Ethereum

Crypto Pundit Says Ethereum Price Is ‘Destined’ To Reach $10,000 This Cycle, Here’s Why

The Ethereum price is drawing attention to its potential future outlook, as a crypto pundit points to a striking resemblance between the altcoin’s price action and Bitcoin’s during the 2015-2017 bull cycle. The analyst’s technical chart analysis suggests that ETH is destined for a breakout to $10,000 this cycle, marking new all-time highs.

Ethereum Price Chart Mirror’s Bitcoin Historic Breakout

According to Ted Pillows, a crypto pundit on X (formerly Twitter), a comparative analysis of Etheruem’s current price movement and that of Bitcoin during a previous bull cycle highlights a familiar bullish pattern. Based on this past trend, the analyst confidently predicts that Ethereum will hit $10,000 this cycle.

Between the bull market in 2015 and 2017, the Bitcoin price hit a bear market bottom between $201 and $205. After experiencing a bit of consolidation and volatility, the cryptocurrency eventually skyrocketed to a historic rally towards $685 and $785, marking new ATHs at the time. This massive surge occurred after Bitcoin broke out of resistance levels around the $465 threshold.

Based on the Pillows’ hypothesis, Ethereum appears to be following a similar trajectory, having completed its accumulation phase and recently breaking through major resistance levels. The number one altcoin has also experienced significant volatility recently, struggling to recover from previous bearish trends and market sell offs that pushed its value below the $3,000 price high.

While still in consolidation, as no strong surge has been recorded in the Ethereum price recently, Pillows highlights factors that could reinforce the altcoin’s bullish outlook. The analyst mentioned Ethereum’s Total Value Locked (TVL) and Stablecoin liquidity dominance. Currently, ETH leads in DeFi, securing the highest TVL across all platforms in the space.

Pillows also highlighted the impact of institutional demand and accumulation. As these factors increase, Ethereum could gain more exposure, potentially boosting its long-term value. Lastly, the analyst mentioned that Ethereum currently has a lower inflation rate than Bitcoin and 99% of the altcoins in the market.

Based on these seemingly bullish factors, Pillows urges investors and traders to set their sights higher, dismissing a $5,000 target as too conservative and advocating for a more ambitious $10,000 projection.

ETH Whales Get Back In Action

While analysts share their optimistic projections about Ethereum’s future outlook, whales are getting in on the ground floor and buying ETH tokens in droves. While the recent decline in the price of ETH may have caused panic selling for some, deep-pocketed investors have taken the market crash as an opportunity to accumulate.

According to TradeerPA, a crypto analyst on X, new reports show that ETH has been getting rapidly accumulated by Ethereum whales. Due to this accumulation trend, the analyst advocates for a price rally to new ATHs, driven by a positive shift in market sentiment and increased demand.

Featured image from Adobe Stock, chart from Tradingview.com

Ethereum

Bitcoin Pepe set to reap big from its virality, fundamentals, and timing

The crypto market is subject to a neutral market sentiment even as the bulls remain in control. Subsequently, majors like Ripple and Ethereum are range-bound while their steady fundamentals support the prices.

On the other hand, more savvy investors are shifting their focus to meme crypto projects with the potential to revolutionize the industry. One such entity is Bitcoin Pepe.

In fact, it is presented as the missing puzzle piece in the Bitcoin network. Through its mission of building “Solana on Bitcoin”, it is creating a platform defined by low fees, speedy transactions, and the ability to launch meme coins on the most steady crypto network. Notably, investors have an opportunity to rake in hefty returns within a relatively short period.

