Market

Top 5 Facts about Pi Network Ahead of Mainnet Launch

Pi Network’s Open Network (mainnet) launch on February 20, 2025, has generated significant speculation regarding its potential listing price. It’s becoming one of the most highly anticipated launches in recent crypto history.

As we near the mainnet launch, here are the top five facts about the Pi Network that every user must know before investing.

Pi Coin Tokenomics

The total supply of Pi is capped at 100 billion tokens, allocated as follows:

- Mining Rewards (65%): Approximately 65 billion Pi are reserved for rewarding users who contribute to the network through activities like mobile mining, referrals, and running nodes.

- Ecosystem Building (10%): Around 10 billion Pi are set aside to support community initiatives, development of decentralized applications (dApps), and other ecosystem-enhancing projects.

- Liquidity Pool (5%): About 5 billion Pi are allocated to provide liquidity for transactions within the Pi ecosystem.

- Core Team Allocation (20%): The remaining 20 billion Pi are allocated to the Pi Core Team as compensation for their development efforts and ongoing maintenance of the network. This allocation is subject to a vesting schedule aligned with the distribution to the community.

As Pi Network approaches its mainnet launch, the Pi Core Team has not publicly disclosed the exact number of tokens to be unlocked at that time.

As of December 2024, approximately 562 million Pi coins have been unlocked and are in circulation.

Notably, a significant number of Pioneers (users who mine Pi using the mobile app) have chosen to lock up their tokens for extended periods. Many are even opting for a three-year lock-up.

Pi Network Was Accused of a Data Leak

In May 2021, reports emerged of a significant data leak involving approximately 17 gigabytes of personal information from around 10,000 Vietnamese citizens. The compromised data included identity card details, home addresses, phone numbers, and email addresses.

Meanwhile, the individual responsible for the leak claimed the data was sourced from Pi Network. The project, however, refuted these allegations.

According to the project, a third-party service, Yoti, conducted its KYC processes. Yoti also claimed that Vietnamese identity cards were not stored on their servers.

“Pi Network or its third-party KYC provider has nothing to do with the recent alleged data leak of Vietnamese national IDs. Pi Network never asked for or collected such data and our third-party KYC provider does not accept this type of ID documentation,” the project wrote back in 2021.

Later, an internal investigation by Pi Network found no evidence of a data breach on their end. Yoti also denied any involvement in the data leak.

Pi Was Involved in China’s Largest Pyramid Scheme

Pi Network has faced significant scrutiny in China, with allegations suggesting it operates as a multi-level marketing (MLM) or pyramid scheme. The platform uses a referral-based system where users can increase their mining rate by inviting others.

In July 2023, the Public Security Bureau of Hengyang City, Hunan Province, labeled Pi Coin as a scam. The Bureau highlighted that Pi Network relies on a hierarchical invitation mechanism. This forms layers of participants where recruiters benefit from bringing in new members.

“PI Network has nothing to do with the real project and will soon rug. Be aware because CABAL is trying to make a meta from the Pi Network 2025 brand,” analyst MASTR wrote on X (formerly Twitter).

The model aligns with the characteristics of pyramid schemes, which are illegal under Chinese law. Several industry leaders like Colin Wu and AB Kuai.Dong have warned about the legal risks of engaging with Pi Network in China.

In response, Pi Network has implemented restrictions on Pi coin trading in certain regions, including mainland China. Exchanges like OKX have confirmed that Pi Network requested an isolated listing method.

“PI is the largest pyramid scheme in the Chinese-speaking world. Since mobile phones can be used for digging directly, the threshold is low. As the number of users increases, mining rewards will gradually decrease. But the disadvantage is that it involves pyramid schemes and gambling, and there are many cases involving police in various places,” wrote AB Kuai.Dong.

Pi Network is Among the Top 5 Most Popular Crypto Projects

Even without a mainnet launch and continuous delays, Pi Network is currently the 5th most followed crypto project on X (formerly Twitter). The project currently has 3.7 million followers, which is higher than Ethereum, Solana, and other popular blockchain networks.

It’s also among the most popular crypto apps in South Korea and India. The project’s mobile app has over 100 million downloads on the Google Play store.

Pi Coin Launch Price

Pi network’s OTC (over-the-counter) price is $2 per Pi token. This represents peer-to-peer transactions where users trade Pi informally without exchange listings.

However, its current IOU ( I owe you) price is around $64. IOUs are speculative prices on exchanges like HTX (formerly Huobi), where traders anticipate future prices before Pi becomes tradable.

Most importantly, Pi Network has over 45 million engaged users, making it one of the largest crypto communities. Social media activity and search trends indicate strong retail interest.

