Market

Bitcoin Price Breakout Dreams Crushed Again—What’s Next?

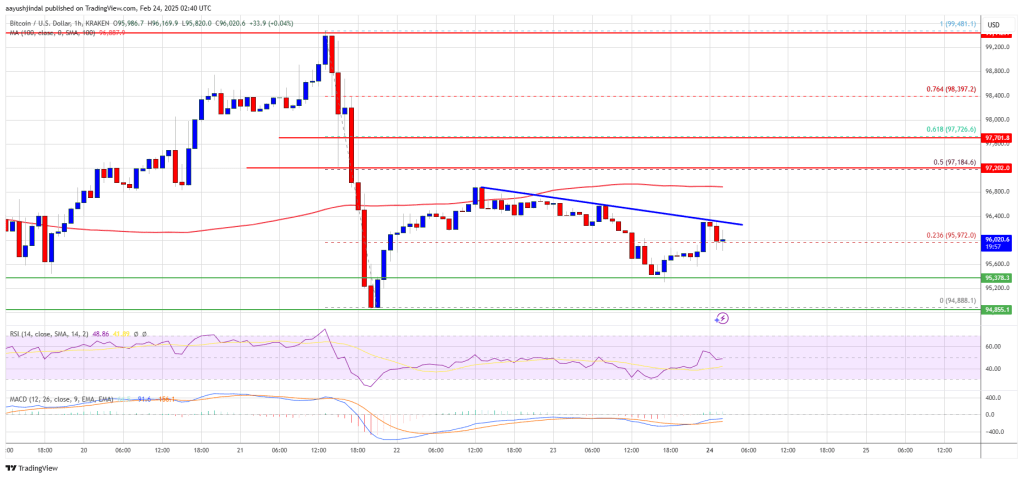

Bitcoin price failed to gain pace for a move above the $100,000 zone. BTC again declined and is currently consolidating near the $96,000 zone.

- Bitcoin started a fresh decline from the $99,500 zone.

- The price is trading below $97,500 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $96,400 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $95,000 zone.

Bitcoin Price Dips Again

Bitcoin price formed a base above the $95,500 level and started a recovery wave. BTC was able to surpass the $97,000 and $98,500 resistance levels.

The price even cleared the $99,000 resistance level. However, the bears remained active below the $100,000 level. A high was formed at $99,481 and the price started a fresh decline. There was a move below the $98,000 and $96,000 levels.

A low was formed at $94,888 and the price is now recovering. There was a move above the $95,500 level. The price surpassed the 23.6% Fib retracement level of the downward move from the $99,481 swing high to the $94,881 low.

Bitcoin price is now trading below $97,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $96,500 level. There is also a connecting bearish trend line forming with resistance at $96,400 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $97,200 level or the 50% Fib retracement level of the downward move from the $99,481 swing high to the $94,881 low. The next key resistance could be $97,750. A close above the $97,750 resistance might send the price further higher. In the stated case, the price could rise and test the $98,800 resistance level. Any more gains might send the price toward the $99,500 level or even $100,000.

Another Decline In BTC?

If Bitcoin fails to rise above the $97,200 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $95,500 level. The first major support is near the $95,000 level.

The next support is now near the $94,200 zone. Any more losses might send the price toward the $93,500 support in the near term. The main support sits at $92,400.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $95,500, followed by $95,000.

Major Resistance Levels – $96,500 and $97,200.

Market

The Altcoins Trending Today – SOL, BERA and SHADOW

The crypto market has resumed its downtrend, shedding $40 billion in market capitalization over the past 24 hours.

Amid the broader sell-off, some altcoins have stood out as the most searched assets over the past day. They include Solana (SOL), Berachain (BERA), and Shadow (SHADOW).

Solana (SOL)

Solana is a trending altcoin, extending its price decline for another consecutive day. Trading at a year-to-date low of $158.88 at press time, SOL price is down almost 10% in the past 24 hours.

