Altcoin

Why Is Bitcoin, Ethereum, Solana & XRP Price Dropping?

Another crypto market crash is occurring, with the Bitcoin price dropping below the crucial $95,000 support level, dragging altcoins like Ethereum, Solana, and the XRP price along with it. This price crash has occurred mainly due to the bearish sentiment in the market, thanks to several factors.

Crypto Market Crash: Why BTC, ETH, SOL & XRP Are Down

CoinMarketCap data shows that a crypto market crash is occurring again, with the Bitcoin price dropping below the psychological $95,000 level. Altcoins like Ethereum, Solana, Dogecoin, and the XRP price have also significantly declined.

This price crash has occurred due to several factors, including global economic uncertainty. For one, US President Donald Trump continues to threaten to impose tariffs on other countries. Yesterday, the president announced that he has decided that for the purposes of fairness, he will charge reciprocal tariffs on countries that charge the US.

This continues to raise concerns about trade wars, which is bearish for the crypto market. Meanwhile, the bearish sentiment in the market is also due to the US Federal Reserve’s quantitative tightening policy, with no hopes of monetary easing policies anytime soon. Traders predict that there will be only one Fed rate cut this year, which is unlikely to come until the second half of the year.

These developments sparked a bearish sentiment among investors, ultimately leading to this crypto market crash. The Bitcoin price has struggled to reclaim $100,000 for a while now and now even looks more likely to touch $90,000.

Bearish Factors In The Market

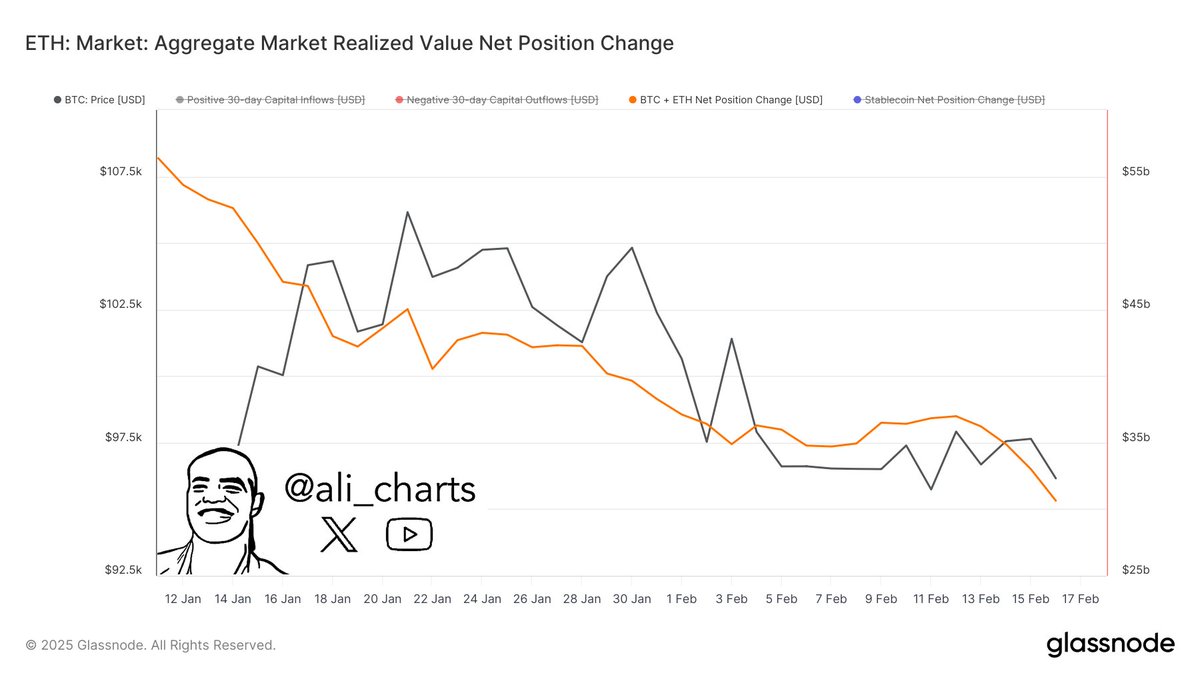

Besides the uncertainty on the macro side, other developments have led to the crypto market crash. Crypto analyst Ali Martinez recently revealed that the capital inflows into Bitcoin and Ethereum have declined by over 30% in the past month, dropping from $45 billion to $30 billion.

This indicates that there is a lack of liquidity in the market to sustain higher prices. Investors look to be holding off on allocating more capital to the market due to the bearish sentiment. Instead, more investors look to offloading their coins as the market likely priced in to Donald Trump’s administration even before he took office.

Moreover, some community members believe that Trump’s administration has fallen short of its promises to the crypto industry, considering that the Strategic Bitcoin Reserve initiative hasn’t yet happened.