Currently, a large percentage of Pi is locked due to voluntary lock-up periods set by users. Given these factors, BeInCrypto analysts predict Pi coin to trade between $30 – $50 on mainnet launch date.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Falls 5% Following $1.5 Billion Bybit Hack

The Bybit Hack has shaken the market today, with over $1.46 billion in ETH stolen, marking one of the largest security breaches in history. As the stolen assets are being liquidated, Ethereum’s price dropped by 5% in a straight line, impacting key technical indicators.

Speculation is growing about Bybit’s next moves, with some suggesting a potential market buyback to compensate users, which could create significant buying pressure. However, it remains uncertain how Ethereum’s price will behave in the coming days as the situation continues to unfold.

Will Bybit Hack Lead to a Strong Buyback?

Earlier today, one of the largest crypto exchanges, Bybit, was hacked. Over $1.46 billion worth of Ethereum was stolen from its hot wallets, marking one of the largest security breaches in crypto history.

CEO Ben Zhou confirmed that attackers tricked Bybit’s security system, leading wallet signers to unknowingly approve changes to the smart contract logic, giving the hacker control.

The stolen ETH is being liquidated, causing Ethereum’s price to drop by over 4%. After the assets were stolen, the hacker’s addresses started to send money to dozens of different wallets.

Some users are speculating about Bybit’s next moves to recover users’ funds.

Some analysts claim that if Bybit can’t recover the stolen $1.5 billion, they might market-buy ETH to maintain users’ funds, potentially creating bullish buy pressure. However, nothing guarantees this will happen or when, as Bybit’s next steps are still unfolding.

Recently, Arkham published on X that a Bybit Cold wallet transferred more than $500 million to another Bybit wallet, suggesting the exchange could be getting ready to prepare funds for user reimbursements following the hack.

Indicators Suggest Stolen Assets Impacted Ethereum Price

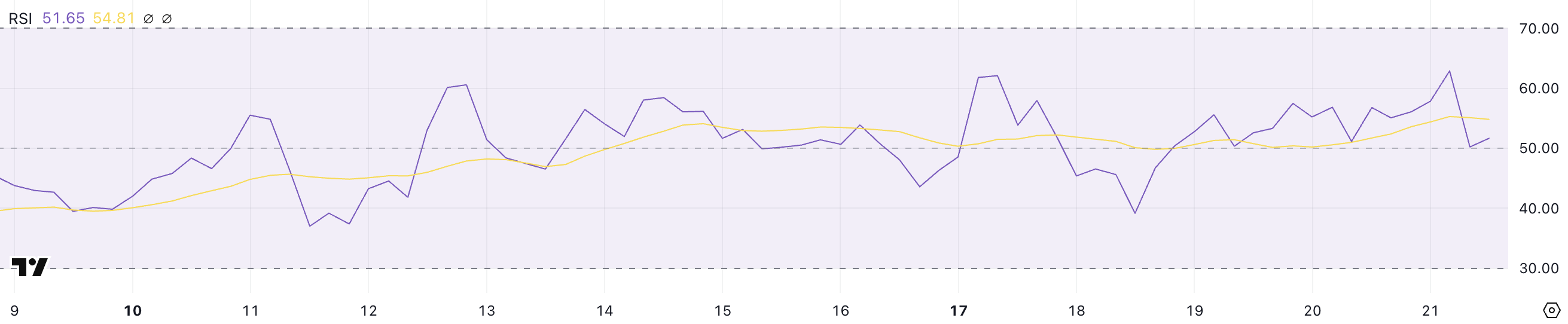

The recent hack impacting Bybit caused Ethereum’s Relative Strength Index (RSI) to drop sharply from 62.8 to 51.6 in just a few hours.

This rapid decline indicates a sudden loss of buying momentum, reflecting increased selling pressure as the stolen ETH was liquidated.

Although the RSI is still above the neutral 50 mark, the sharp drop suggests that bullish sentiment has weakened considerably.

With ETH’s RSI at 51.6, it remains in a neutral zone, showing balanced buying and selling pressure. Notably, ETH’s RSI has been neutral since February 3, reflecting a period of consolidation and market indecision.

If the RSI drops below 50, it could signal bearish momentum, while a rise above 60 would indicate renewed buying interest.

