Market

Meme Coin Industry Will Reduce Fraud Over Time

In February, the Libra scandal involving Argentine president Javier Milei shook the crypto sector. It also angered many Web3 members, who argue that meme coins damage the ecosystem’s growth and unfairly target smaller investors.

BeInCrypto spoke with Memeland CEO and Founder Ray Chan at Consensus Hong Kong to discuss recent events involving meme coin launches and the sector’s future.

LIBRA: From a Token to a Meme Coin

The LIBRA meme coin scandal was unique in many ways. An unidentified group created a website for the “Viva La Libertad” project, inspired by a slogan Argentine President Javier Milei uses regularly.

The website, which is still active, has a mission statement of boosting the Argentine economy by funding small projects and local businesses. The LIBRA token was launched to channel funding as part of the project’s strategy.

According to the token distribution diagram, 50% of tokens would be used to fuel Argentina’s growth.

A couple of hours after the website went live, the LIBRA token was created on the Solana blockchain. Half an hour after the token launched, Milei published his first X post.

“A liberal Argentina grows! This private project will dedicate itself to incentivizing the growth of Argentina’s economy, funding small businesses and Argentine start-ups. The world wants to invest in Argentina,” it read.

In that same post, Milei included a link to the Viva La Libertad Project website and LIBRA’s contract number. This identification made it easy for investors to locate and start trading the cryptocurrency immediately.

Soon enough, people started to realize that, more than a token, LIBRA resembled a meme coin.

Meme Coins Face a Piling List of Pump-and-Dumps

Milei’s social media post triggered a surge in the token’s price, with the market cap hitting over $4 billion in hours. This surge allowed insiders to cash out over $100 million in profits.

However, the rally was short-lived. The meme coin had no tokenomics; the website was created hours before the launch, and over $87 million was cashed out in the first three hours. The token’s value crashed soon after, indicating a classic pump-and-dump scheme.

The scheme resulted in mounting criticism, which led Milei to delete his post and attempt to backtrack. The president stated that he had not fully understood the project and that, after learning more, he chose to stop endorsing it.

But the damage had already been done. A joint investigation released by blockchain analytics firm Bubblempas and on-chain researcher Coffeezilla added salt to the open wound.

The investigation revealed evidence that suggested that there were links between the teams behind the LIBRA token launch and the MELANIA coin, launched by First Lady Melania Trump a day before Donald Trump assumed the US presidency.

The analysis confirmed suspicions of insider trading and market manipulation in both cases. It also suggested that this group spearheaded several other token launches, including TRUST, KACY, VIBES, and HOOD, which all ended in sniping schemes and rug pulls.

In response to the scandal, crypto community members took to social media to vent their disappointment in the industry. Some argued that meme coins are extractive, benefiting large insider traders while permanently driving smaller retail investors away from Web3.

“The crypto industry needs to engage in serious self-criticism if it doesn’t want to end up as an irrelevant circus. For years, the major players in the ecosystem have been creating narratives, inflating them, and then dumping tokens on retail investors, securing massive profits while driving the public away from the space. It’s about time we all focus on building value instead of constantly figuring out how to cash out quickly at the expense of those who are just trying to explore what this space is all about,” said blockchain researcher Pablo Sabbatella.

For Memeland founder Ray Chan, a crypto expert with nearly two decades of experience in the meme coin industry, this incident must be analyzed from different perspectives.

It’s common knowledge that the meme coin industry is extractive. Community engagement alone mostly drives many of these coins. Trading is largely speculative, and the market is inherently volatile.

“To me, I think it’s quite important to understand who is launching a token, and what the token is for. If it’s a meme coin, you should expect it to go to zero. Because literally, I think most of these meme coins mentioned that this token doesn’t have any road map or utility. I think this is an entertainment purpose only. If you expect it to go to billions all the time, you’re crazy. That’s on you,” Chan told BeInCrypto.

However, the LIBRA scandal differs from insider cases like the MELANIA coin launch. When Milei shared his original X post, he said the funds would support small businesses and budding Argentine entrepreneurs.

“But at the same time, for some tokens, maybe LIBRA, they mentioned that they are launching a token to support some other companies, to support some goals. If they don’t do it, I think that’s an issue,” he said.

When asked how to safeguard users against common practices in meme coin trading, such as rug pulls, pump-and-dump schemes, insider activity, market manipulation, or sniping, Chan said these issues will likely become less frequent over time.

Meme Coin Industry Still in Its Early Stages

Meme coins have existed for slightly over a decade. The “doge” internet meme became widely popular on social media in mid-2013.

