Market

Meteora Cofounder Ben Chow Resigns Amid Libra Fallout

Solana-based DeFi platform Meteora is now searching for new leadership following co-founder Ben Chow’s resignation amid controversy surrounding the Libra meme coin.

Libra remains controversial, adding to the Solana-based projects that have turned heads over the last few months.

Meteora’s Ben Chow Steps Down as Scandal Unfolds

Meow, the pseudonymous founder of decentralized exchange (DEX) Jupiter and co-founder of Meteora, revealed the news in a statement on Tuesday on X (formerly Twitter).

Meow addressed the situation in a lengthy post, affirming that neither Jupiter nor Meteora had engaged in insider trading or financial misconduct regarding the Libra meme coin. He also announced that an independent third party, Fenwick & West—one of the most reputable law firms globally—has been hired to investigate the matter and publish an independent report.

“I stand by Ben and his statement. I believe him when he says there was no financial inappropriateness in dealing with partners…While I am 100% confident about Ben’s character, as a project lead he has also shown a lack of judgment and care about some of the core aspects of the project…and this is unfortunately unacceptable. Ben understands this and has chosen to resign,” Meow wrote.

Chow’s resignation marks a turning point for Meteora, as the DeFi platform will search for new leadership. Meow urged the community to remain fair to Chow while he worked to clear his name, emphasizing his past contributions to the ecosystem.

This development stems from Kelsier Ventures CEO Hayden Davis’ claims that Libra’s team engaged in insider trading, sniping their token at launch. He made the remarks in a video interview with investigator Coffeezilla.

Davis, who previously played a role in Melania Trump’s MELANIA coin, stated that pre-launch insider knowledge is a standard procedure in major meme coin launches. In response, Chow denied direct involvement with Libra beyond IT support.

“For $LIBRA, although we were made aware of the possibility of it several weeks ago by Hayden, we had no involvement in the project at all beyond providing IT support, including commenting on the liquidity curve and helping verify the token’s authenticity after the token was publicly launched. Neither I nor the Meteora team compromised the $LIBRA launch by leaking information, nor did we purchase, receive, or manage any tokens,” Chow defended.

However, Chow admitted that he had referred Davis and Kelsier Ventures to multiple projects as token deployers. He also added that this led him to trust Davis and Kelsier, referring them to other projects, including the Melania Trump token.

Video Leak Raises Further Questions

The controversy deepened when a video posted by SolanaFloor on X appeared to capture a conversation between DefiTuna founder Dhirk and Chow. In the video, Dhirk alleged that he witnessed Kelsier team members engaging in token sniping.

Chow, seemingly shocked, responded, “I feel so sick because I gave him Melania… I enabled the guy that should not have been enabled… I’m going to have to step down, I’m going to have to quit.”

Despite these revelations, Meow firmly believes that Chow was not financially complicit in wrongdoing. However, he acknowledged that the controversy had damaged Meteora’s reputation, necessitating leadership change.

“Going forward, we will be looking for new leadership for Meteora,” Meow concluded.

The scandal has sparked broader discussions within the crypto space regarding ethical standards in token launches. In a statement shared with BeInCrypto, Chris Chung, founder of Solana-based swap platform Titan, said that the DeFi community must call out extractive behavior to prevent similar issues in the future.

“The entire LIBRA meme coin fiasco over the weekend should serve as a reminder that all of us in the DeFi community have a responsibility to make this space safer for users,” Chung said.

He added that DEXs must carefully consider how retail users interpret token verifications. Specifically, even small gestures like a “verified” label can be misconstrued as an endorsement.

Similarly, Harrison Seletsky, director of business development at SPACE ID, warned that the Libra controversy highlights a troubling trend in crypto. He argued that the industry is at a tipping point and must pivot away from speculative trading toward genuine utility.

“The LIBRA meme coin, endorsed by Argentine president Javier Milei, has shown the worst side of cryptocurrency for all the world to see. We need to evaluate where the crypto industry is going and who is truly benefiting. Right now, it isn’t the average investor—it’s insiders who pump and dump tokens to their own advantage,” Seletsky told BeInCrypto.

