Ethereum

Is Ethereum Quietly Building Momentum for a Rally? Analysts Weigh In

Ethereum’s recent price performance indicates a departure from the negative trends that are seen in the broader cryptocurrency market.

While assets such as Bitcoin have faced downward pressure, Ethereum managed a slight positive move yesterday, pushing its market value back above $2,700. Amid this price move, questions have been raised about whether the asset might be quietly building momentum for a sudden rally.

Quiet Moves Behind The Scenes

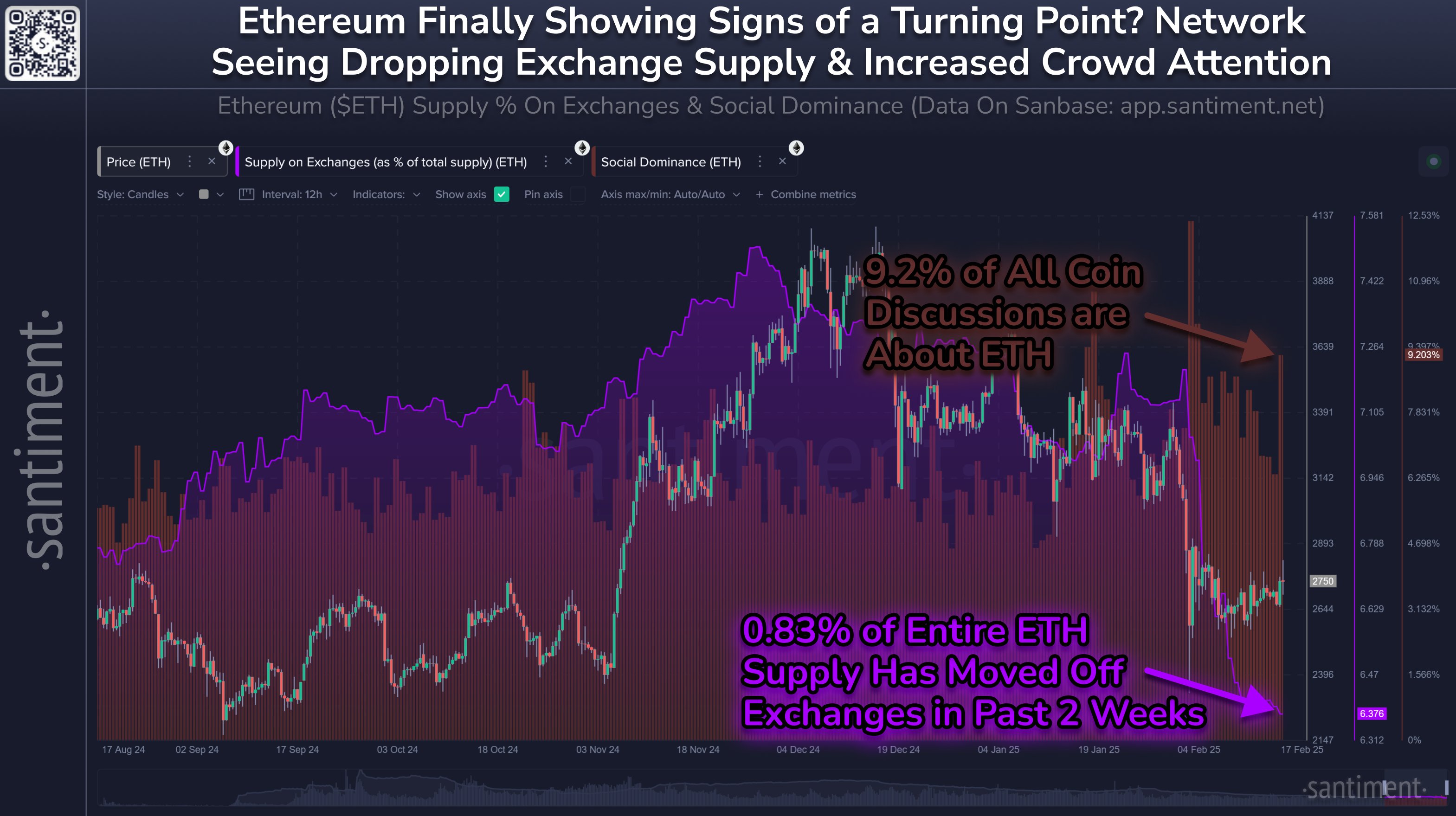

Santiment, a well-regarded market intelligence platform has recently highlighted this price performance from ETH on X, noting that Ethereum has outpaced many altcoins at the start of the week.

