Market

Crypto Wallets to Overtake Exchanges for Daily Use

Former Binance CEO Changpeng ‘CZ’ Zhao believes that crypto wallets should be the primary interface for everyday blockchain usage, while exchanges should mostly serve professional traders and liquidity providers.

CZ expressed this in a recent X (formerly Twitter) discussion with Trust Wallet CEO Eowyn Chen.

CZ Thinks Crypto Wallets and Exchanges Have Very District Use Cases

Although no longer a boss, CZ lives a pretty busy life every day, as he revealed in this latest discussion. The former Binance CEO is now committed to looking for new investment opportunities with YZI Labs (previously Binance Labs). He’s also actively contributing to the Giggle Academy.

CZ also talked about his dog Broccoli, which recently became quite the phenomenon in the meme coin space. When discussing crypto wallets, he expressed how exchanges serve more professional trading needs, and wallets can become the go-to platform for daily blockchain usage.

” I don’t think there should be any block in the future. The exchanges should only be for professional traders. You know, very large traders with liquidity. The exchange is a liquidity pool. Most people should not need to interact with Exchange,” The former Binance CEO expressed.

CZ stressed that most people have been using crypto exchanges as a wallet, which is wrong. Platforms like Binance, Coinbase, and other exchanges should be used only for trading. On the other hand, apps like Trust Wallet serve the purpose of storing cryptoassets.

This statement reflects a shift in the crypto industry. Wallets, which have served as simple storage tools, now play a key role in asset management, digital identity, and payment functions.

Wallets now support a wide range of functions, such as remittance, wealth management, and access to DeFi services.

Eowyn Chen pointed out that Trust Wallet has grown its user base significantly. The platform now attracts everyday users rather than those interested in speculative trading.

“We have almost 200 million downloads, and this is about 77% of the finance registration users. So for us, we feel like as a decentralization wallet. And with all the hoops that you have to jump over, that’s quite some honor from the user base,” said Trust Wallet CEO Eowyn Chen.

Gateway for Digital Identities

CZ also mentioned that wallets could become a gateway to digital identification and government services. He noted that many governments are exploring blockchain solutions to provide citizens with secure digital identities.

Wallets could support such initiatives and provide a safe place to store assets and digital credentials. This point suggests that wallets will extend beyond finance into areas like digital education and public services.

“When governments look at blockchain, the first thing they’re going to need is a digital and decentralized ID solution. For that, you need a wallet. You should be able to do everything from the wallet. The wallet is kind of like the browser to the internet, right? So they are a key infrastructure,” said CZ.

The discussion came as wallet providers and exchanges face increased scrutiny over user data and market practices. Eowyn Chen said that separating wallet functions from exchange functions can benefit the ecosystem by capturing different user profiles.

As a result, wallet platforms have the opportunity to serve a wider audience with everyday financial needs.

The debate also touches on the emerging role of digital identity and educational tools. Chen described a concept where digital certificates and identity systems integrate with wallets.

This integration would allow users to access educational content, government services, and financial tools from a single interface. Such innovation could improve everyday crypto usage and pave the way for increased adoption of blockchain technology.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What It Means for the XRP Lawsuit

The SEC is dropping its lawsuit against Coinbase, according to an announcement from CEO Brian Armstrong. However, the Commission’s lawsuit against Ripple remains open for now, raising more questions.

Both lawsuits deal with certain cryptoassets’ status as securities, not commodities. For Coinbase, this interpretation would hamper operations, but it could prove fatal for the XRP issuer.

SEC Drops the Coinbase Suit

Brian Armstrong, the founder and CEO of Coinbase, is having a good day today. Recently, the company has been advocating for better US crypto regulation, and it achieved a major milestone today. Armstrong announced that the SEC was dropping its 2023 lawsuit.

