Market

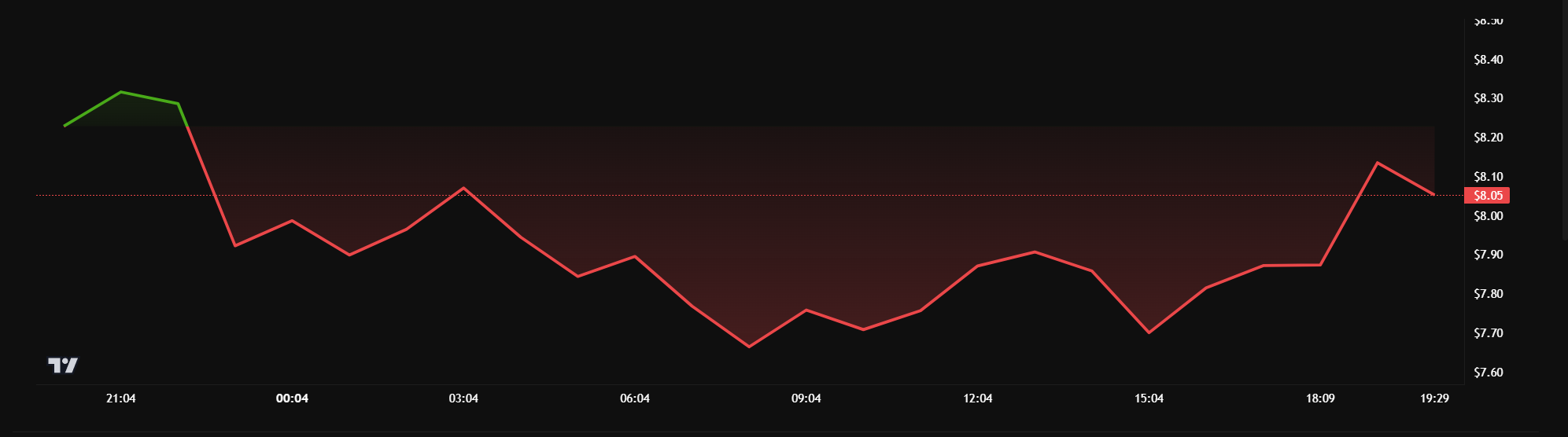

Pi Coin Price Aims for New All-Time Highs Even as Bears Weigh In

Pi Coin has faced a tumultuous period following its mainnet launch last week. After the launch, the altcoin suffered a massive crash, losing 99% of its value in just four days.

While it has shown signs of recovery, the damage remains significant, and the token still struggles to regain lost ground.

