Market

IP Price Surges 11%, Market Cap Now Crossing $500 Million

Story (IP) price has surged more than 10% in the last 24 hours as excitement builds around its newly launched mainnet. Story was one of the most anticipated crypto launches of the year, backed by $134 million in funding from investors like Andreessen Horowitz and Polychain Capital.

With strong momentum driving its price action, technical indicators suggest that IP is at an important point. Its market cap crossed $500 million before seeing a brief correction. Whether it continues its rally toward new highs or faces resistance and pulls back will depend on how traders react to key support and resistance levels.

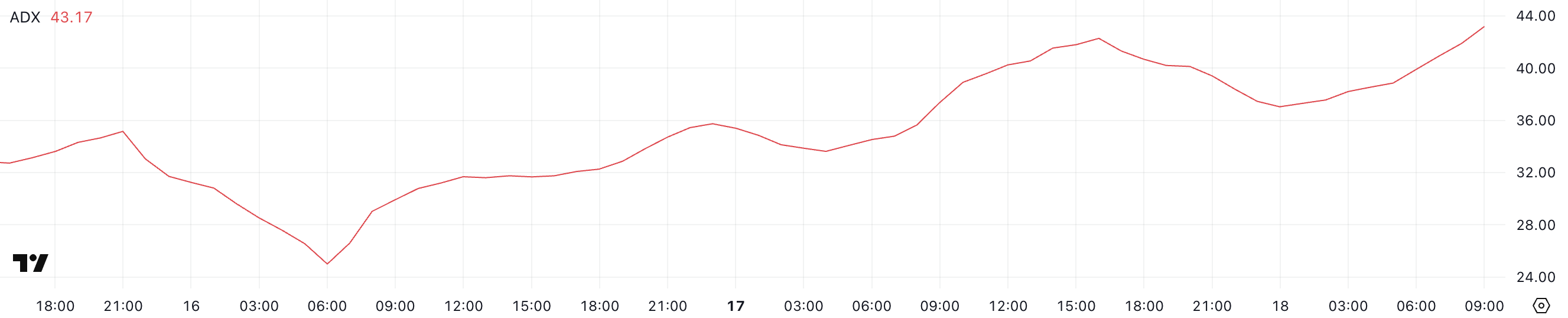

Story ADX Shows the Uptrend Is Very Strong

Story is trending after the official launch of its Layer-1 mainnet, with its recent surge triggering a strong increase in ADX. The Average Directional Index (ADX), which measures trend strength regardless of direction, has climbed from 25 yesterday to 43 today.

Its price raised more than 11% in the last 24 hours, making it the best-performing altcoin of the day.

Typically, an ADX reading above 25 confirms a strong trend, while values below 20 indicate weak or choppy price action. The current rise suggests that momentum is picking up, with increased trading activity and a sustained directional move.

With ADX now at 43, the trend remains strong, reinforcing bullish sentiment. This means buyers are in control, and the price could continue its upward trajectory if momentum holds. If ADX continues rising, it could support further gains and signal an extended trend.

However, if ADX starts declining, it may suggest that Story (IP) momentum is fading, which could lead to consolidation or even a potential reversal.

A drop in ADX alongside price weakness would be an early warning of trend exhaustion, while a stabilization in ADX at high levels would indicate that the market is still in a strong phase.

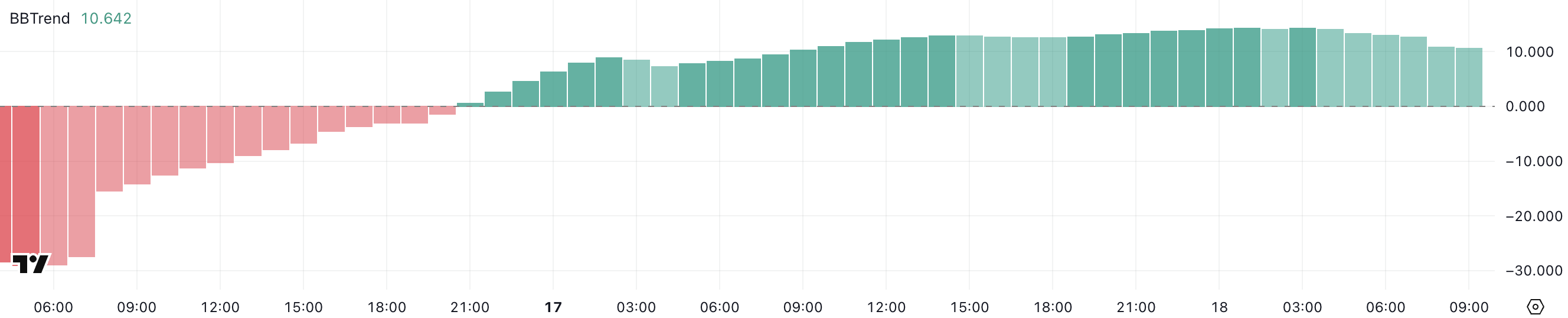

IP BBTrend Is Still Very Positive, But Stable

IP’s BBTrend has remained positive for more than a day, reaching a peak of 14.3 before pulling back to 10.6. This comes after a strong recovery from its February 16 low, when it hit a negative peak of -29.

