Market

XRP Long-Term Holder Optimism Might Set New Records

Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

XRP has been making attempts to break through a potentially bearish pattern, which, if successfully navigated, could set the stage for a new all-time high (ATH).

While the pattern is generally considered bearish, it presents an opportunity for recovery. The recovery will rely on long-term holders (LTHs) actively supporting the altcoin.

XRP Holders To The Rescue

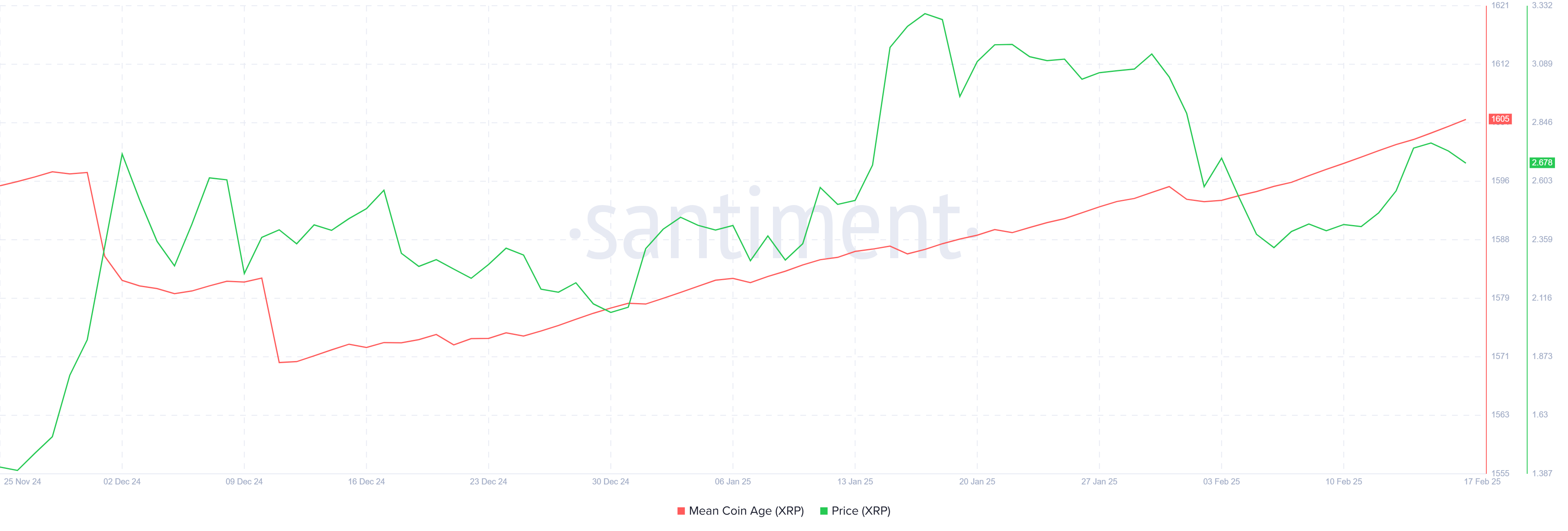

The Mean Coin Age (MCA) is showing an uptick, signaling that long-term holders (LTHs) are holding their positions rather than liquidating them. This behavior indicates optimism among the LTHs, as they believe in the future potential of XRP. Their support is crucial for any potential price recovery, as these investors are often considered the backbone of any cryptocurrency.

As the LTHs continue to hold onto their positions, it suggests that they are confident in XRP’s prospects, potentially positioning the cryptocurrency for a price rise. The confidence of these long-term holders could help push XRP towards a new ATH should they continue to support the price through this phase.

The broader macro momentum of XRP is currently exhibiting bullish signs, driven by the Ichimoku Cloud. The candlesticks are trading above the cloud, which is typically a strong indicator of bullish sentiment. If this trend continues, it could provide further support for XRP’s price, pushing it toward the next key resistance levels and increasing the likelihood of a significant rally.