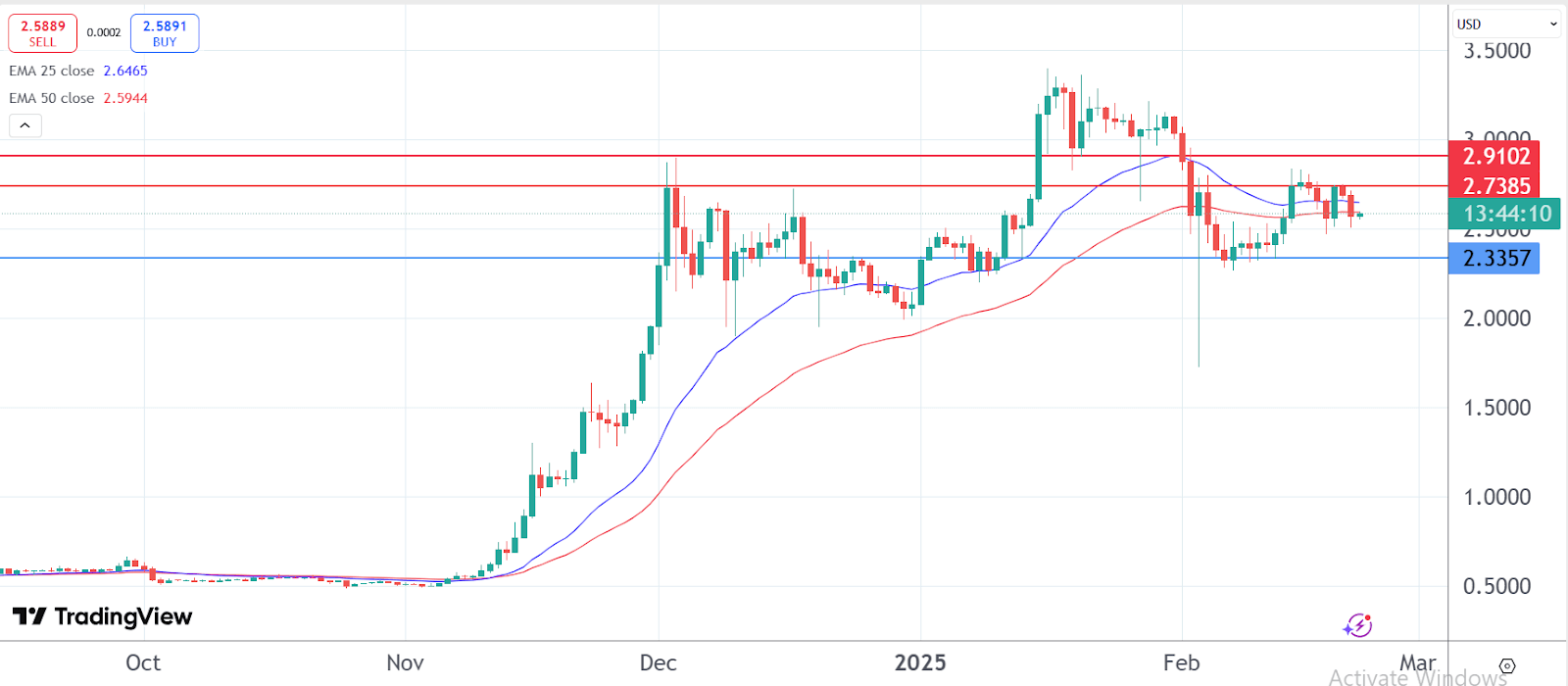

Ripple lacks enough momentum for a weekly gain despite steady fundamentals

Ripple price has held steady above the crucial support zone of $2.5000 even as it lacked enough buyers to lock in the second weekly gain in a row. On the one hand, a neutral market sentiment in the broader crypto sector has pushed buyers to the sidelines. Even so, the bulls remain in control as XRP ETFs and heightened global adoption is set to bolster the crypto to January levels.

In the near term, the bulls are striving to break the resistance at $2.7385. Past that level, the next target will be at $2.9100. On the lower side, a pullback past $2.5000 will still have the bulls in control as $2.3357 remains a steady support level.

Bitcoin Pepe: The missing puzzle on Bitcoin’s network

Bitcoin, the leading cryptocurrency, began with no intrinsic value about 15 years ago and has since grown to a market cap of $1.9 trillion at $96,278. Bitcoin Pepe has emerged as a project whose mission is to revolutionize the BTC network by transforming it into a meme coin hub.

This explains why an overwhelming number of savvy investors are rushing to amass BPEP tokens ahead of its listing in Q2’25. Besides, President Trump has made clear his intentions to foster a pro-crypto environment.

Subsequently, Bitcoin Pepe has become so popular that within the first 24 hours of its presale launch, it raised over $1 million. 11 days later, it has already reached stage 5 of the total 30 stages; raising over $2.8 million.

With 25 more stages before it hits the public shelves, early adopters have an apt opportunity to buy BPEP tokens at the current price of $0.0255 and watch their investment yield hefty returns. By the end of the presale, the token price is set to have increased by a total of 311.4% to $0.0864. Read more on how to buy Bitcoin Pepe.