BBTrend (Bollinger Band Trend) is an indicator that measures price direction relative to its Bollinger Bands, helping to identify trend strength and potential reversals.

Positive values indicate bullish momentum, while negative values suggest a downtrend. Extreme readings often signal overbought or oversold conditions.

With BBTrend now at 10.6, the indicator remains in bullish territory, but its decline from 14.3 suggests that momentum is cooling off. This could mean that buying pressure is fading, leading to either a period of consolidation or a potential shift in trend.

If BBTrend stabilizes around this level, the uptrend may continue, but a further drop could indicate growing weakness. Traders will be watching closely to see if the pullback is temporary or the beginning of a larger move downward.

IP Price Prediction: Can Story Reach $2.30 Soon?

Story (IP), which is placing it between the intersection of Intellectual Property and Artificial Intelligence, is currently trading between a resistance at $2.12 and a support at $1.90, staying within a key price range. If the uptrend weakens and $1.90 is lost, the next major support lies at $1.79.

A continued downtrend could push the price further toward $1.58 or even $1.40, signaling a deeper correction. These levels will be critical in determining whether buyers step in to defend the trend or if selling pressure intensifies.

On the other hand, if the uptrend holds strong, the altcoin could test the $2.12 resistance. A breakout above this level could confirm bullish momentum and open the door for a move toward $2.20 or even $2.30.

In this case, buyers would remain in control, and price action could extend higher.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What It Means for the XRP Lawsuit

The SEC is dropping its lawsuit against Coinbase, according to an announcement from CEO Brian Armstrong. However, the Commission’s lawsuit against Ripple remains open for now, raising more questions.

Both lawsuits deal with certain cryptoassets’ status as securities, not commodities. For Coinbase, this interpretation would hamper operations, but it could prove fatal for the XRP issuer.

SEC Drops the Coinbase Suit

Brian Armstrong, the founder and CEO of Coinbase, is having a good day today. Recently, the company has been advocating for better US crypto regulation, and it achieved a major milestone today. Armstrong announced that the SEC was dropping its 2023 lawsuit.

“Great news! After years of litigation, millions of your taxpayer dollars spent, and irreparable harm done to the country, we reached an agreement with SEC staff to dismiss their litigation against Coinbase. Once approved by the Commission (which we’re told to expect next week) this would be a full dismissal, with $0 in fines paid and zero changes to our business,” he said.

Armstrong called this development “hugely vindicating,” claiming it was a real challenge to resist the Commission’s “mafia tactics” under the previous leadership.

He also said that this suit is a groundbreaking development for the future of crypto in the US because it would’ve substantially hindered exchanges’ ability to do business nationwide. For Coinbase, the SEC legal battle appears over.

However, the SEC has another active crypto lawsuit – its fight against Ripple. The two suits have major similarities, both hinging upon the notion that certain cryptoassets are securities. This interpretation opens crypto-related businesses to much stricter regulation.

How Will the Coinbase Settlement Impact the XRP Lawsuit?

For Coinbase, the issue is that the SEC insisted upon a lack of clarity with these classifications, essentially claiming that it could demand the exchange delist any token at a whim. In the Ripple case, however, it alleged that the firm was forbidden from raising funds through XRP token sales without registration.

In both instances, the SEC leaned on a lack of clear standards for crypto.

Even before today’s announcement, the SEC had already signaled it would drop charges against Coinbase, but the process has been murkier for Ripple. The Commission recently removed the XRP lawsuit from its website, and may be waiting for a few broader changes to dismiss it outright.

Ultimately, however, the Ripple case may be more complicated. The SEC alleged that Coinbase was hosting certain unlawful assets, and complying would severely impact the business model for all exchanges.

In the latter suit, it claimed that selling XRP was itself a securities violation, which would severely impact a great number of token projects.

The SEC is already taking a few measures to lay the groundwork for a broader policy realignment. Commissioner Peirce claimed that it wants to formally remove some tokens’ security status.

Also, the Commission is looking to reduce its crypto enforcement activities generally. Overall, the Coinbase case does provide some optimism for the XRP community.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

LINK Price Action Turns Cautious As Bearish Pennant Shapes Up

Chainlink (LINK) is flashing bearish signals as it forms a pennant pattern, hinting at a potential continuation of its downward trajectory. After struggling to gain bullish momentum, the price remains in consolidation, with sellers keeping a tight grip on the market. If this pattern plays out, LINK could be at risk of a steep drop, with key support levels facing increased pressure.

