Market

Could Bitcoin ETF Outflows Signal a Bear Market?

Concerns about a bear market are growing as Bitcoin ETF outflows ramp up dramatically alongside the ongoing volatility. Other hopes, like state-level Bitcoin Reserves, are failing, and it’s difficult to find a clear bullish trend.

Industry experts like Arthur Hayes predict that any losses will be temporary, with a fierce rebound by the end of the year. However, this would be the first major price collapse since ETF approval and institutional adoption, and non-crypto-native investors could behave in unpredictable ways.

Is Bitcoin Headed for a Bear Market?

Bitcoin, the world’s first and largest cryptocurrency, has been on a downward price trajectory lately. Strategy (formerly MicroStrategy) saw a huge drop in stock price despite spending nearly $2 billion on the asset, and broader economic headwinds are having a real dampening effect.

A few worrying trends are building speculation about a Bitcoin bear market:

“Bitcoin goblin town incoming: Lots of IBIT holders are hedge funds that went long ETF [and] short CME futures to earn a yield greater than where they fund, short term US treasuries. If that basis drops as BTC falls, then these funds will sell IBIT and buy back CME futures,” claimed Arthur Hayes, former CEO of BitMEX.

Hayes also referenced his earlier prediction from January that the asset was set for a price drop to $70,000. This bear market will not last forever, he claimed, and Bitcoin would rebound by the end of the year, but it would face significant pain first.

Hayes’ predictions centered around the US Bitcoin ETF market, which has been facing its own pressures.

These ETFs are indeed showing signs of a bear market, caused by one simple correlation: the tendency of Bitcoin to decline alongside traditional stocks.

Even though there is a huge appetite for institutional investment, it’s very shallow in some ways. If BTC’s potential returns diminish, investors will look elsewhere, as evidenced by substantial outflows.

These one-day outflows total over $500 million from the top 10 ETFs alone. Last week, however, the entire market had $585 million in outflows, the worst level in five months.

If ETF outflows keep accelerating at this dramatic pace, a Bitcoin bear market seems very likely.

Bitcoin Reserve Hopes Fail, Deflating Enthusiasm

Another factor might cause additional downward pressure if political developments don’t live up to hopes. Specifically, many US states launched efforts to enact Bitcoin Reserves, which would trigger up to $23 billion in BTC purchases.

However, some Republican members themselves are defeating these efforts nationwide. With its other setbacks, can Bitcoin bear a major disappointment here?

In short, many factors are making a Bitcoin bear market seem like a credible prospect. However, the industry is no stranger to harsh price fluctuations. Hayes and other commentators have claimed that it will be temporary at best, with a rebound by the end of 2025.

The only question, then, is how a non-crypto-native investor class will deal with these cyclical patterns. Since the Bitcoin ETFs were approved in 2024, the industry has yet to face a genuine bear market on par with previous collapses.

Institutional investors have recently poured billions into crypto, but it’s uncertain how they will deal with the volatility inherent in this industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