SOL’s decline has pushed its price below a long-term ascending parallel channel for the first time since June 2023. This channel forms when an asset’s price consistently moves between two upward-sloping parallel trendlines, signaling a buy trend.

However, SOL’s break below this pattern confirms rising selling pressure, potentially leading to further declines if the asset fails to reclaim the channel. In this scenario, the altcoin’s price could drop to $136.62.

Conversely, if coin accumulation resumes, it could drive SOL’s value up to $220.58.

Berachain (BERA)

Layer-1 (L1) coin BERA is another asset trending today. As of this writing, it trades at $6.94, down 5% over the past 24 hours.

However, a look at its performance on an hourly chart reveals a steady uptick in BERA’s demand, hinting at a potential rebound in the near term. For example, its Relative Strength Index (RSI) has broken above the center line and is in an upward trend at press time.

This indicator measures an asset’s oversold and overbought market conditions. When set up this way, it signals a potential shift toward stronger buying pressure. This suggests that BERA buyers are gaining control, increasing the likelihood of a price rebound. In this case, BERA’s price could climb to $8.62 and rally toward its all-time high of $15.50.

On the other hand, if the decline continues, the coin’s price could fall to $5.44.

Shadow (SHADOW)

SHADOW has bucked the broader market trend, climbing by 34% over the past day. It trades at $160.27 at press time and is poised to extend these gains.

The token’s rising on-balance volume (OBV) on its hourly chart supports this bullish outlook. This momentum indicator measures an asset’s cumulative buying and selling pressure by adding volume on up days and subtracting volume on down days.

When it climbs, it indicates strong buying interest. This suggests that SHADOW’s price may continue to rise as demand increases. If this happens, it could break above the resistance at $162.44 to reach $210.55.

However, SHADOW could lose recent gains and fall to $132.68 if demand stalls.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Week In Crypto: Major Events to Watch

This week in crypto, several major events are set to capture the attention of industry participants. Among the top stories include a massive Solana unlock, the debut of Aave on Sonic Layer-1 (L1), and the KernelDAO token launch.

Each of these events promises significant developments across their respective ecosystems. They offer insights and potential growth opportunities, which forward-looking traders and investors are likely to capitalize on.

$1.9 Billion Solana Unlock

This week’s key highlight is the unlocking of $1.9 billion worth of Solana (SOL) on March 1. Specifically, roughly 11.2 million SOL tokens will be released, representing about 2.2% of Solana’s current circulating supply (around 488 million SOL).

This event is tied to the FTX bankruptcy estate. The tokens stem from FTX’s liquidation process, where the bankrupt exchange previously sold locked SOL at discounted rates of around $64 to $102 per token to big players like Galaxy Digital, Pantera Capital, and others.

As of this writing, SOL is trading for around $158.91, so these institutional buyers are sitting on hefty unrealized profits. The unlock happens this Saturday, and the big question is whether they will hold or sell.

A mass sell-off could flood the market, potentially tanking SOL’s price due to increased supply outpacing demand. However, the impact might be muted if they hold, especially if Solana’s ecosystem keeps growing. Nevertheless, market sentiment is already jittery, with posts on X showing retail investors selling off SOL in anticipation, fearing a dip.

“While the team’s, seed investors’, and foundation’s shares are locked (also about 40%), the release of such a large volume poses a risk of market shock,” a popular account on X stated.

Technicals are not rosy either as Solana buyers retreat. Notwithstanding, SOL fundamentals like its fast, low-cost blockchain and rising adoption could cushion the blow long-term. Similarly, past unlocks, like the 7x supply increase in 2020, actually kicked off a bull run, though the market was less mature then.