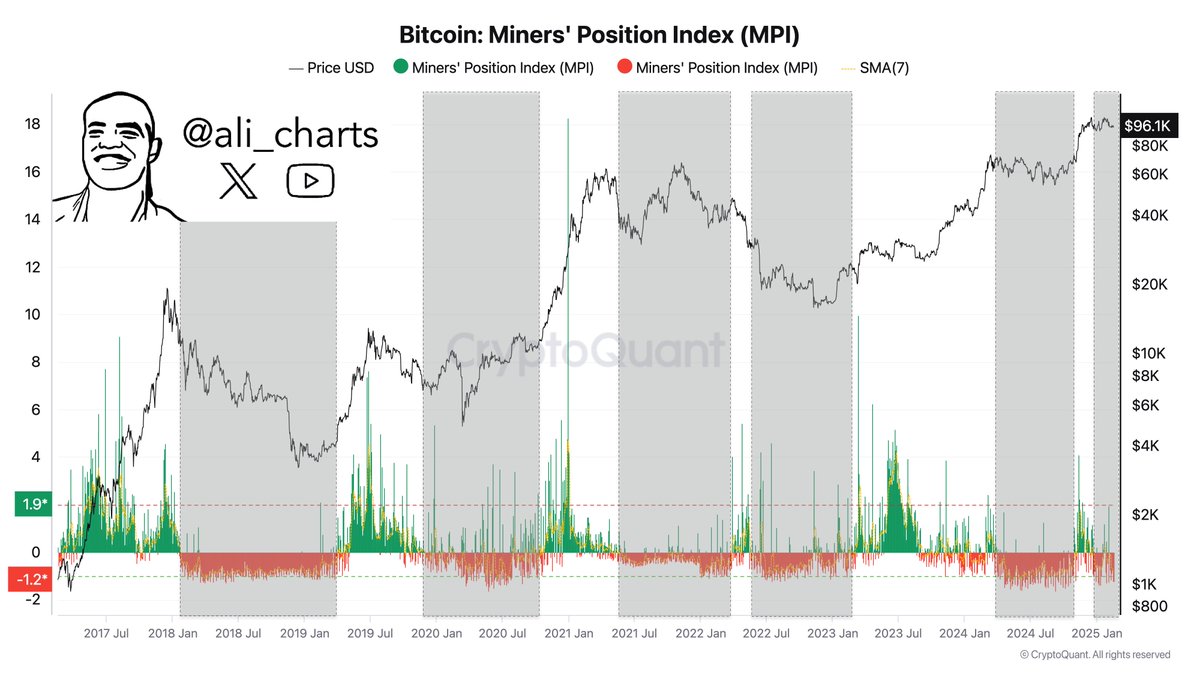

Amid this crypto market crash, Martinez has also suggested that the market could witness lower prices, as he revealed that prolonged price corrections have historically followed a decline in Bitcoin mining activity.

Away from the Bitcoin ecosystem, the bearish sentiment in the Solana sentiment also looks to be at an all-time high (ATH) following the LIBRA meme coin rug pull. Traders allegedly lost over $286 million to the rug pull, which has further sucked liquidity out of the crypto market.

This development has further dampened investors’ confidence, especially considering Argentina’s President Javier Milei promoted this meme coin on his X account. This saga has raised the ghosts of the TRUMP and Melania meme coins, which sucked liquidity from the market just before Donald Trump took office.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Sui Price Sees Explosive Growth Amid Increasing Daily Active Addresses: Will It Hit $8?

The Sui token is currently making significant rebound, outperforming top cryptocurrencies including Bitcoin, Ethereum, and XRP. While these assets are exhibiting modest gains in line with the broader market trend, the Sui price is making impressive strides, surging over 7% in a single day. This significant uptick has sparked optimism, with market analysts and experts remaining bullish on the altcoin’s potential to reach new all-time highs.

Sui Price Breaks Past Crucial Resistance, Eyes $8

Notably, Sui’s current bullish trend significantly influences traders and analysts. While traders demonstrate this optimistic view via increasing market activity, analysts express their positive predictions. For instance, market expert CryptoBullet forecasted the Sui price’s surge to a new all time-high of $8.9 in an X post.

In a one-day chart, CryptoBullet highlighted SUI’s prevailing consolidation below 0.618 Fibonacci level. Significantly, SUI has touched twice the same price level within months. Driven by past trends, CryptoBullet remains confident that the Sui price could hit new ATH breaking past this consolidation.

Increasing Daily Active Addresses: How It Impacts Token Price?

According to investor Momin, SUI looks primed for higher highs triggered by increasing daily active addresses. Reportedly, the daily active wallets hit a record high of 1.2 million, paving the way for a massive breakout in the Sui price. Acknowledging the platform’s growth, the trader wrote, “Sui Network is undeniably one of the fastest-growing chains fundamentally!”