This performance as reported by Santiment may be attributed to the ongoing trend of ETH moving from exchanges into cold wallets at an accelerating rate.

In fact, only 6.38% of the available supply remains on exchanges, the lowest figure since Ethereum’s inception, according to Santiment. Santiment also revealed that renewed interest from the ETH community appears to be another factor behind this momentum.

Ethereum has shown mild signs of a rebound, currently back up to a market value of $2,745 and outpacing most altcoins to start the week. From a long-term perspective, ETH continues to move off of exchanges and into cold wallets at a shocking pace, with just 6.38% of the… pic.twitter.com/4MTJgpOLDT

— Santiment (@santimentfeed) February 17, 2025

Having underperformed compared to other large-cap assets throughout 2024, Ethereum is now drawing attention as market participants begin anticipating a rebound when broader market conditions improve.

Santiment’s analysis points to these movements as early indicators that Ethereum may be positioned for more sustained growth in the coming months.

A Potential Upside for Ethereum and Altcoins

Looking ahead, various market analysts have shared optimistic outlooks for Ethereum’s performance. Javon Marks, for example, sees ETH emerging from a lengthy consolidation phase.

According to Marks, the asset could potentially recover over 72% from its current levels, returning to its all-time high zones. Such a move might also spark significant bullish momentum for other altcoins, further enhancing Ethereum’s role as an altcoin market leader.

Coming out of what may have only been a massive bottoming/consolidation, $ETH could be setting up here for an over +72.1% surge in a recovery back to its ATH areas!

Ethereum could still have a major upside coming, and this could also aid alts into significant bull moves as well. https://t.co/yKb13rWh99 pic.twitter.com/6fLTjolHQ0

— JAVON

MARKS (@JavonTM1) February 17, 2025

Another perspective comes from crypto analyst Ali, who identified a crucial support level at $2,425. This level is noteworthy as it represents the accumulation zone for 10.33 million wallets holding a total of 62.43 million ETH.

Featured image created with DALL-E, Chart from TradingView

Ethereum

Extremely Strong Support And Monthly 55 EMA Says ETH Is Headed For $4,867

Ethereum has yet to return to its all-time high for over three years, a stark contrast to Bitcoin, which has surged past many price levels in the current cycle. Despite being the second-largest cryptocurrency, Ethereum has struggled to keep up with the broader market even during price rallies. However, a new technical outlook suggests that Ethereum may soon break free from this underwhelming trend and push toward $4,867 based on a strong meeting of multiple technical indicators.

Extremely Strong Support Shows Ethereum Breakout Is Close

As revealed by a technical analyst on the TradingView platform, technical analysis of the Ethereum price poses a bullish outlook to finally break above its all-time high of $4,878. Ethereum is currently positioned at a key inflection point, where it is trading just above a multi-year support trendline. Notably, this trendline has acted as a solid foundation during previous downturns, allowing ETH to consistently rebound after touching this level. Given this historical precedent, the next expected move is another upward bounce, potentially setting the stage for a renewed bullish push.

Related Reading

The strength of this support trendline is further reinforced by key Fibonacci levels, which have previously served as inflection points for Ethereum’s major rallies. At present, Ethereum is positioned around the 14.6% Fib retracement level from its break above $4,000 in September 2024, which is a zone that has historically caused reversals and strong bullish momentum.

In addition to the Fibonacci level, Ethereum’s price structure is also currently supported by the monthly 55 Exponential Moving Average (EMA), which is typically known for marking long-term bullish trends. This adds weight to a bounce on the multi-year support trendline.