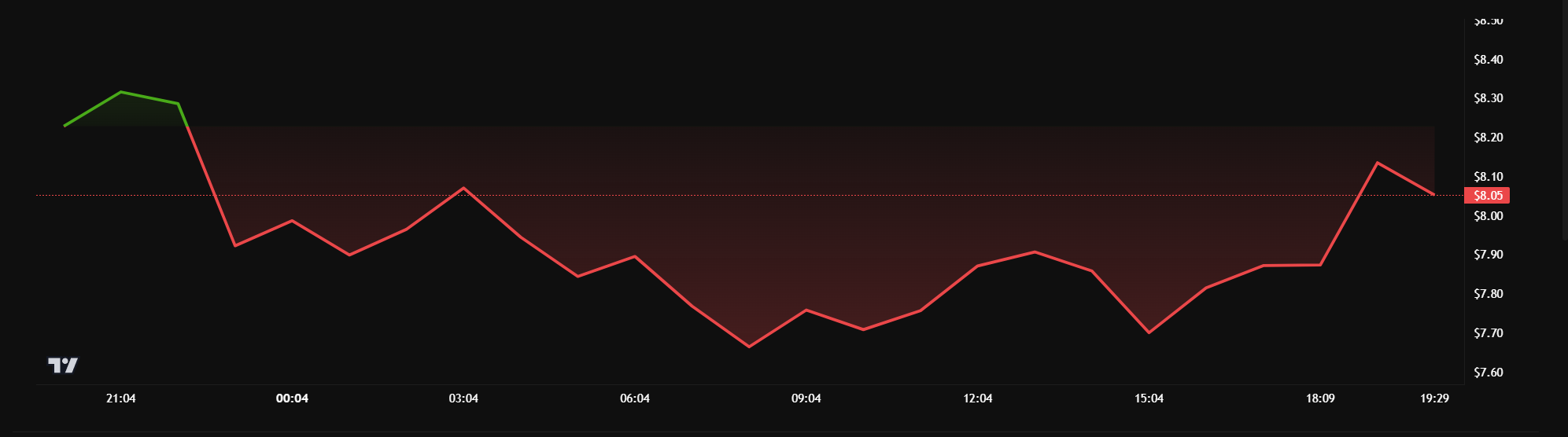

Ethereum Whales Pause Buying, Price Could Drop Below $2,200

Ethereum (ETH) is down almost 10% on February 25. This drop has pushed its market cap below $300 billion, marking the first time it has fallen to this level since early November 2024.

Multiple indicators, including RSI and moving averages, show bearish momentum. As ETH navigates this downturn, market watchers are looking for signs of either a continued decline or a potential reversal.

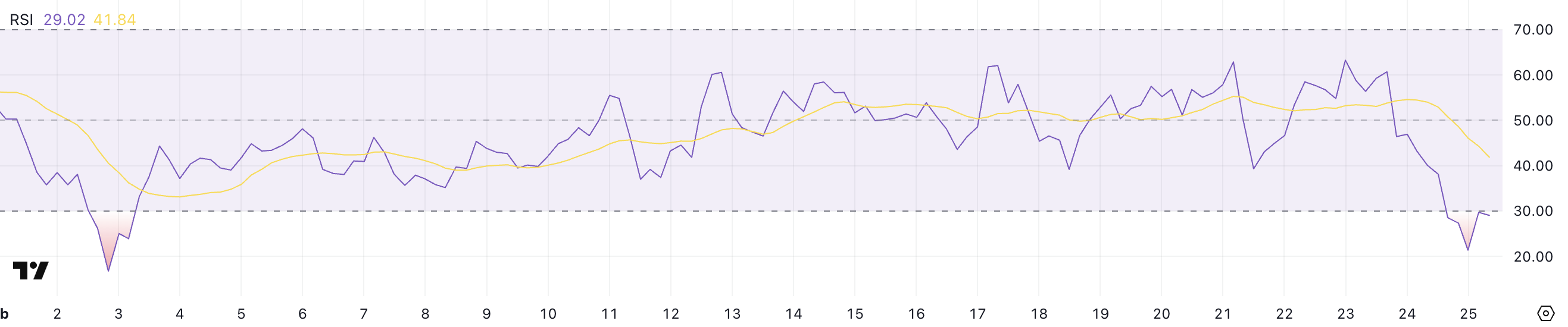

RSI Shows an Oversold State for Ethereum

ETH’s RSI is currently at 29 after dropping to 21.3 a few hours ago. This marks the first time since February 3 that ETH has entered oversold territory, indicating intense selling pressure.

RSI measures the speed and change of price movements, helping traders identify overbought or oversold conditions. An RSI below 30 typically signals that an asset is oversold, while above 70 suggests it is overbought.

With ETH’s RSI at 29, it indicates that selling momentum may be exhausted, potentially setting the stage for a short-term rebound. However, oversold conditions do not always guarantee an immediate price recovery.