“Great news! After years of litigation, millions of your taxpayer dollars spent, and irreparable harm done to the country, we reached an agreement with SEC staff to dismiss their litigation against Coinbase. Once approved by the Commission (which we’re told to expect next week) this would be a full dismissal, with $0 in fines paid and zero changes to our business,” he said.

Armstrong called this development “hugely vindicating,” claiming it was a real challenge to resist the Commission’s “mafia tactics” under the previous leadership.

He also said that this suit is a groundbreaking development for the future of crypto in the US because it would’ve substantially hindered exchanges’ ability to do business nationwide. For Coinbase, the SEC legal battle appears over.

However, the SEC has another active crypto lawsuit – its fight against Ripple. The two suits have major similarities, both hinging upon the notion that certain cryptoassets are securities. This interpretation opens crypto-related businesses to much stricter regulation.

How Will the Coinbase Settlement Impact the XRP Lawsuit?

For Coinbase, the issue is that the SEC insisted upon a lack of clarity with these classifications, essentially claiming that it could demand the exchange delist any token at a whim. In the Ripple case, however, it alleged that the firm was forbidden from raising funds through XRP token sales without registration.

In both instances, the SEC leaned on a lack of clear standards for crypto.

Even before today’s announcement, the SEC had already signaled it would drop charges against Coinbase, but the process has been murkier for Ripple. The Commission recently removed the XRP lawsuit from its website, and may be waiting for a few broader changes to dismiss it outright.

Ultimately, however, the Ripple case may be more complicated. The SEC alleged that Coinbase was hosting certain unlawful assets, and complying would severely impact the business model for all exchanges.

In the latter suit, it claimed that selling XRP was itself a securities violation, which would severely impact a great number of token projects.

The SEC is already taking a few measures to lay the groundwork for a broader policy realignment. Commissioner Peirce claimed that it wants to formally remove some tokens’ security status.

Also, the Commission is looking to reduce its crypto enforcement activities generally. Overall, the Coinbase case does provide some optimism for the XRP community.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

LINK Price Action Turns Cautious As Bearish Pennant Shapes Up

Chainlink (LINK) is flashing bearish signals as it forms a pennant pattern, hinting at a potential continuation of its downward trajectory. After struggling to gain bullish momentum, the price remains in consolidation, with sellers keeping a tight grip on the market. If this pattern plays out, LINK could be at risk of a steep drop, with key support levels facing increased pressure.

Market sentiment appears cautious, as bulls attempt to hold the line against growing bearish momentum. A breakdown from this structure might accelerate losses, pushing LINK toward lower price zones. However, if buyers manage to invalidate the pattern, a relief rally may be in play.

Analyzing Price Action: Bearish Pennant Signals Breakdown

Currently, Chainlink continues to trade within the confines of the bearish pennant pattern, indicating a state of indecision in the market. Neither the bulls nor the bears have established firm control, as the price remains constrained within converging trendlines.

Typically, this consolidation phase suggests that market participants are in a wait-and-see mode, anticipating a technical or fundamental catalyst for a decisive breakout in either direction.

While the structure of a bearish pennant typically signals a continuation of the previous downtrend, LINK’s hesitation indicates that bulls are still attempting to defend key support levels. Nevertheless, without a strong surge in buying pressure, the risk of a breakdown remains high.

If LINK breaches the lower boundary of the pennant with strong volume, an accelerated decline is likely, reinforcing the bearish outlook and increasing selling pressure. This breakdown could attract bearish momentum, pushing the price toward key support levels.

Additionally, the asset is currently trading below the 100-day Simple Moving Average (SMA), further strengthening the negative trend in the market. This positioning suggests that LINK’s ongoing attempts to regain upward momentum may face significant resistance.

Potential Breakdown Targets: How Low Can LINK Go?

The formation of a bearish pennant in Chainlink’s price action raises the possibility of further downside, with the measured move target and key support levels providing a roadmap for potential price movement.

