating privacy-preserving technologies. Moreover, the Pectra upgrade is also nearing, with the launch expected on May 7.

Meanwhile, ETH continues to face market headwinds, trading at March 2023 lows. This year has been quite hard for the altcoin, as it saw a decline of 50.8%. In fact, Ethereum dominance hit a 5-year low last week.

Nonetheless, BeInCrypto data showed a slight recovery over the last 14 days. ETH rose by 6.1%. Over the past day alone, it saw modest gains of 1.7%. At the time of writing, ETH was trading at $1,639.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

Solana started a fresh increase from the $120 support zone. SOL price is now consolidating and might climb further above the $142 resistance zone.

- SOL price started a fresh increase above the $125 and $132 levels against the US Dollar.

- The price is now trading above $130 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if it clears the $142 resistance zone.

Solana Price Gains Over 5%

Solana price formed a base above the $120 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $125 and $132 resistance levels.

The pair even spiked toward the $145 resistance zone. A high was formed at $143.06 and the price is now retreating lower. There was a move below the 23.6% Fib retracement level of the upward move from the $135 swing low to the $143 high.

Solana is now trading above $130 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair. The trend line is close to the 76.4% Fib retracement level of the upward move from the $135 swing low to the $143 high.

On the upside, the price is facing resistance near the $142 level. The next major resistance is near the $145 level. The main resistance could be $150. A successful close above the $150 resistance zone could set the pace for another steady increase. The next key resistance is $155. Any more gains might send the price toward the $165 level.

Pullback in SOL?

If SOL fails to rise above the $142 resistance, it could start another decline. Initial support on the downside is near the $138.50 zone. The first major support is near the $137 level and the trend line.

A break below the $137 level might send the price toward the $132 zone. If there is a close below the $132 support, the price could decline toward the $125 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $137 and $132.

Major Resistance Levels – $142 and $145.

-

Market15 hours ago

Market15 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market22 hours ago

Market22 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market20 hours ago

Market20 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Market21 hours ago

Market21 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Market16 hours ago

Market16 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Leads Crypto Shopping List For Latin America Ahead Of ETH, SOL—Report