Triangle Formation Confirms The Explosive Move

The analyst also noted that ETH has been trading within a triangle pattern in a multi-month timeframe. Triangle patterns often signal a period of consolidation before a strong move in either direction and in Ethereum’s case, the supporting trendlines and Fibonacci levels suggest a higher probability of an upward breakout.

Related Reading

The specific pattern forming on Ethereum’s chart is an ascending triangle, a bullish continuation pattern characterized by a rising lower trendline and a horizontal resistance zone. The upper resistance trendline for this formation sits around the $4,000 mark, a level that has proven difficult to breach three different times this cycle. However, the next try could cause a breakout if Ethereum continues to build on the growing bullish signals with the Fib level and the 50 EMA. Once Ethereum clears the ascending triangle’s upper resistance, the next primary price target would be around $4,867, its current all-time high.

At the time of writing, Ethereum is trading at $2,760, up by 1.1% in the past 24 hours.

Featured image from Ethereum, chart from Tradingview.com

Ethereum

Ethereum Holds Key Support – Analyst Doubts Bears Can Defend $4K Anymore

Ethereum has been attempting to reclaim the $2,800 level for days, but bears continue to apply selling pressure, keeping the price below this key resistance. Despite this, demand remains strong, with bulls successfully holding ETH above the crucial $2,600 support level. The short-term outlook for ETH remains uncertain, as investors speculate on whether the current consolidation phase will lead to a breakout or further declines.

Related Reading

Despite this, there is a growing sentiment that Ethereum could soon recover. Top analyst Jelle shared a technical analysis on X, revealing that ETH recently took out the lows, retested the key trendline, bounced off key support, and held above the 200-week exponential moving average (EMA). According to Jelle, this confirms that the uptrend structure remains intact, suggesting that ETH still has bullish potential.

While price action remains sluggish, Jelle’s analysis highlights that Ethereum is still holding critical levels, which could lead to a strong move upward. If ETH reclaims $2,800 in the coming days, momentum could build toward a push above $3,000. However, if selling pressure continues and ETH loses $2,600, a deeper retrace could be expected. For now, patience is key as Ethereum hovers near crucial technical levels.

Ethereum Price Signals Potential Recovery Phase

Ethereum has been attempting to reclaim the $2,800 level for the past few days, with bulls struggling to confirm a recovery rally into higher supply zones. Price action remains uncertain, as investors watch closely to see whether ETH can push past this resistance or if selling pressure will drive it lower. The ongoing volatility has kept traders on edge, with some fearing that Ethereum might continue to drop further, testing lower support levels before any potential recovery.

Related Reading

Market sentiment remains divided, with one side expecting a prolonged consolidation or further correction, while the other believes ETH is on the verge of a breakout. Analysts suggest that Ethereum is at a critical juncture, and the coming days could define its short-term trajectory.

Jelle’s technical analysis explains that ETH’s recent price action took out its previous lows, retesting the key trendline and holding above the 200-week exponential moving average (EMA) are all good signs. Jelle says the uptrend structure remains intact despite the slow price movement. He acknowledges that this may be one of the slowest uptrends Ethereum has ever experienced, but he still sees bullish momentum building.

Jelle also doubts that bears will be able to defend the $4,000 level once more if Ethereum gains strength. As ETH continues to hold key support levels and attempts to reclaim the $2,800 mark, a breakout could lead to a significant rally in the coming weeks. Investors are advised to remain patient as Ethereum navigates this critical phase, with many closely watching for potential trend confirmation.

ETH Testing Short-Term Supply

Ethereum is trading at $2,805, attempting to hold this level and push higher to confirm a recovery rally. Bulls are trying to establish support at this key price zone, aiming to regain momentum after weeks of consolidation. The price is just 7% away from the critical $3,000 mark, which sits slightly above the 4-hour 200 Moving Average. A break above $2,950 and a successful hold above this level would likely trigger an aggressive bullish recovery, pushing ETH toward higher resistance levels.

However, if Ethereum fails to hold above $2,800, the bullish momentum could weaken, leading to another round of selling pressure. In that case, ETH could drop back toward the $2,600 demand zone or even lower. This level has previously acted as strong support, and losing it could indicate further downside risks.

