Market

Binance Faces Backlash for Considering Pi Network Listing

Binance, the world’s largest cryptocurrency exchange, has drawn backlash after reopening its token listing by community vote and considering adding Pi Network (PI).

The decision has faced significant pushback, with critics questioning the platform’s priorities and highlighting the potential risks.

Pi Network Listing on Binance Sparks Concerns

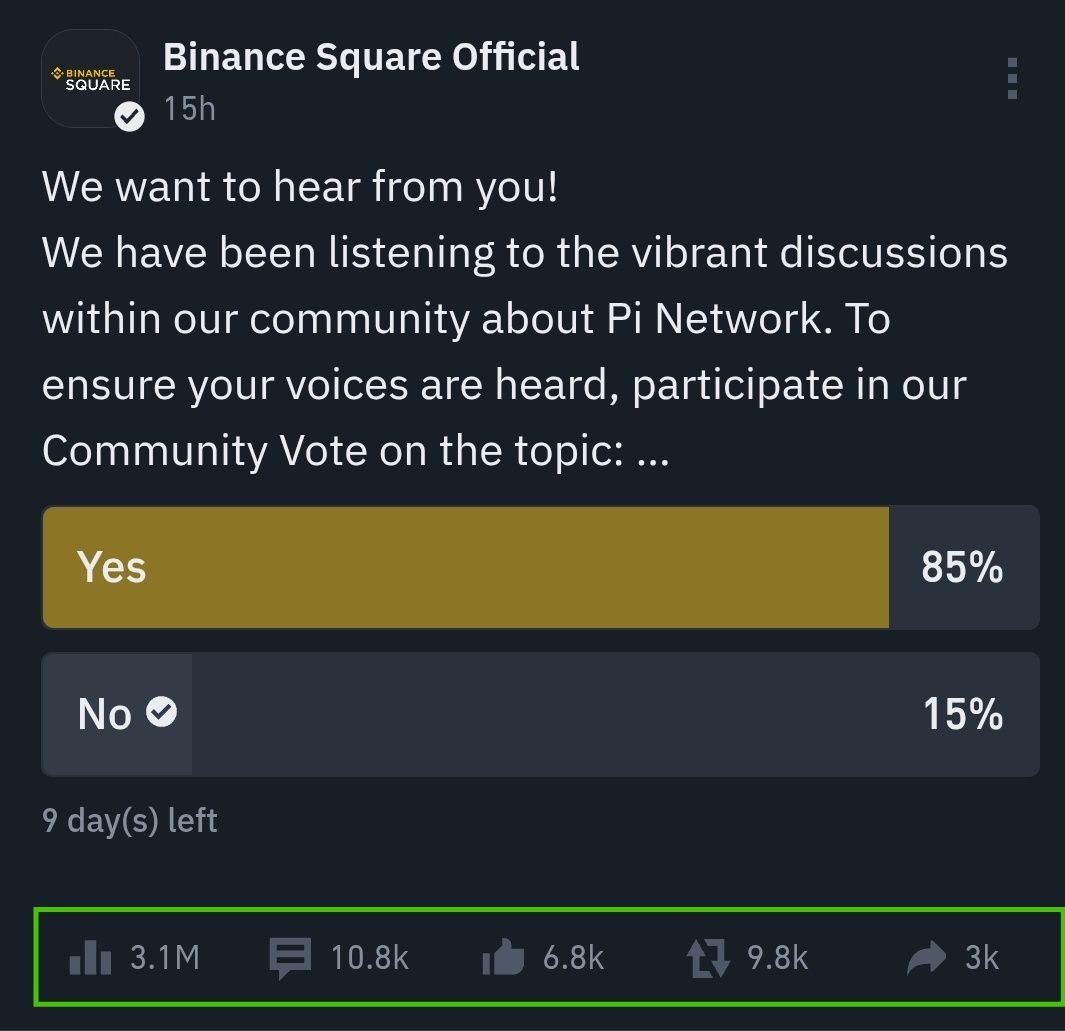

BeInCrypto reported that on February 17, the exchange launched a Binance Community Vote for Pi Network. This marketing-driven polling event lets users voice their opinions on whether Pi should be listed on the exchange.

The voting for the Pi Network listing ends on February 27. Currently, 85% of voters support listing Pi, just one day before its mainnet launch. Moreover, the project has gained remarkable traction and visibility within the crypto community.

Despite the support, some users, including Colin Wu, founder of the Wu Blockchain, have not responded favorably to Binance’s decision. He expressed concerns about Binance’s decision to revive community-driven listings after a seven-year hiatus.

“I originally thought OKX was already playing it risky, but Binance took it even further with PI,” Wu said.