Pi Coin Has Some Challenges Ahead

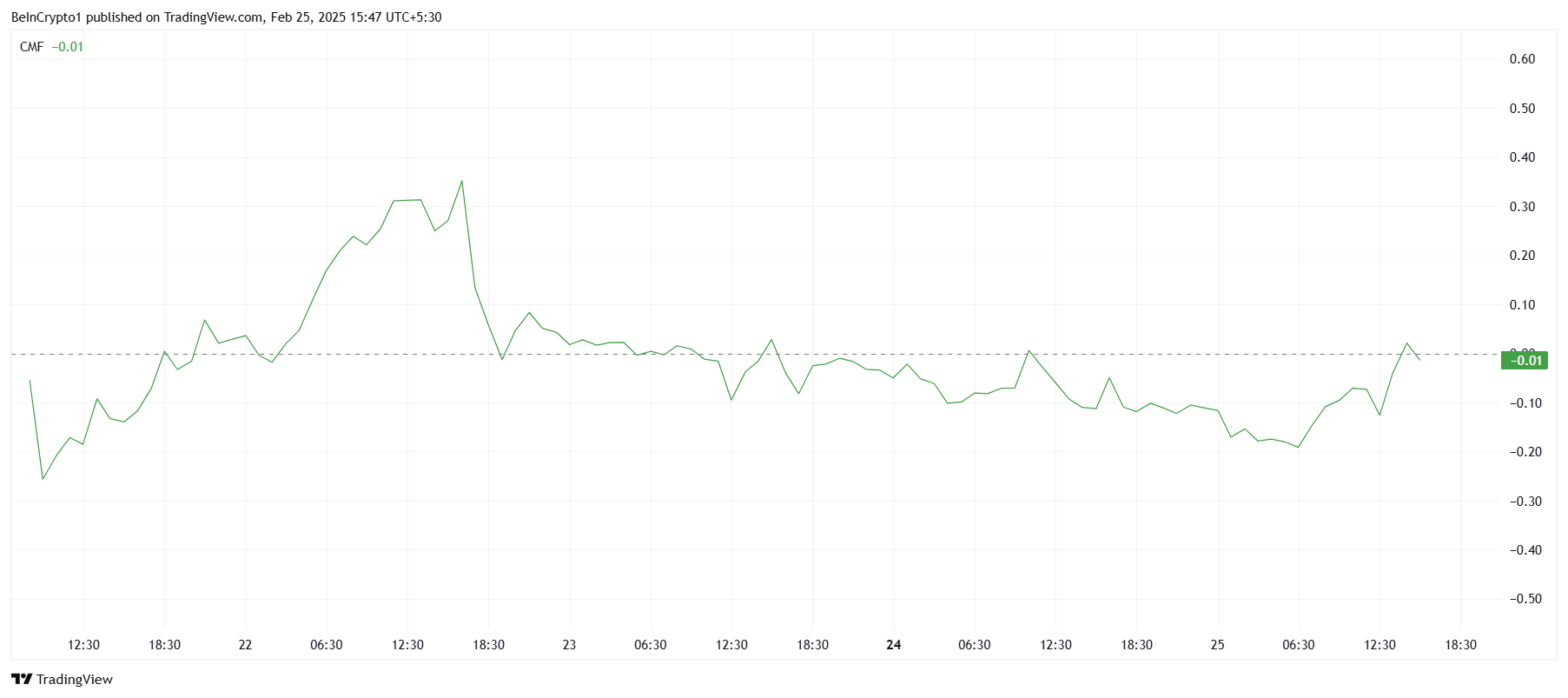

The Chaikin Money Flow (CMF) indicator has shown a dramatic fluctuation in Pi Coin’s market sentiment over the past week. Investors sold heavily following the mainnet launch, causing the CMF to drop. However, others took advantage of the low prices, causing a sharp spike in inflows.

This is evident in the spike in the indicator. Despite these inflows, a true bullish confirmation will occur when the CMF crosses the zero line, signaling sustained positive momentum and investor confidence in Pi Coin’s recovery.

Pi Coin’s recovery is still in its early stages, with the market sentiment showing mixed signals. The volume of inflows indicates some investors believe in the altcoin’s potential, but the indicator’s failure to consistently stay above the zero line suggests that the bullish momentum is not yet fully established. The token will need to see consistent buying pressure for the price to build momentum and for investor confidence to stabilize.