Another trader Giannis Andreou underscored the substantial surge in Sui’s daily active wallets. Currently marked at 1,253,935, the daily active addresses increased by a staggering 135.89% over the last seven days.

Meanwhile, Quinten Francois, a prominent crypto voice on X, wrote, “SUI active addresses are exploding.” The substantial surge in Sui’s price, coupled with a growing user base, has garnered significant attention, especially considering the token’s recent 36% downturn.

Sui Price Regains Positive Momentum: Will It Sustain?

At press time, Sui is trading at $3.55, marking a significant increase of 7.9% over the last seven days. However, over the last week and month, the token has seen massive declines of 4.3% and 24.3%, respectively.

Celebrating SUI’s current positive track, traders are actively engaging in market activity. The token’s 24-hour trading has seen a notable uptick of 15.44%, reaching $1.03 billion. Furthermore, SUI has achieved a milestone of over 8.5 billion total transactions, marking a notable 10.37% increase over the past 30 days. With a market cap of $10.67 billion, Sui has secured 12th spot on CoinMarketCap.

Although analysts see a massive surge ahead, it needs to be seen if SUI will sustain the current momentum and gain new highs.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ondo Finance Leads the RWA Sector – Data Reveals Unmatched Volume Growth

Altcoin

Dogecoin Whales Grab 110M DOGE Amid Recent Dip, Is A Breakout Brewing?

The latest Dogecoin whale data rattled the crypto market on Friday, flagging massive accumulations amid the meme coin’s recent price dip. Renowned market analyst Ali Martinez revealed that whales bought a whopping 110 million DOGE tokens in the last 48 hours. As a response, market participants eagerly await a bullish price breakout ahead, with top analysts further projecting optimism over future price movements due to strong market technicals.

Dogecoin Whales Scoop Up Heavily Near $0.25 Price Level

In an X post shared by analyst Ali Martinez on February 21, it can be seen that Dogecoin whales bought 110 million tokens in the past two days. These accumulations occurred as the meme coin hovered around the $0.25 price level.

In turn, this mark remains extensively gauged by market participants as it could carve out a vital support level ahead. Another report by CoinGape previously revealed that DOGE whales did not sell massive amounts when the coin moved around $0.25. The upshot remains that investors eye considerable gains for the dog-themed meme coin ahead as whale data reflects strong market support.

Why Are Whales Accumulating?

Meanwhile, the current hot buzz for the dog-themed meme coin remains rising odds of an ETF approval. CoinGape reported last week that the U.S. SEC acknowledged Grayscale’s 19-b filing for Dogecoin ETF. This news appears to have substantially uplifted whale sentiment for the asset, given that an approval ahead could provide significant money influx to the token and fuel a price upswing.

However, Dogecoin price tanked nearly 6% over the week, which appears to have ushered in a ‘buy-the-dip’ sentiment among whales amid the ETF advancements.

Is DOGE Price Breakout On The Horizon? Top Analysts Bullish

DOGE price has mainly shown signs of consolidation in recent days, trading up nearly 1% intraday to $0.2564. The meme coin hit a bottom and peak of $0.2505 and $0.2576 in the past 24 hours. Notably, it’s worth mentioning that the coin’s broader time frame volatility is primarily attributable to the crypto market’s turbulent trend.

However, market analysts have projected a bullish outlook ahead, sparking market optimism in tandem with rising Dogecoin whale buying. Analyst ‘Trader Tardigrade’ recently took to X, revealing that the coin’s price chart shows a ‘symmetrical triangle’ pattern. This metric indicates that the token is consolidating whilst a breakout awaits.

Given the massive whale buying, the chances of the analyst’s projection getting true gained substantial weight. Also, another renowned trader, ‘Altcoin Scholar,’ revealed on X that the $0.22 price level remains a strong support zone for the meme coin. A sustained break above this level solidifies the chances of further gains.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Regulation3 hours ago

Regulation3 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Regulation23 hours ago

Regulation23 hours agoSEC launches new unit to combat crypto fraud and cybercrime

-

Market15 hours ago

Market15 hours agoSUI Targets Bullish Breakout with Golden Cross Potential

-

Market14 hours ago

Market14 hours agoBitcoin Price Recovers Strongly—Is a New Rally Beginning?

-

Altcoin14 hours ago

Altcoin14 hours agoXRP Price Eyes New ATH As Grayscale’s XRP ETF Filing Enters US SEC Review

-

Market13 hours ago

Market13 hours agoTrust Wallet Discusses the Challenges and Future of Crypto Wallets

-

Altcoin13 hours ago

Altcoin13 hours agoPi Coin Price Crashes 50%, What Shall Investors Do Next?

-

Altcoin8 hours ago

Altcoin8 hours agoWill Litecoin ETF Advancements Push LTC Price Above $200?

✓ Share: