Market

SOL Price Struggles Below $200 Amid Increased Scams on Solana

Solana (SOL) price has been struggling below $200, currently down nearly 13% over the past 30 days. Despite strong momentum in previous months, recent indicators suggest a weakening trend, with bearish signals dominating the charts.

The Ichimoku Cloud, ADX, and price action all point to ongoing challenges as SOL fails to reclaim key resistance levels. However, if buying pressure returns and SOL can break above $209, a path toward $219 and even $244 could open up.

Users Discuss Solana Meme Coin Scams and Usage

Solana has been under scrutiny following the launch of LIBRA, a controversial meme coin promoted by Argentina’s president, Javier Milei.

The aftermath of this potential pump-and-dump led many users to question specific Solana applications, such as Meteora and Pumpfun. The community is also concerned about whether the blockchain itself has peaked in terms of adoption and price.

Some users, like the popular artist Gino Borri, argue that Solana apps like Jupiter, Pumpfun, and Meteora extract value from users through scams. This raises concerns about how projects operate within the ecosystem.

“Radio silence from Solana leadership as their community gets scammed multiple times a day in the Mass Extraction Olympics sponsored by Jupiter, Meteora, and PumpFun,” Gino Borri posted on X (formerly Twitter).

Others, like DefilLama contributor 0xngmi, have shared data on the amount of value taken from meme coin trading on the chain.

“Calculated the total extracted from memes on solana. Trading bots & apps: $1.09 billion; pump.fun: $492 million; MEV: $1.5-2 billion; Trump insiders: $0.5-1 billion; AMMs: $0-2bn; Total: $3.6 to $6.6+ billion” 0xngmi wrote.

However, Mert, CEO of Helius, a Solana infrastructure provider, counters that the high number of scams is a byproduct of Solana’s scale rather than an inherent flaw.

He suggests that widespread usage naturally attracts bad actors, similar to what has happened in other major blockchain ecosystems.

“Hopefully, the last I’ll say on this: crypto is full of speculation -> speculation leads to rugs -> Solana scales crypto -> so there are more rugs on Solana. All chains with sufficient activity will have tons of this as crypto gets bigger and regulation matures — and they’ve all had it historically btw (ICOs, NFTs, etc). This is a transient period. The solution is better launch mechanisms, better regulation, and better norms. When you do all of that it, it will get better but it will never go away as long as there are humans on the other side,” Mert Mumtaz wrote on X.