Related Reading

For now, Ethereum remains at a pivotal point, where bulls must step up to maintain short-term strength. A breakout above resistance could fuel renewed optimism among investors, while failure to sustain current levels may lead to continued market uncertainty. All eyes are on ETH’s ability to reclaim and consolidate above key resistance levels to determine its next major move.

Featured image from Dall-E, chart from TradingView

Ethereum

Crypto Pundit Says Ethereum Price Is ‘Destined’ To Reach $10,000 This Cycle, Here’s Why

The Ethereum price is drawing attention to its potential future outlook, as a crypto pundit points to a striking resemblance between the altcoin’s price action and Bitcoin’s during the 2015-2017 bull cycle. The analyst’s technical chart analysis suggests that ETH is destined for a breakout to $10,000 this cycle, marking new all-time highs.

Ethereum Price Chart Mirror’s Bitcoin Historic Breakout

According to Ted Pillows, a crypto pundit on X (formerly Twitter), a comparative analysis of Etheruem’s current price movement and that of Bitcoin during a previous bull cycle highlights a familiar bullish pattern. Based on this past trend, the analyst confidently predicts that Ethereum will hit $10,000 this cycle.

Between the bull market in 2015 and 2017, the Bitcoin price hit a bear market bottom between $201 and $205. After experiencing a bit of consolidation and volatility, the cryptocurrency eventually skyrocketed to a historic rally towards $685 and $785, marking new ATHs at the time. This massive surge occurred after Bitcoin broke out of resistance levels around the $465 threshold.

Based on the Pillows’ hypothesis, Ethereum appears to be following a similar trajectory, having completed its accumulation phase and recently breaking through major resistance levels. The number one altcoin has also experienced significant volatility recently, struggling to recover from previous bearish trends and market sell offs that pushed its value below the $3,000 price high.

While still in consolidation, as no strong surge has been recorded in the Ethereum price recently, Pillows highlights factors that could reinforce the altcoin’s bullish outlook. The analyst mentioned Ethereum’s Total Value Locked (TVL) and Stablecoin liquidity dominance. Currently, ETH leads in DeFi, securing the highest TVL across all platforms in the space.

Pillows also highlighted the impact of institutional demand and accumulation. As these factors increase, Ethereum could gain more exposure, potentially boosting its long-term value. Lastly, the analyst mentioned that Ethereum currently has a lower inflation rate than Bitcoin and 99% of the altcoins in the market.

Based on these seemingly bullish factors, Pillows urges investors and traders to set their sights higher, dismissing a $5,000 target as too conservative and advocating for a more ambitious $10,000 projection.

ETH Whales Get Back In Action

While analysts share their optimistic projections about Ethereum’s future outlook, whales are getting in on the ground floor and buying ETH tokens in droves. While the recent decline in the price of ETH may have caused panic selling for some, deep-pocketed investors have taken the market crash as an opportunity to accumulate.

According to TradeerPA, a crypto analyst on X, new reports show that ETH has been getting rapidly accumulated by Ethereum whales. Due to this accumulation trend, the analyst advocates for a price rally to new ATHs, driven by a positive shift in market sentiment and increased demand.

Featured image from Adobe Stock, chart from Tradingview.com

-

Regulation5 hours ago

Regulation5 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Ethereum21 hours ago

Ethereum21 hours agoBig Players Keep Buying Ethereum – Whales Accumulate 430,000 ETH In 72 Hours

-

Altcoin15 hours ago

Altcoin15 hours agoPi Coin Price Crashes 50%, What Shall Investors Do Next?

-

Market20 hours ago

Market20 hours agoKAITO Price Attempts Recovery as Top Holders Exit Post-Airdrop

-

Market14 hours ago

Market14 hours agoXRP Price Upside Move Slows—What’s Stopping the Breakout?

-

Altcoin20 hours ago

Altcoin20 hours agoCan Shiba Inu Price Surge 422%? This Pattern Signal SHIB New All-Time High

-

Altcoin14 hours ago

Altcoin14 hours agoBTC Crosses $98K, Altcoins Flux, IP Soars 67%

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Could Target $3,000 Once It Breaks Current Supply Levels – Analyst