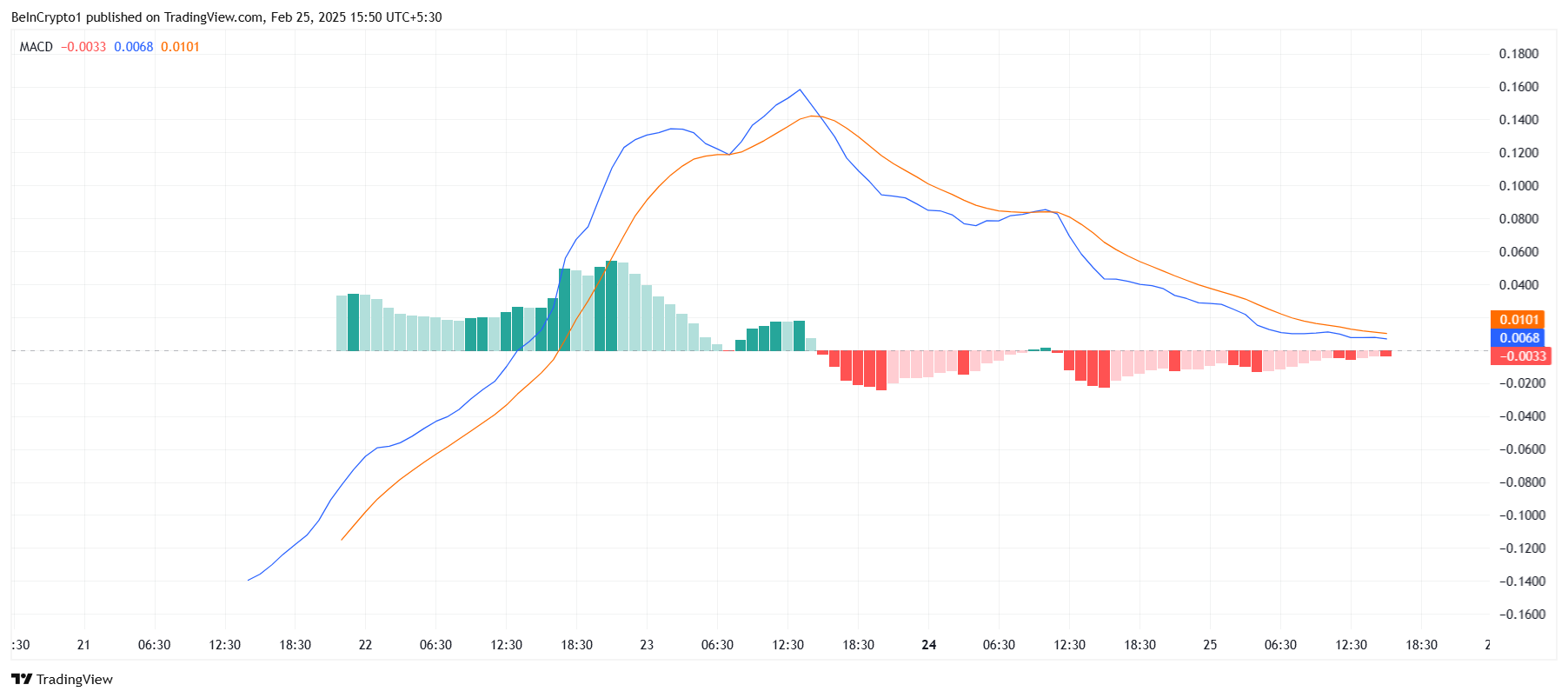

Pi Coin is also facing strong macro headwinds in the form of a bearish crossover. The Moving Average Convergence Divergence (MACD) has been observing a bearish crossover over the past 36 hours, which typically signals that further downward price action is likely.

The market is under pressure, and Pi Coin’s price action reflects these broader trends. However, if the gradual recovery remains persistent and Pi Coin manages to generate a stronger interest among investors to boost the inflows, the altcoin could witness a bullish crossover. This would signal potential recovery ahead, confirmed by the bars on the histogram flipping above the neutral line.