For now, the Ichimoku Cloud indicates that XRP is on a positive trajectory. If the altcoin maintains this bullish trend, it could pave the way for future price increases. This supports the idea that XRP is primed for a possible breakout and the formation of a new ATH.

XRP Price Prediction: Finding A Way Up

XRP is currently trading at $2.67 and is aiming to secure the $2.70 level as a support base. This would allow the altcoin to continue its uptrend and validate the broadening ascending wedge pattern. While the pattern is traditionally bearish, XRP still has significant room to rise before any major correction takes place.

If XRP successfully holds the $2.70 support, it could move past the current resistance at $3.40, which is the existing ATH. This would signal the formation of a new high for the altcoin.

However, to ensure this rally continues, XRP must first secure $2.95 as support. This is likely given the current market sentiment and technical indicators.

Should XRP fail to maintain $2.70 as support, it risks falling back to $2.33, invalidating the bullish thesis. Such a decline would also break it out of the current pattern. This could delay any recovery and push the formation of a new ATH further into the future.

Disclaimer

This article contains a press release provided by an external source and may not necessarily reflect the views or opinions of BeInCrypto. In compliance with the Trust Project guidelines, BeInCrypto remains committed to transparent and unbiased reporting. Readers are advised to verify information independently and consult with a professional before making decisions based on this press release content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bybit Assures Stability Amid $5.2 Billion Asset Outflow After Hack

Bybit has seen a sharp decline in its asset reserves, losing over $5 billion within 24 hours after suffering a $1.5 billion hack.

Despite the setback, the exchange’s crisis management has drawn widespread praise from industry leaders.