Should the bears seize control and a breakdown occur below the lower trendline, LINK’s downward trend could accelerate, pushing the price below the critical $17.96 support level. This drop eyes a deeper decline toward the $15 mark, where buyers may attempt to regain momentum and prevent additional losses.

However, if bulls manage to defend these key levels and initiate a strong rebound, LINK might invalidate the bearish setup and shift toward a recovery, possibly targeting the $19.87 resistance level. A decisive move above this threshold would reaffirm bullish momentum and pave the way for more gains.

Market

Bybit Reportedly Hacked for Over $1.5 Billion

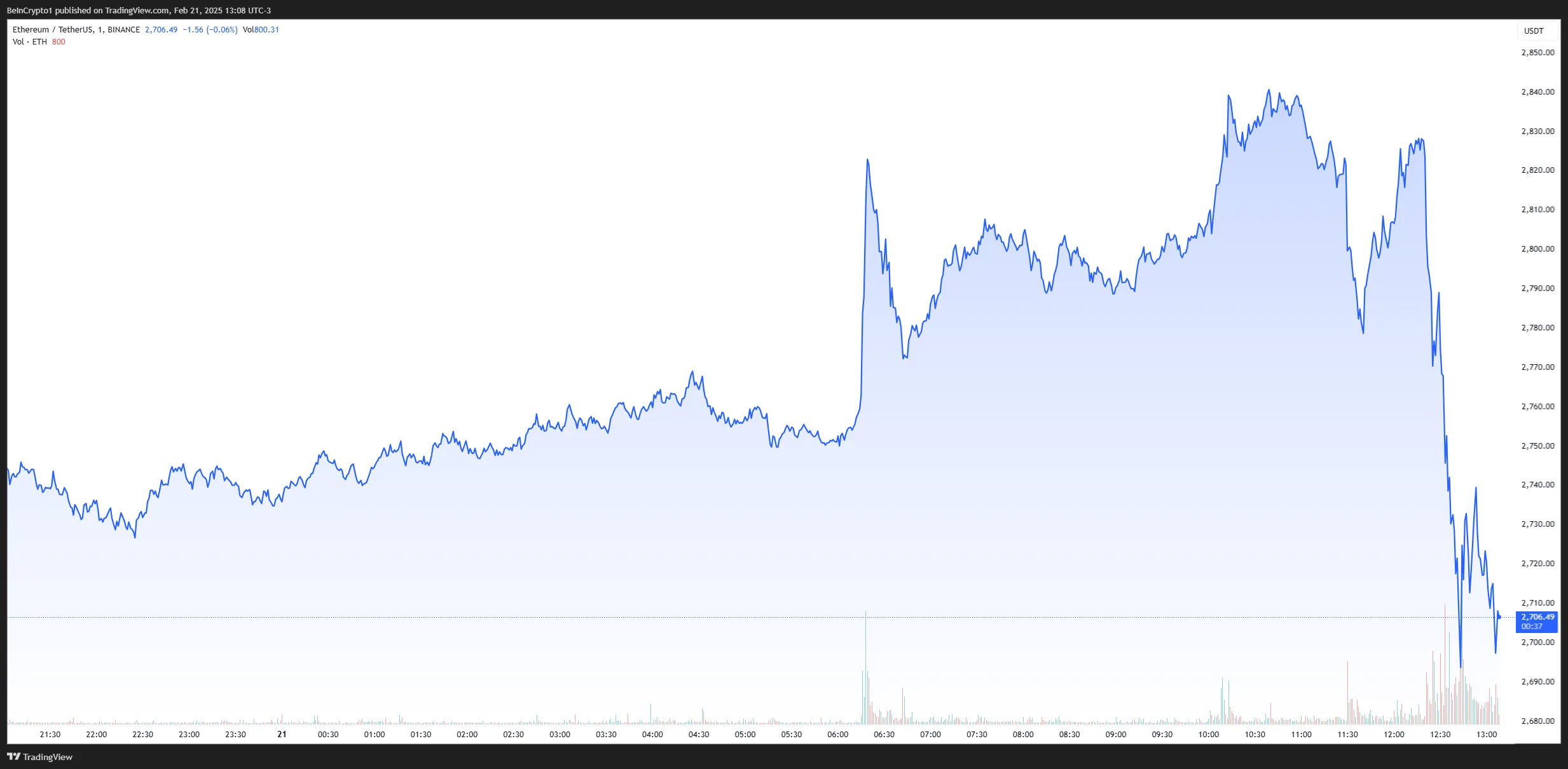

According to the latest reports, crypto exchange Bybit suffered a major hack, and over $1.46 billion in Ethereum was withdrawn from its hot wallets.

This could potentially be the biggest security breach in crypto history.

Bybit Hack: Everything We Know So Far

On-chain data shows that a staggering 401,346 ETH (valued at $1.13 billion) was reportedly transferred from Bybit’s hot wallet to an unknown wallet address. The amount is now being liquidated, which also immediately impacted Ethereum’s market price.

This large transfer immediately sparked concerns that Bybit had suffered a breach, especially considering the significant value of the assets involved.

Bybit CEO Ben Zhou confirmed the reports on social media.

“Hacker took control of the specific ETH cold wallet we signed and transferred all ETH in the cold wallet to this unidentified address. Please rest assured that all other cold wallets are secure. All withdraws are normal,” Zhou wrote on X (formerly Twitter).

According to his statement, Bybit’s Ethereum cold wallet was hacked because the attackers tricked their security system. The wallet signers (authorized people) saw a fake user interface that showed the correct address, making them believe they were approving a normal transfer.

However, in reality, they were unknowingly signing a change to the smart contract logic, which gave the hacker control over the wallet. As a result, all the ETH in that cold wallet was transferred to an unknown address.