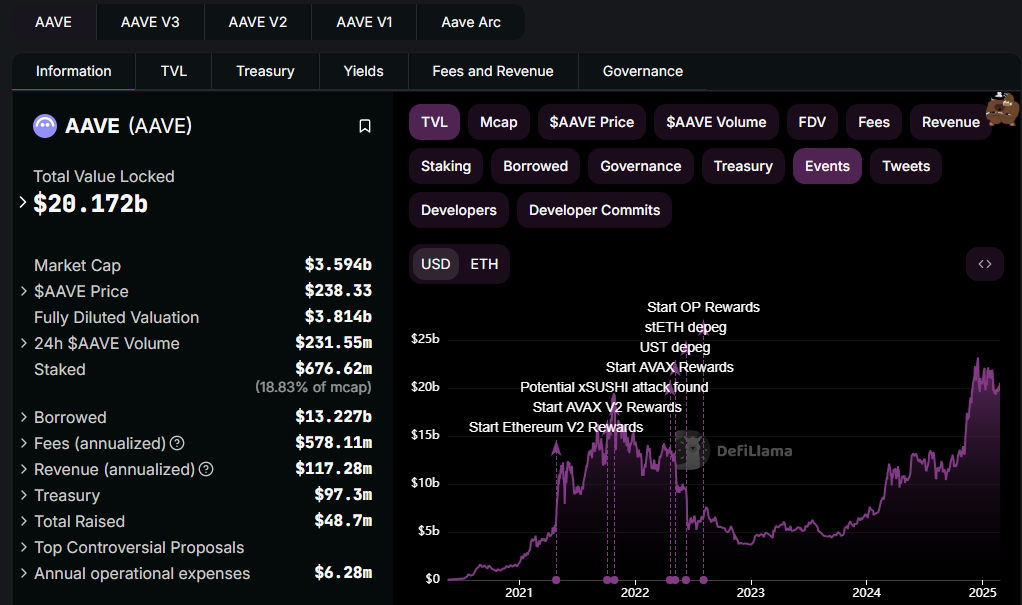

Aave Debuting on Sonic L1

In December, Sonic Labs indicated the Aave governance process to bring the $22 billion lending market to Sonic. This week in crypto, Aave is going live on Sonic. This marks a major development, given that Aava dominates the DeFi lending market with $20 billion in total value locked (TVL), according to DefiLlama data.

Launching on the L1 would allow Sonic users to tap on-chain native credit lines and offer liquidity to other investors. Sonic’s high transaction speed and fee-sharing model could also prove to be major incentives for Aave’s deployment on the network.

“AAVE will be the tangible breakthrough for Sonic that gets it from “small but promising chain” to full-fledged powerhouse. The network effect of AAVE is immense. And on Sonic that effect will be galvanized by the existing landscape,” popular user Jack the Oiler observed.

This partnership will also mean a $63 million liquidity commitment, including monetary contributions from various sources. Specifically, the Sonic Foundation pledged $15 million, with an additional $20 million promised in Circles USD Coin (USDC).

The funding would also include up to 50 million S tokens from Sonic, while Aave would contribute $800,000 in stablecoins. This sizable liquidity commitment would secure the financial backbone for Aave’s introduction to the Sonic network.

Nvidia Earnings

Nvidia’s earnings report will also be on the crypto watchlist this week. Nvidia’s fiscal fourth quarter (Q4) report, ending January 2025, is to be released this Wednesday, February 26. The report will be out after the market closes, making it a focal point for investors this week.

As the world’s top chipmaker by market cap, Nvidia’s results are a bellwether for the artificial intelligence boom, meaning impact on AI coins.

“NVDA 1D update-bearish AI news dropping this week…you won’t catch me buying any AI coins when I see the NVDA chart looking that way. I’ve always felt that way about AI coins bc NVDA has been ready to pop since November. All it took was some fake Deep Seek news for the initial distro and then AI memes did -95% of that,” an analyst shared in a post.

KernelDAO Token Launch

Also, this week in crypto, the launch of KernelDAO’s KERNEL token is expected. In a recent blog, KernelDAO said KERNEL would also be the native token of Kelp DAO, a popular liquid restaking protocol.