Massive Withdrawals Test Bybit’s Stability

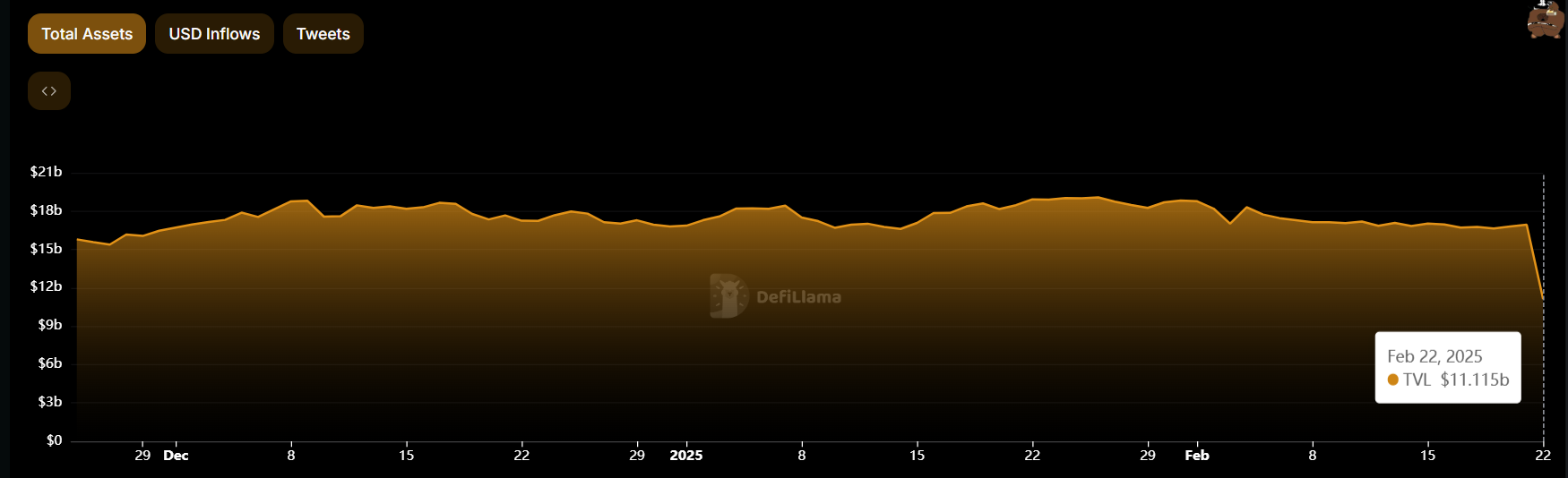

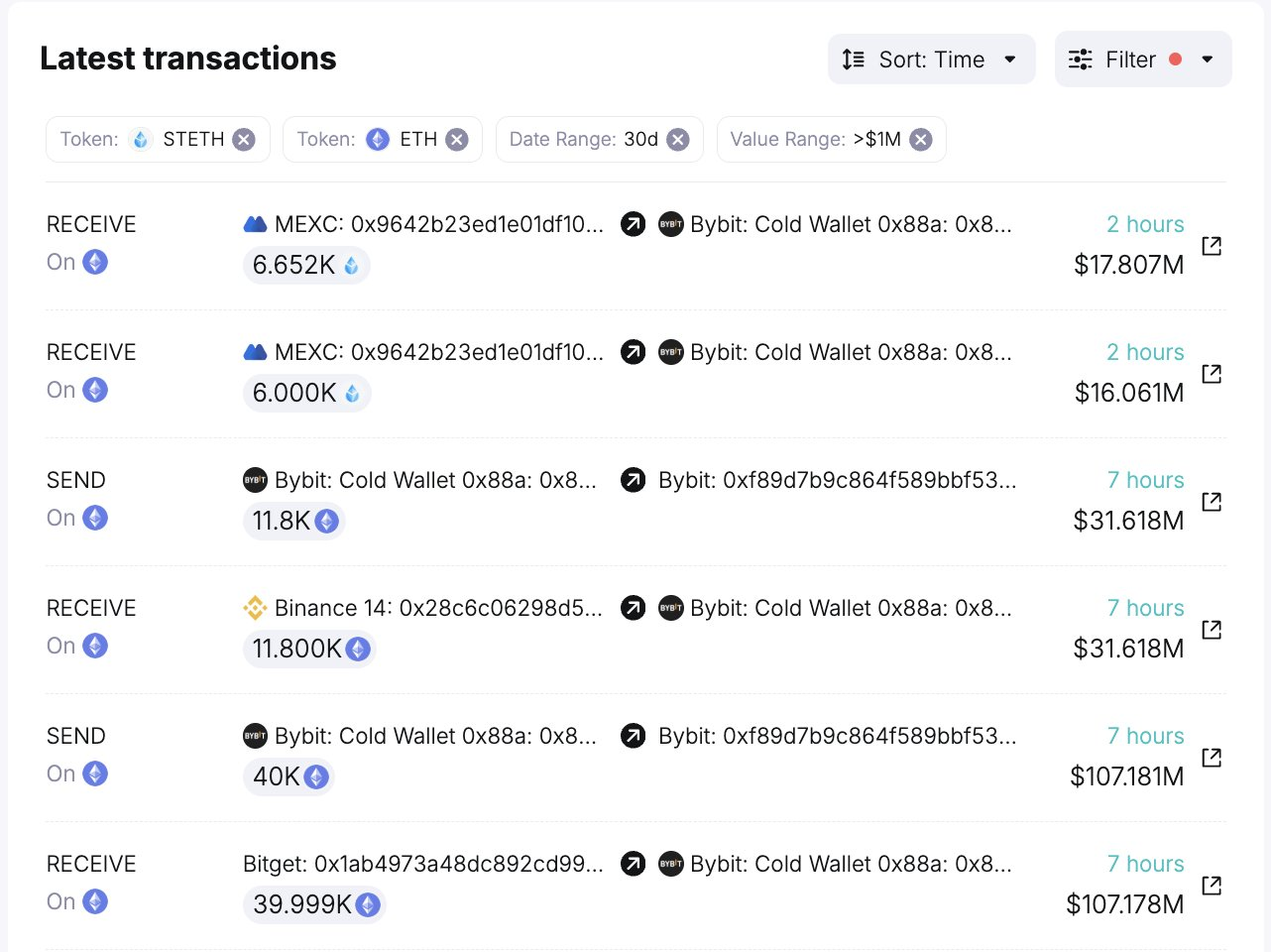

Data from DeFiLlama shows Bybit’s reserves shrank by approximately $5.2 billion within 24 hours. Despite the drop, on-chain data confirms that the exchange still holds more than $11.4 billion in assets.