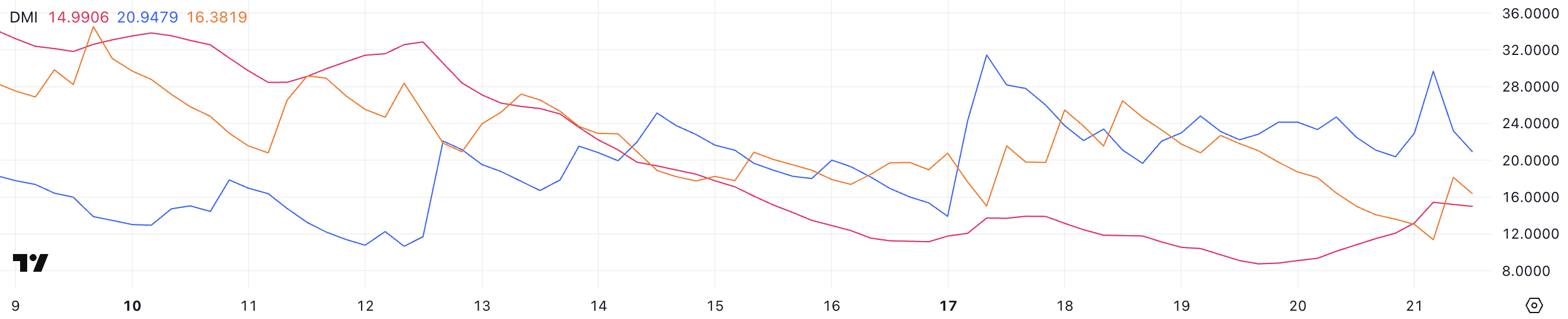

Ethereum’s Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) is currently at 14.9, indicating a weak trend.

Meanwhile, the +DI has dropped from 29.6 to 20.94, showing a decline in buying pressure since the Bybit hack. Conversely, the -DI has risen from 11.3 to 16.3, demonstrating selling pressure as the stolen Ethereum has been liquidated.

This shift suggests a change in market sentiment, with sellers gaining more control over the price movement.

The ADX measures trend strength, with values below 20 indicating a weak or non-existent trend, regardless of direction. The decline in +DI and rise in -DI suggest that bullish momentum has weakened while bearish pressure is increasing.

With the ADX still low, ETH is likely to remain in a consolidation phase, lacking strong directional movement. However, if -DI continues to rise above +DI, ETH could face more selling pressure, potentially leading to a further price decline.

How Will Ethereum’s Market Change Following the Hack?

If liquidations continue or user confidence weakens following the Bybit hack, ETH could soon test the support at $2,551.

A break below this level could lead to a decline toward $2,160, signaling increased selling pressure.

Conversely, if Bybit manages to recover the stolen assets or if significant buying pressure emerges, ETH price could test the resistance at $3,020. Breaking this level could push the price higher to $3,442, its highest point since the end of January.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FARTCOIN, POPCAT Decline, BRETT Rallies

The crypto market has displayed mixed signals over the past week, with Bitcoin struggling around the $98,200 resistance level. As a result, most altcoins, including meme coins, have experienced sharp losses.

BeInCrypto has analyzed three meme coins—two are facing significant declines, while one is seeing gains despite the bearish market conditions.

Fartcoin (FARTCOIN)

FARTCOIN has experienced a 32% decline over the past week, trading at $0.38 after failing to breach the $0.60 barrier. The meme coin has struggled to regain upward momentum, highlighting the difficulty in surpassing previous resistance levels. As FARTCOIN faces these challenges, it becomes more vulnerable to further declines unless market conditions provide stronger support for a reversal.

After hitting a two-month low, FARTCOIN is currently holding above the support of $0.26. Should the price recovery fail, it risks consolidating around this level or potentially falling further, possibly to $0.16. The inability to break through key resistance points reflects traders’ ongoing caution, indicating that a full recovery may take longer to materialize.

However, if FARTCOIN can successfully secure $0.37 as a support floor, it could pave the way for a rise towards the $0.60 resistance. A successful breach of this level would invalidate the bearish thesis, potentially sending FARTCOIN beyond $0.69.

Popcat (SOL) (POPCAT)

POPCAT price has dropped by 23% over the past seven days, trading at $0.26. Despite this, the meme coin has managed to reclaim $0.23 as a support level. This recovery is still tentative, and POPCAT faces uncertainty as it attempts to regain lost ground and sustain a rebound.

POPCAT remains vulnerable to a potential drop to $0.20, as past performance indicates that the coin struggles to sustain recovery. Historically, when it doesn’t bounce back from key support levels, it often falls back to these levels to recover.

If the broader market momentum remains positive, however, POPCAT could break through resistance levels and rise toward $0.34 or even higher. With favorable conditions, the altcoin could target $0.49, invalidating the bearish outlook and setting the stage for more substantial gains in the coming days.

Brett (BRETT)

BRETT, one of the few top meme coins, has defied broader market trends, rising by 15.7% to trade at $0.049. This uptick signals a positive shift for the altcoin, suggesting that it may continue to gain momentum if favorable conditions persist.