Leveraging this trend, Jackson Palmer and Billy Markus created Dogecoin, launching it as a cryptocurrency on the Bitcointalk forum in December of the same year. This event marked Dogecoin’s distinction as the first cryptocurrency based on an internet meme.

According to Chan, given that this industry is still in its nascent stages, investors need to accept the market’s natural instability before deciding to participate.

“Before going in, or whether you invest $10,000 or $100,000, you have to understand that this industry is very new, and any new thing is very volatile. So, it’s very important to understand the risk before you make the investment or make the gamble,” he said.

Players with extensive knowledge and experience in the field will inevitably have the upper hand.

Expanding the User Pool

Because the meme coin industry is so new, players already well-versed in its mechanisms are more likely to profit from the common schemes associated with the market.

“I think it’s just part of the growing pain because, just like any tech and any sector, someone who is very sophisticated right from the beginning will probably understand the loophole. They will understand the opportunity, be it good or bad, and will just grab the opportunity to make some money,” Chan told BeInCrypto.

As the market ages and the meme coin industry draws new players, these schemes will become less frequent.

“Ultimately, expanding the audience to include more builders who understand crypto and blockchain will attract reputable individuals with their own goals and reputations to uphold. As more legitimate companies and builders enter the space, I expect the entire industry to grow in a healthier direction,” Chan explained.

Consequently, the meme coins will rely less on an important public figure to back them up and focus more on the message they are trying to convey.

“I think the space will be in a better place when support for tokens isn’t driven by influencers but instead by an understanding of the team and their work. Once we reach that stage, it will be a healthier and more sustainable environment,” Chan added.

He also underlined that, though inflating the price of a token based on community engagement has negative aspects, there is also a silver lining.

A Positive to Every Negative

In his interview with BeInCrypto, Chan emphasized the key difference between building on Web2 and building on Web3.

“In Web2, companies heavily rely on venture capital and IPOs, facing numerous constraints. In Web3, however, if you can mobilize a community that understands and supports what you’re building, VC funding becomes far less essential,” Chan explained.

Moreover, launching a meme coin is one of the easiest processes on Web3. Anyone can do it, and this has become one of the most important drivers of its success.

“Number one is the ease of creation. I actually think that tokens are kind of like content. When you lower the barrier of creation, more quote-on-quote creators will join, and they create more content. I think the meme coin is the lowest barrier in crypto. That explains why there are so many new coins launching every single day,” he said.

Jointly using these fundamental aspects of meme coin launches for a specific purpose that prioritizes substance over hype can create much more meaningful outcomes.

“You actually can turn your so-called consumer into a supporter, even into your investor. I think all these kinds of developments and breakthroughs, once you understand them, you won’t give up that easily in crypto and in blockchain,” Chan added.

Given these unique aspects, Chan expects meme coins to have a bright future.

The Future of Meme Coins

Chan argues that the meme coin trend reflects a generalized tendency in technological development. Science and technology are often invented to provide a meaningful solution to an existing problem.

Scientists developed vaccines to prevent terminal diseases like polio and influenza, while engineers invented planes to make the world more interconnected.

Satoshi Nakamoto similarly developed Bitcoin to offer an alternative to traditional financial systems. Blockchain solves acute issues related to data storage, user security, supply chain management, and voting systems, to name a few.

But not all technology is equal in popularity.

“For example, when you look at social networks, the most useful social network is LinkedIn, but the most popular social network is TikTok. That’s because it’s fun, engaging, easy to join, and participate,” said Chan.

Since meme coins in Web3 serve a similar purpose to TikTok in Web2, they can be leveraged to drive further adoption in the long run.

“I think meme coin is the TikTok of crypto. A lot of people say it’s useless, but a lot of people are joining it. And this is actually the biggest driving force of mass adoption. So what I’m believing in when crypto gets more mainstream and when blockchain gets more adopted, meme coin as a category, will gain more market share,” Chan concluded.

Whether or not Chan’s predictions come true largely depends on the sentiment of the crypto sector– especially how newly onboarded users interact with meme coins.

Only time will tell whether the crypto industry’s recent flurry of schemes will push people out of the sector for good or whether the meme coin market will mature like fine wine.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

Solana started a fresh increase from the $120 support zone. SOL price is now consolidating and might climb further above the $142 resistance zone.

- SOL price started a fresh increase above the $125 and $132 levels against the US Dollar.

- The price is now trading above $130 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if it clears the $142 resistance zone.

Solana Price Gains Over 5%

Solana price formed a base above the $120 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $125 and $132 resistance levels.

The pair even spiked toward the $145 resistance zone. A high was formed at $143.06 and the price is now retreating lower. There was a move below the 23.6% Fib retracement level of the upward move from the $135 swing low to the $143 high.