Pi Coin Price Recovery May Take A While

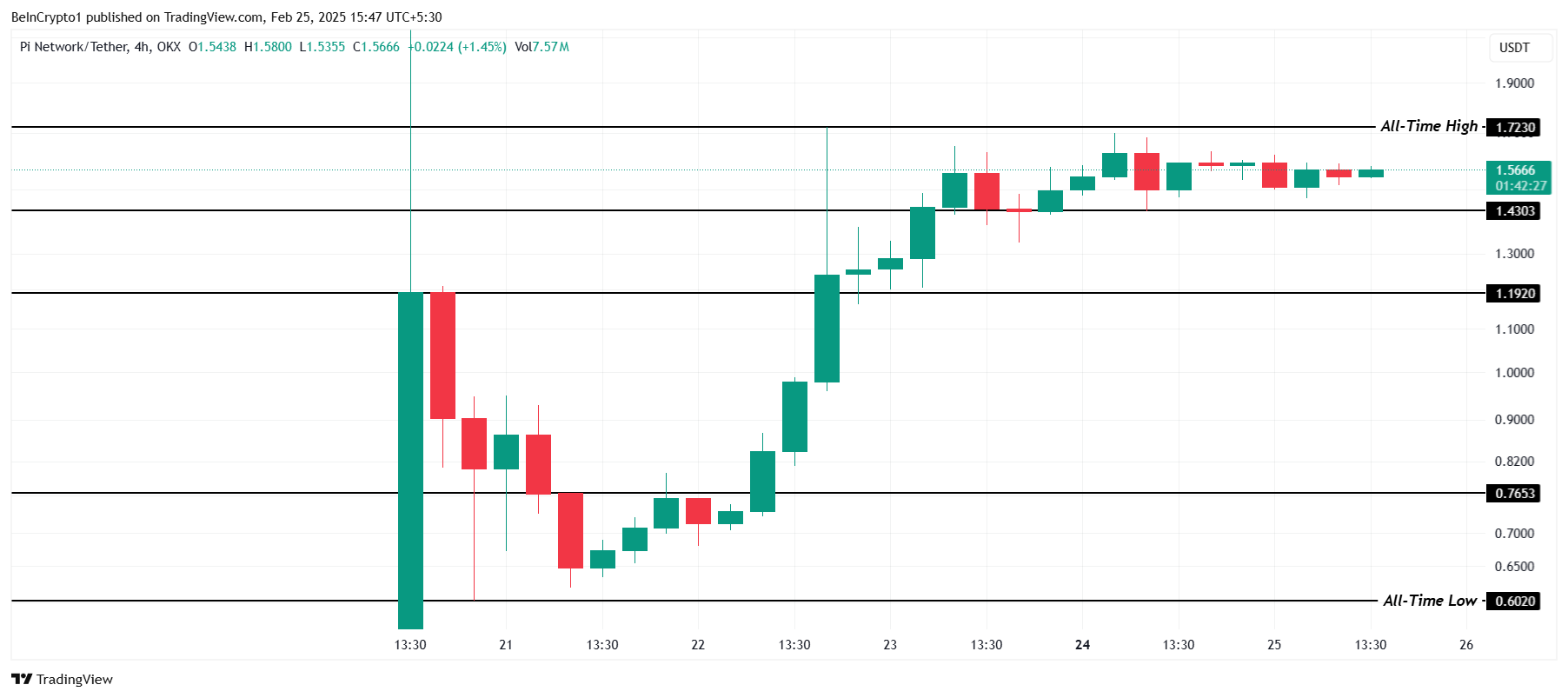

At the time of writing, Pi Coin is trading at $1.56 after a 116% bounce over the weekend. Despite this brief recovery, the prevailing bearish signals point to the possibility of further decline. While the altcoin did chart an all-time high (ATH) of $1.72, it is closer to the support of $1.43.

Given the current market outlook and the technical indicators, it is likely to fall through this support soon and slip towards the support of $1.19. If not, the altcoin could continue to consolidate under $1.72, facing persistent downward pressure from both the bearish crossover and broader market negativity.

For Pi Coin to actually break out, it would need stronger support from the investors, a breach of the $1.72 barrier, a move to $2.00 and higher, and continued formation of new ATHs. This would be a significant turnaround and invalidate the current bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

