Bitcoin

What It Means for Bitcoin & Crypto

Crypto markets need to monitor several key US economic data points this week, given the abounding influence of macroeconomic events on Bitcoin (BTC).

Bitcoin is trading near the $95,000 range, with this week’s economic events likely to provoke its next directional bias.

Consumer Confidence

The University of Michigan will report the US consumer confidence on Tuesday, detailing buyer attitudes, buying intentions, vacation plans, expectations for inflation, stock prices, and interest rates.

After the previous consumer confidence index of 104.1, the consensus is a minor retraction to 102.4. This sentiment comes amid President Donald Trump’s policies, with Ark Invest’s Cathie Wood noting the new administration’s impact on spending.

“…today nearly a third of the labor force, and perhaps their families, could be holding back on spending until they see the impact of rapid policy changes. While we believe the changes will be net positive for the economy – perhaps massively so – the short-term uncertainty is palpable,” Wood explained.

Notably, consumer confidence data does not move crypto markets the way a Federal Reserve (Fed) rate hike might. However, it is a signal of how people are feeling about discretionary spending and investment. Crypto and Bitcoin, in particular, largely being a retail-driven market, are sensitive to that vibe.

Initial Jobless Claims

Thursday’s initial jobless claims report is also a key US economic data to watch this week. It measures the number of people filing for unemployment benefits for the first time in a week, serving as a real-time pulse on the labor market and broader economy.

As such, this report’s influence ties to how the data shapes investor sentiment, including expectations about monetary policy. When jobless claims rise unexpectedly, it signals potential economic weakness—think layoffs, slowing growth, or recession risks.

Investors often interpret this as a cue to dial back risk, pulling money from volatile assets like Bitcoin and cryptocurrencies in favor of safer bets like cash or bonds. Conversely, when initial jobless claims drop or come in lower than expected, it is a sign of labor market strength.

This can boost confidence, encouraging investors to invest in riskier assets, including crypto. A strong jobs picture might ease fears of aggressive rate hikes, giving Bitcoin room to climb—especially if it keeps its digital gold allure intact.

According to data from MarketWatch, after a previous reading of 219,000 jobless claims, economists anticipate a rise to 225,000 for the week ending February 22.

GDP

The US GDP report, scheduled for release this Thursday, could also significantly sway Bitcoin and cryptocurrency markets. Like consumer confidence and initial jobless claims, the data could shape investor perceptions of economic health and monetary policy direction.

A stronger-than-expected GDP figure might signal strong economic growth, potentially reducing Bitcoin’s appeal as a hedge against uncertainty. Investors could lean toward traditional assets like stocks, expecting tighter Federal Reserve policies to curb inflation.

This risk-off shift often pressures crypto prices downward, as Bitcoin’s correlation with equities has tightened recently. For instance, if GDP growth exceeds forecasts (above the projected 2.3% for Q4 2024), it might dampen hopes for rate cuts. Such an outcome would prompt a sell-off in speculative assets like crypto.

Conversely, a weaker-than-expected GDP report could fuel a crypto rally. If growth slows significantly, perhaps falling short of the prior quarter, it might stoke recession fears, pushing the Fed toward a more dovish stance with potential rate cuts.

This scenario often boosts Bitcoin’s allure as a digital gold or alternative store of value, especially if investors lose faith in fiat stability amid economic softness.

PCE

Another US economic data point to watch this week is the January PCE (Personal Consumption Expenditures), set for release on Friday. As the Fed’s preferred inflation gauge, this metric will give a fresh read on how price pressures are trending, potentially swaying expectations for interest rates and, by extension, risk assets like crypto.

If the PCE comes in hotter than expected, above the consensus estimate of 0.3% monthly growth for the headline index or 0.2% for the core, it might signal stubborn inflation. This could reduce the odds of near-term rate cuts, possibly spooking investors and dragging Bitcoin down as money flows out of speculative plays and into safer bets like bonds.

On the other hand, a cooler-than-expected PCE, which is closer to or below the Fed’s 2% annual target, could spark a rally.

“The idea of a 2% inflation target was first introduced by the Fed in 2012, when core PCE, the Fed’s preferred measure, was 1.8%. It was just an excuse to justify QE. For the first 99 years of the Fed’s existence, the unofficial target was zero, as the mandate was price stability,” Bitcoin critic Peter Schiff highlighted.