The altcoin is establishing $0.047 as a support floor, which is critical for BRETT’s recovery. Holding this level will be essential for the altcoin to break past the resistance at $0.058, marking its next key target. Maintaining this support could pave the way for further upward movement in the coming days.

However, if $0.047 fails to hold, BRETT could see a pullback, potentially falling to $0.035. Such a drop would invalidate the bullish outlook and extend the losses for investors, signaling a potential halt in its recovery. A sustained breach of this support could significantly impact the altcoin’s future price action.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PI Surges, CZ Comments, Safe Denies Breach

The Bybit hack from this morning is already seeing a massive fallout, with conflicting narratives surrounding the security breach. The exchange is seeing extreme liquidity demand for withdrawals while Pi Network surges nearly 10%.

Due to high demand, users are experiencing difficulty withdrawing their funds, but CEO Ben Zhou has assured them that withdrawals will remain open.

Bybit Hack Leaves Crypto in Chaos

Bybit, one of the world’s leading crypto exchanges, is in a tumultuous moment right now. This morning, it suffered a $1.5 billion hack, which is already being called the “biggest security breach in crypto history.”

The whole community is scrambling, and nobody seems to have the full picture yet. However, Safe.eth, the multisig wallet that manages Bybit’s Ethereum cold wallet, denies any breach on their end.

“Safe’s security team is working closely with Bybit on an ongoing investigation. We have not found evidence that the official Safe frontend was compromised. However, out of caution, Safe {Wallet} is temporarily pausing certain functionalities. User security is our top priority, and we’ll provide more updates soon,” the firm claimed.

Essentially, Safe uses a smart contract-based wallet system to manage its Ethereum cold storage. If its front-end wasn’t compromised, this means authorized Bybit users had to sign off on the mechanism to enable the hack.

If the attackers managed to fool Bybit authorities into signing an exploit, they could rewrite the code and begin draining funds.

“Bybit signers had malware on their endpoints. They were trying to initiate legit transactions, but the malware was acting like a man-in-the-middle attack, they were connecting their hardware wallet to sign,” security firm Cyvers told BeInCrypto.

Because Bybit staff may have been the weak point in this hack, this has only added to the chaos. CZ, the former CEO of Binance, urged Bybit to halt all withdrawals, but this didn’t happen.

Zhou assured users that the exchange has enough funds to remain solvent, and Arkham Intelligence identified a transfer proving at least $500 million in reserves. Zhou even claims that Bybit will take loans to ensure all withdrawal requests are fulfilled.

“Not an easy situation to deal with. Might suggest to halt all withdrawals for a bit as a standard security precaution. Will provide any assistance if needed. Good luck,” CZ wrote on X (formerly Twitter).

Pi Network Turned Bullish After Bybit’s Woes

There is absolutely zero firm evidence, but some in the crypto community believe that Pi Network enthusiasts were somehow responsible.

Pi Network’s mainnet launched yesterday with the biggest airdrop in crypto history. While several exchanges listed the token on day one, Ben Zhou firmly denounced it as a scam yesterday. Bybit has been consistently reluctant to list the token.

As a result, there has been a strange positive reaction to the PI market after the Bybit hack. The token’s price surged nearly 10%.

In short, everything is in chaos. In the latest livestream, Zhou discussed some of Bybit’s next steps after the hack. He claimed that withdrawals are still open, but traffic is 100x higher than usual, so users may not be able to access services smoothly.

“We’ve experienced massive withdrawals since the $1.4 billion ETH hack. Even if we are experiencing a bank run, it’s not an issue. We have enough tokens to give to the clients” Zhou said.

The firm will not try to buy back lost assets immediately, relying on bridge loans, but remains adamant that it can keep its users whole.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation7 hours ago

Regulation7 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Market23 hours ago

Market23 hours agoAnalyst Says PEPE Price Must Break This Resistance Level For 150% Surge Toward ATHs

-

Ethereum22 hours ago

Ethereum22 hours agoBig Players Keep Buying Ethereum – Whales Accumulate 430,000 ETH In 72 Hours

-

Market22 hours ago

Market22 hours agoKAITO Price Attempts Recovery as Top Holders Exit Post-Airdrop

-

Altcoin21 hours ago

Altcoin21 hours agoCan Shiba Inu Price Surge 422%? This Pattern Signal SHIB New All-Time High

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Could Target $3,000 Once It Breaks Current Supply Levels – Analyst

-

Market16 hours ago

Market16 hours agoTrust Wallet Discusses the Challenges and Future of Crypto Wallets

-

Altcoin16 hours ago

Altcoin16 hours agoPi Coin Price Crashes 50%, What Shall Investors Do Next?