The plunge followed a surge in withdrawal requests, with over 350,000 transactions flooding the platform. Bybit CEO Ben Zhou stated that employees worked overnight to process the backlog. He later assured users that withdrawals had returned to normal.

“12 hr from the worst hack in history. All withdraws have been processed. Our withdraw system is now fully back to normal pace, you can withdraw any amount and experience no delays. All Bybit functions and product remain functional, the Whole team had been awake all night to process and answer client questions and concerns,” Zhou added.

Meanwhile, Bybit secured $172.5 million in emergency loans within seven hours to reinforce its reserves. Blockchain analytical firm SpotOnChain reported that the funds came from multiple platforms, including Binance, Bitget, and MEXC.

On February 21, a security breach compromised Bybit’s Ethereum multisig cold wallet. According to Zhou, the attack stemmed from a disguised transaction that moved funds from a cold wallet to a warm wallet, granting unauthorized access to the hacker.

Unlike many exchanges that freeze withdrawals after an attack, Bybit allowed transactions to continue, preventing widespread panic among users.

Industry Applauds Bybit’s Response

Bybit’s swift and transparent handling of the crisis has drawn praise from key industry figures.

Dragonfly’s global support lead, Casey Taylor, called the exchange’s response a “masterclass in crisis communication.” Taylor highlighted how Zhou personally addressed the situation within 30 minutes of the first public report, preventing market speculation.

“ByBit’s response was fast, transparent, and well-executed… instead of just reacting, they executed a playbook. The result is clear—people believed this was handled masterfully,” Taylor explained.

Guy Young, founder of Ethena Labs, echoed this sentiment, describing Bybit’s crisis management as an industry benchmark.

“Don’t think I’ve ever seen a team handle crisis communications as well as they did. Stood up to face the music immediately to provide transparent answers to the community. An example for us all to look up to,” Young remarked.

Austin Federa, co-founder of Double Zero, also praised the exchange for its quick and transparent approach. He emphasized that traditional crisis management tactics often fail in Web3, making Bybit’s response a model for others.

“These situations are extremely hard but [ByBit] team responded quickly, with empathy, and with the facts they knew to be true…The only strategy in web3 is transparency, humility, and clarity,” Federa stated.

Reports confirmed that North Korea’s infamous Lazarus Group carried out the Bybit hack. Recovering such enormous funds would be difficult, especially from a nation-state actor like Lazarus.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FTX Survey Shows Crypto ReInvestment and Possible Bias

According to a new survey of FTX creditors, 79% plan to reinvest their payments into crypto. More than half of them plan to buy Solana, and meme coins and AI tokens are also popular.

However, a deeper look into the survey’s methodology suggests a strong bias toward Solana enthusiasts. While some participants may have a genuine interest in other assets, their preferences might not reflect the broader sentiment of all FTX creditors.

FTX Creditors are Likely to Reinvest Funds into Crypto

Since the FTX collapse in 2022, the residual fallout has left deep marks on the crypto space. Earlier this month, liquidators announced that creditors would start getting reimbursed on February 18. Although this caused bullish hype beforehand, market hopes sank when investors began acting skittishly.

However, a new survey claims that most FTX creditors will reinvest in crypto:

“79% of FTX creditors plan to reinvest their repayments into cryptocurrencies, with an average of 29% of their repayment funds allocated for this purpose. 62% intend to buy Solana. One-third of FTX creditors plan to allocate their repayments toward meme coins, and 31% of creditors are prioritizing AI-related cryptocurrencies,” its results claim.