Wu argued that Binance’s focus on driving traffic and user registrations through high-risk tokens compromises its responsibility to maintain security and uphold its industry-leading reputation.

This isn’t the first time Binance has faced criticism for its listing process. Recently, the exchange’s former CEO, Changpeng Zhao (CZ), even called the process “a bit broken.” According to the latest data from CoinGecko, 398 coins are currently listed on Binance.

Meanwhile, Wu also cautioned that the decision to list Pi could pose significant risks to the “highly fragile Chinese-speaking community.”

“Binance has already become the infrastructure of this industry—it should focus more on security and reputation rather than chasing traffic,” he added.

Binance, however, defended its position by emphasizing that it would not consider all votes as valid.

“Votes from users reported in certain countries or regions, including but not limited to mainland China, will not be counted as valid,” the post read.

The statement clarified that any votes that fail to meet eligibility criteria, come from inapplicable regions, or violate the platform’s terms and conditions will be excluded from the final count.

It further highlighted that the platform considers the voting results for reference. An internal evaluation will determine the ultimate decision on listing Pi Network.

Apart from Binance, several centralized exchanges have announced Pi coin listings. Nonetheless, many industry experts remain skeptical of the Pi Network, highlighting the legal and listing risks associated with it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Lazarus Group Committed $1.5 Billion Bybit Hack

An on-chain investigation proved that the Bybit hack earlier today was carried out by the infamous North Korean Lazarus Group. As previous incidents showed, it will be nearly impossible to recover funds from these hackers.

Arkham Intelligence offered a bounty for strong evidence, which ZachXBT was able to provide. Apparently, Lazarus hackers used the same wallets today as in last month’s Phemex hack.

Bybit Becomes the Biggest Crypto Target for Lazarus

Bybit suffered a $1.5 billion security breach today, potentially the largest crypto hack of all time. Arkham Intelligence offered a bounty to uncover the actors behind this breach, and ZachXBT found significant evidence linking the attack to North Korea’s infamous Lazarus Group.

“At 19:09 UTC today, ZachXBT submitted definitive proof that this attack on Bybit was performed by the Lazarus Group. His submission included a detailed analysis of test transactions and connected wallets used ahead of the exploit, as well as multiple forensics graphs and timing analyses. The submission has been shared with the Bybit team,” Arkham claimed.

ZachXBT, one of the crypto community’s most famous investigators, has a lot of experience tracking the Lazarus Group. This North Korean hacker collective was responsible for nearly $1 billion worth of stolen funds last year.

Specifically, he claimed that wallets from the Bybit hack were connected to the Phemex breach in January.

At the time, this earlier breach was not clearly recognizable as Lazarus’ handiwork, but a more reliable paper trail has since been established. Now that a chain of proof exists, it must come as a relief to the community.

Immediately after the hack, some users baselessly accused Pi Network’s supporters of the crime because Bybit’s CEO criticized the project.

Bybit users have at least gotten some clarity, but it will be difficult to directly recover stolen funds from the hack. ZachXBT received Arkham tokens worth around $30,000 for this discovery. Since the attack is seemingly backed by North Korea’s nation-state actors, recovering the stolen funds would be extremely difficult.

However, Bybit hack victims at least get some peace of mind, which will hopefully prevent further false accusations from spreading.

The exchange’s CEO claims that all users will be reimbursed through existing reserves, but a solid plan hasn’t been released yet. For now, the wounds are still very fresh.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Whales Decline As Price Remains Consistently Below $3

XRP price has been moving sideways over the past seven days, reflecting market indecision. Although it is still down almost 15% in the last 30 days, its Relative Strength Index (RSI) is currently neutral at 55.1, showing balanced momentum after recovering from near-oversold levels.

Meanwhile, XRP whale addresses have been declining recently, suggesting caution among large holders. Yet, the numbers remain historically high, indicating continued interest. XRP could either challenge resistance at $2.83 or test critical support at $2.52 if selling pressure intensifies.

