Market

Crypto Outflows Hit $508 Million as Bitcoin Bleeds, Altcoins Surge

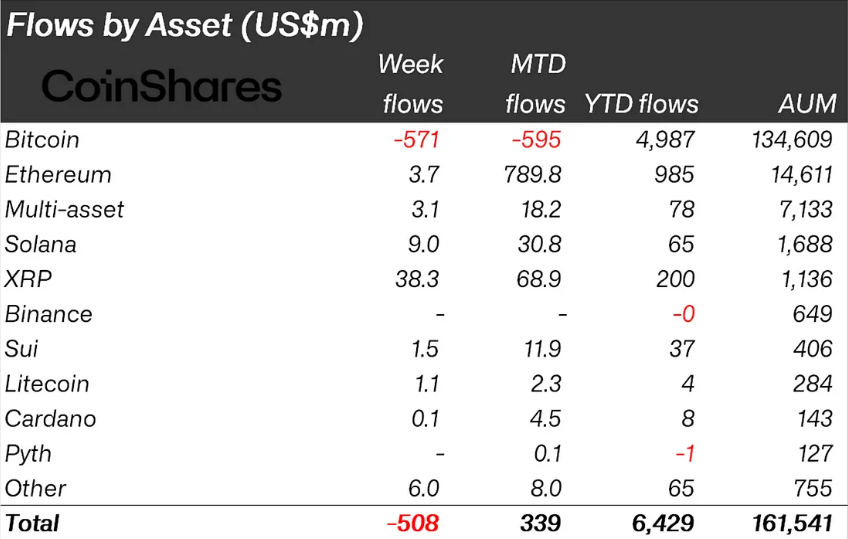

Crypto outflows reached $508 million last week, marking the second series of negative flows in 2025. This brings the last two weeks of outflows to $925 million.

The outflows point to a shift in sentiment following an 18-week rally that accumulated $29 billion as investors weigh the impact of the US economic events and uncertainty surrounding trade tariffs, inflation, and monetary policy.

Bitcoin Takes the Biggest Hit While Altcoins Rally

The latest CoinShares report indicates that Bitcoin (BTC) bore the brunt of investor caution, seeing outflows of $571 million. Further, some traders opted to increase short positions, leading to $2.8 million in inflows for short-Bitcoin products.

This follows a similar trend from the previous week, when hawkish rhetoric from the Federal Reserve and CPI data contributed to the first crypto outflows of 2025. According to CoinShares, the latest stream of outflows comes amid heightened caution as investors continue to digest US economic data.

“We believe investors are exercising caution following the US Presidential inauguration and the consequent uncertainty around Trump’s trade tariffs, inflation, and monetary policy. This is also evident in trading turnover, which has fallen considerably from $22 billion 2 weeks ago to $13 billion last week,” an excerpt in the report read.

Regionally, the US accounted for most of the outflows, losing $560 million, accentuating concerns about the country’s economic policies.

Interestingly, however, while Bitcoin struggled, altcoins continued to see positive momentum. XRP led the way with $38.3 million in inflows, bringing its total since mid-November 2025 to $819 million.

XRP’s strong performance comes amid increasing anticipation of a US SEC (Securities and Exchange Commission) decision on an XRP ETF. The deadline for the SEC to approve or reject certain ETF applications has begun. Investors remain hopeful that XRP will gain regulatory clarity.

If approved, an XRP ETF could drive further institutional investment, reinforcing the altcoin’s resilience amid broader market uncertainty. However, XRP’s surge reflects increasing investor optimism that the US SEC may drop its lawsuit against Ripple.

Recent developments, including the SEC’s acknowledgment of Bitwise’s XRP ETF application and the launch of an XRP ETF in Brazil via Hashdex, fuel speculation further.

Other altcoins also saw inflows, with Solana attracting $9 million, Ethereum gaining $3.7 million, and Sui receiving $1.5 million. This suggests a potential shift in investor focus from Bitcoin’s digital gold narrative towards altcoins with stronger technical fundamentals and growth potential.

Meanwhile,this skittish market sentiment could be further influenced by upcoming US economic data this week. As BeInCrypto reported, Thursday’s GDP and Friday’s PCE inflation data could provide key insights into Federal Reserve policy direction.

As Bitcoin’s sensitivity to macroeconomic uncertainty amplifies, undesirable reports later in the week could exacerbate selling pressure. Altcoins appear to be benefiting from speculative interest and potential diversification plays.