“The KERNEL token distribution emphasizes community-first principles, allocating the majority of tokens to the users and ecosystem participants,” the network shared.

KERNEL holders could actively participate in decision-making processes for major network products like Kelp LRT, Kernel Infrastructure, and Gain. Governance decisions can include protocol upgrades, fund allocations, and new partnerships.

It would also have a restaking function to provide shared economic security for the Kernel ecosystem, middleware, and decentralized applications (dApps). Further, KERNEL token holders can earn staking rewards from partner protocols and middleware.

Stacks Increase sBTC Deposit Cap

Stacks will increase the deposit cap for sBTC, its yield-bearing, Bitcoin-backed token, on Tuesday, February 25. This move marks a significant step in its mission to activate Bitcoin’s economy.

The sBTC token is a 1:1 Bitcoin-backed asset on the Stacks Layer-2 blockchain. It is designed to bring programmability and DeFi capabilities to BTC while maintaining its security through 100% hash power finality.

Launched on the mainnet in December 2024 with an initial cap of 1,000 BTC, that limit was hit fast—within two days—showing strong demand. This second cap, dubbed “Cap-2,” will add 2,000 more BTC, raising the total to 3,000 BTC available for minting.

“Hold sBTC, Earn Bitcoin. sBTC Cap-2 → Feb 25. Max 3,000 BTC Step 1. Put your BTC to work. Earn 5% APY in real Bitcoin rewards just by holding sBTC. Step 2. Deploy sBTC in DeFi apps for extra yield. Check thread for BTCFi,” Stacks shared recently.

Deposits open on February 25 at 10 a.m. ET on a first-come, first-served basis, with a minimum deposit of 0.01 BTC. sBTC lets BTC holders earn yield without giving up custody or relying on intermediaries, a big shift from wrapped BTC models.

ETHDenver Conference

The ETHDenver conference starts its main event on Thursday, February 27, in Denver, Colorado. Based on social media chatter, it is already shaping to be a pivotal moment for the Ethereum ecosystem.

Billed as the world’s largest and longest-running Ethereum-focused event, it draws thousands of developers, entrepreneurs, and blockchain enthusiasts. During the same event in 2024, over 15,000 attendees came from 115 countries. The expectation is that Ethereum projects could drop major updates, leveraging the event as a launchpad.

“Some analysts believe this event could positively impact Ethereum’s price, as the reduced market supply might lead to a price increase,” a user on X quipped.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Outflows Hit $508 Million as Bitcoin Bleeds, Altcoins Surge

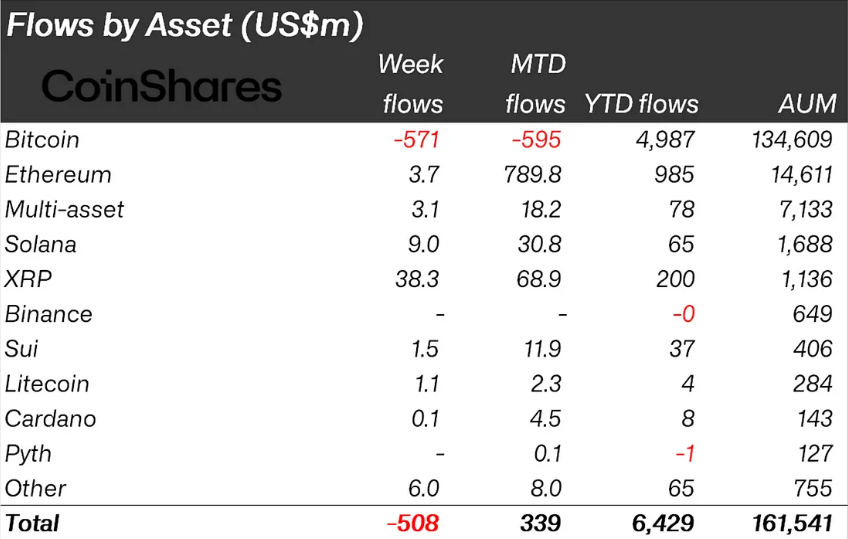

Crypto outflows reached $508 million last week, marking the second series of negative flows in 2025. This brings the last two weeks of outflows to $925 million.