Solana Indicators Are Still Bearish

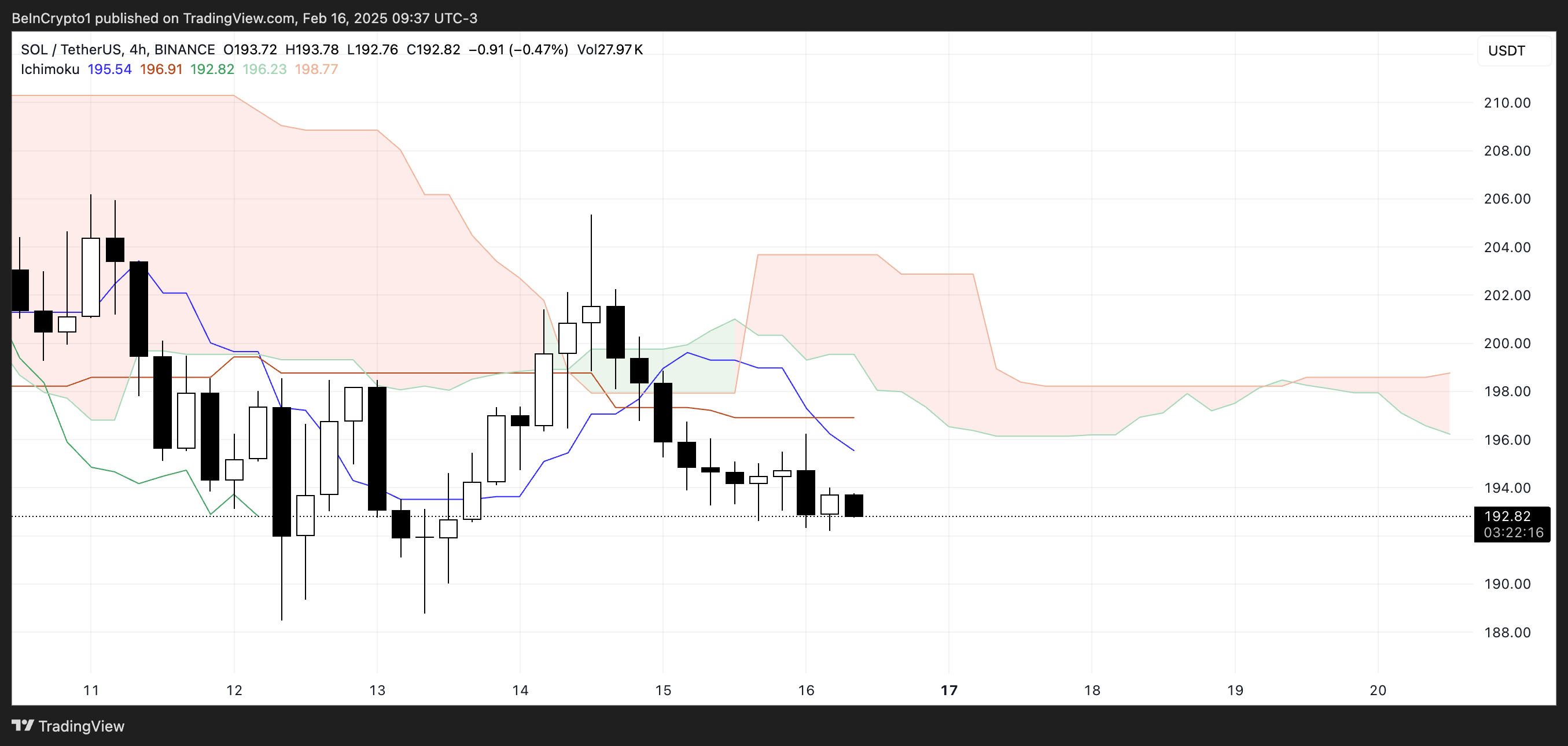

The Ichimoku Cloud chart for Solana shows a bearish outlook, with price trading below the cloud and key indicators suggesting weak momentum.

The conversion line (blue) is below the baseline (brown), indicating short-term weakness. Additionally, the cloud ahead remains red, suggesting continued bearish sentiment.

For SOL price to regain bullish momentum, it would need to break above the cloud resistance around $198 and sustain a move beyond $200.

If SOL fails to reclaim key levels, the downward pressure could persist.

A shift in trend would require SOL to push above both the conversion and baseline lines, alongside increasing volume to confirm bullish strength. Until then, price action remains under bearish control.