Solana is now trading above $130 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair. The trend line is close to the 76.4% Fib retracement level of the upward move from the $135 swing low to the $143 high.

On the upside, the price is facing resistance near the $142 level. The next major resistance is near the $145 level. The main resistance could be $150. A successful close above the $150 resistance zone could set the pace for another steady increase. The next key resistance is $155. Any more gains might send the price toward the $165 level.

Pullback in SOL?

If SOL fails to rise above the $142 resistance, it could start another decline. Initial support on the downside is near the $138.50 zone. The first major support is near the $137 level and the trend line.

A break below the $137 level might send the price toward the $132 zone. If there is a close below the $132 support, the price could decline toward the $125 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $137 and $132.

Major Resistance Levels – $142 and $145.

Market

Bitcoin Price Breakout In Progress—Momentum Builds Above Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price is slowly moving higher above the $86,500 zone. BTC is gaining pace and might continue higher in the near term.

- Bitcoin found support at $84,200 and started a recovery wave.

- The price is trading above $85,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $88,000 zone.

Bitcoin Price Eyes Steady Increase

Bitcoin price remained stable above the $83,200 level and started a fresh increase. BTC was able to climb above the $84,200 and $85,000 resistance levels.

There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair. The bulls were able to pump the price above the $86,500 resistance. It even spiked above $87,000. A high is formed near $87,562 and the price might continue to rise unless there is a move below the 23.6% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high.

Bitcoin price is now trading above $86,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $87,500 level. The first key resistance is near the $88,000 level.

The next key resistance could be $88,800. A close above the $88,800 resistance might send the price further higher. In the stated case, the price could rise and test the $89,500 resistance level. Any more gains might send the price toward the $90,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $88,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $87,000 level. The first major support is near the $86,750 level.

The next support is now near the $86,000 zone. Any more losses might send the price toward the $85,750 support or the 50% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high in the near term. The main support sits at $84,850.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $86,750, followed by $86,000.

Major Resistance Levels – $87,500 and $88,000.

Market

Will XRP Break Support and Drop Below $2?