Market sentiment appears cautious, as bulls attempt to hold the line against growing bearish momentum. A breakdown from this structure might accelerate losses, pushing LINK toward lower price zones. However, if buyers manage to invalidate the pattern, a relief rally may be in play.

Analyzing Price Action: Bearish Pennant Signals Breakdown

Currently, Chainlink continues to trade within the confines of the bearish pennant pattern, indicating a state of indecision in the market. Neither the bulls nor the bears have established firm control, as the price remains constrained within converging trendlines.

Typically, this consolidation phase suggests that market participants are in a wait-and-see mode, anticipating a technical or fundamental catalyst for a decisive breakout in either direction.

While the structure of a bearish pennant typically signals a continuation of the previous downtrend, LINK’s hesitation indicates that bulls are still attempting to defend key support levels. Nevertheless, without a strong surge in buying pressure, the risk of a breakdown remains high.

If LINK breaches the lower boundary of the pennant with strong volume, an accelerated decline is likely, reinforcing the bearish outlook and increasing selling pressure. This breakdown could attract bearish momentum, pushing the price toward key support levels.

Additionally, the asset is currently trading below the 100-day Simple Moving Average (SMA), further strengthening the negative trend in the market. This positioning suggests that LINK’s ongoing attempts to regain upward momentum may face significant resistance.

Potential Breakdown Targets: How Low Can LINK Go?

The formation of a bearish pennant in Chainlink’s price action raises the possibility of further downside, with the measured move target and key support levels providing a roadmap for potential price movement.

Should the bears seize control and a breakdown occur below the lower trendline, LINK’s downward trend could accelerate, pushing the price below the critical $17.96 support level. This drop eyes a deeper decline toward the $15 mark, where buyers may attempt to regain momentum and prevent additional losses.

However, if bulls manage to defend these key levels and initiate a strong rebound, LINK might invalidate the bearish setup and shift toward a recovery, possibly targeting the $19.87 resistance level. A decisive move above this threshold would reaffirm bullish momentum and pave the way for more gains.