If bearish sentiment persists, ETH could continue to face downward pressure before any significant reversal occurs. Conversely, if buyers step in at these oversold levels, a relief rally could follow.

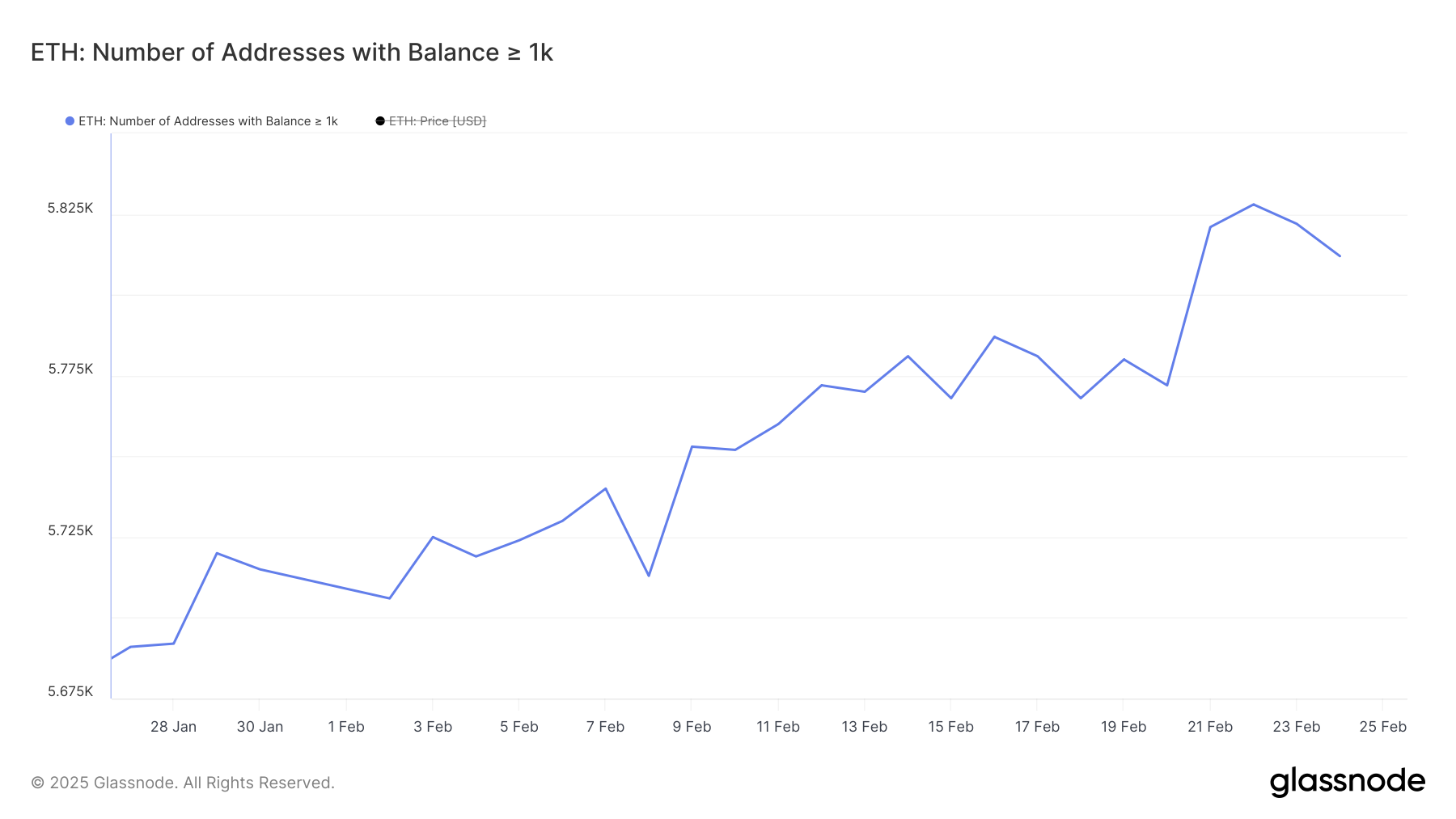

ETH Whales Dropped After Reaching Its Highest Levels In One Year

The number of ETH whales – addresses holding at least 1,000 ETH – steadily increased throughout the last month, peaking at 5,828 on February 22, the highest level since February 2024. However, this upward trend has recently reversed, with the number now slightly declining to 5,812.

This shift suggests that some large holders have started to reduce their positions, potentially contributing to the recent selling pressure on ETH.

Tracking ETH whales is crucial because they control a significant portion of the total supply, influencing price movements with their buying and selling activities. When the number of whales increases, it often indicates accumulation, which can support price stability or even drive a rally. Conversely, a decrease suggests distribution, potentially leading to increased selling pressure.

The recent decline in ETH whale numbers could indicate cautious sentiment, possibly signaling short-term weakness.

However, the overall number remains relatively high, suggesting that while some whales are offloading, a substantial number still hold their positions, which could help cushion any sharp declines.

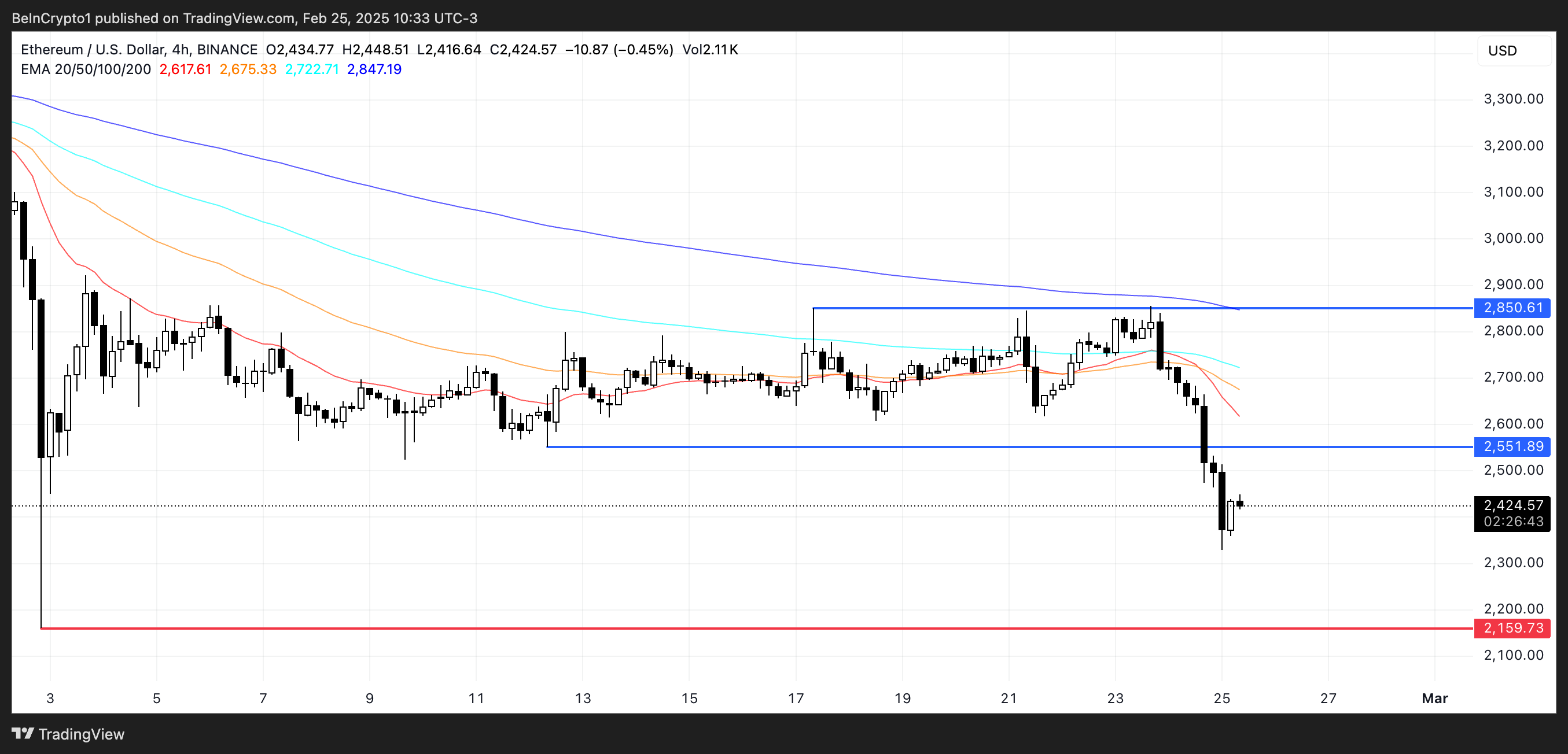

Ethereum Could Drop Below $2,200 Soon

Ethereum price recently formed a death cross, where the short-term moving average crossed below the long-term moving average, signaling a bearish trend.

Following this pattern, Ethereum’s price dropped below $2,500, reflecting increased selling pressure. If this downtrend continues, ETH could decline further to $2,159, falling below $2,200 for the first time since December 2023. This death cross indicates that bearish momentum is dominating, and caution is warranted as downward pressure could persist.

However, if Ethereum manages to reverse this trend, it could attempt to break through the resistance at $2,551. Successfully overcoming this level could pave the way for a rally toward $2,850.

For this reversal to occur, buying pressure would need to increase, pushing the short-term moving average back above the long-term one. Until that happens, the death cross suggests that the bearish sentiment remains strong.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Blockchain Throughput is Overhyped, Claims Taraxa