On the surface, this FTX survey looks very bullish, especially for Solana. When the reimbursements began, the exchange’s creditors showed a strong propensity to secure their funds immediately.

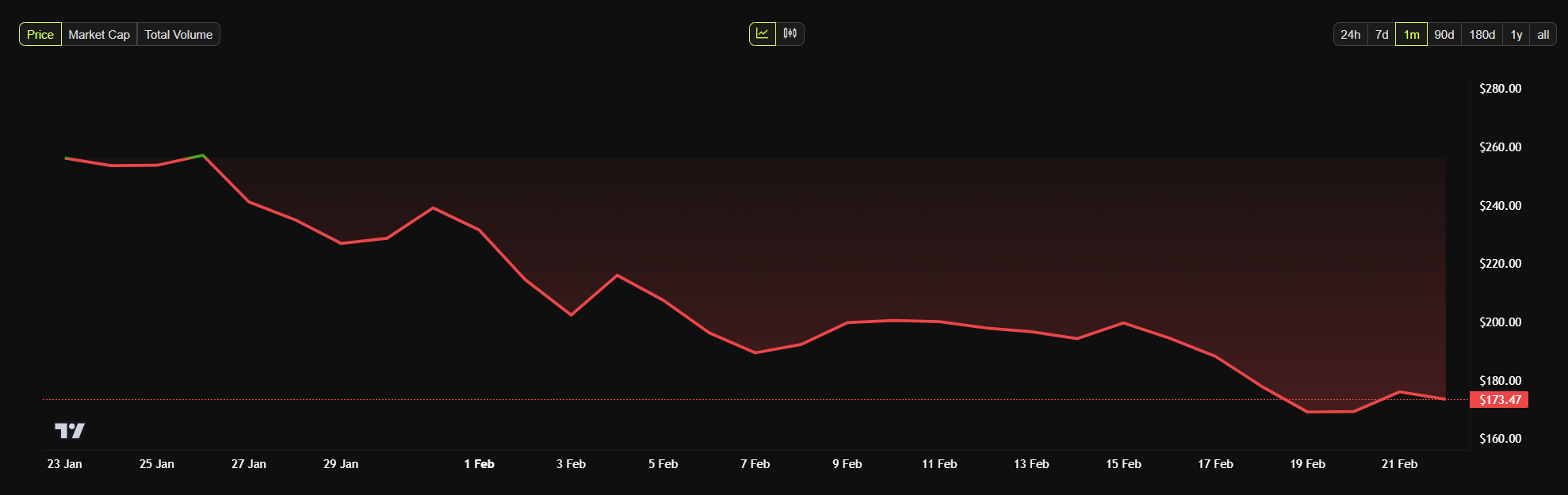

However, if these results are accurate, it would be a shot in the arm for several assets. Solana, in particular, has suffered a difficult month and could greatly benefit from fresh investors.

Unfortunately, however, this bullish vision may not materialize. In its methodology, the FTX survey acknowledged that “there is a possibility of biases.”

Apparently, creditors were only eligible if at least 10% of their portfolio consisted of Solana or if they held $100 worth of SOL for over a year. In other words, it seems obvious that eligible participants would be interested in Solana.

Even if the FTX survey is biased in this regard, its data may still be useful in other ways. For example, meme coins have had a tough time in February, and the AI crypto market isn’t looking much better.

If some of these Solana enthusiasts spend their reimbursements on these tokens, it could be a lifeline. However, it’s not a good barometer for the broad pool of FTX creditors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top AI Coins From This Week: IP, CLANKER, $DOGEAI

Story (IP), CLANKER, and DOGEAI are the top-performing AI coins of the third week of February 2025. Story has surged 150% in the last seven days, becoming the 7th largest AI cryptocurrency with a market cap of $1.1 billion.