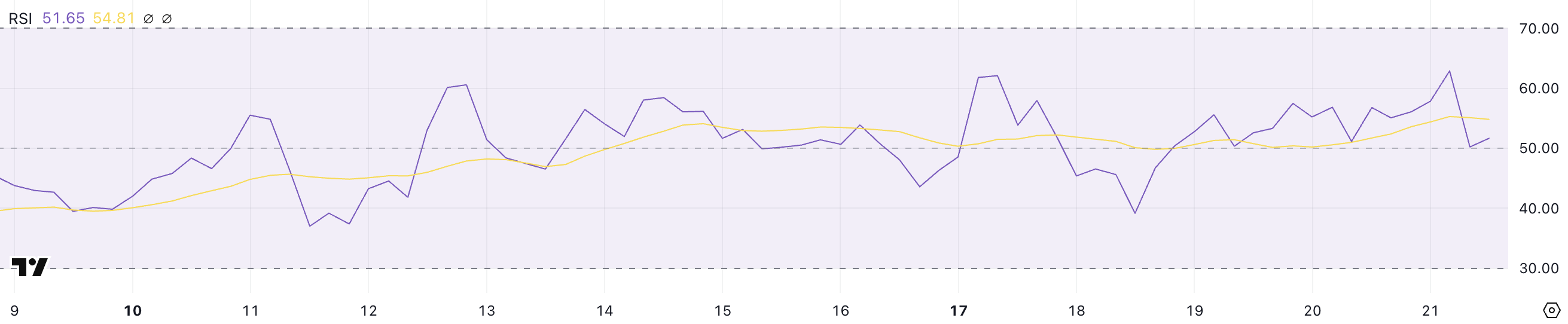

XRP RSI Is Currently Neutral, Recovering After Almost Touching Oversold Levels

XRP’s Relative Strength Index (RSI) is currently at 55.1, down from a recent peak of 62 two days ago but up significantly from 33.2 just three days ago.

This shows that buying momentum has increased over the past few days, pushing XRP RSI higher after almost reaching oversold territory. However, the drop from 62 suggests that the buying pressure is cooling off slightly, with XRP now in a neutral zone.

This level indicates balanced momentum, leaving the price direction uncertain in the short term.

RSI is a momentum oscillator that ranges from 0 to 100, measuring the speed and change of price movements. Typically, an RSI above 70 is considered overbought, signaling a potential pullback, while an RSI below 30 is considered oversold, suggesting a possible buying opportunity.

With XRP’s RSI at 55.1, it is above the neutral 50 mark, showing slightly more buying pressure than selling pressure. This could indicate a cautious bullish sentiment, with the potential for XRP to continue its upward movement if buying interest remains strong.

Conversely, if the RSI starts to decline below 50, it could signal weakening momentum and a possible price pullback.

XRP Whales Are Still High, But Declining

XRP whale addresses, holding between 1 million and 10 million XRP, peaked at 2,137 on February 3 but have been declining since then, now at 2,117.

This steady drop suggests some large holders are reducing their positions, which could indicate caution or profit-taking. Despite this decline, the number of whales remains higher than historical averages, showing continued interest from big investors.

Tracking whale addresses is important because they can significantly influence price movements. A decline in whale numbers can indicate selling pressure, which may weigh on XRP price.

However, since the current number of whales is still historically high, it suggests that substantial capital remains invested, potentially supporting the price if buying interest picks up again.

XRP Next Trend Direction Isn’t Clear Yet

XRP price has been moving sideways over the past week, with its Exponential Moving Average (EMA) lines clustered closely together.

This indicates a lack of clear momentum, suggesting market indecision and low volatility. It shows that buying and selling pressures are balanced, making it unclear whether an uptrend or downtrend will follow.

If an uptrend develops, XRP could first test the resistance at $2.83, and breaking above it could lead to targets at $3.15 or even $3.28, its highest levels since the end of January.

Conversely, if a downtrend emerges, the support at $2.52 is crucial. A break below this level could lead to a drop to $2.33, and if selling pressure continues, it could fall as low as $1.77.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Falls 5% Following $1.5 Billion Bybit Hack

The Bybit Hack has shaken the market today, with over $1.46 billion in ETH stolen, marking one of the largest security breaches in history. As the stolen assets are being liquidated, Ethereum’s price dropped by 5% in a straight line, impacting key technical indicators.

Speculation is growing about Bybit’s next moves, with some suggesting a potential market buyback to compensate users, which could create significant buying pressure. However, it remains uncertain how Ethereum’s price will behave in the coming days as the situation continues to unfold.

Will Bybit Hack Lead to a Strong Buyback?

Earlier today, one of the largest crypto exchanges, Bybit, was hacked. Over $1.46 billion worth of Ethereum was stolen from its hot wallets, marking one of the largest security breaches in crypto history.

CEO Ben Zhou confirmed that attackers tricked Bybit’s security system, leading wallet signers to unknowingly approve changes to the smart contract logic, giving the hacker control.

The stolen ETH is being liquidated, causing Ethereum’s price to drop by over 4%. After the assets were stolen, the hacker’s addresses started to send money to dozens of different wallets.

Some users are speculating about Bybit’s next moves to recover users’ funds.

Some analysts claim that if Bybit can’t recover the stolen $1.5 billion, they might market-buy ETH to maintain users’ funds, potentially creating bullish buy pressure. However, nothing guarantees this will happen or when, as Bybit’s next steps are still unfolding.