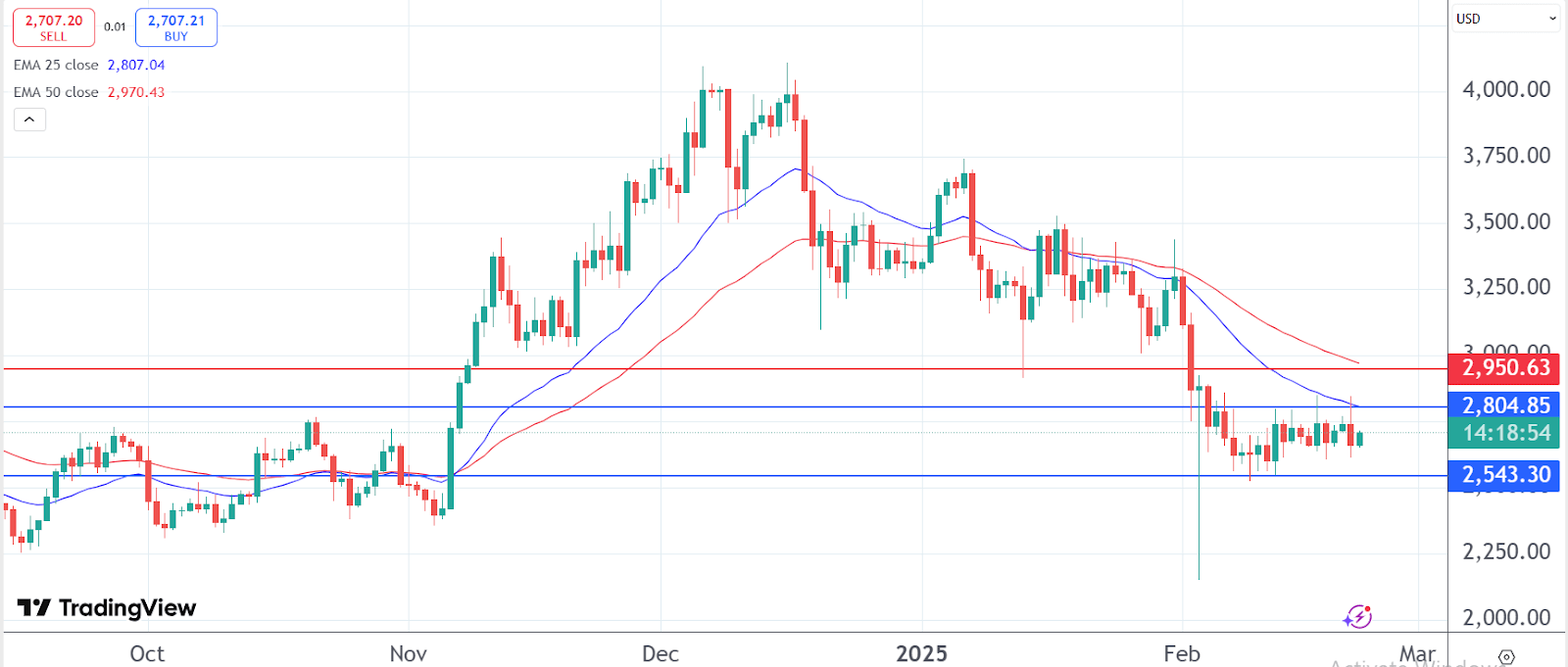

Ethereum price analysis: Neutral outlook with a bullish bias

Ethereum price recorded its second week of gains after plunging to a 5-month low earlier in February. Even so, it continues to trade below the 25 and 50-day EMAs. In the absence of a key immediate-term bullish catalyst, the crypto may remain under pressure for a while longer.

At its current level, the range between $2,543 and $2,804 is still worth watching. If successful at breaking the resistance along the range’s upper limit, the bulls will have a chance to retest the crucial support-turn-resistance zone of 2,950. However, a decline past $2,500 will invalidate this thesis.

Ethereum

Grayscale’s Ethereum ETF On The Brink Of Major Change With NYSE’s Staking Proposal

The New York Stock Exchange (NYSE) has submitted a proposed rule change aimed at allowing the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum Mini Trust (EZET) to stake their ETH holdings.

This proposal is particularly noteworthy because it seeks to enable the trusts to earn rewards on their staked ETH while ensuring that the assets remain under the custody of their current custodian.

Grayscale Advocates For Staking In Crypto ETFs

Staking, a process integral to Ethereum’s proof-of-stake (PoS) model, allows holders to earn yield on their assets. By staking through trusted providers, ETHE and EZET could potentially bolster their returns, making these investment vehicles more attractive to institutional investors who are increasingly seeking opportunities that offer staking benefits.

Unlike traditional staking-as-a-service models, which have drawn scrutiny from the Securities and Exchange Commission (SEC), Grayscale claims that its approach is designed exclusively for the benefit of fund shareholders. This means that the assets will not be pooled with those of third parties, which could mitigate some regulatory concerns.

Industry advocates, including organizations such as Jito Labs and Multicoin Capital, have been vocal in their support for integrating staking features into exchange-traded funds (ETFs).