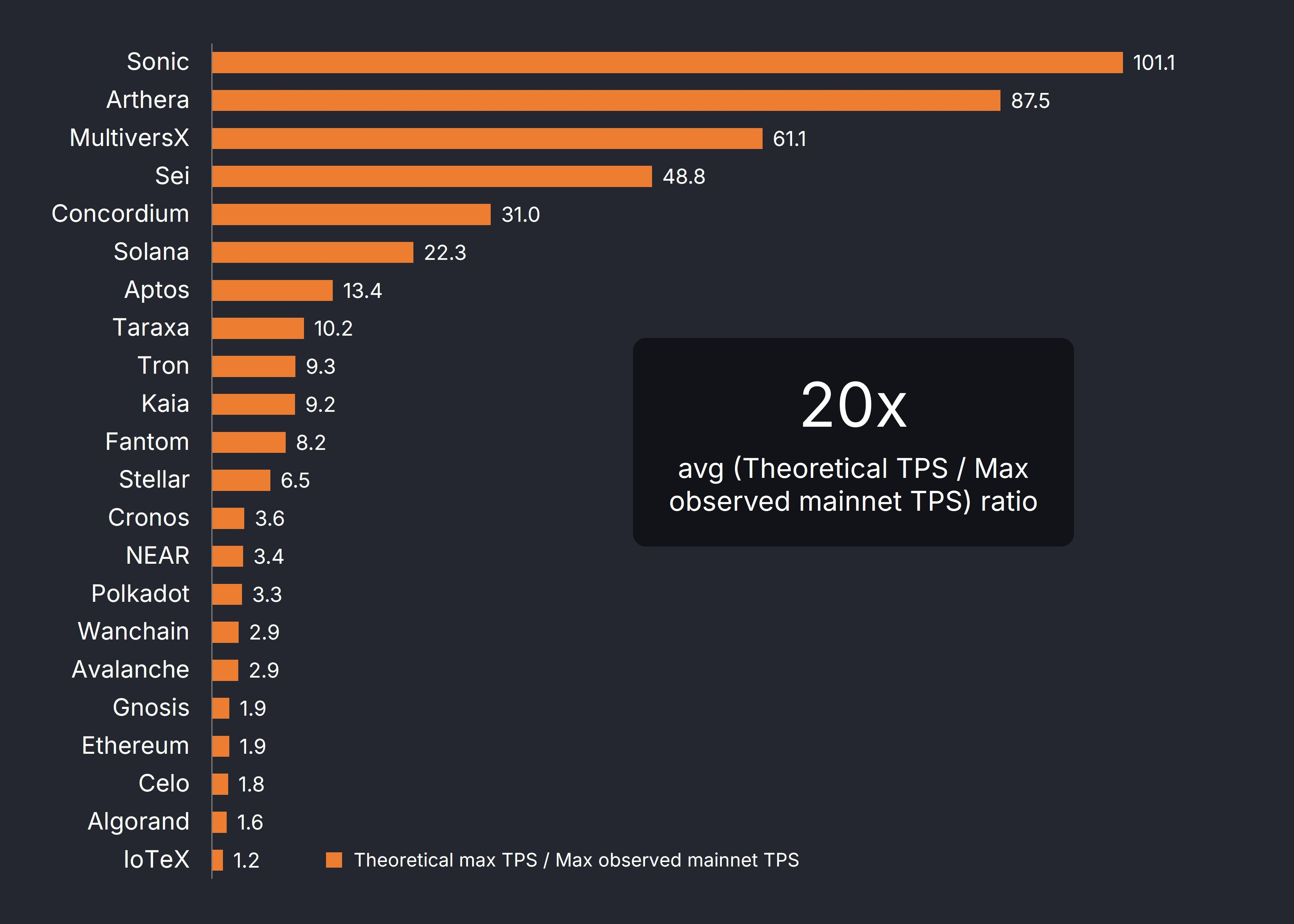

Blockchain Throughput is Overhyped, Claims Taraxa

A new report from Taraxa claims that many leading blockchain projects have dramatically overestimated their throughput. The study shows that major blockchain networks like Sonic, Solana, and Aptos have a significant gap between theoretical TPS (transaction per second) and the actual max TPS on the mainnet.

The findings suggest a massive overestimation of network efficiency and speed for these networks.

Most Blockchains Overestimate Efficiency

Taraxa, a Layer-1 blockchain, conducted an extensive analysis of several leading blockchains. It’s evident that most networks publicize new advances in their blockchain’s throughput, but many of these tests are conducted in ideal conditions. This study wished to observe how the most ‘bullish’ claims compare to regular operating conditions.