The outflows point to a shift in sentiment following an 18-week rally that accumulated $29 billion as investors weigh the impact of the US economic events and uncertainty surrounding trade tariffs, inflation, and monetary policy.

Bitcoin Takes the Biggest Hit While Altcoins Rally

The latest CoinShares report indicates that Bitcoin (BTC) bore the brunt of investor caution, seeing outflows of $571 million. Further, some traders opted to increase short positions, leading to $2.8 million in inflows for short-Bitcoin products.

This follows a similar trend from the previous week, when hawkish rhetoric from the Federal Reserve and CPI data contributed to the first crypto outflows of 2025. According to CoinShares, the latest stream of outflows comes amid heightened caution as investors continue to digest US economic data.

“We believe investors are exercising caution following the US Presidential inauguration and the consequent uncertainty around Trump’s trade tariffs, inflation, and monetary policy. This is also evident in trading turnover, which has fallen considerably from $22 billion 2 weeks ago to $13 billion last week,” an excerpt in the report read.

Regionally, the US accounted for most of the outflows, losing $560 million, accentuating concerns about the country’s economic policies.

Interestingly, however, while Bitcoin struggled, altcoins continued to see positive momentum. XRP led the way with $38.3 million in inflows, bringing its total since mid-November 2025 to $819 million.

XRP’s strong performance comes amid increasing anticipation of a US SEC (Securities and Exchange Commission) decision on an XRP ETF. The deadline for the SEC to approve or reject certain ETF applications has begun. Investors remain hopeful that XRP will gain regulatory clarity.

If approved, an XRP ETF could drive further institutional investment, reinforcing the altcoin’s resilience amid broader market uncertainty. However, XRP’s surge reflects increasing investor optimism that the US SEC may drop its lawsuit against Ripple.

Recent developments, including the SEC’s acknowledgment of Bitwise’s XRP ETF application and the launch of an XRP ETF in Brazil via Hashdex, fuel speculation further.

Other altcoins also saw inflows, with Solana attracting $9 million, Ethereum gaining $3.7 million, and Sui receiving $1.5 million. This suggests a potential shift in investor focus from Bitcoin’s digital gold narrative towards altcoins with stronger technical fundamentals and growth potential.

Meanwhile,this skittish market sentiment could be further influenced by upcoming US economic data this week. As BeInCrypto reported, Thursday’s GDP and Friday’s PCE inflation data could provide key insights into Federal Reserve policy direction.

As Bitcoin’s sensitivity to macroeconomic uncertainty amplifies, undesirable reports later in the week could exacerbate selling pressure. Altcoins appear to be benefiting from speculative interest and potential diversification plays.

The divergence in investor sentiment between Bitcoin and altcoins suggests a potential shift in market structure, with some analysts already visualizing an altcoin season.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours ago3 Token Unlocks for the Last Week of February: PORTAL, ALT, NFP

-

Market10 hours ago

Market10 hours agoEther recovers from its dip to $2,600 following Bybit’s hack

-

Market23 hours ago

Market23 hours agoBNB Faces Bearish Pressure Despite Booming Ecosystem

-

Market21 hours ago

Market21 hours agoTop 5 Made in USA Cryptos to Watch – Late February Picks

-

Altcoin19 hours ago

Altcoin19 hours agoBybit Hack: Exchanges Freeze $42 Million From Exploit

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Price Nears Breakout Zone, Is a Rally To $5 on the Horizon?

-

Market12 hours ago

Market12 hours agoXRP Price Nears Key Support—A Breakdown Could Be Devastating

-

Bitcoin24 hours ago

Bitcoin24 hours agoMicroStrategy Might Announce a Big Bitcoin Purchase Soon