Lower inflation might fuel hopes that the Fed will ease rates sooner, maybe even at the March 19 meeting. This would make cheap money more available and boost the appetite for crypto.

Bitcoin has been sensitive to these macro cues lately, including its recent response to President Trump’s tariffs. Either way, investors should brace for possible volatility amid crypto’s tendency to react to these releases.

“PCE may be a bigger market mover than NVDA this week. Embrace the volatility,” one user on X observed.

BeInCrypto data shows Bitcoin was trading for $95,437 as of this writing, down by 1.1% since Monday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

What Does This Mean for Altcoins?

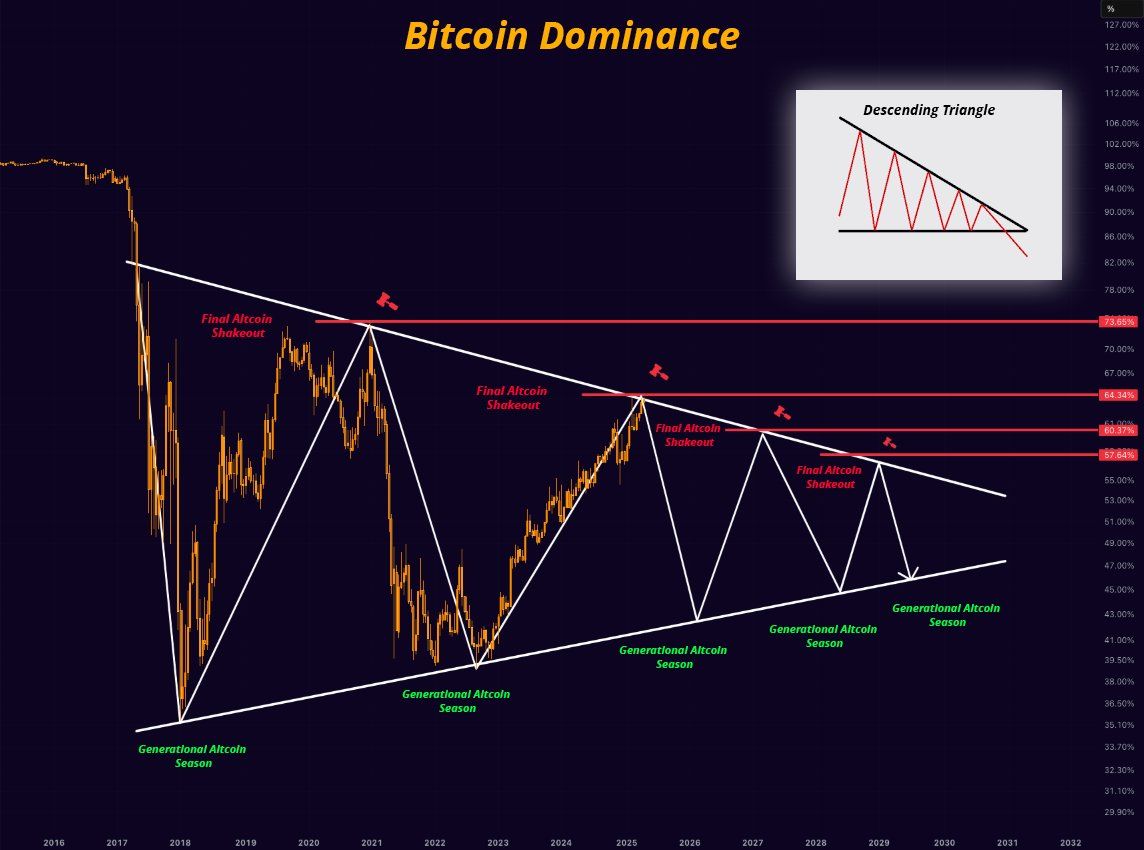

Bitcoin’s (BTC) market dominance has surged to 64%, reaching its highest level in over four years.

However, experts remain divided on what this means for the future. Some predict an impending altcoin season, and others caution that Bitcoin’s dominance could continue to suppress altcoins.

What Does Bitcoin’s Rising Dominance Mean?

For context, Bitcoin dominance (BTC.D) refers to the percentage of the total cryptocurrency market capitalization that BTC holds. It is a key indicator of Bitcoin’s market strength relative to other cryptocurrencies. A rising dominance suggests that Bitcoin is outperforming altcoins, while a decrease may signal growing interest or investment in other digital assets.