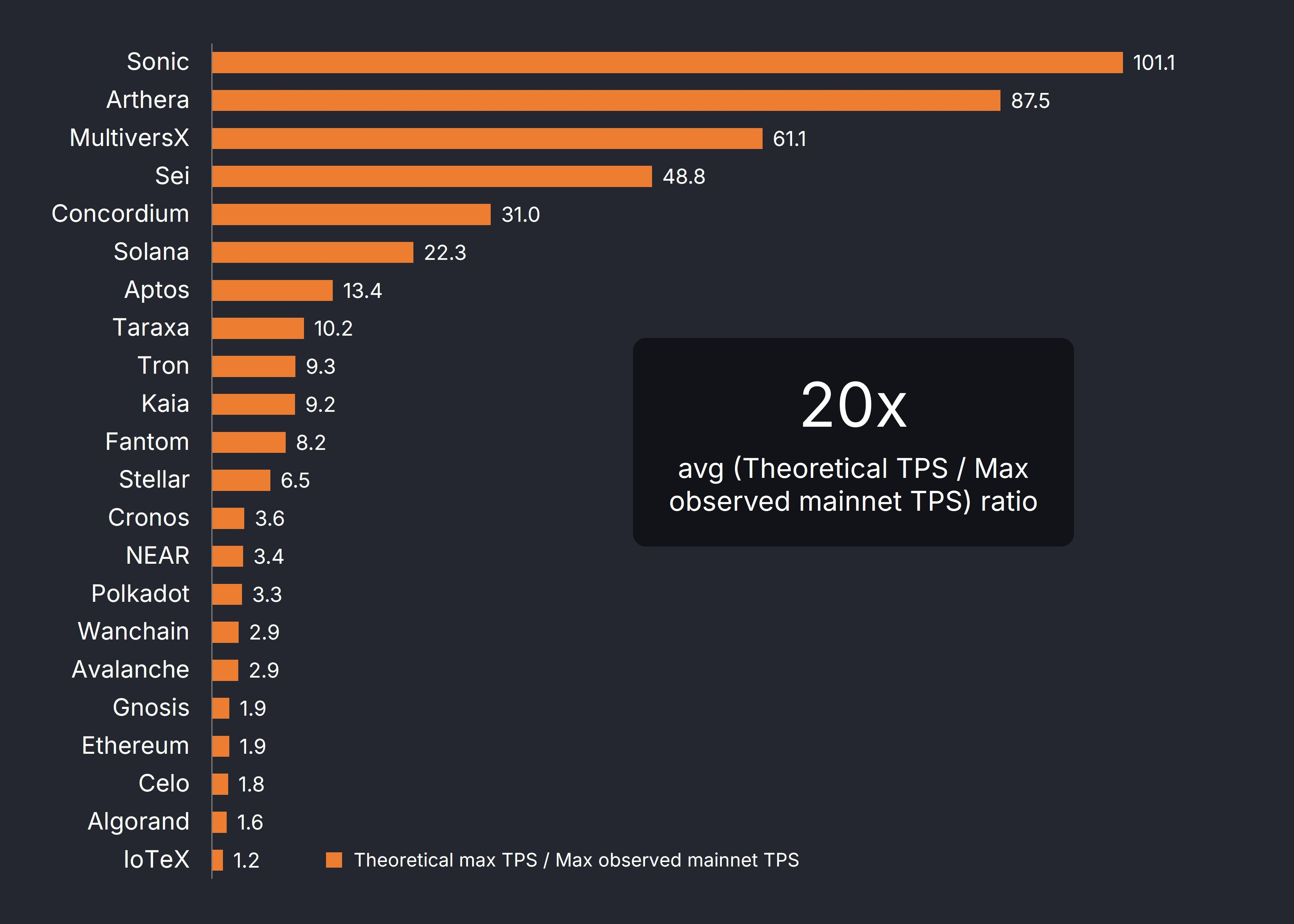

A new report from Taraxa claims that many leading blockchain projects have dramatically overestimated their throughput. The study shows that major blockchain networks like Sonic, Solana, and Aptos have a significant gap between theoretical TPS (transaction per second) and the actual max TPS on the mainnet.

The findings suggest a massive overestimation of network efficiency and speed for these networks.

Most Blockchains Overestimate Efficiency

Taraxa, a Layer-1 blockchain, conducted an extensive analysis of several leading blockchains. It’s evident that most networks publicize new advances in their blockchain’s throughput, but many of these tests are conducted in ideal conditions. This study wished to observe how the most ‘bullish’ claims compare to regular operating conditions.

“Investors, developers, and users deserve transparency. The blockchain industry has long been obsessed with theoretical performance figures, but numbers generated in a lab mean little if they can’t be replicated in real-world conditions,” Taraxa co-founder Steven Pu said in an exclusive press release shared with BeInCrypto.

This investigation sought to assess these real-world conditions through a metric called “TPS per dollar.” Taraxa compared a blockchain’s transactions per second to the actual cost of running a validator node and used that to determine actual throughput.

This would be a more accurate way to determine how well these firms can live up to expectations.

Case in point, the study looked at the highest-ever recorded throughput on several blockchain projects, with a few important caveats. Permissioned and sharded networks were excluded, and some specific transactions (like voting transactions) were discarded to avoid number inflation.

Then, these figures were compared to developer-provided TPS claims:

The results of this test revealed extremely high exaggeration. Sonic (formerly Fantom) reported blockchain throughput over 100x its actual capabilities, but the industry average was 20x. The L1 blockchain space is full of fierce competition, providing a clear incentive for this systematic inflation.

“Our research also shows that many networks require expensive hardware just to achieve modest transaction rates, which is neither technically impressive nor decentralized. By focusing on verifiable data from live networks, we can shift the conversation toward meaningful performance metrics,” Pu added.

Comparing TPS to dollar costs also provided interesting data. Solana had the highest costs by far, but it used these resources efficiently to maintain a high blockchain throughput. Taraxa also claimed that it had the best ratio in the entire industry by wide margins, which may impact its reasons for conducting the study and using this metric.