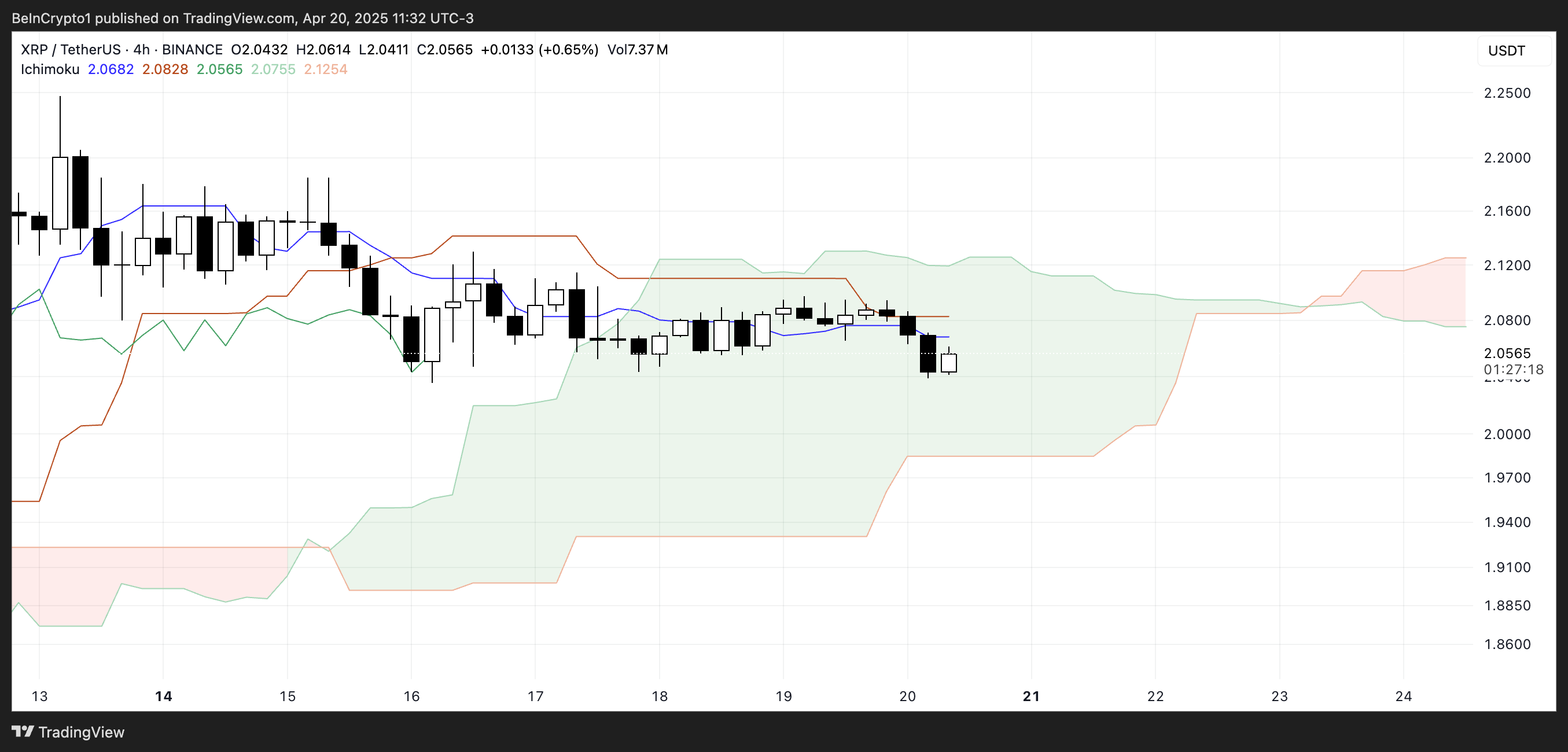

XRP is down 5% over the past week, struggling to regain momentum as technical indicators flash mixed signals. Its Relative Strength Index (RSI) has dropped below 50, and the price remains stuck within a tight range between key support and resistance levels.

At the same time, the Ichimoku Cloud has shifted from green to red, with a thickening cloud ahead suggesting growing bearish pressure. With volatility compressing and momentum fading, XRP is nearing a critical point where a breakout—or breakdown—seems increasingly likely.

XRP Struggles to Regain Momentum as RSI Drops Below 50

XRP’s Relative Strength Index (RSI) is currently sitting at 44.54, after recovering from an intraday low of 40.67. Just yesterday, it was at 51.30, highlighting increased short-term volatility.

RSI is a momentum indicator that measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions.

Readings above 70 typically suggest an asset is overbought, while readings below 30 indicate it may be oversold.

With XRP’s RSI at 44.54, it’s currently in neutral territory, showing neither strong buying nor selling pressure.

However, the fact that it hasn’t crossed the overbought threshold of 70 since March 19—over a month ago—signals a lack of sustained bullish momentum. This could mean XRP is still in a consolidation phase, with the market waiting for a clearer direction.

If RSI continues to climb toward 50 and beyond, it may hint at building momentum, but without a breakout above 70, upside could remain limited.

XRP Faces Uncertainty as Bearish Trend Begins to Expand

XRP is currently trading inside the Ichimoku Cloud, signaling market indecision and a neutral trend.

The Tenkan-sen (blue line) has crossed below the Kijun-sen (red line), which is a bearish signal, but with the price still within the cloud, it lacks full confirmation.

The cloud itself acts as a zone of support and resistance, and XRP is now moving sideways within that zone.

Looking ahead, the cloud has shifted from green to red—a sign that bearish momentum may be building. Even more concerning is that the red cloud is widening, which suggests increasing downward pressure in the near future.

A thickening red Kumo often signals stronger resistance overhead and a potential continuation of a bearish trend if the price breaks below the cloud.

Until XRP breaks out decisively in either direction, the market remains in a wait-and-see phase, but the growing red cloud tilts the bias toward caution.

XRP Compression Zone: A Breakout Could Send Price to $2.50 — Or Much Lower

XRP price is currently trading within a tight range, caught between a key support level at $2.05 and resistance at $2.09. This narrow channel reflects short-term uncertainty, but a decisive move in either direction could set the tone for what’s next.

If the $2.05 support fails, the next level to watch is $1.96. A break below that could trigger a steep drop toward $1.61, which would mark the first close below $1.70 since November 2024—a bearish signal that could accelerate selling pressure.

Recently, veteran analyst Peter Brandt warned that a major correction could hit XRP soon.

On the flip side, if bulls regain control and push XRP above the $2.09 resistance, the next target lies at $2.17. A breakout beyond that could open the door to a move toward $2.50, a price level not seen since March 19.

For that to happen, XRP would need a clear resurgence in momentum and buying volume.

Until then, the price remains trapped in a narrow zone, with both upside and downside potential on the table.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market20 hours ago

Market20 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market14 hours ago

Market14 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Altcoin23 hours ago

Altcoin23 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market18 hours ago

Market18 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point

-

Market19 hours ago

Market19 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026