“Investors, developers, and users deserve transparency. The blockchain industry has long been obsessed with theoretical performance figures, but numbers generated in a lab mean little if they can’t be replicated in real-world conditions,” Taraxa co-founder Steven Pu said in an exclusive press release shared with BeInCrypto.

This investigation sought to assess these real-world conditions through a metric called “TPS per dollar.” Taraxa compared a blockchain’s transactions per second to the actual cost of running a validator node and used that to determine actual throughput.

This would be a more accurate way to determine how well these firms can live up to expectations.

Case in point, the study looked at the highest-ever recorded throughput on several blockchain projects, with a few important caveats. Permissioned and sharded networks were excluded, and some specific transactions (like voting transactions) were discarded to avoid number inflation.

Then, these figures were compared to developer-provided TPS claims:

The results of this test revealed extremely high exaggeration. Sonic (formerly Fantom) reported blockchain throughput over 100x its actual capabilities, but the industry average was 20x. The L1 blockchain space is full of fierce competition, providing a clear incentive for this systematic inflation.

“Our research also shows that many networks require expensive hardware just to achieve modest transaction rates, which is neither technically impressive nor decentralized. By focusing on verifiable data from live networks, we can shift the conversation toward meaningful performance metrics,” Pu added.

Comparing TPS to dollar costs also provided interesting data. Solana had the highest costs by far, but it used these resources efficiently to maintain a high blockchain throughput. Taraxa also claimed that it had the best ratio in the entire industry by wide margins, which may impact its reasons for conducting the study and using this metric.

Regardless of the firm’s desire to market its own capabilities, blockchain throughput estimations seem heavily inflated across the whole industry. Taraxa has been analyzing several crucial Web3 sectors, such as the AI industry, and its results seem valuable.

Hopefully, some hard data here will encourage more realistic reporting from these projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Drops Uniswap Investigation After Coinbase and Robinhood

The SEC dropped its investigation into Uniswap Labs, causing the UNI token to briefly jump while bearish conditions still dominate the market. Despite the volatility, it has been a positive month for the decentralized exchange, as it launched the v4 upgrade and Unichain mainnet this month.

Uniswap’s CEO Hayden Adams claimed that TradFi regulations are not applicable to the crypto space and that new ones are required. Now that another enforcement case has been dropped, pressure is building to create these friendlier regulations.

SEC Vs Uniswap Ends Without Any Enforcement

When the SEC sent a Wells Notice to Uniswap last year, it kicked off a year-long investigation. The Commission claimed it was an operated unregistered broker, exchange, and clearing agency and issued an unregistered security.

In response, the industry rallied behind it. This probe, which was considered integral to the future of DeFi, has now been dropped by the SEC.

“This is a huge win, not just for Uniswap Labs but for DeFi as a whole. I’m grateful that the new SEC leadership is taking a more constructive approach, and I look forward to working with Congress and regulators to help create rules that actually make sense for DeFi. The best days for DeFi are ahead,” claimed Uniswap CEO Hayden Adams.

The quiet end to the Uniswap case is part of a new trend at the SEC. Since President Trump’s term began last month, the Commission has been dropping crypto enforcement suits left and right. In the last few days, it dropped a major suit against Coinbase, while ending investigations into Opensea and Robinhood.

Now that the SEC has dropped its case, Uniswap’s UNI token can breathe a little easier. Over the past month, its price has suffered a 30% drop. Even the long-awaited v4 update and the Unichain launch did not have any notable impact.

Despite the stale price movements, UNI jumped briefly after the SEC’s announcement, indicating some positive outlook. Also, the token’s daily trading volume surged over 140% today, according to CoinMarketCap data.

A New Future for Crypto Enforcement

It will be interesting to see how this development fits into a broader mosaic of federal crypto policy.

In his statement, Adams claimed that “decentralized technology and self-custody are inherently different” from TradFi and that they should be held to different regulations. This is a common refrain, and the SEC is working to receive constructive industry feedback.