Regardless of the firm’s desire to market its own capabilities, blockchain throughput estimations seem heavily inflated across the whole industry. Taraxa has been analyzing several crucial Web3 sectors, such as the AI industry, and its results seem valuable.

Hopefully, some hard data here will encourage more realistic reporting from these projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Drops Uniswap Investigation After Coinbase and Robinhood

The SEC dropped its investigation into Uniswap Labs, causing the UNI token to briefly jump while bearish conditions still dominate the market. Despite the volatility, it has been a positive month for the decentralized exchange, as it launched the v4 upgrade and Unichain mainnet this month.

Uniswap’s CEO Hayden Adams claimed that TradFi regulations are not applicable to the crypto space and that new ones are required. Now that another enforcement case has been dropped, pressure is building to create these friendlier regulations.

SEC Vs Uniswap Ends Without Any Enforcement

When the SEC sent a Wells Notice to Uniswap last year, it kicked off a year-long investigation. The Commission claimed it was an operated unregistered broker, exchange, and clearing agency and issued an unregistered security.

In response, the industry rallied behind it. This probe, which was considered integral to the future of DeFi, has now been dropped by the SEC.

“This is a huge win, not just for Uniswap Labs but for DeFi as a whole. I’m grateful that the new SEC leadership is taking a more constructive approach, and I look forward to working with Congress and regulators to help create rules that actually make sense for DeFi. The best days for DeFi are ahead,” claimed Uniswap CEO Hayden Adams.

The quiet end to the Uniswap case is part of a new trend at the SEC. Since President Trump’s term began last month, the Commission has been dropping crypto enforcement suits left and right. In the last few days, it dropped a major suit against Coinbase, while ending investigations into Opensea and Robinhood.

Now that the SEC has dropped its case, Uniswap’s UNI token can breathe a little easier. Over the past month, its price has suffered a 30% drop. Even the long-awaited v4 update and the Unichain launch did not have any notable impact.

Despite the stale price movements, UNI jumped briefly after the SEC’s announcement, indicating some positive outlook. Also, the token’s daily trading volume surged over 140% today, according to CoinMarketCap data.

A New Future for Crypto Enforcement

It will be interesting to see how this development fits into a broader mosaic of federal crypto policy.

In his statement, Adams claimed that “decentralized technology and self-custody are inherently different” from TradFi and that they should be held to different regulations. This is a common refrain, and the SEC is working to receive constructive industry feedback.

To sum it up, The SEC is dropping a lot of enforcement cases made under Gary Gensler’s interpretation of the law, and Uniswap is part of that trend.

However, as the Commission changes its focus, it also puts pressure on developing this constructive new regulatory environment. Crypto has a real chance to chart its own future, but it must comply with the new rules it helps create.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin13 hours ago

Altcoin13 hours ago칸예 밈코인, 러그풀 우려 제기…모금액 400만 달러 임박한 밈인덱스가 제안하는 안전 밈코인 투자 솔루션

-

Market24 hours ago

Market24 hours agoOKX Reaches DoJ Settlement, Pays $504 Million

-

Regulation24 hours ago

Regulation24 hours agoUS SEC Acknowledges Grayscale’s Spot Cardano ETF Filing

-

Market23 hours ago

Market23 hours agoEthereum Struggles Despite Bybit’s Reserve Recovery

-

Altcoin23 hours ago

Altcoin23 hours agoSolana Price Could Drop To $109 As Whale Move $127M SOL

-

Market18 hours ago

Market18 hours agoCZ Reveals BNB Holdings, BROCCOLI Meme Coin Spikes

-

Altcoin18 hours ago

Altcoin18 hours agoWhy BTC Plunged To $90K & Altcoins Followed?

-

Bitcoin17 hours ago

Bitcoin17 hours agoTrump’s Tariff Move Triggers $1 Billion Crypto Market Slide