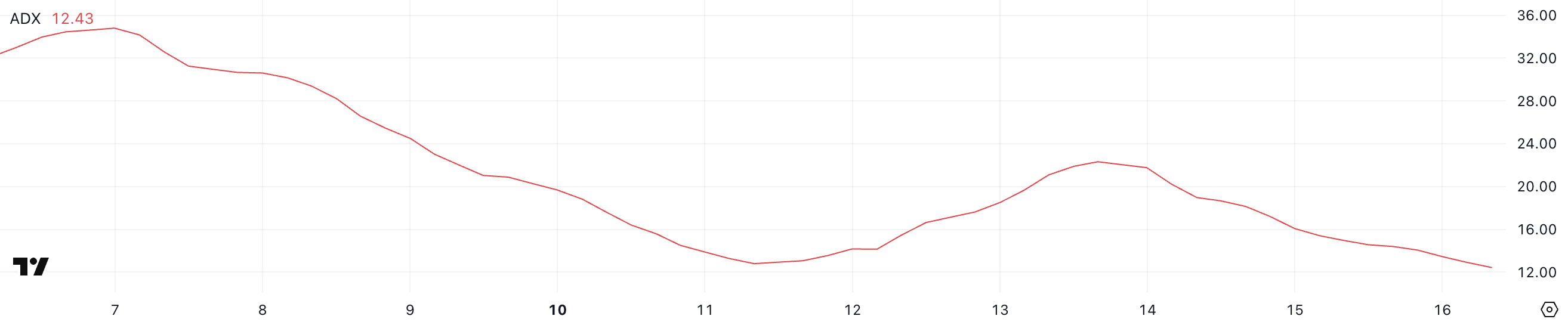

Solana’s Average Directional Index (ADX) is currently at 12.4, down from 22.3 three days ago. ADX measures trend strength, with values above 25 indicating a strong trend and below 20 suggesting a weak or no trend.

The drop in ADX signals that Solana’s current downtrend is losing momentum, but it has not yet reversed.

A low ADX reading like 12.4 suggests that the ongoing downtrend lacks strong directional pressure. While this could mean that selling pressure is weakening, it also indicates that SOL price lacks the strength for a meaningful reversal.

For a bullish shift, ADX would need to rise above 20 while price action shows signs of recovery, such as higher highs and higher lows. Until then, SOL remains vulnerable to further downside or consolidation.

SOL Price Prediction: Will SOL Reclaim $209 Soon?