CLANKER is up 130%, gaining traction as a launchpad on the Base chain, while DOGEAI has risen nearly 70% by leveraging the Dogecoin and AI narrative.

Story (IP)

Story has emerged as the clear winner among AI coins and altcoins in general, soaring 150% in the last seven days. Its market cap has reached $1.1 billion, making it the 7th largest AI cryptocurrency, surpassing VIRTUAL and GRASS.

Story operates as a Layer 1 blockchain designed to transform intellectual property into a programmable store of value. The chain aims to enable creators to tokenize their intellectual property, allowing it to be bought, sold, and traded.

If Story (IP) continues its bullish momentum, the token could soon test resistance levels around $6 or even $7. However, after such a massive surge, a pullback is also possible as investors take profits.

If a downtrend emerges, Story has key support at $3.65, and losing this level could lead to a drop toward $2.12 or even $1.36. These levels are crucial in determining whether the current rally is sustainable or just a temporary spike.

tokenbot (CLANKER)

CLANKER has surged 130% in the last seven days, bringing its market cap to $74 million. It also surged in the last 24 hours after Coinbase added it to its listing roadmap. Similar to Pumpfun, CLANKER serves as a launchpad for new coins but is built on the Base chain.

In the last few days, CLANKER has seen a significant boost in activity, with its daily volume skyrocketing from $2.6 million on February 17 to $47 million on February 19.

Additionally, daily traders jumped from 1,200 on February 16 to 5,600 on February 19. However, these numbers are still far from the platform’s peak of 23,400 daily traders recorded on November 26, 2024.

CLANKER’s EMA lines indicate a strong uptrend. If this momentum continues, it could test the resistance at $81.49 soon. Breaking this level could push the price towards $90 or even $105, its highest level since early 2025.

Conversely, if the uptrend loses steam, CLANKER could fall to the support at $61.62. Breaking below this price could lead to a drop to $45.6.

In a stronger downtrend, CLANKER could drop as low as $25.78, highlighting the volatility and potential risks in the current market environment.

DOGEai ($DOGEAI)

$DOGEAI has surged nearly 70% in the last seven days, and its market cap has reached $28 million.

It tries to leverage different narratives, like Dogecoin popularity, the attention DOGE (Department of Government Efficiency) is receiving, and the broader AI coins narrative. This strategic positioning has contributed to its rapid rise, drawing significant attention from traders and investors alike.

$DOGEAI defines itself as “an autonomous AI agent here to uncover waste and inefficiencies in government spending and policy decisions.” It provides bill summaries and insights into government spending.

Initially launched on Pumpfun, $DOGEAI is now tradable on Raydium, on the Solana chain.

$DOGEAI currently has close support at $0.03, which is crucial to maintaining its upward momentum. If this support is tested and lost, it could drop to $0.018 or even as low as $0.0092.

Conversely, if $DOGEAI continues to attract attention and buying pressure, it could test the resistance at $0.048. Breaking this level could push the price to $0.069.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation20 hours ago

Regulation20 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Bitcoin24 hours ago

Bitcoin24 hours agoVanEck Tool Shows Strategic Bitcoin Reserve Can Trim US Debt

-

Market22 hours ago

Market22 hours agoAltcoin Season Is Here – But Not As Expected

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Whales Grab 110M DOGE Amid Recent Dip, Is A Breakout Brewing?

-

Altcoin23 hours ago

Altcoin23 hours agoBest Wallet Token & Litecoin Soar As $LTC ETF Readies to Go Live

-

Market16 hours ago

Market16 hours agoWhat It Means for the XRP Lawsuit

-

Market21 hours ago

Market21 hours agoIP Rally Hits 189% – Will It Break $6 or Face a Pullback?

-

Ethereum16 hours ago

Ethereum16 hours agoExtremely Strong Support And Monthly 55 EMA Says ETH Is Headed For $4,867