The metric has been steadily increasing since late 2022. As of the latest data, it surged to 64%, marking highs last seen in early 2021.

Notably, Benjamin Cowen, founder of Into The Cryptoverse, highlighted that the number is much higher when excluding stablecoins.

“Excluding stable coins, Bitcoin dominance is now at 69%,” Cowen revealed.

The rise in Bitcoin dominance has sparked debate among analysts about its implications for altcoins. Cowen believes there will be a correction or downward movement in altcoins before any substantial gains can be expected in the market. This implies that the altcoin season may not be imminent yet.

“I think ALT/ BTC pairs need to go down before they can go up,” he stated.

Nordin, founder of Nour Group, also expressed caution. He stressed that Bitcoin dominance is nearing the levels seen during the peak of the 2020 bear market.

“This isn’t just a BTC move. Its capital rotating out of alts,” he noted.

Moreover, Nordin warned that a break above 66% could intensify selling pressure on altcoins. This, in turn, could delay the altcoin season.

“Bitcoin dominance back to 64%. No Alt seasons in 2024 or 2025,” analyst, Alessandro Ottaviani, predicted.

On the other hand, analyst Mister Crypto predicts that Bitcoin’s dominance may follow a long-term descending triangle pattern. A descending triangle typically suggests bearish momentum, where the price or dominance gradually decreases as lower highs are formed.

However, this could prolong its market control before a broader correction allows altcoins to gain traction.

Another analyst mentioned that Bitcoin dominance is currently testing the resistance zone between 64% and 64.3%. Therefore, a possible retracement may be on the horizon. Should this retracement occur, altcoins could begin to gain traction, with some potentially emerging as top performers in the market as capital shifts away from Bitcoin.

“However, a breakout from this zone could mean further declines for alts,” the analyst remarked.

Finally, Junaid Dar, CEO of Bitwardinvest, offered a more optimistic view. According to Dar’s analysis, if Bitcoin’s dominance drops below 63.45%, it could trigger a strong upward movement in altcoins. This, he believes, would create an ideal opportunity to profit from altcoin positions.

“For now, alts are stuck. Just a matter of time,” Dar added.

Tether Dominance Signals Potential Altcoin Season

Meanwhile, many analysts believe that the trends in Tether dominance (USDT.D) signal a potential altcoin season. From a technical analysis standpoint, USDT.D has reached a resistance zone and may be due for a correction, suggesting the possibility of capital flowing from USDT into altcoins.

“The USDTD is in a rejection zone, as long as it does not close above 6.75% it will be favorable for the market,” a technical analyst wrote.

Another analyst also stressed that the USDT.D and USD Coin dominance (USDC.D) have reached resistance, forecasting an incoming altcoin season. Doğu Tekinoğlu drew similar conclusions by observing the combined chart of BTC.D, USDT.D, and USDC.D.

As Bitcoin’s dominance climbs, investors are closely monitoring these technical and on-chain signals. The interplay between Bitcoin’s strength and stablecoin dynamics could dictate whether altcoins stage a comeback this summer or face further consolidation. For now, Bitcoin’s grip on the market remains firm.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Babylon’s TVL Drops 32% After Massive Bitcoin Unstaking