Market

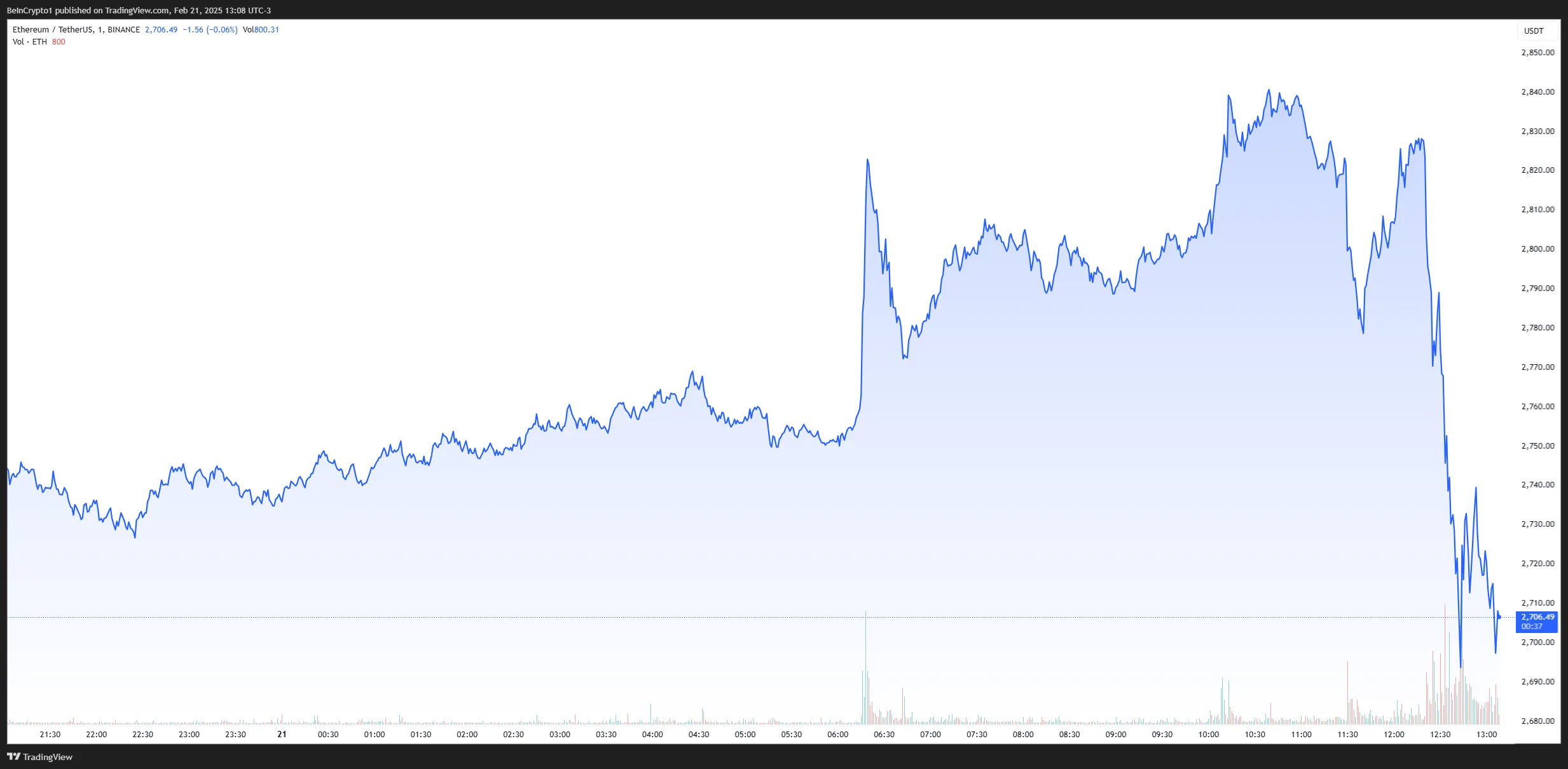

Bybit Reportedly Hacked for Over $1.5 Billion

According to the latest reports, crypto exchange Bybit suffered a major hack, and over $1.46 billion in Ethereum was withdrawn from its hot wallets.

This could potentially be the biggest security breach in crypto history.

Bybit Hack: Everything We Know So Far

On-chain data shows that a staggering 401,346 ETH (valued at $1.13 billion) was reportedly transferred from Bybit’s hot wallet to an unknown wallet address. The amount is now being liquidated, which also immediately impacted Ethereum’s market price.

This large transfer immediately sparked concerns that Bybit had suffered a breach, especially considering the significant value of the assets involved.

Bybit CEO Ben Zhou confirmed the reports on social media.

“Hacker took control of the specific ETH cold wallet we signed and transferred all ETH in the cold wallet to this unidentified address. Please rest assured that all other cold wallets are secure. All withdraws are normal,” Zhou wrote on X (formerly Twitter).

According to his statement, Bybit’s Ethereum cold wallet was hacked because the attackers tricked their security system. The wallet signers (authorized people) saw a fake user interface that showed the correct address, making them believe they were approving a normal transfer.

However, in reality, they were unknowingly signing a change to the smart contract logic, which gave the hacker control over the wallet. As a result, all the ETH in that cold wallet was transferred to an unknown address.

“The biggest hack ever by far. Very similar to the WazirX $235 million access control attack,” Deddy Lavid, CEO of blockchain security firm Cyvers, told BeInCrypto.

Meanwhile, the hack immediately impacted Ethereum’s market price. As large volumes of the stolen ETH were liquidated, the altcoin fell over 4% in a straight line.

According to Arkham data, nearly $200 million worth of Lido Staked Ether (stETH) were sold within the first 30 minutes. Security experts have told BeInCrypto that this attack was almost identical to last year’s WazirX and Radiant Capital hack.

“Two minutes before the outflow transactions, the hacker re-implemented their Safe multisig wallet to delegate calls to the hacker’s malicious contract. This was likely caused by blind signing while attempting to execute a legitimate transaction. From that moment, the hackers had full control over the wallet and no longer needed additional signatures. This attack is very similar to those on WazirX and Radiant Capital,” Meir Dolev, Co-Founder and CTO of Cyvers, told BeInCrypto.

It appears that Bybit fell victim to the same malicious techniques that caused the biggest hacks of 2024.

This is an ongoing story. More information will be provided as the investigation unfolds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation4 hours ago

Regulation4 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Regulation23 hours ago

Regulation23 hours agoSEC launches new unit to combat crypto fraud and cybercrime

-

Market15 hours ago

Market15 hours agoSUI Targets Bullish Breakout with Golden Cross Potential

-

Market14 hours ago

Market14 hours agoBitcoin Price Recovers Strongly—Is a New Rally Beginning?

-

Altcoin14 hours ago

Altcoin14 hours agoXRP Price Eyes New ATH As Grayscale’s XRP ETF Filing Enters US SEC Review

-

Market13 hours ago

Market13 hours agoTrust Wallet Discusses the Challenges and Future of Crypto Wallets

-

Bitcoin8 hours ago

Bitcoin8 hours agoVanEck Tool Shows Strategic Bitcoin Reserve Can Trim US Debt

-

Altcoin18 hours ago

Altcoin18 hours agoCan Shiba Inu Price Surge 422%? This Pattern Signal SHIB New All-Time High