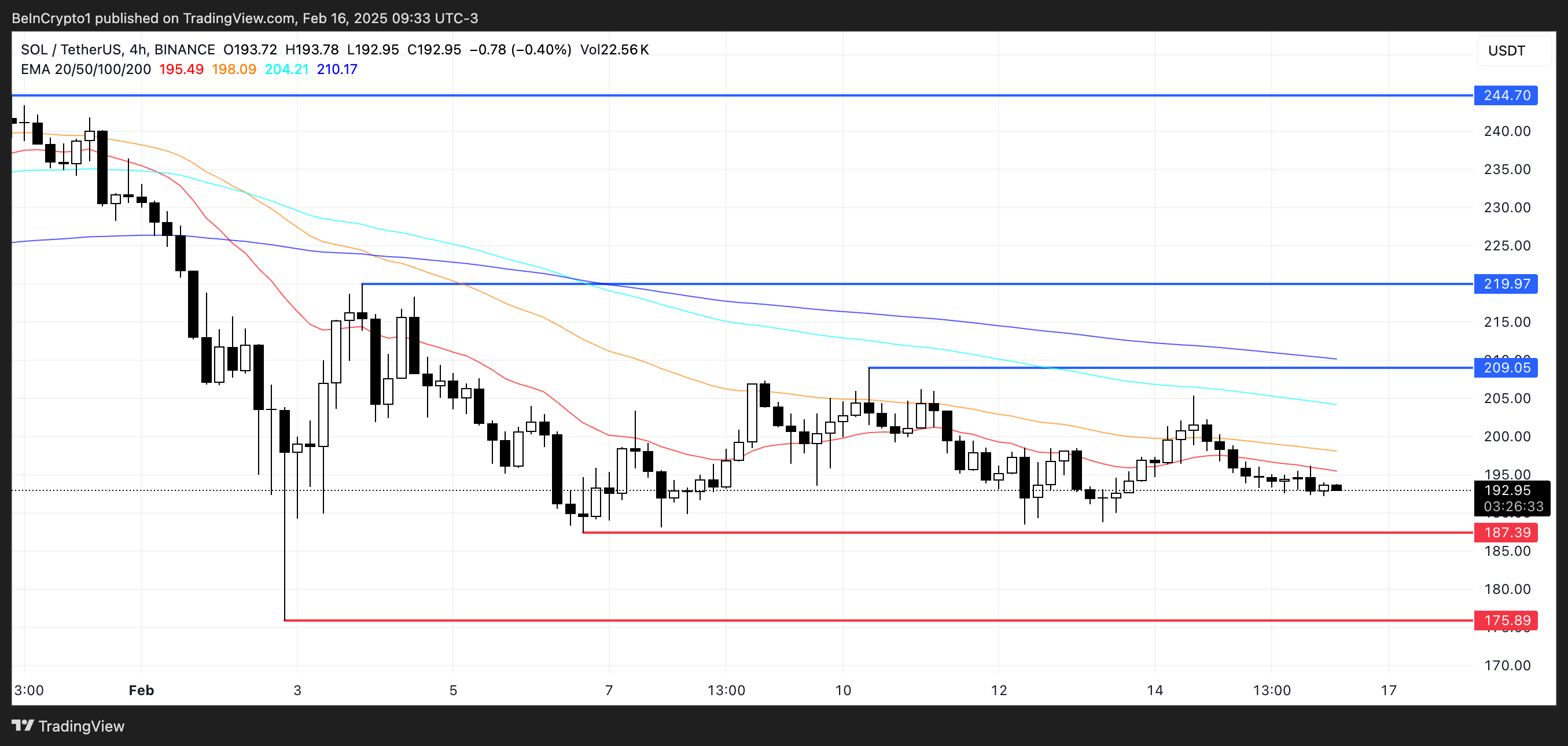

Solana has been struggling to reclaim levels above $205, consistently dropping below $200 when failing to break that resistance.

If SOL tests the $187 support again and fails to hold, it could extend losses toward $175, signaling further weakness.

On the other hand, if Solana price regains the strong momentum seen in previous months and enters a clear uptrend, it could push toward the $209 resistance.

A breakout above that level would open the door for a rally to $219, and if bullish strength continues, SOL could even revisit $244.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MELANIA Crashes to All-Time Low Amid Insiders Continued Sales

A wave of heavy sell-offs linked to the team behind the Melania meme coin (MELANIA) has raised fresh concerns about insider activity within the project.

These activities have contributed to the token’s value dropping to an all-time low, a staggering 97% down from its all-time high on Trump’s inauguration day back in January.

Heavy Insider Selling Sends MELANIA to Historic Low

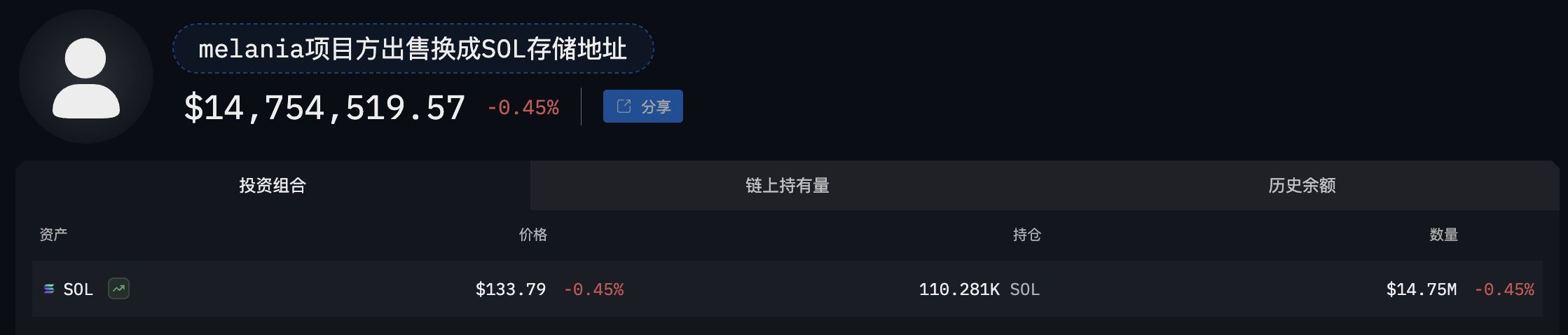

On April 19, on-chain analyst EmberCN reported that wallets tied to the project offloaded nearly 3 million MELANIA tokens.