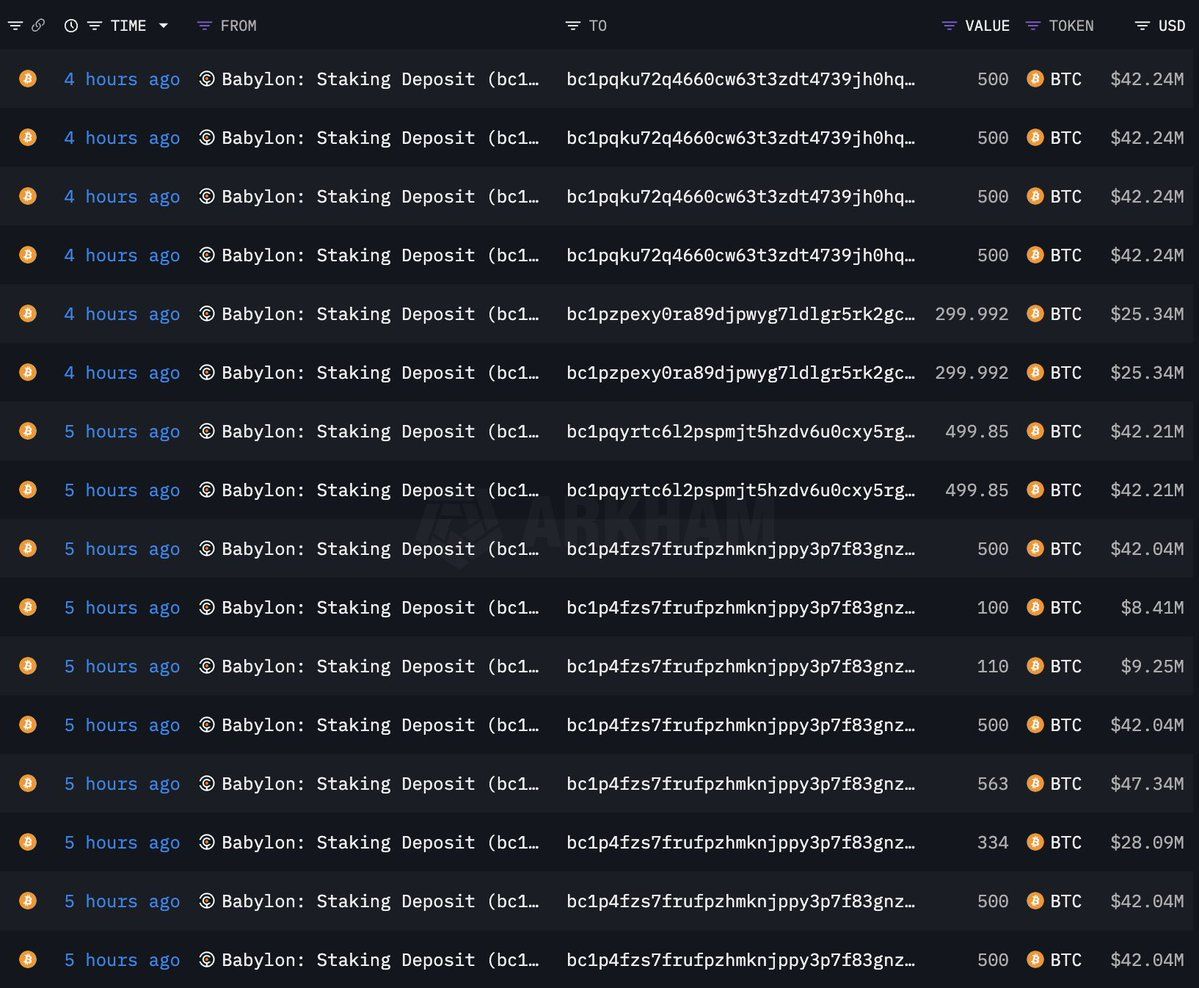

Babylon, a platform enabling native Bitcoin (BTC) staking, recorded a notable unstaking event on April 17. Approximately $1.26 billion worth of BTC was withdrawn from the protocol.

The move resulted in a significant decline in Babylon’s total value locked (TVL). Moreover, the price of its native token, BABY, also dipped.

Babylon’s TVL Drops 32% After Massive BTC Unstaking

Blockchain analytics firm Lookonchain alerted users about the unstaking on X (formerly Twitter).

“About 5 hours ago, 14,929 BTC($1.26 billion) was unstaked from Babylon,” the post read.

This move triggered a sharp drop in the platform’s TVL. According to data from DefiLama, Babylon’s TVL dropped from $3.9 billion to $2.6 billion in just a day, representing a decline of 32.7%. Moreover, only 31,502 BTC remain staked in the protocol at press time.

That’s not all. The BABY token was also not immune to market pressures. According to BeInCrypto data, the token depreciated by 9.8% over the past day alone. At the time of writing, the altcoin was trading at $0.8.

The unstaking led to widespread speculation about the platform’s stability and the broader implications for Bitcoin-based decentralized finance (DeFi) protocols.

“What’s going on. I don’t waste my time partaking in staking BTC, but this can be concerning. You don’t just see so much unstaking in such a short window,” a user said.

Nonetheless, Lombard Finance quickly moved to calm investor concerns. The Bitcoin restaking protocol, built on Babylon, clarified that the withdrawal was part of a planned transition to a new set of finality providers.