To sum it up, The SEC is dropping a lot of enforcement cases made under Gary Gensler’s interpretation of the law, and Uniswap is part of that trend.

However, as the Commission changes its focus, it also puts pressure on developing this constructive new regulatory environment. Crypto has a real chance to chart its own future, but it must comply with the new rules it helps create.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

The Altcoins Trending Today – VANA, S, and TRUMP

The crypto market continues its downward trend today, with bearish pressure overpowering bullish efforts.

Amid this decline, some altcoins have emerged as the most searched assets, continuing to attract investors’ attention. They include Vana (VANA), Sonic (S), and Official Trump (TRUMP).

Vana (VANA)

VANA has bucked the broader market downtrend, noting a 46% uptick over the past 24 hours. This double-digit rally comes as YZi Labs (formerly Binance Labs) announced an undisclosed investment in Vana, a crypto-AI startup focused on data ownership.

The firm confirmed that Binance co-founder Changpeng “CZ” Zhao—who recently took on an active role at YZi Labs following its rebrand—has joined Vana as an advisor as part of the deal.

At press time, VANA trades at $8.78. Over the past 24 hours, its trading volume has totaled $639 million, surging by over 2,800% during that period. This significant hike in VANA’s trading volume indicates that its current rally is driven by demand for the altcoin.

If the rally continues, VANA’s price could reach $10.77.

On the other hand, a rise in profit-taking activity could result in a decline to $7.77.

Sonic (prev. FTM) (S)

Sonic’s S is another altcoin trending today. Its price is down 17%, mirroring the general market decline of the past 24 hours.

S’ plummeting buying pressure also contributes to this price fall. Its declining on-balance volume (OBV) confirms this. This indicator measures an asset’s cumulative trading volume to gauge its buying and selling pressure.

When it falls, it suggests that selling pressure outweighs buying pressure, potentially signaling further price weakness or a bearish trend. If selloffs continue to strengthen, S’ price could fall to $0.59.

However, a bullish shift in market trend would invalidate this bearish projection. If S demand soars, it could push its price to $0.76. A successful breach of this resistance could create a path for the altcoin to trade above the $0.90 price level.

Official Trump (TRUMP)

Solana-based meme coin TRUMP is one of the most searched altcoins today. It exchanges hands at $12.78, plunging 14% in the past 24 hours. Having lost 55% of its value over the past month, readings from TRUMP’s Relative Strength Index (RSI) suggest that it might be poised for a rebound.

At press time, this momentum indicator, which measures an asset’s oversold and overbought market conditions, is at 27.72.

When an asset’s RSI falls to this low, it indicates that it is in oversold territory. If buyers step in, this could mean a potential price rebound, but it may also signal continued weakness if bearish momentum persists.

If buyers flock in to buy TRUMP, they could trigger a rebound and push its price up toward $18.07.

On the other hand, if the decline persists, the meme coin’s price could fall below $12.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin11 hours ago

Altcoin11 hours ago칸예 밈코인, 러그풀 우려 제기…모금액 400만 달러 임박한 밈인덱스가 제안하는 안전 밈코인 투자 솔루션

-

Regulation22 hours ago

Regulation22 hours agoUS SEC Acknowledges Grayscale’s Spot Cardano ETF Filing

-

Market22 hours ago

Market22 hours agoEthereum Struggles Despite Bybit’s Reserve Recovery

-

Altcoin22 hours ago

Altcoin22 hours agoSolana Price Could Drop To $109 As Whale Move $127M SOL

-

Market21 hours ago

Market21 hours agoGOP Defections Defeat Bitcoin Reserve Bills

-

Altcoin21 hours ago

Altcoin21 hours agoShiba Inu Price Battles Support Levels With Bulls Eyeing a 400% Surge

-

Market24 hours ago

Market24 hours agoCitadel Wants into Crypto, But Robinhood Baggage Builds Distrust

-

Market23 hours ago

Market23 hours agoOKX Reaches DoJ Settlement, Pays $504 Million