In return, the team received approximately 9,009 SOL, valued at around $1.2 million. The tokens were sold through unilateral liquidity provisions added to the MELANIA/SOL trading pair on Meteora.

This transaction is part of a broader pattern. In the past three days, the MELANIA team reportedly moved 7.64 million tokens, worth about $3.21 million, from both liquidity and community wallets.

The team systematically added these tokens to the same liquidity pool and sold them for SOL within a pre-defined price range. Out of the total, they sold 2.95 million tokens just hours before EmberCN’s disclosure.

“In the past 3 days, the $MELANIA project team has continued to transfer out 7.643 million $MELANIA tokens ($3.21M) from liquidity and community addresses, then added them to MELANIA/SOL one-sided liquidity on Meteora, selling $MELANIA within a set range for SOL. Of which, 2.95 million $MELANIA tokens were sold 7 hours ago for 9,009 SOL,” EmberCN stated.

EmberCN further pointed out that the project’s team has sold over 23 million MELANIA tokens in the past month. The tokens were worth approximately $14.75 million.

These repeated sell-offs have added weight to concerns over internal dumping—suspicions that first emerged in March.

At the time, blockchain analytics firm Bubblemaps reported unusual movements of over $30 million in MELANIA tokens. Originally part of the community allocation, the tokens appeared to be gradually transferred to exchanges without explanation.

The firm linked these transactions to Hayden Davis, a co-founder of the meme coin. Davis previously worked on another controversial token, LIBRA, which briefly surged after Argentine President Javier Milei endorsed it, then quickly collapsed.

Bubblemaps also revealed that wallets tied to the MELANIA team control roughly 92% of the token’s total supply. Critics argue that this level of centralization raises red flags over potential market manipulation.

As a result of these concerns, MELANIA has seen its price collapse. After reaching a high of over $13 earlier this year, the token has dropped by over 96% to an all-time low of $0.38, according to data from BeInCrypto.

However, the steep decline reflects both internal turmoil and broader weakness in the meme coin sector. Investor appetite for high-risk tokens appears to be fading amid global uncertainty and a more cautious market sentiment

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

Charles Schwab Plans Spot Crypto Trading Rollout in 2026

Charles Schwab, one of the largest brokerage firms in the United States, is preparing to launch a spot cryptocurrency trading platform within the next year.

This marks a major move by one of the most trusted names in traditional finance and shows that demand for crypto investment options continues to climb.

Charles Schwab Eyes Crypto Expansion

During a recent earnings call, Schwab CEO Rick Wurster said the firm is optimistic about upcoming regulatory changes that could allow it to fully enter crypto trading.

“Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto and our goal is to do that in the next 12 months and we’re on a great path to be able to do that,” Wurster explained.

This move would allow the company to offer direct access to spot crypto trading and place it in direct competition with major players like Coinbase and Binance.

While the company already offers crypto-related products such as Bitcoin futures and crypto ETFs, the addition of direct trading would significantly expand its crypto portfolio. According to the CEO, engagement on these products has grown rapidly in recent months.

Wurster revealed that visits to the firm’s crypto-focused content have surged 400%. Of that traffic, 70% came from users who are not yet customers, showing a growing appetite for digital asset investments.

Wurster’s confidence in crypto aligns with the Trump administration’s efforts to introduce a clearer regulatory framework for digital assets. Compared to past years, progress on crypto legislation and oversight has accelerated, especially among key regulatory bodies like the SEC.

If these improvements continue, Schwab could debut its spot crypto trading platform before mid-2026. The firm believes its reputation in traditional finance gives it a strategic advantage in expanding into the crypto space.