“To carry out the transition to our new set of Finality Providers, the Lombard Protocol has begun the process of unstaking BTC from the Lombard Finality Provider,” Lombard Finance stated.

The post emphasized that this process was a necessary step in the evolution of the platform. In addition, the company reassured investors that the withdrawn funds are expected to be restaked once the unbonding process concludes.

The unstaking event follows closely on the heels of Babylon’s airdrop earlier this month. 600 million BABY tokens—representing 6% of the token’s total supply—were distributed to early adopters, including Phase 1 stakers, Pioneer Pass NFT holders, and contributing developers.

Shortly after the airdrop, $21 million worth of Bitcoin was unstaked within 24 hours. This suggests a pattern of capital withdrawal that has intensified with the latest event.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

What Good Friday Options Expiry Means for Bitcoin & Ethereum

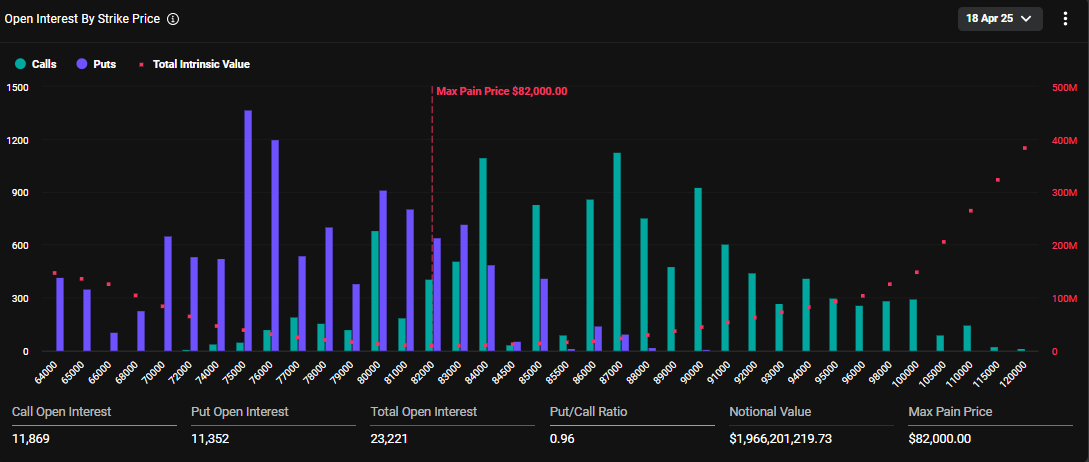

On Good Friday, over $2.2 billion worth of Bitcoin and Ethereum options contracts expire today.

It comes as crypto markets continue to reel from macroeconomic uncertainty. President Donald Trump is pressuring the Federal Reserve (Fed) to cut interest rates, but the chair, Jerome Powell, will not budge.