In the same tone, Solana meme coin launchpad Pump.fun founder Alon expressed disgust about the events surrounding Libra on X. The Pump.fun executive called for witnesses to speak out. His rebuke comes as Pump.fun’s establishment centers on efforts to prevent fraudulent token launches on Solana.

“The people behind this project made substantial personal gains at the expense of many users, the ecosystem, and even an entire country. I hope the people responsible get what they deserve,” Alon shared.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What It Means for the XRP Lawsuit

The SEC is dropping its lawsuit against Coinbase, according to an announcement from CEO Brian Armstrong. However, the Commission’s lawsuit against Ripple remains open for now, raising more questions.

Both lawsuits deal with certain cryptoassets’ status as securities, not commodities. For Coinbase, this interpretation would hamper operations, but it could prove fatal for the XRP issuer.

SEC Drops the Coinbase Suit

Brian Armstrong, the founder and CEO of Coinbase, is having a good day today. Recently, the company has been advocating for better US crypto regulation, and it achieved a major milestone today. Armstrong announced that the SEC was dropping its 2023 lawsuit.

“Great news! After years of litigation, millions of your taxpayer dollars spent, and irreparable harm done to the country, we reached an agreement with SEC staff to dismiss their litigation against Coinbase. Once approved by the Commission (which we’re told to expect next week) this would be a full dismissal, with $0 in fines paid and zero changes to our business,” he said.

Armstrong called this development “hugely vindicating,” claiming it was a real challenge to resist the Commission’s “mafia tactics” under the previous leadership.

He also said that this suit is a groundbreaking development for the future of crypto in the US because it would’ve substantially hindered exchanges’ ability to do business nationwide. For Coinbase, the SEC legal battle appears over.

However, the SEC has another active crypto lawsuit – its fight against Ripple. The two suits have major similarities, both hinging upon the notion that certain cryptoassets are securities. This interpretation opens crypto-related businesses to much stricter regulation.

How Will the Coinbase Settlement Impact the XRP Lawsuit?

For Coinbase, the issue is that the SEC insisted upon a lack of clarity with these classifications, essentially claiming that it could demand the exchange delist any token at a whim. In the Ripple case, however, it alleged that the firm was forbidden from raising funds through XRP token sales without registration.

In both instances, the SEC leaned on a lack of clear standards for crypto.

Even before today’s announcement, the SEC had already signaled it would drop charges against Coinbase, but the process has been murkier for Ripple. The Commission recently removed the XRP lawsuit from its website, and may be waiting for a few broader changes to dismiss it outright.

Ultimately, however, the Ripple case may be more complicated. The SEC alleged that Coinbase was hosting certain unlawful assets, and complying would severely impact the business model for all exchanges.

In the latter suit, it claimed that selling XRP was itself a securities violation, which would severely impact a great number of token projects.

The SEC is already taking a few measures to lay the groundwork for a broader policy realignment. Commissioner Peirce claimed that it wants to formally remove some tokens’ security status.

Also, the Commission is looking to reduce its crypto enforcement activities generally. Overall, the Coinbase case does provide some optimism for the XRP community.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

LINK Price Action Turns Cautious As Bearish Pennant Shapes Up

Chainlink (LINK) is flashing bearish signals as it forms a pennant pattern, hinting at a potential continuation of its downward trajectory. After struggling to gain bullish momentum, the price remains in consolidation, with sellers keeping a tight grip on the market. If this pattern plays out, LINK could be at risk of a steep drop, with key support levels facing increased pressure.

Market sentiment appears cautious, as bulls attempt to hold the line against growing bearish momentum. A breakdown from this structure might accelerate losses, pushing LINK toward lower price zones. However, if buyers manage to invalidate the pattern, a relief rally may be in play.

Analyzing Price Action: Bearish Pennant Signals Breakdown

Currently, Chainlink continues to trade within the confines of the bearish pennant pattern, indicating a state of indecision in the market. Neither the bulls nor the bears have established firm control, as the price remains constrained within converging trendlines.

Typically, this consolidation phase suggests that market participants are in a wait-and-see mode, anticipating a technical or fundamental catalyst for a decisive breakout in either direction.

While the structure of a bearish pennant typically signals a continuation of the previous downtrend, LINK’s hesitation indicates that bulls are still attempting to defend key support levels. Nevertheless, without a strong surge in buying pressure, the risk of a breakdown remains high.