They argue that doing so would not only benefit investors but also more accurately reflect the advantages of native network assets. Furthermore, incorporating staking into ETFs could empower issuers to contribute to the security of the networks on which these assets operate.

Ethereum Surpasses Bitcoin In ETF Inflows

The proposed rule change comes at a crucial time for Grayscale, especially as its ETHE product has faced substantial outflows—nearly $4 billion—making it the largest loser among Ethereum investment products since the approval of spot Ethereum ETFs.

In contrast, the EZET has struggled to gain market traction, attracting only $650 million in inflows, which is minimal compared to its competitors.

Other Ethereum spot ETFs, notably those managed by BlackRock and Fidelity, have seen significant inflows, largely due to their lower fees and strong institutional backing.

The Ethereum ETF market’s dynamics are shifting, with Ethereum now gaining momentum in terms of ETF flows, even surpassing Bitcoin in inflows for the first week of February, as reported by CoinShares.

If the NYSE Arca proposal is approved, it could significantly enhance the appeal of ETHE and EZET, providing a much-needed boost to their performance and potentially curbing outflows.

At the time of writing, ETH is trading at $2,645, recording a 20% loss in the monthly time frame for the market’s second largest cryptocurrency.

Featured image from DALL-E, chart from TradingView.com

Ethereum

Extremely Strong Support And Monthly 55 EMA Says ETH Is Headed For $4,867

Ethereum has yet to return to its all-time high for over three years, a stark contrast to Bitcoin, which has surged past many price levels in the current cycle. Despite being the second-largest cryptocurrency, Ethereum has struggled to keep up with the broader market even during price rallies. However, a new technical outlook suggests that Ethereum may soon break free from this underwhelming trend and push toward $4,867 based on a strong meeting of multiple technical indicators.

Extremely Strong Support Shows Ethereum Breakout Is Close

As revealed by a technical analyst on the TradingView platform, technical analysis of the Ethereum price poses a bullish outlook to finally break above its all-time high of $4,878. Ethereum is currently positioned at a key inflection point, where it is trading just above a multi-year support trendline. Notably, this trendline has acted as a solid foundation during previous downturns, allowing ETH to consistently rebound after touching this level. Given this historical precedent, the next expected move is another upward bounce, potentially setting the stage for a renewed bullish push.

Related Reading

The strength of this support trendline is further reinforced by key Fibonacci levels, which have previously served as inflection points for Ethereum’s major rallies. At present, Ethereum is positioned around the 14.6% Fib retracement level from its break above $4,000 in September 2024, which is a zone that has historically caused reversals and strong bullish momentum.

In addition to the Fibonacci level, Ethereum’s price structure is also currently supported by the monthly 55 Exponential Moving Average (EMA), which is typically known for marking long-term bullish trends. This adds weight to a bounce on the multi-year support trendline.

Triangle Formation Confirms The Explosive Move

The analyst also noted that ETH has been trading within a triangle pattern in a multi-month timeframe. Triangle patterns often signal a period of consolidation before a strong move in either direction and in Ethereum’s case, the supporting trendlines and Fibonacci levels suggest a higher probability of an upward breakout.

Related Reading

The specific pattern forming on Ethereum’s chart is an ascending triangle, a bullish continuation pattern characterized by a rising lower trendline and a horizontal resistance zone. The upper resistance trendline for this formation sits around the $4,000 mark, a level that has proven difficult to breach three different times this cycle. However, the next try could cause a breakout if Ethereum continues to build on the growing bullish signals with the Fib level and the 50 EMA. Once Ethereum clears the ascending triangle’s upper resistance, the next primary price target would be around $4,867, its current all-time high.

At the time of writing, Ethereum is trading at $2,760, up by 1.1% in the past 24 hours.

Featured image from Ethereum, chart from Tradingview.com

-

Regulation24 hours ago

Regulation24 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Market24 hours ago

Market24 hours agoCardano Breakout Hints at Strong Recovery Ahead

-

Market23 hours ago

Market23 hours agoShiba Inu’s December 2024 Downtrend Could End As Inflows Rise

-

Altcoin23 hours ago

Altcoin23 hours agoSui Price Sees Explosive Growth Amid Increasing Daily Active Addresses: Will It Hit $8?

-

Market22 hours ago

Market22 hours agoBybit Reportedly Hacked for Over $1.5 Billion

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Holds Key Support – Analyst Doubts Bears Can Defend $4K Anymore

-

Ethereum19 hours ago

Ethereum19 hours agoExtremely Strong Support And Monthly 55 EMA Says ETH Is Headed For $4,867

-

Market19 hours ago

Market19 hours agoPI Surges, CZ Comments, Safe Denies Breach