Recently, Arkham published on X that a Bybit Cold wallet transferred more than $500 million to another Bybit wallet, suggesting the exchange could be getting ready to prepare funds for user reimbursements following the hack.

Indicators Suggest Stolen Assets Impacted Ethereum Price

The recent hack impacting Bybit caused Ethereum’s Relative Strength Index (RSI) to drop sharply from 62.8 to 51.6 in just a few hours.

This rapid decline indicates a sudden loss of buying momentum, reflecting increased selling pressure as the stolen ETH was liquidated.

Although the RSI is still above the neutral 50 mark, the sharp drop suggests that bullish sentiment has weakened considerably.

With ETH’s RSI at 51.6, it remains in a neutral zone, showing balanced buying and selling pressure. Notably, ETH’s RSI has been neutral since February 3, reflecting a period of consolidation and market indecision.

If the RSI drops below 50, it could signal bearish momentum, while a rise above 60 would indicate renewed buying interest.

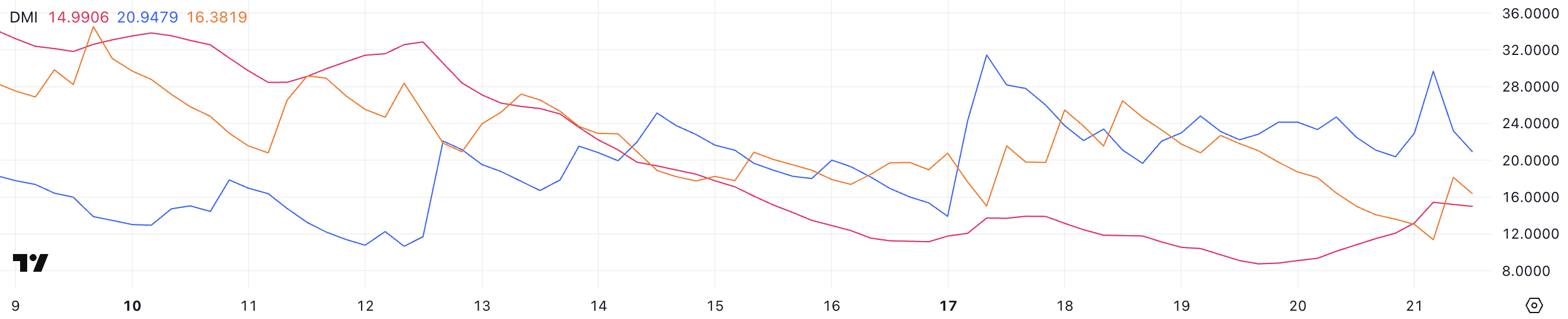

Ethereum’s Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) is currently at 14.9, indicating a weak trend.

Meanwhile, the +DI has dropped from 29.6 to 20.94, showing a decline in buying pressure since the Bybit hack. Conversely, the -DI has risen from 11.3 to 16.3, demonstrating selling pressure as the stolen Ethereum has been liquidated.

This shift suggests a change in market sentiment, with sellers gaining more control over the price movement.

The ADX measures trend strength, with values below 20 indicating a weak or non-existent trend, regardless of direction. The decline in +DI and rise in -DI suggest that bullish momentum has weakened while bearish pressure is increasing.

With the ADX still low, ETH is likely to remain in a consolidation phase, lacking strong directional movement. However, if -DI continues to rise above +DI, ETH could face more selling pressure, potentially leading to a further price decline.

How Will Ethereum’s Market Change Following the Hack?

If liquidations continue or user confidence weakens following the Bybit hack, ETH could soon test the support at $2,551.

A break below this level could lead to a decline toward $2,160, signaling increased selling pressure.

Conversely, if Bybit manages to recover the stolen assets or if significant buying pressure emerges, ETH price could test the resistance at $3,020. Breaking this level could push the price higher to $3,442, its highest point since the end of January.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation10 hours ago

Regulation10 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Market21 hours ago

Market21 hours agoSUI Targets Bullish Breakout with Golden Cross Potential

-

Market20 hours ago

Market20 hours agoBitcoin Price Recovers Strongly—Is a New Rally Beginning?

-

Altcoin20 hours ago

Altcoin20 hours agoXRP Price Eyes New ATH As Grayscale’s XRP ETF Filing Enters US SEC Review

-

Market19 hours ago

Market19 hours agoTrust Wallet Discusses the Challenges and Future of Crypto Wallets

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Could Target $3,000 Once It Breaks Current Supply Levels – Analyst

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin ETFs See Institutional Ownership Multiply 55x In Less Than A Year

-

Market22 hours ago

Market22 hours agoPi Network (PI) Hits Record Airdrop But Momentum Falters