Meanwhile, Schwab is already dipping its toes into the sector through its role as custodian for Truth.Fi, an upcoming digital investment platform launched by Trump Media and Technology Group. Truth.Fi plans to offer a mix of Bitcoin, separately managed accounts, and other crypto-linked products.

Indeed, Schwab’s potential entry into the sector has drawn attention from other industry leaders. Asset management firm Bitwise CEO Hunter Horsley described the brokerage firm’s move as a milestone in crypto’s transition to mainstream finance.

Rachael Horwitz, Chief Marketing Officer at Haun Ventures, echoed that sentiment and encouraged Schwab to consider crypto-collateralized lending as a future offering.

“Schwab should implement crypto-collateralized lending as part of its banking services next,” Horwitz said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Today’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

A long-time supporter of XRP who is not afraid to speak his mind has issued stunning predictions concerning the future value of the cryptocurrency. His assertions have both interested and confused investors.

Investor Forecasts 50-Fold Return On XRP

As per the Alpha Lions Academy founder Edoardo Farina, an investment of $1,000 in XRP today can increase to more than $50,000 in the future. The estimate is based on the altcoin crossing Farina’s desired price target of $100 per token, from its current value of around $2.

“Buying $1,000 worth right now is really buying over $50,000 in the future when $XRP hits $100+”, Farina tweeted recently.

Farina previously revealed he will not sell any of his XRP holdings until the price reaches at least $100 per token. He terms the coin as sitting at the hub of what he refers to as a “multi-generational pump” and points out its potential function within the international finance system.

XRP @ $2

Buying $1,000 worth right now is really buying over $50,000 in the future when $XRP hits $100+

50x return

— EDO FARINA 🅧 XRP (@edward_farina) April 18, 2025

Minimum Holdings Suggestion Sparks Skepticism

According to reports, Farina urges retail investors to own a minimum of 1,000 XRP tokens. He asserts that such an amount is the minimum one needs in order to take advantage of the use and greater adoption of XRP in the future.

Such opinions regarding the issue have been unequivocal. Farina has reportedly said that individuals who have fewer than 1,000 XRP tokens “don’t care enough about their financial success” and called possessing less than that amount “insanity.”

Though these comments represent Farina’s individual investment strategy, they echo a developing perception among XRP enthusiasts that the asset is undervalued and poised for strong growth if regulatory clarity increases and more businesses embrace it.

Doubters Challenge The Life-Changing Assertions

Not everyone shares Farina’s positive perspective. Doubters have raised issues with his assertion that $1,000 in XRP today may be worth $50,000 someday.

One critic pointed out that even if XRP hits $100 and converts $1,000 into $50,000, this may not be sufficient for early retirement. The remark points out that what appears to be a good return may not necessarily be the life-altering wealth many investors expect.

Questions also arise regarding if XRP will ever hit the $100 level, and if so, how long it would take to arrive there.

Price Target Timeline Indicates Long Way To Go

The journey to $100 looks long for XRP, which is currently trading at about $2. It would need a nearly 5,000% rise from where it is now to reach $100.

Featured image from Pexels, chart from TradingView

-

Market23 hours ago

Market23 hours agoCardano (ADA) Moves Sideways, But Bullish Shift May Be Brewing

-

Market19 hours ago

Market19 hours agoBinance Mandates KYC Re-Verification For India Users

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Altcoin22 hours ago

Altcoin22 hours agoPi Coin Price Soars As Pi Network Reveals Massive Community Reward Plans.

-

Market21 hours ago

Market21 hours agoSCR, PLUME, ALT Tokens Unlocking This Week

-

Altcoin14 hours ago

Altcoin14 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Altcoin23 hours ago

Altcoin23 hours agoXRP ETF Approval Could Spark a ‘Perfect Storm’ for Ripple Coin: Expert

-

Market22 hours ago

Market22 hours agoRipple Takes Asia By Storm With New XRP Product, Here Are The Recent Developments