If LINK breaches the lower boundary of the pennant with strong volume, an accelerated decline is likely, reinforcing the bearish outlook and increasing selling pressure. This breakdown could attract bearish momentum, pushing the price toward key support levels.

Additionally, the asset is currently trading below the 100-day Simple Moving Average (SMA), further strengthening the negative trend in the market. This positioning suggests that LINK’s ongoing attempts to regain upward momentum may face significant resistance.

Potential Breakdown Targets: How Low Can LINK Go?

The formation of a bearish pennant in Chainlink’s price action raises the possibility of further downside, with the measured move target and key support levels providing a roadmap for potential price movement.

Should the bears seize control and a breakdown occur below the lower trendline, LINK’s downward trend could accelerate, pushing the price below the critical $17.96 support level. This drop eyes a deeper decline toward the $15 mark, where buyers may attempt to regain momentum and prevent additional losses.

However, if bulls manage to defend these key levels and initiate a strong rebound, LINK might invalidate the bearish setup and shift toward a recovery, possibly targeting the $19.87 resistance level. A decisive move above this threshold would reaffirm bullish momentum and pave the way for more gains.

Market

Bybit Reportedly Hacked for Over $1.5 Billion

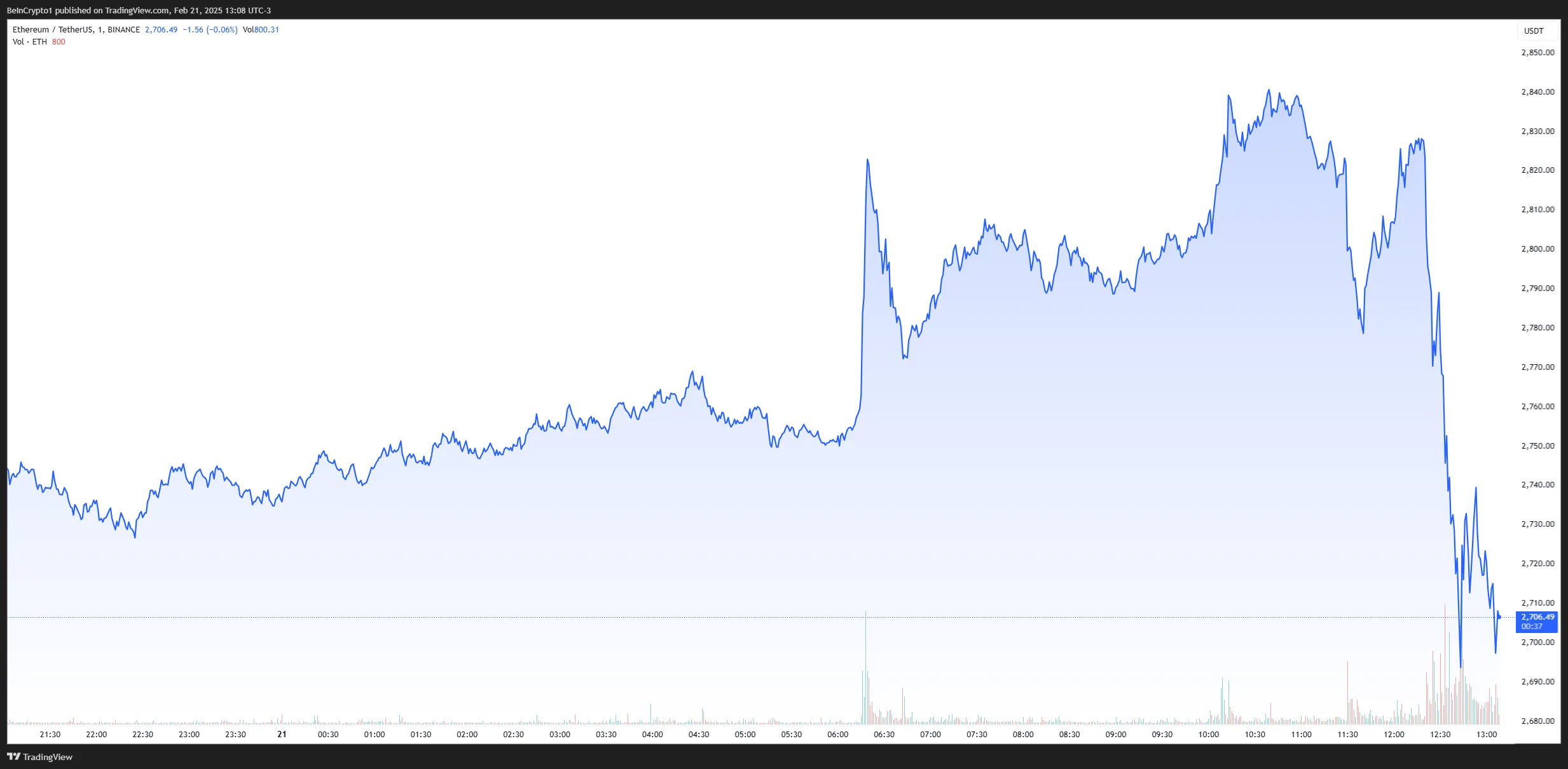

According to the latest reports, crypto exchange Bybit suffered a major hack, and over $1.46 billion in Ethereum was withdrawn from its hot wallets.

This could potentially be the biggest security breach in crypto history.

Bybit Hack: Everything We Know So Far

On-chain data shows that a staggering 401,346 ETH (valued at $1.13 billion) was reportedly transferred from Bybit’s hot wallet to an unknown wallet address. The amount is now being liquidated, which also immediately impacted Ethereum’s market price.

This large transfer immediately sparked concerns that Bybit had suffered a breach, especially considering the significant value of the assets involved.

Bybit CEO Ben Zhou confirmed the reports on social media.

“Hacker took control of the specific ETH cold wallet we signed and transferred all ETH in the cold wallet to this unidentified address. Please rest assured that all other cold wallets are secure. All withdraws are normal,” Zhou wrote on X (formerly Twitter).