Over $2.2 Billion Options Expire Today

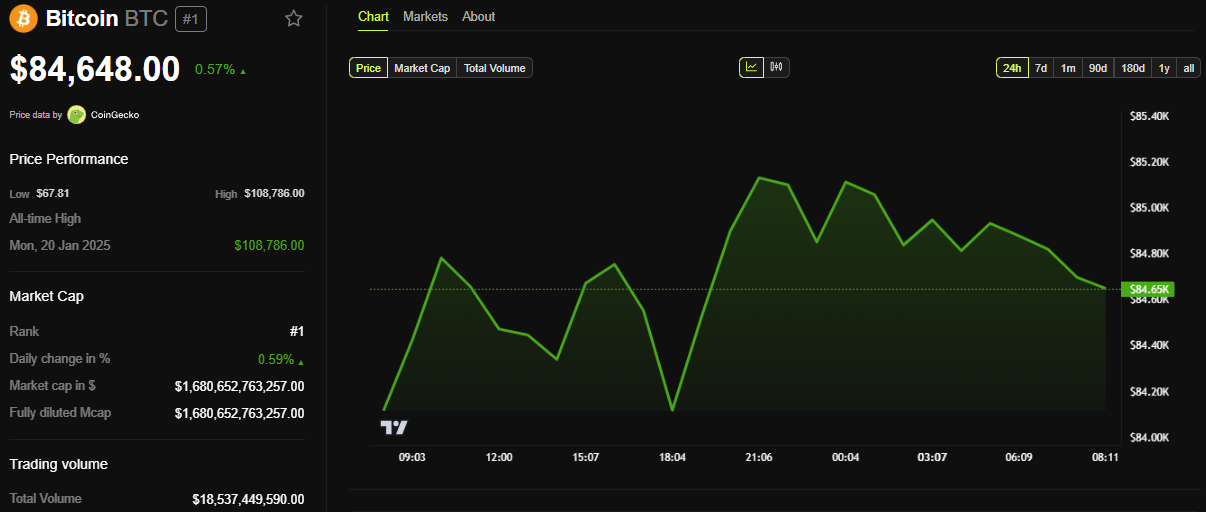

Today, April 18, amid Good Friday celebrations, 23,221 Bitcoin (BTC) options contracts will expire. The notional value for this Friday’s tranche of expiring Bitcoin options contracts is $1.966 billion, according to data on Deribit.

The put/call ratio is 0.96, suggesting a prevalence of purchase options (calls) over sales options (puts).

As the Bitcoin options expire, they have a maximum pain or strike price of $82,000; at this point, the asset will cause the greatest number of holders’ financial losses.

Similarly, crypto markets will witness the expiry of 177,130 Ethereum contracts, with a notional value of $279.789 million. The put-to-call ratio for these expiring Ethereum options is 0.84, with a maximum pain of $1,600.

This week’s options expiry event is slightly smaller than what crypto markets witnessed last week on Friday. As BeInCrypto reported, approximately $2.5 billion worth of BTC and ETH options expired then, with short-term dips bringing put demand.

Traders and investors must closely monitor today’s developments as options expiry could lead to price volatility. Nevertheless, put-to-call ratios below 1 for Bitcoin and Ethereum in options trading indicate optimism in the market. It suggests that more traders are betting on price increases.

Meanwhile, analysts at Deribit highlight low volatility and flat skew. While this suggests a calm market, historical data from CoinGlass suggests post-expiry price swings are common, potentially signaling an upcoming move.

“With volatility crushed and skew flat, is the market setting up for a post-expiry move?” they posed.

Blackswan Event Likely, Greeks.live Analysts Say

Analysts at Greeks.live shed light on current market sentiment, echoing the calm outlook. However, they note that the market is predominantly bearish to neutral. Traders expect continued choppy action before potentially revisiting $80,000 to $82,000.

As of this writing, Bitcoin was trading for $84,648, slightly above its strike price of $82,000. Based on the Max Pain theory, prices will likely move toward this strike price as options near expiry.

Citing a mild sentiment, Greek.live analysts ascribe the calm to Trump not putting out a lot of news this week. Nevertheless, they anticipate more trade wars, heightened uncertainty, and volatility.

“We expect the trade and tariff wars to be far from over, and the uncertainty in the market will continue for a long time, as will the volatility in the market,” Greeks.live wrote.

They also ascribe the outlook to Powell’s comments, which created downward pressure as 100 bps rate cut expectations for the year were reduced. This led to crypto correlation with traditional markets.

Against this backdrop, Greeks.live says the probability of a black swan event is higher, where a rare, unexpected event that has a significant and often disruptive impact on the market occurs.

“…it is now a period of pain when the bulls have completely turned to bears, and investor sentiment is relatively low. In this worse market of bulls turning to bears, the probability of a black swan will be significantly higher,” they explained.

They urge traders to buy out-of-the-money (OTM) put options. An option is classified as out-of-the-money when its strike price is less favorable than the current market price of the underlying asset. This means it has no intrinsic value, only time value (the potential for it to become valuable before expiration).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price Gears Up for Next Leg Higher—Upside Potential Builds

-

Altcoin18 hours ago

Altcoin18 hours agoEthereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

-

Market10 hours ago

Market10 hours agoPi Network Roadmap Frustrates Users Over Missing Timeline

-

Market9 hours ago

Market9 hours agoSolana (SOL) Price Rises 13% But Fails to Break $136 Resistance

-

Market21 hours ago

Market21 hours ago100 Million Tokens Could Trigger Decline

-

Market11 hours ago

Market11 hours agoMEME Rallies 73%, BONE Follows

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Price Stalls In Tight Range – Big Price Move Incoming?

-

Market16 hours ago

Market16 hours agoHow $31 Trillion in US Bonds Could Impact Crypto Markets in 2025