“The biggest hack ever by far. Very similar to the WazirX $235 million access control attack,” Deddy Lavid, CEO of blockchain security firm Cyvers, told BeInCrypto.

Meanwhile, the hack immediately impacted Ethereum’s market price. As large volumes of the stolen ETH were liquidated, the altcoin fell over 4% in a straight line.

According to Arkham data, nearly $200 million worth of Lido Staked Ether (stETH) were sold within the first 30 minutes. Security experts have told BeInCrypto that this attack was almost identical to last year’s WazirX and Radiant Capital hack.

“Two minutes before the outflow transactions, the hacker re-implemented their Safe multisig wallet to delegate calls to the hacker’s malicious contract. This was likely caused by blind signing while attempting to execute a legitimate transaction. From that moment, the hackers had full control over the wallet and no longer needed additional signatures. This attack is very similar to those on WazirX and Radiant Capital,” Meir Dolev, Co-Founder and CTO of Cyvers, told BeInCrypto.

It appears that Bybit fell victim to the same malicious techniques that caused the biggest hacks of 2024.

This is an ongoing story. More information will be provided as the investigation unfolds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation4 hours ago

Regulation4 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Regulation24 hours ago

Regulation24 hours agoSEC launches new unit to combat crypto fraud and cybercrime

-

Market16 hours ago

Market16 hours agoSUI Targets Bullish Breakout with Golden Cross Potential

-

Market15 hours ago

Market15 hours agoBitcoin Price Recovers Strongly—Is a New Rally Beginning?

-

Altcoin15 hours ago

Altcoin15 hours agoXRP Price Eyes New ATH As Grayscale’s XRP ETF Filing Enters US SEC Review

-

Market14 hours ago

Market14 hours agoTrust Wallet Discusses the Challenges and Future of Crypto Wallets

-

Bitcoin8 hours ago

Bitcoin8 hours agoVanEck Tool Shows Strategic Bitcoin Reserve Can Trim US Debt

-

Altcoin19 hours ago

Altcoin19 hours agoCan Shiba Inu Price Surge 422%? This Pattern Signal SHIB New All-Time High