According to his statement, Bybit’s Ethereum cold wallet was hacked because the attackers tricked their security system. The wallet signers (authorized people) saw a fake user interface that showed the correct address, making them believe they were approving a normal transfer.

However, in reality, they were unknowingly signing a change to the smart contract logic, which gave the hacker control over the wallet. As a result, all the ETH in that cold wallet was transferred to an unknown address.

“The biggest hack ever by far. Very similar to the WazirX $235 million access control attack,” Deddy Lavid, CEO of blockchain security firm Cyvers, told BeInCrypto.

Meanwhile, the hack immediately impacted Ethereum’s market price. As large volumes of the stolen ETH were liquidated, the altcoin fell over 4% in a straight line.

According to Arkham data, nearly $200 million worth of Lido Staked Ether (stETH) were sold within the first 30 minutes. Security experts have told BeInCrypto that this attack was almost identical to last year’s WazirX and Radiant Capital hack.

“Two minutes before the outflow transactions, the hacker re-implemented their Safe multisig wallet to delegate calls to the hacker’s malicious contract. This was likely caused by blind signing while attempting to execute a legitimate transaction. From that moment, the hackers had full control over the wallet and no longer needed additional signatures. This attack is very similar to those on WazirX and Radiant Capital,” Meir Dolev, Co-Founder and CTO of Cyvers, told BeInCrypto.

It appears that Bybit fell victim to the same malicious techniques that caused the biggest hacks of 2024.

This is an ongoing story. More information will be provided as the investigation unfolds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation4 hours ago

Regulation4 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Regulation24 hours ago

Regulation24 hours agoSEC launches new unit to combat crypto fraud and cybercrime

-

Market14 hours ago

Market14 hours agoTrust Wallet Discusses the Challenges and Future of Crypto Wallets

-

Market16 hours ago

Market16 hours agoSUI Targets Bullish Breakout with Golden Cross Potential

-

Market15 hours ago

Market15 hours agoBitcoin Price Recovers Strongly—Is a New Rally Beginning?

-

Altcoin15 hours ago

Altcoin15 hours agoXRP Price Eyes New ATH As Grayscale’s XRP ETF Filing Enters US SEC Review

-

Market9 hours ago

Market9 hours agoLitecoin ETF Approval Odds at 85% on Polymarket

-

Ethereum19 hours ago

Ethereum19 hours agoBig Players Keep Buying Ethereum – Whales Accumulate 430,000 ETH In 72 Hours