The divergence in investor sentiment between Bitcoin and altcoins suggests a potential shift in market structure, with some analysts already visualizing an altcoin season.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Crypto Narratives to Watch For the Last Week of February

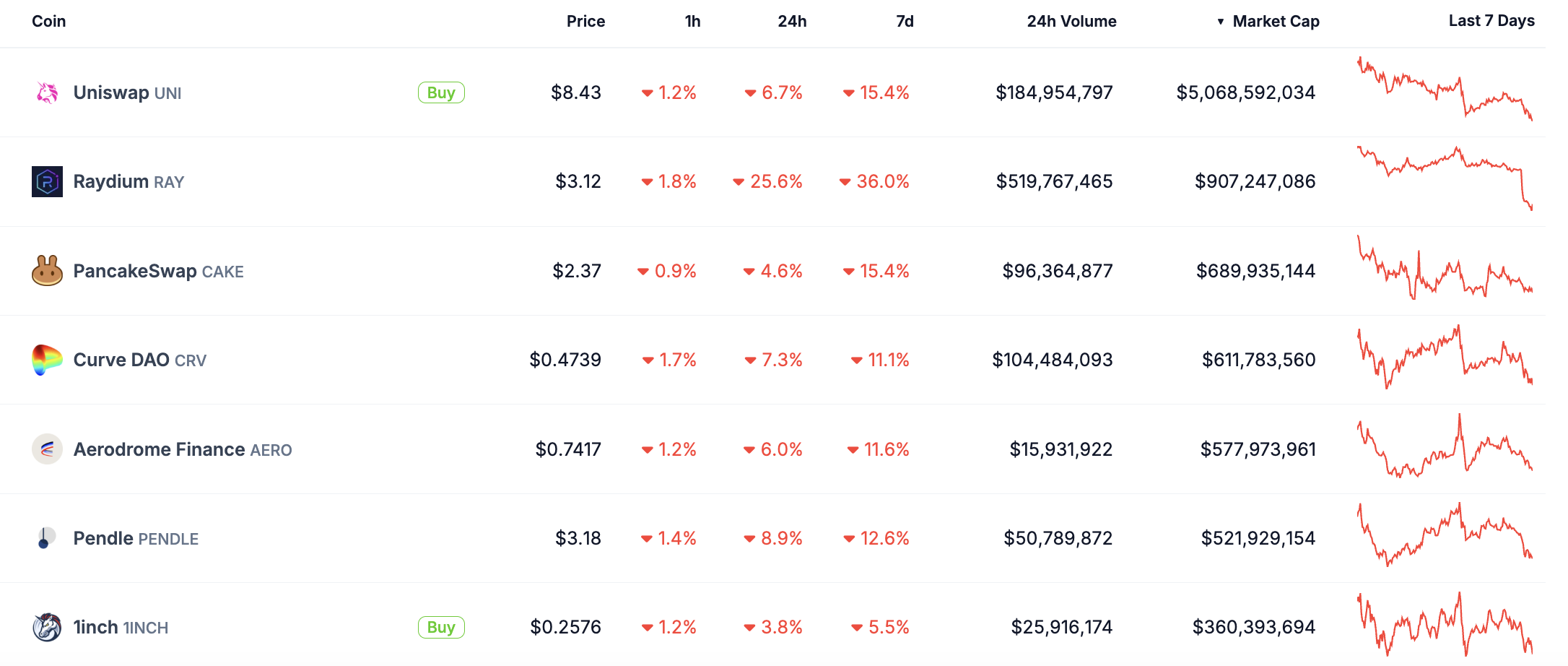

Automated Market Makers (AMMs), BNB Ecosystem Coins, and AI are the top three crypto narratives to watch for the last week of February. AMMs are facing a challenging week, with all top seven coins in red, but potential catalysts like Unichain’s growth and competition in Solana’s DEX space keep them relevant.

The BNB ecosystem is gaining momentum with CZ’s renewed advocacy, an AI-focused roadmap, and surging activity on PancakeSwap. Meanwhile, the AI narrative is showing mixed signals. While the broader AI crypto market struggles, projects like Story (IP), CLANKER, FORT, and BNKR are capitalizing on niche use cases.

Automated Market Makers (AMMs)

AMMs coins have had a rough week, with all seven top seven coins in red. Automated Market Makers are decentralized exchanges that allow users to trade digital assets without using a traditional order book.

They rely on liquidity pools, where users provide funds that facilitate trading and earn fees in return. This model enhances liquidity and removes the need for centralized intermediaries, making AMMs a crucial part of decentralized finance (DeFi).

RAY is the biggest loser among the top AMMs. Rumors about Pumpfun launching their own AMM solution could impact Raydium’s usage and fee generation, causing its price to fall almost 30% in just 24 hours.

UNI and CAKE are both down 15%, as the market doesn’t seem excited about Uniswap’s new chain, Unichain. Additionally, CAKE is correcting after its recent surge alongside the rising BNB ecosystem.

However, RAY continues to be a dominant force in Solana, which could lead some users to question whether the recent drop isn’t an overreaction.

Chris Chung, founder of Solana decentralized exchange aggregator Titan believes that this could be good for the Solana ecosystem after all.

“The fact that pump.fun is developing its own automated market maker (AMM) is no surprise – it’s an obvious business move. They’ve created so much volume with meme coin trading that it was only a matter of time before they built infrastructure to take advantage of the fees. This creates competition for Jupiter and Meteora, but Raydium is the most affected, given meme coins make up the majority of the volume on Raydium,” Chung told BeInCrypto.

Also, Unichain is in its early days, and a new altcoin season could boost its usage. Additionally, the BNB ecosystem appears to have built good momentum in the last few weeks, which could set the stage for a CAKE price recovery.

All that combined makes AMMs one of the most interesting crypto narratives for this week.

“Now that competition in the Solana DEX space is heating up, exchanges will likely start competing for token listings. Some expect this to lead to lower fees, but I believe we’re more likely to see other incentives, like revenue sharing, token allocations beyond liquidity pool fees, or advertising support. DEXs have large treasuries and we’re going to see them dipping into these to make their offering stand out,” said Chung.

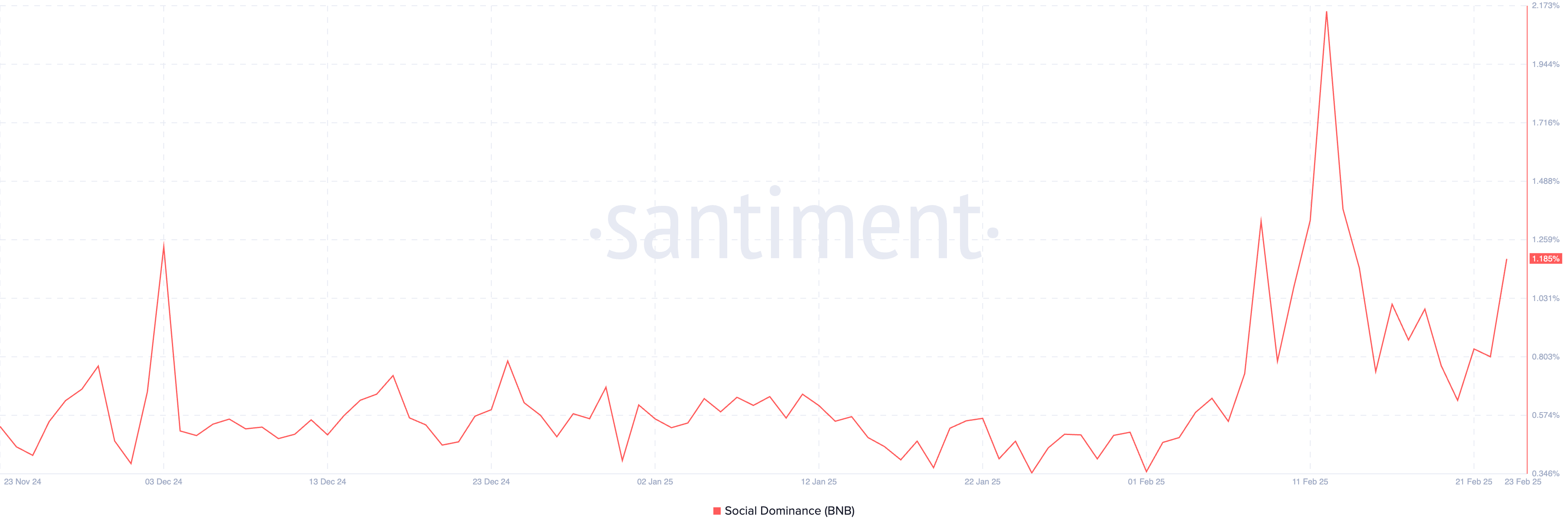

BNB Ecosystem Coins

BNB chain has been in the spotlight recently as CZ has renewed his advocacy for the network. The chain introduced an AI-focused roadmap and a new solution to make it easier for users to launch new coins.

These developments for the BNB chain also align with other crypto narratives, such as meme coins and artificial intelligence.

PancakeSwap, the largest decentralized exchange on the BNB ecosystem, experienced a surge in fees, jumping from $2 to $3 million in early January to consistently staying above $4 million and even reaching $18 million on some days since January 16.

This growth reflects increased activity and interest in the BNB chain.

The chain has also seen the rise of trending meme coins, such as BROCCOLI, inspired by CZ’s dog, and TST, which has become one of the biggest native meme coins on the BNB chain.

If this momentum continues, it could attract more builders and new coins to the chain, benefiting existing products and altcoins within the ecosystem.

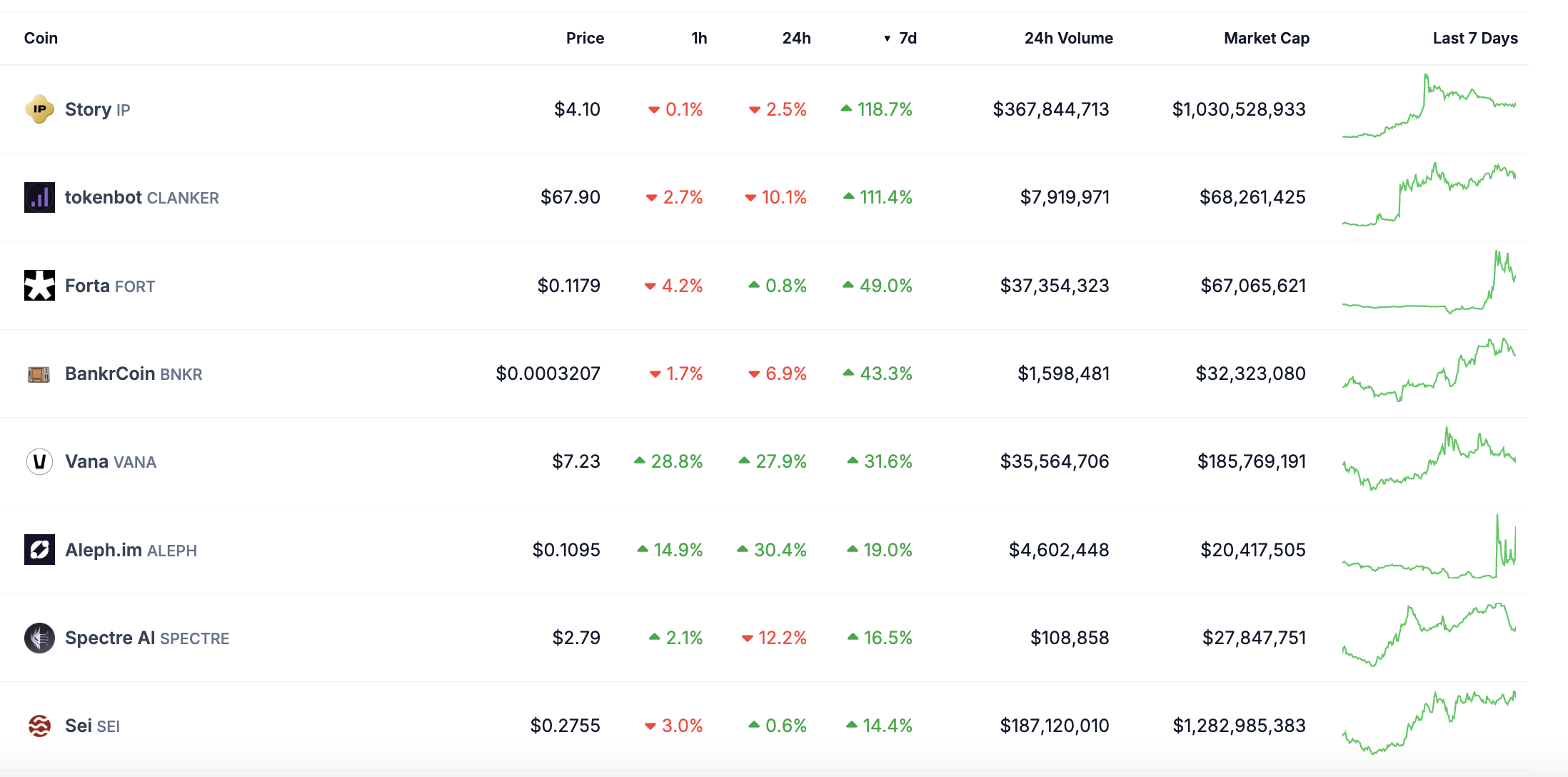

Artificial Intelligence

Although several AI coins are struggling, with RENDER, FET, and VIRTUAL all registering double-digit losses in the last seven days, some specific segments are managing to rise despite the overall narrative correction.

Story (IP) is a standout performer, up roughly 120% in the last week. It has become one of the most trending altcoins and quickly reached a $1 billion market cap. Similarly, CLANKER, one of Base’s biggest coin launchpads, is up 111%, reaching its highest price levels since early January 2025.

FORT is up 49%, leveraging on its security crypto firewall following the Bybit hack. BNKR has also gained 43%, capitalizing on the narrative around crypto AI agents and crypto companions.

Maybe the market is signaling that merely branding as an “AI coin” isn’t enough anymore. This shift could open up more space for coins that are becoming more specific about their use cases and not just defining themselves as a “crypto AI framework” or a “crypto AI agent coin.”

The post Top 3 Crypto Narratives to Watch For the Last Week of February appeared first on BeInCrypto.

Market

Top 3 Altcoins To Watch In The Fourth Week of February

Story (IP), Sonic (S), and Hyperliquid (HYPE) are the top three altcoins to watch for the last week of February. Story has surged by 140% in the past seven days, driven by its focus on programmable intellectual property, positioning it as a leading artificial intelligence coin.

Sonic, formerly known as Fantom, is up nearly 40% this week, showing strong bullish momentum after rebranding. Meanwhile, Hyperliquid remains highly profitable but faces bearish pressure due to market skepticism about its new HyperEVM, making all three altcoins crucial to watch as February ends.

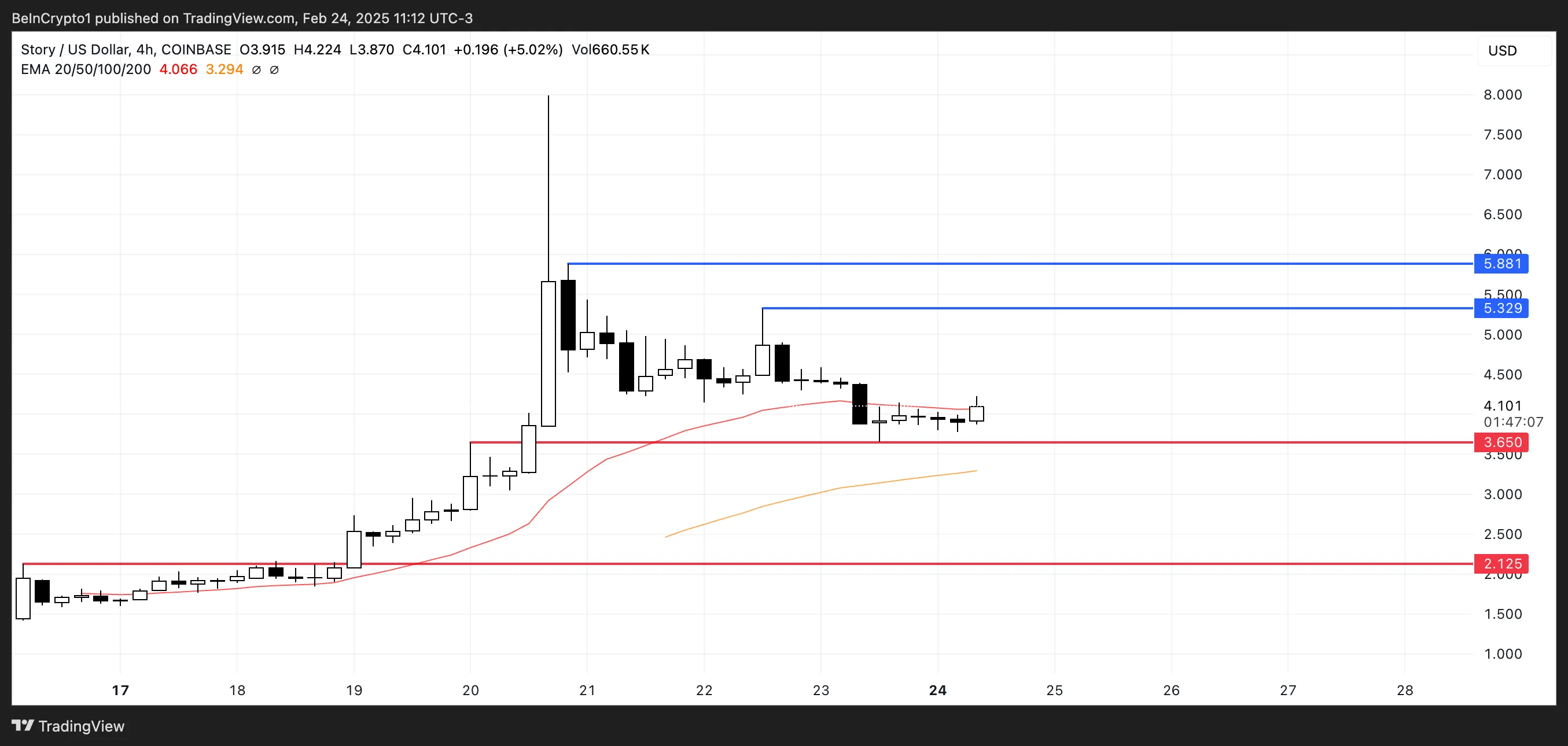

Story (IP)

Story is one of the most trending new altcoins in the market. It is known for being a layer-1 chain that focuses on programmable intellectual property (IP).

The platform is built on the idea that IP is the world’s largest asset class and essential for the existence of artificial intelligence. After its launch, it has quickly become one of the biggest artificial intelligence altcoins in the market.

Story’s market cap is currently at $1 billion, and its price has surged by 140% in the last seven days, reflecting strong bullish momentum. If this trend continues, IP could test resistances at $5.32 and $5.88 soon, with the potential to rise above $6 or even $7.

However, the IP is currently in a correction phase, and if the downward movement persists, it could test the support at $3.65. A break below this level could push the price as low as $2.12, highlighting the importance of maintaining bullish momentum to sustain its recent gains.

Sonic (S)

Sonic, formerly known as Fantom, has been trending in the last few weeks, showing strong bullish momentum. Its price is up almost 40% in the last seven days and 55% in the last 30 days, pushing its market cap to $2.4 billion. S reached $0.97 on February 21, one of its highest levels ever.

If this positive momentum continues, Sonic could rise to test levels close to $1 again, potentially breaking above $1 for the first time ever and setting new all-time highs.

However, if the trend reverses, Sonic could test the support at $0.78, and if that level fails to hold, it could drop as low as $0.50.

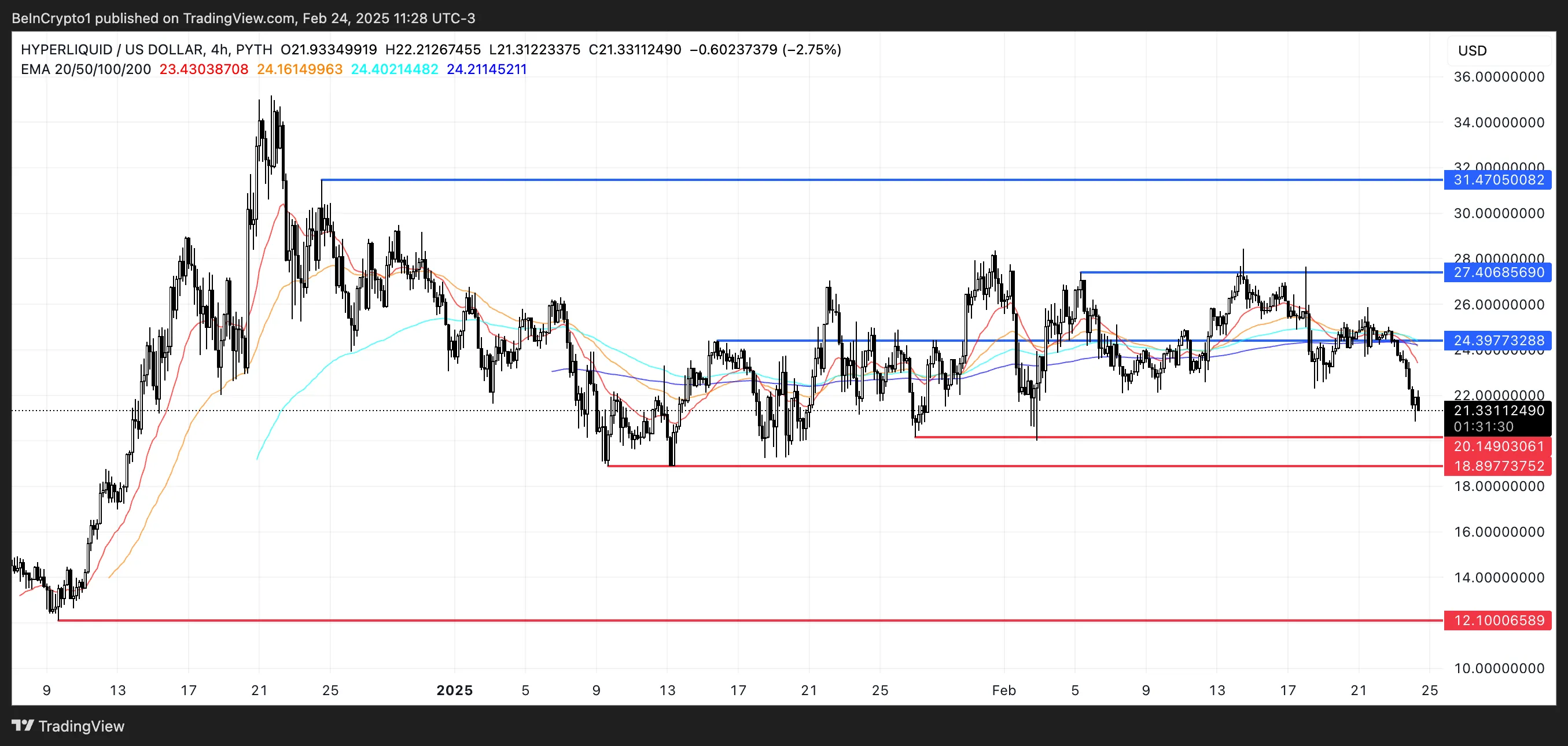

Hyperliquid (HYPE)

Hyperliquid remains one of the most profitable businesses in crypto, generating $9.15 million in fees over the last seven days.

However, its token, HYPE, is not reflecting this success, having dropped more than 10% in the last 24 hours and 18% in the past seven days. The market appears skeptical about HyperEVM, which Hyperliquid announced last week, contributing to the recent downtrend.

If this bearish momentum continues, HYPE could test two crucial supports at $20.1 and $18.8. A break below these levels could push the price down to $12.1, marking its lowest point since mid-December 2024.

Conversely, if sentiment reverses, Hyperliquid could test the resistance at $24.3, and a break above that could lead to $27.4.

If HyperEVM gains traction and attention returns to the chain, HYPE could rise to $31.4, potentially breaking above $30 for the first time in two months.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MicroStrategy Buys $2 Billion in Bitcoin, Its Largest of 2025

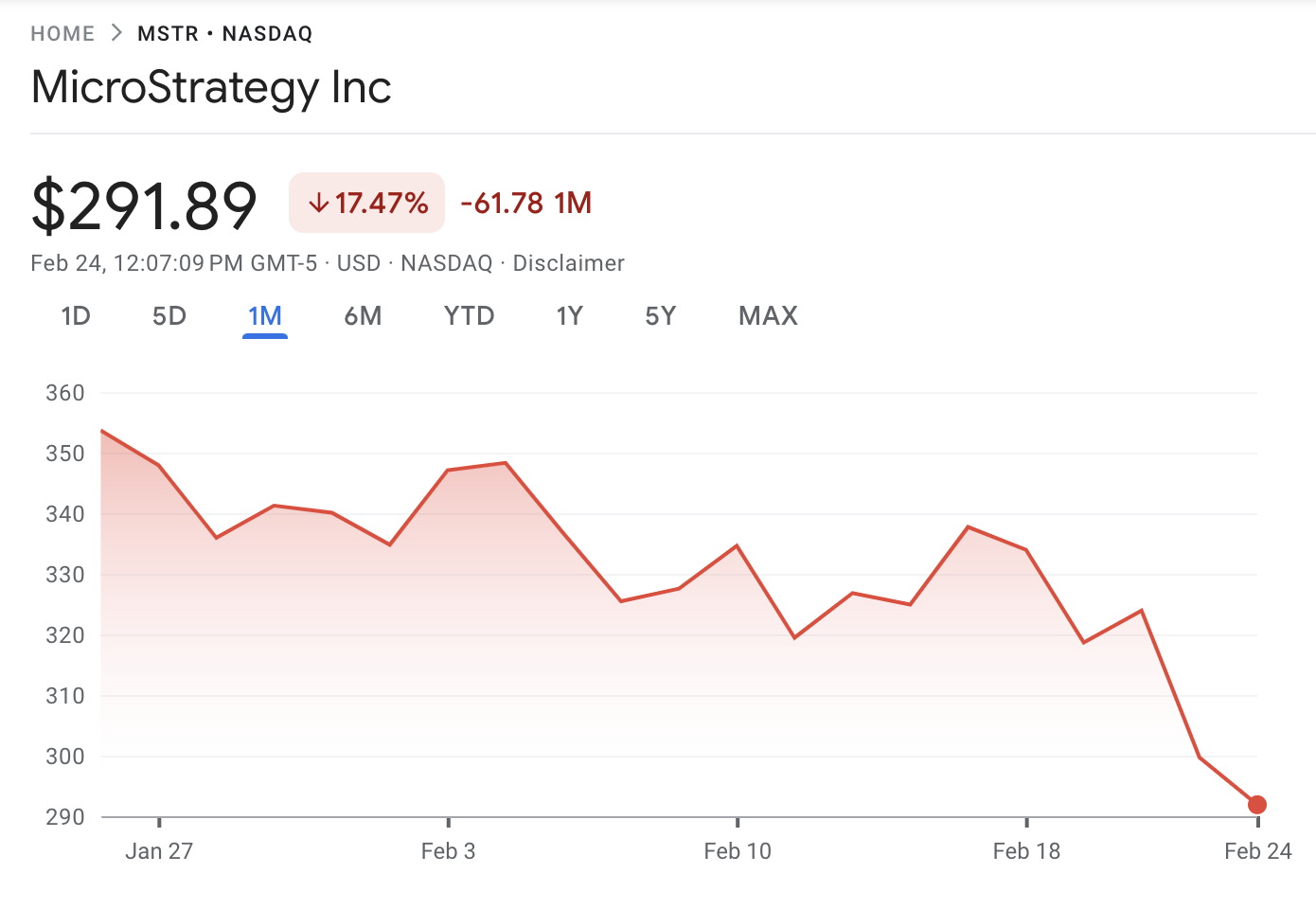

Strategy (formerly MicroStrategy) just bought 20,356 more Bitcoin, per an announcement from Michael Saylor. This is the company’s largest purchase in over two months, but its stock price has been dropping.

Strategy has been funding these acquisitions through multibillion-dollar stock sales, which are apparently shaking confidence in the company. If Bitcoin’s own price doldrums continue, it could have a severely negative impact on the firm.

Saylor Keeps Buying Bitcoin

Strategy, which recently rebranded from MicroStrategy, has once again extended its lead as one of the world’s largest Bitcoin holders. Earlier today, the firm completed a $2 billion stock offering, and Michael Saylor just announced that the proceeds are being used on Bitcoin acquisitions.

“Strategy has acquired 20,356 BTC for $1.99 billion at $97,514 per bitcoin and has achieved BTC Yield of 6.9% YTD 2025. As of February 23, we hold 499,096 BTC acquired for ~$33.1 billion at ~$66,357 per bitcoin,” Saylor claimed.

Today’s acquisition is the firm’s largest purchase in over two months. Despite the outward bullish appearance, however, some concerns are beginning to surface.

Saylor has continued these massive Bitcoin purchases for months, but there were multiple significant pauses in February. Despite the latest purchase, the company’s stock MSTR has underperformed so far this year.

There are likely a few reasons why MSTR has seen a decline in the stock market. Last year, MicroStrategy’s stock performance showed a clear correlation with Bitcoin’s market growth.

However, Bitcoin’s own price has suffered recently thanks to bearish market conditions, and this hasn’t helped Saylor’s company.

More to the point, these massive stock sales are impacting Strategy itself. For example, the firm carried out another $2 billion sale in January, and today’s sale included another optional offering of up to $300 million.

Strategy also launched a new perpetual security, diversifying its offerings. BlackRock alone holds 5% of the company, a clear signifier of how much stock the firm has sold.

Rumors have been building that these Bitcoin purchases may be creating a tax dilemma, and Saylor seems content to keep plowing ahead with acquisitions.

Overall, Saylor is still looking at the long term. Offloading huge quantities of shares is visibly impacting MSTR. Yet, this could significantly change when Bitcoin enters another bullish cycle.

Previously, BeInCrypto analysts noted that BTC supply on exchanges has plummeted to 2.5 million, which means a supply shock is imminent. MicroStrategy or Strategy’s continued purchases could add to this pressure.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market14 hours ago

Market14 hours agoEther recovers from its dip to $2,600 following Bybit’s hack

-

Ethereum9 hours ago

Ethereum9 hours agoWhat we know about the $49.5 million Infini exploit so far

-

Altcoin23 hours ago

Altcoin23 hours agoBybit Hack: Exchanges Freeze $42 Million From Exploit

-

Altcoin22 hours ago

Altcoin22 hours agoXRP Price Nears Breakout Zone, Is a Rally To $5 on the Horizon?

-

Market15 hours ago

Market15 hours agoKanye West Denies Barkmeta Ties Amid Meme Coin Controversy

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Developer Counters Idea Of Blockchain Rollback Amidst Bybit Hack

-

Market16 hours ago

Market16 hours agoXRP Price Nears Key Support—A Breakdown Could Be Devastating

-

Altcoin16 hours ago

Altcoin16 hours agoBTC Slips To $95K, ETH Above $2,700